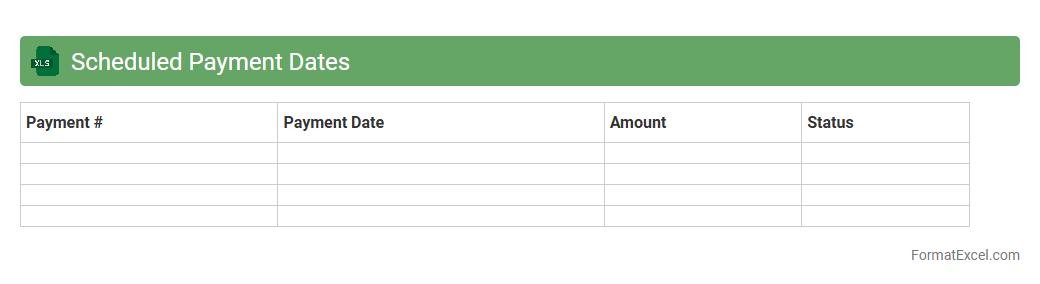

Scheduled Payment Dates

A

Scheduled Payment Dates Excel document organizes and tracks upcoming payment deadlines, ensuring timely financial management and avoiding late fees. It allows users to input payment amounts, due dates, and payment statuses, providing a clear overview of all financial obligations in one place. This tool improves cash flow planning and helps maintain a disciplined budget by reminding users of important payment dates.

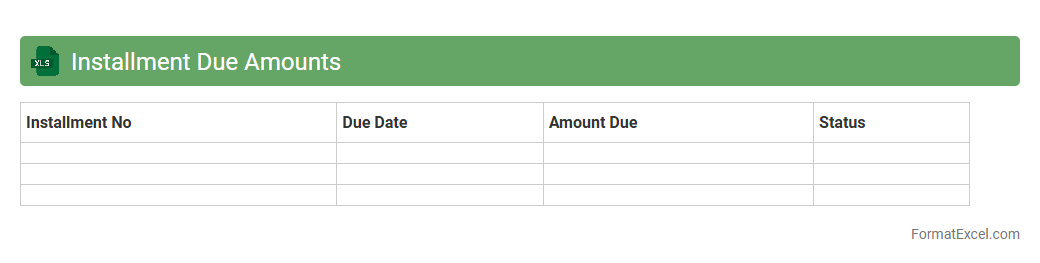

Installment Due Amounts

The

Installment Due Amounts Excel document is a financial tracking tool designed to organize and monitor scheduled payments for loans or purchases. It provides a clear summary of each installment's due date, amount, and outstanding balance, enabling users to manage cash flow effectively and avoid late fees. By consolidating payment data in one place, it enhances budgeting accuracy and supports timely financial decision-making.

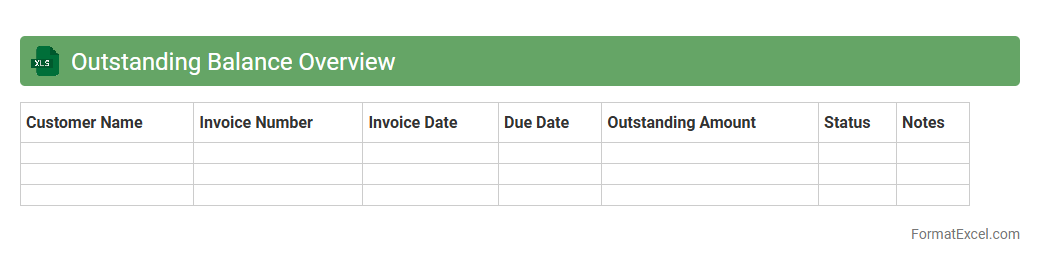

Outstanding Balance Overview

The

Outstanding Balance Overview Excel document is a comprehensive financial tool that tracks and summarizes unpaid amounts across various accounts or clients, providing clear visibility into pending receivables and payables. It consolidates data such as invoice dates, due amounts, and payment statuses, enabling users to monitor cash flow effectively and prioritize follow-ups. This document is essential for maintaining accurate financial records, improving debt collection processes, and supporting strategic decision-making in business operations.

Payment Frequency Tracker

The

Payment Frequency Tracker Excel document is a tool designed to monitor and record the timing and regularity of payments across various accounts or vendors. It helps users identify payment patterns, avoid late fees, and improve cash flow management by providing clear visibility into recurring payment schedules. Businesses and individuals benefit from its ability to streamline financial planning and ensure timely payments through systematic tracking and analysis.

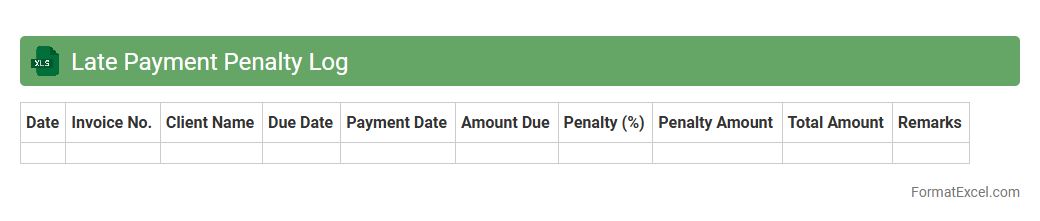

Late Payment Penalty Log

The

Late Payment Penalty Log Excel document is a structured spreadsheet designed to track and record instances of delayed payments along with corresponding penalties. It helps organizations maintain accurate records of overdue accounts, calculate penalty charges consistently, and monitor payment compliance efficiently. This log enhances financial accountability and supports timely follow-up actions to improve cash flow management.

Early Payment Discount Tracker

The

Early Payment Discount Tracker Excel document is a specialized tool designed to monitor and manage supplier payment terms to maximize discounts offered for early invoice settlements. It helps businesses systematically record due dates, discount percentages, and payment timelines, ensuring timely payments that improve cash flow and reduce expenses. By providing clear visibility on discount opportunities, the tracker supports strategic decision-making to optimize working capital and enhance vendor relationships.

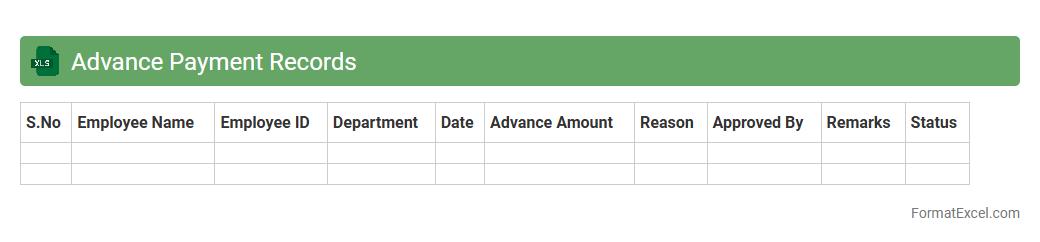

Advance Payment Records

An

Advance Payment Records Excel document systematically tracks prepayments made to vendors or employees, ensuring transparency and accurate financial management. It helps monitor outstanding advances, reconcile payments with expenses, and maintain up-to-date records for auditing purposes. This tool improves cash flow control by providing clear visibility into advance disbursements and their subsequent settlements.

Partial Payment Tracking

A

Partial Payment Tracking Excel document is a tool designed to monitor and record installment payments made towards outstanding invoices or debts. It helps businesses maintain accurate financial records by showing remaining balances, payment dates, and amounts paid, ensuring transparency and accountability. Utilizing this document improves cash flow management and simplifies the reconciliation process with customers or vendors.

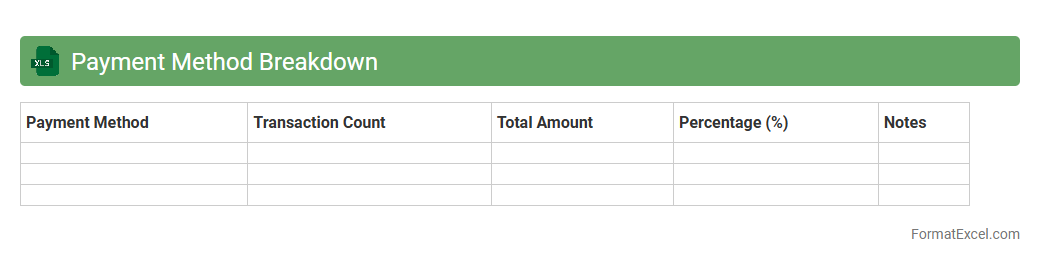

Payment Method Breakdown

The

Payment Method Breakdown Excel document provides a detailed analysis of various payment options used by customers, categorizing transactions by credit card, debit card, digital wallets, and other methods. This breakdown helps businesses track payment trends, optimize cash flow management, and identify the most preferred payment channels for improving customer experience. By leveraging this data, companies can make informed financial decisions and tailor their payment strategies to increase efficiency and reduce processing costs.

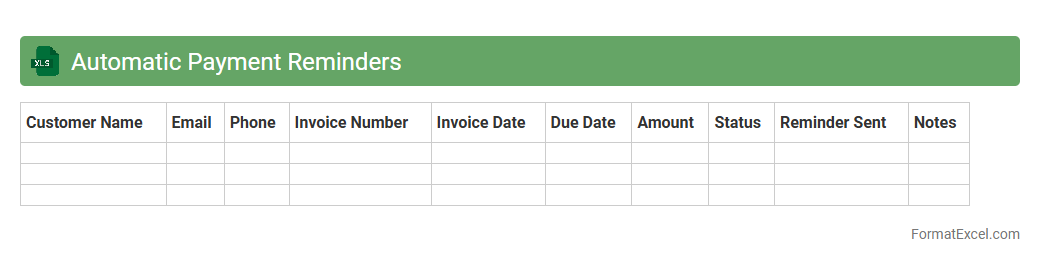

Automatic Payment Reminders

An

Automatic Payment Reminders Excel document is a tool designed to schedule and track payment deadlines, generating alerts to ensure timely transactions. It helps businesses and individuals maintain financial discipline by reducing late payments and improving cash flow management. Using this document enhances organization and accountability, minimizing the risk of missed payments and associated penalties.

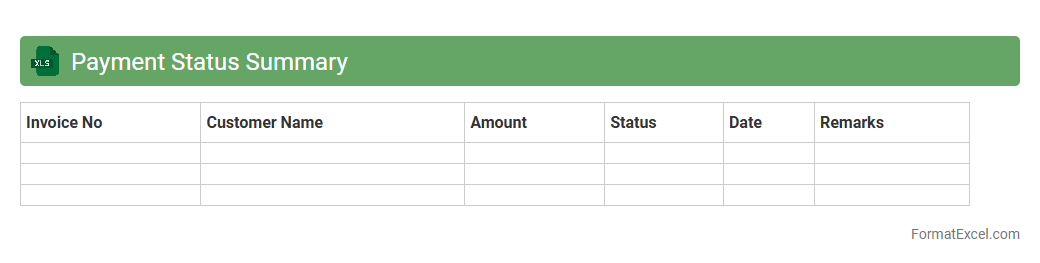

Payment Status Summary

A

Payment Status Summary Excel document provides a comprehensive overview of all payment transactions, including pending, completed, and overdue payments. It helps businesses track financial flows efficiently, identify payment delays, and manage cash flow effectively. By consolidating payment data, this document enables informed decision-making and improves financial accountability.

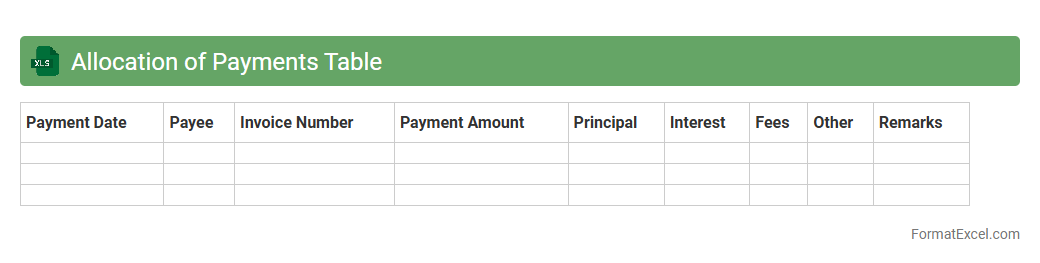

Allocation of Payments Table

The

Allocation of Payments Table Excel document systematically organizes payment data, allowing users to track how funds are distributed across various accounts or expenses. It helps businesses and individuals maintain accurate financial records by clearly showing payment sources, amounts, and applied balances. This tool improves budgeting accuracy, financial analysis, and ensures transparent payment tracking for better decision-making.

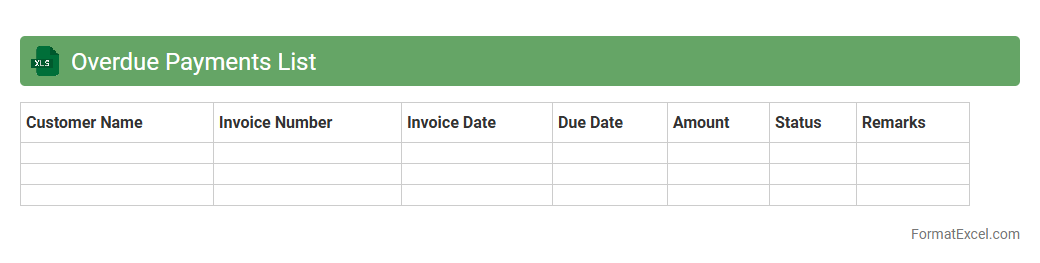

Overdue Payments List

The

Overdue Payments List Excel document is a comprehensive tool that tracks outstanding invoices and payment deadlines. It helps businesses monitor client payment statuses, prioritize collections, and manage cash flow effectively. By organizing financial data clearly, this document reduces the risk of missed payments and supports timely financial decision-making.

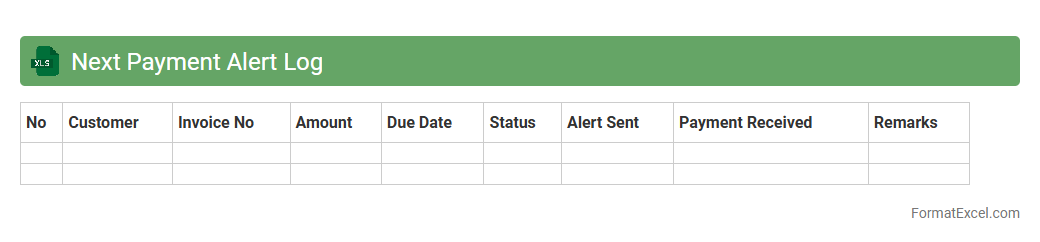

Next Payment Alert Log

The

Next Payment Alert Log Excel document tracks upcoming payment dates, ensuring timely reminders for financial obligations. It helps monitor payment schedules, reducing missed deadlines and improving cash flow management. By consolidating payment information in one place, the log enhances organization and financial planning efficiency.

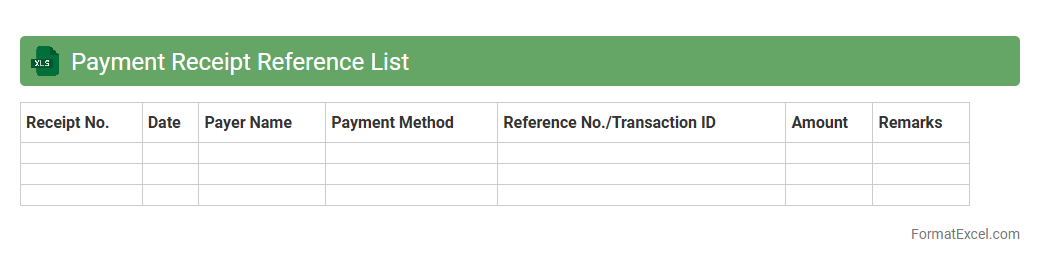

Payment Receipt Reference List

A

Payment Receipt Reference List Excel document is a structured spreadsheet that records and organizes payment receipts, including dates, amounts, payers, and transaction references. It is useful for tracking financial transactions, ensuring accurate record-keeping, and simplifying auditing or reconciliation processes by providing a clear overview of all received payments. This document enhances efficiency in financial management and reduces errors in accounting workflows.

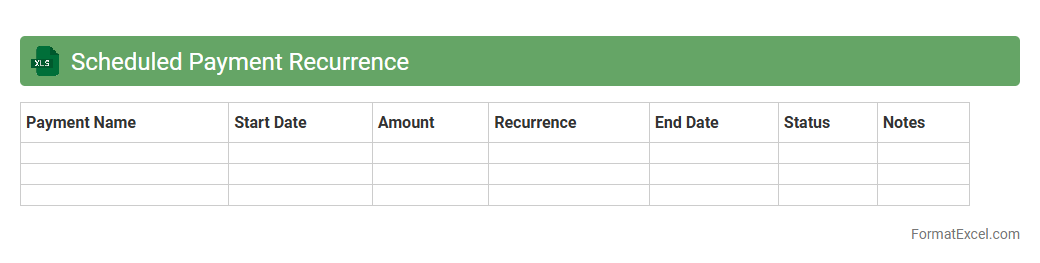

Scheduled Payment Recurrence

The

Scheduled Payment Recurrence Excel document is a tool designed to automate the tracking and management of recurring payments, helping users maintain consistent financial records. It allows the user to set payment intervals, amounts, and due dates, reducing the risk of missed payments and improving budget forecasting. By providing a clear overview of scheduled transactions, it enhances financial planning and cash flow management for both personal and business use.

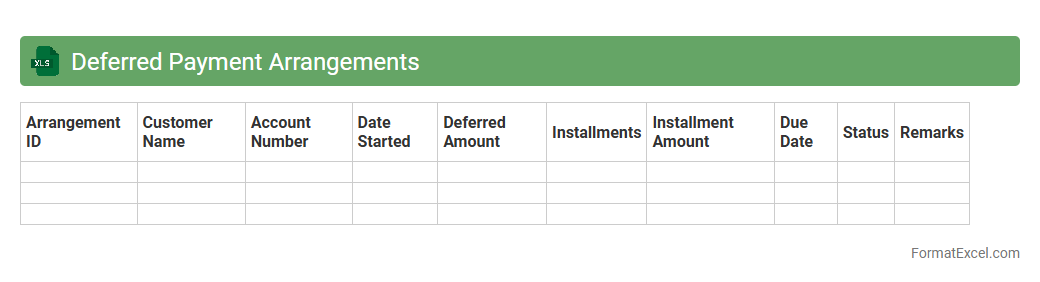

Deferred Payment Arrangements

A

Deferred Payment Arrangements Excel document is a structured spreadsheet designed to track and manage agreements where payments are postponed to a later date. It allows users to monitor scheduled payment dates, outstanding balances, and interest calculations, thereby ensuring accurate financial planning and cash flow management. This tool is essential for businesses and individuals aiming to maintain organized records of delayed payments while minimizing the risk of missed or late payments.

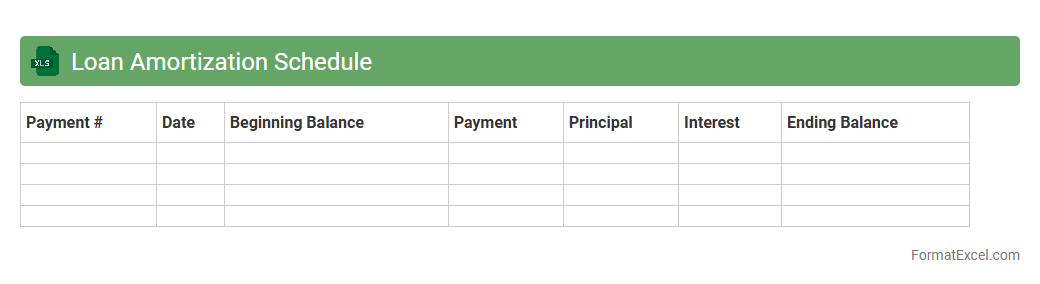

Loan Amortization Schedule

A

Loan Amortization Schedule Excel document is a detailed spreadsheet that breaks down each loan payment into principal and interest components over the loan term. It helps borrowers visualize the repayment process by showing payment dates, outstanding balances, and interest amounts, enabling better financial planning. This tool is essential for managing budgets, forecasting loan costs, and understanding the impact of extra payments on loan duration and total interest paid.

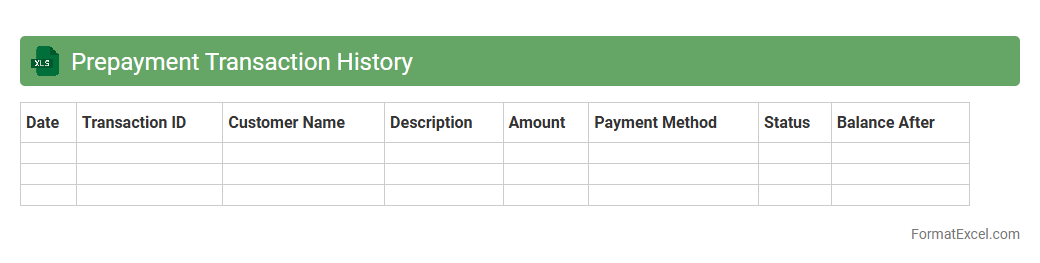

Prepayment Transaction History

A

Prepayment Transaction History Excel document records all advance payments made by a customer or organization, detailing dates, amounts, and related invoices. This document helps track financial activities, ensuring accurate reconciliation of prepaid amounts against outstanding balances. It is useful for budgeting, forecasting cash flow, and maintaining transparent financial records.

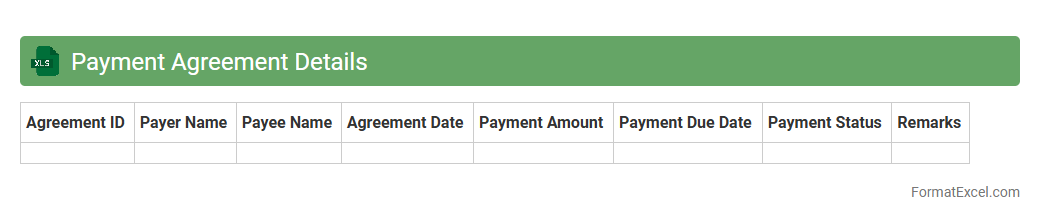

Payment Agreement Details

The

Payment Agreement Details Excel document organizes comprehensive data on payment terms, schedules, and parties involved, ensuring clear visibility of financial obligations. It streamlines tracking of agreed payments, facilitating timely follow-ups and reducing risks of missed or delayed transactions. Businesses use this document to maintain accountability, enhance cash flow management, and support accurate financial reporting.

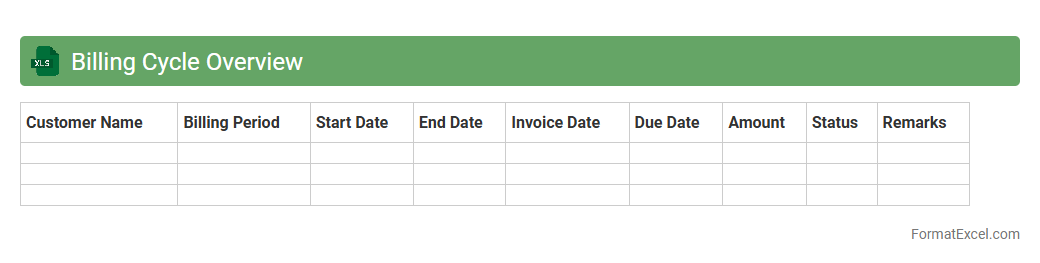

Billing Cycle Overview

The

Billing Cycle Overview Excel document provides a detailed summary of billing periods, payment due dates, and transaction records, allowing users to track financial obligations efficiently. This tool helps businesses monitor cash flow, avoid late payments, and maintain organized financial records. By consolidating billing data into one accessible spreadsheet, it simplifies the reconciliation process and improves budgeting accuracy.

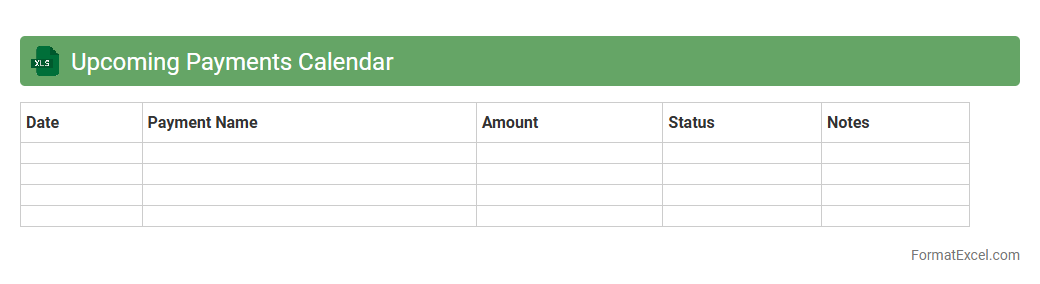

Upcoming Payments Calendar

The

Upcoming Payments Calendar Excel document organizes and tracks all scheduled payments, ensuring timely bill settlements and cash flow management. It helps users anticipate due dates, avoid late fees, and maintain financial discipline by providing a clear overview of upcoming financial obligations. This tool is essential for budgeting and forecasting, allowing businesses and individuals to plan expenses effectively.

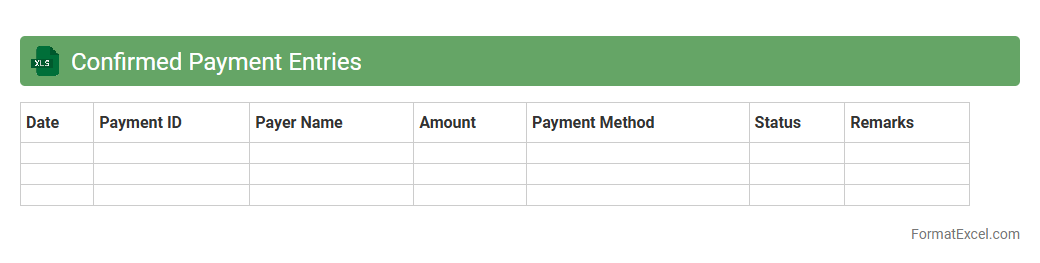

Confirmed Payment Entries

The

Confirmed Payment Entries Excel document tracks verified transactions, ensuring accuracy in financial records and facilitating efficient reconciliation processes. It consolidates payment details such as dates, amounts, and payer information, enabling quick verification and reporting for auditing purposes. This tool is essential for maintaining transparent cash flow management and supporting financial decision-making.

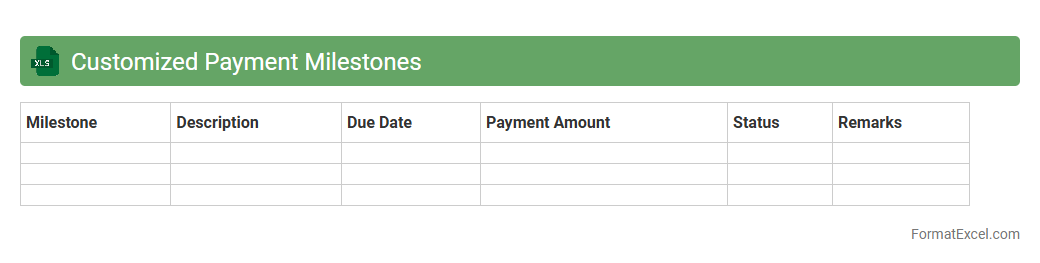

Customized Payment Milestones

A

Customized Payment Milestones Excel document is a tailored financial tracking tool designed to outline specific payment schedules and deadlines for projects or contracts. It helps businesses monitor payment progress, ensuring timely invoicing and receipt of funds, which improves cash flow management. This document enhances transparency between stakeholders by clearly defining payment terms and milestone achievements.

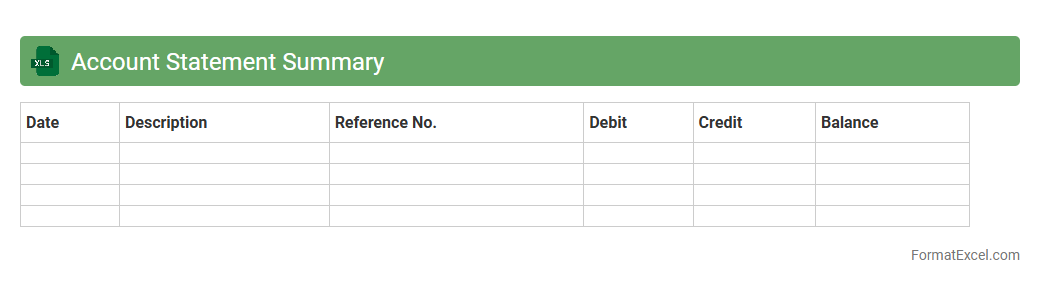

Account Statement Summary

An

Account Statement Summary Excel document consolidates transaction data, balances, and financial activities into an organized, easy-to-read format. It allows users to quickly review account performance, track expenses, and reconcile discrepancies, enhancing financial management and decision-making. Access to summarized data in Excel supports efficient analysis and reporting for personal or business accounts.

Introduction to Payment Schedule Lists

A payment schedule list is a structured timeline that details payment amounts and due dates, helping manage financial obligations efficiently. It ensures transparency and aids in tracking expenses and income. Using such lists improves financial planning and accountability.

Benefits of Using Excel for Payment Schedules

Excel offers flexibility and powerful tools for creating and managing payment schedules. Its capacity for data organization, calculation automation, and customization makes it ideal for tracking payment schedules. Additionally, Excel's user-friendly interface supports error reduction and timely reminders.

Key Components of a Payment Schedule List

A well-designed payment schedule includes key components such as payment dates, amounts, payee details, and status indicators. These elements ensure comprehensive tracking of financial transactions. Ensuring accurate payment tracking is essential for effective budget management.

Step-by-Step Guide to Creating a Payment Schedule in Excel

Start by listing all payment items with respective due dates and amounts in Excel columns. Then, apply formulas and conditional formatting to highlight upcoming payments. This step-by-step method results in a clear and functional payment schedule.

Essential Columns for Payment Tracking

Key Excel columns for payment tracking include Payment Date, Amount, Payee, Payment Method, and Status. These columns provide essential data for monitoring and reconciliation purposes. Tracking payment status helps avoid missed or late payments.

Formatting Tips for Clear Payment Schedules

Use bold headers, alternating row colors, and conditional formatting to enhance readability. Formatting ensures that crucial details, like due dates and overdue payments, stand out. Clear visual formatting aids quick decision-making and reduces errors.

Automating Due Dates and Reminders in Excel

Leverage Excel formulas and conditional formatting to automate due date notifications and reminders. Setting alerts for upcoming or overdue payments helps maintain timely payment management. Automation minimizes manual oversight and enhances efficiency.

Using Formulas for Payment Calculations

Excel formulas like SUM, IF, and VLOOKUP facilitate accurate payment calculations and status updates. These functions automate totals, conditional checks, and data retrieval within the payment schedule. Utilizing Excel formulas optimizes accuracy and saves time.

Customizable Excel Payment Schedule Templates

Excel templates provide pre-built structures for different payment scheduling needs, which can be customized easily. Templates streamline setup and ensure consistency across payment schedules. Employing customizable templates saves time and enhances professionalism.

Best Practices for Maintaining Payment Schedules

Regularly update payment records, verify due dates, and review status for accuracy. Consistent maintenance of the payment schedule prevents errors and supports effective financial control. Establishing a routine check system ensures ongoing reliability.