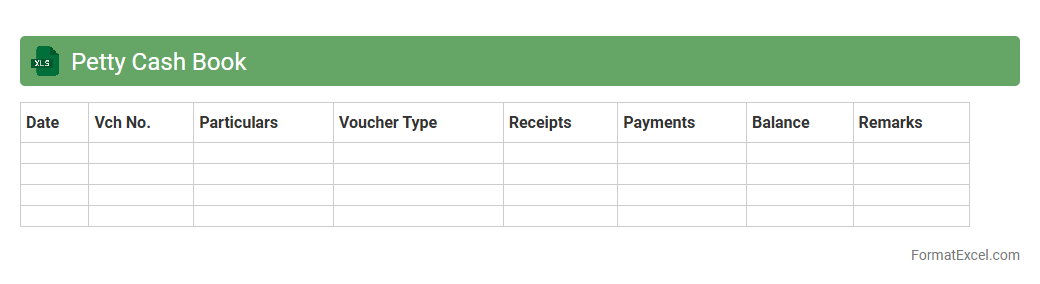

Petty Cash Book

A

Petty Cash Book Excel document is a digital ledger used to record small, day-to-day business expenses in a structured and organized manner. It helps track petty cash transactions efficiently, enabling easy monitoring and reconciliation of expenses without the need for complex accounting software. This tool improves financial accuracy and provides a clear audit trail for minor expenditures.

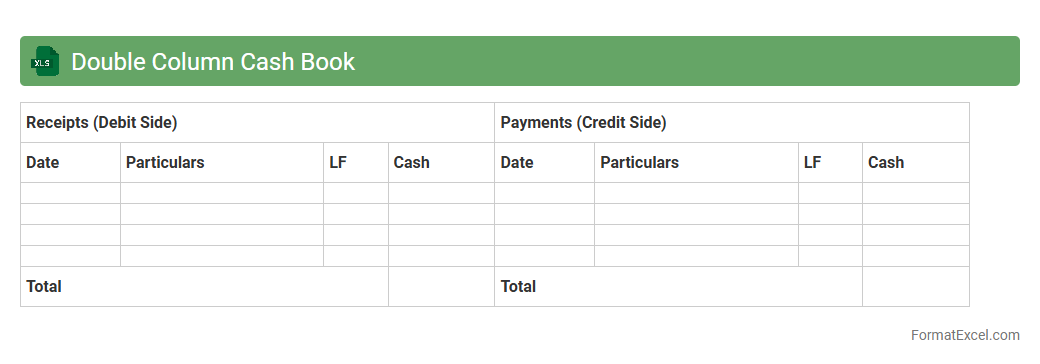

Double Column Cash Book

A

Double Column Cash Book Excel document is a financial record-keeping tool that tracks both cash and bank transactions simultaneously in separate columns. It allows businesses to maintain accurate and organized records of receipts and payments, facilitating easy reconciliation and cash flow management. By using this Excel template, users can efficiently monitor their financial status and generate detailed reports for better decision-making.

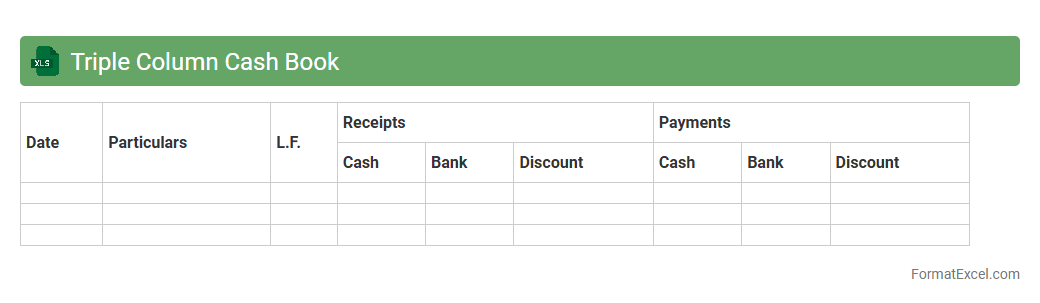

Triple Column Cash Book

A

Triple Column Cash Book Excel document is a financial record-keeping tool that tracks cash, bank, and discount transactions within a single ledger. It helps users efficiently monitor inflows and outflows, making reconciliation and financial management more streamlined and accurate. This Excel format automates calculations and enhances data analysis, improving overall accuracy and saving time in accounting processes.

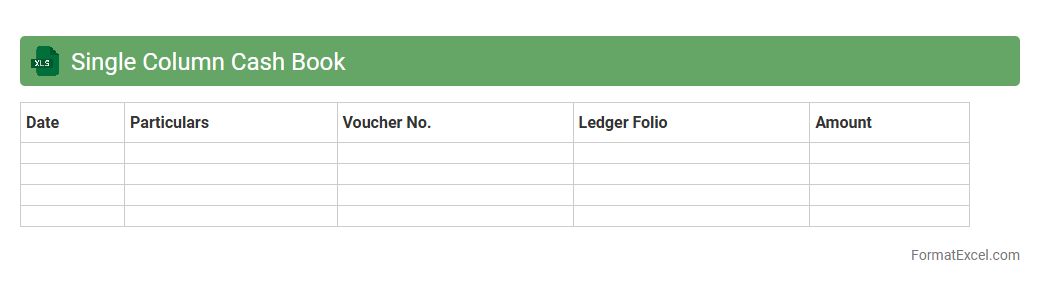

Single Column Cash Book

A

Single Column Cash Book Excel document is a financial record-keeping tool that tracks all cash transactions in a single column format, including both receipts and payments. It helps maintain clear and organized cash flow records, simplifying cash management for businesses and individuals. Using this tool enhances accuracy in monitoring daily cash balances and supports effective budgeting and financial analysis.

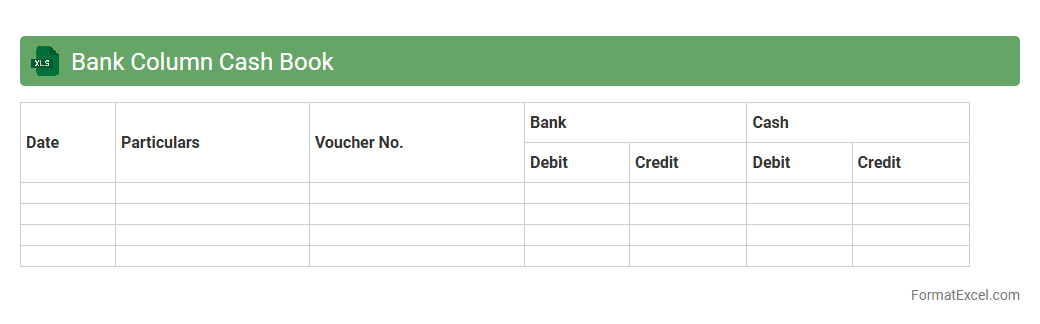

Bank Column Cash Book

A

Bank Column Cash Book Excel document is a financial tool designed to systematically record all banking transactions, including deposits, withdrawals, and bank charges. It helps businesses and individuals maintain accurate and organized financial records, facilitating easier reconciliation with bank statements. Using this document improves cash flow management and ensures transparency in tracking funds.

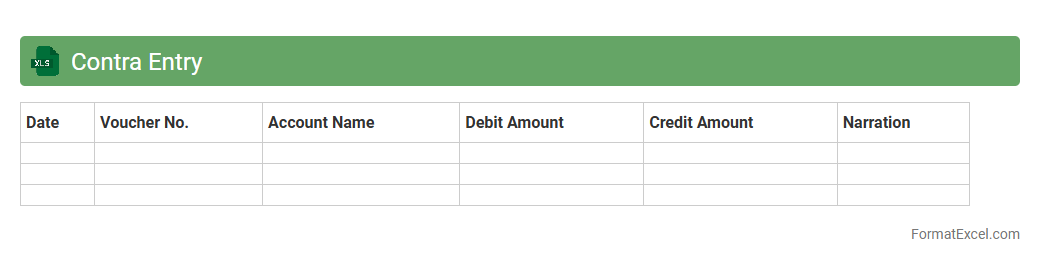

Contra Entry

A

Contra Entry Excel document records transactions where money is transferred between cash and bank accounts without involving third parties, ensuring accurate cash and bank ledger reconciliation. It helps maintain clear financial records by tracking both debit and credit entries within the same ledger, reducing errors and streamlining account management. Organizations use this document to monitor internal fund movements, improving transparency and simplifying audit processes.

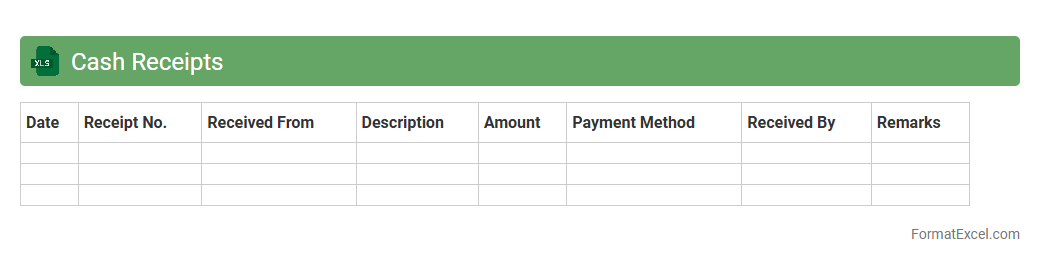

Cash Receipts

A

Cash Receipts Excel document is a spreadsheet used to record and track all cash inflows in a business, including sales, loans, and other income sources. This tool helps maintain accurate financial records, facilitates cash flow management, and supports reconciliation with bank statements. By providing clear visibility into daily cash transactions, it aids in budgeting and financial reporting processes.

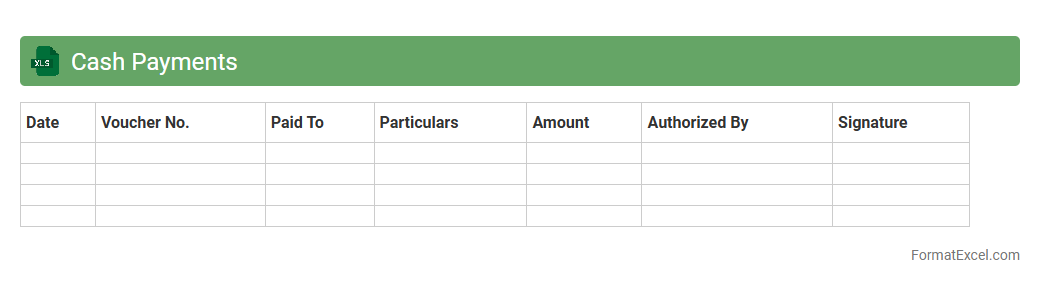

Cash Payments

The

Cash Payments Excel document is a structured spreadsheet used to record and track all cash transactions, including payments and receipts, in an organized manner. It helps users maintain accurate financial records, monitor cash flow, and quickly identify discrepancies or outstanding payments. This tool is essential for effective budget management, audit preparation, and ensuring transparency in financial operations.

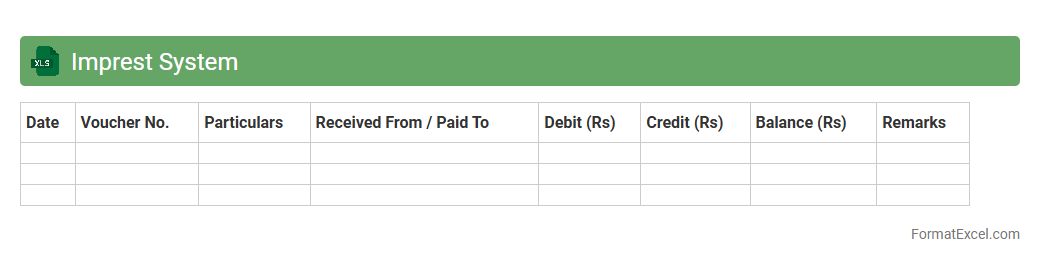

Imprest System

The

Imprest System Excel document is a financial management tool designed to track and control petty cash or advance funds within an organization. It helps maintain accurate records of disbursements, reimbursements, and balances by automating calculations and organizing transactions efficiently. This system enhances transparency, reduces errors, and streamlines cash handling processes, ensuring proper accountability and financial discipline.

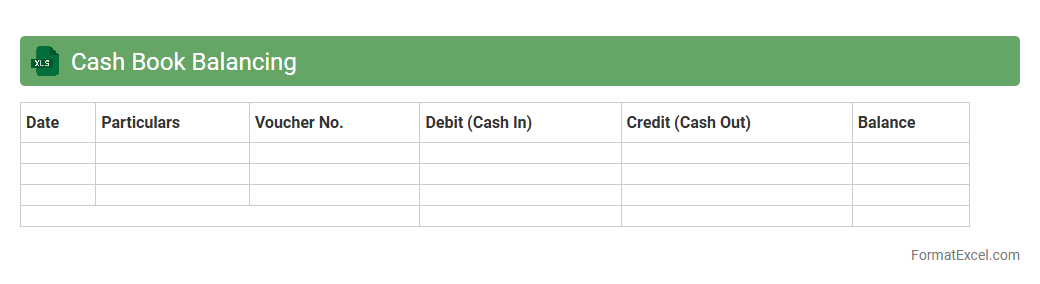

Cash Book Balancing

A

Cash Book Balancing Excel document is a financial tool used to record and reconcile all cash transactions, ensuring accuracy in cash flow management. It helps track daily cash receipts and payments, making it easier to detect discrepancies and maintain up-to-date financial records. This document is essential for businesses to monitor liquidity, streamline accounting processes, and prepare reliable financial statements.

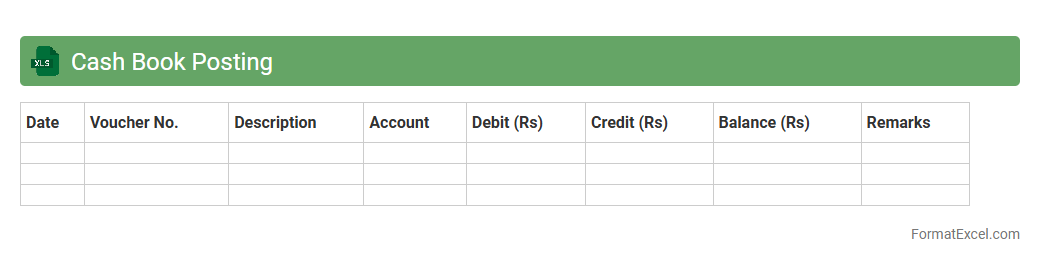

Cash Book Posting

A

Cash Book Posting Excel document is a digital ledger designed to record and track cash transactions systematically, including receipts and payments. It helps maintain accurate financial records by allowing easy entry, organization, and real-time monitoring of cash flow, which supports effective budgeting and financial planning. This tool enhances transparency and reduces errors compared to manual bookkeeping, making it essential for businesses and individuals managing daily cash activities.

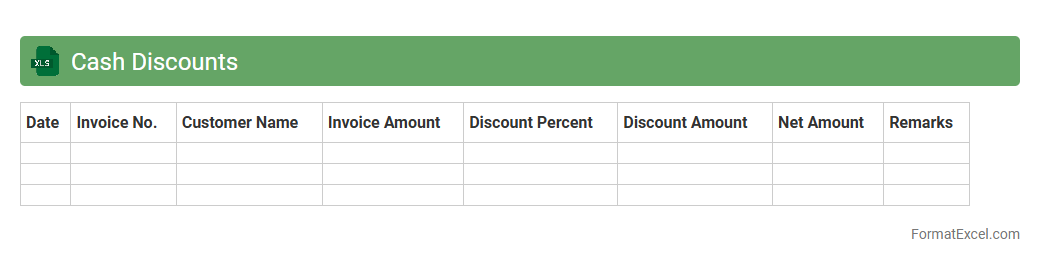

Cash Discounts

The

Cash Discounts Excel document is a structured spreadsheet designed to calculate and manage cash discount terms offered by suppliers or vendors, streamlining financial tracking and payment efficiency. It helps businesses quickly determine discount eligibility based on payment dates and invoice amounts, reducing errors and improving cash flow management. By automating these calculations, organizations can maximize savings and make informed financial decisions.

Trade Discounts

A

Trade Discounts Excel document is a spreadsheet designed to systematically record and calculate reductions in the price offered by suppliers to buyers for bulk purchases or promotional deals. It helps businesses track discount percentages, manage pricing strategies, and maintain accurate financial records, ensuring clear visibility of cost savings and improved budgeting. Using this tool enhances decision-making by providing detailed insights into supplier pricing and the impact of discounts on overall expenses.

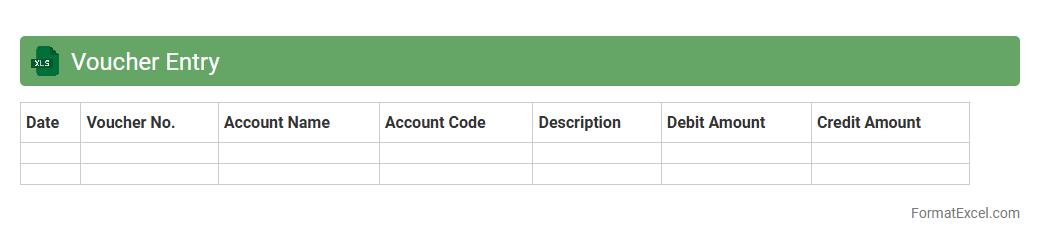

Voucher Entry

A

Voucher Entry Excel document is a structured spreadsheet designed to record financial transactions, including expenses, payments, and receipts. It organizes voucher details such as date, amount, voucher number, and description, facilitating accurate bookkeeping and audit trails. This document enhances financial management by enabling efficient tracking, verifying, and reporting of business transactions.

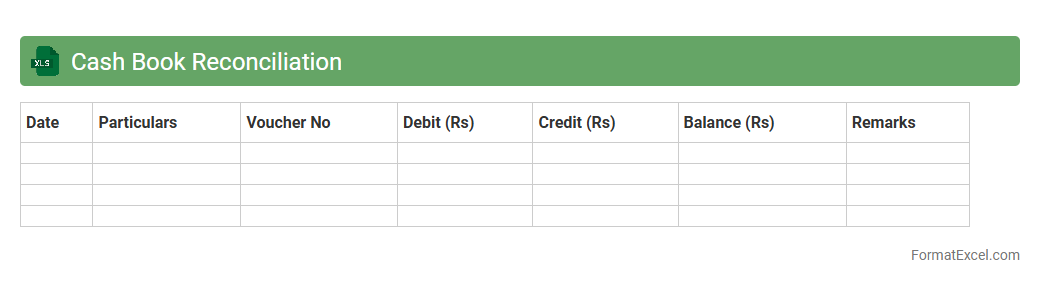

Cash Book Reconciliation

A

Cash Book Reconciliation Excel document is a financial management tool used to match and verify cash transactions recorded in the cash book with corresponding bank statements or receipts. It helps identify discrepancies, errors, or missing entries to ensure accurate cash flow tracking and accounting records. This document streamlines the reconciliation process, enhancing financial accuracy and control for businesses or individuals.

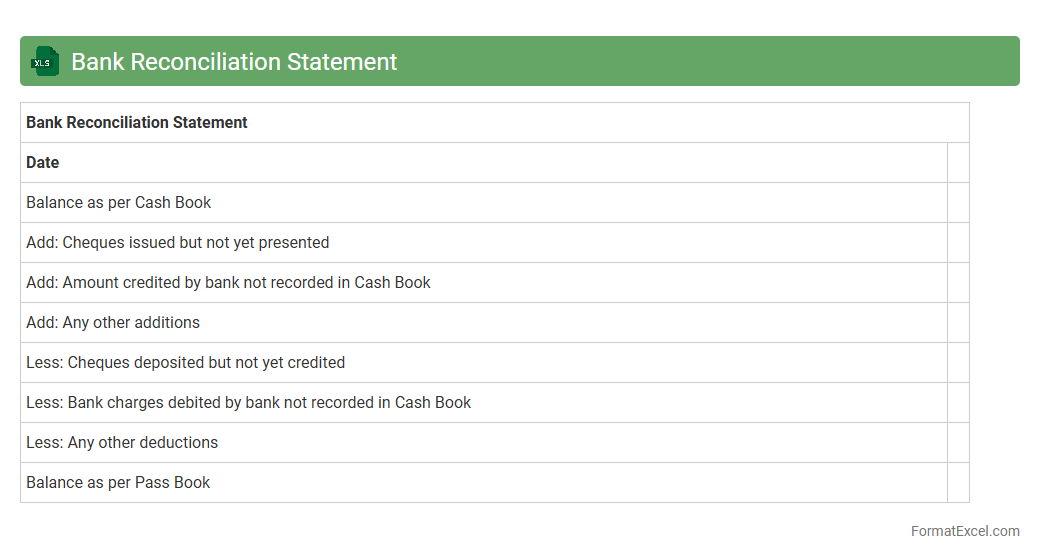

Bank Reconciliation Statement

A

Bank Reconciliation Statement Excel document is a financial tool used to match and compare the bank statement balance with the company's accounting records. It helps identify discrepancies such as outstanding checks, deposits in transit, or bank errors, ensuring that the recorded cash balance is accurate and up-to-date. Using this Excel file improves financial accuracy, prevents fraud, and aids in better cash flow management.

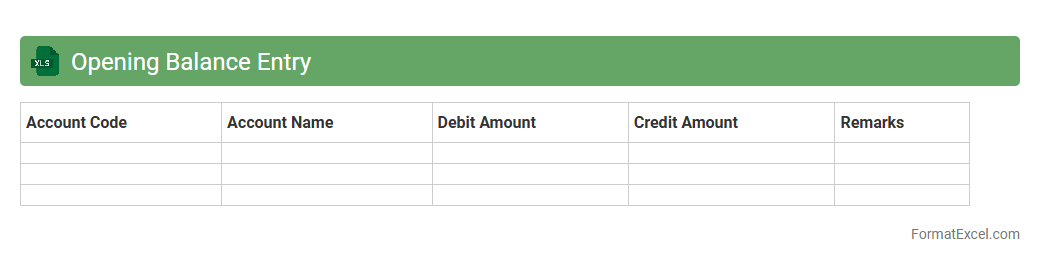

Opening Balance Entry

An

Opening Balance Entry Excel document records the initial financial position of an account at the beginning of an accounting period, capturing assets, liabilities, and equity balances. This document is essential for accurate bookkeeping and financial analysis, as it ensures continuity between accounting periods and aids in tracking business performance over time. Businesses use it to set a clear financial baseline, facilitating streamlined reconciliation and improved decision-making.

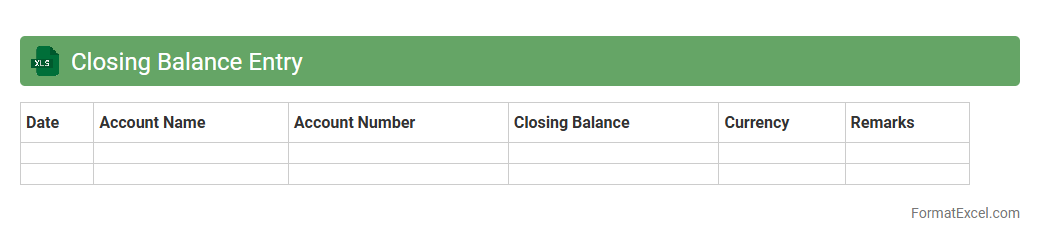

Closing Balance Entry

A

Closing Balance Entry Excel document records the final account balances at the end of a financial period, summarizing assets, liabilities, and equity. This document is essential for accurate financial reporting, ensuring consistency and helping in the preparation of financial statements such as balance sheets and profit and loss accounts. It streamlines the auditing process and supports better decision-making by providing a clear snapshot of an organization's financial standing.

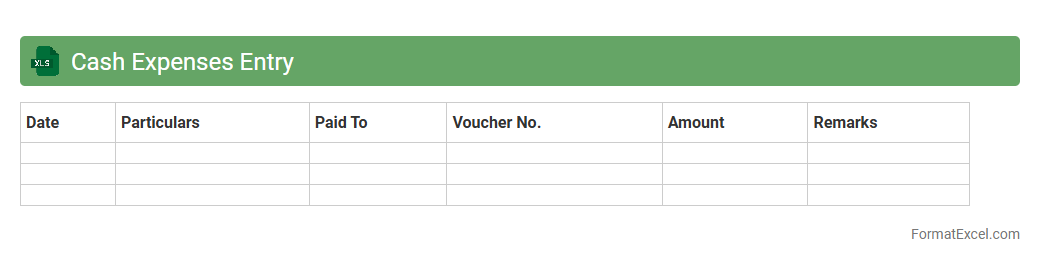

Cash Expenses Entry

A

Cash Expenses Entry Excel document serves as a systematic tool for recording daily cash outflows, enabling accurate tracking of expenditures. It helps businesses and individuals maintain organized financial records, ensuring easy access for budgeting, expense analysis, and audit preparation. By automating calculations and categorizing expenses, it enhances financial transparency and supports efficient cash flow management.

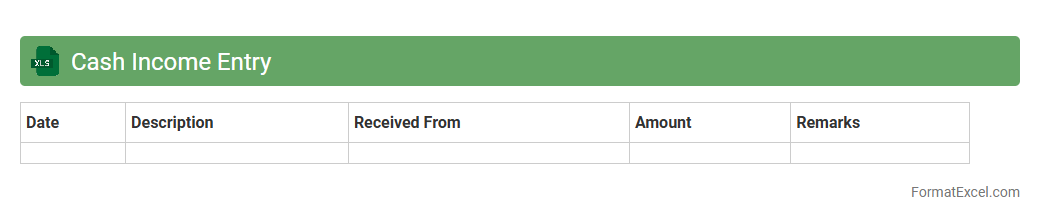

Cash Income Entry

The

Cash Income Entry Excel document is a structured spreadsheet designed to record and track all cash inflows efficiently. It helps businesses and individuals maintain accurate financial records, monitor daily cash receipts, and simplify the reconciliation of cash accounts. This tool enhances financial management by providing clear visibility into income sources and facilitating timely reporting for budgeting and auditing purposes.

Correction Entries

Correction Entries Excel document is a vital tool for recording and managing financial adjustments accurately within accounting systems. It helps organizations track discrepancies, rectify errors, and maintain precise financial statements, ensuring compliance with accounting standards. Utilizing this document improves audit readiness and enhances financial data integrity by providing a clear record of all corrections made.

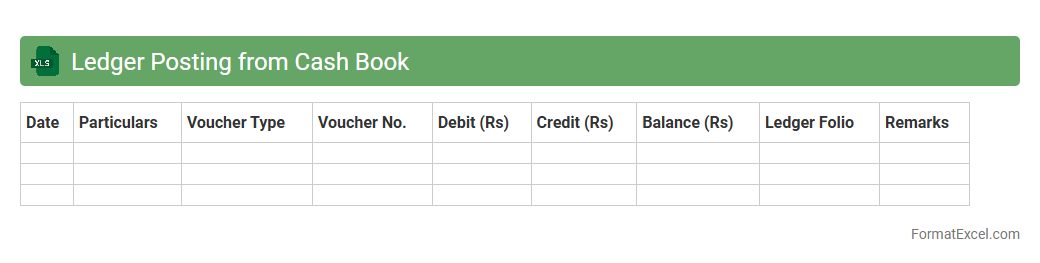

Ledger Posting from Cash Book

Ledger Posting from a Cash Book Excel document involves transferring individual cash transactions systematically into respective ledger accounts, ensuring accurate financial records. This process helps maintain organized accounts payable and receivable, simplifies reconciliation, and provides clear insights into cash flow management.

Ledger Posting enhances financial accuracy and supports efficient auditing by consolidating transaction data into a structured format.

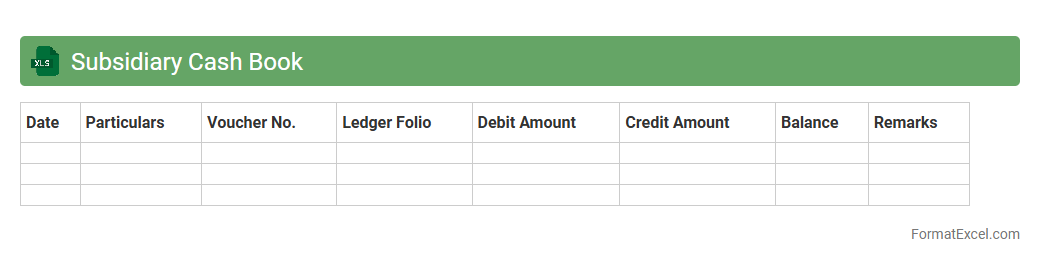

Subsidiary Cash Book

A

Subsidiary Cash Book Excel document is a specialized financial record that tracks detailed cash transactions for various accounts, making it easier to monitor inflows and outflows accurately. It helps maintain organized records of petty cash, separate bank accounts, or specific cash transactions, ensuring transparency and ease of reconciliation. Using this document enhances financial management by providing clear, real-time data, reducing errors, and simplifying auditing processes.

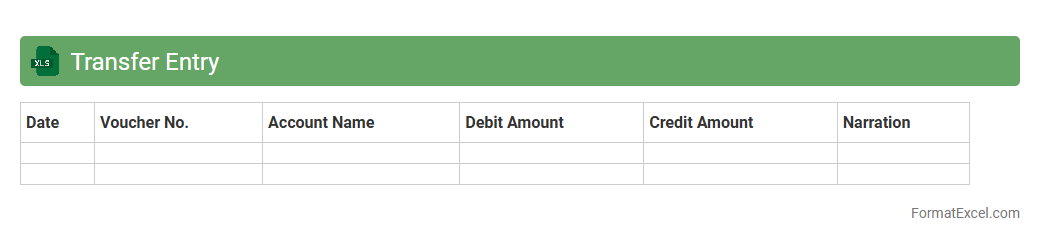

Transfer Entry

A

Transfer Entry Excel document is a structured spreadsheet used to record and manage the transfer of assets, inventory, or data between departments, locations, or accounts. It streamlines tracking by providing clear, organized entries that enhance accuracy and accountability in internal or external transfers. This document aids in reducing errors, improving audit trails, and facilitating seamless communication across teams.

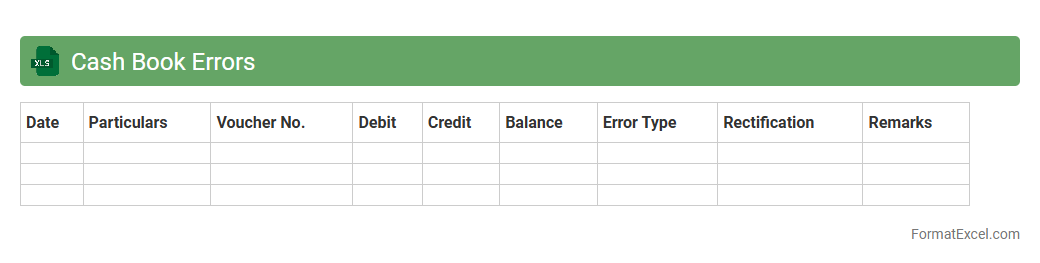

Cash Book Errors

The

Cash Book Errors Excel document is a valuable tool designed to identify and correct discrepancies in cash transactions, ensuring accurate financial records. It systematically tracks and highlights errors such as omissions, duplications, or misentries, facilitating timely reconciliation of accounts. This enhances financial transparency and supports effective cash flow management for businesses and individuals.

Introduction to Cash Book Format in Excel

The cash book format in Excel is a digital ledger used to record all cash receipts and payments. It simplifies tracking daily financial transactions with accuracy. Excel's flexibility allows customization to suit various business needs.

Importance of Maintaining a Cash Book

Maintaining a cash book helps monitor cash flow, ensuring transparency and financial control. It supports timely decision-making by providing real-time financial data. Proper records reduce errors and improve accountability.

Key Features of an Excel Cash Book

An Excel cash book includes features like automated calculations, date-wise entries, and categorized expenses. It offers easy filtering, sorting, and data visualization. These features enhance financial management efficiency.

Types of Cash Book Formats in Excel

Common types include single-column, double-column, and triple-column cash books. Each varies by the number of transaction details recorded, such as cash, bank, and discounts. Choosing the right format depends on business complexity and transaction volume.

Step-by-Step Guide to Creating a Cash Book in Excel

Start by inserting key columns like Date, Description, and Amount. Use Excel formulas to calculate totals and balances automatically. This step-by-step approach ensures an accurate and functional cash book.

Essential Columns in an Excel Cash Book

Essential columns include Date, Particulars, Voucher Number, Debit, Credit, and Balance. These fields capture all necessary details for effective financial tracking. Proper column setup is crucial for maintaining a clear transaction record.

Sample Cash Book Template in Excel

A sample template provides pre-built structures with formulas and formats. It saves time and ensures consistency in recording daily transactions. Templates are valuable tools for standardizing cash book maintenance.

Tips for Automating Calculations in Excel Cash Book

Use SUM, IF, and conditional formatting functions to automate totals and highlight errors. Automation minimizes manual effort and reduces mistakes. Leveraging Excel's formulas boosts accuracy in financial entries.

Common Mistakes to Avoid in Cash Book Management

Avoid errors like missing entries, incorrect calculations, and poor record organization. Regular reconciliation and timely updates are essential to prevent discrepancies. Staying vigilant helps maintain a reliable cash book.

Downloadable Excel Cash Book Templates

Many websites offer free downloadable Excel cash book templates for various business needs. These templates can be customized to fit specific accounting requirements. Using ready-made templates accelerates the setup process.