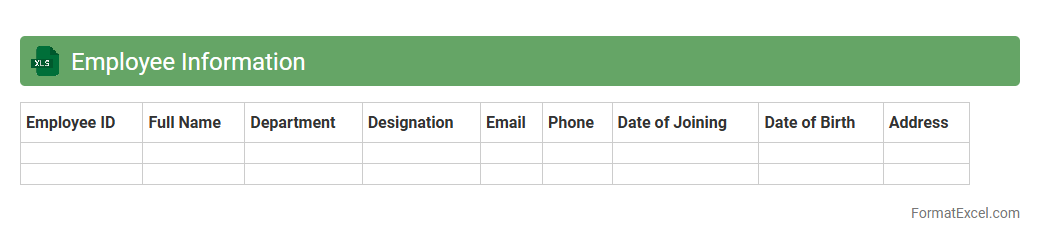

Employee Information

An

Employee Information Excel document is a structured spreadsheet that organizes crucial employee data such as names, contact details, job titles, departments, and employment dates. It streamlines HR management by providing quick access to workforce information, enabling efficient tracking and reporting. This tool enhances decision-making, payroll accuracy, and regulatory compliance by maintaining up-to-date personnel records in one centralized location.

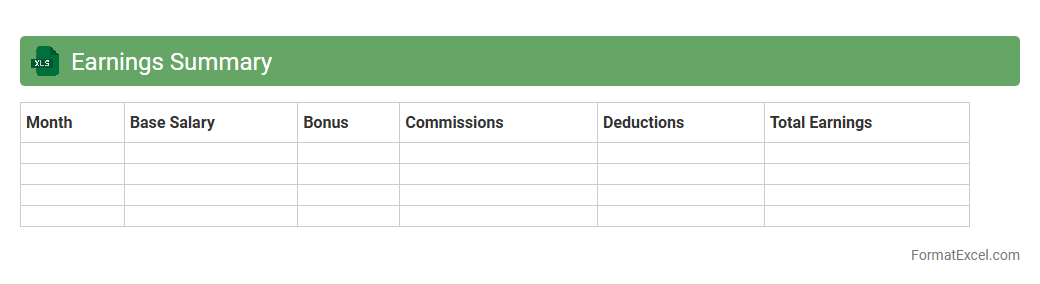

Earnings Summary

An

Earnings Summary Excel document consolidates financial data, detailing total income, deductions, and net pay for a specific period. It helps individuals and businesses track compensation trends, manage payroll accurately, and prepare for tax obligations efficiently. Using this organized format improves financial transparency and decision-making by providing clear visibility into earnings and related expenses.

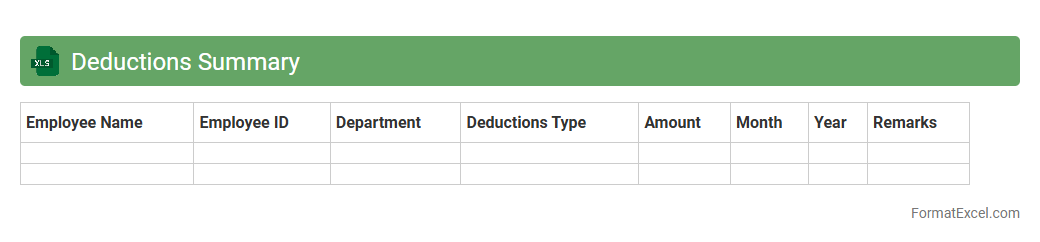

Deductions Summary

The

Deductions Summary Excel document consolidates all employee payroll deductions into a clear and organized format, enabling accurate tracking of taxes, benefits, and other withholdings. It streamlines financial reporting by providing a comprehensive overview of all deduction types, improving compliance and simplifying audit processes. This tool is essential for payroll management, ensuring transparency and facilitating efficient reconciliation of employee compensation records.

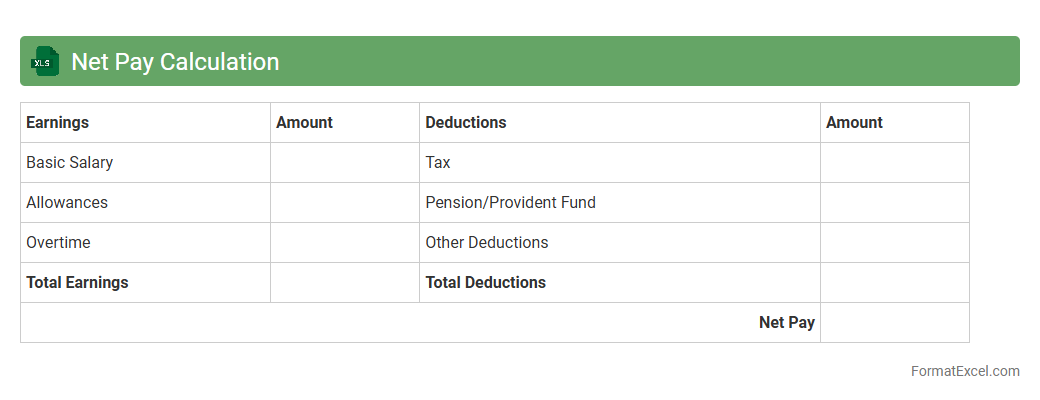

Net Pay Calculation

Net Pay Calculation Excel document is a

financial tool designed to automate the computation of an employee's net salary by subtracting taxes, deductions, and other withholdings from gross pay. It streamlines payroll processing, reduces errors, and ensures accurate payment records for both employees and employers. Businesses use this document to maintain compliance with tax regulations and efficiently manage employee compensation.

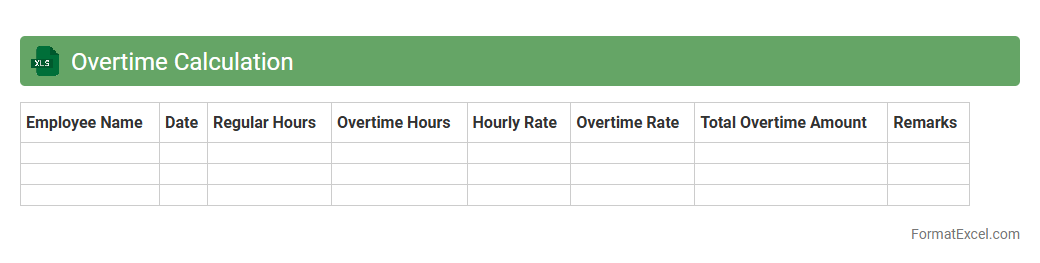

Overtime Calculation

An

Overtime Calculation Excel document is a spreadsheet designed to accurately track and compute extra hours worked beyond regular schedules, ensuring precise payroll processing. It automates complex time tracking by applying company-specific overtime rates and labor laws, reducing errors and saving valuable administrative time. This tool is essential for businesses aiming to maintain compliance, enhance workforce management, and control labor costs effectively.

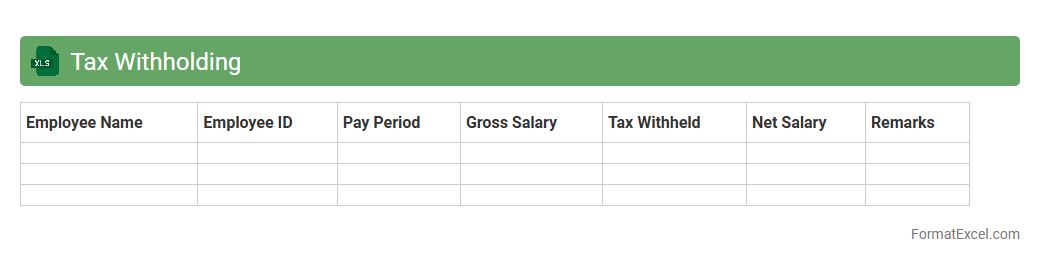

Tax Withholding

A

Tax Withholding Excel document is a digital spreadsheet designed to calculate and track the amount of tax deducted from an individual's or employee's income. It simplifies managing federal and state tax withholdings, ensuring accurate compliance with tax regulations and preventing underpayment or overpayment. This tool is essential for payroll administrators and individuals to monitor withholding amounts and plan finances efficiently.

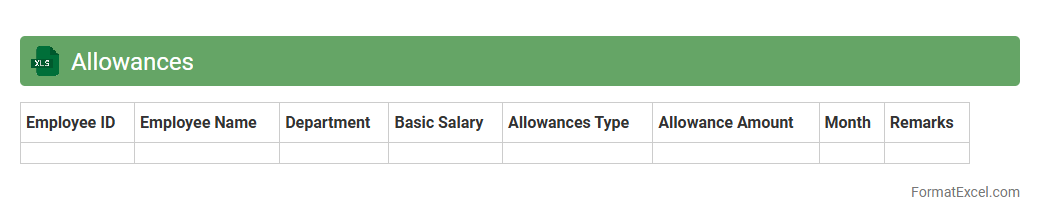

Allowances

An

Allowances Excel document is a structured spreadsheet designed to track and calculate various employee allowances such as housing, travel, or meal allowances. It helps organizations maintain accurate financial records, streamline payroll processing, and ensure compliance with compensation policies. Utilizing this tool improves budget management and enhances transparency in employee benefit administration.

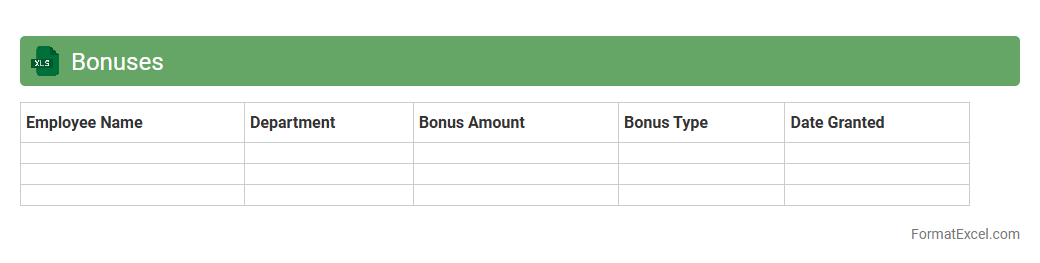

Bonuses

A

Bonuses Excel document is a spreadsheet designed to track, calculate, and manage employee bonus payments efficiently. It helps organizations maintain accurate records, analyze bonus trends, and ensure timely and fair compensation distribution. Using this tool improves financial transparency and supports strategic decision-making in workforce management.

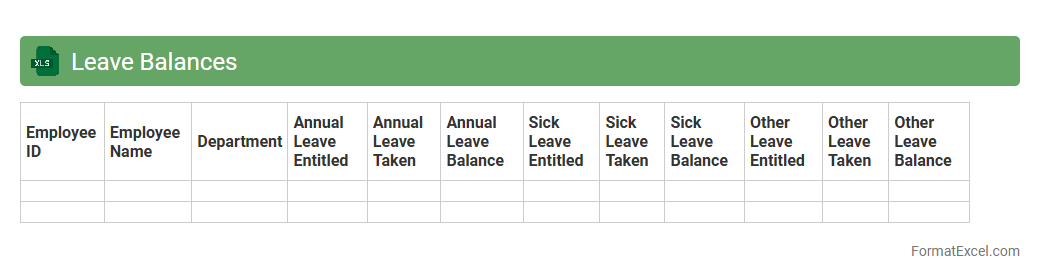

Leave Balances

A

Leave Balances Excel document is a structured spreadsheet that tracks employee leave data, including vacation, sick, and personal days earned, used, and remaining. It allows organizations to efficiently monitor leave entitlements, ensure compliance with company policies, and facilitate accurate payroll processing. This tool enhances workforce planning by providing real-time visibility into employee availability and leave trends.

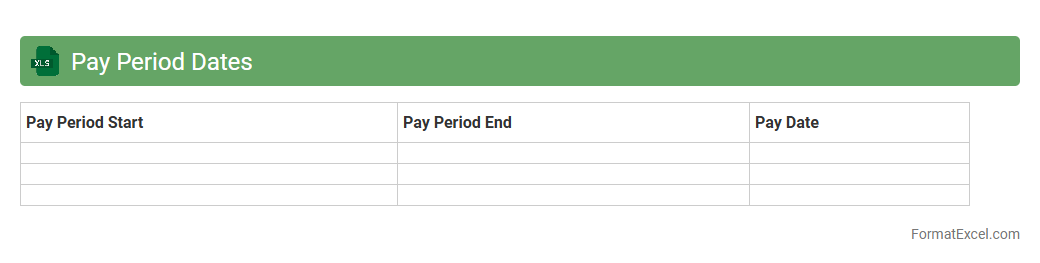

Pay Period Dates

A

Pay Period Dates Excel document is a structured spreadsheet that records the start and end dates of pay periods within a fiscal year, facilitating accurate payroll processing. It helps businesses track employee work hours, calculate wages, and ensure timely salary disbursements. This document is essential for maintaining compliance with labor laws and streamlining financial reporting.

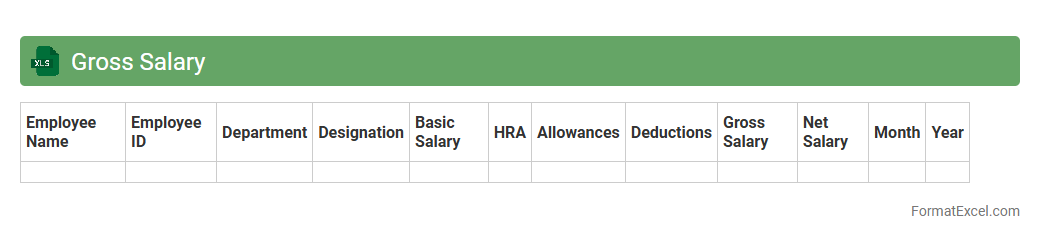

Gross Salary

A

Gross Salary Excel document is a spreadsheet that calculates an employee's total earnings before deductions such as taxes and social security contributions. This tool helps businesses and employees accurately track salary components, including basic pay, allowances, and bonuses, ensuring transparent payroll management. It streamlines salary computations and improves financial planning by providing clear, organized salary data in an easily accessible format.

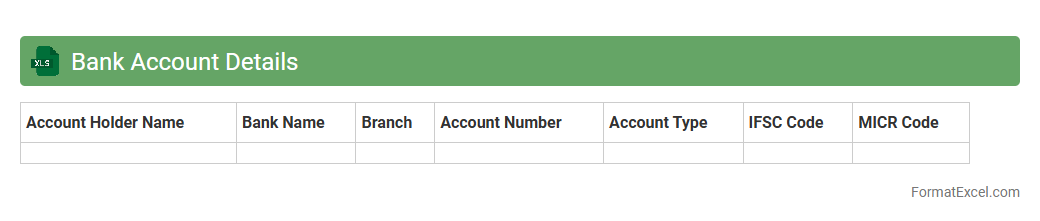

Bank Account Details

A

Bank Account Details Excel document is a structured spreadsheet used to organize and store essential banking information such as account numbers, bank names, IFSC codes, and account holder names. It streamlines financial management by enabling quick access, easy update, and efficient tracking of multiple bank accounts in one place. This tool enhances accuracy in transactions and simplifies reconciliation processes for businesses and individuals.

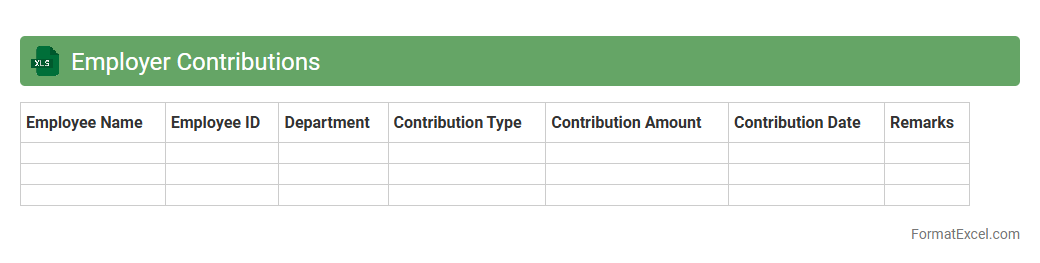

Employer Contributions

The

Employer Contributions Excel document is a detailed spreadsheet that tracks and calculates the monetary contributions made by employers to employee benefits such as retirement funds, health insurance, and social security. It is useful for ensuring accurate payroll processing, compliance with labor laws, and financial planning by providing clear, organized data on employer obligations. This document simplifies auditing, budgeting, and reporting tasks by consolidating all relevant contribution information in one accessible format.

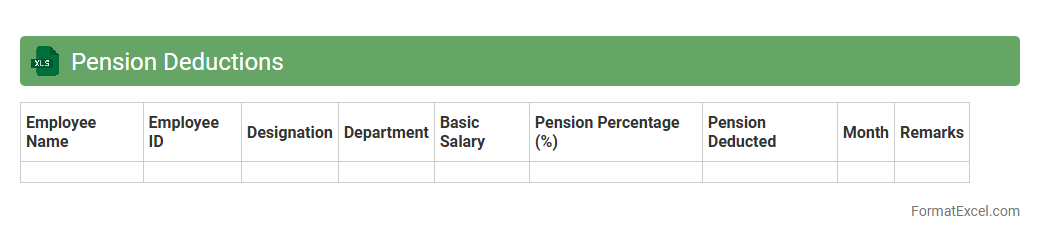

Pension Deductions

A

Pension Deductions Excel document is a detailed spreadsheet that tracks and calculates contributions deducted from employees' salaries for retirement savings. It helps employers maintain accurate records of individual pension amounts, ensuring compliance with legal regulations and simplifying payroll management. This tool streamlines financial planning and reporting, facilitating transparency and efficient administration of pension schemes.

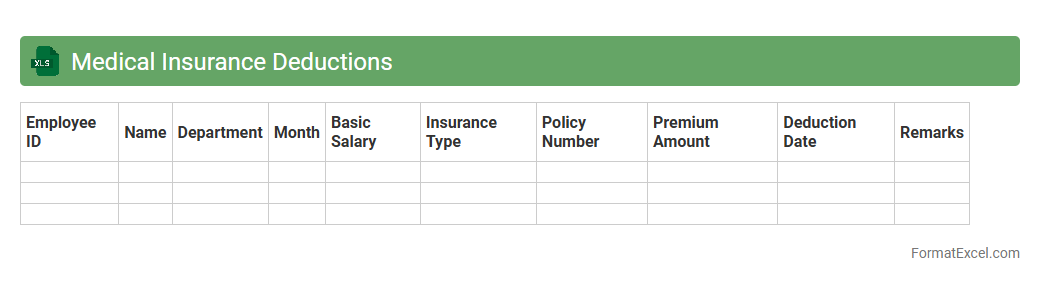

Medical Insurance Deductions

A

Medical Insurance Deductions Excel document is a spreadsheet designed to track and calculate medical insurance premiums, deductions, and employee contributions systematically. It streamlines the payroll process by providing accurate deductions for insurance benefits, ensuring compliance with company policies and government regulations. This document is essential for HR and finance departments to maintain transparency, reduce errors, and simplify financial reporting related to medical insurance.

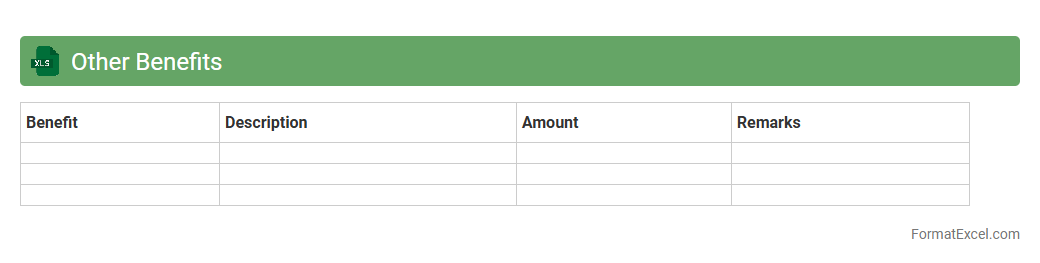

Other Benefits

The

Other Benefits Excel document serves as a comprehensive tool to track and manage employee perks beyond regular salary components, such as bonuses, allowances, and non-monetary incentives. It enables HR teams and managers to efficiently organize, update, and analyze benefit distribution, ensuring transparency and accuracy in compensation packages. This document supports strategic decision-making by highlighting trends and helping maintain competitive employee satisfaction and retention.

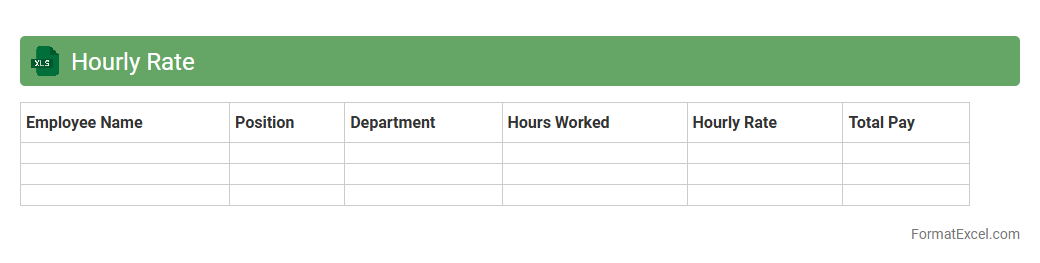

Hourly Rate

An

Hourly Rate Excel document is a spreadsheet designed to calculate and track the cost of labor based on hours worked, enabling accurate payroll and budgeting. It allows users to input hourly wages, hours worked, and automatically computes total pay, improving financial management and project cost estimation. This tool enhances efficiency by providing clear insights into labor expenses, facilitating better decision-making for businesses and freelancers alike.

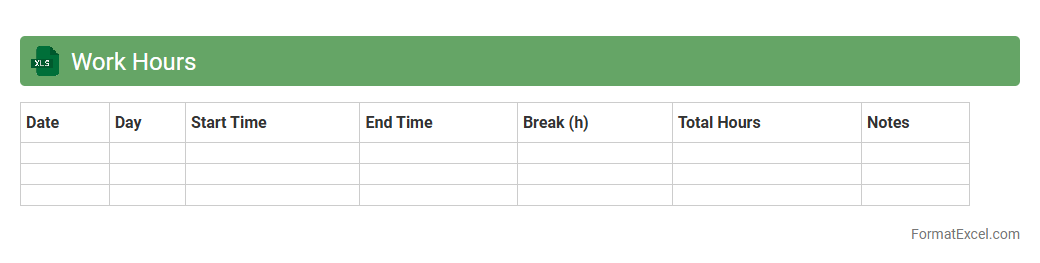

Work Hours

A

Work Hours Excel document is a digital spreadsheet designed to track and calculate employee or project time efficiently. It helps monitor daily, weekly, or monthly hours worked, facilitating accurate payroll management and productivity analysis. Utilizing this tool enhances timekeeping accuracy and supports better workforce planning.

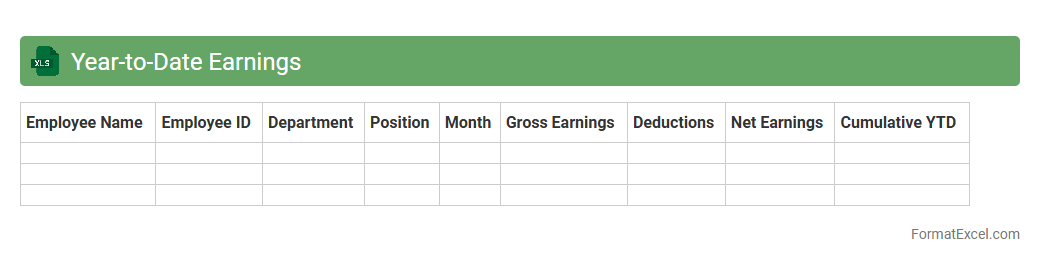

Year-to-Date Earnings

A

Year-to-Date Earnings Excel document is a spreadsheet that tracks and compiles all income earned by an individual or business from the beginning of the calendar year up to the current date. This tool enables users to monitor financial performance, manage budgets, and prepare for tax filings with accurate, up-to-date income data. It is particularly useful for identifying earning trends and making informed decisions based on comprehensive financial records.

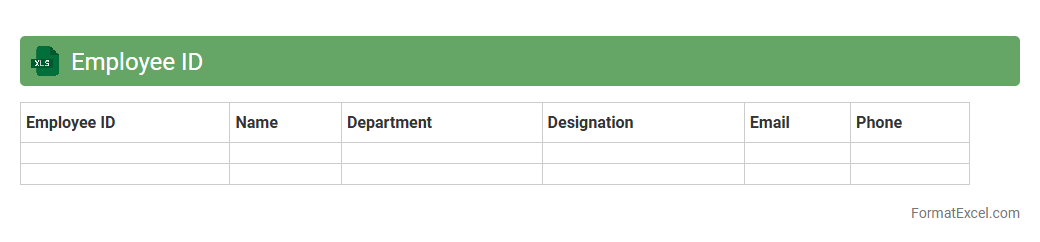

Employee ID

An

Employee ID Excel document is a structured spreadsheet that stores unique identification numbers for employees, along with relevant details such as names, departments, and job titles. This document streamlines HR processes by enabling quick access to individual employee records, facilitating attendance tracking, payroll management, and organizational reporting. Utilizing this Excel file ensures accuracy and efficiency in managing workforce data across various business functions.

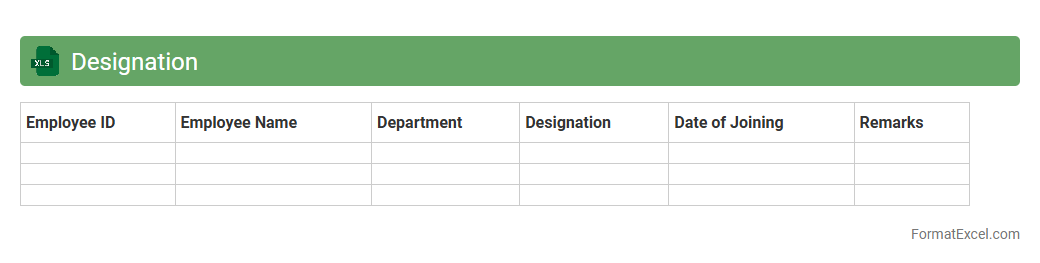

Designation

A

Designation Excel document is a structured spreadsheet used to categorize and track employee job titles, roles, and responsibilities within an organization. It helps streamline human resource management by providing clear visibility of workforce hierarchy, assisting in payroll processing, performance evaluations, and organizational planning. Utilizing this tool enhances accuracy in reporting and ensures consistency in role assignments across departments.

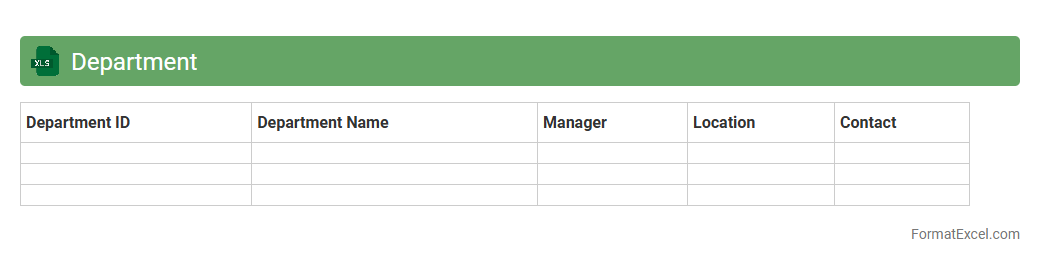

Department

A

Department Excel document is a structured spreadsheet used to organize and manage data specific to a department's operations, including budgets, schedules, and performance metrics. It enhances efficiency by allowing easy data analysis, tracking progress, and generating reports that support informed decision-making. This tool is essential for maintaining transparency, improving coordination, and optimizing resource allocation within the department.

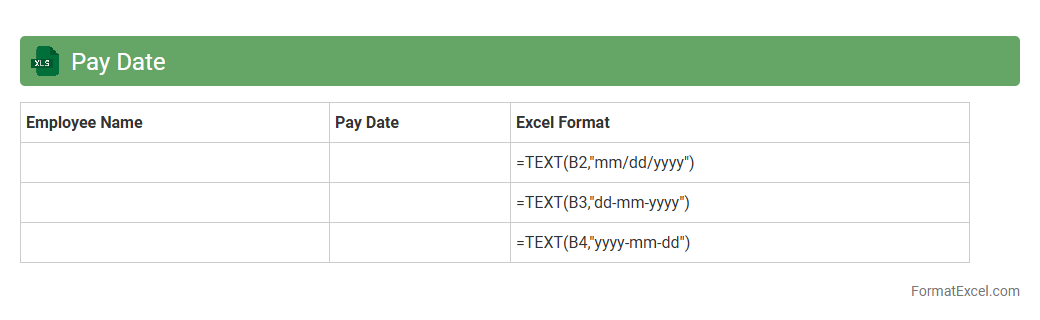

Pay Date

A

Pay Date Excel document is a spreadsheet tool designed to organize and track employee payment schedules, ensuring timely salary disbursements. It helps businesses plan payroll cycles by clearly listing pay dates, payment periods, and related financial data, improving accuracy and compliance. Using this document streamlines payroll management, reduces errors, and facilitates budget forecasting.

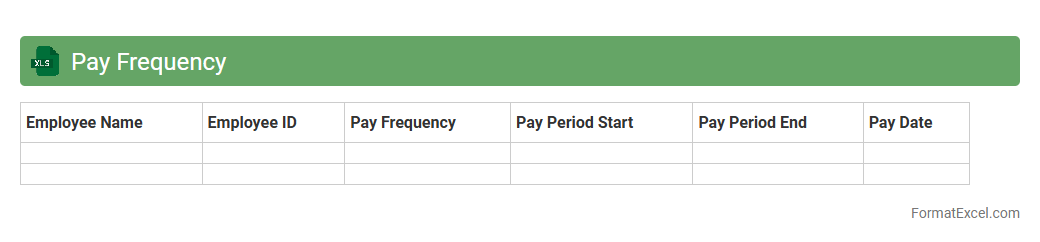

Pay Frequency

A

Pay Frequency Excel document is a spreadsheet tool designed to track and manage employee salary payment intervals, such as weekly, bi-weekly, or monthly cycles. It enables accurate calculation of pay periods, facilitates payroll processing, and helps maintain compliance with labor regulations by ensuring timely payments. Businesses and HR professionals use this document to streamline payroll management, reduce errors, and optimize workforce compensation planning.

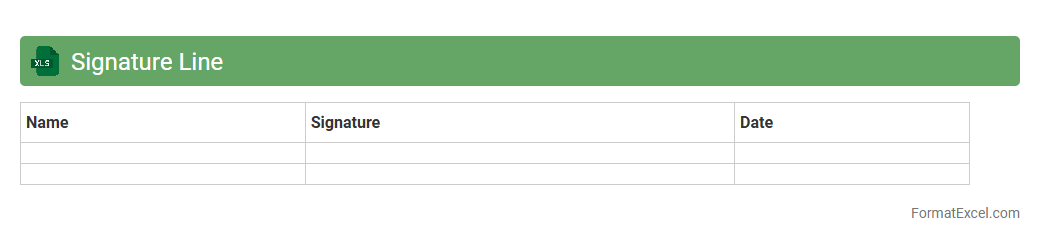

Signature Line

A

Signature Line in an Excel document serves as a designated area where users can digitally sign, ensuring the authenticity and integrity of the file. This feature is particularly useful for tracking approvals, confirming data accuracy, and enhancing document security in professional workflows. By incorporating signature lines, businesses can streamline verification processes and maintain clear audit trails within their spreadsheets.

Understanding the Importance of a Payslip

A payslip is a crucial document that details an employee's earnings, deductions, and net salary. It serves as legal proof of payment and helps maintain transparency between employers and employees. Additionally, it assists employees in financial planning and tax filing.

Key Components of a Payslip

A typical payslip includes essential elements such as basic salary, allowances, deductions, taxes, and the net pay. It also contains employee details like name, ID, and pay period. These components ensure clarity and completeness in salary reporting.

Why Use Excel for Payslip Creation?

Excel offers a flexible and user-friendly platform for creating and managing payslips. It allows easy customization and automation of calculations, reducing errors. Moreover, Excel supports saving and sharing templates efficiently.

Essential Columns in an Excel Payslip Format

Key columns typically include Employee Name, Employee ID, Basic Salary, Allowances, Deductions, Tax Amount, and Net Salary. Including a pay period and date is also important for record-keeping. These columns help ensure accuracy and transparency.

Step-by-Step Guide to Creating a Payslip in Excel

Start by setting up column headers for all salary components. Use Excel formulas to calculate totals and deductions automatically. Finally, format the spreadsheet for readability and save it as a reusable template.

Sample Payslip Format in Excel (Template)

A standard template includes fields for earnings, deductions, and net pay with automated calculations. It also features company and employee details for identification. This sample can be customized to suit specific organizational needs.

Tips for Customizing Your Payslip Template

Use consistent formatting, add company logos, and include tax year references. Ensure all formulas are locked to avoid accidental changes. Personalize the template to match your company's branding for a professional look.

Common Mistakes to Avoid in Excel Payslips

Avoid manual calculations that can lead to errors and discrepancies. Do not forget to update formulas if compensation structures change. Always double-check data entries and ensure employee information is accurate.

Automation and Formulas for Accurate Payslip Generation

Utilizing Excel's formulas like SUM, IF, and VLOOKUP can automate salary computations efficiently. Conditional formatting highlights discrepancies for quick error detection. Automation reduces manual errors and saves time.

Download Free Payslip Format Excel Templates

Many websites offer ready-to-use Excel payslip templates for free download. These templates can be customized according to company policies and tax regulations. Using a free template accelerates the payslip creation process significantly.