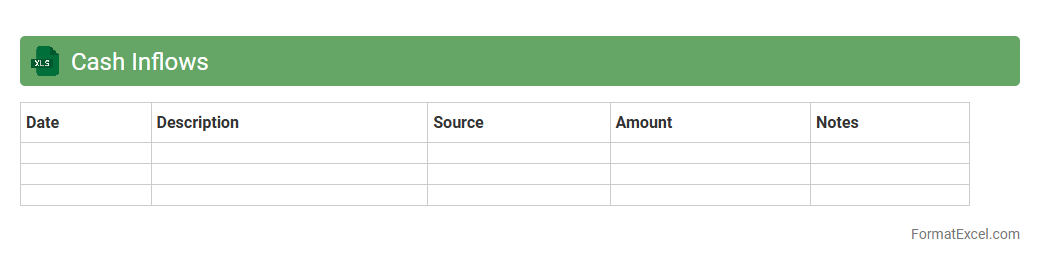

Cash Inflows

The

Cash Inflows Excel document is a structured spreadsheet designed to track and analyze incoming cash transactions from various sources such as sales, loans, or investments. It enables businesses and individuals to monitor liquidity, forecast financial positions, and make informed decisions based on precise cash flow data. This tool supports budgeting and ensures efficient management of funds by providing clear visibility into all cash receipts over time.

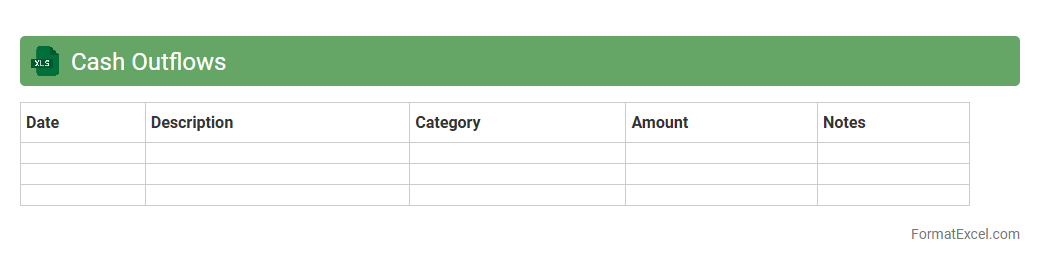

Cash Outflows

A

Cash Outflows Excel document is a financial tool used to track and manage all expenses and payments from a business or individual's accounts over a specific period. It helps users monitor spending patterns, forecast future cash requirements, and maintain budget control by organizing data into clear categories such as operational costs, salaries, and loan repayments. Using this document enhances financial planning and decision-making by providing real-time visibility into where money is going, ensuring better liquidity management.

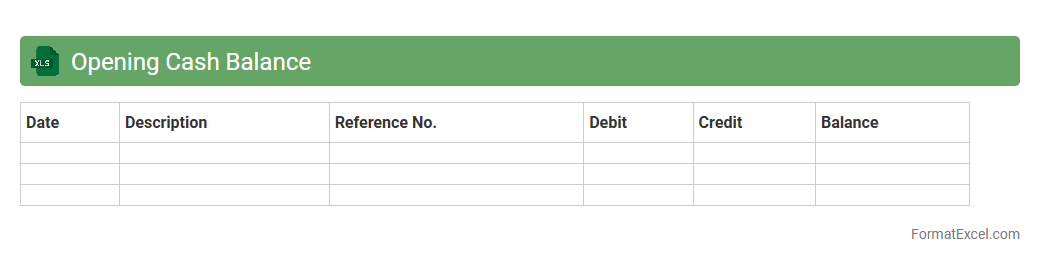

Opening Cash Balance

The

Opening Cash Balance Excel document records the initial amount of cash available at the beginning of a financial period, serving as a crucial input for accurate cash flow management and budgeting. It helps businesses monitor liquidity by comparing the opening balance with cash inflows and outflows throughout the period. This document ensures precise financial forecasting and supports informed decision-making regarding expenditures and investments.

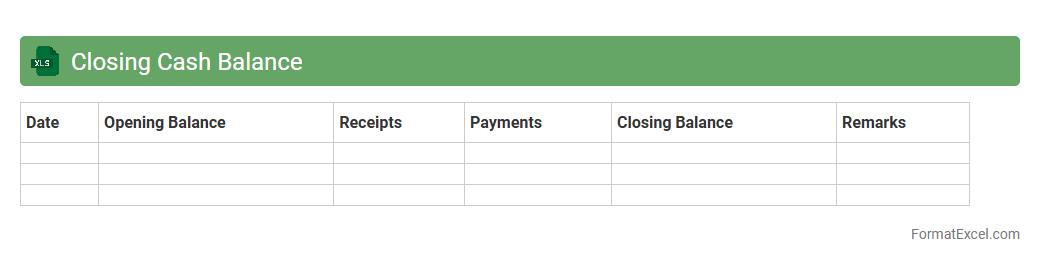

Closing Cash Balance

The

Closing Cash Balance Excel document is a financial tool used to track the ending cash position of a business over a specific period. It consolidates cash inflows and outflows, providing a clear snapshot of available liquidity at the close of accounting cycles. This document aids in effective cash management, ensuring businesses maintain sufficient funds for operations and strategic investments.

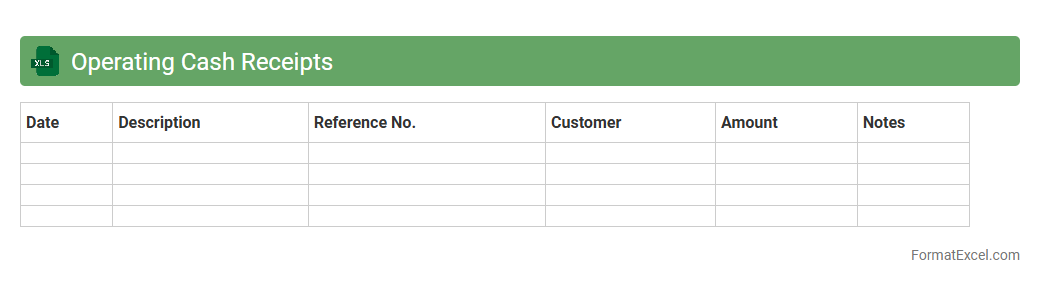

Operating Cash Receipts

An

Operating Cash Receipts Excel document is a financial tool used to record and track all cash inflows from the core business operations, such as sales revenue and customer payments. This document helps businesses monitor liquidity, forecast cash flow, and manage working capital efficiently by providing clear visibility into daily cash receipts. Utilizing this Excel sheet ensures accurate financial reporting and facilitates informed decision-making for maintaining stable operational funding.

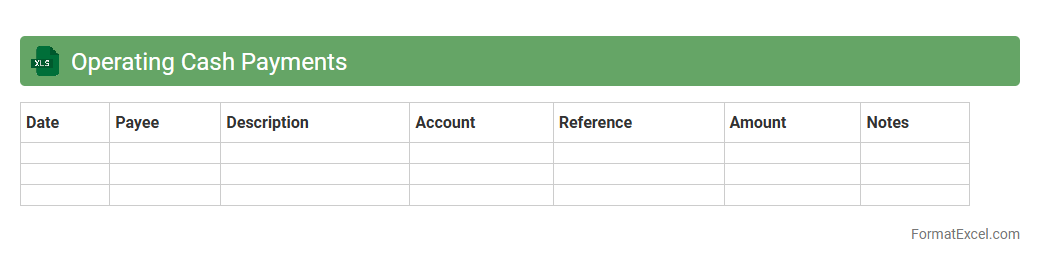

Operating Cash Payments

The

Operating Cash Payments Excel document tracks all cash outflows related to daily business operations, including payments to suppliers, employee salaries, and other operational expenses. This detailed record helps monitor liquidity, control spending, and ensure timely payment processing, facilitating accurate financial planning and cash flow management. Businesses rely on this document to optimize working capital and maintain a healthy cash position essential for operational continuity.

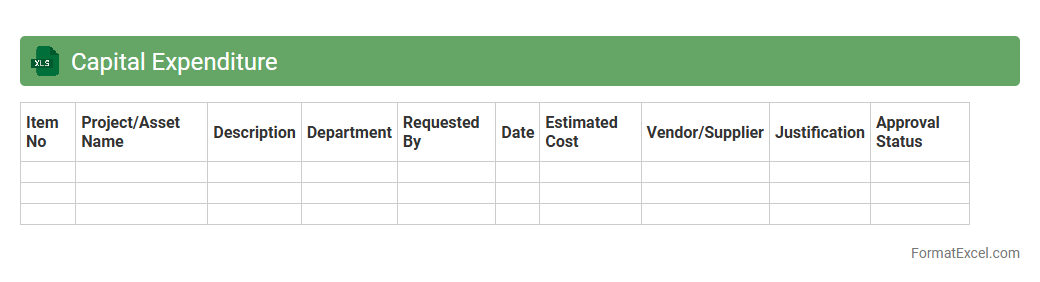

Capital Expenditure

A

Capital Expenditure Excel document is a financial tool used to plan, track, and analyze investments in long-term assets such as equipment, property, or infrastructure. It helps organizations forecast cash flows, budget for large purchases, and evaluate the financial impact of capital projects over time. This document enhances decision-making by providing clear visibility into expenditure patterns and ensuring alignment with strategic financial goals.

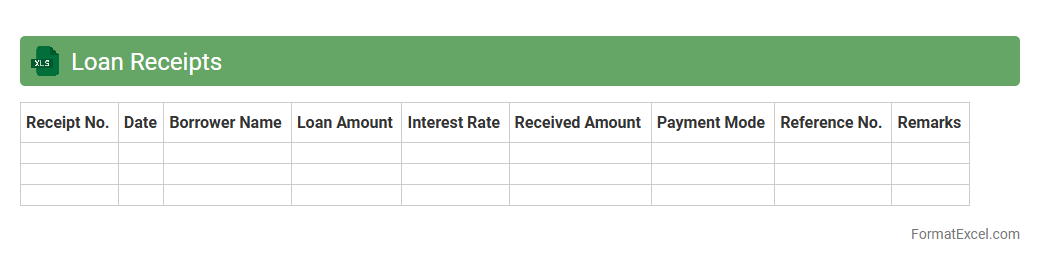

Loan Receipts

A

Loan Receipts Excel document is a structured spreadsheet designed to record and track all loan payments received, including dates, amounts, and payer details. It provides a clear and organized overview of repayment history, simplifying financial management and audit processes for businesses or individuals. Using this document enhances accuracy in tracking outstanding balances, ensuring timely follow-ups and effective cash flow monitoring.

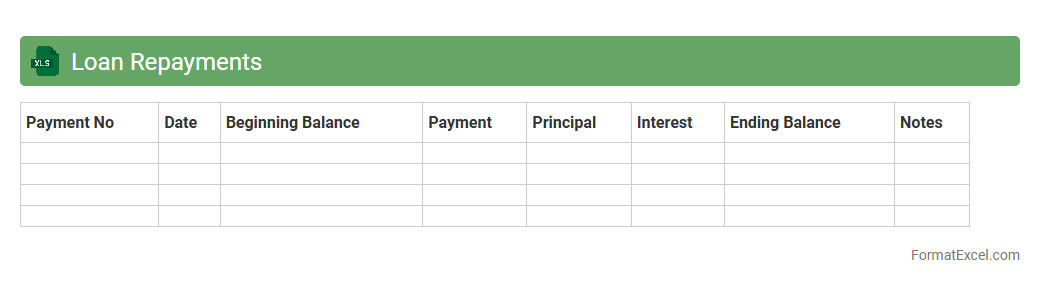

Loan Repayments

A

Loan Repayments Excel document is a spreadsheet tool designed to track and calculate monthly loan payments, interest rates, and outstanding balances. It helps users manage their debt by providing a clear schedule of payment amounts and due dates, enabling better financial planning and budgeting. This document also allows for scenario analysis, showing the impact of different repayment terms or additional payments on the total loan cost.

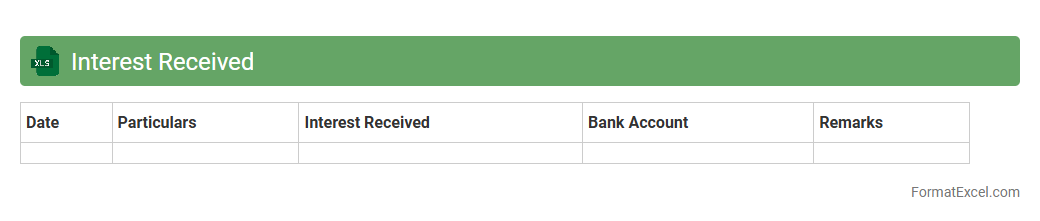

Interest Received

The

Interest Received Excel document systematically records all interest payments earned from investments, savings accounts, or loans. It helps users track income streams, forecast cash flow, and analyze interest-related financial performance over time. This tool is essential for accurate financial planning and ensuring compliance with tax reporting requirements.

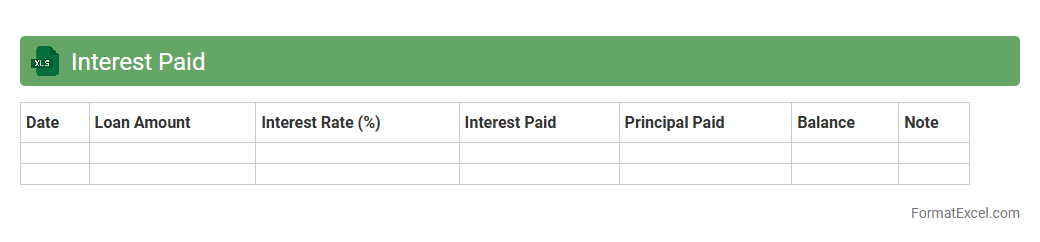

Interest Paid

The

Interest Paid Excel document is a financial tool designed to track and analyze the interest payments made on loans or mortgages over time. It helps users calculate total interest paid, remaining loan balance, and payment schedules, providing clear visibility into loan amortization. This document is useful for budgeting, financial planning, and making informed decisions about refinancing or paying off debt early.

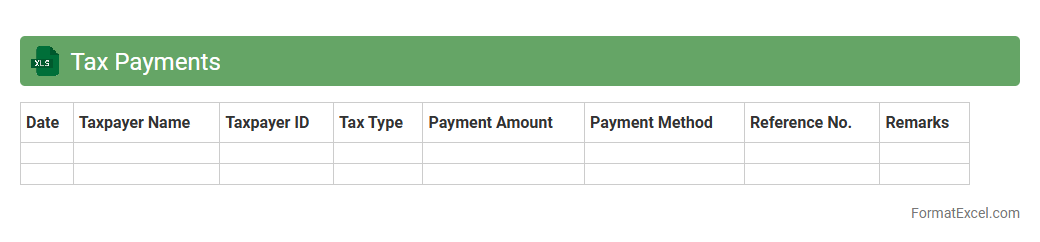

Tax Payments

A

Tax Payments Excel document is a digital spreadsheet designed to track, organize, and calculate various tax-related payments and obligations. It helps individuals and businesses maintain accurate records of taxes paid, deadlines, amounts owed, and payment methods, streamlining financial management. By using this tool, users can ensure timely compliance with tax regulations, avoid penalties, and simplify the preparation of tax returns.

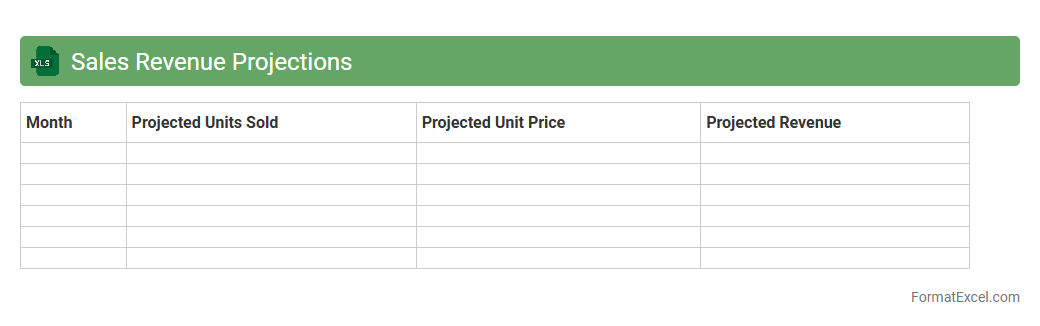

Sales Revenue Projections

The

Sales Revenue Projections Excel document is a financial tool designed to estimate future sales income based on historical data, market trends, and business goals. It helps businesses plan budgets, allocate resources, and set realistic targets by providing a clear forecast of expected revenue over specific periods. Utilizing this document enables better decision-making, efficient cash flow management, and strategic growth planning.

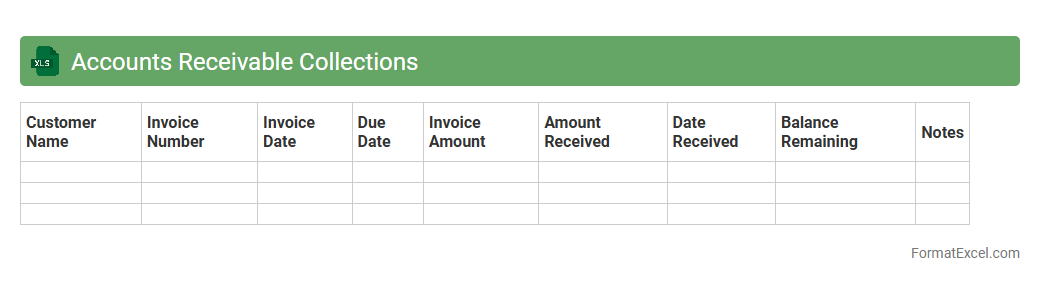

Accounts Receivable Collections

An

Accounts Receivable Collections Excel document is a spreadsheet tool designed to track, manage, and analyze outstanding invoices and customer payments. It helps businesses monitor payment statuses, identify overdue accounts, and streamline collection efforts to improve cash flow. This document enhances financial control by providing clear visibility into receivables and supporting timely follow-ups on unpaid balances.

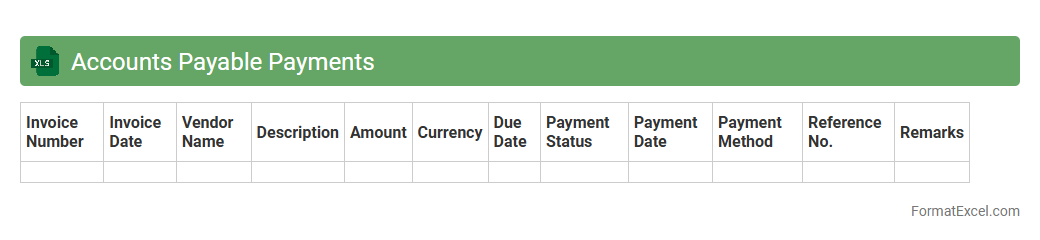

Accounts Payable Payments

The

Accounts Payable Payments Excel document is a structured spreadsheet used to track, manage, and schedule outgoing payments to vendors or suppliers. It helps organizations maintain accurate records of due invoices, payment dates, and amounts, reducing errors and ensuring timely settlements. This tool improves cash flow management and supports financial reporting by consolidating critical payment data in a clear, accessible format.

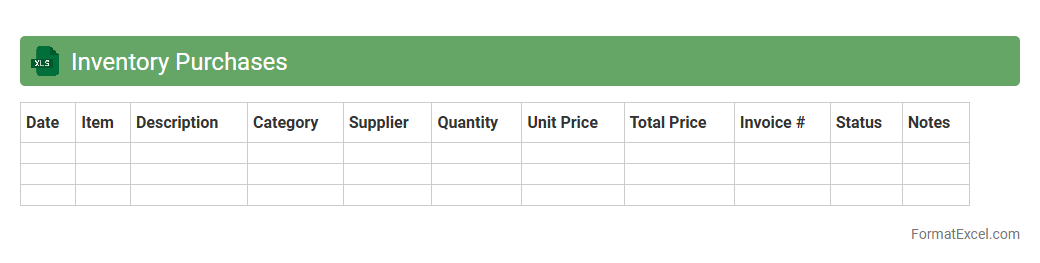

Inventory Purchases

An

Inventory Purchases Excel document is a spreadsheet designed to track and manage the acquisition of stock items, detailing quantities, purchase costs, dates, and suppliers. It helps businesses maintain accurate records, optimize inventory levels, and control purchasing budgets, ensuring efficient supply chain management. By analyzing this data, companies can make informed decisions to reduce stockouts and excess inventory, improving overall operational efficiency.

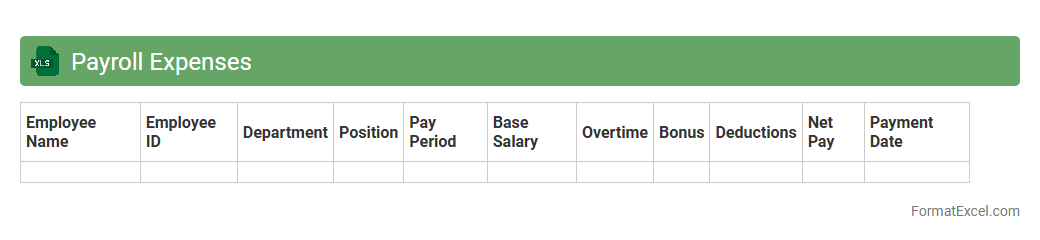

Payroll Expenses

A

Payroll Expenses Excel document is a structured spreadsheet used to track and manage employee compensation, including wages, bonuses, taxes, and deductions. It simplifies the process of calculating total payroll costs, ensuring accuracy in budgeting and financial reporting. This tool enhances payroll management efficiency and aids in compliance with labor laws and tax regulations.

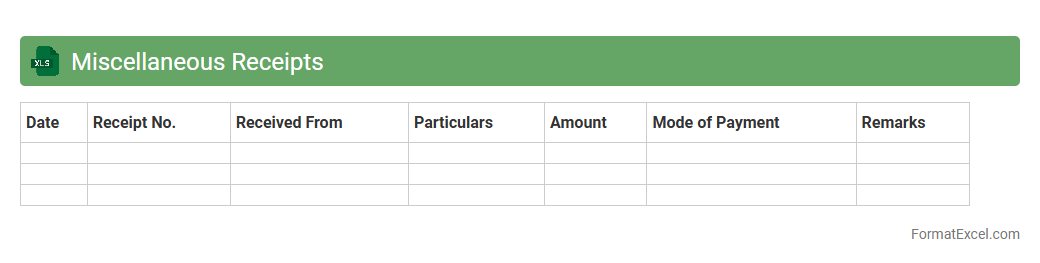

Miscellaneous Receipts

A

Miscellaneous Receipts Excel document is a structured spreadsheet used to record various types of income or payments that do not fit into standard accounting categories. It helps in organizing financial data efficiently by categorizing and tracking diverse receipts, ensuring accurate bookkeeping and easy retrieval during audits. This tool enhances financial management by providing clear visibility into miscellaneous income streams and supporting effective expense reconciliation.

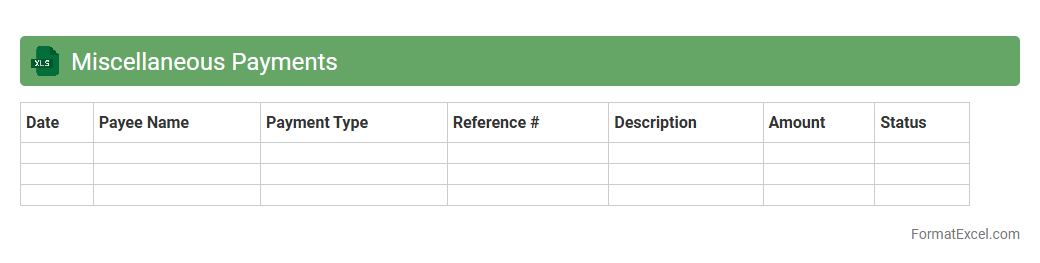

Miscellaneous Payments

The

Miscellaneous Payments Excel document is a comprehensive financial tool designed to track and manage various non-standard payments within an organization. It allows users to record detailed information such as payment dates, amounts, payees, and descriptions, ensuring accurate expense monitoring and budgeting. This document streamlines expense reconciliation, enhances financial transparency, and supports efficient auditing processes.

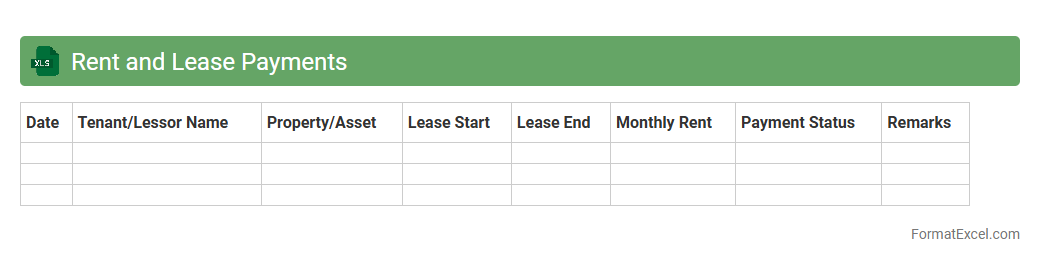

Rent and Lease Payments

The

Rent and Lease Payments Excel document is a structured spreadsheet designed to track, manage, and analyze rental and lease expenses efficiently. It helps users monitor payment schedules, calculate total costs, and maintain records for budgeting and financial reporting purposes. This tool enhances financial organization by providing clear visibility into lease obligations and due dates, reducing the risk of missed payments and optimizing cash flow management.

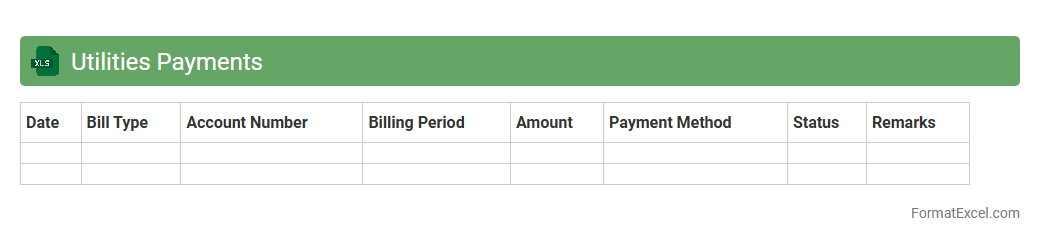

Utilities Payments

A

Utilities Payments Excel document is a spreadsheet used to track and manage monthly expenses related to services like electricity, water, gas, and internet. It helps users organize payment dates, amounts, and service providers, enabling efficient budget management and timely payments. This document minimizes the risk of missed bills and provides a clear overview of utility costs over time.

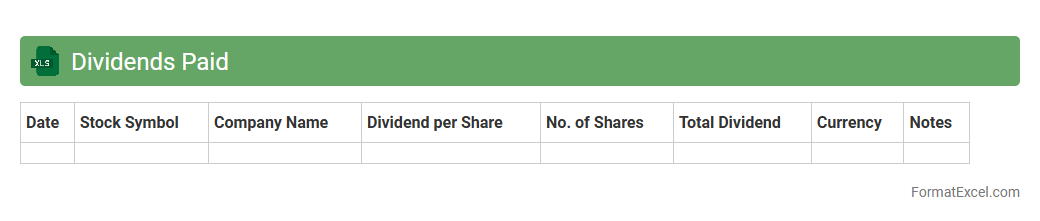

Dividends Paid

The

Dividends Paid Excel document is a structured spreadsheet that tracks dividend payments made by a company to its shareholders over a specific period. It allows investors and financial analysts to monitor cash flows, assess the reliability of dividend distributions, and evaluate the company's financial health. By organizing dividend data effectively, this document supports informed investment decisions and simplifies financial reporting.

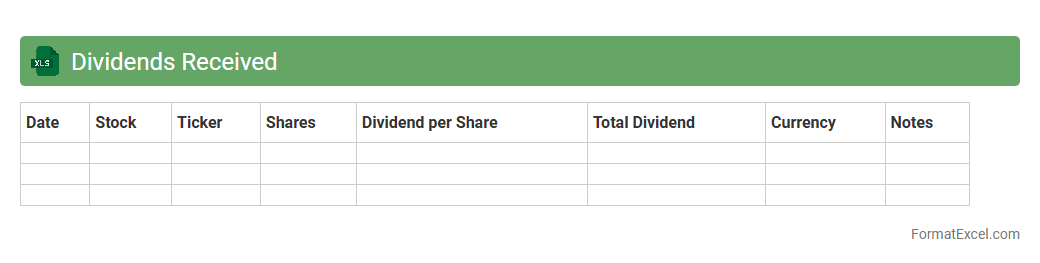

Dividends Received

A

Dividends Received Excel document tracks dividend payments from various investments, detailing the amounts, payment dates, and issuing companies. It helps investors monitor income streams, manage tax reporting, and analyze dividend trends to make informed financial decisions. This organized record supports accurate portfolio management and enhances investment planning efficiency.

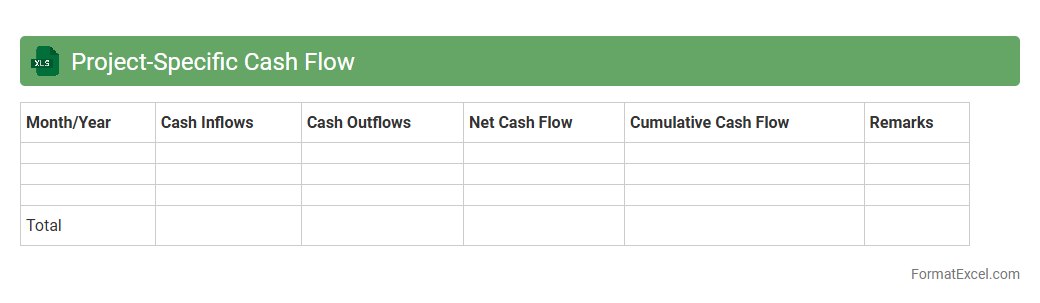

Project-Specific Cash Flow

The

Project-Specific Cash Flow Excel document is a financial tool designed to track and analyze inflows and outflows of cash related to a particular project. It provides a detailed overview of project revenues, expenses, and net cash position over time, enabling effective budgeting and financial planning. This document is useful for ensuring liquidity, forecasting project viability, and supporting informed decision-making throughout the project lifecycle.

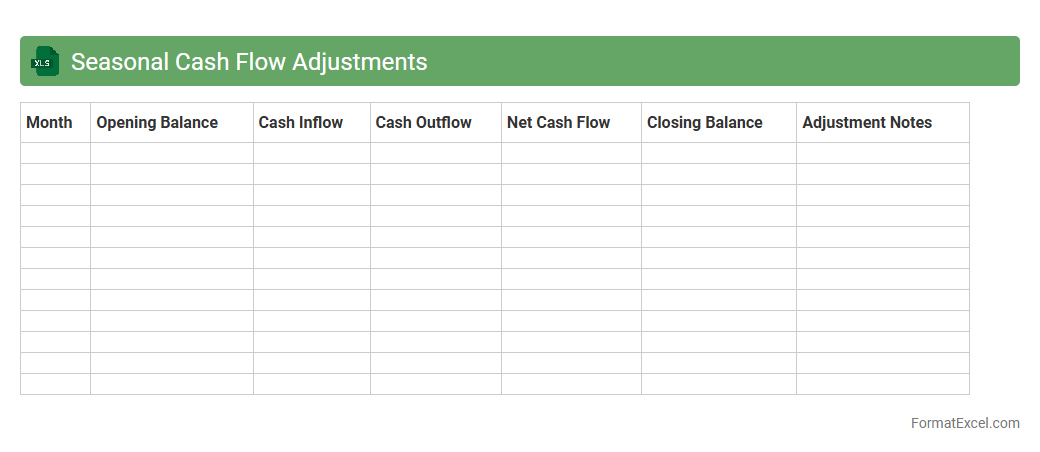

Seasonal Cash Flow Adjustments

Seasonal Cash Flow Adjustments Excel document is a powerful financial tool designed to analyze and manage cash flow variations caused by seasonal business cycles. It allows businesses to forecast and adjust their cash inflows and outflows based on historical seasonal data, ensuring accurate budgeting and improved liquidity management. Using this

seasonal cash flow adjustment model helps organizations optimize working capital and prepare for periods of low or high cash availability effectively.

Introduction to Cash Flow Forecasting

Cash flow forecasting is the process of estimating the inflows and outflows of cash over a specific period. It helps businesses anticipate liquidity needs and plan accordingly. Understanding cash flow is essential for maintaining financial stability.

Importance of Cash Flow Forecasts for Businesses

Cash flow forecasts enable businesses to predict cash shortages or surpluses, ensuring timely payments and investments. They are vital for making informed financial decisions and avoiding insolvency risks. Accurate forecasts provide a clear financial outlook for business growth.

Key Components of a Cash Flow Forecast

A cash flow forecast typically includes cash inflows, outflows, opening balance, and closing balance for each period. It captures sales revenue, expenses, loans, and other financial activities. These components provide a comprehensive view of expected cash movements.

Choosing the Right Excel Template

Select an Excel template that suits your business size and complexity to save time and improve accuracy. Look for templates with user-friendly layouts and built-in formulas. The right template enhances forecasting efficiency and reliability.

Step-by-Step Guide to Setting Up a Cash Flow Forecast in Excel

Start by listing all expected cash inflows and outflows chronologically. Input your opening balance and use formulas to calculate closing balances for each period. Following a structured approach ensures a clear and functional forecast.

Essential Formulas for Accurate Cash Flow Analysis

Key formulas include SUM for totaling cash flows and simple addition or subtraction to update balances. Use IF functions for conditional scenarios like delays or unexpected expenses. Mastering these formulas improves forecast precision and usability.

Customizing Your Cash Flow Forecast Format

Adjust columns, rows, and categories to reflect your business's unique cash flow patterns. Incorporate color coding and conditional formatting to highlight critical data points. Customization makes the forecast more intuitive and actionable.

Common Mistakes to Avoid in Excel Cash Flow Forecasts

Avoid neglecting to update forecasts regularly and overlooking irregular cash flows or seasonal variations. Mistakes like incorrect formula references can distort results. Prevent errors by double-checking inputs and maintaining consistent data updates.

Tips for Maintaining and Updating Your Forecast

Review and revise your cash flow forecast weekly or monthly based on actual performance. Keep track of changes in business conditions to adjust projections promptly. Regular maintenance ensures your forecast remains relevant and accurate.

Free and Paid Excel Cash Flow Forecast Template Resources

Numerous free and premium Excel templates are available online, catering to different industries and needs. Paid templates often provide advanced features and customer support. Accessing the right resources can simplify your forecasting process significantly.