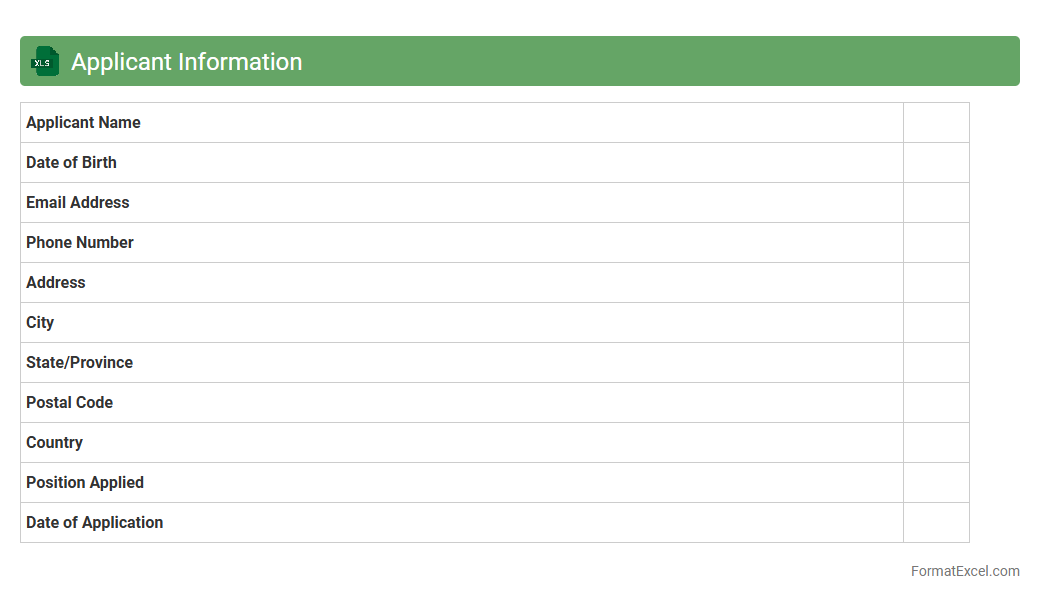

Applicant Information

The

Applicant Information Excel document systematically organizes candidate data, including names, contact details, qualifications, and application statuses, enabling efficient tracking and management throughout the recruitment process. It enhances decision-making by providing a clear overview of applicant pools, facilitating comparisons and quick access to essential information. This tool streamlines hiring workflows, reduces errors in data handling, and improves communication between HR teams and stakeholders.

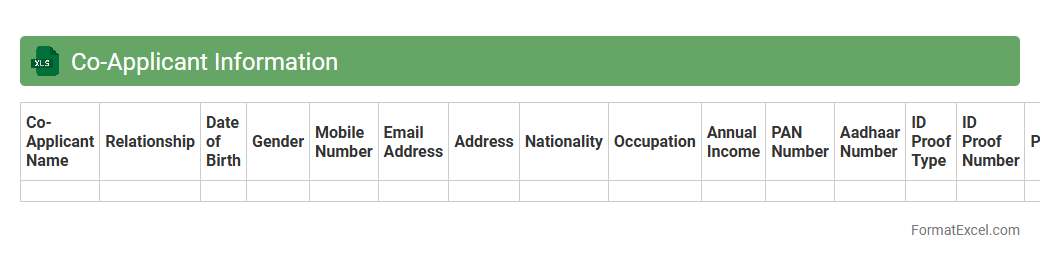

Co-Applicant Information

The

Co-Applicant Information Excel document is a structured file designed to collect and organize detailed data about individuals applying jointly for loans, mortgages, or credit. This document helps streamline the verification process by consolidating key personal, financial, and credit information, facilitating quicker decision-making and reducing errors. It enhances collaboration between lenders and clients by providing clear, accessible records of all co-applicant details in one place.

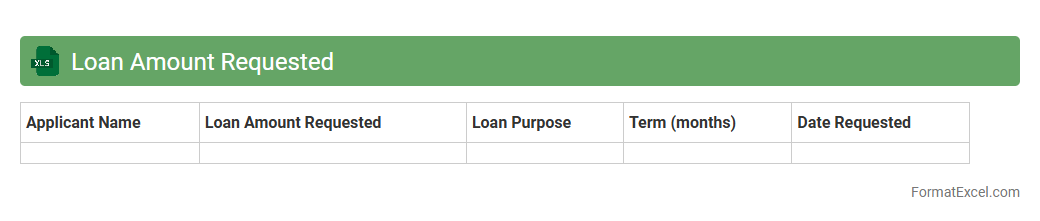

Loan Amount Requested

The

Loan Amount Requested Excel document is a structured spreadsheet used to track and manage loan applications by recording the exact amounts borrowers request. It provides a clear overview of funding needs, enabling more accurate financial planning and risk assessment for lenders. This tool enhances decision-making by organizing critical data such as borrower details, requested sums, and loan statuses in one accessible location.

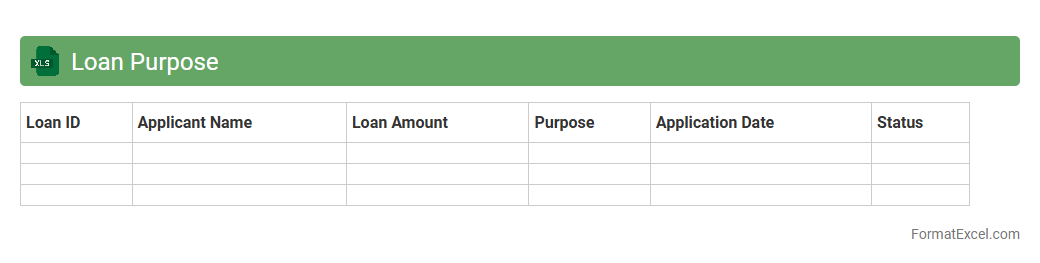

Loan Purpose

The

Loan Purpose Excel document organizes and categorizes various reasons borrowers seek loans, enabling clear tracking and analysis of financial requests. It helps financial institutions and loan officers assess risk, tailor loan products, and improve decision-making by providing structured data on loan purposes. This document enhances reporting accuracy and supports strategic planning by offering insights into borrowing trends and customer needs.

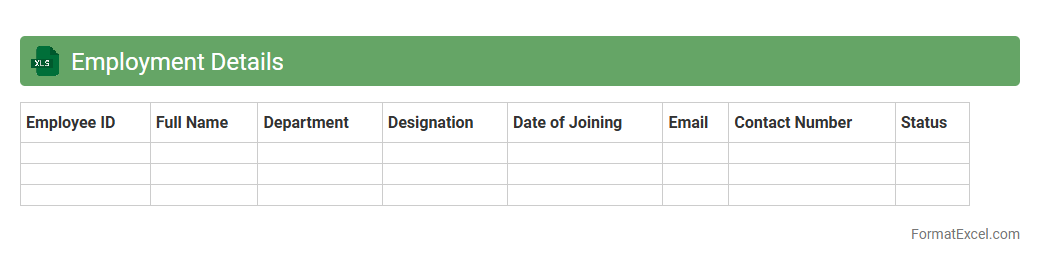

Employment Details

An

Employment Details Excel document is a structured spreadsheet that records comprehensive employee information, including job titles, hire dates, salaries, and department assignments. This document streamlines human resource management by enabling easy tracking of workforce data, facilitating payroll processing, and supporting compliance with labor regulations. Employers and HR professionals utilize it to analyze employment trends, optimize staffing, and maintain organized records for audits and employee performance reviews.

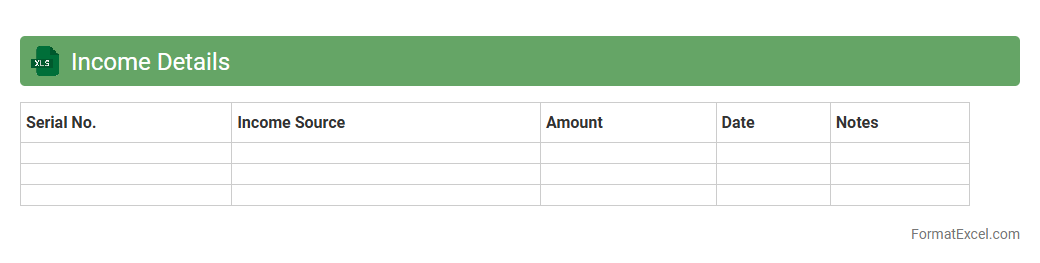

Income Details

An

Income Details Excel document is a structured spreadsheet used to systematically record and analyze various sources of income. It enables accurate tracking of earnings over time, which assists in budgeting, financial planning, and tax preparation. This organized approach enhances clarity in financial management by consolidating income data in one accessible and easily interpretable format.

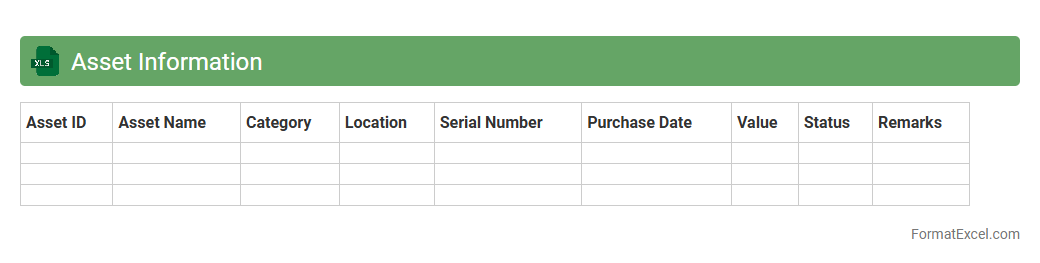

Asset Information

An

Asset Information Excel document is a structured spreadsheet used to systematically record, track, and manage details about physical or digital assets within an organization. It helps streamline asset management by consolidating information such as asset types, purchase dates, maintenance schedules, and value assessments in one accessible location. Utilizing this document enhances decision-making, improves asset lifecycle tracking, and optimizes resource allocation.

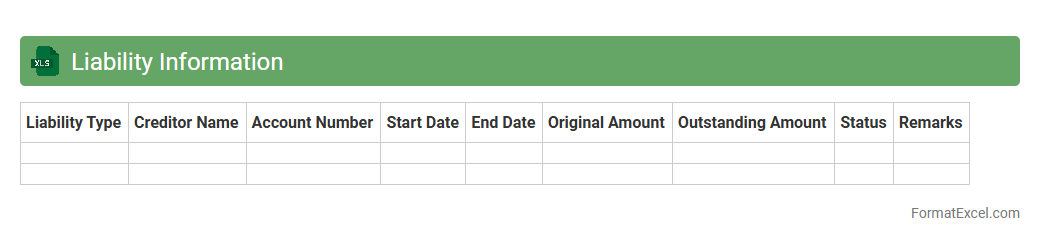

Liability Information

A

Liability Information Excel document is a structured spreadsheet that organizes and tracks all outstanding liabilities, including debts, loans, and financial obligations. It enables businesses and individuals to monitor payment schedules, amounts due, and creditor details efficiently. This tool supports effective financial management by providing clear visibility into liabilities, aiding in budgeting, risk assessment, and strategic decision-making.

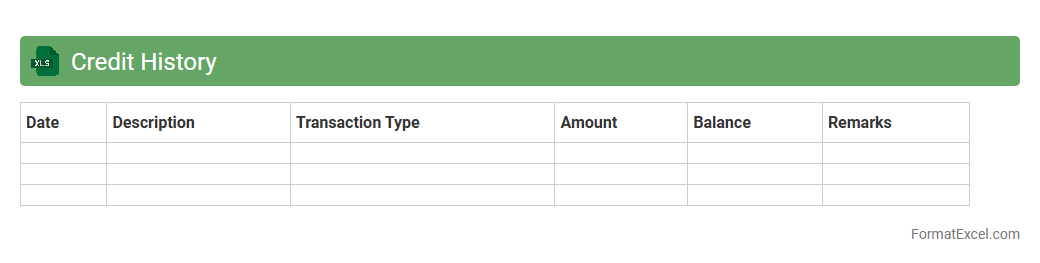

Credit History

A

Credit History Excel document organizes an individual's or business's credit transactions, payment dates, and outstanding balances to provide a clear overview of financial behavior. It is useful for tracking creditworthiness, managing debt, and preparing accurate reports for loan applications or financial planning. This document helps identify payment patterns and potential risks, enabling better decision-making for both creditors and borrowers.

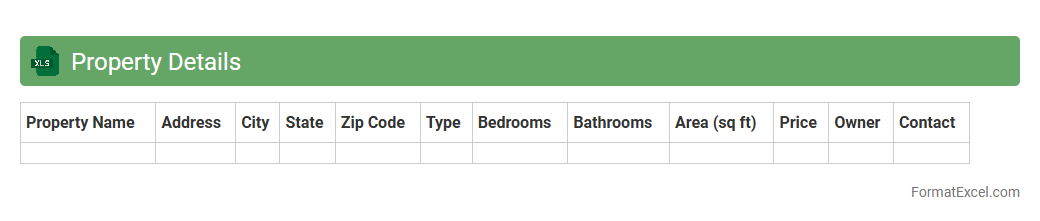

Property Details

A

Property Details Excel document is a structured spreadsheet that organizes key information about real estate assets, including property size, location, price, owner details, and transaction history. This document is essential for investors, real estate agents, and property managers to analyze market trends, track asset performance, and make informed decisions. Efficient data management within the Excel format enables easy sorting, filtering, and comparison of multiple properties, streamlining portfolio management and reporting processes.

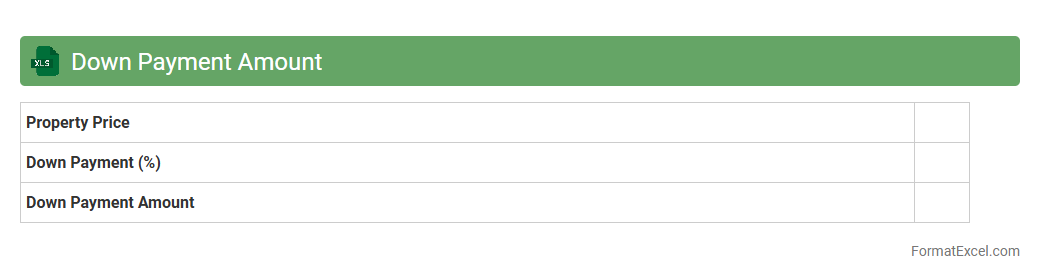

Down Payment Amount

The

Down Payment Amount Excel document calculates and tracks initial payment sums required for purchases or loans, streamlining financial planning and budgeting processes. It allows users to input variables such as total price, percentage down payment, and financing terms to automatically compute the exact upfront cost. This tool enhances decision-making accuracy by providing clear visibility into upfront financial commitments, aiding in efficient loan management and payment scheduling.

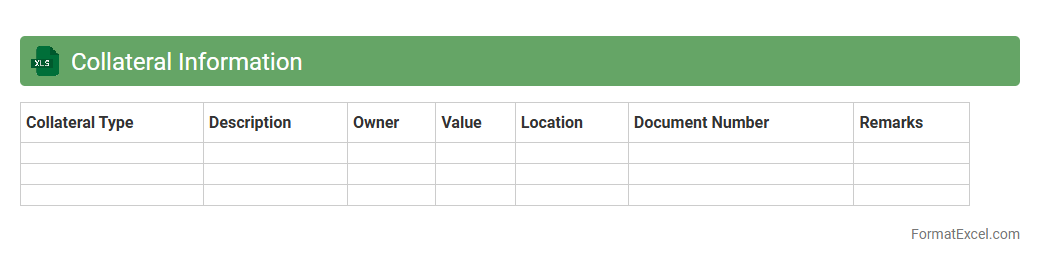

Collateral Information

The

Collateral Information Excel document serves as a centralized repository for tracking and managing all asset details, valuations, and encumbrances related to loans or financing agreements. It enables better risk assessment and decision-making by providing clear visibility into the status and value of collateral, facilitating efficient monitoring and reporting. This document streamlines communication between stakeholders, improves accuracy in financial records, and supports regulatory compliance efforts.

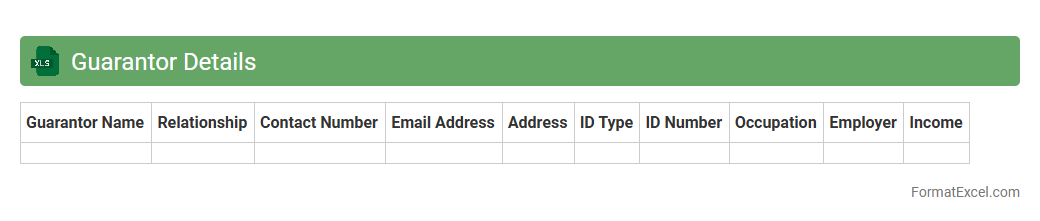

Guarantor Details

The

Guarantor Details Excel document is a structured spreadsheet that stores comprehensive information about guarantors, including personal identification, contact details, financial status, and agreement terms. This document is useful for verifying the credibility of guarantors, assessing their ability to fulfill obligations, and streamlining decision-making processes in loan approvals or rental agreements. It enhances record-keeping accuracy and facilitates quick access to guarantor data, improving overall risk management and compliance.

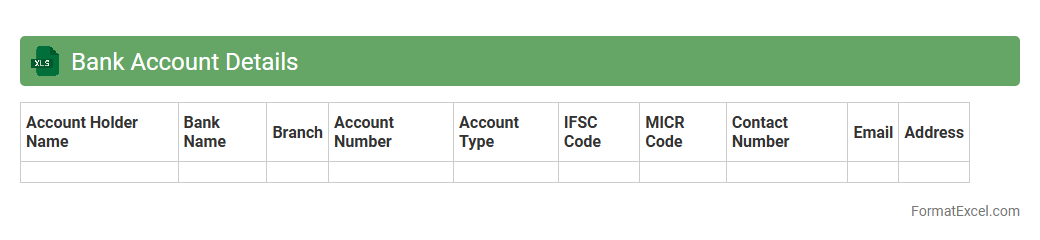

Bank Account Details

A

Bank Account Details Excel document organizes essential financial information such as account numbers, bank names, branch codes, and account holder details in a structured format. This facilitates easy tracking, reconciliation, and management of multiple bank accounts, ensuring accuracy and quick access to critical data. Businesses and individuals benefit from streamlined financial operations, enhanced record-keeping, and improved auditing processes by using this document.

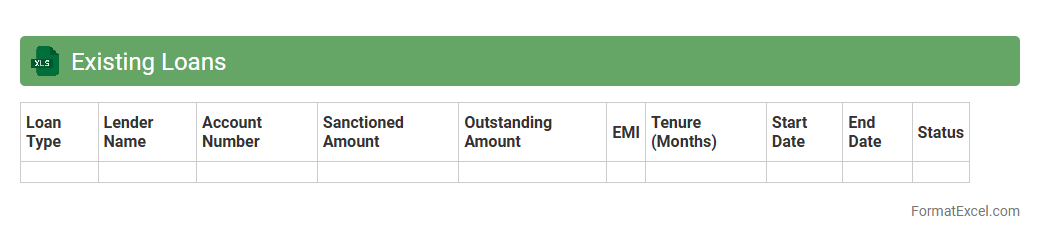

Existing Loans

The

Existing Loans Excel document is a comprehensive financial tool designed to track and manage all current loan accounts, including principal amounts, interest rates, payment schedules, and outstanding balances. It enables accurate monitoring of loan repayments, facilitates budgeting, and helps in forecasting cash flow by providing a clear overview of liabilities. Businesses and individuals use this document to optimize debt management strategies and ensure timely payments, reducing financial risks and improving credit standing.

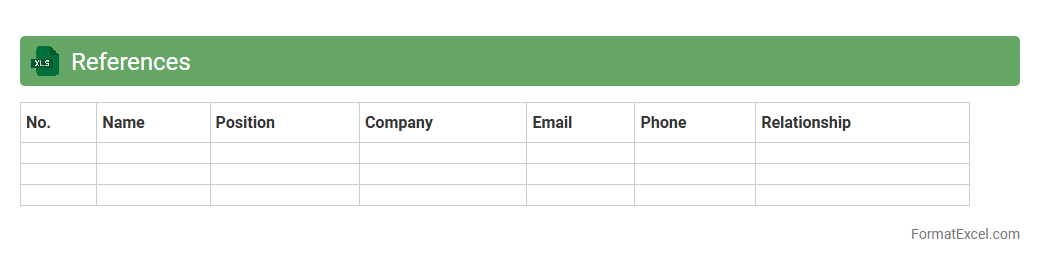

References

A

References Excel document is a structured spreadsheet used to organize and store data sources, citations, or important links related to research, projects, or reports. It enables efficient tracking, validation, and quick access to referenced materials, enhancing the accuracy and credibility of work. Utilizing this document helps streamline the management of information, ensuring consistency and easy updates in any professional or academic environment.

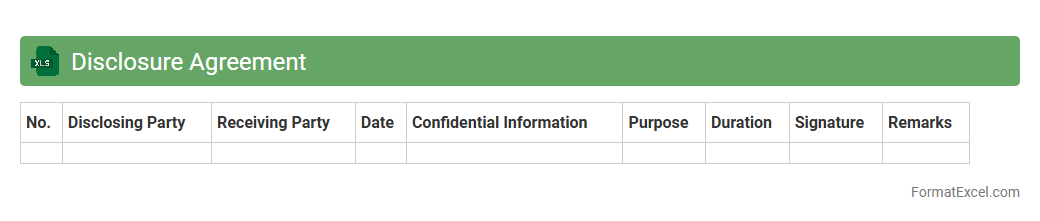

Disclosure Agreement

A

Disclosure Agreement Excel document is a structured digital file used to record, organize, and manage confidentiality agreements between parties efficiently. It allows for easy tracking of essential details such as parties involved, effective dates, and terms of disclosure, ensuring compliance and reducing the risk of unauthorized information sharing. Utilizing this document enhances transparency, accountability, and streamlined communication in business or legal processes.

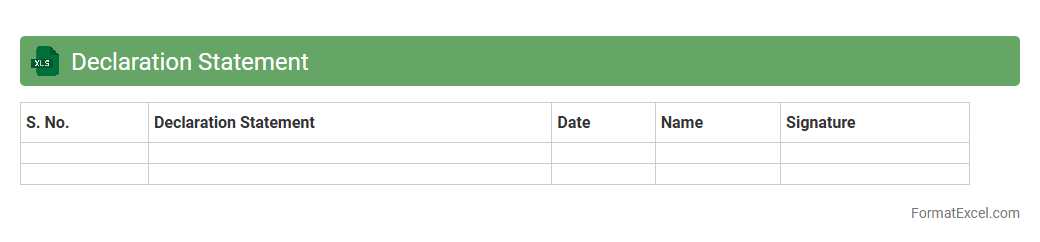

Declaration Statement

A

Declaration Statement Excel document is a structured spreadsheet used to formally record and verify information such as personal details, compliance data, or financial disclosures. It streamlines data collection and ensures accuracy by providing a standardized format for input and review. This document is useful for maintaining transparency, facilitating audits, and supporting regulatory compliance in various organizational processes.

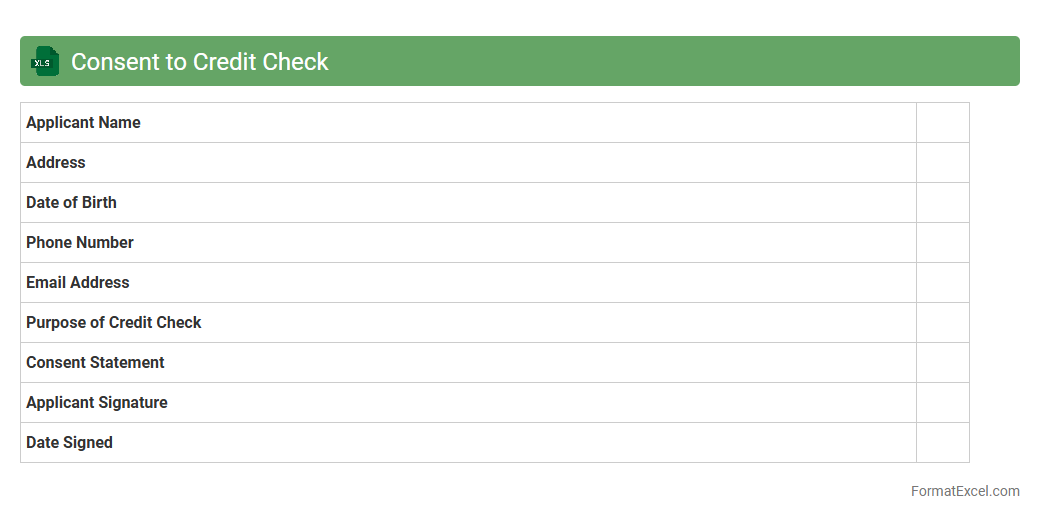

Consent to Credit Check

The

Consent to Credit Check Excel document is a structured form used to obtain explicit permission from individuals or businesses before performing a credit inquiry. It streamlines the process by recording critical details such as consent dates, personal information, and authorization status, ensuring compliance with legal requirements like the Fair Credit Reporting Act (FCRA). This document is essential for businesses to maintain transparency, protect customer rights, and make informed lending or service decisions based on accurate credit assessments.

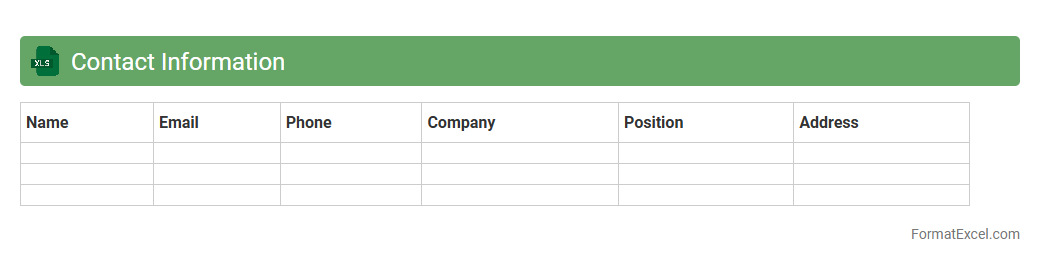

Contact Information

A

Contact Information Excel document is a structured spreadsheet designed to store and organize essential details such as names, phone numbers, email addresses, and physical addresses. It enables efficient management and quick retrieval of contact data, facilitating communication and networking in both personal and professional environments. This tool enhances productivity by allowing easy updates, sorting, filtering, and sharing of contact lists.

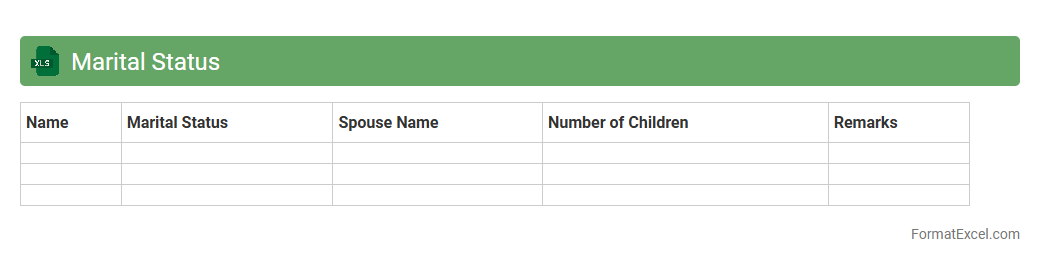

Marital Status

A

Marital Status Excel document is a structured spreadsheet used to record and analyze individuals' marital statuses, such as single, married, divorced, or widowed. It helps organizations, researchers, and HR departments efficiently manage demographic data, aiding in accurate reporting and decision-making processes. This document enhances data organization and supports targeted policy development, employee benefits allocation, and market research analysis.

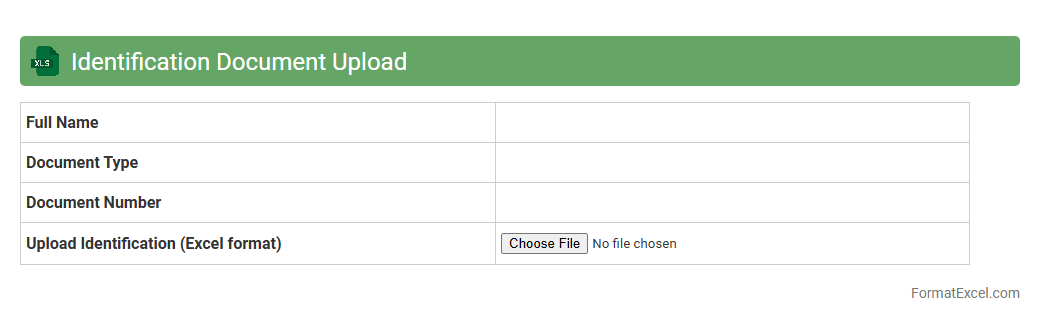

Identification Document Upload

An

Identification Document Upload Excel document serves as a centralized tool to record and manage the details of uploaded identification documents such as passports, driver's licenses, and national IDs. It streamlines verification processes by maintaining accurate records with fields for document type, upload date, verification status, and user information. This facilitates efficient tracking, reduces manual errors, and enhances compliance with regulatory requirements in organizations.

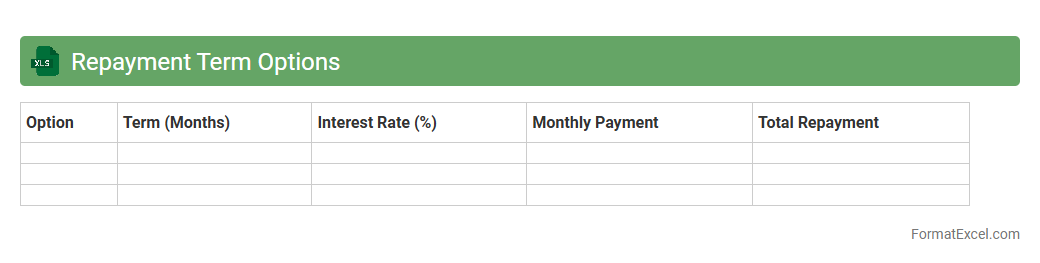

Repayment Term Options

The

Repayment Term Options Excel document outlines various loan repayment schedules, including duration, interest rates, and installment amounts, allowing users to compare and select the best financial plan. It is useful for budgeting, financial planning, and ensuring timely loan repayments. By organizing repayment data systematically, this tool enhances decision-making and reduces the risk of default.

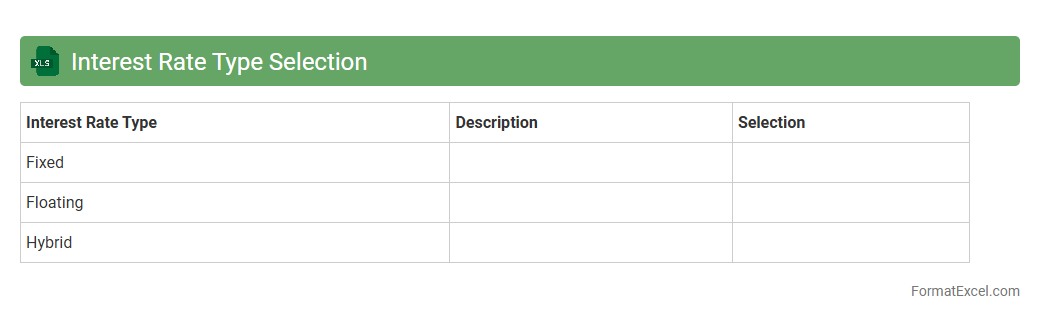

Interest Rate Type Selection

The

Interest Rate Type Selection Excel document is a tool designed to help users compare and choose between different types of interest rates, such as fixed, variable, or adjustable rates. It enables clear visualization of potential financial outcomes based on rate fluctuations, aiding in informed decision-making for loans, mortgages, or investments. By organizing and analyzing interest rate options, it saves time and reduces errors, ensuring optimized financial planning.

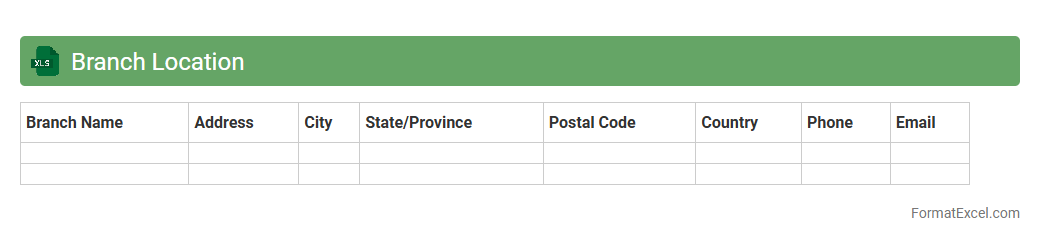

Branch Location

A

Branch Location Excel document is a structured spreadsheet that catalogs the geographic details and contact information of various company branches. It enables efficient data management, quick access to branch-specific details, and streamlined communication across multiple locations. This tool supports decision-making by providing a clear overview of regional distribution and resource allocation.

Introduction to Loan Application Form Formats

Loan application form formats are structured documents used to collect detailed borrower information. They streamline the process of assessing eligibility and risk. Understanding the format structure helps lenders maintain consistency.

Importance of Using Excel for Loan Applications

Excel provides an efficient platform for organizing and analyzing loan application data. It offers flexibility in formatting and automates calculations with formulas. Leveraging Excel spreadsheets enhances accuracy and data management.

Key Components of a Loan Application Form

Essential components include personal details, loan amount, repayment terms, and financial information. Proper structure ensures all critical data is captured for credit evaluation. Highlighting key components ensures completeness of the application.

Step-by-Step Guide to Creating a Loan Form in Excel

Start by setting up labeled fields, then format cells for data entry and apply validation rules. Use formulas to calculate totals and interest automatically, improving efficiency. Following a step-by-step approach simplifies form creation in Excel.

Essential Fields to Include in Your Excel Loan Form

Include borrower name, contact information, loan purpose, amount requested, income details, and repayment schedule. These fields capture the necessary data for loan approval decisions. Incorporating essential fields ensures data completeness.

Sample Loan Application Form Format in Excel

A sample form should present a clean layout with input boxes, dropdown lists, and formula-driven summaries. It serves as a practical template for quick customization and deployment. An effective sample format guides proper form design.

Tips for Customizing Loan Forms in Excel

Customize by adjusting layouts, adding conditional formatting, and embedding helpful instructions for users. Tailor the form to specific loan types or lender requirements for improved usability. Using customization tips enhances form functionality.

Common Mistakes to Avoid in Loan Application Forms

Avoid omitting key borrower details, unclear instructions, and errors in formula settings. Such mistakes can delay processing or lead to inaccurate evaluations. Recognizing common mistakes ensures form reliability.

Downloadable Excel Loan Application Form Templates

Templates save time and offer professionally designed formats ready for immediate use. They often include pre-set calculations and validation, improving efficiency. Access to downloadable templates accelerates the application process.

Final Thoughts on Using Excel for Loan Applications

Excel remains a powerful tool for managing loan application data with flexibility and ease. Combining proper design and accurate formulas results in streamlined lending workflows. Mastering Excel loan forms boosts productivity and decision accuracy.