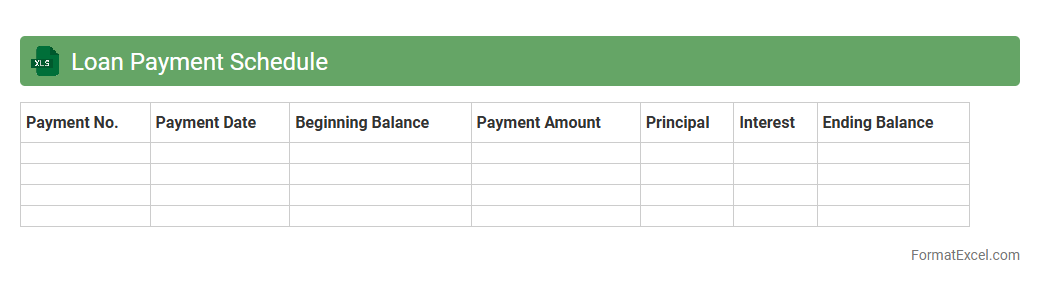

Loan Payment Schedule

A

Loan Payment Schedule Excel document outlines the detailed timeline of loan repayments, including principal, interest amounts, and due dates. It helps borrowers track their payment progress, plan finances effectively, and avoid missed payments or penalties. Using this schedule enhances financial management by providing a clear, organized view of loan obligations.

Principal Payment Tracker

The

Principal Payment Tracker Excel document is a financial tool designed to monitor and record loan principal repayments over time. It helps users visualize payment progress, calculate outstanding balances, and manage loan schedules efficiently. This tracker aids in avoiding missed payments and optimizing debt repayment strategies.

Interest Payment Tracking

The

Interest Payment Tracking Excel document is a financial tool designed to monitor loan interest payments over time, ensuring accurate calculation and timely updates. It helps users maintain a clear record of principal amounts, interest rates, payment dates, and outstanding balances, facilitating effective cash flow management. By providing detailed insights into interest obligations, it supports better budgeting and decision-making for both personal and business finances.

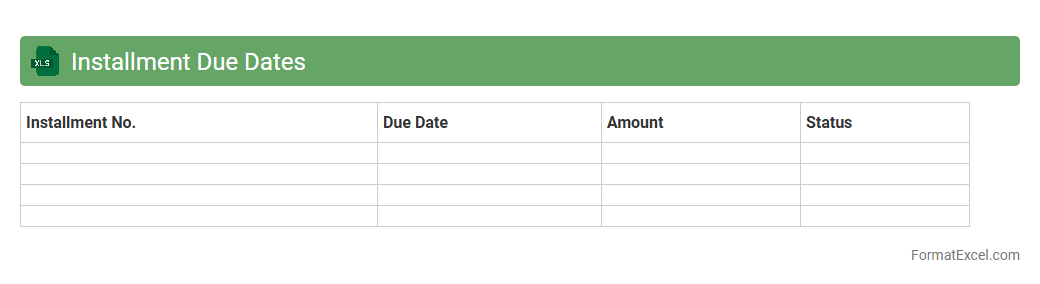

Installment Due Dates

An

Installment Due Dates Excel document is a spreadsheet designed to track payment schedules for loans, subscriptions, or installment plans. It helps users organize and manage upcoming due dates efficiently, reducing the risk of missed payments and late fees. By providing clear visibility of payment timelines, this tool ensures better financial planning and timely budgeting.

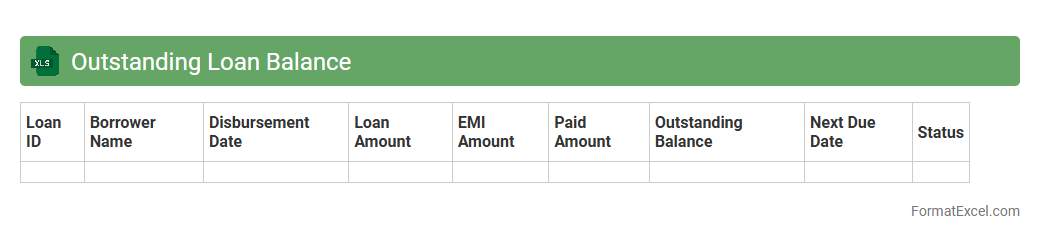

Outstanding Loan Balance

An

Outstanding Loan Balance Excel document is a spreadsheet that tracks the remaining amount owed on various loans, including principal and interest details. It helps individuals and businesses monitor repayment progress, manage cash flow, and plan future financial obligations effectively. By providing clear visibility of loan statuses, this tool supports better decision-making and ensures timely payments.

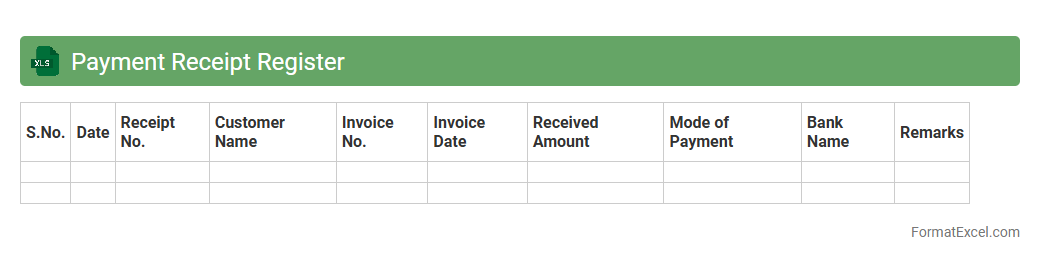

Payment Receipt Register

A

Payment Receipt Register Excel document is a structured spreadsheet used to record and track payments received from customers or clients. It helps businesses maintain accurate financial records by documenting payment dates, amounts, modes of payment, and payer details, facilitating efficient reconciliation and audit processes. This register enhances cash flow management and ensures transparency in financial transactions, making it an essential tool for accounting and financial reporting.

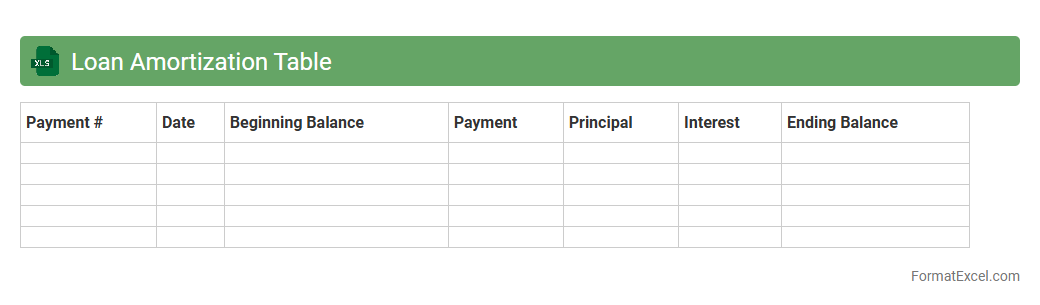

Loan Amortization Table

A

Loan Amortization Table Excel document is a detailed spreadsheet that breaks down each loan payment into principal and interest components over the loan term. It helps users track outstanding loan balances, visualize repayment schedules, and understand how much interest will be paid throughout the life of the loan. This tool is valuable for budgeting, financial planning, and comparing different loan scenarios to make informed borrowing decisions.

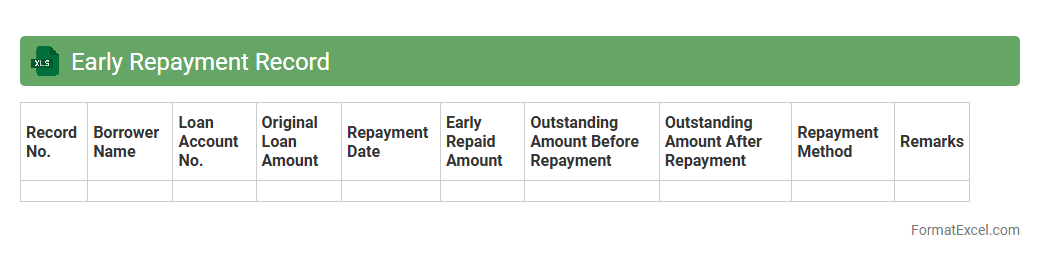

Early Repayment Record

The

Early Repayment Record Excel document tracks loan repayments made ahead of schedule, detailing amounts, dates, and remaining balances. It provides clear visibility into prepayments, helping lenders manage cash flow and forecast interest earnings more accurately. This record also assists borrowers in monitoring their repayment progress and planning future financial decisions.

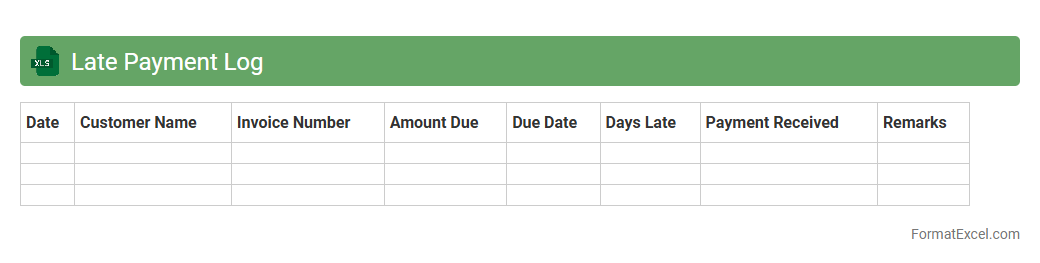

Late Payment Log

The

Late Payment Log Excel document is a tool designed to track overdue payments efficiently, capturing details such as invoice numbers, due dates, payment dates, and outstanding amounts. It is useful for businesses to monitor payment delays, identify recurring defaulters, and manage cash flow by providing clear visibility into financial liabilities. This organized record helps improve collection efforts and supports timely follow-ups with clients or vendors.

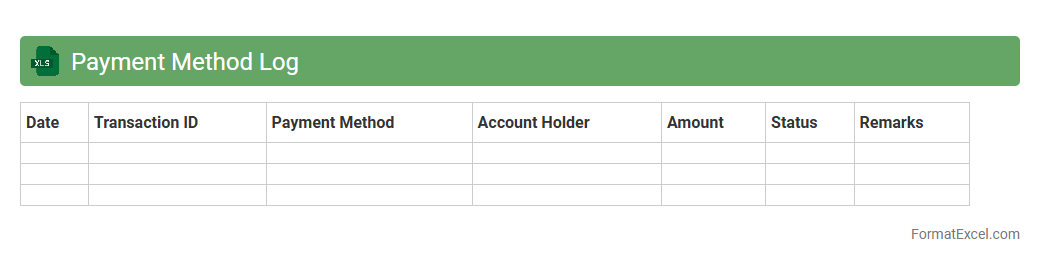

Payment Method Log

The

Payment Method Log Excel document systematically records all transactions categorized by payment types such as credit cards, cash, and online transfers, enabling accurate financial tracking. It allows businesses to monitor payment trends, streamline accounting processes, and quickly identify discrepancies for audit purposes. Utilizing this log enhances transparency in financial operations and supports effective cash flow management.

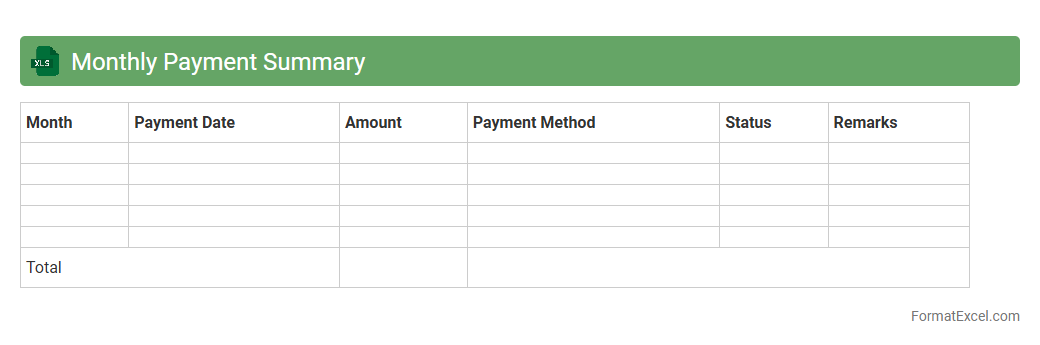

Monthly Payment Summary

The

Monthly Payment Summary Excel document consolidates all payment transactions within a given month, providing a clear overview of expenses, vendor payments, and employee reimbursements. This organized summary aids in tracking cash flow, ensuring accuracy in financial records, and facilitating budget management. Using this document enhances transparency and streamlines the reconciliation process for accounting teams.

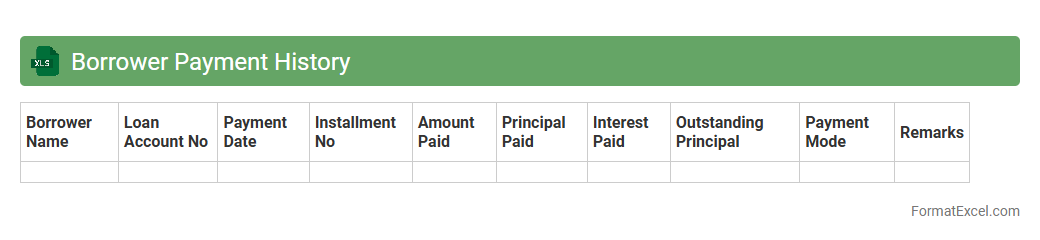

Borrower Payment History

The

Borrower Payment History Excel document records all past transactions, including payment dates, amounts, and outstanding balances, providing a comprehensive timeline of borrower activity. It is useful for tracking repayment patterns, identifying delinquencies, and assessing creditworthiness. This detailed record supports effective loan management and informed decision-making in financial institutions.

Partial Payment Tracker

The Partial Payment Tracker Excel document is a powerful tool designed to monitor and manage

partial payments efficiently, providing a clear overview of outstanding balances and payment schedules. It helps businesses and individuals keep track of multiple payments made over time, reducing errors and improving financial organization. By using this tracker, users can quickly reconcile accounts, forecast cash flow, and ensure timely follow-up on pending amounts.

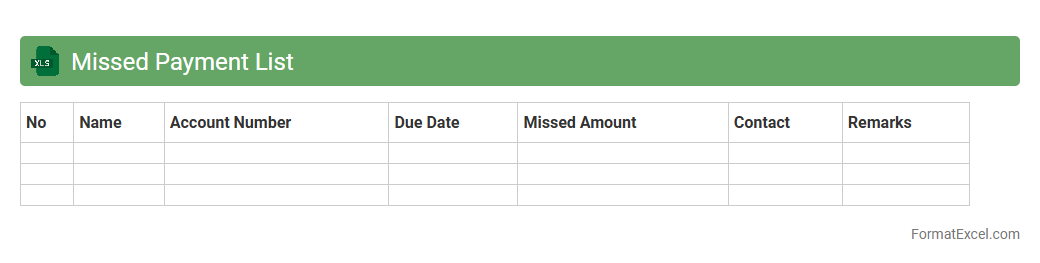

Missed Payment List

The

Missed Payment List Excel document is a detailed record of all overdue payments, including client names, amounts owed, and payment due dates. It helps businesses track outstanding debts efficiently, identify late payers, and prioritize follow-up actions to improve cash flow. This organized format enhances financial management by reducing missed collections and maintaining accurate accounts receivable data.

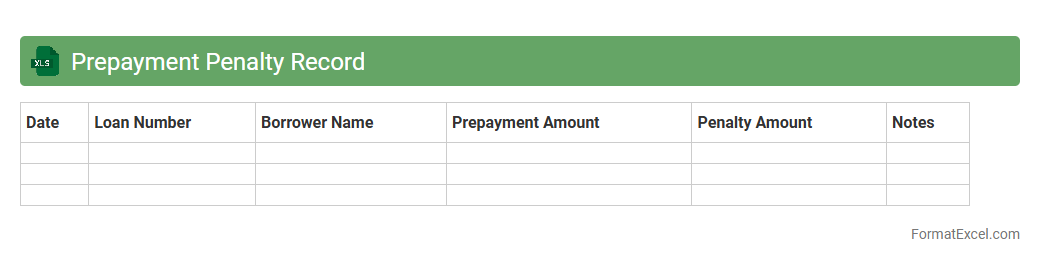

Prepayment Penalty Record

A

Prepayment Penalty Record Excel document tracks fees charged when loans are paid off early, detailing loan amounts, penalty rates, and payment dates. This record is useful for accurately calculating potential costs, managing financial planning, and ensuring transparency in loan agreements. It streamlines decision-making by providing clear insights into penalties associated with early loan repayments.

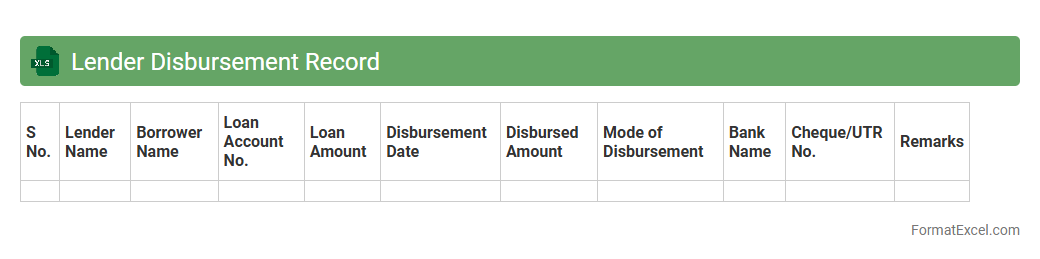

Lender Disbursement Record

The

Lender Disbursement Record Excel document is a detailed financial tracking tool that records loan disbursements from lenders to borrowers, capturing key data such as disbursement dates, amounts, and borrower information. This document enhances loan management efficiency by providing clear visibility into payment histories and outstanding balances, enabling accurate reconciliation and timely follow-ups. It is particularly useful for financial institutions and loan officers to monitor cash flows and ensure compliance with lending agreements.

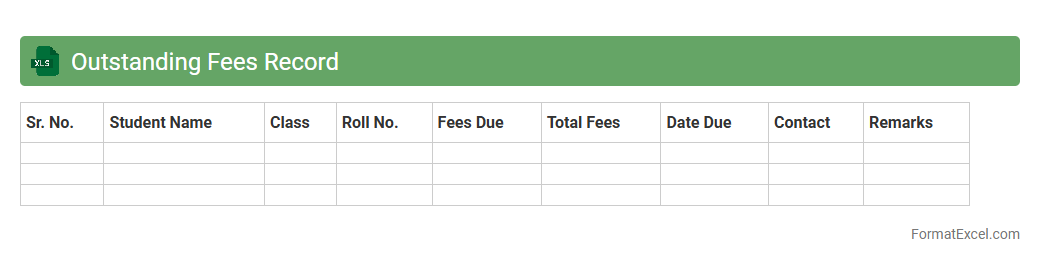

Outstanding Fees Record

The

Outstanding Fees Record Excel document is a systematic ledger that tracks unpaid fees or dues owed by individuals or organizations, providing a clear overview of pending payments. It helps in efficiently managing financial collections by recording details such as debtor names, amounts due, due dates, and payment status, ensuring transparency and accountability. This tool is invaluable for businesses, schools, or service providers to monitor cash flow, reduce default risks, and streamline follow-up processes.

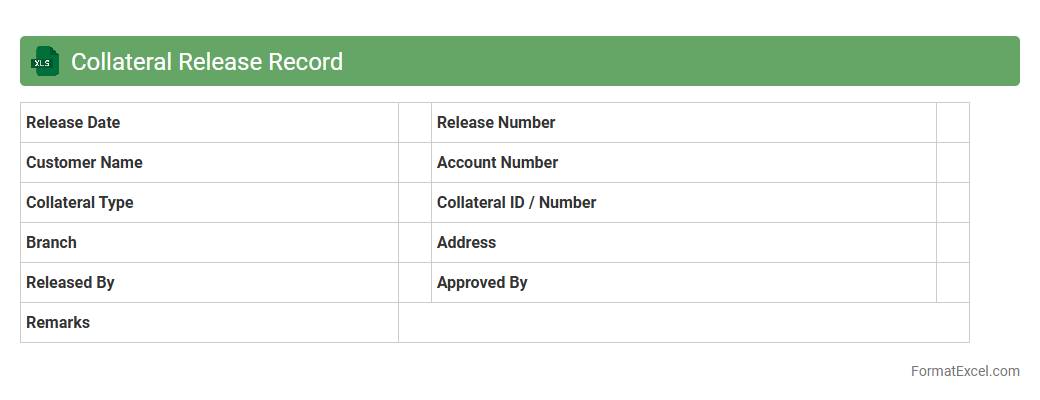

Collateral Release Record

The

Collateral Release Record Excel document is a structured ledger used to track the release status of collateral assets tied to loans or financial agreements. It provides clear, organized data on collateral types, release dates, borrower details, and approval status, enhancing transparency and accountability in asset management. This tool is useful for financial institutions and businesses to ensure accurate monitoring, reduce risk, and streamline audit processes related to secured transactions.

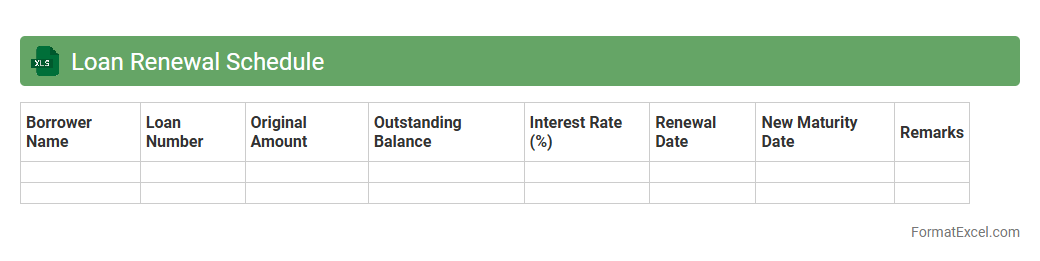

Loan Renewal Schedule

A

Loan Renewal Schedule Excel document is a structured spreadsheet that tracks the dates and details of loan renewals, including principal amounts, interest rates, and maturity dates. It helps individuals and businesses manage their loan obligations by providing a clear timeline for upcoming renewals, ensuring timely payments and avoiding penalties. This tool enhances financial planning and cash flow management by offering an organized overview of all loan renewal activities.

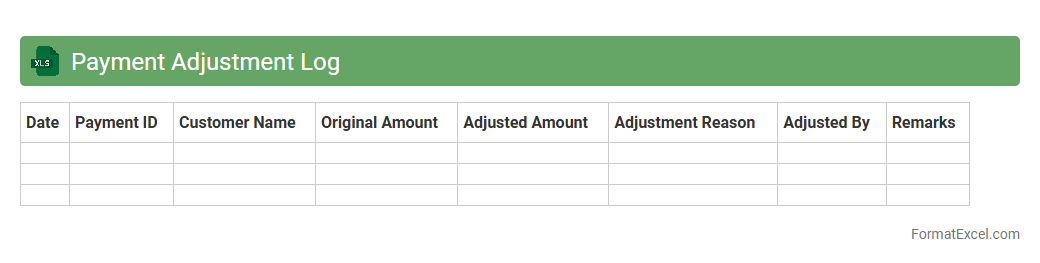

Payment Adjustment Log

The

Payment Adjustment Log Excel document tracks and records changes made to payments, including corrections, refunds, and additional charges, ensuring transparency and accuracy in financial transactions. It allows businesses to monitor discrepancies, reconcile accounts efficiently, and maintain a clear audit trail for compliance purposes. Utilizing this log helps reduce errors, improve payment processing workflows, and supports financial decision-making by providing detailed payment adjustment histories.

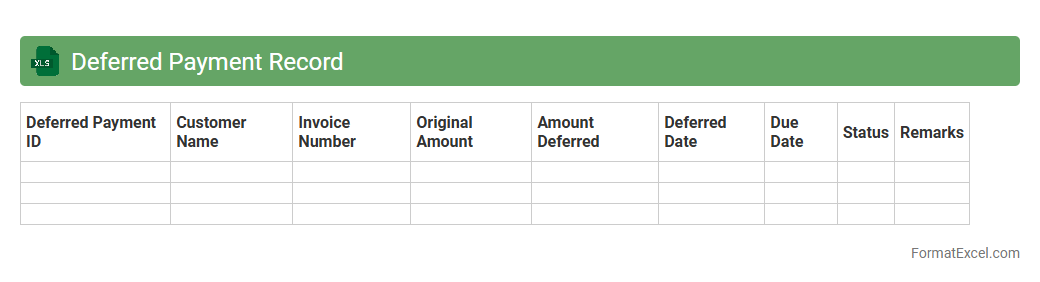

Deferred Payment Record

A

Deferred Payment Record Excel document is a structured spreadsheet used to track and manage payment obligations that are postponed to a later date. It records essential details such as payment dates, amounts, client information, and outstanding balances, enabling accurate monitoring of financial commitments. This tool enhances cash flow management, reduces the risk of missed payments, and supports timely financial planning for businesses and individuals.

Grace Period Tracking

Grace Period Tracking Excel document is a powerful tool designed to monitor deadlines and manage extensions within specified time frames for tasks or payments. It helps businesses avoid penalties by clearly outlining

grace periods, ensuring timely actions and improving operational efficiency. Utilizing this document increases accuracy in tracking deadlines, reduces missed opportunities, and supports better decision-making.

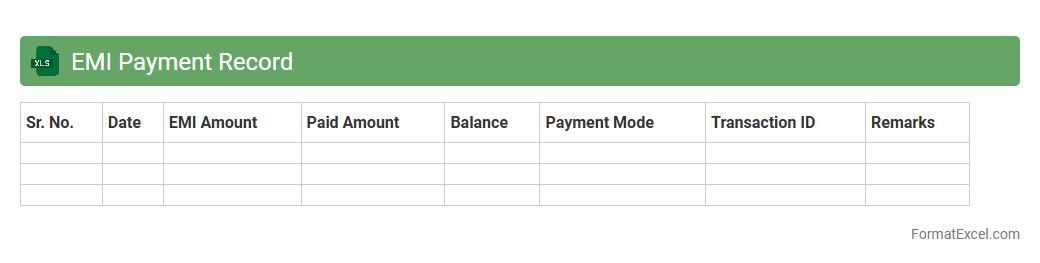

EMI Payment Record

An

EMI Payment Record Excel document is a structured spreadsheet that tracks Equated Monthly Installments (EMIs) for loans or credit payments. It helps users monitor payment schedules, outstanding balances, interest amounts, and due dates in an organized manner. This document is useful for maintaining financial discipline, ensuring timely payments, and analyzing loan repayment progress effectively.

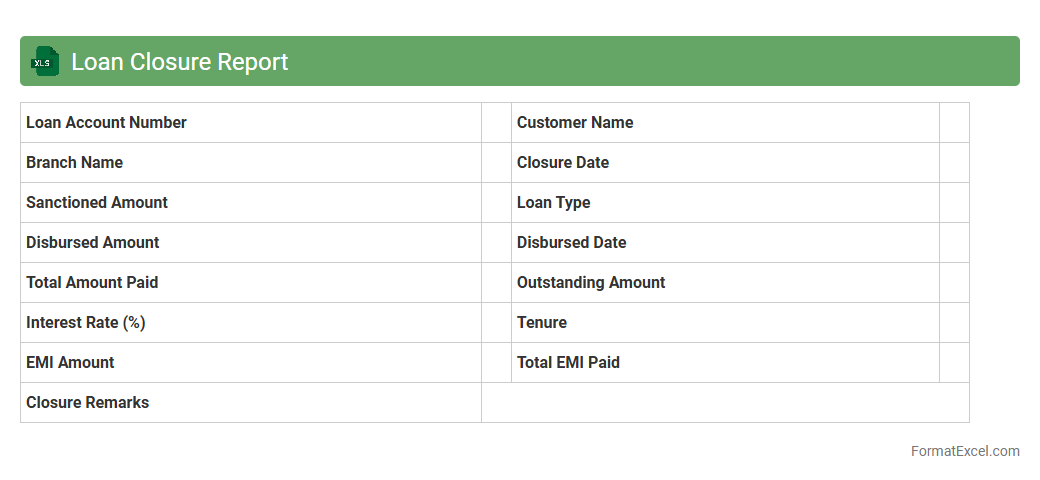

Loan Closure Report

A

Loan Closure Report Excel document is a comprehensive tool that tracks the final settlement of loans, detailing principal amounts, interest paid, and any outstanding dues. It helps individuals and financial institutions verify that loans are fully repaid, ensuring accurate financial records and preventing future disputes. Using this report enhances transparency in loan management and supports effective financial planning.

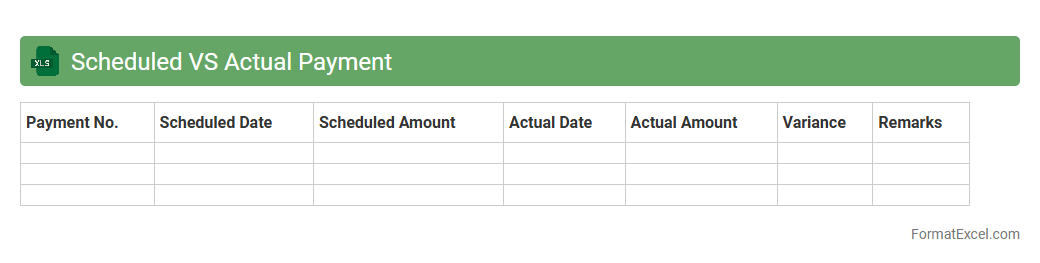

Scheduled VS Actual Payment

The

Scheduled VS Actual Payment Excel document tracks and compares planned payment dates and amounts against the payments actually made, helping businesses monitor cash flow accuracy. It enables timely identification of discrepancies, delays, or overpayments, facilitating better financial control and forecasting. Using this document streamlines budgeting processes and enhances accountability in payment management.

Introduction to Loan Payment Records

Loan payment records are crucial for tracking debt repayments and managing finances effectively. These records help borrowers and lenders maintain a clear history of all transactions. Understanding how to maintain a loan payment record in Excel is essential for financial clarity.

Importance of Organized Loan Payment Tracking

Organizing loan payments ensures timely repayments and helps avoid missed deadlines. Proper tracking builds trust between lenders and borrowers by documenting each payment. Maintaining an organized loan payment ledger simplifies financial audits and planning.

Essential Fields for Loan Payment Records

A typical loan payment record includes fields such as payment date, amount paid, remaining balance, and payment method. Including borrower details and loan terms adds context to the record. Accurate completion of essential record fields enhances data reliability.

Step-by-Step Guide to Creating an Excel Template

Start by setting up columns for date, payment amount, principal, interest, and balance. Format cells for currency and dates to ensure clarity and consistency. Following a step-by-step Excel setup streamlines data entry and tracking.

Best Practices for Data Entry in Excel

Data should be entered consistently with proper formatting and validation rules to prevent errors. Keep formulas intact and locked to avoid accidental changes. Adhering to best practices in Excel data entry guarantees accurate and reliable records.

Sample Loan Payment Record Format

A sample format displays a clear timeline of payments, balances, and interest calculations. It typically uses rows for payment entries and columns for descriptive data. Utilizing a structured sample format provides a practical framework for managing loans.

Automating Calculations with Excel Formulas

Excel formulas can automatically calculate outstanding balances, interest accrued, and total payments. Common formulas include SUM, IF, and PMT for loan calculations. Using automated Excel formulas saves time and reduces manual errors.

Tips for Enhancing Record Accuracy

Double-check data entries regularly and use Excel's data validation features. Backup your spreadsheet frequently to avoid data loss. Maintaining accuracy tips ensures trustworthy payment records.

Security and Confidentiality in Financial Spreadsheets

Protect your Excel files with passwords and limit access to authorized users only. Avoid sharing sensitive financial information through unsecured channels. Prioritizing spreadsheet security and confidentiality safeguards personal and financial data.

Free Downloadable Loan Payment Record Templates

Many websites offer free Excel templates to simplify loan payment tracking. These templates come preformatted with key fields and formulas for ease of use. Utilizing free downloadable templates is a convenient way to manage loan payments efficiently.