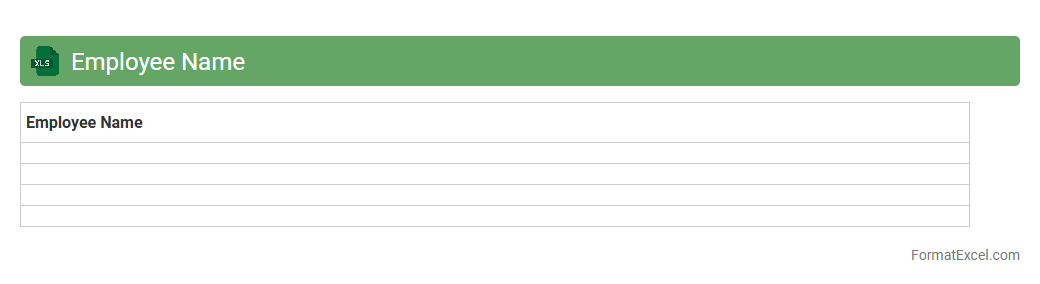

Employee Name

An

Employee Name Excel document is a structured spreadsheet that organizes employee names along with relevant details such as job titles, departments, and identification numbers. This document is essential for human resource management, enabling quick access to employee information, efficient tracking of personnel data, and simplifying tasks such as payroll, attendance, and communication. Utilizing this file improves operational efficiency and enhances data accuracy within an organization.

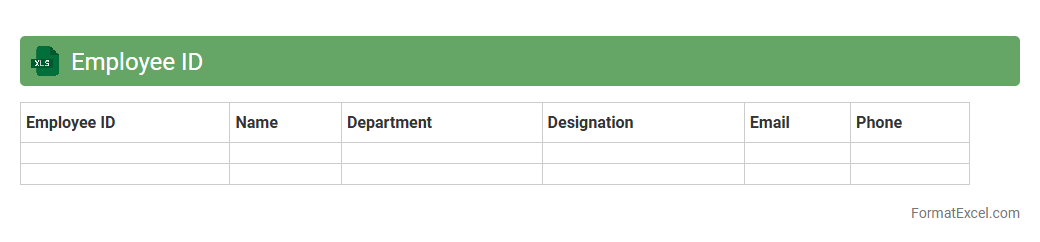

Employee ID

An

Employee ID Excel document is a structured spreadsheet that organizes unique identification numbers assigned to each employee within a company. This document facilitates efficient employee tracking, attendance management, and payroll processing by linking individual records to their respective IDs. It enhances data accuracy and streamlines HR operations by providing a centralized and easily accessible reference for employee information.

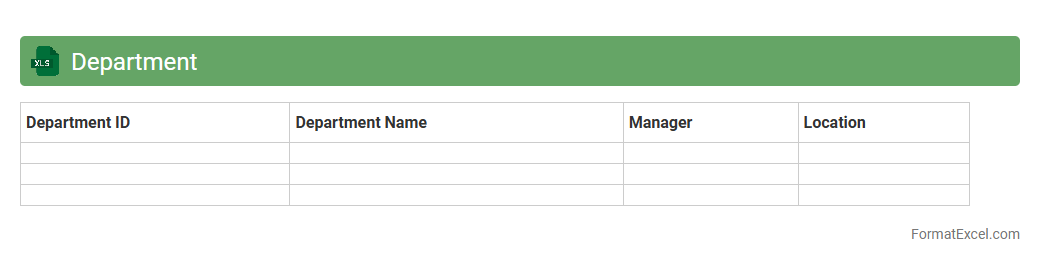

Department

A

Department Excel document is a structured spreadsheet designed to organize, analyze, and manage departmental data such as budgets, schedules, and project progress. It enhances efficiency by providing a clear overview of key metrics, enabling better decision-making and resource allocation. This tool supports collaboration and ensures accurate tracking of departmental performance and goals.

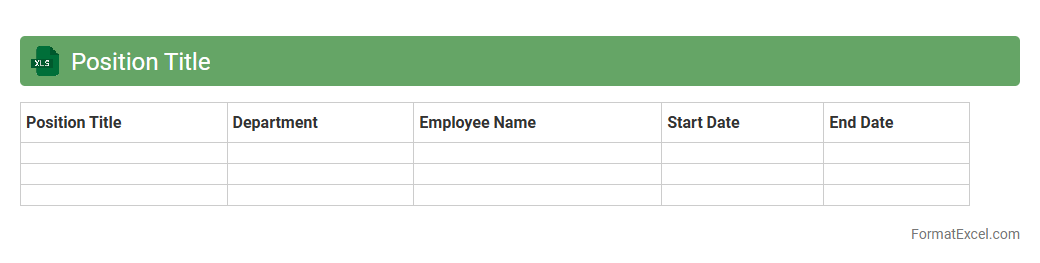

Position Title

A

Position Title Excel document organizes job titles within an organization, allowing for clear categorization and tracking of roles and responsibilities. It facilitates efficient human resource management, payroll processing, and workforce planning by providing a centralized reference for all position titles. This document enhances consistency in job descriptions and supports strategic decision-making related to talent acquisition and development.

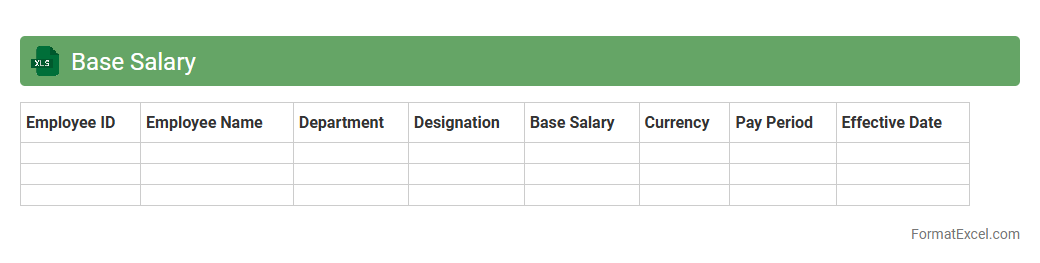

Base Salary

A

Base Salary Excel document is a structured spreadsheet used to organize, calculate, and analyze employee base salaries within an organization. It helps in maintaining accurate salary data, comparing compensation structures, and ensuring compliance with budget limits. This tool streamlines payroll management, supports financial planning, and enhances transparency in salary administration.

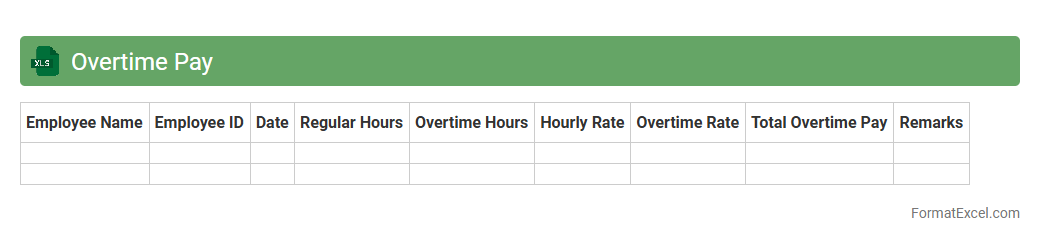

Overtime Pay

An

Overtime Pay Excel document is a spreadsheet designed to calculate and track extra hours worked beyond regular schedules, ensuring accurate compensation. It automates the computation of overtime rates, reducing errors and saving time for payroll management. This tool is essential for businesses to maintain compliance with labor laws and improve employee satisfaction through timely and precise payment processing.

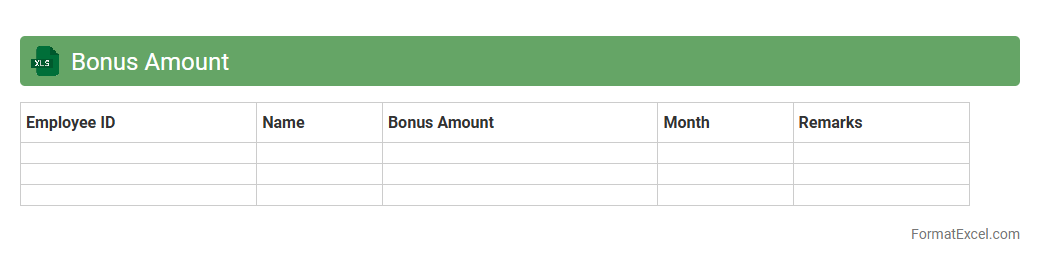

Bonus Amount

The

Bonus Amount Excel document is a structured spreadsheet designed to calculate, track, and manage employee bonus payments efficiently. It helps organizations maintain transparency, accuracy in financial planning, and ensures timely distribution of incentives based on performance metrics. Utilizing this tool enhances payroll management and simplifies bonus-related data analysis for better decision-making.

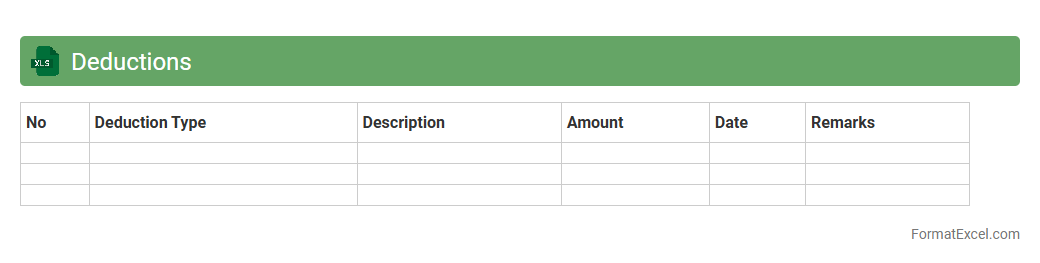

Deductions

A

Deductions Excel document is a structured spreadsheet used to track and calculate various payroll deductions such as taxes, insurance premiums, and retirement contributions. It streamlines the payroll process by automating deduction calculations, ensuring accuracy and compliance with financial regulations. This tool enhances financial management by providing clear visibility into employee deductions and facilitating efficient record-keeping for audits and reporting.

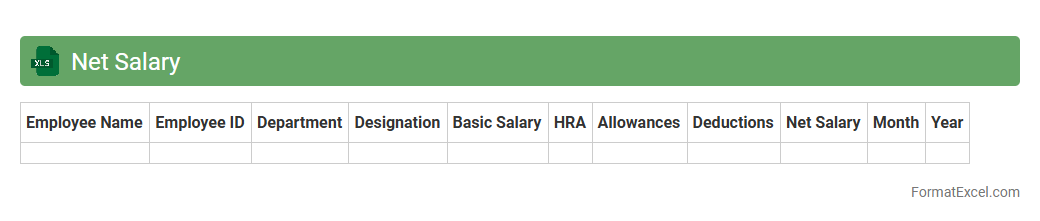

Net Salary

A

Net Salary Excel document is a spreadsheet designed to calculate an employee's take-home pay after deductions such as taxes, social security, and other withholdings. It is useful for quickly determining precise net income, budgeting, and financial planning by providing clear, organized salary details. Employers and employees benefit from its ability to automate complex calculations, reduce errors, and maintain accurate payroll records.

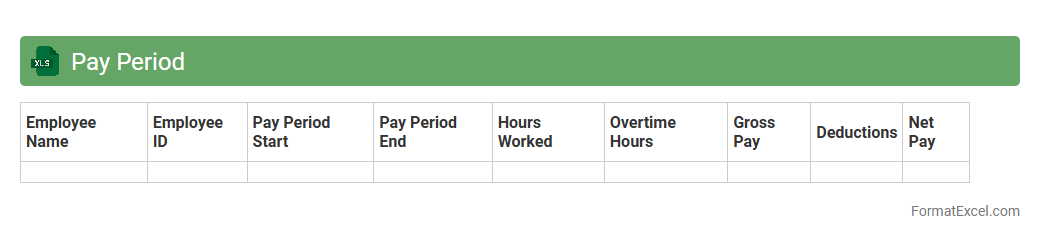

Pay Period

A

Pay Period Excel document is a spreadsheet used to track employee work hours, calculate wages, and manage payroll efficiently. It helps businesses maintain accurate records of start and end dates for pay cycles, ensuring timely and precise salary payments. This tool streamlines payroll processing, reduces errors, and supports compliance with labor regulations.

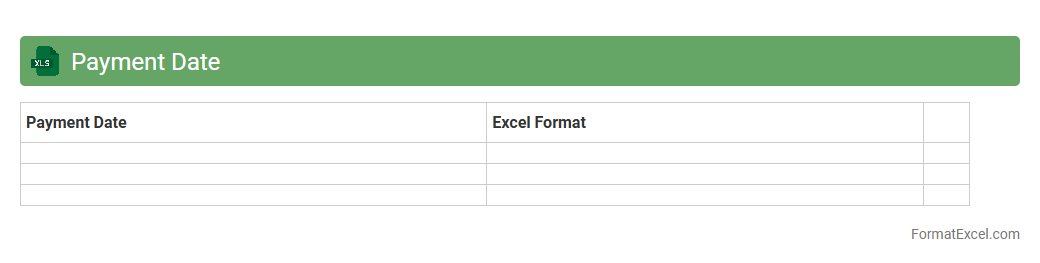

Payment Date

The

Payment Date Excel document is a spreadsheet designed to organize and track payment schedules, ensuring timely bill settlements and financial management. It allows users to input due dates, payment amounts, and vendor details, providing a clear overview of upcoming financial obligations. This tool enhances budgeting accuracy and helps avoid late fees by maintaining an organized record of all payment transactions.

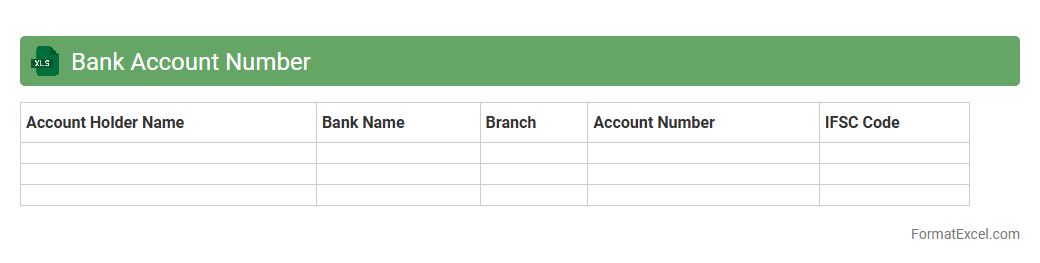

Bank Account Number

A

Bank Account Number Excel document is a spreadsheet that organizes and stores multiple bank account numbers along with related details such as account holder names, bank names, and transaction histories. This document is useful for efficiently managing financial information, simplifying the reconciliation process, and ensuring accurate record-keeping for personal or business accounts. It aids in quick reference, analysis, and secure tracking of banking data, enhancing overall financial management.

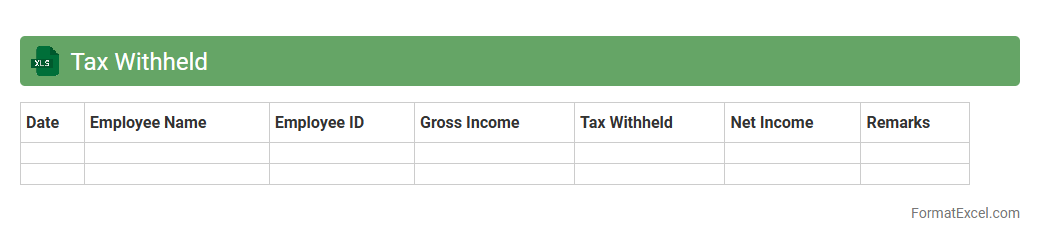

Tax Withheld

A

Tax Withheld Excel document is a spreadsheet used to accurately track and calculate the amount of tax withheld from employee salaries or contractor payments. It helps organizations ensure compliance with tax regulations by providing a clear record of deductions, payment dates, and amounts withheld for each individual. This tool is essential for financial reporting, tax filing, and simplifying audits by maintaining organized and accessible tax withholding data.

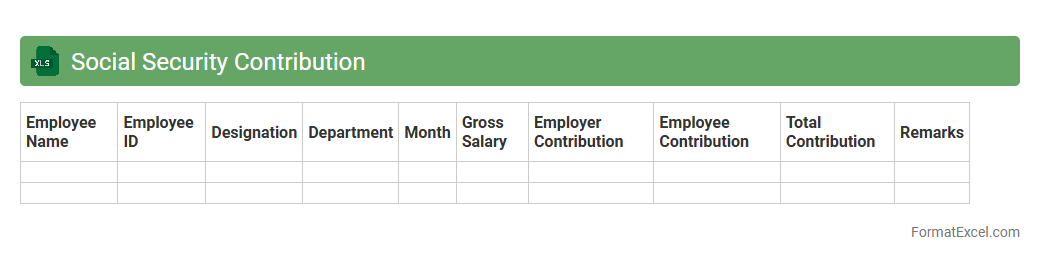

Social Security Contribution

The

Social Security Contribution Excel document is a structured tool designed to calculate and track employee and employer contributions to social security funds based on current regulations and salary data. It helps ensure accurate payroll processing by automating deduction calculations, reducing errors, and maintaining compliance with legal requirements. Employers and HR professionals benefit from streamlined record-keeping and easy generation of reports for audits and financial planning.

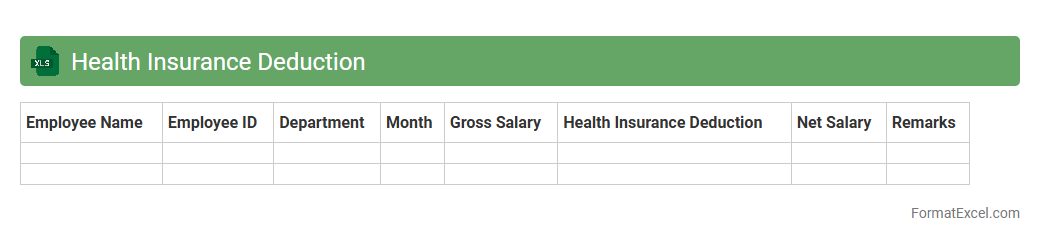

Health Insurance Deduction

A

Health Insurance Deduction Excel document is a spreadsheet designed to track and calculate deductions related to health insurance premiums from employee salaries or personal expenses. It helps users organize data efficiently, ensuring accurate accounting and simplifying tax reporting by providing clear visibility on deduction amounts over time. This tool is useful for both individuals managing their finances and businesses maintaining payroll records, enhancing financial transparency and compliance.

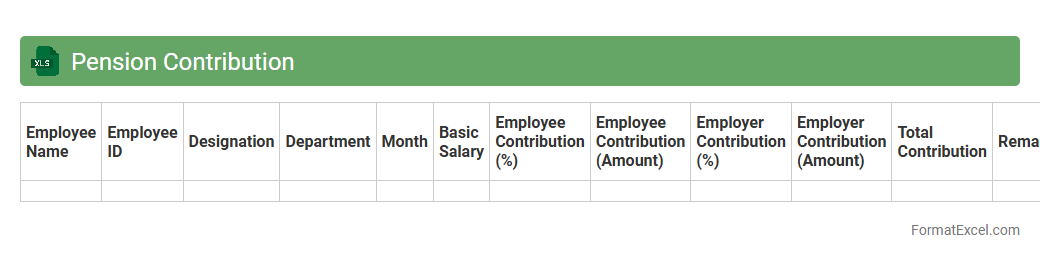

Pension Contribution

A

Pension Contribution Excel document is a detailed spreadsheet designed to track and calculate the contributions employees and employers make toward retirement funds. It helps in maintaining accurate records of monthly or annual payments, ensuring compliance with pension regulations and facilitating financial planning. This document is essential for managing pension fund growth, forecasting future benefits, and simplifying audit processes.

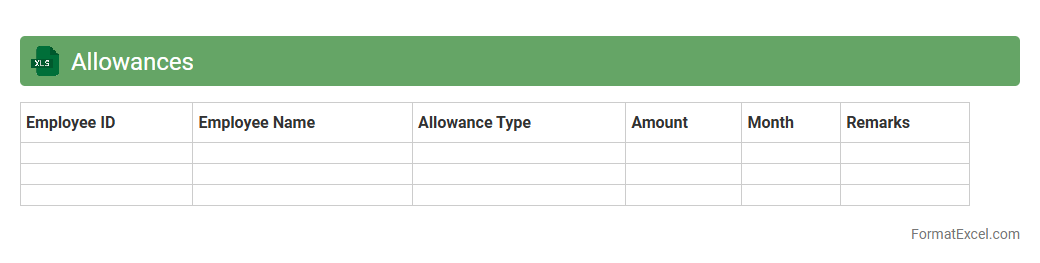

Allowances

An

Allowances Excel document is a structured spreadsheet used to record, calculate, and manage employee allowances such as travel, housing, or meal stipends. It provides a clear and organized way to track individual and total allowance amounts, ensuring accurate financial management and compliance with company policies. This document is useful for simplifying payroll processes, enhancing transparency, and facilitating budget analysis within organizations.

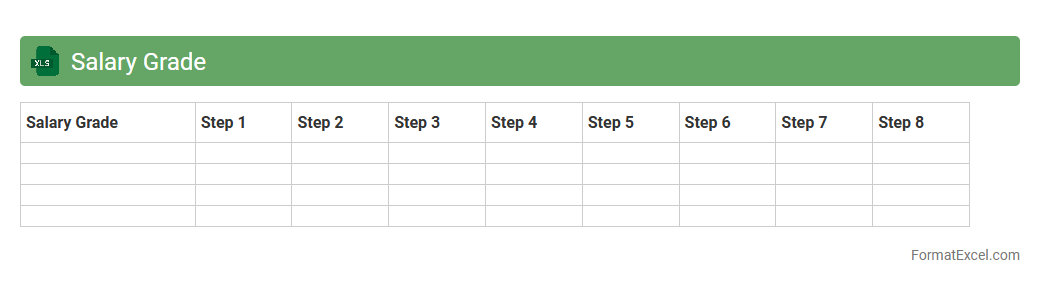

Salary Grade

A

Salary Grade Excel document is a structured spreadsheet that categorizes employee compensation into different salary grades based on roles, experience, and performance levels. It helps organizations maintain consistent and transparent pay structures while facilitating budget planning, payroll management, and compensation analysis. Using this document allows HR professionals and managers to align salaries with industry standards and ensure equitable pay across the workforce.

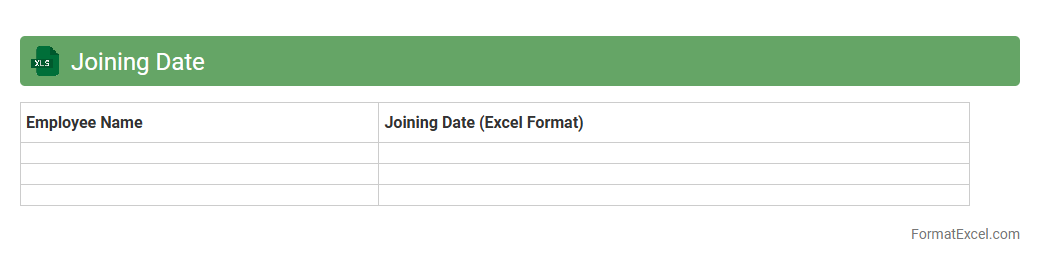

Joining Date

A

Joining Date Excel document records the precise date employees start working in a company, enabling efficient workforce management and payroll processing. It helps track employee tenure, calculate benefits, and organize training schedules effectively. This document serves as a reliable reference for HR departments to maintain accurate employment records and ensure compliance with company policies.

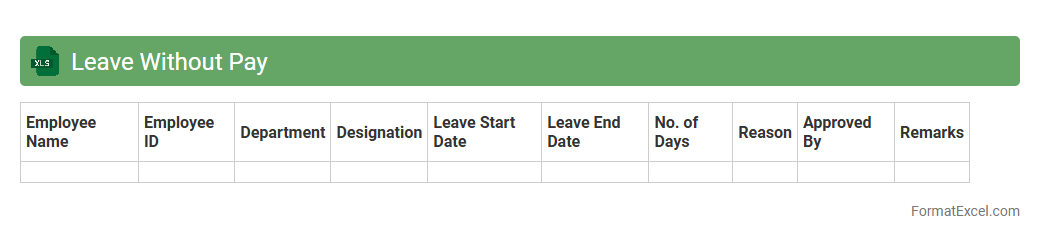

Leave Without Pay

A

Leave Without Pay (LWOP) Excel document is a structured spreadsheet used to track employee absences where no salary is provided. It helps organizations maintain accurate records of unpaid leave durations, ensuring compliance with HR policies and facilitating payroll adjustments. The document enhances transparency and simplifies leave management by providing clear data on leave balances and unpaid time off.

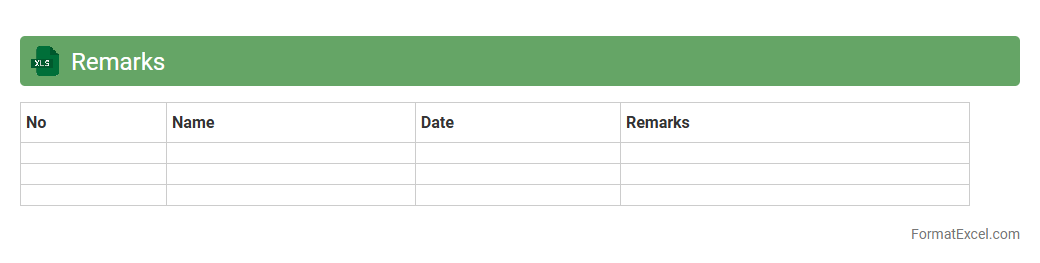

Remarks

A

Remarks Excel document serves as a structured template for recording comments, observations, or feedback related to specific data entries or projects. It enhances clarity and communication within teams by consolidating important notes in a single, accessible file, enabling efficient tracking of project progress or data analysis. Using this document improves collaboration and decision-making by providing a clear audit trail of remarks and suggested actions.

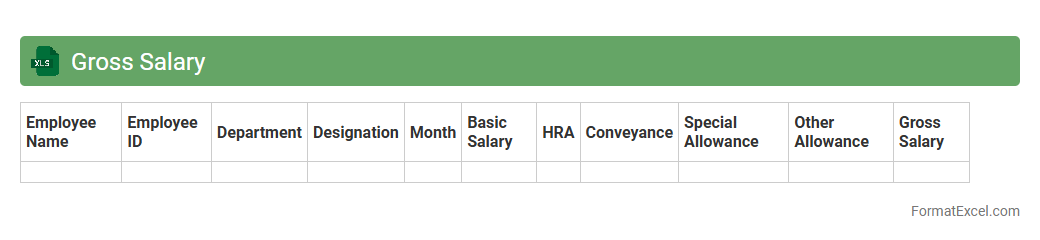

Gross Salary

A

Gross Salary Excel document is a spreadsheet used to calculate and record an employee's total earnings before any deductions such as taxes or benefits. It allows users to organize salary components like basic pay, bonuses, and allowances in a structured format, facilitating accurate payroll processing and financial planning. This tool is useful for HR professionals and accountants to ensure compliance, manage budgets, and generate detailed salary reports efficiently.

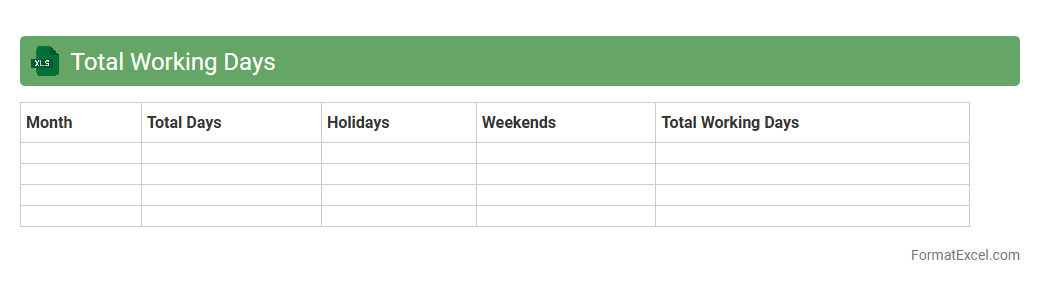

Total Working Days

The

Total Working Days Excel document calculates the exact number of working days between two dates by excluding weekends and holidays, streamlining project scheduling and payroll processing. This tool enhances accuracy in attendance tracking and resource planning, making it essential for human resources and operations management. By automating these calculations, it reduces errors and saves significant time in administrative tasks.

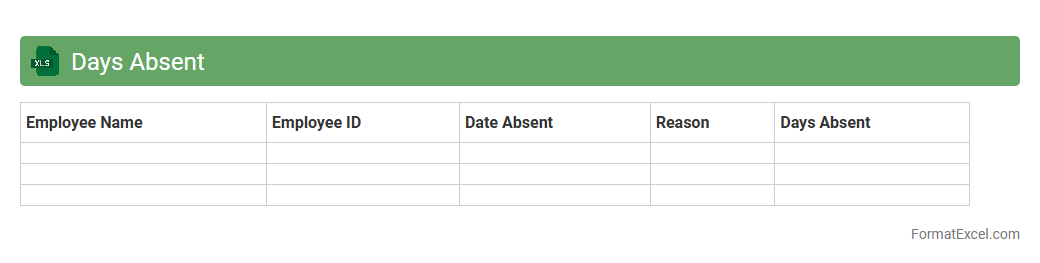

Days Absent

The

Days Absent Excel document is a digital tool designed to track employee attendance by recording the number of days each individual is absent over a specific period. This document helps organizations monitor attendance patterns, identify potential issues such as absenteeism trends, and maintain accurate records for payroll and performance evaluations. Utilizing this tool ensures efficient workforce management and supports informed decision-making in human resources.

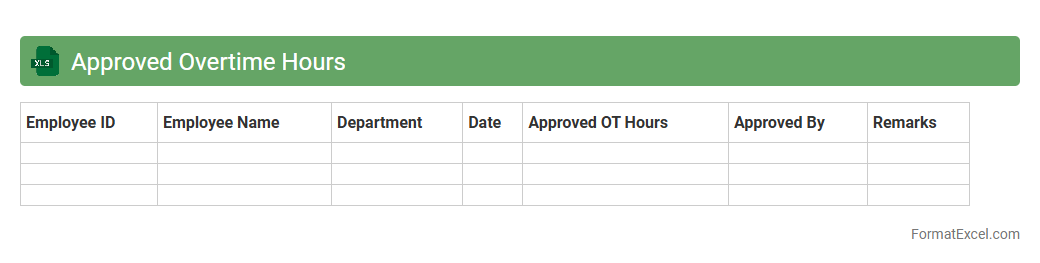

Approved Overtime Hours

The

Approved Overtime Hours Excel document tracks and records the extra hours employees work beyond their standard schedule, ensuring accurate calculation of compensation and compliance with labor regulations. It provides a clear overview of overtime approvals, enabling efficient monitoring and management of workforce productivity. This tool helps businesses control labor costs, improve payroll accuracy, and maintain transparent employee work records.

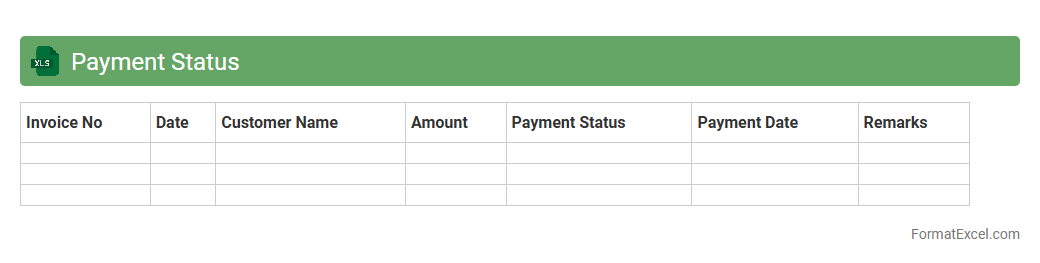

Payment Status

A

Payment Status Excel document is a spreadsheet used to track and manage payments, including due dates, amounts, and payment confirmations. It helps businesses or individuals monitor outstanding invoices, avoid missed payments, and maintain accurate financial records. By organizing payment information systematically, this document enhances cash flow management and simplifies financial reporting.

Introduction to Salary List Formats in Excel

Creating a salary list format in Excel enables efficient management of employee compensation details. Excel's grid system facilitates organized data entry and quick updates. This format supports various payroll processes and reporting needs.

Key Components of a Salary List

A comprehensive salary list includes employee names, ID numbers, basic salary, allowances, deductions, and net pay. Incorporating these key components ensures transparent and accurate payroll management. Additional columns may track bonuses, taxes, and payment dates.

Benefits of Using Excel for Salary Lists

Excel offers powerful data manipulation, easy customization, and formula-driven automation for salary calculations. The ability to visualize data through charts and conditional formatting increases payroll accuracy. It also supports secure data storage and sharing.

Essential Columns for Salary Data

Important columns include Employee ID, Name, Department, Basic Salary, Allowances, Deductions, and Net Salary. Maintaining structured columns enhances clarity and simplifies payroll processing. Accurate column headers improve data filtering and analysis.

Step-by-Step Guide to Creating a Salary List in Excel

Begin by setting up column headers and inputting employee details. Use formulas to calculate totals, deductions, and net pay automatically. Finalize by reviewing data accuracy and applying conditional formatting to highlight errors or important entries.

Best Excel Formulas for Salary Calculations

Common formulas include SUM for total pay, IF for conditional deductions, and VLOOKUP for retrieving employee details. Using these essential formulas streamlines salary computations and reduces errors. Combining functions enhances payroll efficiency.

Salary List Sample Template in Excel

A sample template typically features predefined columns, example data, and embedded formulas for automatic calculations. This template helps users quickly adapt and customize their own salary sheets. Templates save time and ensure consistency across payroll records.

Tips for Automating Salary Lists in Excel

Utilize pivot tables, macros, and advanced formulas to automate data summarization and repetitive tasks. Setting up data validation improves input accuracy. Automation boosts payroll productivity and minimizes manual errors.

Common Mistakes in Excel Salary Sheets

The most frequent errors include incorrect formula references, missing employee data, and inconsistent formatting. Avoid these by double-checking formulas and standardizing data entry. Ensuring data integrity is crucial for reliable salary management.

Downloadable Salary List Format Excel Templates

Many websites offer free and premium Excel salary list templates tailored for different business sizes. Downloading these templates provides a ready-to-use payroll framework. Customizing templates according to company policies enhances payroll accuracy.