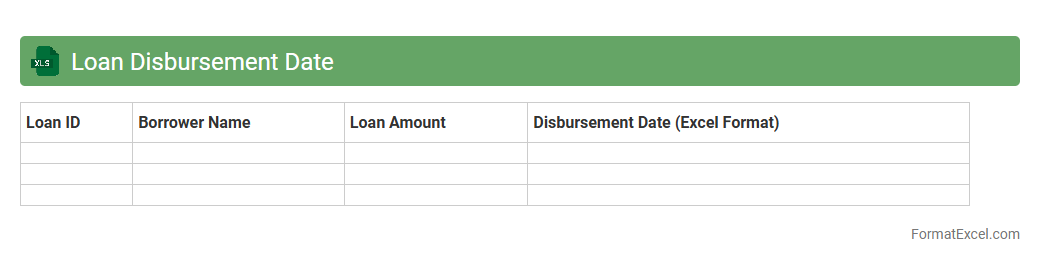

Loan Disbursement Date

The

Loan Disbursement Date Excel document records the exact dates when loan funds are released to borrowers, ensuring precise tracking of financial transactions. It helps financial institutions monitor loan schedules, manage cash flow, and generate timely reports for compliance and auditing purposes. This document streamlines loan management by providing clear visibility into disbursement timelines, improving decision-making and operational efficiency.

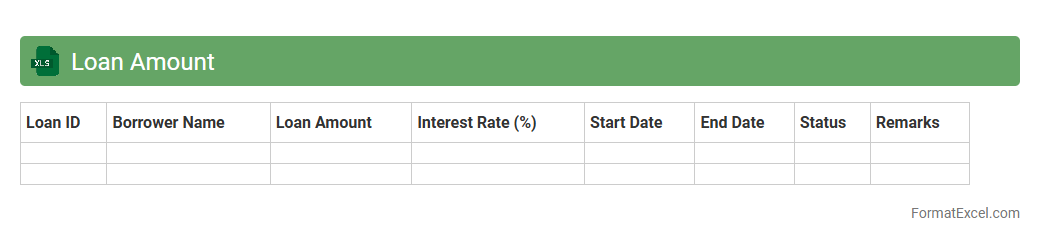

Loan Amount

A

Loan Amount Excel document is a spreadsheet tool designed to calculate, track, and manage loan details such as principal amounts, interest rates, repayment schedules, and total payments. It helps users analyze different loan scenarios, optimize repayment plans, and maintain accurate financial records for better decision-making. This document is essential for individuals and businesses aiming to monitor loans efficiently and avoid errors in financial planning.

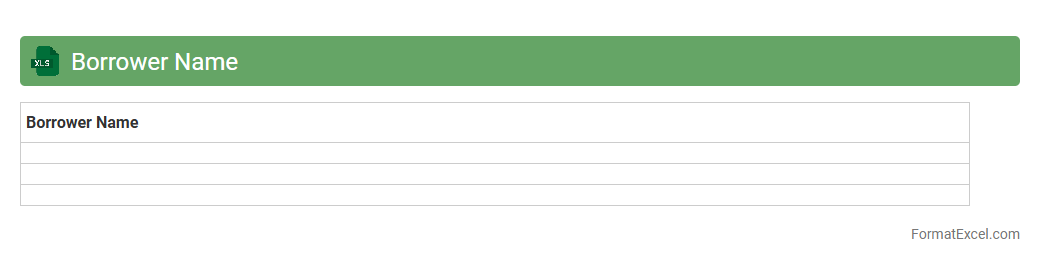

Borrower Name

The

Borrower Name Excel document serves as a comprehensive database that organizes borrower information systematically, enabling efficient tracking of loan recipients. It facilitates quick access to individual borrower details, repayment histories, and contact information, which enhances loan management and decision-making processes. Using this document improves accuracy in record-keeping and supports better financial analysis within lending institutions.

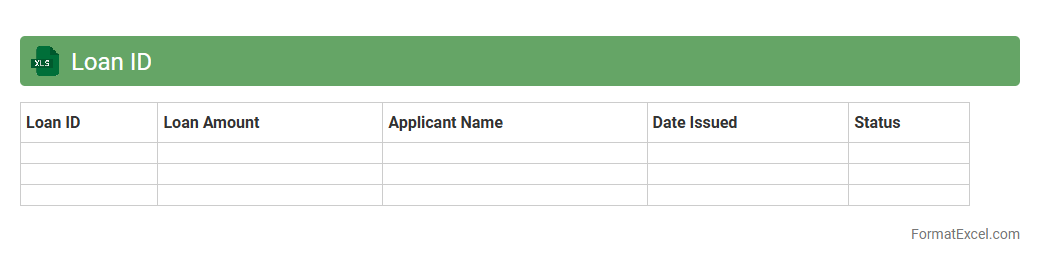

Loan ID

The

Loan ID Excel document is a structured spreadsheet designed to organize and track unique loan identification numbers along with associated borrower information, loan amounts, interest rates, and repayment schedules. This tool streamlines loan management by enabling quick data retrieval, error reduction, and efficient monitoring of loan statuses across multiple accounts. Financial institutions and loan officers rely on it to enhance accuracy, facilitate reporting, and improve overall loan processing workflows.

Loan Type

A

Loan Type Excel document is a structured spreadsheet designed to categorize and manage various loan products such as personal, mortgage, auto, and business loans. It helps users track loan details, compare interest rates, repayment schedules, and other loan-specific criteria efficiently. This tool is essential for financial planning, analysis, and making informed borrowing decisions.

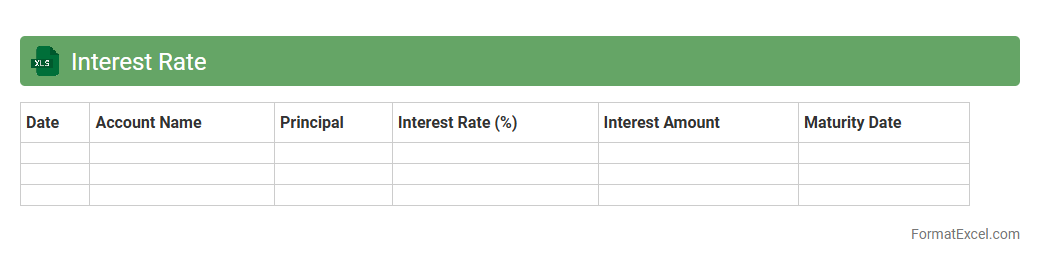

Interest Rate

An

Interest Rate Excel document is a spreadsheet tool designed to calculate, analyze, and project interest rates for various financial products such as loans, savings, and investments. It enables users to model different interest scenarios, compare fixed and variable rates, and understand the impact on overall repayments or earnings. This tool is valuable for making informed financial decisions, budgeting, and optimizing investment strategies by providing clear, data-driven insights.

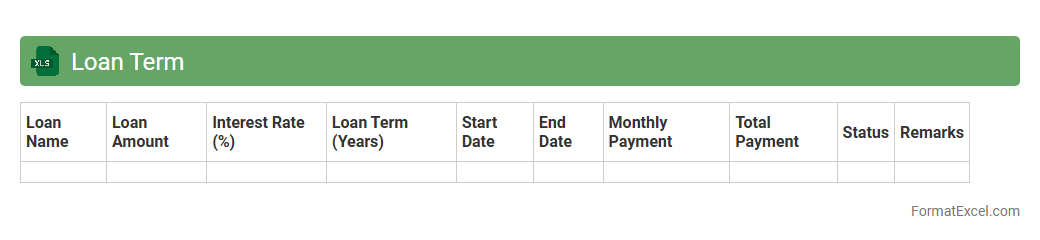

Loan Term

A

Loan Term Excel document is a structured spreadsheet used to track and manage the duration, payment schedules, interest rates, and amortization details of a loan. It provides clear insights into monthly payments, principal balance reduction, and total interest over time, helping users plan and budget effectively. Utilizing this document enhances financial decision-making by offering transparency and precision in loan management.

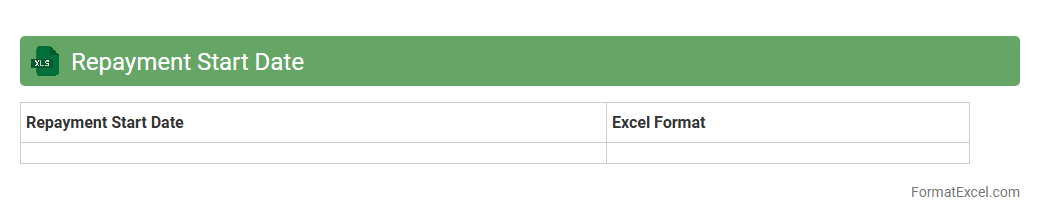

Repayment Start Date

The

Repayment Start Date Excel document records the initial date from which loan repayments begin, allowing precise tracking of payment schedules and due dates. It helps users manage financial obligations by providing clear timelines for installments, improving budgeting and cash flow planning. This tool is essential for lenders and borrowers to ensure timely repayments and avoid penalties.

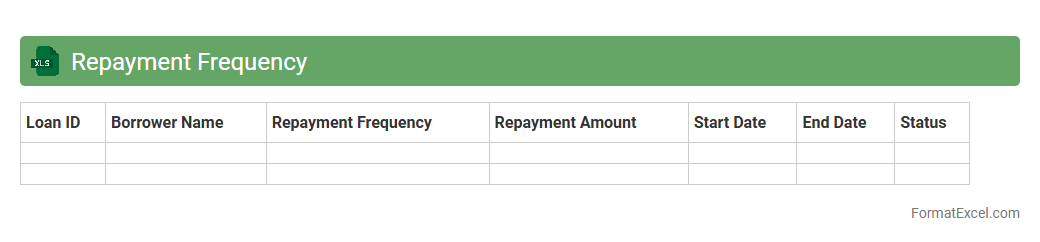

Repayment Frequency

A

Repayment Frequency Excel document is a spreadsheet tool designed to track and calculate loan or mortgage repayments based on different payment intervals such as weekly, bi-weekly, or monthly. It enables users to visualize how varying repayment frequencies impact the total interest paid and the loan payoff timeline. This document is essential for financial planning, helping individuals or businesses optimize cash flow and reduce debt more efficiently.

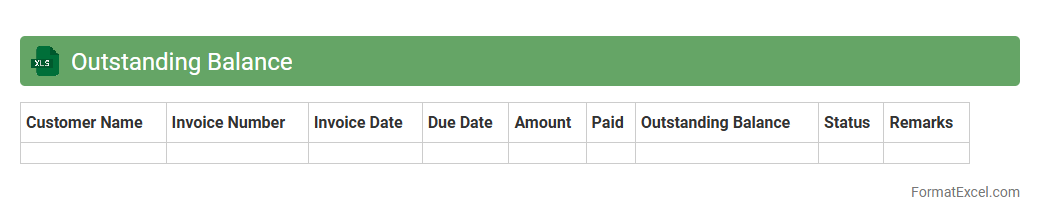

Outstanding Balance

An

Outstanding Balance Excel document is a spreadsheet used to track unpaid amounts owed by customers or clients, providing a clear overview of pending payments. It helps businesses maintain accurate accounts receivable records, monitor cash flow, and identify overdue invoices efficiently. By organizing financial data systematically, this tool supports better financial management and timely follow-ups on outstanding debts.

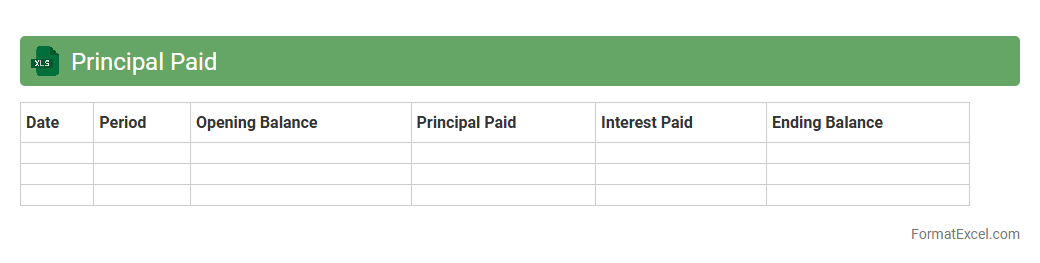

Principal Paid

A

Principal Paid Excel document is a financial tool that tracks the amount of principal paid on a loan over time, separating it from interest payments. It helps users monitor loan repayment progress, manage budgets effectively, and predict the remaining balance with accuracy. Utilizing this document can improve financial planning and ensure timely loan payoff.

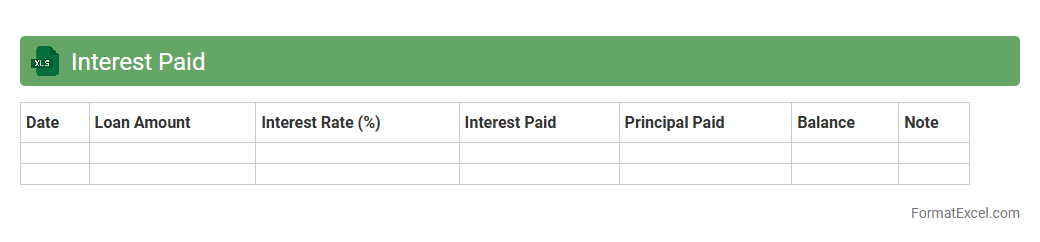

Interest Paid

An

Interest Paid Excel document tracks and calculates the total interest paid on loans or mortgages over specific periods, providing clear visibility into payment schedules and interest amounts. This tool helps users manage finances effectively by offering precise insights into interest expenses, enabling better budgeting and financial planning. It simplifies complex calculations, reducing errors and saving time compared to manual computations.

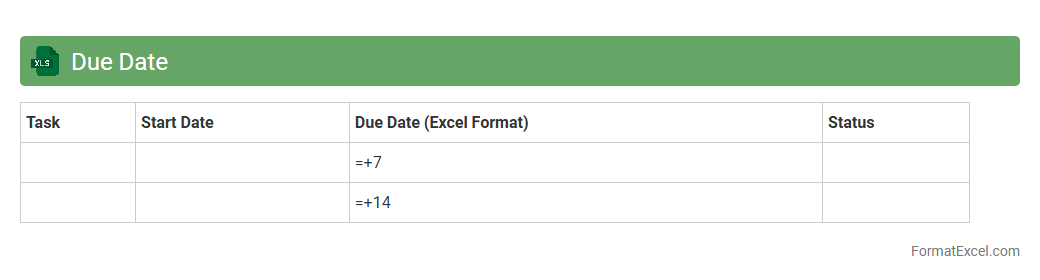

Due Date

Due Date Excel document is a spreadsheet designed to track and manage important deadlines efficiently, enhancing productivity and time management. It allows users to input task names, assign due dates, and set reminders, ensuring critical projects are completed on schedule. Using a

Due Date Excel document helps prevent missed deadlines and streamlines workflow prioritization in personal and professional environments.

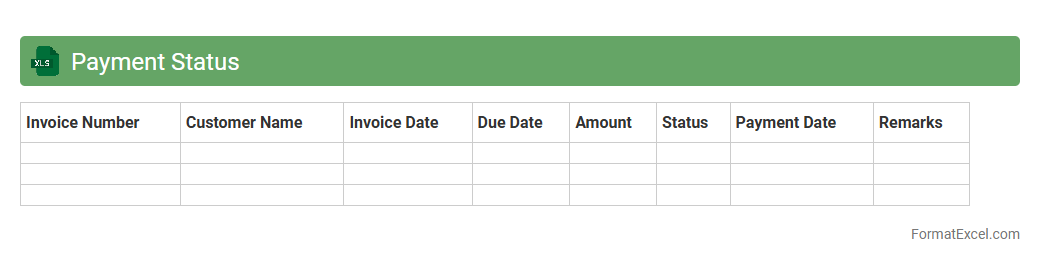

Payment Status

A

Payment Status Excel document is a spreadsheet tool designed to track and monitor the progress of payments, including pending, completed, and overdue transactions. It helps businesses maintain accurate financial records, improve cash flow management, and ensure timely follow-ups on outstanding payments. Utilizing this document can streamline accounting processes and enhance transparency in financial operations.

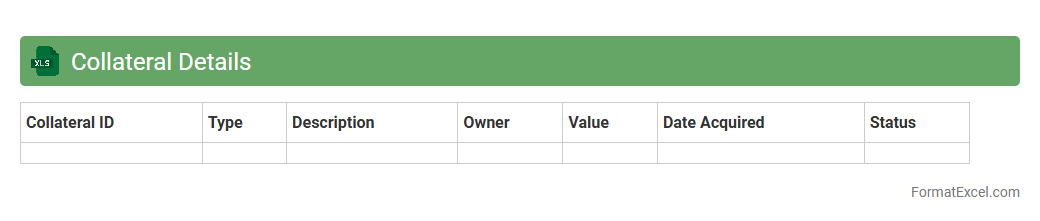

Collateral Details

The

Collateral Details Excel document serves as a comprehensive record of assets pledged as security for loans, detailing item descriptions, valuation, ownership, and lien information. It enables organizations to efficiently track and manage collateral portfolios, ensuring compliance with lending policies and supporting risk assessment processes. This structured format enhances data accuracy, streamlines reporting, and improves decision-making in financial and credit management.

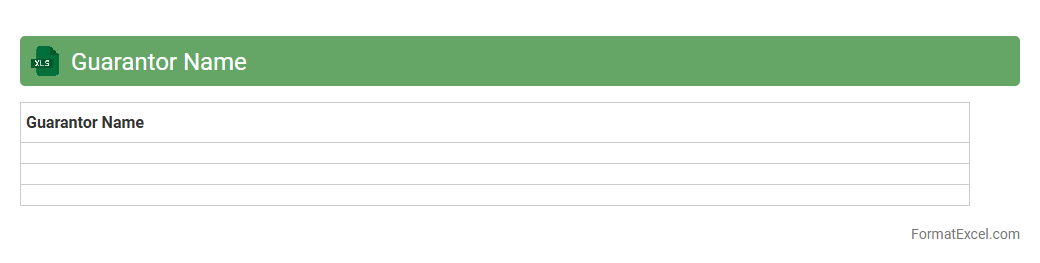

Guarantor Name

The

Guarantor Name Excel document is a structured spreadsheet that records and organizes the names and details of guarantors associated with loans or agreements. It helps in tracking guarantor information efficiently, ensuring accurate and quick reference during financial assessments or legal processes. This document enhances accountability and streamlines communication between lenders and borrowers.

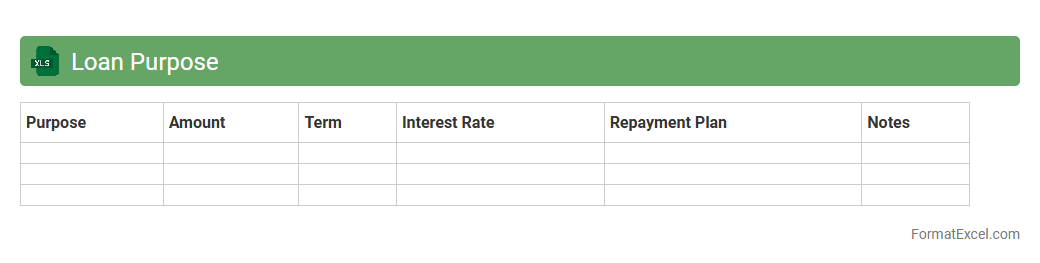

Loan Purpose

The

Loan Purpose Excel document systematically categorizes various reasons borrowers seek loans, such as home improvement, debt consolidation, or business expansion. This organized data enables lenders and financial analysts to assess risk profiles, track loan trends, and tailor lending strategies effectively. Businesses leverage this tool to improve decision-making, streamline loan processing, and enhance customer service by understanding borrower intentions clearly.

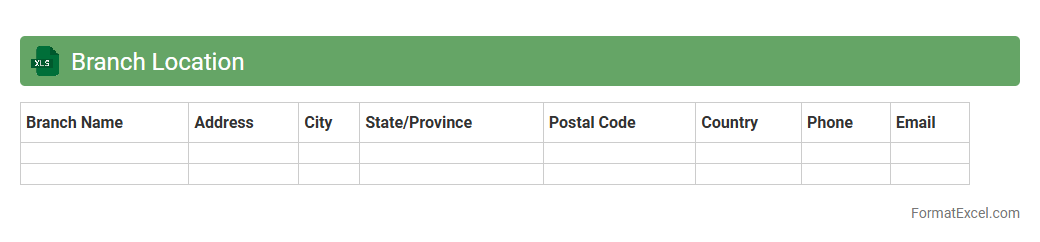

Branch Location

A

Branch Location Excel document is a structured spreadsheet that lists detailed information about various branch offices, including addresses, contact numbers, operating hours, and key personnel. It is useful for organizing, managing, and quickly accessing branch-specific data, enabling efficient communication and streamlined operations across multiple locations. This document enhances decision-making and logistical planning by providing a centralized source of accurate branch information.

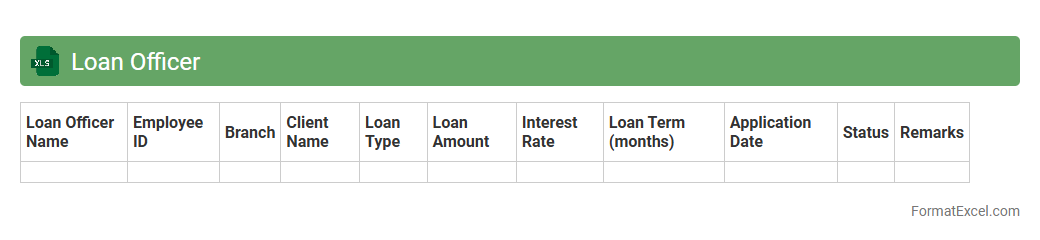

Loan Officer

A

Loan Officer Excel document is a specialized spreadsheet designed to streamline loan management by tracking client information, loan details, repayment schedules, and performance metrics. It enhances decision-making efficiency, enables accurate financial analysis, and supports compliance with lending regulations. This tool is essential for loan officers to monitor portfolios, reduce errors, and optimize the loan approval process.

Date of Last Payment

The

Date of Last Payment Excel document is a spreadsheet that tracks the most recent payment dates for various accounts or invoices, helping businesses maintain accurate financial records. This document allows users to monitor payment patterns, identify overdue accounts, and streamline cash flow management. By providing clear visibility into payment timelines, it supports efficient billing and collection processes.

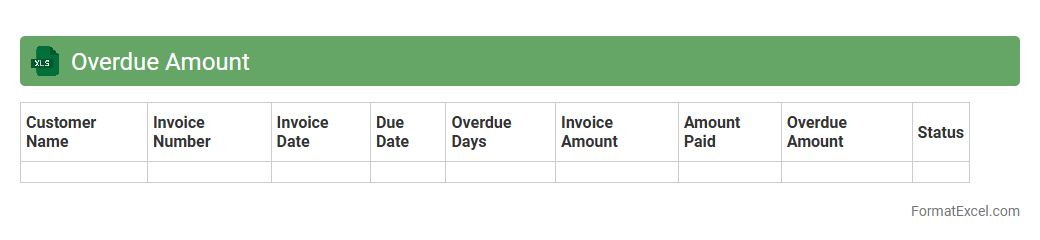

Overdue Amount

An

Overdue Amount Excel document is a spreadsheet that tracks unpaid invoices or debts past their due dates, enabling businesses to monitor outstanding payments efficiently. It helps organizations prioritize collections, manage cash flow, and reduce financial risks by providing clear visibility into overdue receivables. By systematically organizing data such as customer names, invoice numbers, due dates, and outstanding balances, this document enhances accuracy and accountability in financial management.

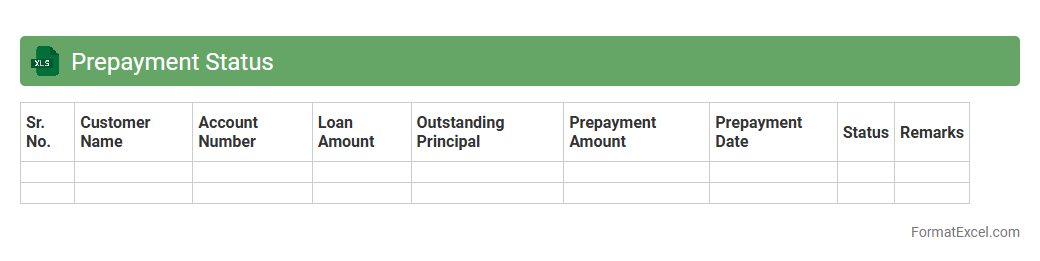

Prepayment Status

The

Prepayment Status Excel document tracks advance payments made to vendors or clients, providing a clear overview of outstanding and settled prepayments. Its organized layout helps businesses monitor cash flow, ensure accurate accounting, and avoid double payments. Using this document enhances financial transparency and streamlines the reconciliation process.

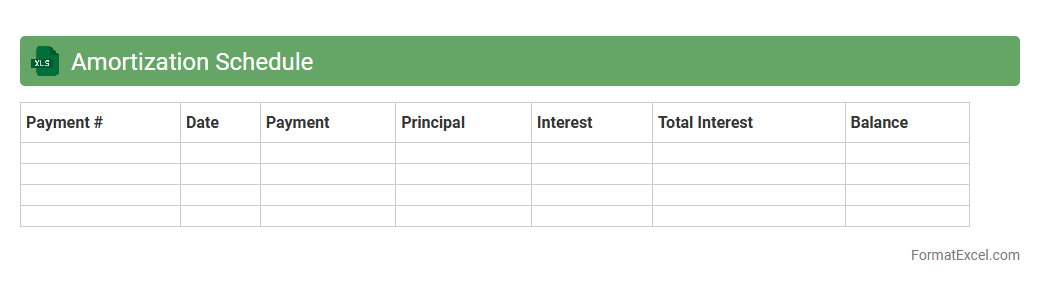

Amortization Schedule

An

Amortization Schedule Excel document is a detailed table that breaks down each loan payment into principal and interest components over the loan term. It helps users track payment dates, outstanding balance, and interest paid, providing clear insight into loan repayment progress. This tool is essential for financial planning, budgeting, and understanding the total cost of borrowing.

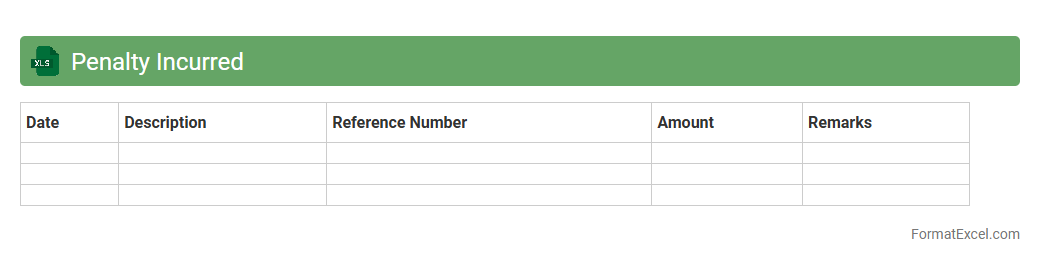

Penalty Incurred

The

Penalty Incurred Excel document tracks and calculates financial penalties associated with various business activities or contractual obligations, ensuring accurate and timely record-keeping. It helps organizations monitor compliance issues, manage risk, and avoid costly disputes by providing clear visibility into penalty amounts and due dates. This tool enhances decision-making by summarizing penalty data and supporting efficient financial management.

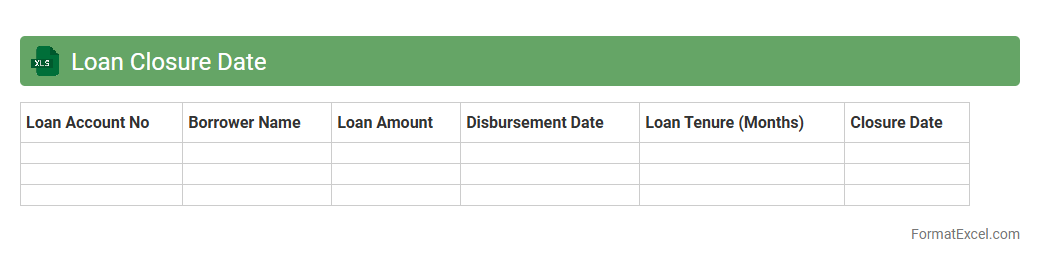

Loan Closure Date

The

Loan Closure Date Excel document is a structured spreadsheet that tracks the final repayment date of loans, ensuring accurate financial management and timely loan settlement. It helps individuals and businesses monitor outstanding loan durations, avoid penalties, and plan repayments effectively by providing clear visibility into loan closure timelines. Utilizing this document streamlines loan management processes, enhances financial organization, and supports strategic decision-making regarding debt obligations.

Introduction to Loan Record Management

Loan record management is essential for tracking the details and status of loans efficiently. Using a structured format in Excel helps maintain clarity and accessibility. A well-organized loan record ensures accurate monitoring and reporting.

Importance of a Structured Loan Record Format

A structured format minimizes errors and simplifies data entry. It allows for quick access to loan information and improves financial decision-making. The structured format enhances overall loan accountability.

Key Components of a Loan Record Excel Sheet

Essential components include loan amount, borrower details, payment schedules, interest rates, and due dates. These elements provide a comprehensive view of the loan status. Each component plays a vital role in tracking loan performance.

Setting Up Loan Details Columns

Loan details columns should capture loan ID, date issued, principal amount, and loan term. Proper labeling ensures easy identification and retrieval. Including these columns streamlines the tracking process.

Tracking Payment Schedules and Due Dates

Payment schedules and due dates columns help monitor timely repayments and overdue payments. This aids in managing cash flow and reducing defaults. Timely tracking of payment schedules is crucial for loan management.

Including Interest and Principal Calculation Fields

Interest and principal fields calculate outstanding balances automatically. These help in understanding the loan payoff progress. Accurate calculations ensure precise financial records.

Incorporating Borrower Information

Borrower details like name, contact information, and credit score are vital for loan records. This information supports borrower communication and credit assessments. Comprehensive borrower information enhances loan tracking.

Automating Calculations with Excel Formulas

Excel formulas like PMT, IPMT, and PPMT automate loan payment and interest calculations. Automation reduces manual errors and saves time on updates. Using Excel formulas improves worksheet accuracy.

Data Validation and Error Prevention Tips

Data validation restricts incorrect entries and maintains data integrity. Simple rules like date formats and numeric limits prevent common mistakes. Implementing data validation safeguards loan records.

Sample Loan Record Template in Excel

A sample template includes loan details, payment schedules, borrower info, and automated calculations. It serves as a practical starting point for loan management. Using a template speeds up setup and enhances accuracy.