Monthly Income Tracker

A

Monthly Income Tracker Excel document is a structured spreadsheet designed to record, monitor, and analyze income sources on a monthly basis. It helps individuals and businesses maintain accurate financial records, identify income patterns, and make informed budgeting decisions. Using this tool enhances financial planning by providing clear visibility into cash flow and supporting goal-oriented money management.

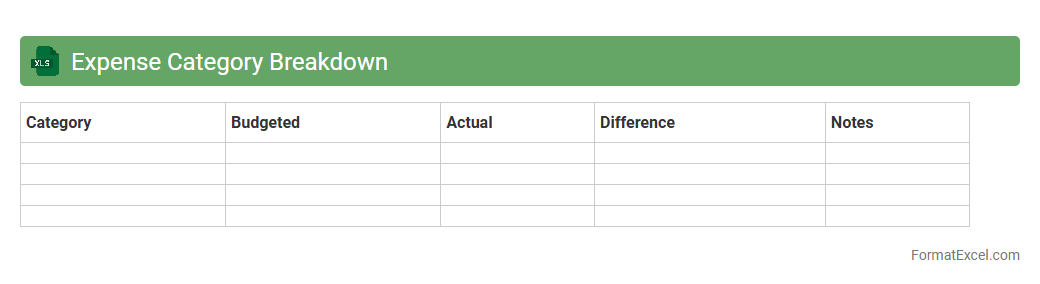

Expense Category Breakdown

An

Expense Category Breakdown Excel document organizes and classifies expenses into specific categories, providing a clear view of where money is spent. This structured approach helps in tracking spending patterns, identifying cost-saving opportunities, and improving budget management. By analyzing detailed expense categories, individuals and businesses can make informed financial decisions and optimize resource allocation.

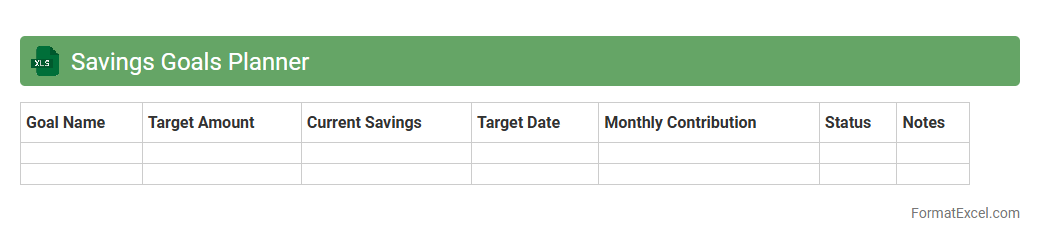

Savings Goals Planner

A

Savings Goals Planner Excel document is a structured digital spreadsheet designed to help individuals set, track, and achieve their financial savings objectives. It enables users to input target amounts, deadlines, and monitor progress through customizable formulas and charts, making financial planning more precise and actionable. By using this tool, people can maintain disciplined saving habits, prioritize expenses, and visualize their path to financial milestones efficiently.

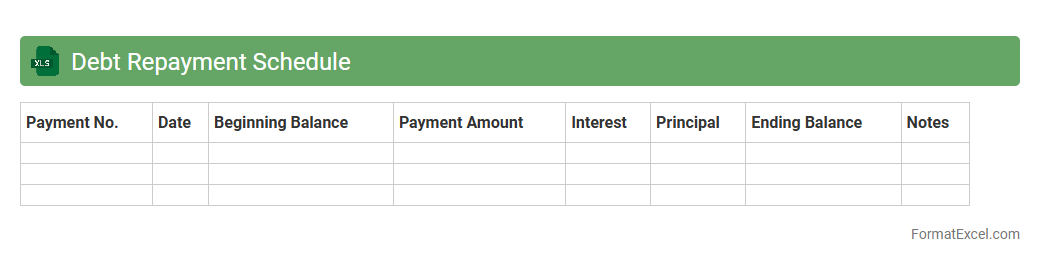

Debt Repayment Schedule

A

Debt Repayment Schedule Excel document is a structured spreadsheet that tracks loan balances, payment dates, and interest calculations to manage debt effectively. It helps users visualize repayment progress, forecast remaining balances, and plan payments strategically to avoid default. By organizing financial obligations clearly, it enhances budgeting accuracy and supports financial stability.

Yearly Expense Summary

The

Yearly Expense Summary Excel document consolidates all financial expenditures over a 12-month period, providing a clear overview of spending patterns. It enables users to identify cost-saving opportunities, budget more effectively, and track expenses against income or financial goals. This tool is essential for maintaining financial discipline and making informed decisions based on accurate, organized data.

Emergency Fund Tracker

An

Emergency Fund Tracker Excel document is a financial tool designed to help individuals monitor and manage their savings set aside for unexpected expenses. It provides a structured format to record contributions, track progress towards a target amount, and visualize growth over time. Using this tracker enhances financial preparedness by encouraging consistent savings and offering clear insight into the current status of emergency reserves.

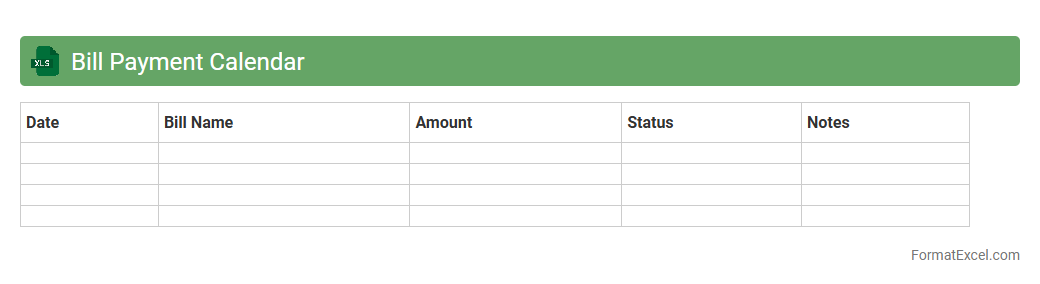

Bill Payment Calendar

A

Bill Payment Calendar Excel document is a spreadsheet tool designed to organize and track all upcoming bill payments by date, amount, and payee. It helps individuals and businesses avoid late fees, manage cash flow effectively, and maintain a clear overview of financial obligations. Using this calendar ensures timely payments and enhances budgeting accuracy by consolidating multiple bills into a single, manageable format.

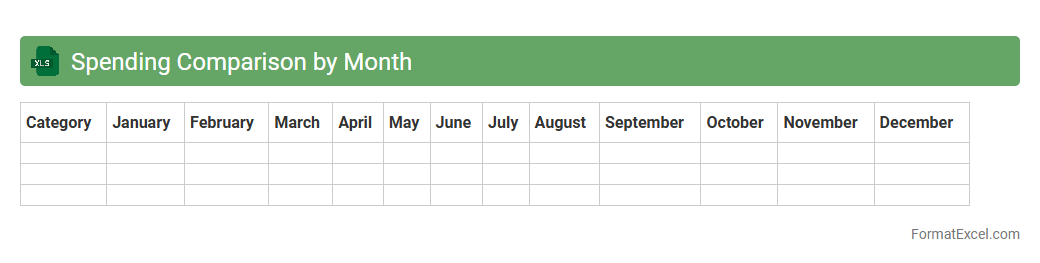

Spending Comparison by Month

The

Spending Comparison by Month Excel document is a financial tool that tracks and analyzes monthly expenses across different categories, enabling users to identify spending patterns and fluctuations over time. By visualizing data in tables and charts, it helps individuals and businesses make informed budgeting decisions, optimize cash flow, and detect areas for cost savings. The document supports efficient financial planning by providing a clear overview of monthly expenditure variations and highlighting trends that impact overall financial health.

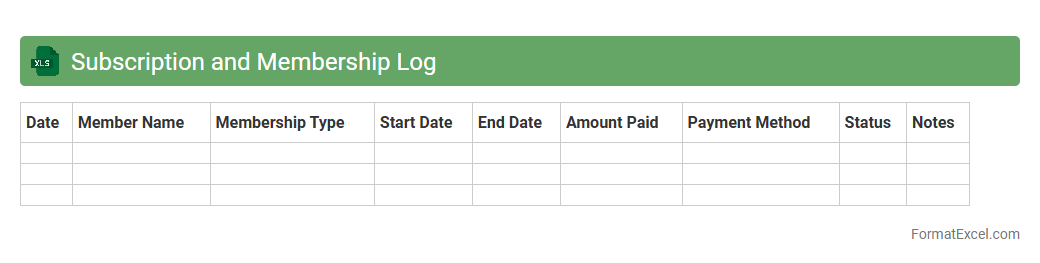

Subscription and Membership Log

A

Subscription and Membership Log Excel document is a comprehensive tool designed to track and manage subscriber details, payment status, renewal dates, and membership levels efficiently. It enables businesses and organizations to monitor recurring revenue streams, identify active versus expired subscriptions, and analyze membership trends to enhance customer retention strategies. By organizing all subscription-related data in one place, it simplifies billing processes and supports informed decision-making for marketing and service improvements.

Grocery Spending Tracker

A

Grocery Spending Tracker Excel document is a customizable spreadsheet designed to monitor and analyze household grocery expenses efficiently. It helps users categorize purchases, identify spending patterns, and set budget limits, ultimately promoting smarter financial decisions. By providing clear insights into grocery costs, this tool supports better money management and reduces unnecessary expenditures.

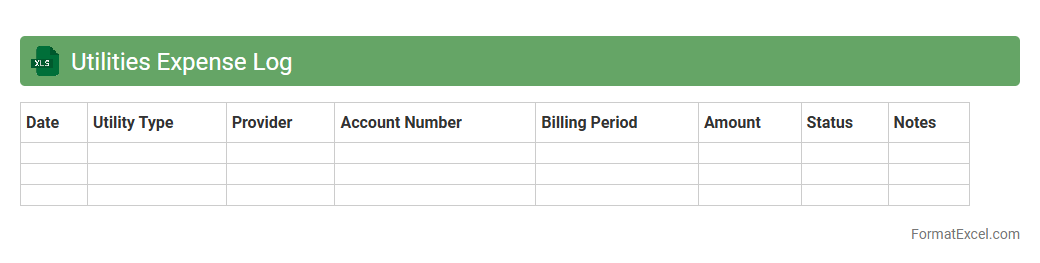

Utilities Expense Log

The

Utilities Expense Log Excel document is a structured spreadsheet designed to track and manage monthly utility costs such as electricity, water, and gas expenses. It allows businesses and households to monitor spending patterns, identify cost-saving opportunities, and maintain accurate financial records for budgeting and tax purposes. This tool enhances financial transparency and supports efficient utility expense management by providing clear, organized data visualization.

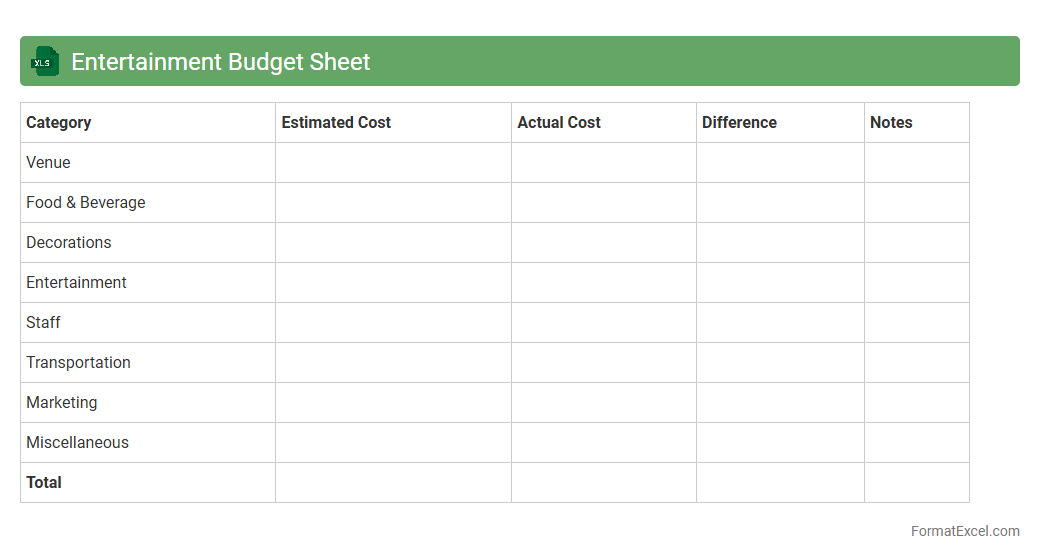

Entertainment Budget Sheet

An

Entertainment Budget Sheet Excel document helps individuals or organizations track and manage expenses related to entertainment activities such as events, parties, or outings. It provides a clear overview of costs, enabling better financial planning and preventing overspending. Using this tool improves expense transparency and supports efficient allocation of funds within entertainment budgets.

Transportation Cost Tracker

The

Transportation Cost Tracker Excel document is a powerful tool designed to monitor and analyze expenses related to logistics, including fuel, maintenance, tolls, and driver salaries. It helps businesses optimize route planning and budgeting by providing detailed cost breakdowns and trend analysis. Using this tracker enhances cost efficiency, improves financial forecasting, and supports strategic decision-making in transportation management.

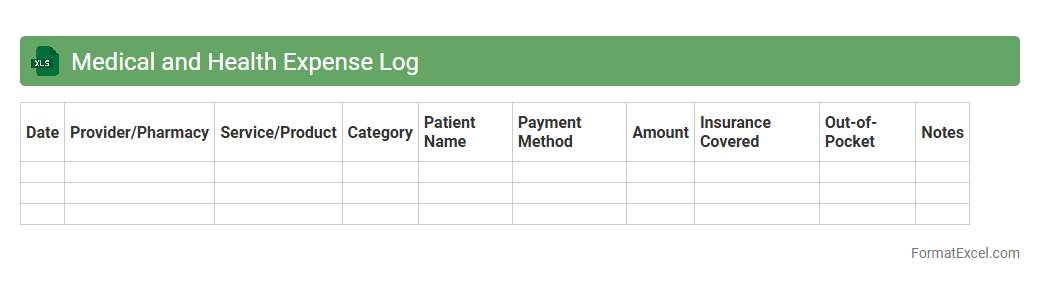

Medical and Health Expense Log

A

Medical and Health Expense Log Excel document is a systematic tool designed to track and organize all healthcare-related expenditures, including doctor visits, medication costs, and insurance payments. It helps users monitor spending patterns, manage budgets effectively, and prepare accurate reports for insurance claims or tax deductions. By maintaining detailed records in a structured format, this log enhances financial transparency and supports better healthcare decision-making.

Charitable Donations Tracker

A

Charitable Donations Tracker Excel document is a spreadsheet tool designed to record, organize, and monitor all contributions made to various charitable organizations. It helps users keep accurate records of donation dates, amounts, and recipients, facilitating easier tax deductions and financial planning. By maintaining clear documentation, this tracker ensures transparency and accountability in philanthropic activities, making it essential for personal and organizational giving strategies.

Vacation and Travel Expense Tracker

A

Vacation and Travel Expense Tracker Excel document is a tool designed to help individuals or families monitor and manage their travel-related spending by organizing costs such as transportation, accommodation, meals, and activities in one place. This spreadsheet facilitates budget planning, ensuring users stay within their financial limits while providing clear insights into where money is being allocated during trips. Using this tracker enhances financial control, reduces overspending, and simplifies expense reporting for future travel planning or reimbursement purposes.

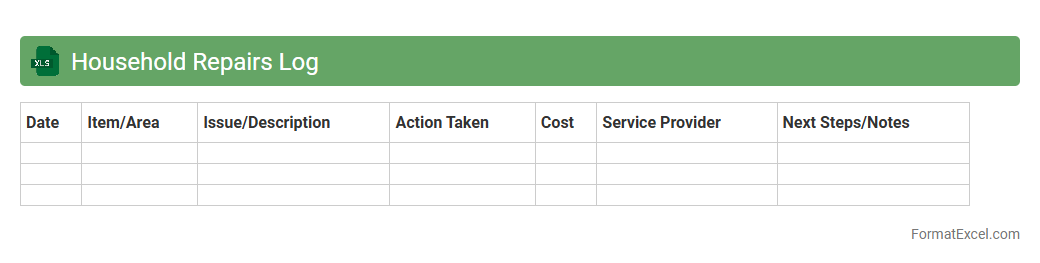

Household Repairs Log

A

Household Repairs Log Excel document is a detailed record-keeping tool designed to track maintenance tasks, repair dates, costs, and service providers for home-related issues. It helps homeowners organize repair histories, budget for future expenses, and ensure timely upkeep of appliances and infrastructure. Using this log improves home management efficiency and supports informed decision-making for property maintenance.

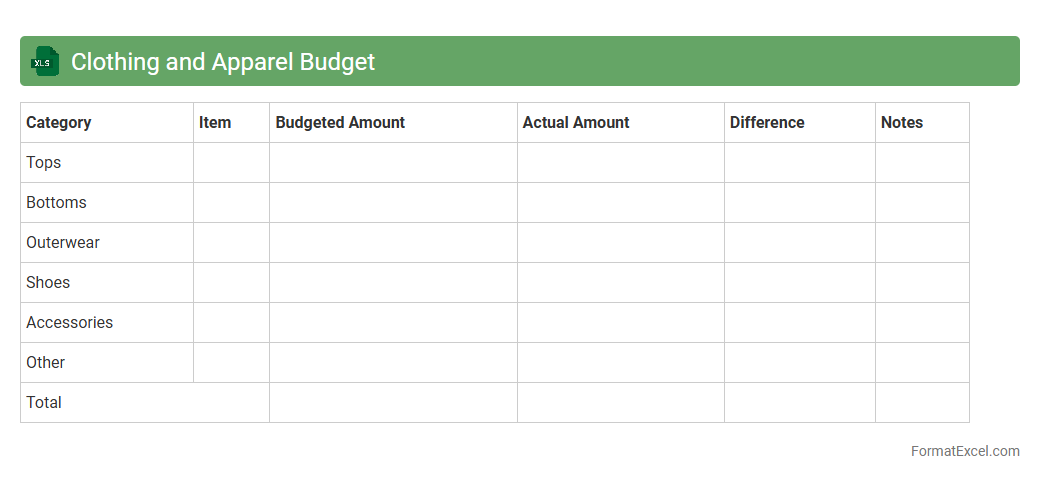

Clothing and Apparel Budget

A

Clothing and Apparel Budget Excel document is a financial planning tool designed to track and manage expenses related to clothing purchases. It helps users allocate a specific budget for clothing, monitor spending patterns, and avoid overspending by providing clear visual summaries and customizable categories. This document is useful for maintaining financial discipline and ensuring efficient allocation of funds for apparel needs.

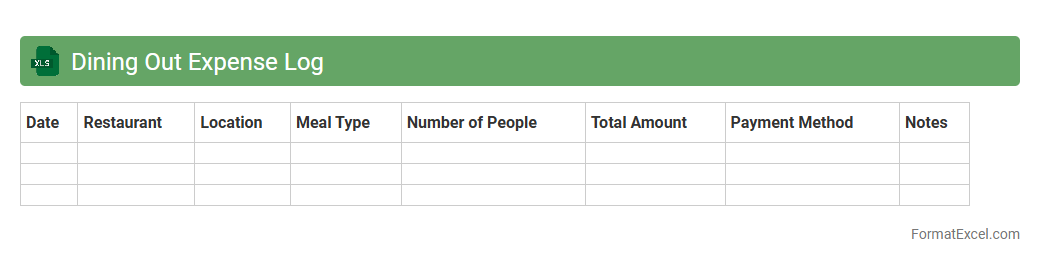

Dining Out Expense Log

A

Dining Out Expense Log Excel document is a structured spreadsheet designed to track and categorize all expenses related to eating out, enabling detailed financial monitoring. It helps users identify spending patterns, set dining budgets, and manage monthly expenses more effectively. This tool is essential for maintaining personal or business financial discipline by providing clear insights into food-related expenditures.

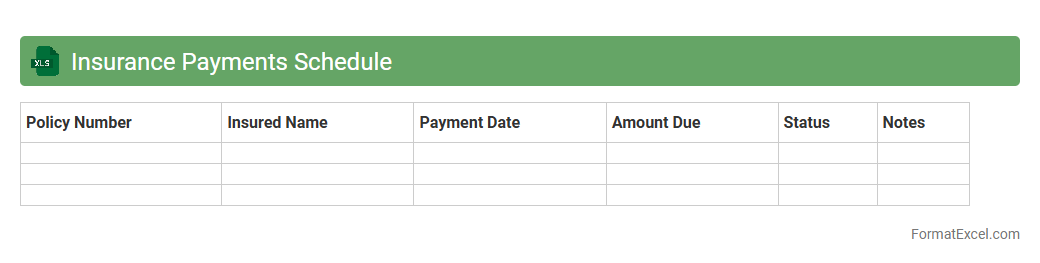

Insurance Payments Schedule

An

Insurance Payments Schedule Excel document systematically tracks premium due dates, payment amounts, and policy details, ensuring timely and accurate payments. It helps users maintain organized financial records, avoid missed payments, and manage multiple insurance policies efficiently. This tool enhances budgeting accuracy and supports compliance with insurance contract terms.

Personal Allowance Tracker

A

Personal Allowance Tracker Excel document is a tool designed to monitor and manage individual spending limits and budgets efficiently. It helps users keep detailed records of allowances, categorize expenses, and track remaining balances in real-time. This organized approach enables better financial planning, reduces overspending, and promotes accountability in personal finance management.

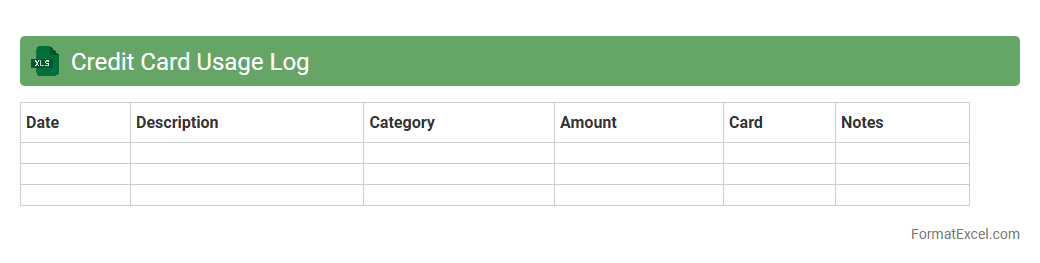

Credit Card Usage Log

A

Credit Card Usage Log Excel document is a detailed record that tracks all credit card transactions, including dates, amounts, merchants, and categories of spending. It helps users monitor their expenses, identify spending patterns, and manage budgets effectively by providing clear insights into credit card usage. This organized tracking reduces the risk of overspending and assists in timely payment of credit card bills to avoid interest charges and maintain a good credit score.

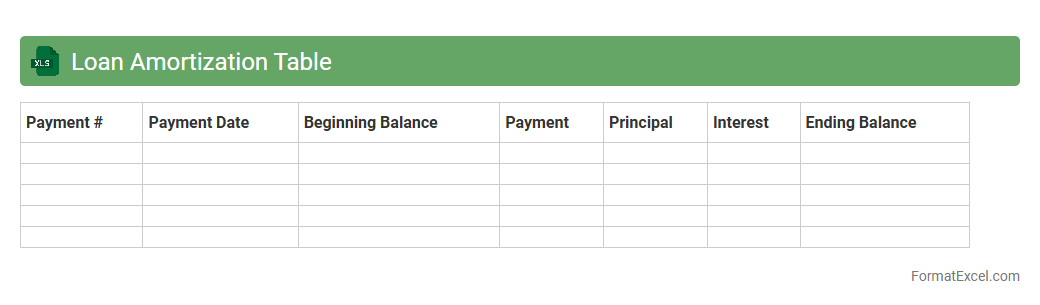

Loan Amortization Table

A

Loan Amortization Table in Excel is a detailed schedule that breaks down each loan payment into principal and interest components over the life of the loan. It helps borrowers track payment amounts, remaining loan balance, and interest paid, enabling effective financial planning and budgeting. Using this table, individuals and businesses can visualize the payoff timeline and manage debt more efficiently.

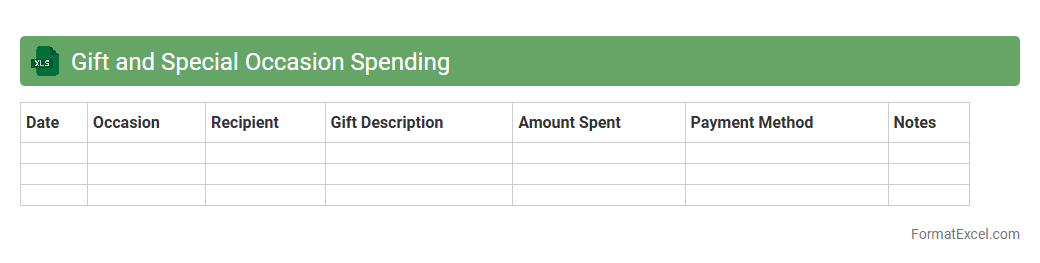

Gift and Special Occasion Spending

The

Gift and Special Occasion Spending Excel document is a detailed financial tracker designed to organize and monitor expenses related to gifts and special events such as birthdays, holidays, and anniversaries. This tool helps users budget effectively, avoid overspending, and gain insights into their spending patterns over time. By categorizing expenditures, it enables better financial planning and ensures that funds are allocated appropriately for personal celebrations.

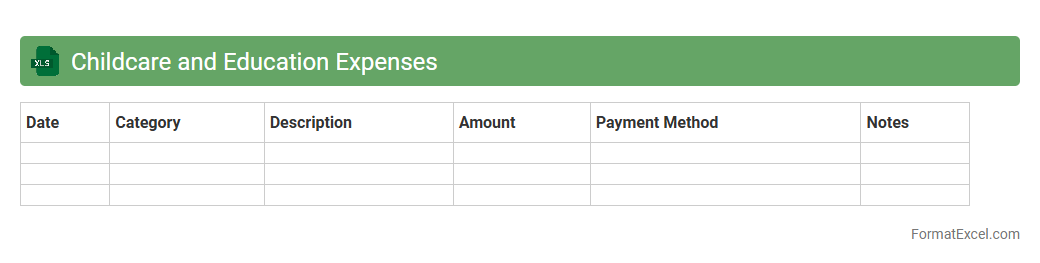

Childcare and Education Expenses

The

Childcare and Education Expenses Excel document is a structured spreadsheet designed to track and manage costs related to child care and educational needs efficiently. It helps families and guardians monitor expenses such as tuition fees, daycare costs, school supplies, and extracurricular activities, enabling better budgeting and financial planning. By consolidating this data, users can identify spending patterns, prepare for tax deductions, and ensure they allocate resources effectively to support their child's development.

Introduction to Personal Budget Formats

A personal budget format helps individuals organize their finances clearly and effectively. It provides a structured approach to recording income and expenses, ensuring better financial control. Adopting a consistent format is essential for long-term financial planning and success.

Why Use Excel for Budgeting

Excel offers a powerful platform with flexible tools ideal for budgeting. It allows for easy data entry, calculation automation, and visualization through charts and graphs. Using Excel enhances accuracy and helps track financial goals efficiently.

Key Components of a Personal Budget

A comprehensive budget includes income, fixed and variable expenses, savings, and debt repayments. Categorizing each component helps in better monitoring and decision-making. These key elements form the basis of a functional personal budget.

Step-by-Step Guide to Setting Up Your Excel Budget

Start with defining income sources and listing expense categories in separate columns. Use formulas to calculate totals and differences automatically for accuracy. This clear setup enables regular updates and easy adjustments to your budget.

Essential Excel Features for Budget Management

Features like SUM, IF functions, and conditional formatting make Excel a budget management powerhouse. PivotTables and charts provide visual insights into spending habits. These tools help optimize financial tracking and decision-making.

Sample Personal Budget Template Structure

A typical template includes sections for income, fixed expenses, variable expenses, and savings goals. Rows list individual items while columns track monthly amounts. This logical structure simplifies financial overview at a glance.

Tips for Customizing Your Budget Format

Tailor your budget format by adding categories that fit your lifestyle and financial goals. Use color codes and data validation to improve clarity and prevent errors. Customization ensures the format stays relevant and easy to use.

Common Budgeting Categories in Excel

Common categories include housing, utilities, groceries, transportation, and entertainment. Proper classification within these groups aids in detailed expense tracking. Accurate categorization is crucial to understanding spending patterns.

Tracking and Analyzing Expenses in Excel

Regular entry of expenses coupled with charts helps in continuous expense tracking. Analysis through trends reveals areas for potential savings. This proactive approach improves overall financial health.

Free and Downloadable Personal Budget Excel Templates

Many websites offer free, downloadable Excel budget templates for immediate use. These templates save time and provide a professional layout to start budgeting right away. Selecting the right template can simplify financial management.