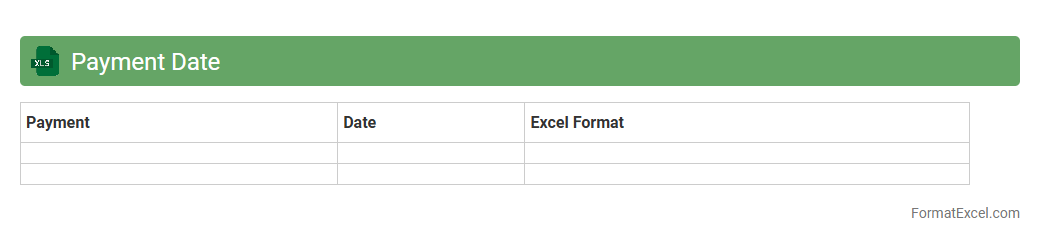

Payment Date

The

Payment Date Excel document is a structured spreadsheet designed to track and manage payment deadlines for invoices, bills, or salary disbursements. It helps individuals and businesses organize financial obligations by providing clear visibility of due dates, preventing late payments, and optimizing cash flow management. Using this document improves financial planning accuracy and enhances timely payment processing.

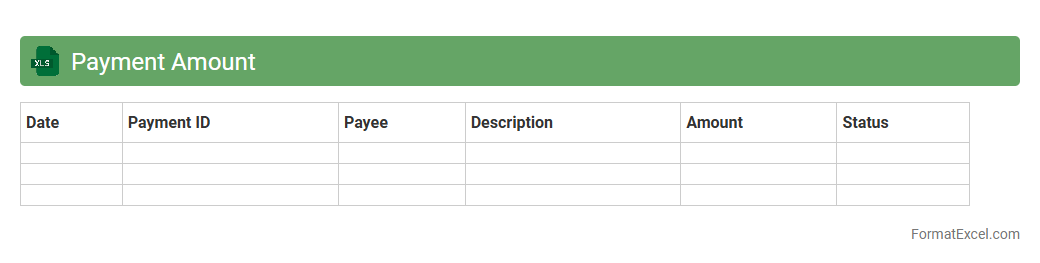

Payment Amount

The

Payment Amount Excel document is a spreadsheet tool designed to track and calculate payment transactions efficiently. It helps users organize financial data, monitor payment schedules, and ensure accurate and timely payments, which is essential for budgeting and financial planning. Utilizing this document enhances transparency and reduces errors in managing both personal and business payments.

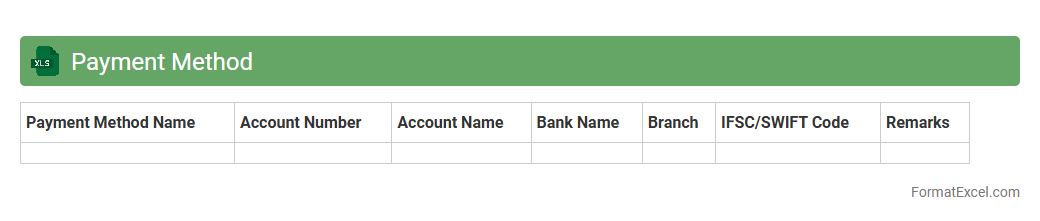

Payment Method

A

Payment Method Excel document is a structured spreadsheet that organizes various payment options, details, and transaction records in a clear and accessible format. It helps businesses efficiently track and manage multiple payment types such as credit cards, bank transfers, and digital wallets, ensuring accurate financial reporting and reconciliation. Using this document enhances operational efficiency by reducing errors, streamlining payment processing, and providing quick access to critical payment information.

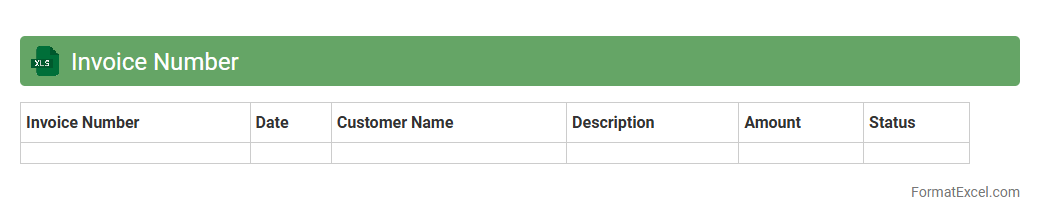

Invoice Number

An

Invoice Number Excel document is a spreadsheet designed to organize and track invoice numbers systematically, ensuring each transaction is uniquely identifiable. This document helps businesses efficiently manage billing records, streamline accounting processes, and quickly retrieve past invoices for audits or customer queries. Using such a file reduces errors, enhances financial transparency, and supports accurate record-keeping.

Vendor Name

The

Vendor Name Excel document is a structured spreadsheet that organizes vendor information such as company names, contact details, and service offerings. It streamlines supplier management by enabling quick access to critical vendor data, simplifying procurement processes, and enhancing communication efficiency. Utilizing this document helps businesses maintain accurate records, improve vendor relationships, and optimize administrative tasks.

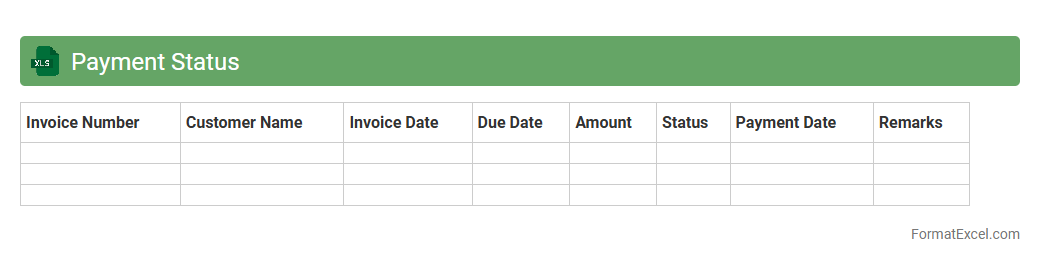

Payment Status

A

Payment Status Excel document is a structured spreadsheet used to track and record the current state of financial transactions, including payments made, pending, or overdue. It helps businesses monitor cash flow, manage accounts receivable and payable, and ensure timely follow-ups on unpaid invoices. Utilizing this document enhances financial transparency, reduces errors, and supports efficient decision-making in budgeting and forecasting.

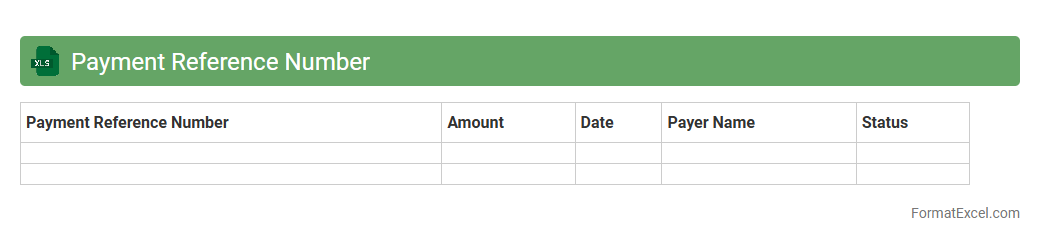

Payment Reference Number

A

Payment Reference Number Excel document is a spreadsheet that organizes and tracks unique identifiers assigned to individual payment transactions, facilitating easy identification and reconciliation. This document helps businesses and individuals efficiently manage financial records, ensuring accurate payment processing and reducing errors during audits. By maintaining systematic data in the Excel format, users can quickly search, filter, and analyze payment histories to improve financial transparency and control.

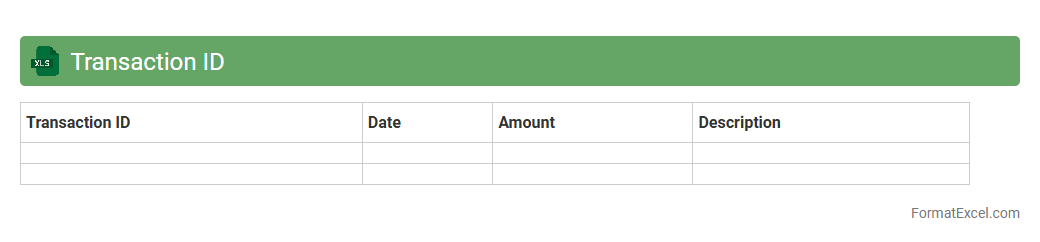

Transaction ID

A

Transaction ID Excel document is a spreadsheet that organizes and tracks unique identifiers assigned to individual financial or business transactions. It helps streamline data management by allowing users to quickly locate specific transactions, verify accuracy, and reconcile accounts efficiently. This tool is essential for audit trails, fraud detection, and ensuring transparent record-keeping in financial operations.

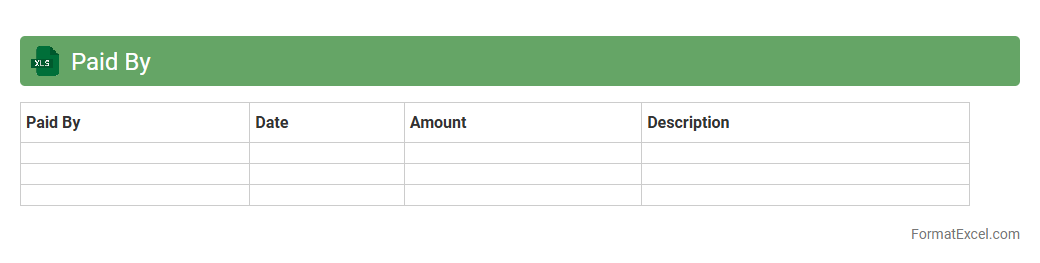

Paid By

A

Paid By Excel document is a spreadsheet used to track and manage payment transactions, detailing who made payments, payment dates, and amounts. It helps businesses and individuals maintain accurate financial records, ensuring transparency and accountability in payment processes. By organizing payment information systematically, it improves cash flow management and simplifies audit and reconciliation tasks.

Received By

The

Received By Excel document is a structured digital record used to track and verify the receipt of goods, services, or information within a business or organization. It enables efficient monitoring of delivery statuses, ensuring accountability and reducing errors in inventory management or project workflows. Using this document facilitates clear communication, timely updates, and accurate record-keeping, supporting better decision-making and operational transparency.

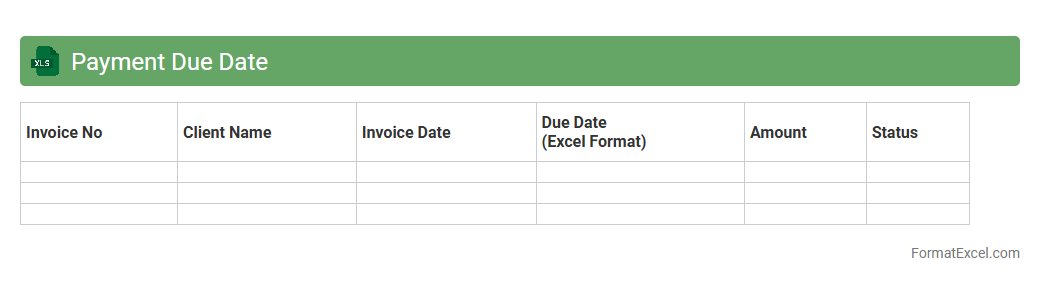

Payment Due Date

A

Payment Due Date Excel document is a spreadsheet designed to track and manage deadlines for financial obligations, helping individuals and businesses avoid late fees and maintain good credit standing. It allows users to organize payment schedules, set reminders, and monitor outstanding balances efficiently. This tool improves cash flow management and ensures timely payments, contributing to better financial planning and accountability.

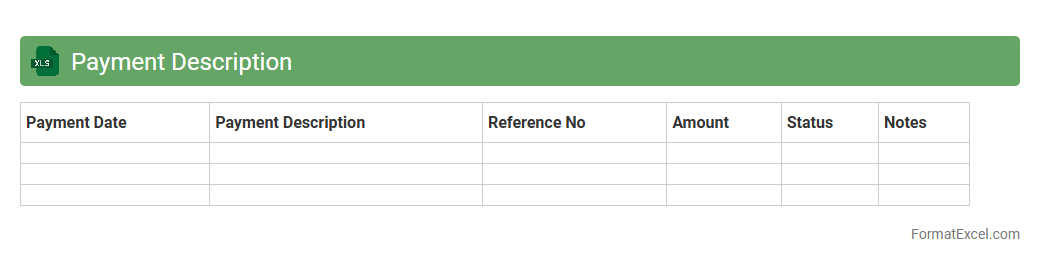

Payment Description

A

Payment Description Excel document is a structured spreadsheet that details the specifics of financial transactions, including payment dates, amounts, payees, and transaction references. This document is useful for financial tracking, reconciliation, and auditing purposes, ensuring accuracy and transparency in managing payments. Businesses rely on it to streamline accounting processes, monitor cash flow, and maintain organized financial records.

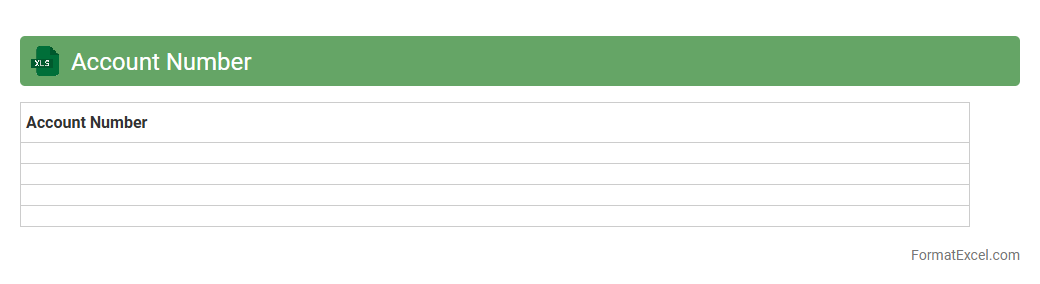

Account Number

An

Account Number Excel document is a spreadsheet that organizes and stores unique account identifiers for financial transactions or client records. It streamlines data management, enabling quick retrieval and accurate tracking of multiple accounts, which is essential for auditing and reporting purposes. Using this document enhances efficiency by reducing manual errors and facilitating automated processes in accounting and finance operations.

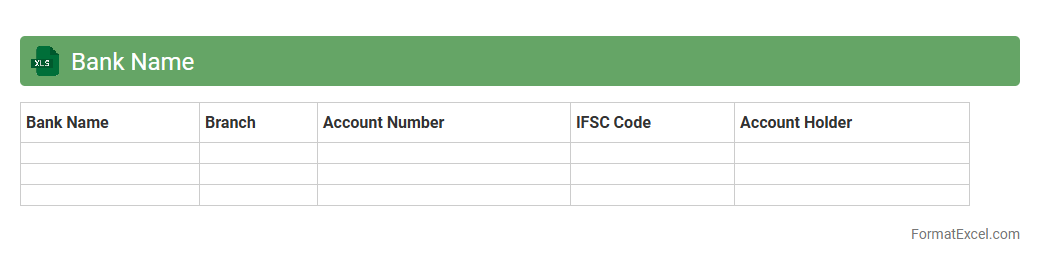

Bank Name

A

Bank Name Excel document is a structured spreadsheet containing a comprehensive list of bank names, often accompanied by relevant details such as branch locations, contact information, and banking codes. This document streamlines the process of identifying and verifying banks in financial transactions, ensuring accuracy and efficiency. It is particularly useful for businesses, accountants, and financial institutions in managing payment processes, maintaining records, and conducting audits.

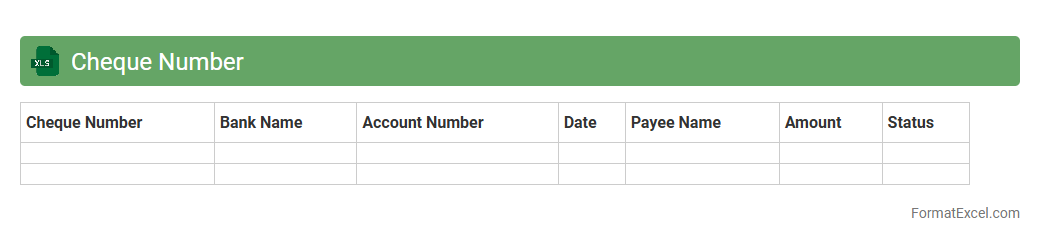

Cheque Number

A

Cheque Number Excel document is a structured spreadsheet used to record and track cheque numbers along with associated transaction details, such as dates, payees, and amounts. It streamlines financial management by providing an organized, searchable record that helps prevent errors and fraud, ensuring accurate reconciliation of bank statements. This tool is essential for businesses and individuals aiming to maintain clear, efficient documentation of cheque payments for budgeting and auditing purposes.

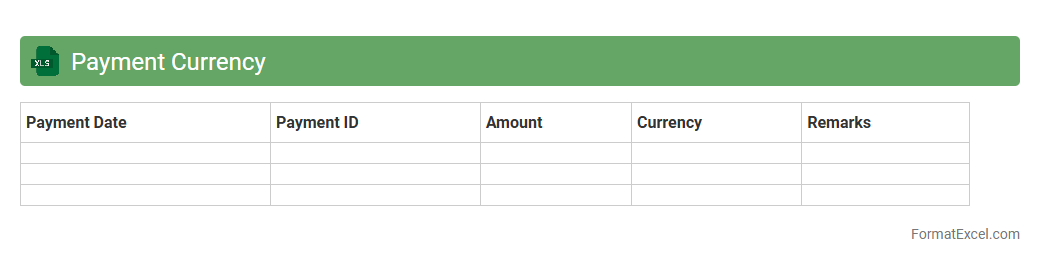

Payment Currency

A

Payment Currency Excel document is a structured spreadsheet used to manage and track transactions involving different currencies. It helps businesses monitor exchange rates, calculate conversion amounts, and maintain accurate financial records for international payments. This tool enhances financial accuracy, streamlines currency management, and supports better decision-making in global trade operations.

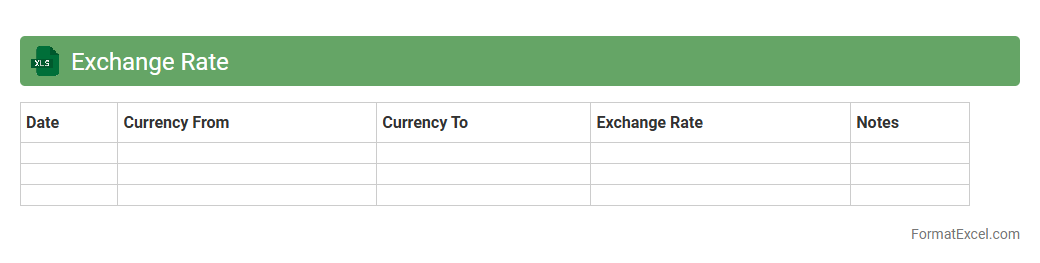

Exchange Rate

An

Exchange Rate Excel document is a spreadsheet tool designed to track, analyze, and convert currency values based on current or historical exchange rates. It helps businesses and individuals manage international transactions, budget forecasting, and financial reporting by providing real-time currency conversion and trend visualization. Using this document streamlines decision-making processes related to forex exposure and optimizes financial planning in a global market.

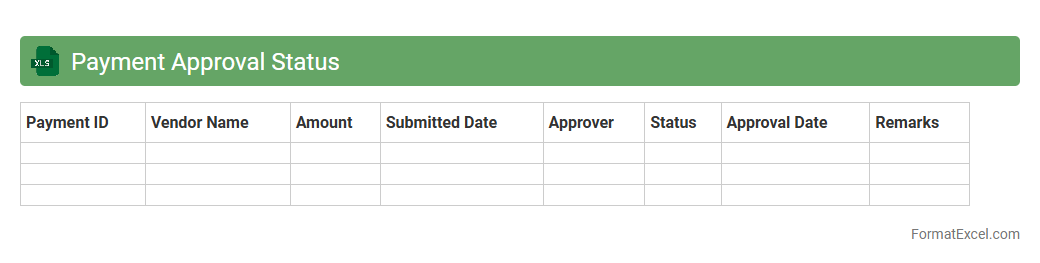

Payment Approval Status

The

Payment Approval Status Excel document tracks the current stage of payment authorizations, ensuring transparency and accountability in financial operations. It helps businesses monitor pending, approved, or rejected payments, enabling efficient cash flow management and dispute resolution. This organized overview reduces errors and accelerates decision-making processes within finance teams.

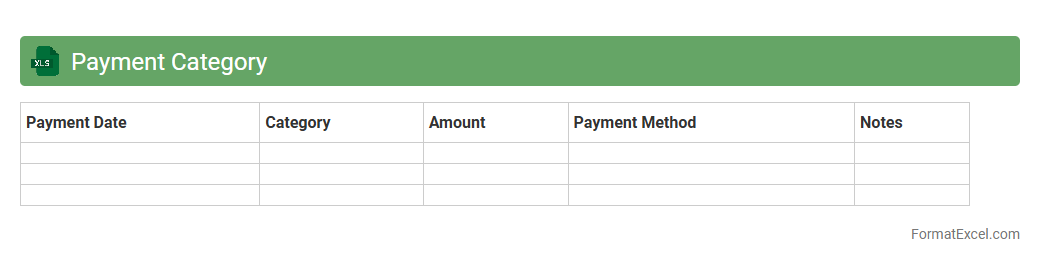

Payment Category

The

Payment Category Excel document organizes various types of payments into distinct categories, enabling efficient tracking and analysis of financial transactions. It helps businesses streamline expense management, identify spending patterns, and prepare accurate budgets. By categorizing payments, users can enhance financial reporting and improve decision-making processes.

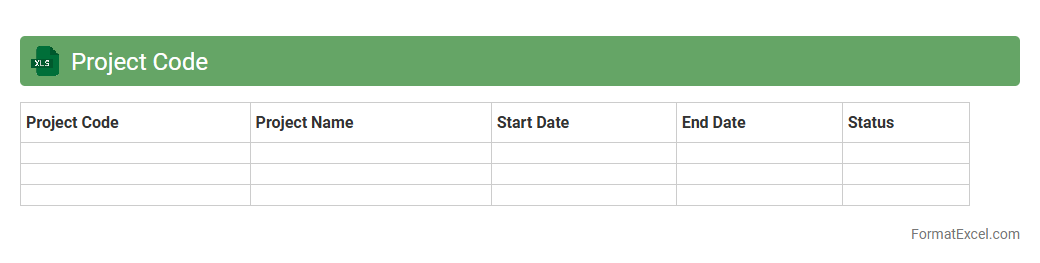

Project Code

A

Project Code Excel document is a structured spreadsheet that organizes project-related codes, tasks, and progress tracking within a centralized platform. It enhances project management efficiency by providing clear categorization, easy updates, and real-time data analysis for stakeholders. This tool supports resource allocation, timeline monitoring, and budget control, leading to improved decision-making and successful project outcomes.

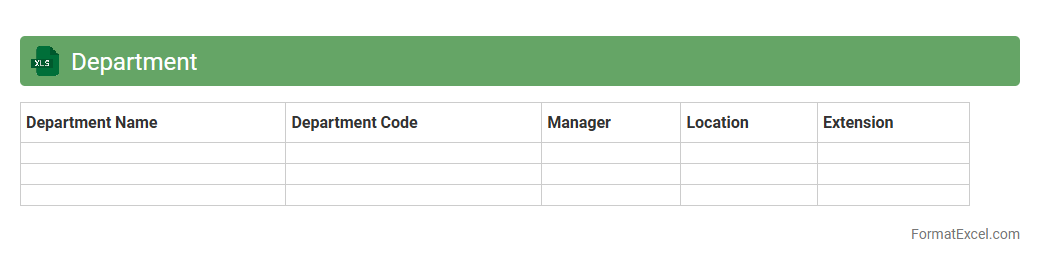

Department

A

Department Excel document is a structured spreadsheet that organizes and tracks data specific to various departments within an organization, such as sales, finance, human resources, or marketing. It allows for efficient management of tasks, budgeting, performance metrics, and resource allocation by providing a clear overview and easy data analysis tools like charts and pivot tables. This document enhances collaboration and decision-making by consolidating critical departmental information in a centralized, accessible format.

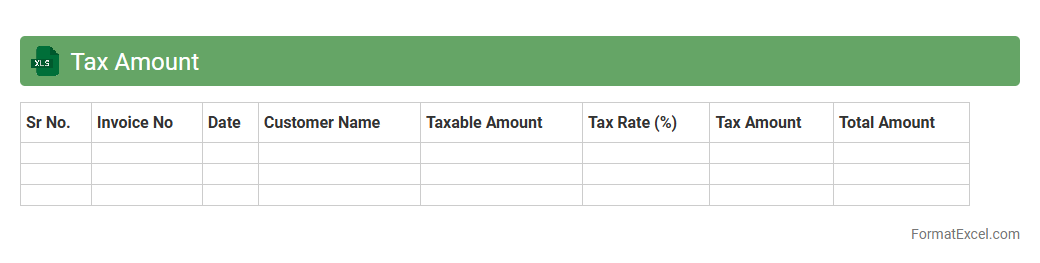

Tax Amount

A

Tax Amount Excel document is a spreadsheet tool designed to calculate, organize, and track tax liabilities and payments efficiently. It helps users manage complex tax data by automating calculations, ensuring accuracy, and providing a clear overview of tax obligations for individuals or businesses. This tool simplifies tax preparation, aids in compliance with tax regulations, and supports financial planning by offering detailed insights into tax amounts owed or refunded.

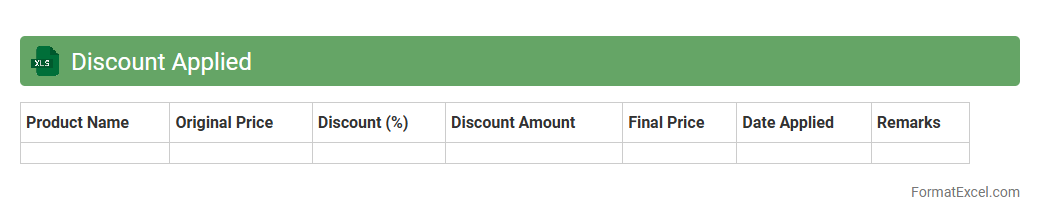

Discount Applied

The

Discount Applied Excel document is a spreadsheet that tracks and calculates discounts applied to products or services, aiding in accurate financial reporting and sales analysis. It automates the process of applying discount rates to sales data, ensuring consistency and reducing errors in manual calculations. This tool is essential for businesses to monitor discount impacts on revenue, optimize pricing strategies, and improve profitability.

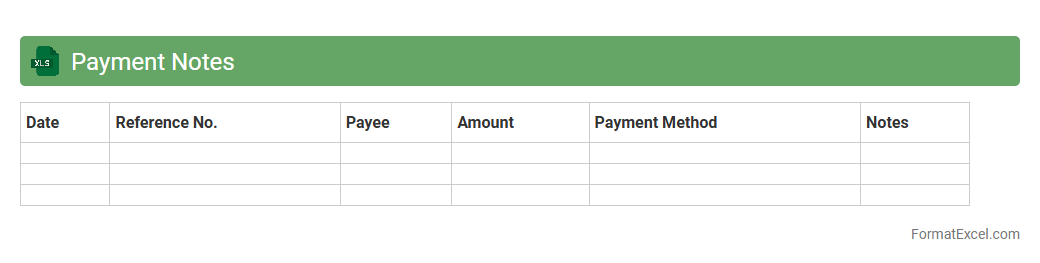

Payment Notes

Payment Notes Excel document is a

financial record-keeping tool that organizes payment details such as dates, amounts, payees, and transaction references. It enables efficient tracking and reconciliation of payments, ensuring accuracy in financial management and reducing the risk of errors or missed transactions. The document aids businesses and individuals by providing clear, searchable, and customizable payment histories for budgeting and auditing purposes.

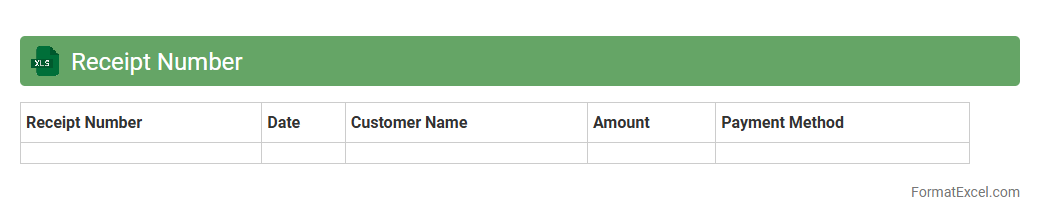

Receipt Number

A

Receipt Number Excel document is a spreadsheet that organizes and tracks individual receipt numbers for financial transactions, ensuring systematic record-keeping. It enables businesses and individuals to easily verify payments, manage expenses, and streamline accounting processes by providing quick access to transaction details. This tool enhances accuracy and efficiency in financial reporting and auditing tasks.

Introduction to Payment Record Format in Excel

Keeping a payment record format in Excel ensures organized tracking of financial transactions. Excel offers flexibility to customize layouts as per business requirements. This format helps streamline accounting and enhances accuracy.

Importance of Structured Payment Records

Structured payment records in Excel improve data accessibility and reduce errors. They provide a clear overview of all transactions, aiding in financial analysis. Maintaining structured records is key to effective financial management.

Key Components of a Payment Record Spreadsheet

A robust payment record includes essential elements like dates, amounts, payer details, and payment methods. These components help to monitor payments systematically. Having these core components ensures thorough financial documentation.

Designing a Clear Payment Record Layout

A clean and logical layout enhances readability and ease of use. Group related data in well-defined sections with proper headers. Prioritizing a clear design allows quicker data entry and retrieval.

Essential Columns for Payment Tracking

Common columns include Invoice Number, Payment Date, Amount Paid, Payment Status, and Notes. These columns capture all critical payment details for monitoring purposes. Utilizing essential columns supports efficient tracking.

Using Excel Formulas for Payment Calculations

Leveraging Excel formulas like SUM, IF, and VLOOKUP automates totals and conditional checks. This reduces manual calculation errors and saves time. Applying formulas enhances payment record accuracy.

Data Validation and Error Prevention Tips

Implementing data validation rules prevents incorrect data entries such as invalid dates or negative amounts. Drop-down lists and input restrictions help maintain data integrity. Proper error prevention ensures reliable records.

Customizing Templates for Business Needs

Templates can be modified to fit specific business workflows and reporting requirements. Adding extra fields or changing formats personalizes the payment record sheet. Customization creates a tailored template for better usability.

Automating Payment Records with Excel Features

Excel features like macros and pivot tables can automate data processing and reporting tasks. Automation reduces manual input and improves efficiency in managing payments. Utilizing automation drives consistency and saves time.

Best Practices for Securing and Sharing Excel Payment Files

Protect sensitive payment data by using passwords and restricting file access permissions. Secure sharing methods ensure confidentiality between stakeholders. Following security best practices maintains data privacy and integrity.