Personal Expenses Tracking

A

Personal Expenses Tracking Excel document is a digital tool designed to record, organize, and analyze individual spending habits. It helps users monitor their financial activities by categorizing expenses, setting budgets, and identifying trends over time, which enhances money management and savings potential. Utilizing this spreadsheet promotes financial awareness and supports more informed decisions to achieve financial goals efficiently.

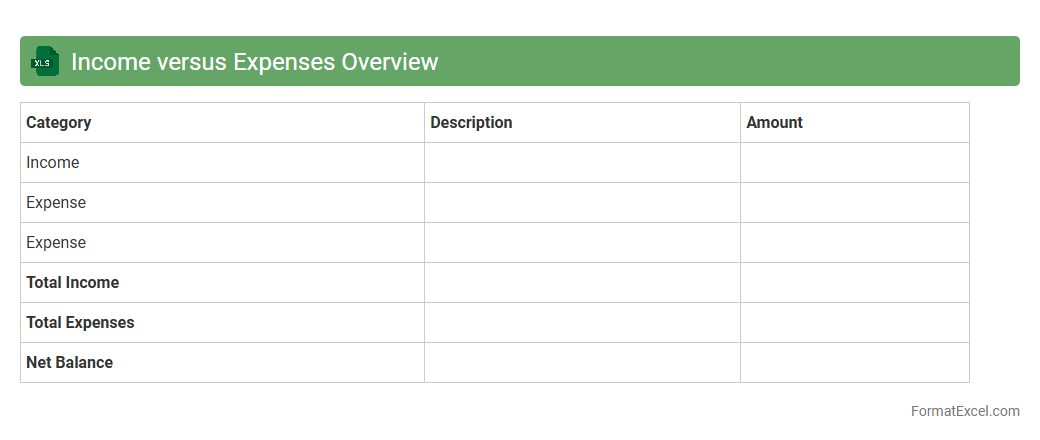

Income versus Expenses Overview

The

Income versus Expenses Overview Excel document is a financial tool that tracks and compares all income sources against expenditures, providing a clear snapshot of cash flow. It helps individuals and businesses monitor budgeting, identify spending patterns, and make informed financial decisions. By summarizing data visually through charts and tables, this overview facilitates better financial planning and control.

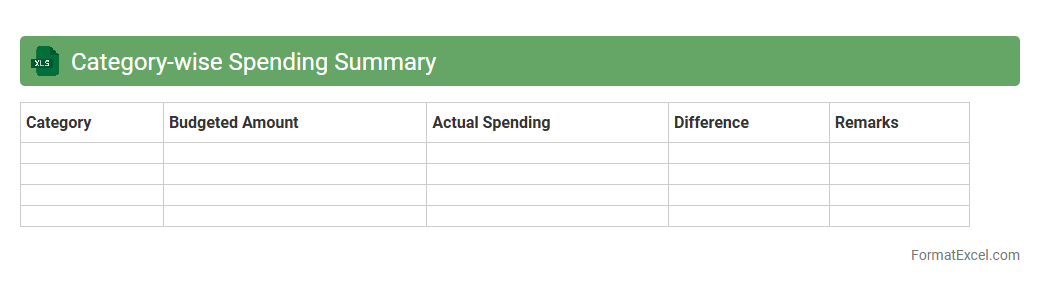

Category-wise Spending Summary

The

Category-wise Spending Summary Excel document organizes expenses into distinct categories, providing a clear overview of where funds are allocated over a specific period. This summary enables users to identify spending patterns, manage budgets effectively, and make informed financial decisions. By highlighting category-wise expenditures, it helps prioritize savings and optimize resource allocation for better financial health.

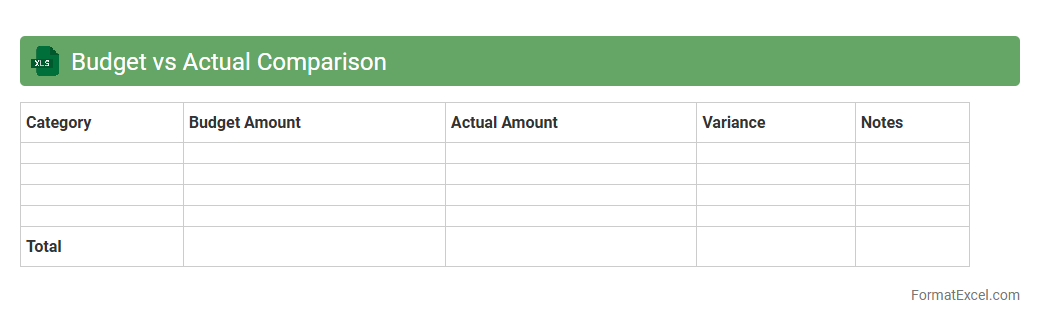

Budget vs Actual Comparison

A

Budget vs Actual Comparison Excel document is a financial tool that tracks planned budget amounts against actual expenditures, enabling precise monitoring of financial performance. This comparison highlights variances between expected and real costs, facilitating better decision-making and resource allocation. Businesses use it to control spending, improve forecasting accuracy, and ensure alignment with financial goals.

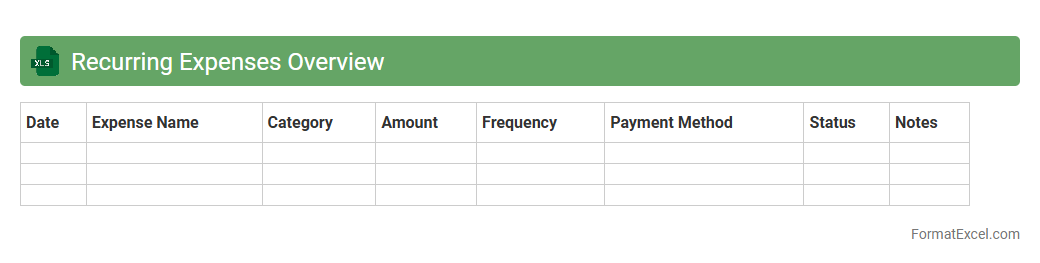

Recurring Expenses Overview

The

Recurring Expenses Overview Excel document tracks and categorizes regular financial obligations such as rent, utilities, and subscriptions, providing a clear snapshot of ongoing costs. It enables better budgeting by forecasting monthly and annual expenditures, helping users manage cash flow efficiently. This document supports informed decision-making by highlighting trends and identifying opportunities to reduce unnecessary expenses.

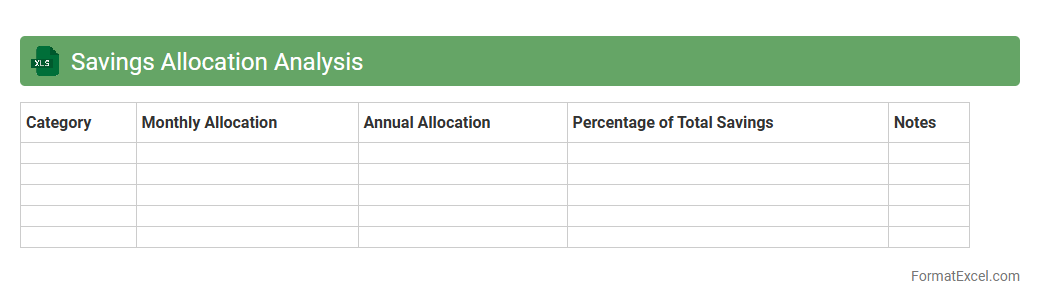

Savings Allocation Analysis

Savings Allocation Analysis excel document is a powerful tool designed to track and evaluate the distribution of savings across different categories or accounts. It helps users visualize where their money is being saved, identify patterns, and make informed decisions to optimize their financial growth. By offering detailed insights and clear data representation, this document plays a crucial role in improving budget management and enhancing overall savings strategies.

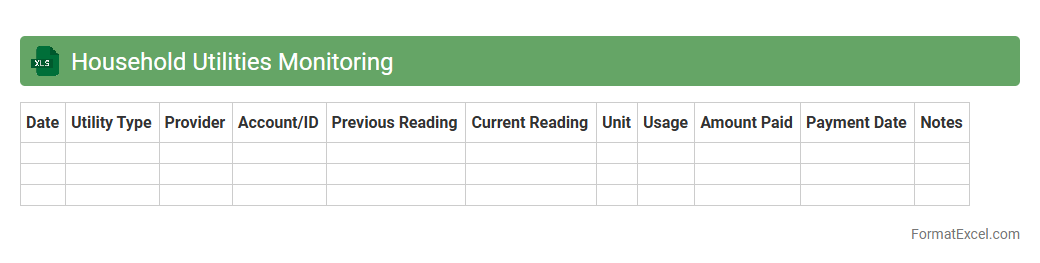

Household Utilities Monitoring

A

Household Utilities Monitoring Excel document is a tool designed to track and analyze consumption of water, electricity, gas, and other utilities in a household. It helps users identify patterns, manage budgets, and reduce waste by providing clear insights into monthly usage and costs. This document facilitates informed decision-making for optimizing utility expenses and promoting sustainability.

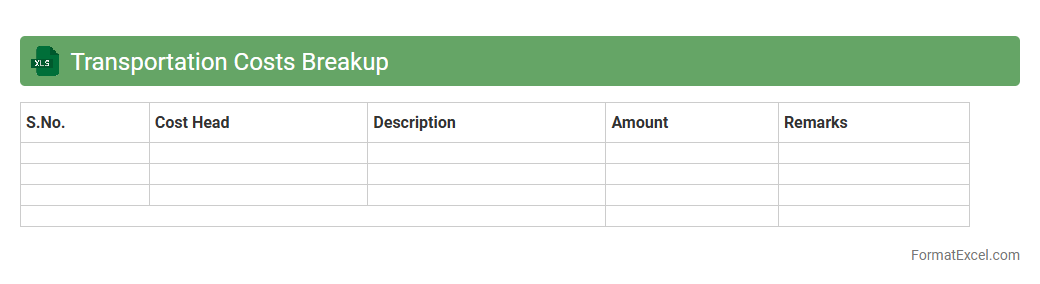

Transportation Costs Breakup

The

Transportation Costs Breakup Excel document itemizes expenses related to shipping, fuel, labor, and vehicle maintenance, providing a detailed overview of all transportation-related expenditures. This breakdown allows businesses to analyze cost drivers, identify inefficiencies, and optimize budgeting for logistics operations. Accurate cost segregation enhances decision-making, aids in negotiating contracts, and supports financial forecasting in supply chain management.

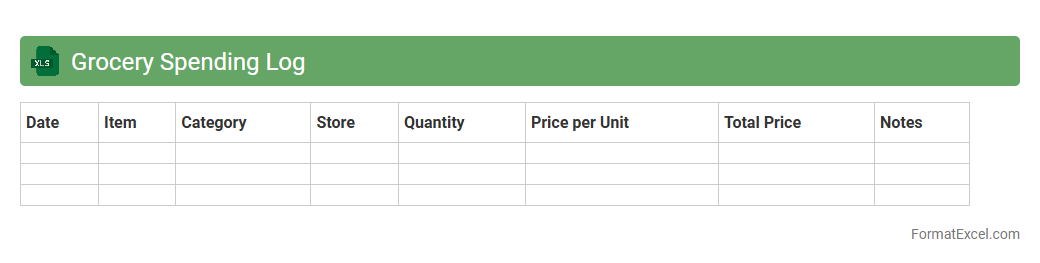

Grocery Spending Log

A

Grocery Spending Log Excel document is a digital tool designed to track and organize grocery expenses systematically. It helps users monitor their spending patterns, manage budgets efficiently, and identify areas to reduce costs by categorizing purchases. This log provides clear insights into monthly or weekly expenditures, promoting informed financial decisions and minimizing unnecessary spending.

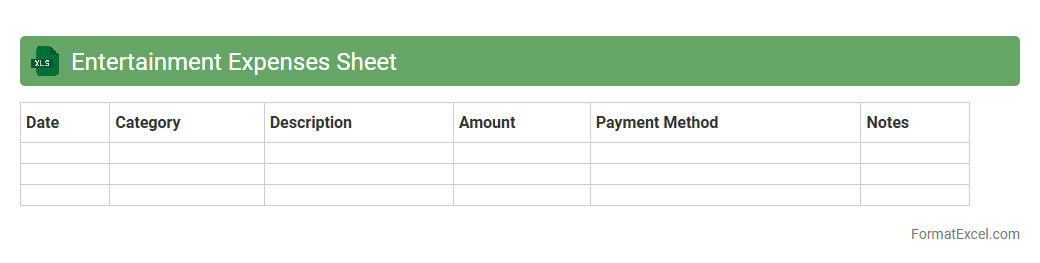

Entertainment Expenses Sheet

An

Entertainment Expenses Sheet in Excel is a structured document designed to track and manage costs related to client entertainment, business meals, and event hosting. It helps businesses maintain accurate records for budgeting, tax deductions, and financial reporting by categorizing expenses and providing clear summaries. This tool enhances financial transparency and control, ensuring all entertainment-related expenditures are monitored effectively.

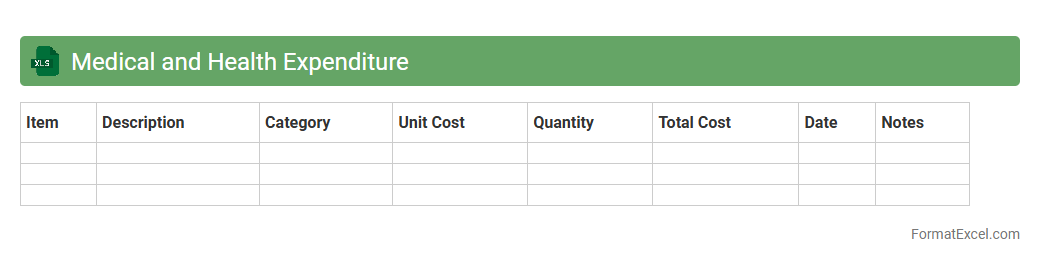

Medical and Health Expenditure

The

Medical and Health Expenditure Excel document is a structured tool designed to track, analyze, and manage healthcare-related costs effectively. It organizes expenses such as hospital bills, medication costs, insurance payments, and preventive care fees, allowing users to monitor spending patterns and identify potential savings. This document is invaluable for budgeting personal or organizational healthcare expenses, ensuring financial transparency and informed decision-making.

Debt Repayment Tracker

A

Debt Repayment Tracker Excel document is a customizable spreadsheet designed to monitor outstanding debts, payments made, interest rates, and remaining balances. It helps users organize financial data, set repayment goals, and visualize progress through charts or graphs. This tool promotes responsible money management by enabling clear insight into debt reduction timelines and prioritizing payments effectively.

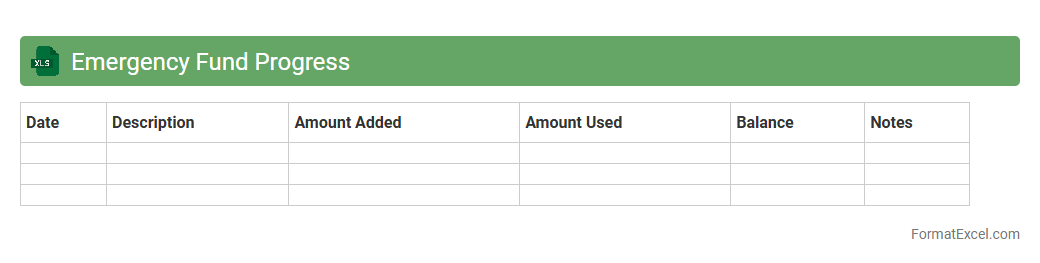

Emergency Fund Progress

The

Emergency Fund Progress Excel document tracks savings growth toward a predefined financial safety net, allowing users to monitor monthly contributions and overall fund status. It provides visual charts and detailed breakdowns to help individuals assess their preparedness for unexpected expenses, promoting better financial stability. Regular use of this tool fosters disciplined saving habits and informed decision-making in personal finance management.

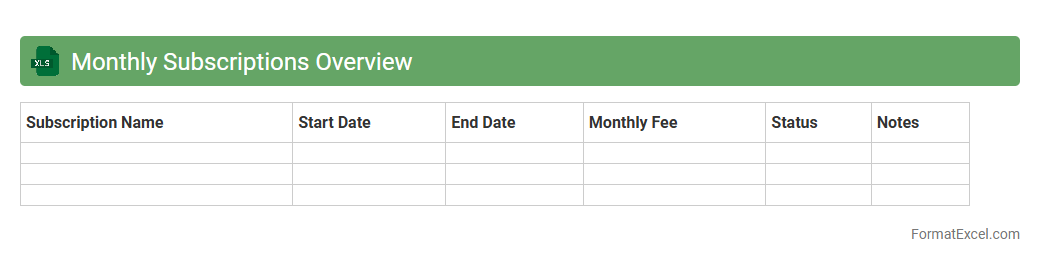

Monthly Subscriptions Overview

The

Monthly Subscriptions Overview Excel document provides a detailed summary of subscription metrics, including active users, revenue, churn rates, and growth trends. It helps businesses track performance, identify patterns, and make data-driven decisions to optimize customer retention and profitability. By consolidating key subscription data, this tool enhances forecasting accuracy and supports strategic planning.

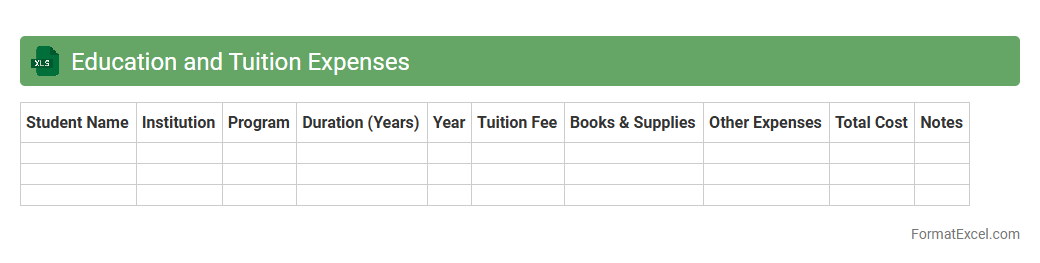

Education and Tuition Expenses

The

Education and Tuition Expenses Excel document is a structured digital tool designed to track, organize, and analyze spending related to educational fees. It enables users to manage tuition payments, monitor scholarship allocations, and forecast future education costs efficiently. This document helps families, students, and financial planners control budgets and optimize financial aid opportunities for academic investments.

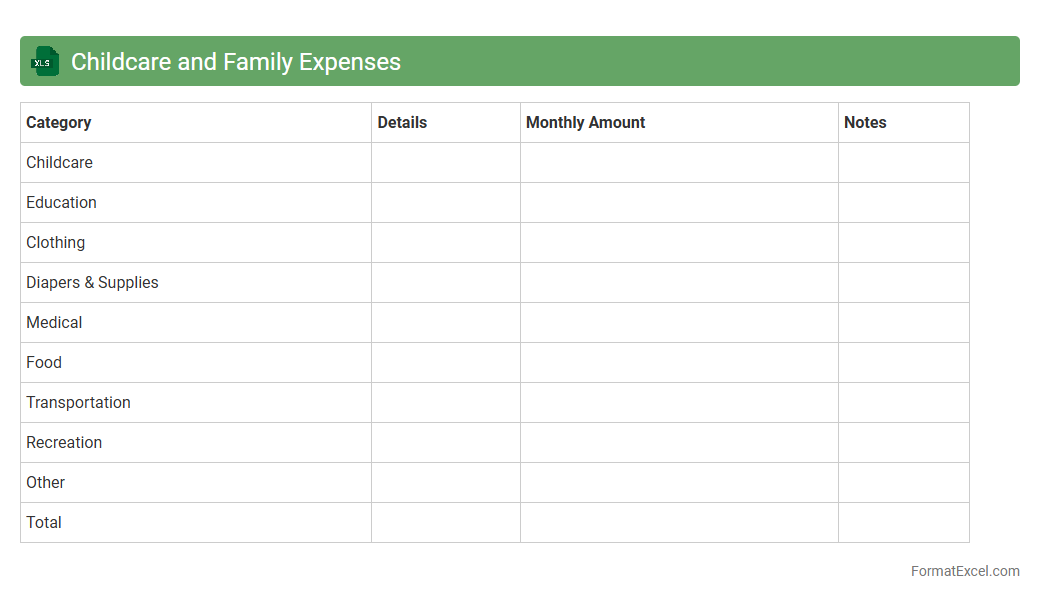

Childcare and Family Expenses

The

Childcare and Family Expenses Excel document is a structured spreadsheet designed to track, organize, and manage household costs related to childcare and family needs. It helps users monitor expenses such as daycare fees, school supplies, medical bills, and other routine family expenditures, ensuring a clear overview of spending patterns. By enabling detailed financial tracking, this document supports budgeting efforts, helps identify saving opportunities, and facilitates better financial planning for families.

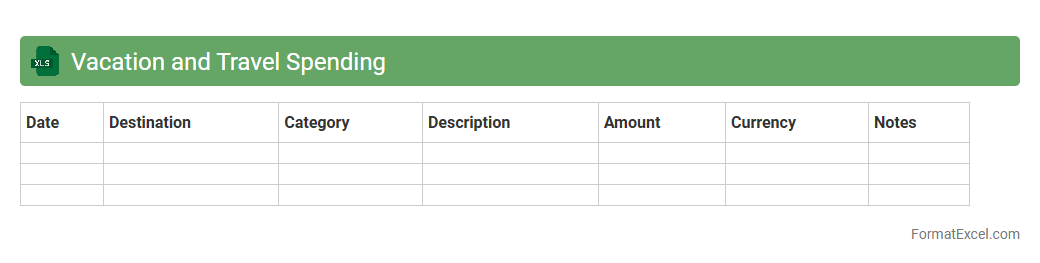

Vacation and Travel Spending

The

Vacation and Travel Spending Excel document is a structured tool designed to track and manage expenses related to trips and holidays. It provides detailed categories for accommodation, transportation, meals, and entertainment, enabling users to monitor their budget and avoid overspending. By organizing travel costs in one place, it offers valuable insights for future trip planning and financial control.

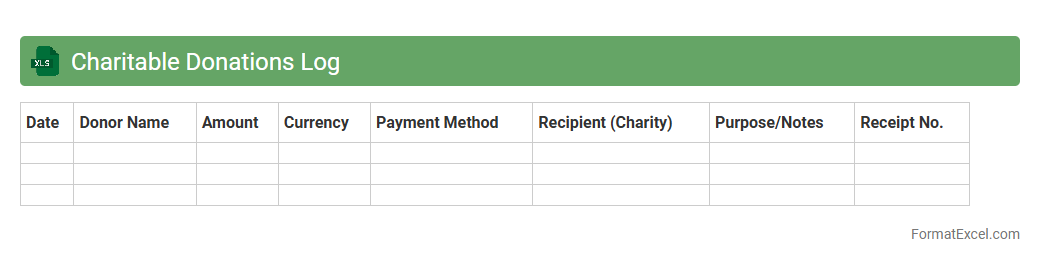

Charitable Donations Log

A

Charitable Donations Log Excel document is a structured spreadsheet designed to record and track all charitable contributions made by an individual or organization, including details like donor names, donation amounts, dates, and causes supported. It provides a clear overview of giving patterns, aiding in financial management, tax filing, and ensuring compliance with legal requirements. This organized record-keeping enhances transparency, simplifies reporting, and helps maximize tax deductions through accurate documentation.

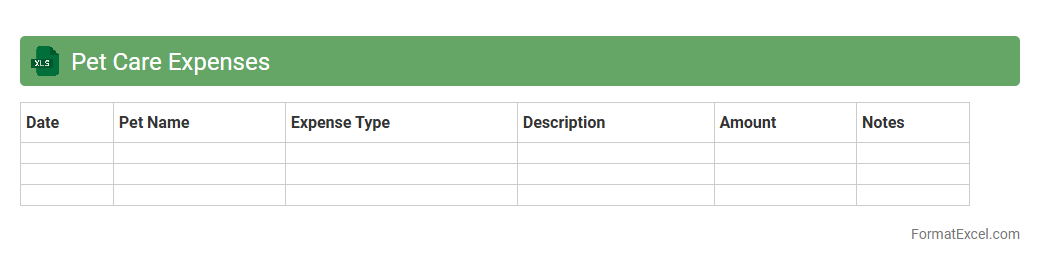

Pet Care Expenses

The

Pet Care Expenses Excel document is a detailed spreadsheet designed to track and manage all costs associated with pet ownership, including food, veterinary bills, grooming, and medication. It helps pet owners maintain an organized budget, identify spending patterns, and plan for future expenses to ensure their pets receive consistent, quality care. This tool provides valuable financial insights that promote responsible pet care and reduce unexpected costs.

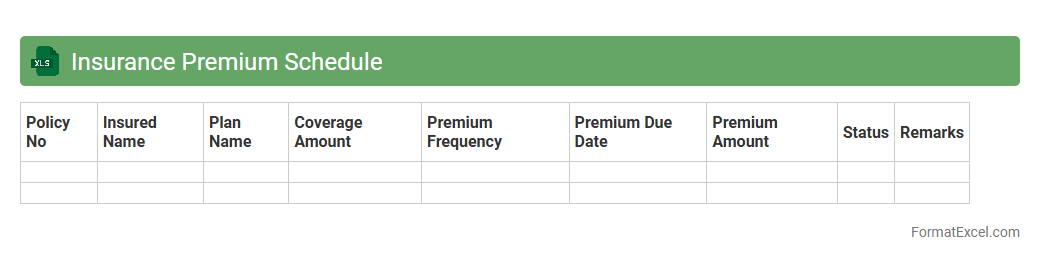

Insurance Premium Schedule

An

Insurance Premium Schedule Excel document organizes detailed information about insurance policies, including premium amounts, payment dates, and coverage periods. It helps individuals and businesses track timely payments, avoid lapses in coverage, and compare premium costs across different policies efficiently. This tool enhances financial planning by providing a clear overview of insurance expenses and due dates.

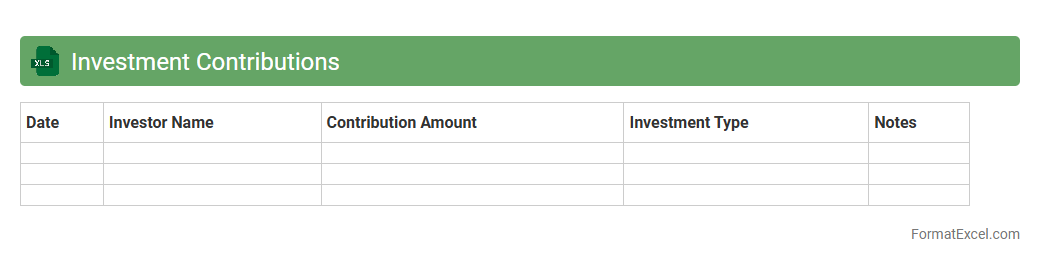

Investment Contributions

An

Investment Contributions Excel document is a spreadsheet designed to track and analyze financial inputs into various investment accounts or portfolios. It helps users monitor contribution amounts, dates, and growth over time, enabling better financial planning and performance assessment. This tool is essential for maintaining organized records and making informed decisions to optimize investment returns.

Credit Card Payments Tracker

A

Credit Card Payments Tracker Excel document is a tool designed to monitor and organize your credit card transactions, due dates, and payment statuses efficiently. It helps users avoid late fees and interest charges by providing clear visibility of outstanding balances and payment deadlines. This tracker improves financial management by enabling timely payments and better budgeting through detailed expense categorization.

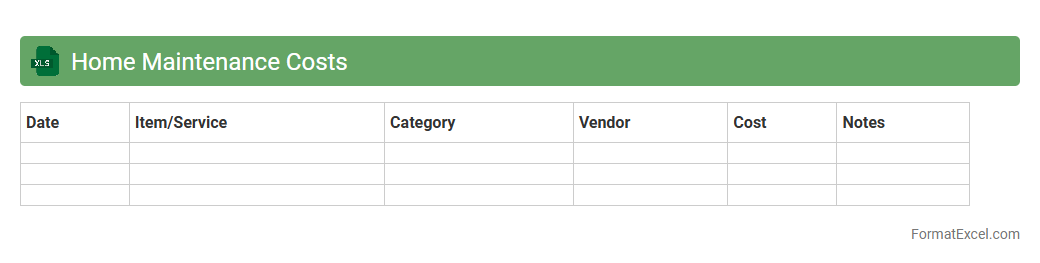

Home Maintenance Costs

The

Home Maintenance Costs Excel document is a detailed spreadsheet designed to track and manage expenses related to the upkeep of a property. It allows homeowners to organize costs by category, monitor budgeting, and predict future maintenance needs efficiently. This tool helps prevent unexpected financial burdens by providing a clear overview of all maintenance activities and associated expenditures.

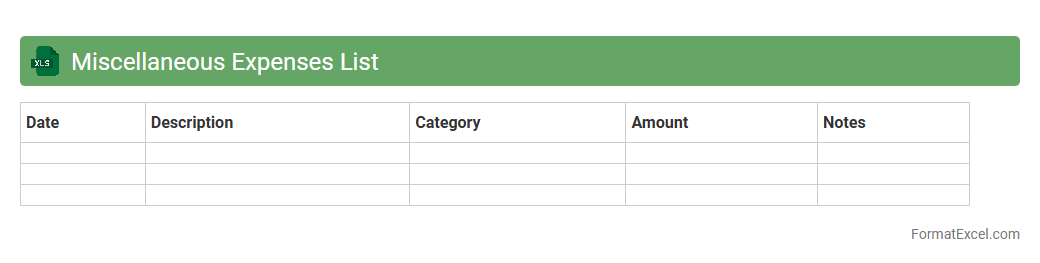

Miscellaneous Expenses List

A

Miscellaneous Expenses List Excel document organizes and tracks various small or irregular expenses that do not fit into standard categories, ensuring comprehensive financial management. It helps users monitor spending patterns, maintain accurate budgeting, and generate detailed reports for better expense control. This tool is essential for individuals or businesses aiming to prevent overlooked costs and improve overall financial transparency.

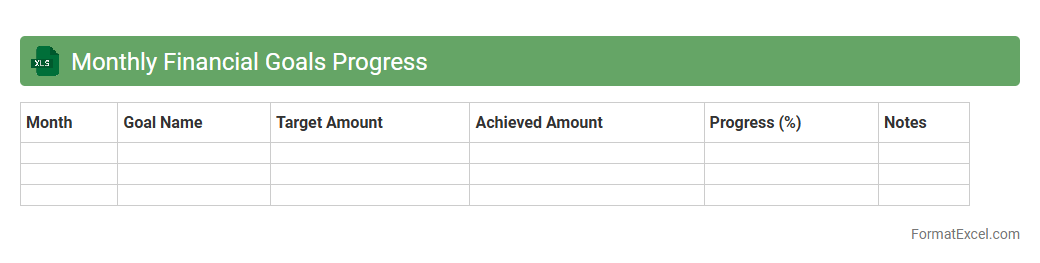

Monthly Financial Goals Progress

The

Monthly Financial Goals Progress Excel document tracks income, expenses, savings, and investment targets to help manage personal or business finances efficiently. It provides clear visualization of financial performance against set goals, enabling better decision-making and timely adjustments. Regular use improves budgeting accuracy, promotes financial discipline, and supports long-term financial planning.

Introduction to Monthly Budget Format in Excel

The Monthly Budget Format in Excel provides a structured way to manage personal or business finances efficiently. It allows users to organize income, expenses, and savings goals clearly. This format helps visualize budgeting trends and financial health monthly.

Benefits of Using Excel for Budgeting

Excel offers powerful tools like formulas and charts that simplify budgeting and financial tracking. Its flexibility enables users to customize budgets based on personal needs without requiring advanced skills. Additionally, Excel's accessibility makes it a preferred choice for managing budgets effectively.

Essential Components of a Monthly Budget Spreadsheet

A standard monthly budget spreadsheet includes income sources, expense categories, savings goals, and a summary section. It is critical to have clearly labeled columns for tracking monthly income and expenses. Proper structuring ensures accurate data analysis and financial planning.

Step-by-Step Guide to Creating a Budget in Excel

Start by listing all income sources followed by categorizing fixed and variable expenses. Use Excel's built-in functions like SUM to calculate totals automatically for easy budget management. Finally, review the budget and adjust categories to fit financial goals better.

Downloadable Monthly Budget Excel Templates

Several free and premium budget templates are available for download, offering pre-built structures for quick setup. These templates usually include categorized expenses and income tracking for efficient monthly budgeting. Using a template saves time and provides proven formats to follow.

Customizing Categories for Personal Finance

Modify income and expense categories to fit your unique financial situation, such as adding specific bills or income streams. Customization ensures your budget reflects real-life spending and savings habits accurately. Tailored categories enhance budgeting relevance and control.

Using Formulas and Functions for Accurate Calculations

Excel's formulas like SUM, IF, and VLOOKUP help automate calculations and data organization for accuracy. Implementing these formulas reduces errors, providing reliable insights into your financial status. Mastery of functions is key to effective budgeting in Excel.

Tracking Income and Expenses Efficiently

Record all sources of income and every expense regularly to maintain accuracy. Utilize Excel tables and filters to analyze expenditure trends and identify potential savings for better financial management. Consistent tracking prevents budget overruns and supports goal achievement.

Tips for Maintaining and Updating Your Budget

Set a regular schedule to update your budget with new expenses and income changes. Review and adjust categories and limits monthly to keep the budget relevant and financially sustainable. Ongoing maintenance helps avoid surprises and promotes disciplined spending.

Frequently Asked Questions About Excel Budget Formats

Common questions include how to customize templates, use formulas, and troubleshoot errors in budgeting spreadsheets. Understanding these FAQs helps users maximize Excel's budgeting capabilities for effective money management. Access to tutorials and community forums can also provide additional support.