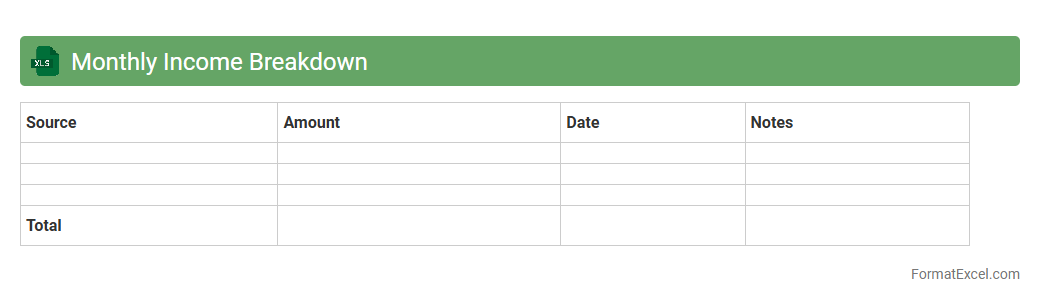

Monthly Income Breakdown

The

Monthly Income Breakdown Excel document organizes and categorizes income sources on a monthly basis, allowing for detailed financial tracking and analysis. It helps users identify patterns, monitor fluctuations, and manage cash flow effectively. By providing a clear overview of earnings, it supports informed budgeting and financial planning decisions.

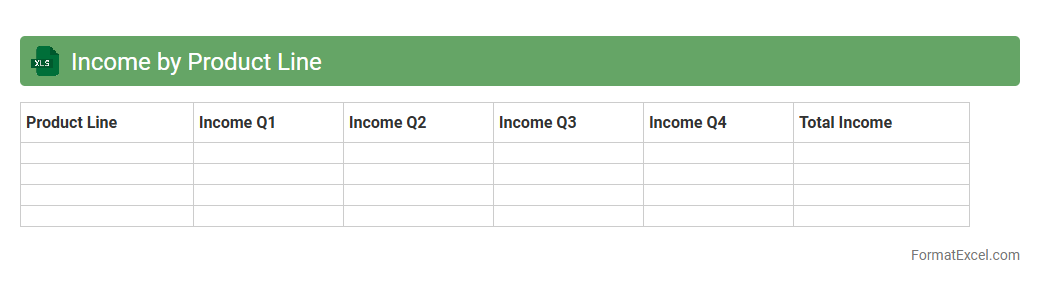

Income by Product Line

The

Income by Product Line Excel document provides a detailed breakdown of revenue generated from each product category, enabling businesses to analyze profitability and sales trends at a granular level. This information helps identify high-performing products and areas needing improvement, driving strategic decisions for product development and marketing. By tracking income by product line, companies can optimize resource allocation and forecast future financial performance more accurately.

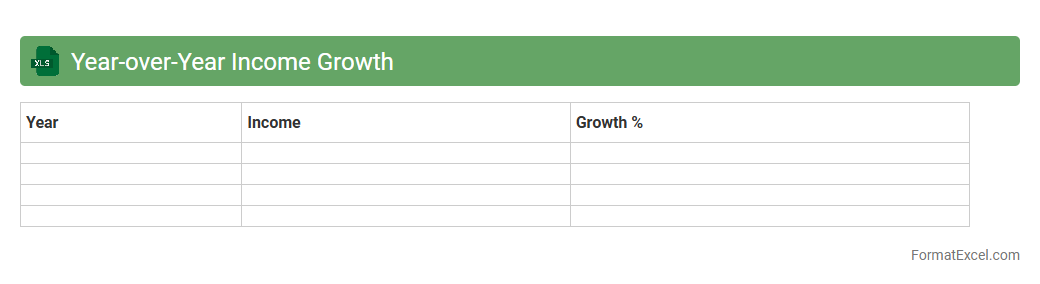

Year-over-Year Income Growth

Year-over-Year Income Growth Excel document tracks changes in income over successive years, providing a clear comparison of financial performance. It helps identify trends, measure business progress, and make data-driven decisions by calculating percentage growth between periods. Using this tool enhances financial analysis and strategic planning for businesses and individuals alike.

Income by Region

The

Income by Region Excel document organizes financial data segmented by geographic areas, enabling businesses to analyze revenue streams across different markets. This structured format aids in identifying regional performance trends, supporting data-driven decisions for targeted marketing and resource allocation. By providing clear insights into income distribution, it enhances strategic planning for growth and investment.

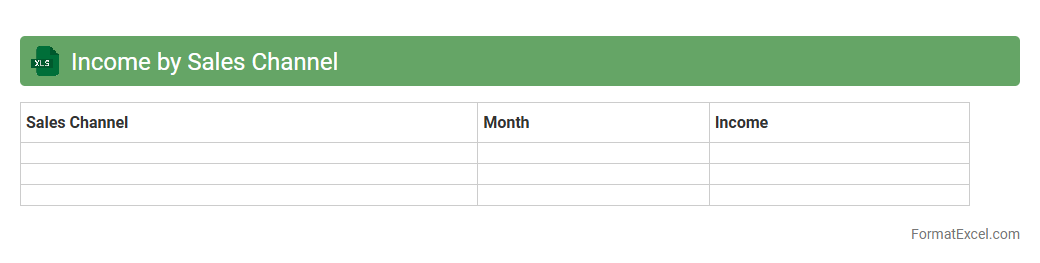

Income by Sales Channel

The

Income by Sales Channel Excel document breaks down revenue generated from various sales platforms, allowing businesses to analyze performance across channels such as online stores, physical locations, and third-party marketplaces. It provides detailed insights into which channels contribute most to income, enabling data-driven decisions for marketing strategies and resource allocation. Tracking income by sales channel helps optimize sales efforts and maximize profitability by identifying trends and areas for growth.

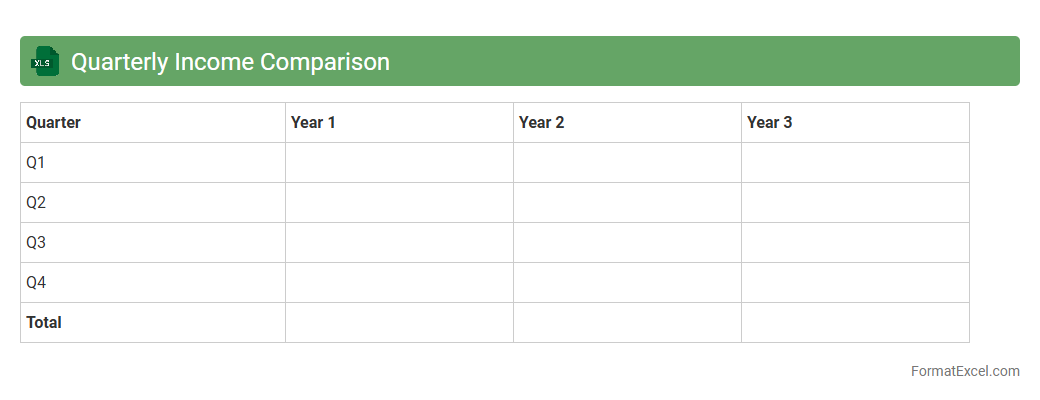

Quarterly Income Comparison

A

Quarterly Income Comparison Excel document is a financial tool designed to track and analyze income across different quarters of the fiscal year. It enables businesses to identify trends, measure growth or decline, and make informed decisions based on consistent income data. By comparing quarterly earnings, organizations can optimize budgeting, forecast future revenue, and enhance overall financial planning.

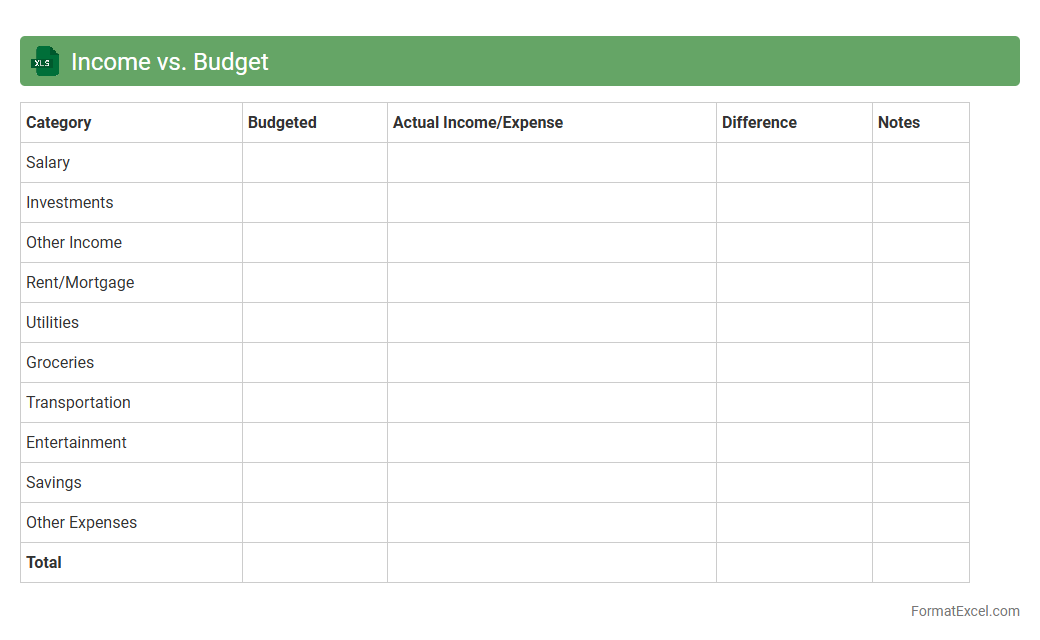

Income vs. Budget

An

Income vs. Budget Excel document is a spreadsheet tool designed to track and compare actual income against planned budget figures. It helps individuals and businesses monitor financial performance, identify spending patterns, and adjust expenses to stay within budget limits. This document enhances financial decision-making by providing clear visibility into cash flow and budget adherence.

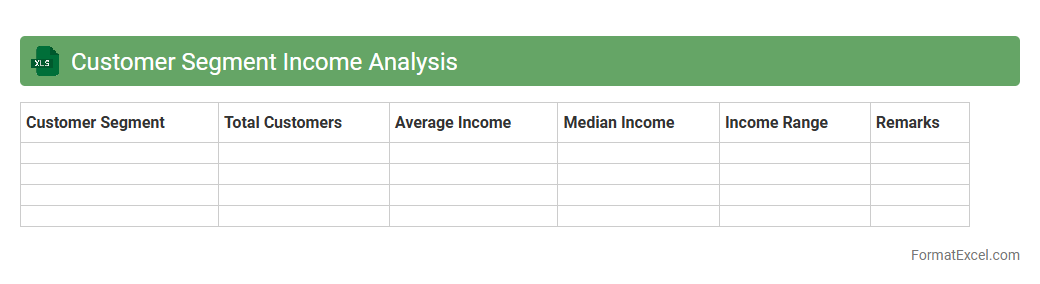

Customer Segment Income Analysis

Customer Segment Income Analysis Excel document is a powerful tool designed to categorize and evaluate the income levels of different customer groups, enabling businesses to identify high-value segments and tailor marketing strategies accordingly. By analyzing revenue patterns, spending behavior, and demographic data, this

Customer Segment Income Analysis helps optimize resource allocation and improve targeted sales efforts. Businesses gain valuable insights to enhance customer retention, increase profitability, and make informed financial decisions.

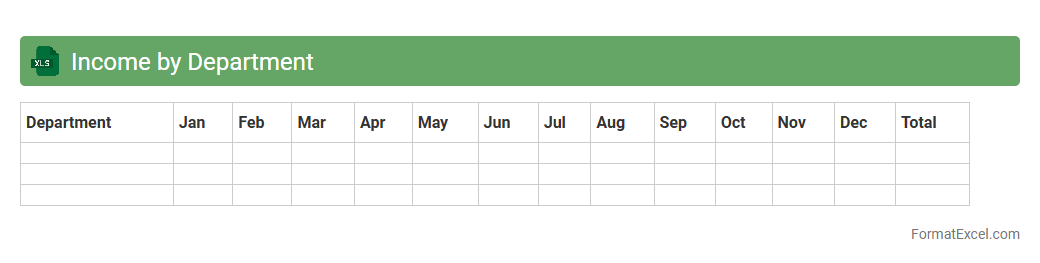

Income by Department

The

Income by Department Excel document organizes revenue data across various departments, enabling clear financial tracking and analysis. It helps identify high-performing units and areas needing improvement, supporting strategic decision-making and budget allocation. This document enhances financial transparency and efficiency in managing organizational income streams.

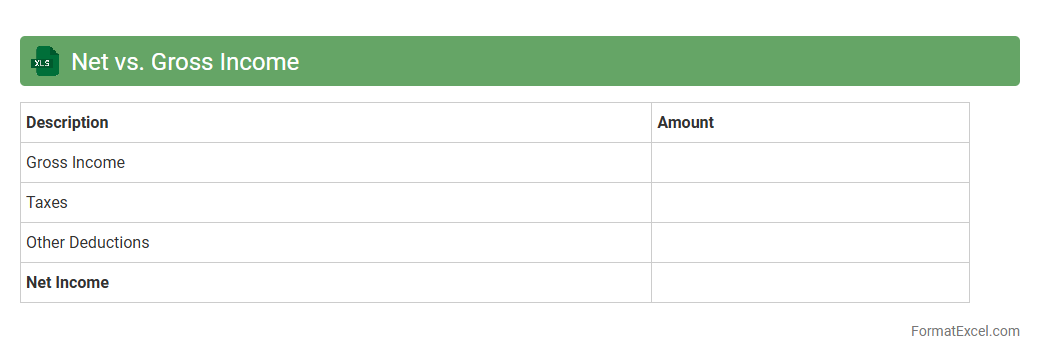

Net vs. Gross Income

A

Net vs. Gross Income Excel document is a financial tool used to calculate and compare an individual's or business's total earnings before and after deductions such as taxes, insurance, and expenses. This document helps users clearly understand their actual take-home pay or net profit, providing better insight for budgeting, tax preparation, and financial planning. By organizing income components efficiently, it supports informed decision-making and accurate financial reporting.

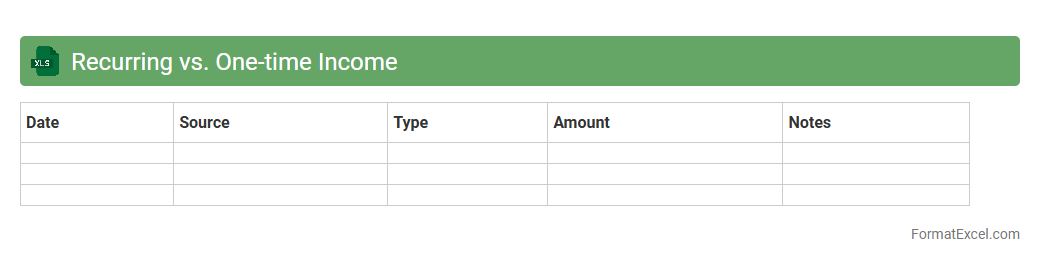

Recurring vs. One-time Income

A

Recurring vs. One-time Income Excel document categorizes and tracks different types of income streams, distinguishing between consistent, ongoing earnings and single, non-repetitive payments. This tool helps individuals and businesses manage cash flow, forecast future revenue, and identify stable versus variable income sources for better financial planning. It is particularly useful for budget optimization, tax preparation, and assessing financial health over time.

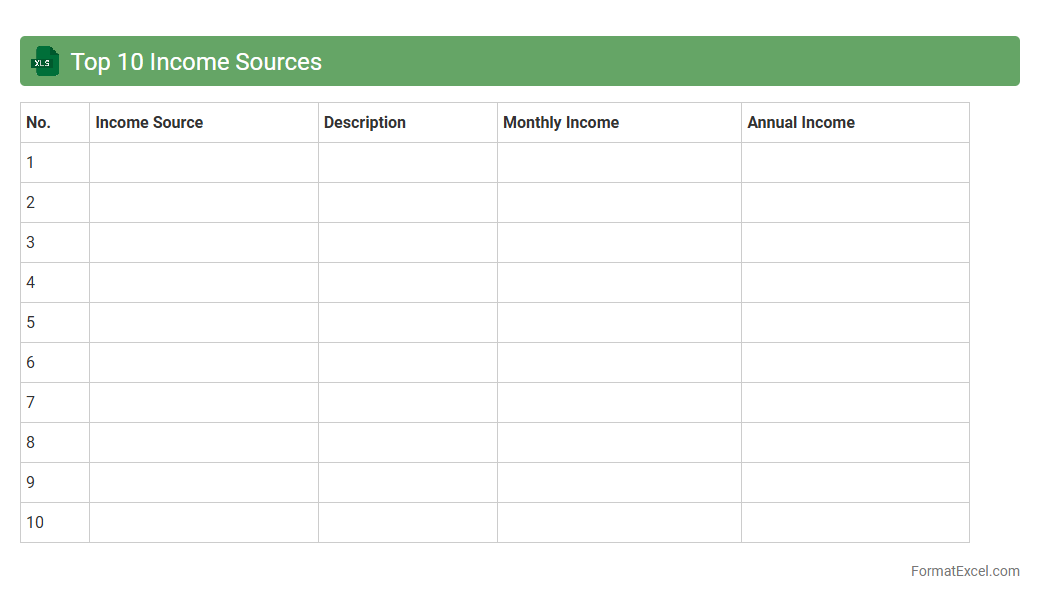

Top 10 Income Sources

The

Top 10 Income Sources Excel document organizes and ranks the primary revenue streams of a business or individual, providing clear insights into financial performance. This tool enables effective tracking, comparison, and analysis of income sources, helping identify the most profitable areas to focus efforts on. By visually summarizing income data, it supports strategic decision-making and enhances budget planning.

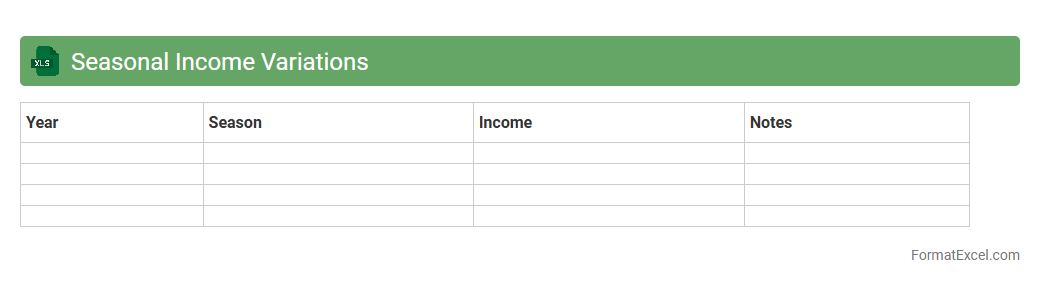

Seasonal Income Variations

The

Seasonal Income Variations Excel document tracks fluctuations in earnings across different periods, identifying patterns related to seasons or specific events. This analysis helps businesses forecast cash flow, optimize budgeting, and adjust marketing strategies according to peak and off-peak income cycles. By leveraging this data, organizations can make informed decisions to improve financial stability and enhance operational efficiency throughout the year.

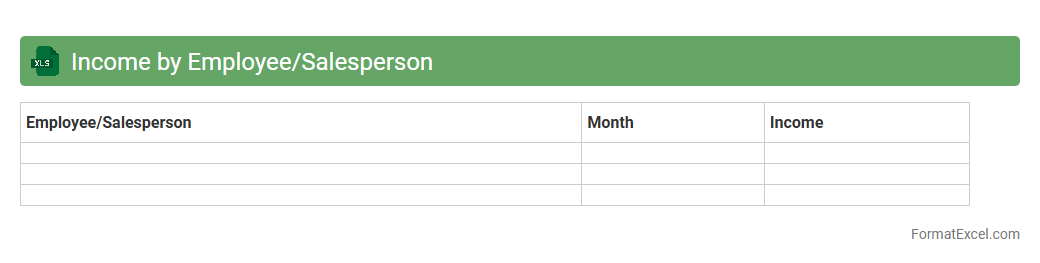

Income by Employee/Salesperson

The

Income by Employee/Salesperson Excel document tracks individual earnings and commission data, providing detailed insights into sales performance and compensation structures. This tool enables businesses to analyze productivity, identify top performers, and optimize payroll management efficiently. By leveraging this data, companies can make informed decisions to boost motivation and improve overall sales strategies.

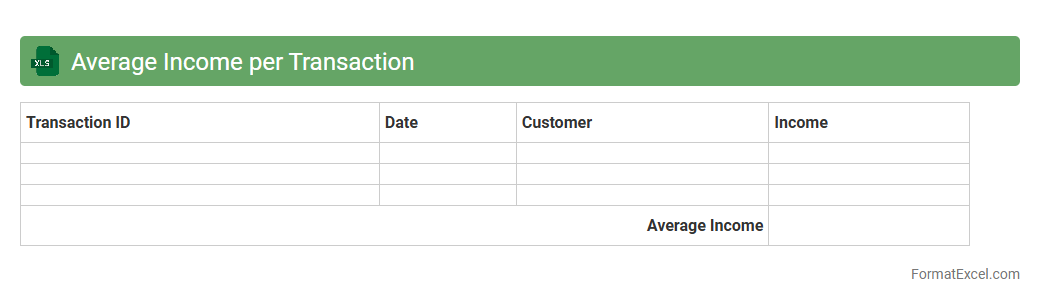

Average Income per Transaction

The

Average Income per Transaction Excel document calculates the average revenue generated from each transaction by dividing total income by the number of transactions. This tool is essential for businesses to evaluate sales performance, identify revenue trends, and optimize pricing strategies. By analyzing average income per transaction, companies can make data-driven decisions to increase profitability and improve customer purchasing behavior.

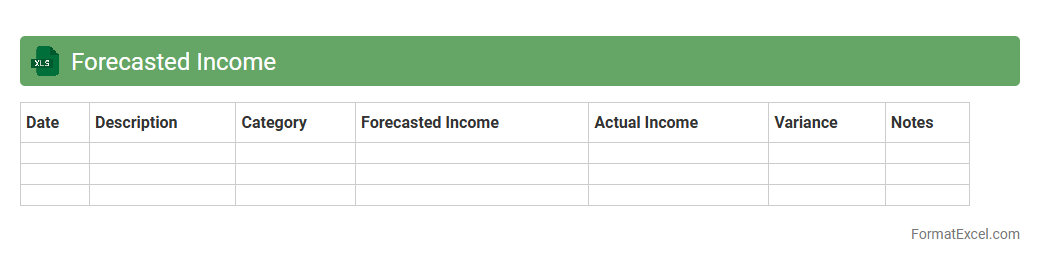

Forecasted Income

A

Forecasted Income Excel document is a financial tool designed to project future earnings based on historical data and anticipated market trends. It allows businesses to estimate revenue streams, manage budgets, and make informed decisions by identifying potential income sources and forecasting cash flow. This document is essential for strategic planning, improving financial stability, and guiding investment opportunities.

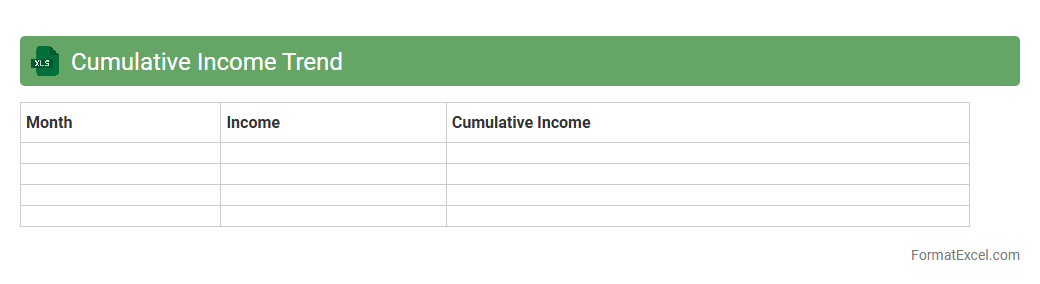

Cumulative Income Trend

A

Cumulative Income Trend Excel document tracks the total income accumulated over a specific period, providing a clear visualization of financial growth and patterns. It helps in identifying income fluctuations, projecting future earnings, and making informed budgeting or investment decisions. Businesses and individuals use this tool to monitor performance and ensure financial goals are met efficiently.

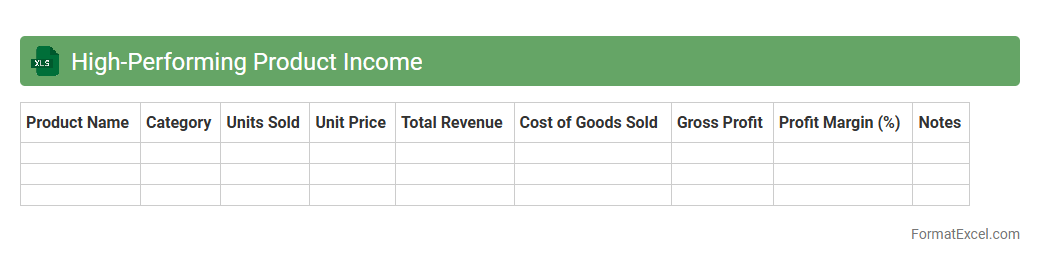

High-Performing Product Income

The

High-Performing Product Income Excel document is a powerful analytical tool designed to track and evaluate the revenue generated by top-selling products. It helps businesses identify key income drivers, monitor sales trends, and optimize inventory management for maximum profitability. By providing detailed income insights, this document supports strategic decision-making and enhances financial forecasting accuracy.

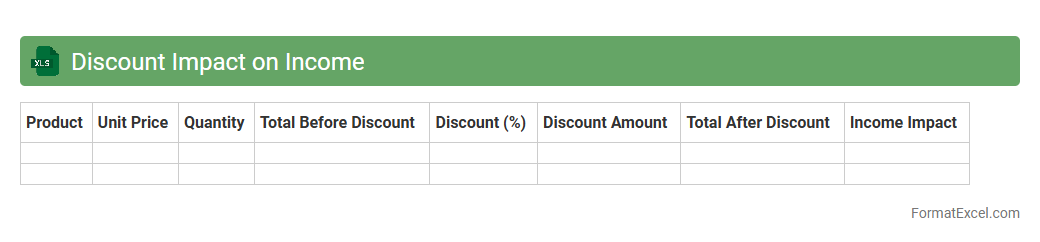

Discount Impact on Income

The

Discount Impact on Income Excel document analyzes how various discount strategies affect overall revenue and profit margins, providing a detailed financial overview. It helps businesses identify the optimal discount rates that maximize income without eroding profitability, supporting data-driven pricing decisions. This tool is essential for forecasting financial outcomes, managing cash flow, and enhancing strategic sales planning.

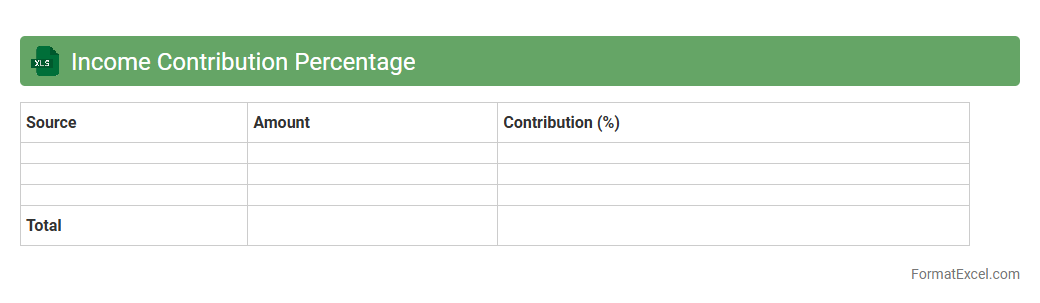

Income Contribution Percentage

An

Income Contribution Percentage Excel document calculates the proportion of individual income sources relative to total income, providing clear insight into financial distribution. This tool helps businesses and individuals identify which revenue streams are most significant for strategic planning and resource allocation. By visualizing income contributions, users can make data-driven decisions to optimize profitability and growth.

Daily Income Tracking

The

Daily Income Tracking Excel document is a tool designed to record and monitor daily revenue streams systematically. It helps individuals and businesses analyze income patterns, ensuring accurate financial management and informed decision-making. By maintaining detailed entries, users can identify growth opportunities and manage cash flow more effectively.

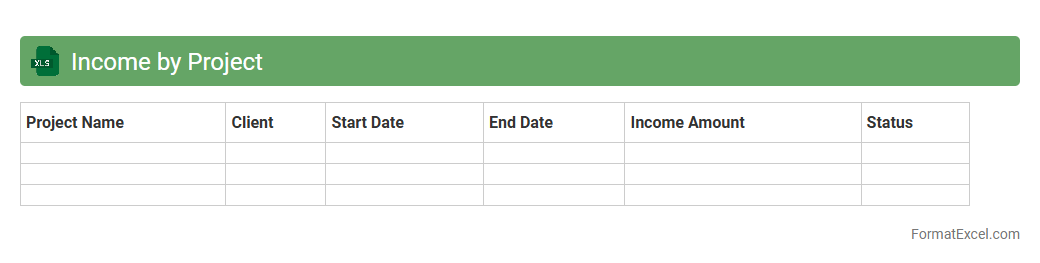

Income by Project

The

Income by Project Excel document is a financial tracking tool designed to monitor revenue generated from individual projects, allowing for detailed analysis of profitability and cash flow. It helps businesses allocate resources efficiently by identifying high-performing projects and areas that require improvement, improving budget management. By organizing income data by project, this document supports informed decision-making and strategic planning, enhancing overall financial transparency and control.

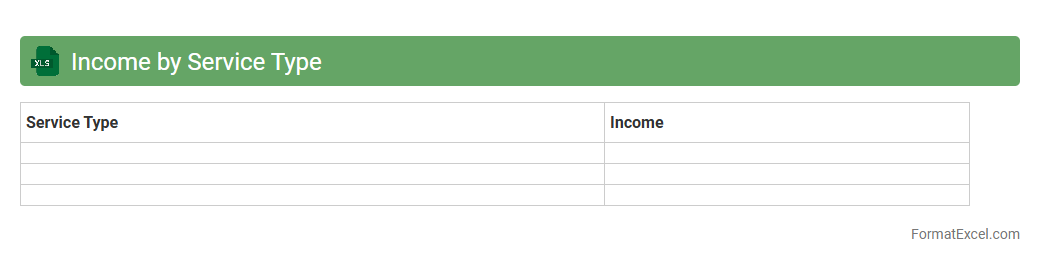

Income by Service Type

The

Income by Service Type Excel document categorizes revenue streams based on different services provided, allowing for detailed financial analysis and performance tracking. It helps businesses identify which service types generate the most income, enabling strategic decision-making and resource allocation. Using this document improves financial transparency and supports targeted growth initiatives.

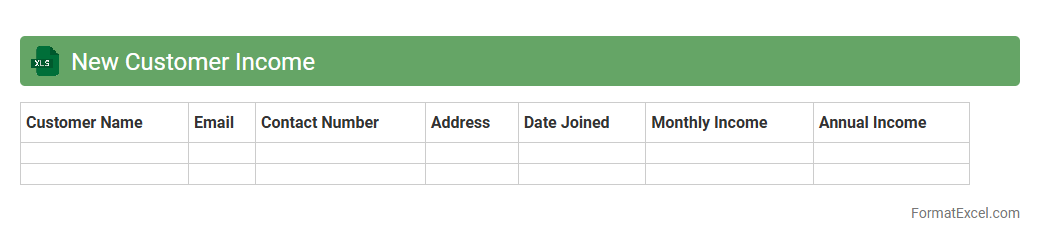

New Customer Income

The

New Customer Income Excel document is a detailed financial tool designed to track and analyze revenue generated from new clients over specified periods. It helps businesses identify income trends, forecast future earnings, and optimize sales strategies by providing clear, organized data on new customer transactions. This document is essential for making informed decisions to drive growth and enhance profitability efficiently.

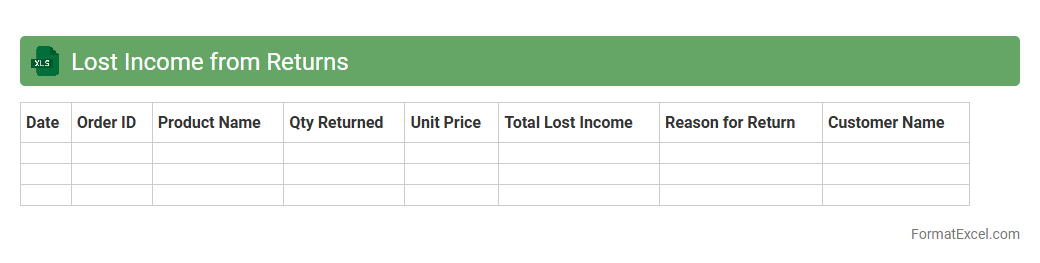

Lost Income from Returns

The

Lost Income from Returns Excel document quantifies potential revenue lost due to product returns, allowing businesses to identify financial impacts accurately. It tracks returned items, reasons for returns, and calculates associated income losses, providing valuable insight for inventory and sales optimization. Using this data-driven approach helps improve decision-making and develop strategies to minimize returns and boost profitability.

Introduction to Income Analysis in Excel

Income analysis in Excel allows you to systematically track and evaluate your earnings to make informed financial decisions. Using Excel's versatile tools, you can organize complex income data with ease. The spreadsheet becomes a powerful asset in managing your financial health.

Key Components of an Income Analysis Format

An effective income analysis format includes income sources, amounts, dates, and categories. Accurate categorization is essential to gain clear insights into your finances. The heart of this process lies in structuring the data for seamless analysis.

Setting Up Your Excel Spreadsheet

Begin by creating columns for date, income source, amount, and category to structure your income data. Proper layout enhances readability and data input efficiency. Establishing a clear spreadsheet format sets the foundation for successful income tracking.

Essential Income Data to Collect

Collect income details like payment date, amount, source, and payment method to ensure comprehensive tracking. This information helps identify trends and irregularities effectively. Accurate data collection is critical for valid income analysis.

Organizing Income Sources in Excel

Categorize income into types such as salary, freelance work, and investments to streamline analysis. Using Excel tables or filters helps manage diverse income streams efficiently. Proper organization simplifies income tracking and reporting.

Using Formulas for Automated Calculations

Excel formulas like SUM, AVERAGE, and IF functions automate calculations and enhance accuracy. They reduce manual errors and save time by processing income data dynamically. Mastering formulas is key to efficient income analysis.

Designing User-Friendly Income Analysis Templates

Create templates with clear labels, consistent formatting, and intuitive navigation to improve usability. A well-designed template encourages regular monitoring and data entry. Focusing on user experience elevates your income analysis practice.

Customizing Categories for Different Income Types

Personalize categories based on your unique income sources to reflect your financial reality accurately. This customization helps tailor reports and insights to your specific needs. Flexibility in categorization enhances the relevance of your analysis.

Visualizing Income Data with Charts and Graphs

Use Excel's chart tools to create bar graphs, pie charts, and line graphs for visual representation of income trends. Visualization aids in quick interpretation and spotting patterns over time. Effective charts make income data more accessible and actionable.

Tips for Accurate and Efficient Income Tracking

Maintain consistent data entry schedules, back up your files regularly, and double-check entries to ensure accuracy. Utilizing Excel's data validation and protection features prevents errors and secures your data. Prioritizing accuracy leads to reliable and insightful income analysis.