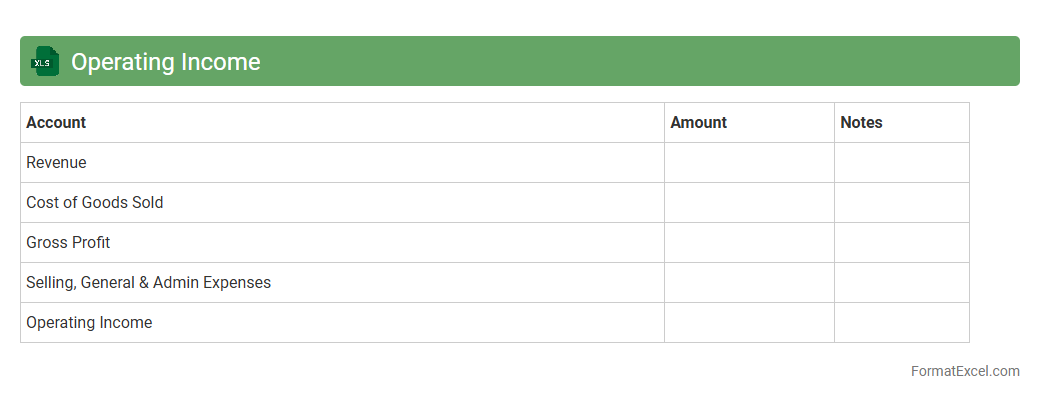

Operating Income

An

Operating Income Excel document calculates a company's profit from core business operations by subtracting operating expenses from gross profit, excluding non-operating income and expenses. It is useful for financial analysts and business managers to evaluate operational efficiency, compare profitability across periods, and make informed decisions about budgeting and cost control. This document helps identify trends in operating performance, enabling targeted strategies to improve earnings before interest and taxes.

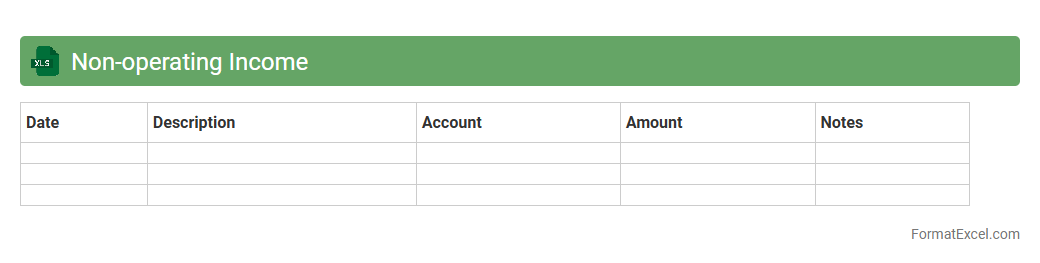

Non-operating Income

A

Non-operating Income Excel document is a spreadsheet designed to track and analyze income generated from activities not related to the core operations of a business, such as interest, dividends, or asset sales. This document helps in accurately distinguishing operating performance from other revenue streams, providing clearer financial insights for decision-making and reporting. Businesses use it to monitor non-operating income trends, enhance budgeting accuracy, and improve overall financial management.

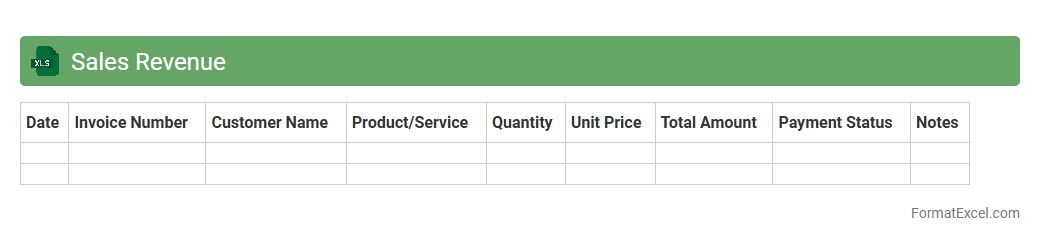

Sales Revenue

A

Sales Revenue Excel document is a structured spreadsheet used to track, analyze, and manage income generated from sales activities. It allows businesses to organize sales data, calculate total revenue, and monitor performance trends over specific time periods. By providing clear insights into sales metrics, this tool supports informed decision-making and helps optimize revenue strategies.

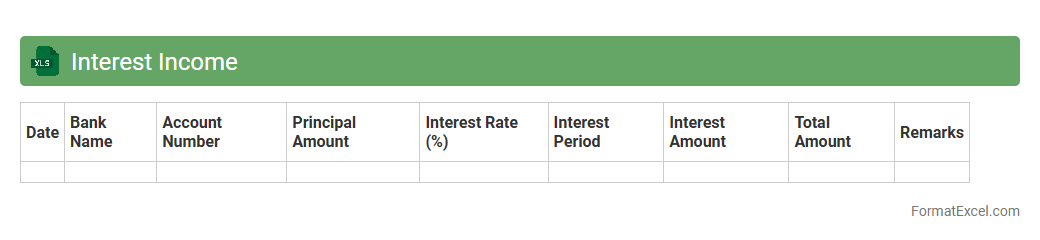

Interest Income

An

Interest Income Excel document is a spreadsheet designed to track and calculate earnings generated from interest-bearing accounts or investments. It helps users monitor different interest sources, organize data systematically, and perform accurate financial analysis for better decision-making. This tool is especially useful for budgeting, tax reporting, and assessing overall investment performance.

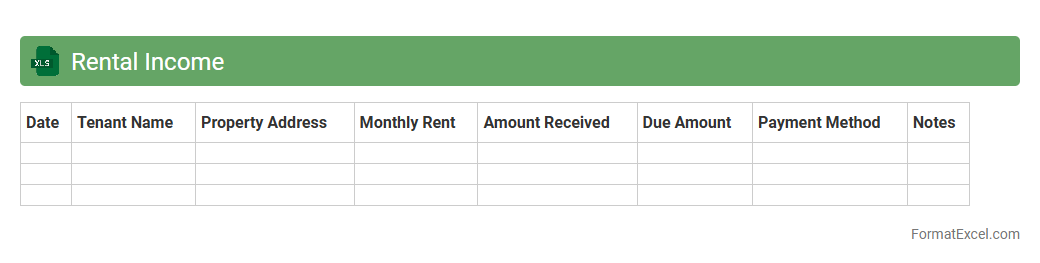

Rental Income

A

Rental Income Excel document is a spreadsheet designed to track and manage rental payments, expenses, and profitability for rental properties. It helps landlords and property managers organize financial data, calculate net income, and forecast cash flow efficiently. Using this tool enhances accuracy in financial reporting and supports better decision-making for property investment.

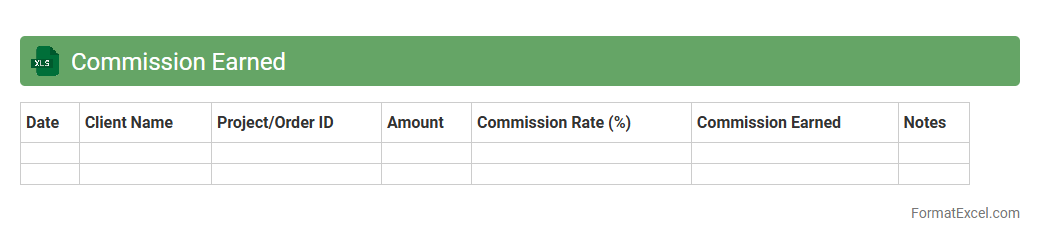

Commission Earned

The

Commission Earned Excel document is a tool designed to track and calculate sales commissions accurately by consolidating sales data, commission rates, and payment schedules. It enables businesses to monitor earnings in real-time, ensuring transparency and reducing errors in financial reporting. This document streamlines payroll processing and motivates sales teams by providing clear insights into individual performance-based compensation.

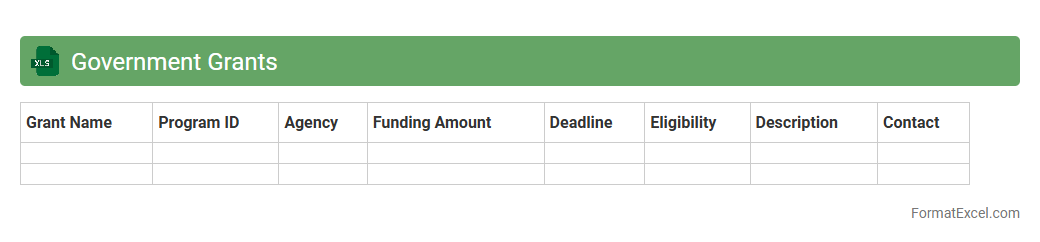

Government Grants

A

Government Grants Excel document is a structured spreadsheet that organizes information on various government funding opportunities, eligibility criteria, application deadlines, and award amounts. It streamlines the grant application process by allowing users to track and manage multiple grants efficiently in one place. This tool is highly useful for individuals, businesses, and organizations seeking financial support for projects, research, or development initiatives.

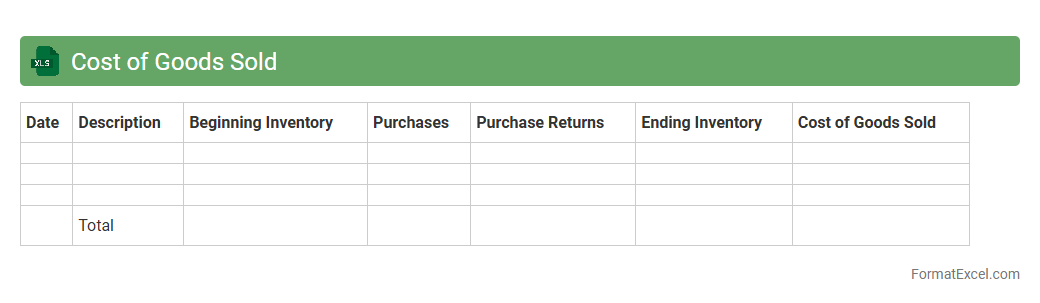

Cost of Goods Sold

A

Cost of Goods Sold (COGS) Excel document is a financial tool used to track and calculate the direct costs associated with producing goods sold by a business. It helps users organize expenses such as raw materials, labor, and manufacturing overhead, providing accurate insights into production costs. This document is essential for budgeting, pricing strategies, and improving profitability by offering clear visibility into cost structures.

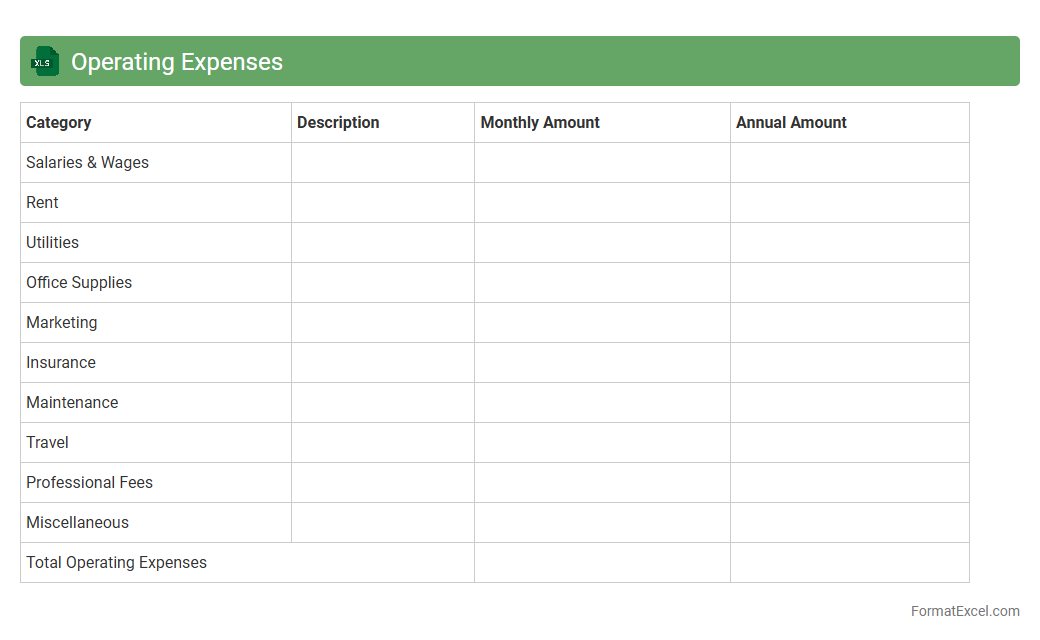

Operating Expenses

An

Operating Expenses Excel document is a structured spreadsheet designed to track and manage a company's day-to-day business costs such as rent, utilities, salaries, and supplies. It enables detailed analysis and categorization of expenses, helping businesses maintain budget control and improve financial forecasting. Utilizing this document enhances decision-making by providing clear insights into where resources are spent and identifying opportunities for cost reduction.

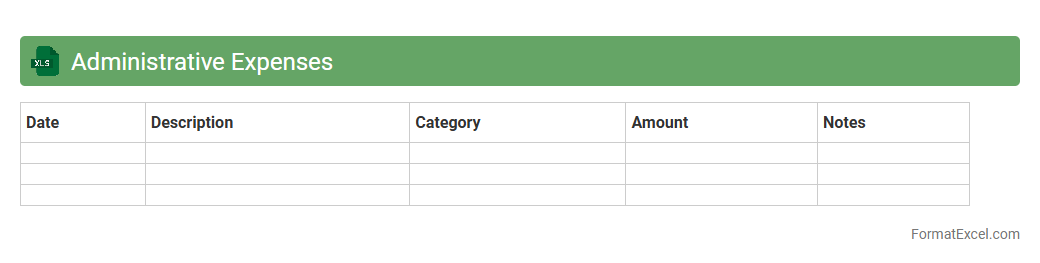

Administrative Expenses

An

Administrative Expenses Excel document is a detailed spreadsheet designed to track and manage the costs related to the general operations of a business, such as salaries, office supplies, and utilities. It helps organizations maintain accurate financial records, monitor budget adherence, and identify opportunities for cost reduction. This tool is essential for improving financial transparency and supporting informed decision-making in administrative management.

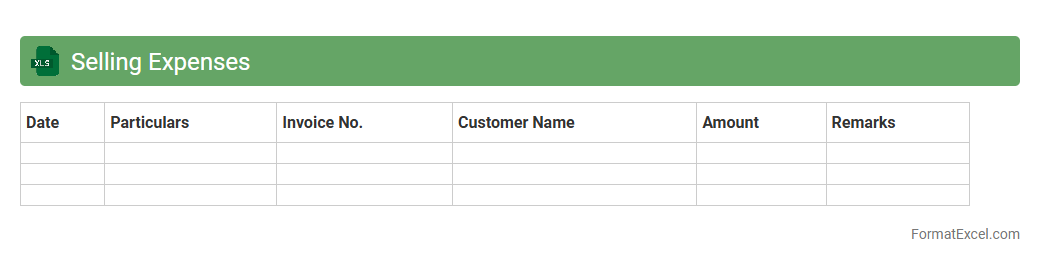

Selling Expenses

A

Selling Expenses Excel document is a spreadsheet used to track and analyze costs related to selling products or services, including advertising, sales commissions, and distribution expenses. It helps businesses monitor spending patterns, control budgets, and identify areas for cost reduction. Utilizing this document improves financial planning and enhances decision-making for sales strategies.

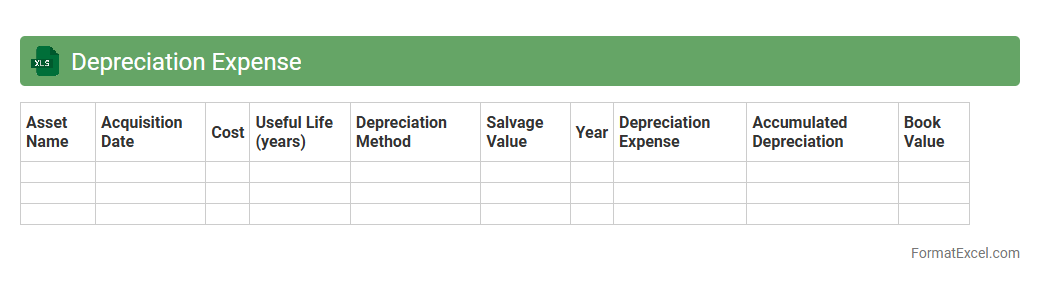

Depreciation Expense

The

Depreciation Expense Excel document is a tool designed to calculate and track the reduction in value of tangible assets over time, utilizing methods such as straight-line, declining balance, or units of production. This document streamlines financial reporting by automating depreciation schedules and ensuring compliance with accounting standards like GAAP or IFRS. It is useful for businesses to manage asset costs accurately, improve budgeting decisions, and optimize tax deductions related to asset depreciation.

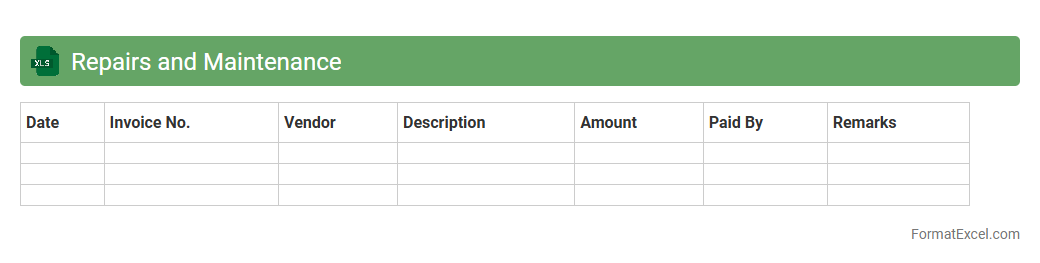

Repairs and Maintenance

A

Repairs and Maintenance Excel document is a structured spreadsheet designed to track, manage, and analyze expenses related to the upkeep of equipment, vehicles, buildings, or machinery. It helps organizations monitor repair schedules, budget effectively, and identify recurring issues to optimize maintenance operations. Using this tool improves cost control, enhances asset lifespan, and supports informed decision-making through detailed record-keeping and data analysis.

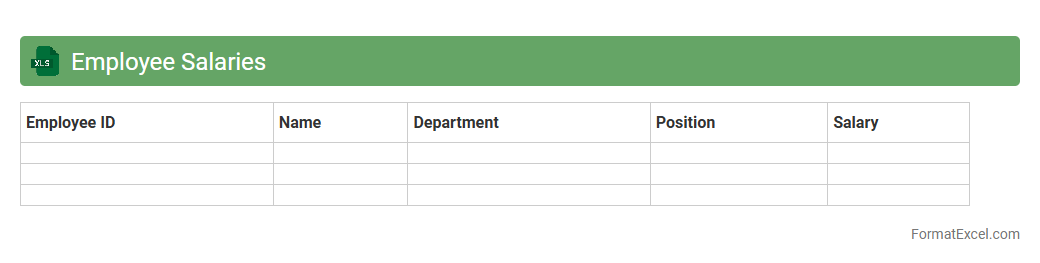

Employee Salaries

An

Employee Salaries Excel document is a spreadsheet that systematically records and organizes employee compensation details such as base pay, bonuses, deductions, and benefits. It helps businesses maintain accurate payroll data, streamline salary calculations, and ensures compliance with tax regulations. This document supports efficient financial planning and reporting by providing a clear overview of salary expenses and trends.

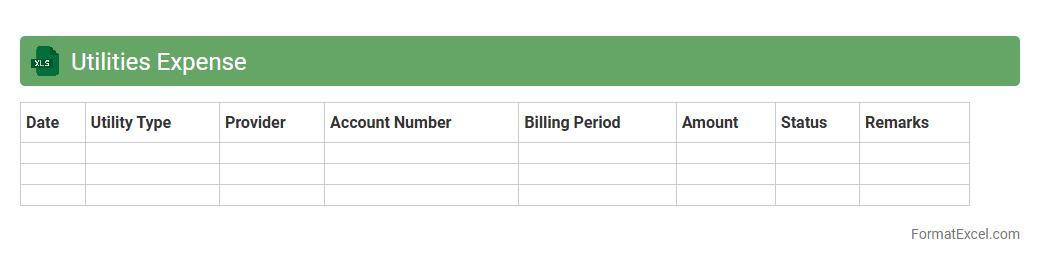

Utilities Expense

A

Utilities Expense Excel document is a spreadsheet designed to track and manage costs related to utilities such as electricity, water, gas, and internet. This tool helps businesses and households monitor monthly utility expenses, identify usage patterns, and create budgets to control spending. Using this document improves financial planning and enhances the ability to make informed decisions on resource consumption.

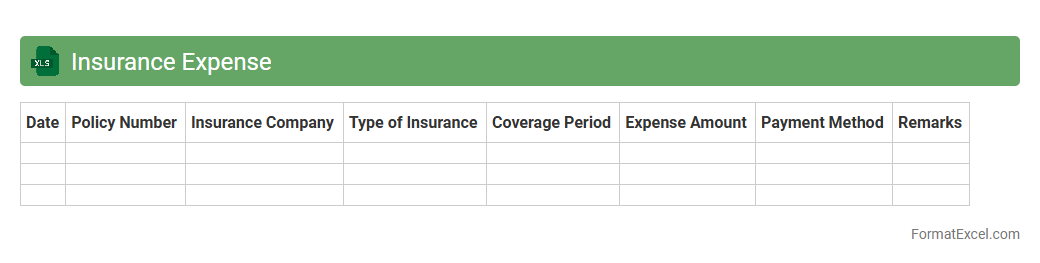

Insurance Expense

An

Insurance Expense Excel document is a financial tool used to track and organize insurance-related costs over a specific period. It helps businesses and individuals monitor premium payments, due dates, and coverage details efficiently, enabling better budgeting and expense management. Accurate recording of insurance expenses facilitates tax reporting and financial analysis, improving overall financial planning.

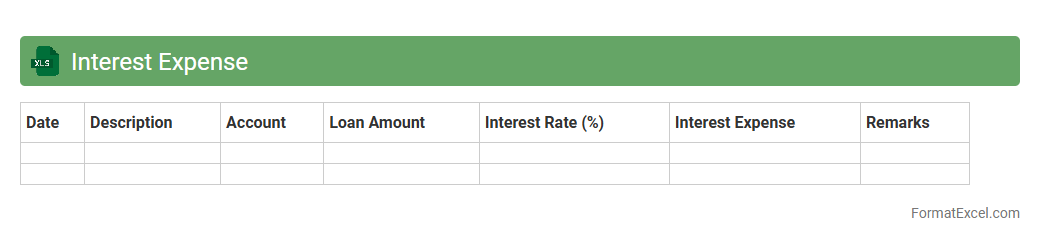

Interest Expense

An

Interest Expense Excel document is a financial spreadsheet designed to track and calculate the cost incurred by an entity for borrowed funds over a specific period. It helps businesses and individuals monitor loan interest payments, manage budgets, and forecast future expenses accurately. Using this document enhances financial planning, ensuring better cash flow management and informed decision-making related to debt obligations.

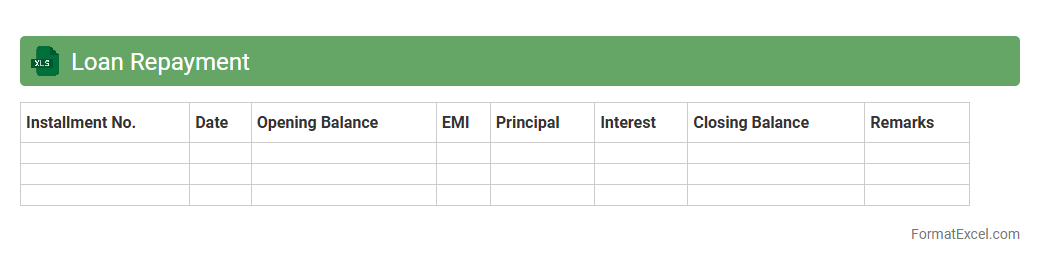

Loan Repayment

A

Loan Repayment Excel document is a spreadsheet tool designed to track and calculate loan payments over time, including principal, interest, and remaining balance. It helps users create detailed amortization schedules, monitor payment due dates, and assess how different payment strategies impact the total cost of a loan. This document is valuable for managing personal or business debt efficiently and planning financial commitments with accuracy.

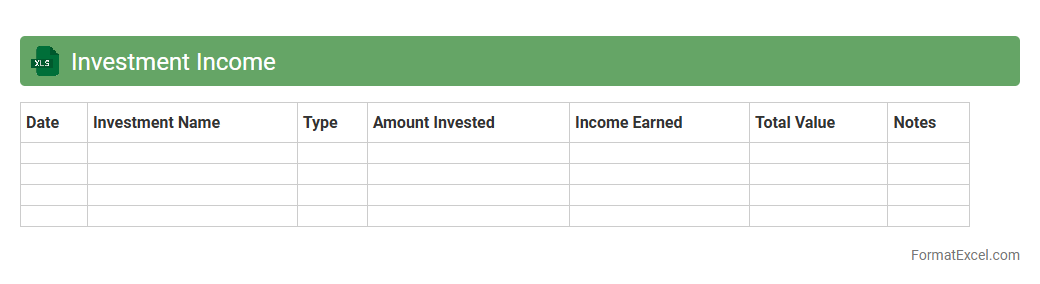

Investment Income

An

Investment Income Excel document is a spreadsheet designed to track and analyze earnings from various investments such as stocks, bonds, mutual funds, and real estate. It helps investors monitor dividend payouts, interest earned, capital gains, and overall portfolio performance with organized data and automated calculations. This tool enhances financial decision-making by providing clear insights into income streams and facilitating tax reporting and future investment planning.

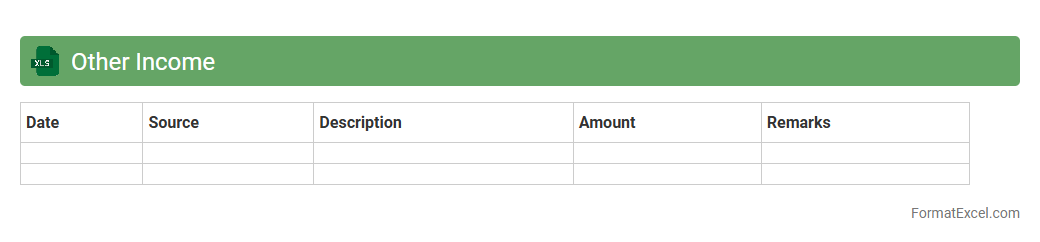

Other Income

The

Other Income Excel document is a financial tool designed to track and categorize miscellaneous income sources outside of primary revenue streams. It allows businesses and individuals to maintain accurate records of supplemental earnings, enhancing financial reporting and analysis. This document supports better budgeting, tax preparation, and overall financial planning by providing a clear overview of all additional income.

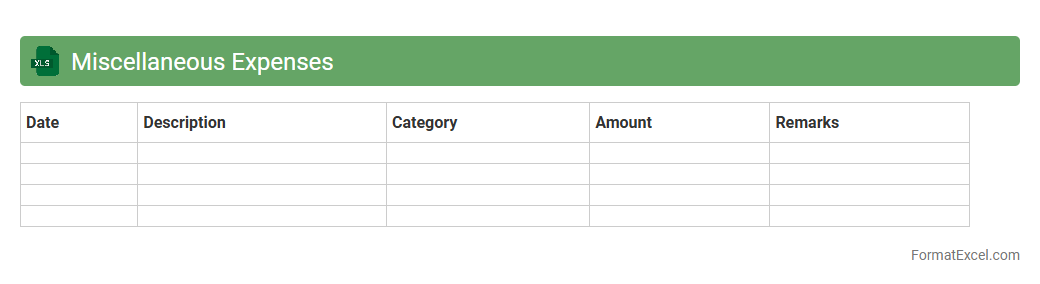

Miscellaneous Expenses

A

Miscellaneous Expenses Excel document is a spreadsheet designed to track and manage various small or irregular costs that do not fit into standard expense categories. It helps businesses and individuals maintain accurate financial records by consolidating diverse expenses, facilitating budgeting, and simplifying accounting processes. This document enhances financial oversight, making it easier to identify spending patterns and optimize resource allocation.

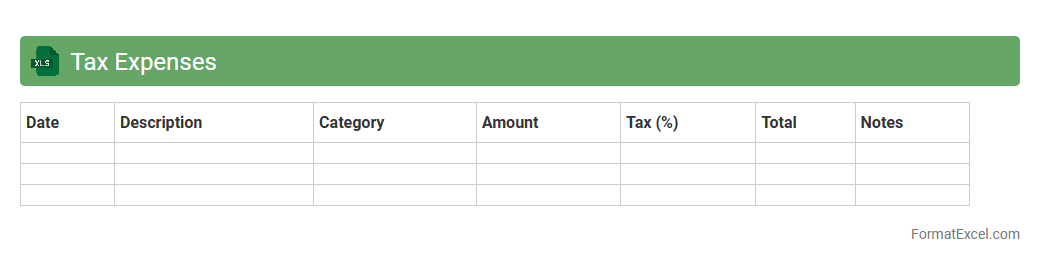

Tax Expenses

A

Tax Expenses Excel document is a spreadsheet designed to systematically record, calculate, and analyze all tax-related payments and liabilities for individuals or businesses. It helps in tracking deductible expenses, estimating tax obligations, and ensuring compliance with tax regulations, thereby reducing errors during tax filing. Using this tool enhances financial planning and provides clear insights into tax performance over different fiscal periods.

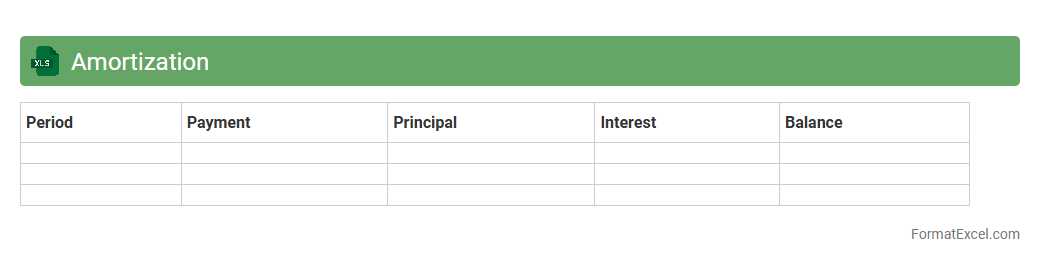

Amortization

An

Amortization Excel document is a spreadsheet tool designed to calculate and display loan repayment schedules, highlighting principal and interest amounts over time. It helps users understand the breakdown of each payment, track remaining loan balances, and plan financial decisions effectively. This document is especially useful for budgeting, forecasting, and managing debt repayment strategies.

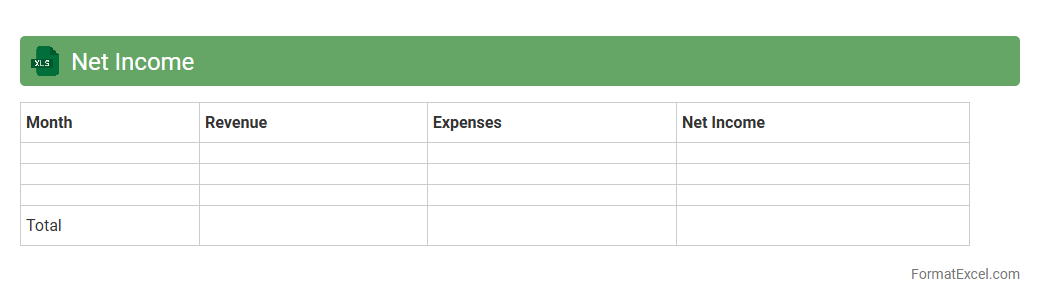

Net Income

A

Net Income Excel document is a financial tool designed to calculate and analyze a company's profitability by subtracting total expenses from total revenues. It helps businesses track earnings over specific periods, enabling informed decisions on budgeting, investment, and growth strategies. This document simplifies complex financial data into clear, actionable insights for enhanced fiscal management.

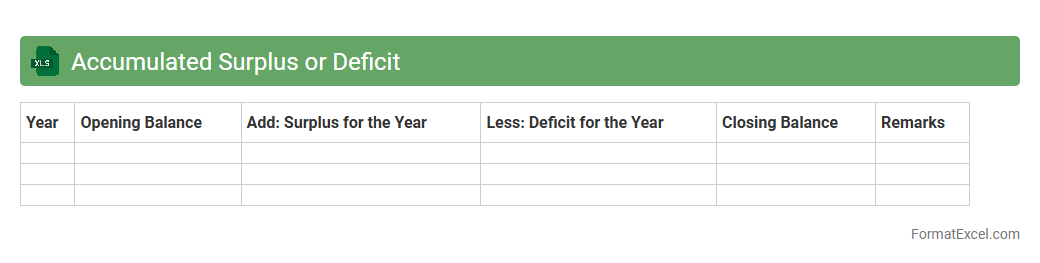

Accumulated Surplus or Deficit

An

Accumulated Surplus or Deficit Excel document is a financial tool that tracks the cumulative net income or loss a company retains over time, beyond dividends and distributions. This spreadsheet helps in analyzing an organization's retained earnings to assess financial health and sustainability. It provides clear insights into past performance and aids in strategic planning and budget allocation.

Introduction to Income and Expenditure Statement

An Income and Expenditure Statement summarizes the financial performance by listing income earned and expenses incurred over a specific period. It helps organizations and individuals track budget adherence and financial health. This statement is vital for making informed financial decisions.

Importance of Using Excel for Financial Statements

Excel provides a flexible and powerful platform for preparing accurate financial statements with automatic calculations and easy data management. Utilizing Excel decreases manual errors and allows for quick updates to financial data. Its features simplify the presentation and analysis of income and expenses.

Key Components of an Income and Expenditure Statement

The main components include revenue sources (income), expense categories, and the net surplus or deficit. Detailed listing of each income and expense helps in precise financial tracking. Proper categorization is essential for clarity and accountability.

Step-by-Step Guide: Creating the Statement in Excel

Start by labeling columns for date, description, income, and expenses. Input your data systematically to ensure clarity and completeness in your statement. Use Excel's sum functions to automatically calculate totals and net results.

Essential Columns to Include in the Format

Include columns for Date, Description, Income, Expenditure, and Balance to track finances comprehensively. A well-structured format enhances readability and accuracy of your financial records. You might also add a Comments column for additional notes.

Sample Income and Expenditure Statement Template

A template typically includes pre-set formulas and headings for quick data entry and total calculations. Utilizing a template saves time and reduces errors in preparing financial reports. Many templates also provide space for customizable categories.

Tips for Customizing Your Excel Statement

Adjust categories to match your specific financial activities and use color codes for better visual organization. Incorporate conditional formatting to highlight important financial trends or anomalies. Customization ensures relevance and usability of your statement.

Common Mistakes to Avoid in Excel Formatting

Avoid omitting dates or mislabeling columns as it reduces clarity and accuracy. Ensure formulas are consistent across rows to prevent calculation errors in your financial statement. Backup your file regularly to safeguard your data.

Automating Calculations with Excel Functions

Functions like SUM, IF, and VLOOKUP help automate totaling income and expenses and analyzing financial data. Setting up these formulas correctly streamlines your reporting process and reduces manual work. Excel's automation enhances accuracy and productivity.

Downloadable Income and Expenditure Statement Excel Templates

Many websites offer free downloadable Excel templates to quickly start your financial tracking process. These templates are preformatted and include essential features for income and expenditure management. Downloading saves time and provides a professional framework.