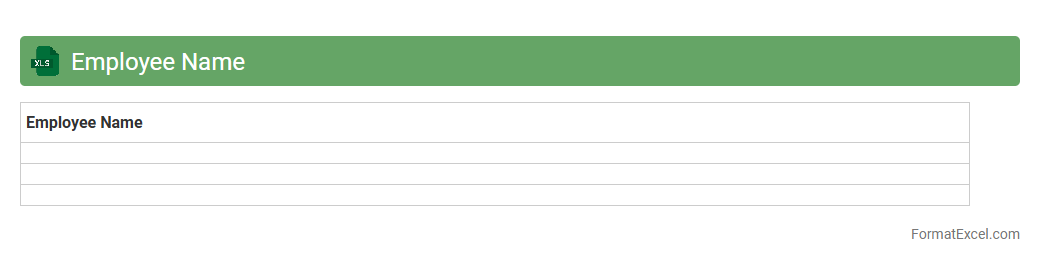

Employee Name

The

Employee Name Excel document is a structured spreadsheet containing employee names, often paired with relevant details like IDs, departments, and contact information. It streamlines workforce management by enabling quick access to personnel data, facilitating payroll processing, attendance tracking, and communication. This document enhances organizational efficiency by providing a centralized, easily searchable list of employees, reducing errors and saving time.

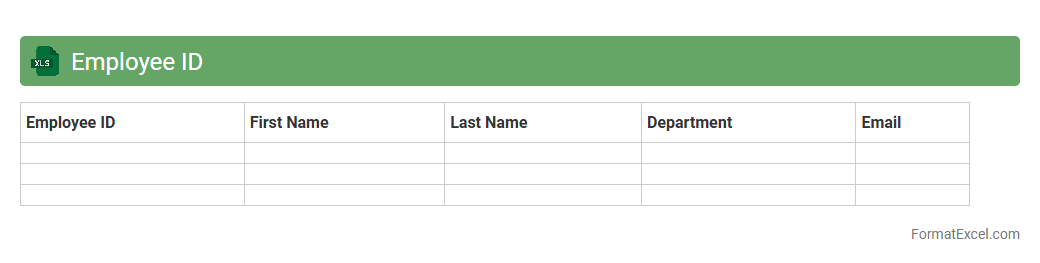

Employee ID

An

Employee ID Excel document is a structured spreadsheet used to organize and track unique identification numbers assigned to employees within an organization. It helps streamline human resource management by enabling quick access to employee records, attendance, payroll, and performance data. This document enhances data accuracy, improves administrative efficiency, and facilitates seamless communication across departments.

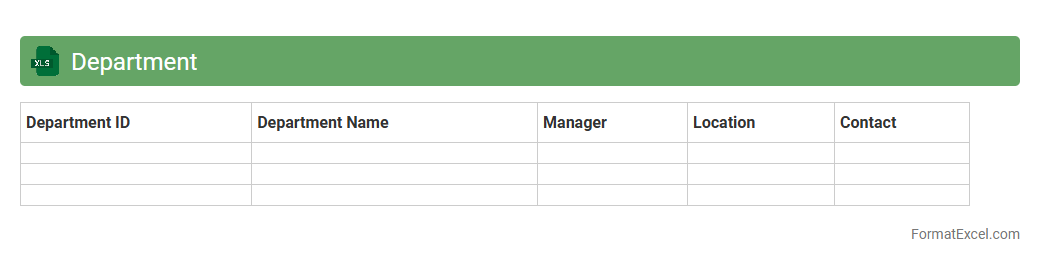

Department

A

Department Excel document is a structured spreadsheet designed to organize, analyze, and manage data specific to a particular department within an organization, such as sales, finance, or human resources. It helps streamline workflows by consolidating essential information like employee details, budget tracking, performance metrics, and project timelines, enabling efficient decision-making. This tool enhances productivity by providing clear insights, facilitating communication, and supporting data-driven strategies across departmental operations.

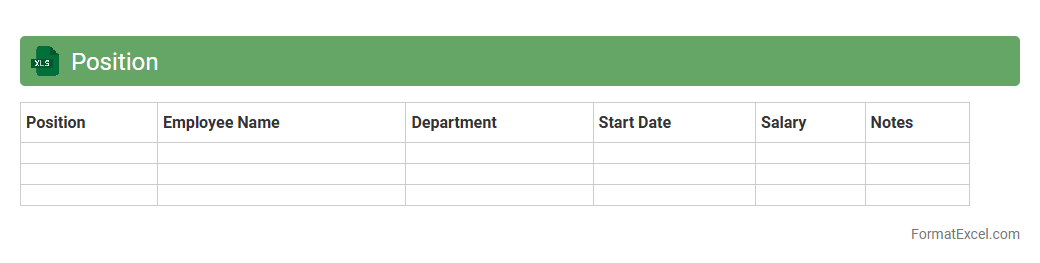

Position

A

Position Excel document is a spreadsheet used to track and analyze various positions within a company, market, or project, including roles, stock holdings, or job assignments. It helps organize critical data such as employee roles, stock quantities, or project statuses, enabling better decision-making and resource management. By providing clear visibility into current positions, it enhances strategic planning and operational efficiency across teams or financial portfolios.

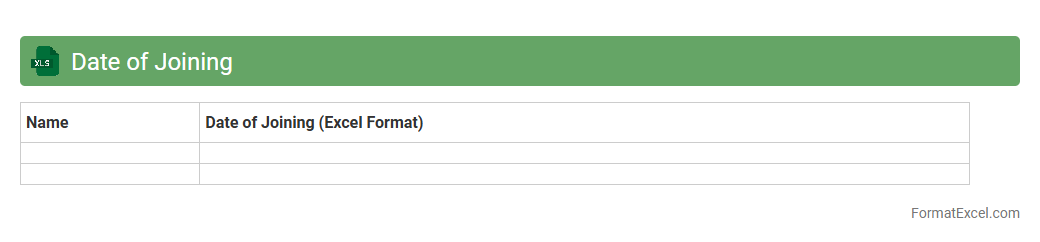

Date of Joining

A

Date of Joining Excel document records the exact date employees begin their tenure within an organization, serving as a critical reference for HR management. It enables accurate calculation of employee seniority, benefits eligibility, and performance review timelines. Utilizing this data ensures streamlined payroll processing and compliance with labor regulations.

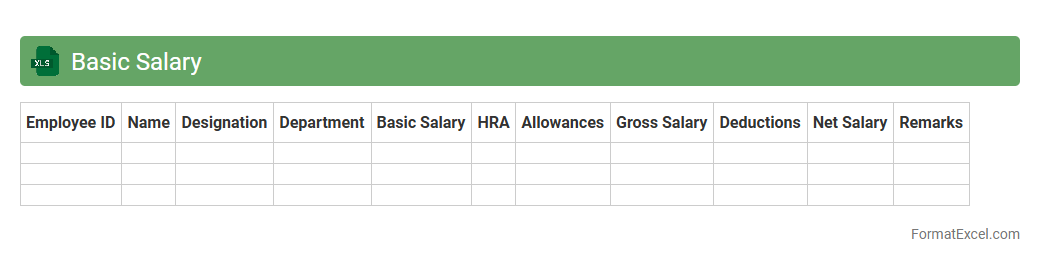

Basic Salary

A

Basic Salary Excel document is a structured spreadsheet designed to calculate and manage employees' base pay efficiently. It helps employers track salary components, automate payroll calculations, and maintain accurate financial records. This tool streamlines salary management, enhances accuracy, and supports timely compensation processing within organizations.

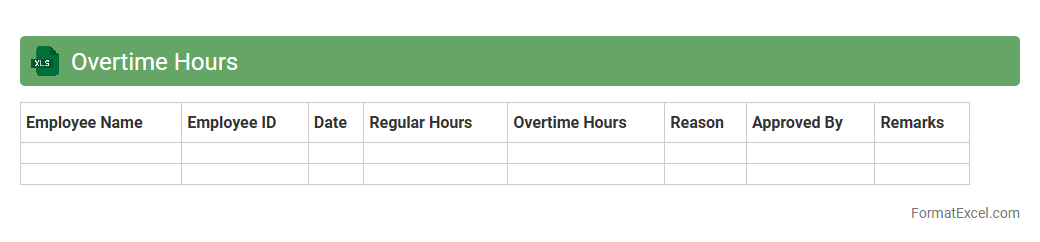

Overtime Hours

Overtime Hours Excel document is a spreadsheet designed to accurately track and calculate the extra hours employees work beyond their regular schedule. This

tool helps businesses monitor productivity, manage payroll efficiently, and ensure compliance with labor laws by providing clear records of overtime. Utilizing this document reduces errors in compensation and supports transparent workforce management.

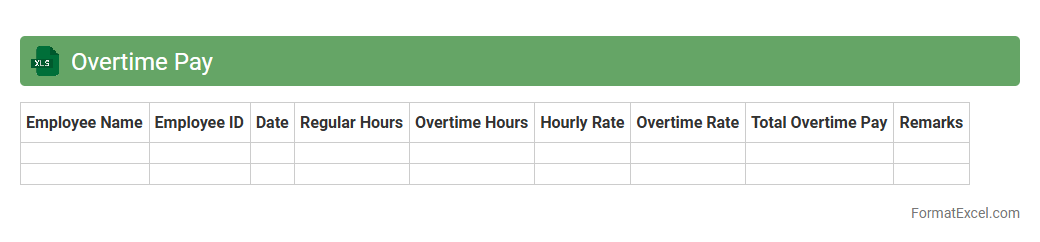

Overtime Pay

An

Overtime Pay Excel document is a spreadsheet designed to calculate and track extra hours worked beyond regular schedules, ensuring accurate compensation for employees. It automates complex calculations, reducing errors and saving time for payroll management. This tool is essential for businesses to maintain compliance with labor laws and streamline overtime payment processes efficiently.

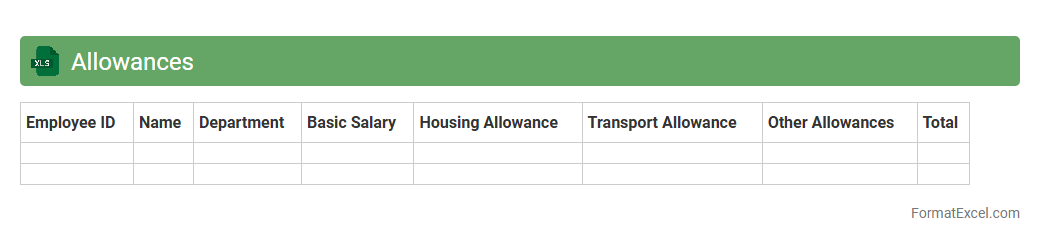

Allowances

An

Allowances Excel document is a spreadsheet used to systematically track and calculate employee allowances such as travel, housing, and meal stipends. It enhances financial accuracy and transparency by automating complex allowance computations and maintaining organized records for payroll and auditing purposes. This tool is essential for HR and finance departments to efficiently manage compensation and ensure compliance with company policies.

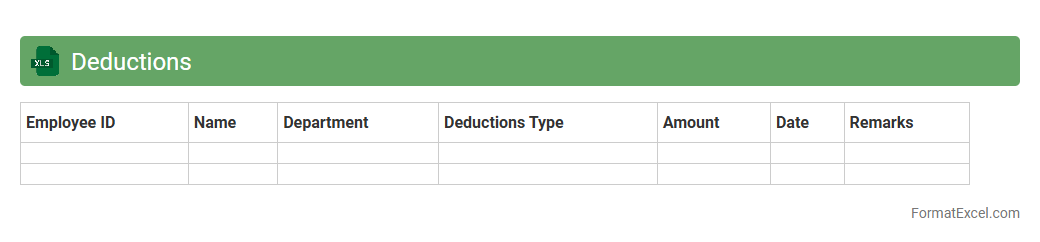

Deductions

A

Deductions Excel document is a structured spreadsheet used to track and calculate various employee deductions such as taxes, insurance premiums, retirement contributions, and loan repayments. It simplifies payroll management by providing clear and accurate deduction records, ensuring compliance with financial regulations and enabling efficient budget planning. This tool enhances transparency and helps organizations maintain organized financial data for auditing and reporting purposes.

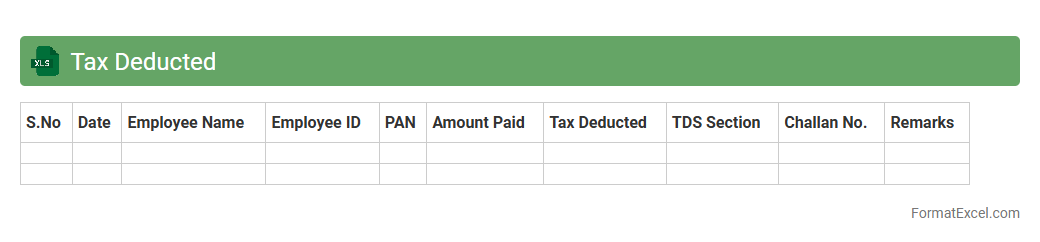

Tax Deducted

A

Tax Deducted Excel document is a structured spreadsheet that records details of tax amounts withheld from payments, facilitating easy tracking of deductions for individuals and businesses. It helps in maintaining accurate records for tax filing, ensuring compliance with government regulations and simplifying the reconciliation process. This document is essential for calculating net income and managing tax liabilities efficiently.

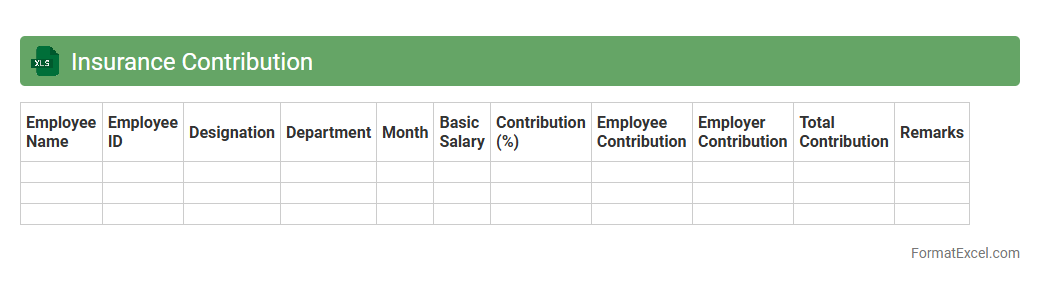

Insurance Contribution

The

Insurance Contribution Excel document is a spreadsheet designed to track and calculate employee and employer insurance payments efficiently. It organizes data such as contribution rates, payment periods, and total amounts, ensuring accurate financial management and compliance with regulatory requirements. Using this document streamlines insurance record-keeping, facilitates timely reporting, and helps prevent errors in contribution calculations.

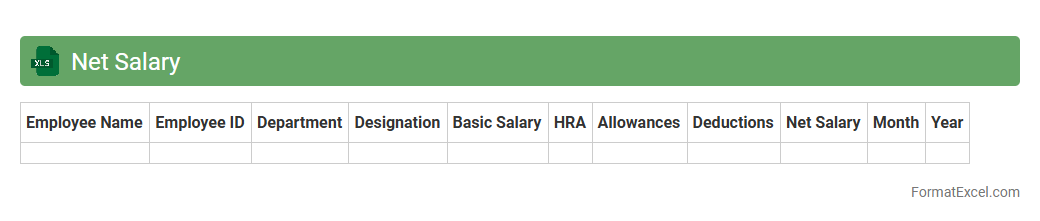

Net Salary

A

Net Salary Excel document is a spreadsheet tool designed to calculate an employee's take-home pay after deducting taxes, insurance, and other contributions from the gross salary. It helps individuals and payroll departments efficiently manage salary computations, ensuring accurate financial planning and compliance with tax regulations. Using this document streamlines payroll processing, reduces errors, and improves transparency in salary breakdowns.

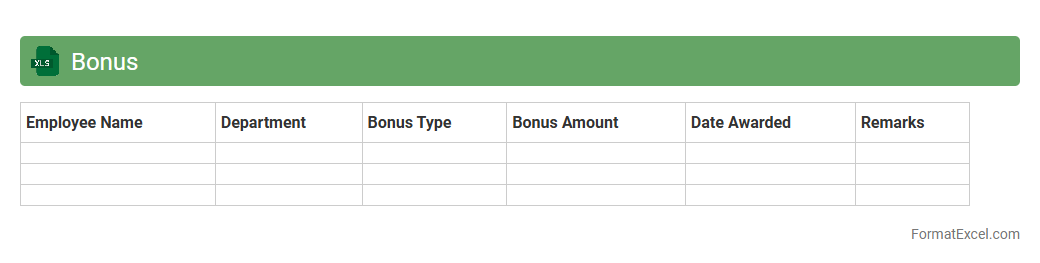

Bonus

A

Bonus Excel document is a structured spreadsheet used to calculate, track, and manage employee bonuses efficiently. It helps organizations automate bonus computations based on performance metrics, sales targets, or other criteria, ensuring accuracy and transparency. This tool enhances financial planning, motivates employees, and simplifies payroll processing by consolidating bonus data in one accessible format.

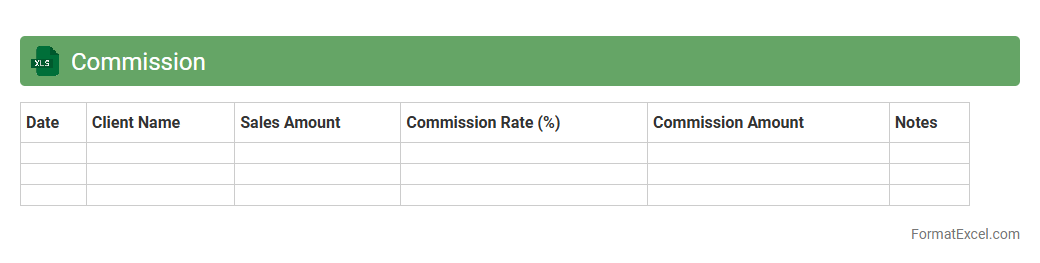

Commission

A

Commission Excel document is a spreadsheet designed to calculate, track, and manage sales commissions effectively. It enables businesses to automate commission calculations based on predefined criteria, reducing errors and ensuring accurate payouts. This tool improves financial transparency, facilitates performance analysis, and streamlines payroll processes by consolidating commission data in one organized platform.

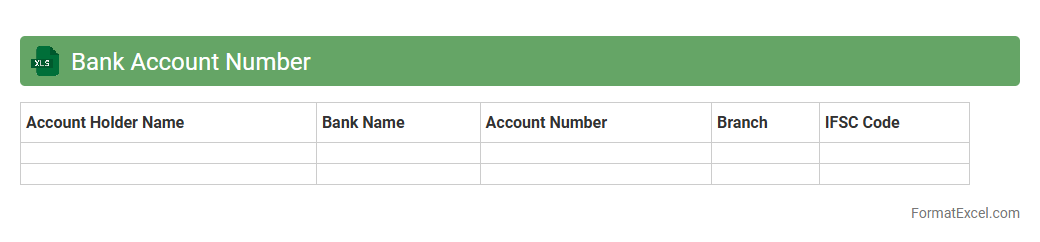

Bank Account Number

A

Bank Account Number Excel document is a structured spreadsheet designed to organize and manage bank account numbers efficiently. It helps users keep track of multiple accounts, simplifies financial record-keeping, and enhances accuracy in transactions by reducing manual errors. This document is essential for businesses and individuals who deal with numerous bank accounts, ensuring streamlined data access and improved financial management.

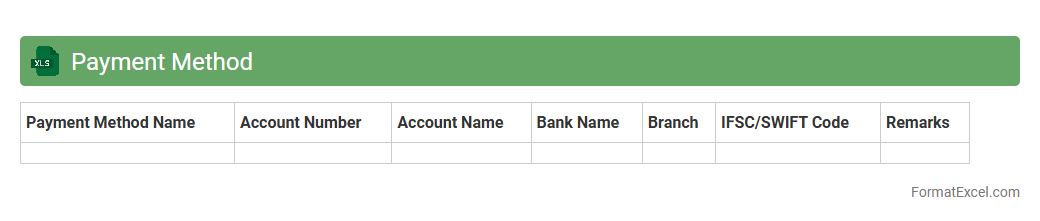

Payment Method

A

Payment Method Excel document is a spreadsheet used to organize and track various payment options, including credit cards, bank transfers, digital wallets, and cash transactions. It helps businesses and individuals manage payment details, automate calculations, and maintain accurate financial records for budgeting, auditing, and reporting purposes. This tool enhances transaction transparency and improves financial management efficiency.

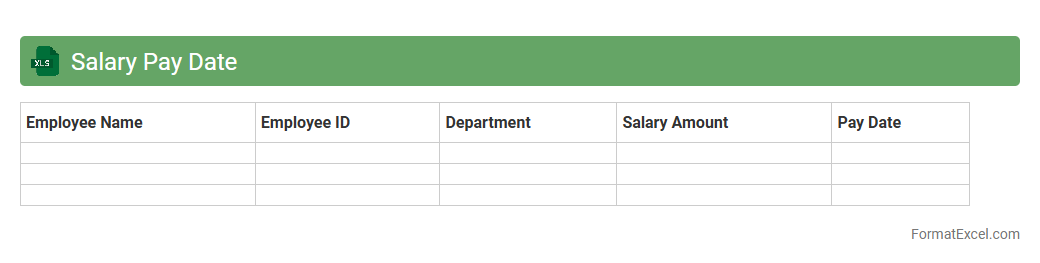

Salary Pay Date

A

Salary Pay Date Excel document is a spreadsheet tool designed to track and organize employee payment schedules accurately. It provides clear visibility into pay periods, payment dates, and helps ensure timely salary disbursements, reducing payroll errors and administrative workload. This document is essential for payroll management as it enhances financial planning and compliance with company policies and legal requirements.

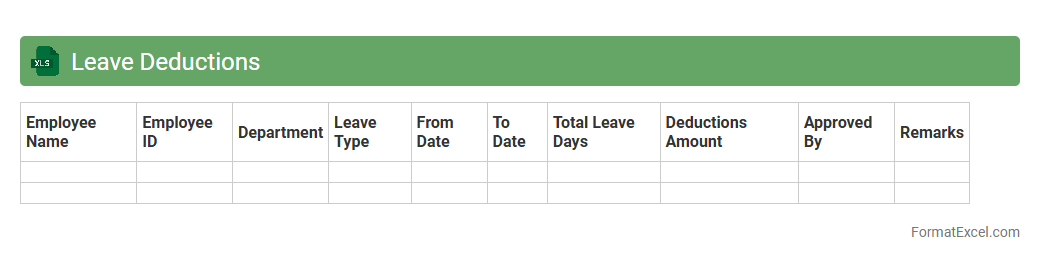

Leave Deductions

The

Leave Deductions Excel document is a spreadsheet tool designed to track and calculate employee leave balances and corresponding salary deductions accurately. It helps HR departments and payroll teams streamline leave management by automating deduction calculations based on company policies and leave taken. Using this document reduces errors, improves transparency, and ensures compliance with leave regulations.

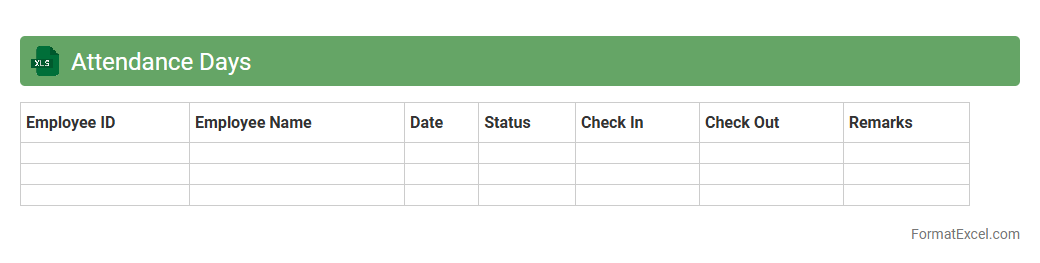

Attendance Days

The

Attendance Days Excel document is a spreadsheet tool designed to track and record employee attendance over a specific period. It helps organizations monitor workdays, absences, and tardiness efficiently, enabling accurate payroll processing and performance analysis. This document provides valuable insights for workforce management, ensuring compliance with attendance policies and improving operational productivity.

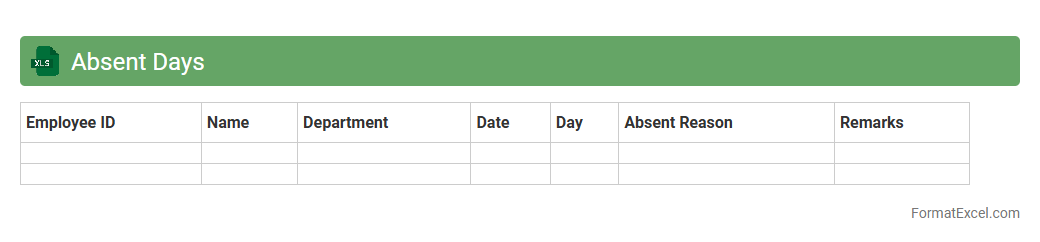

Absent Days

The

Absent Days Excel document systematically tracks employee absences, providing a clear record of present and absent days over a specified period. This tool enhances attendance management by simplifying the analysis of absentee trends and supporting payroll accuracy. It ensures better workforce planning and operational efficiency by identifying patterns that may affect productivity.

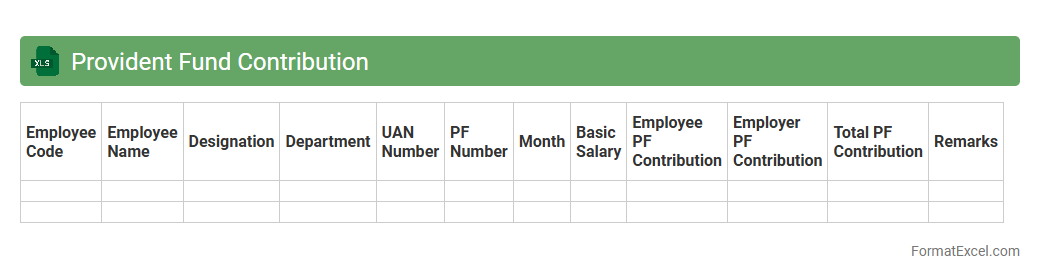

Provident Fund Contribution

A

Provident Fund Contribution Excel document is a structured spreadsheet that tracks employee and employer contributions to the provident fund over time. It simplifies the management of pension funds by calculating monthly deposits, interest accrual, and total balances, ensuring accurate financial records. This document is useful for employees and employers to monitor savings growth, compliance with statutory regulations, and plan for retirement efficiently.

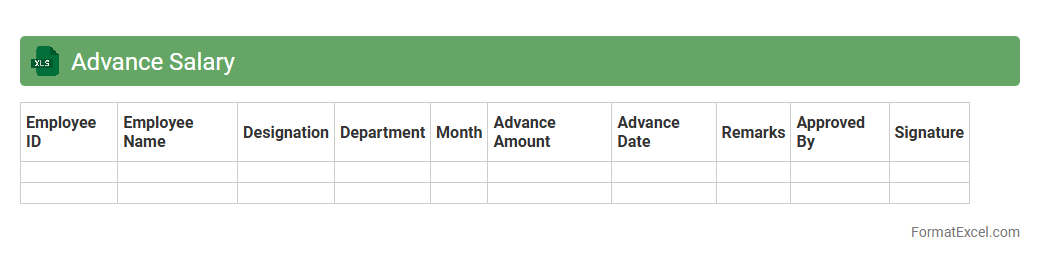

Advance Salary

The

Advance Salary Excel document is a structured spreadsheet designed to track and manage employee salary advances efficiently. It helps employers record advance payments, calculate balances, and monitor repayment schedules, ensuring accurate payroll management. Utilizing this tool reduces errors, streamlines financial processes, and improves transparency in salary disbursement.

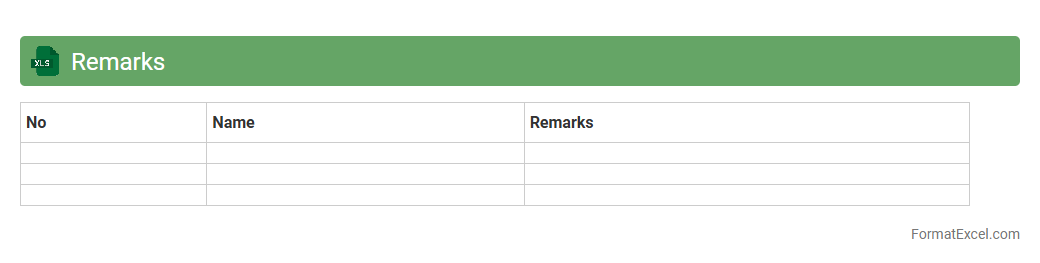

Remarks

A

Remarks Excel document is a spreadsheet file designed to capture comments, feedback, or notes related to data entries or project progress. It is useful for organizing qualitative observations alongside quantitative data, helping teams track issues, improvements, and action points efficiently. By consolidating all remarks in one place, it enhances collaboration and ensures clear communication across departments.

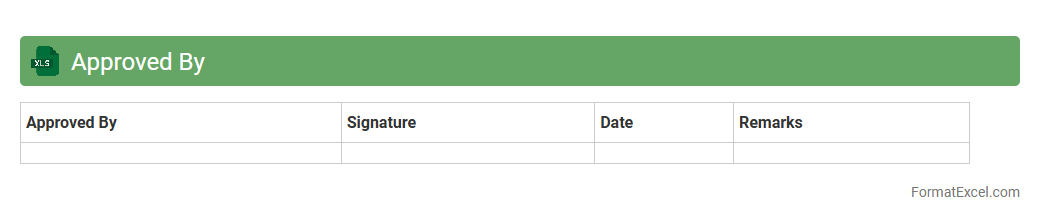

Approved By

An

Approved By Excel document is a structured spreadsheet used to track and verify approvals within a project or business process, recording who authorized specific actions or decisions. It enhances accountability by providing a clear audit trail and helps streamline communication between team members, ensuring transparency and compliance. This document is invaluable for managing workflows, reducing errors, and maintaining organized records for future reference or audits.

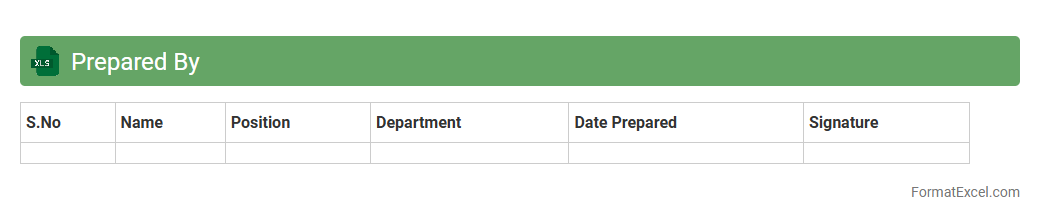

Prepared By

The

Prepared By section in an Excel document identifies the creator or contributor responsible for the content, ensuring accountability and traceability. It helps businesses and teams maintain clarity on document ownership, streamline collaboration, and facilitate communication during project management or data analysis. This feature enhances organization and professionalism, especially in shared or complex spreadsheets.

Introduction to Salary Record Format in Excel

Salary record format in Excel is a structured spreadsheet used to track employee earnings, deductions, and net pay. This format helps in organizing payroll data efficiently and ensures transparent financial management. Utilizing Excel for salary records simplifies payroll processing and record-keeping.

Importance of Maintaining Salary Records

Maintaining accurate salary records is crucial for compliance, auditing, and resolving payment disputes. It ensures transparency and helps in managing employee compensation systematically. Reliable salary records enhance trust between employer and employee.

Key Components of a Salary Record Sheet

A comprehensive salary record includes employee details, salary components, deductions, tax calculations, and net pay. It should also record payment dates and any bonuses or allowances. Each component is essential for accurate payroll processing and reporting.

Choosing the Right Excel Template for Salary Records

Select an Excel template that matches your organizational needs and supports all salary components relevant to your payroll structure. A customizable and easy-to-use template increases efficiency and minimizes errors. The right template streamlines payroll management.

Step-by-Step Guide to Creating Salary Records in Excel

Start by setting up columns for employee names, IDs, salary, deductions, and net pay. Use formulas to automate calculations for taxes and net salary. Following this step-by-step guide ensures accuracy and ease in managing payroll data.

Must-Have Columns in an Excel Salary Record

Critical columns include Employee Name, Employee ID, Basic Salary, Allowances, Deductions, Tax, and Net Salary. Including payment dates and remarks can also enhance record clarity. These columns are essential for a detailed salary record.

Tips for Customizing Your Salary Record Format

Tailor the salary record to fit your company's payroll policies by adding or removing salary components. Use conditional formatting to highlight anomalies or late payments. Customization improves tracking and aligns records with organizational standards.

How to Automate Calculations in Excel Salary Sheets

Leverage Excel functions like SUM, IF, and VLOOKUP to automate salary calculations and tax deductions. Creating formulas reduces manual errors and saves time during payroll processing. Automation is a key feature for efficient salary management.

Data Security Best Practices for Salary Records

Protect salary records by restricting access, using password protection, and regularly backing up files. Encrypt sensitive payroll data to prevent unauthorized access. Following data security best practices safeguards employee information.

Downloadable Salary Record Excel Template

A downloadable Excel template provides a ready-to-use structure for managing salaries effectively. It can be customized to include specific deductions, bonuses, and tax components. Using a template accelerates payroll setup and improves record accuracy.