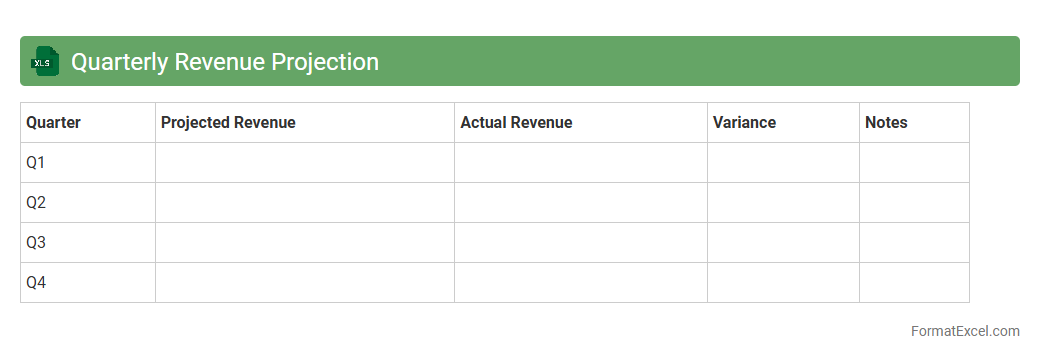

Quarterly Revenue Projection

A

Quarterly Revenue Projection Excel document is a financial tool designed to estimate future income over each quarter by analyzing historical sales data, market trends, and business growth patterns. It helps businesses plan budgets, allocate resources effectively, and set realistic sales targets to optimize profitability. This projection enables decision-makers to identify potential revenue shortfalls early and implement strategies to enhance financial performance.

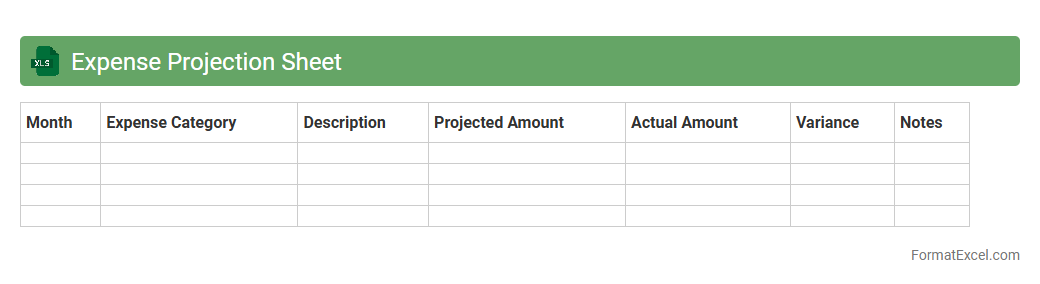

Expense Projection Sheet

An

Expense Projection Sheet Excel document is a financial planning tool designed to estimate future expenses based on various categories such as operational costs, salaries, and utility bills. It helps individuals and businesses forecast cash flow needs, enabling better budget management and financial decision-making. By providing a clear overview of anticipated expenditures, it reduces the risk of overspending and supports strategic resource allocation.

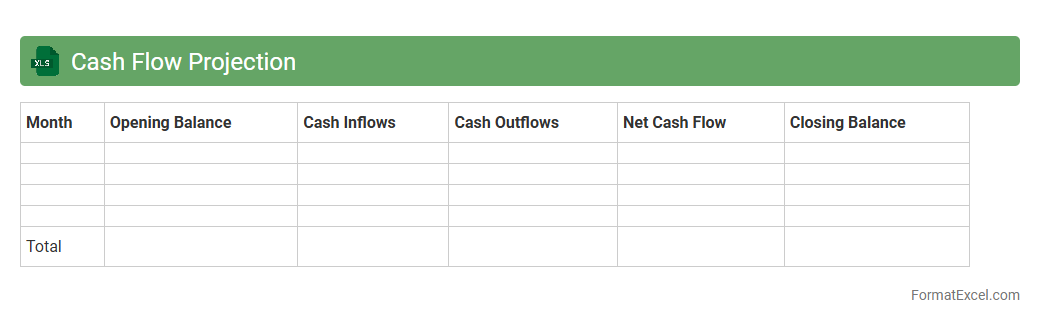

Cash Flow Projection

A

Cash Flow Projection Excel document is a financial tool that forecasts the inflow and outflow of cash over a specific period, helping businesses anticipate their liquidity needs. It enables accurate budgeting, ensuring that funds are available for essential expenses while avoiding cash shortages. Utilizing this projection helps in strategic decision-making by identifying potential financial challenges before they occur.

Sales Forecast Tracker

A

Sales Forecast Tracker Excel document is a tool designed to project future sales based on historical data and market trends, enabling businesses to plan inventory, manage cash flow, and set realistic targets. It allows users to input variables such as sales volume, pricing, and seasonality to generate dynamic forecasts that can be adjusted as new information becomes available. By providing clear insights into expected revenue, this tracker helps improve decision-making and optimize sales strategies.

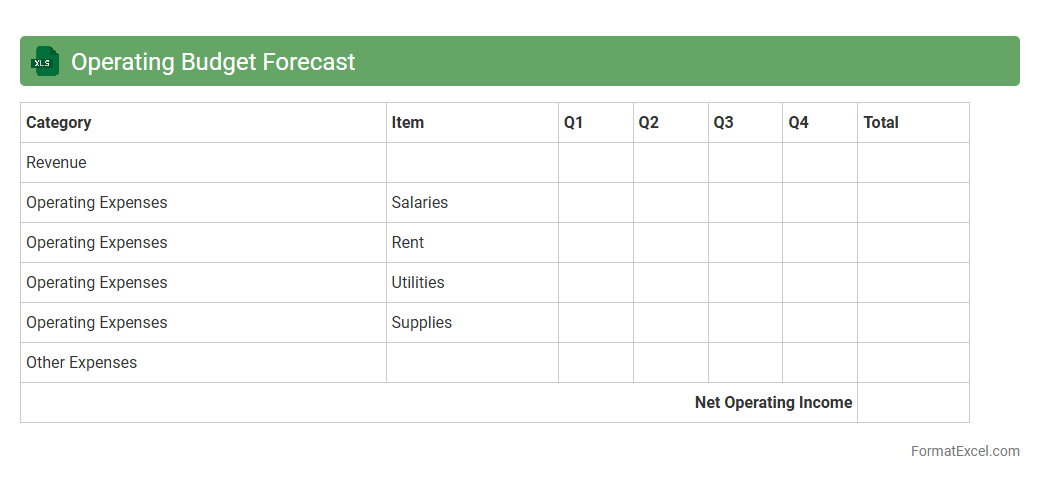

Operating Budget Forecast

An

Operating Budget Forecast Excel document is a financial planning tool that projects an organization's expected income and expenses over a specific period. It helps businesses allocate resources effectively, control costs, and anticipate cash flow needs. Utilizing this forecast enhances strategic decision-making by providing clear visibility into future financial performance.

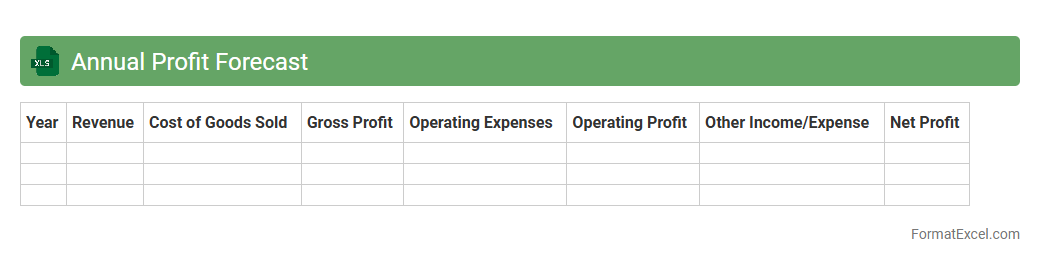

Annual Profit Forecast

An

Annual Profit Forecast Excel document is a financial tool that projects a company's expected revenues, expenses, and net profit over a 12-month period. This forecast helps businesses anticipate cash flow, allocate resources efficiently, and make informed strategic decisions based on anticipated financial performance. Utilizing such a document improves budgeting accuracy and supports goal setting by highlighting potential profit margins and risk factors.

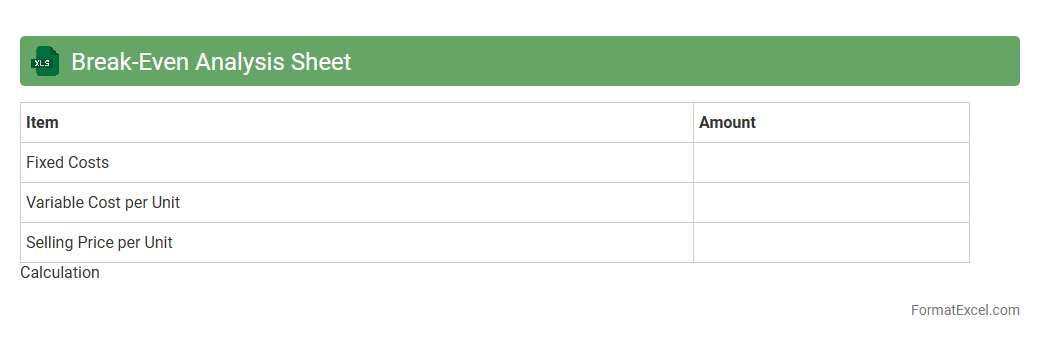

Break-Even Analysis Sheet

A

Break-Even Analysis Sheet in Excel is a financial tool that helps businesses determine the sales volume at which total revenues equal total costs, resulting in neither profit nor loss. This sheet calculates fixed costs, variable costs, and sales price per unit to find the break-even point, providing critical insights for pricing strategies, cost control, and profitability planning. By visualizing data with charts and formulas, it enables decision-makers to assess financial risks and set realistic sales targets.

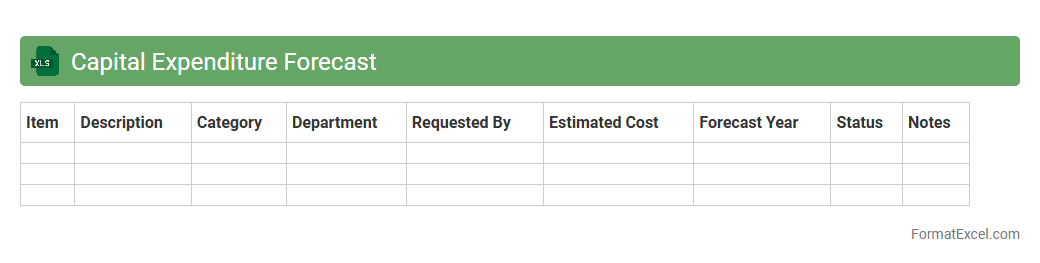

Capital Expenditure Forecast

A

Capital Expenditure Forecast Excel document is a financial planning tool that estimates future spending on long-term assets such as equipment, infrastructure, and property. It helps businesses allocate budgets effectively, track projected investments, and anticipate cash flow needs over specific periods. Using this forecast enables informed decision-making, ensuring resources are optimized for growth and operational efficiency.

Cost of Goods Sold Forecast

The

Cost of Goods Sold (COGS) Forecast Excel document is a financial tool designed to estimate the direct costs associated with producing goods over a specific period. It helps businesses project expenses related to materials, labor, and manufacturing overhead, enabling accurate budgeting and cash flow management. Utilizing this forecast enhances decision-making by providing insight into profitability trends and supporting efficient inventory planning.

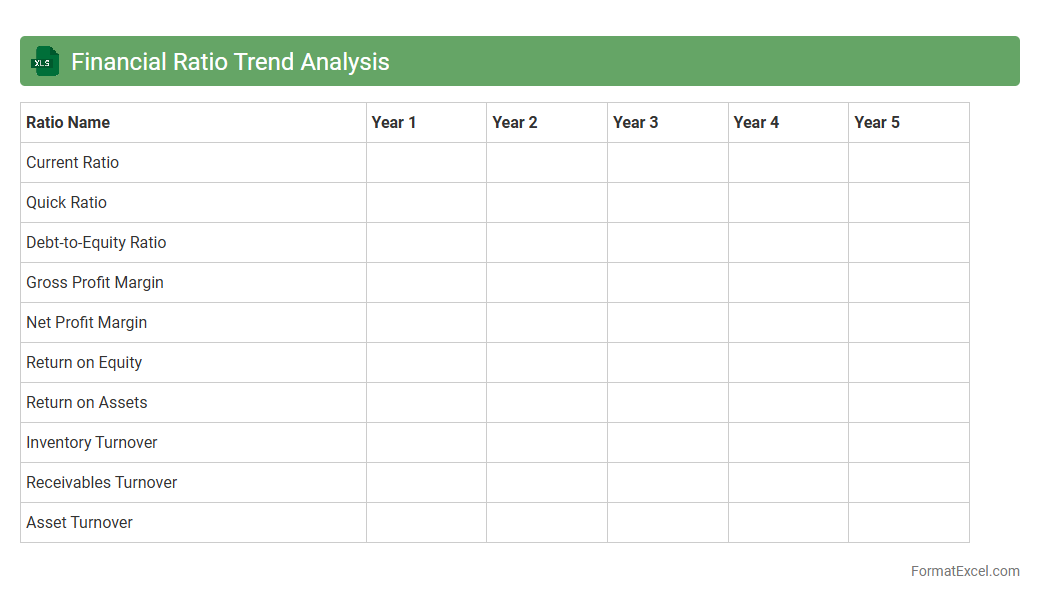

Financial Ratio Trend Analysis

Financial Ratio Trend Analysis Excel document is a powerful tool designed to track and evaluate a company's financial performance over time by calculating and visualizing key financial ratios such as liquidity, profitability, and solvency ratios. This analysis helps identify patterns and trends that provide insights into operational efficiency, financial stability, and growth potential, enabling informed decision-making. By leveraging

historical financial data, businesses and investors can forecast future performance and make strategic adjustments to improve overall financial health.

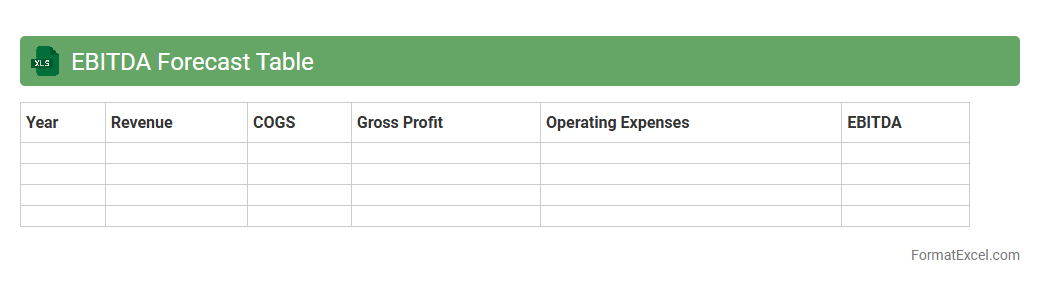

EBITDA Forecast Table

An

EBITDA Forecast Table in an Excel document provides a structured financial model projecting a company's earnings before interest, taxes, depreciation, and amortization over specific periods. This table assists businesses in analyzing profitability trends, budgeting, and making informed decisions about investments or cost management. Utilizing this forecast enhances financial planning accuracy, helping stakeholders evaluate operational performance and potential growth opportunities efficiently.

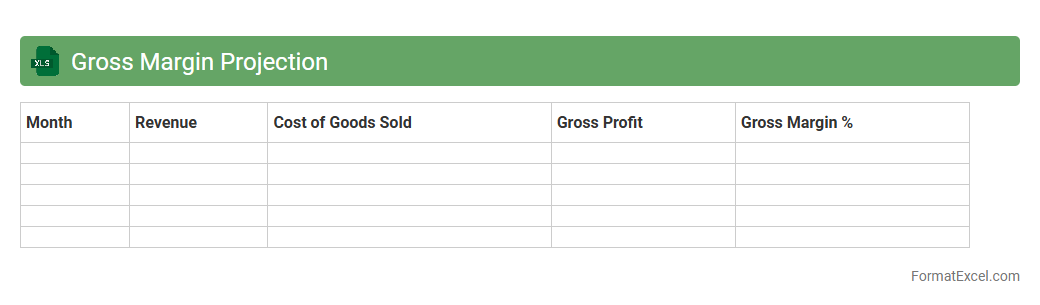

Gross Margin Projection

A

Gross Margin Projection Excel document is a financial tool designed to estimate the future profitability of a business by calculating the difference between sales revenue and the cost of goods sold (COGS). It enables companies to forecast profit margins over a specific period, helping in budgeting and strategic planning. This projection is essential for identifying trends, optimizing pricing strategies, and improving overall financial decision-making.

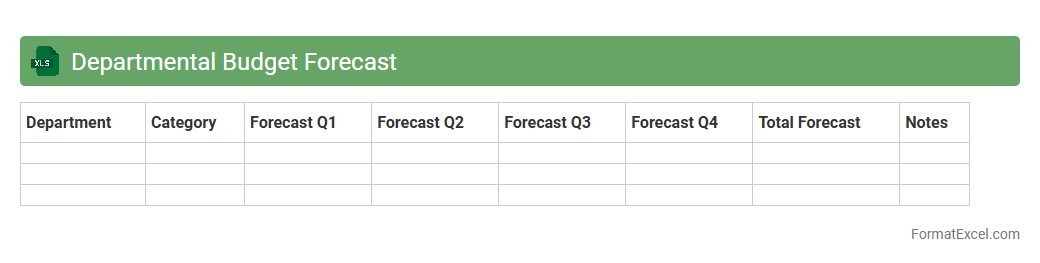

Departmental Budget Forecast

A

Departmental Budget Forecast Excel document is a financial tool designed to project income and expenses for specific departments within an organization over a set period. It enables precise allocation of resources, helps identify potential budget shortfalls, and supports strategic planning by providing clear visibility into departmental financial performance. Utilizing this forecast improves decision-making, enhances cost control, and drives accountability across teams.

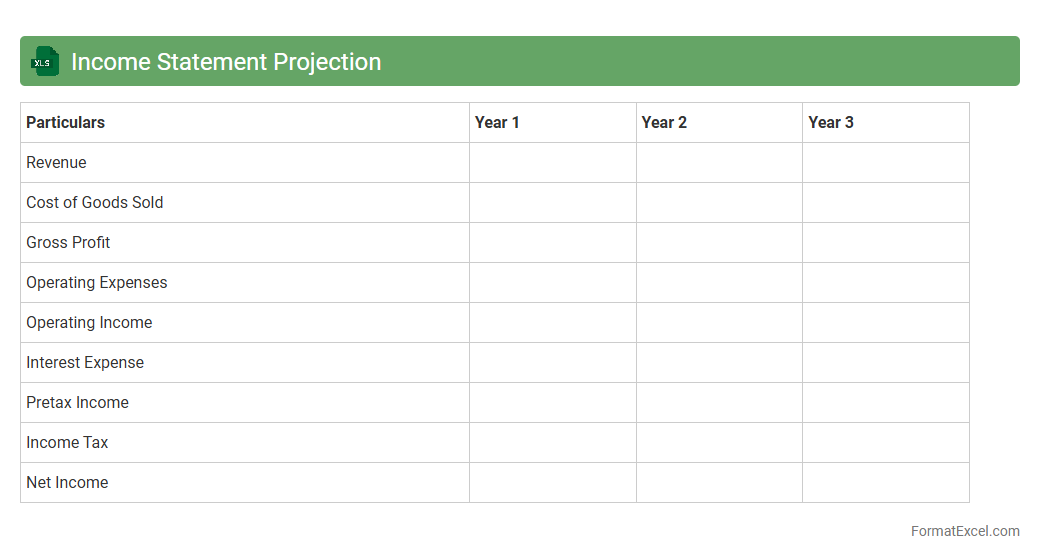

Income Statement Projection

An

Income Statement Projection Excel document is a financial tool used to estimate future revenues, expenses, and net income over a specific period. It helps businesses forecast profitability, plan budgets, and make informed decisions by analyzing anticipated financial performance. This projection supports strategic planning and investor presentations by providing clear insights into expected financial outcomes.

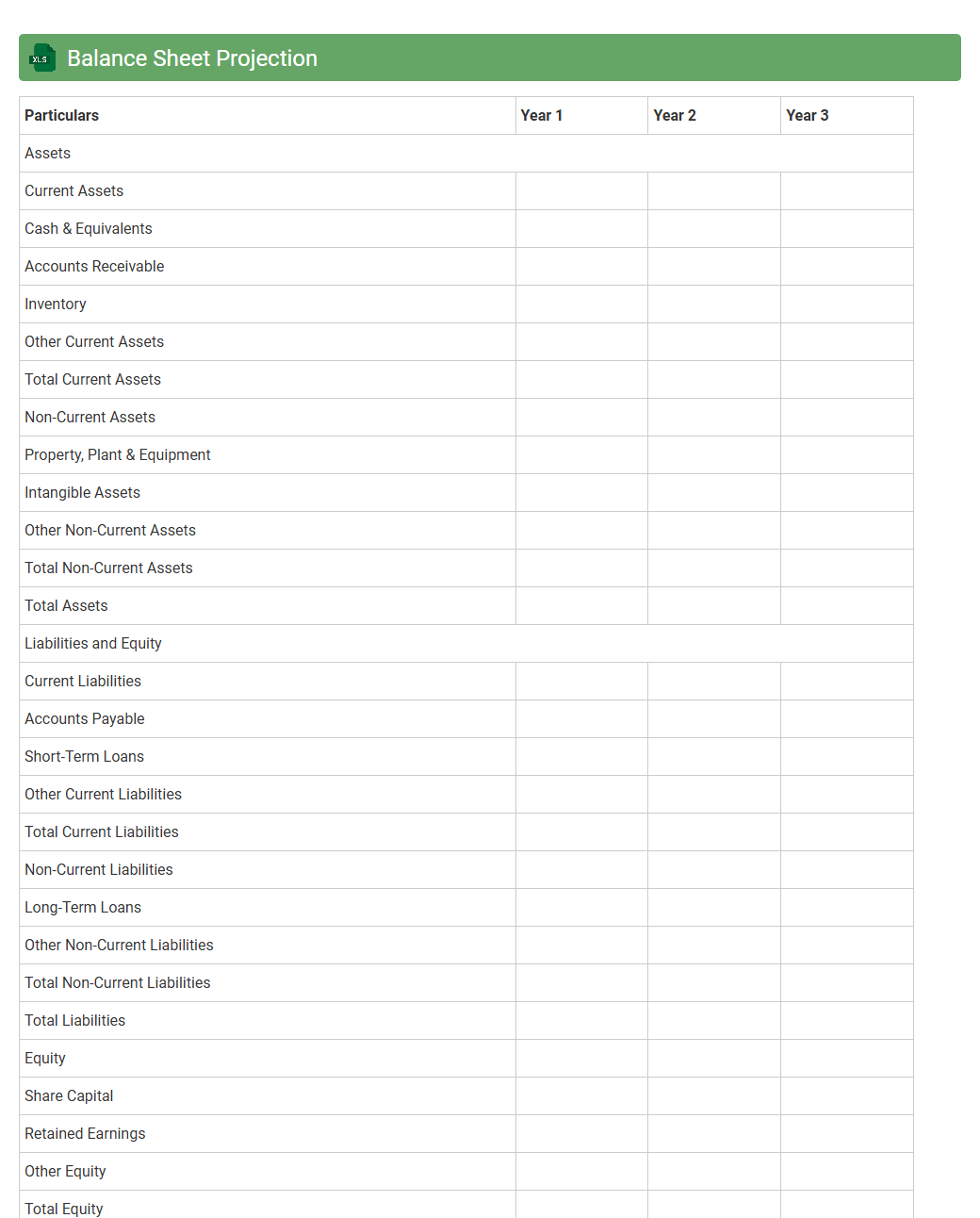

Balance Sheet Projection

A

Balance Sheet Projection Excel document forecasts a company's financial position by estimating assets, liabilities, and equity over a future period, enabling strategic planning and risk management. It helps businesses evaluate liquidity, solvency, and capital structure changes under various scenarios, supporting informed decision-making. This tool is crucial for budgeting, financial analysis, and securing investment or loans by demonstrating expected financial stability.

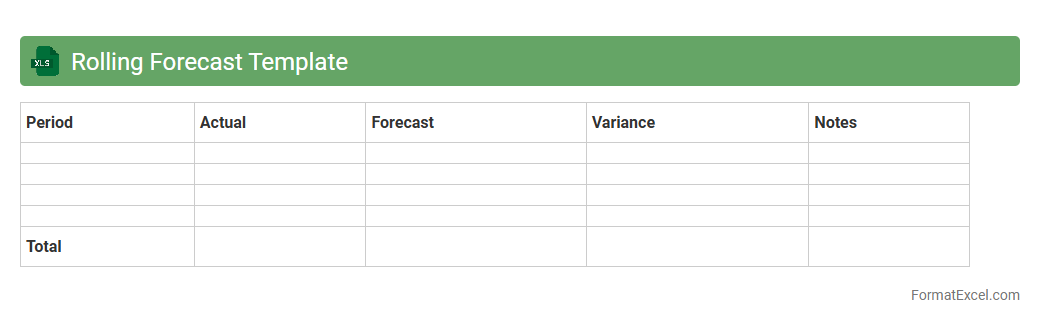

Rolling Forecast Template

A

Rolling Forecast Template in Excel is a dynamic financial planning tool that continuously updates projections by extending the forecast period as actual data becomes available. It enables businesses to adapt quickly to changing market conditions and make informed decisions based on the latest financial trends and performance metrics. Utilizing this template improves budgeting accuracy, enhances cash flow management, and supports strategic planning by maintaining a forward-looking financial perspective.

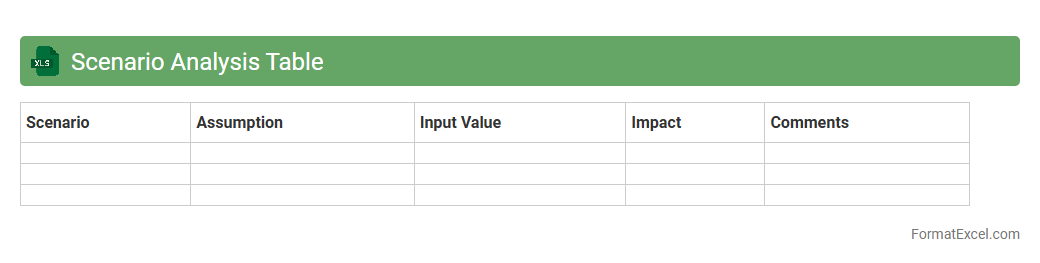

Scenario Analysis Table

A

Scenario Analysis Table in Excel is a tool that helps users evaluate and compare multiple potential outcomes based on different input variables. It allows decision-makers to model financial, operational, or project-related scenarios, facilitating better risk assessment and strategic planning. By systematically organizing these variations, the table simplifies complex data analysis and enhances forecasting accuracy.

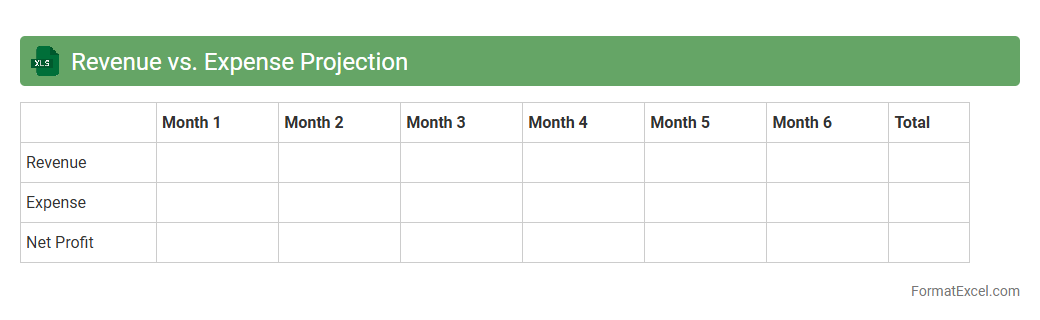

Revenue vs. Expense Projection

A

Revenue vs. Expense Projection Excel document is a financial tool designed to estimate and compare expected income against anticipated costs over a specific period. It helps businesses track cash flow, identify potential profitability issues, and make informed budgeting decisions. Utilizing this projection enables efficient resource allocation and strategic planning to ensure financial stability and growth.

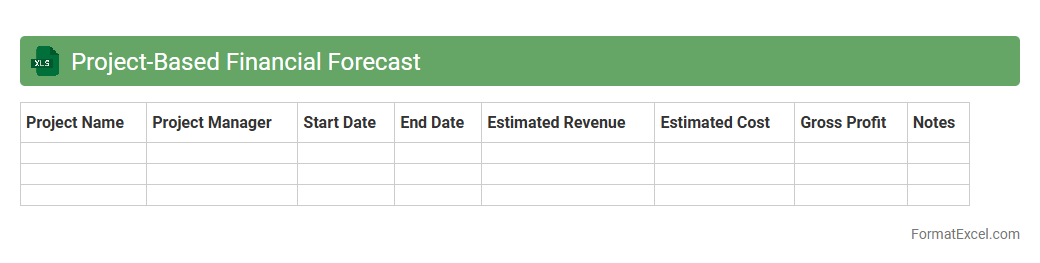

Project-Based Financial Forecast

A

Project-Based Financial Forecast Excel document is a detailed tool used to estimate future revenues, expenses, and cash flows specific to a project, enabling precise budgeting and financial planning. It helps businesses anticipate financial outcomes, identify funding needs, and manage risks by providing a clear financial roadmap tailored to project timelines and milestones. Utilizing this forecast improves decision-making accuracy, resource allocation, and overall project profitability analysis.

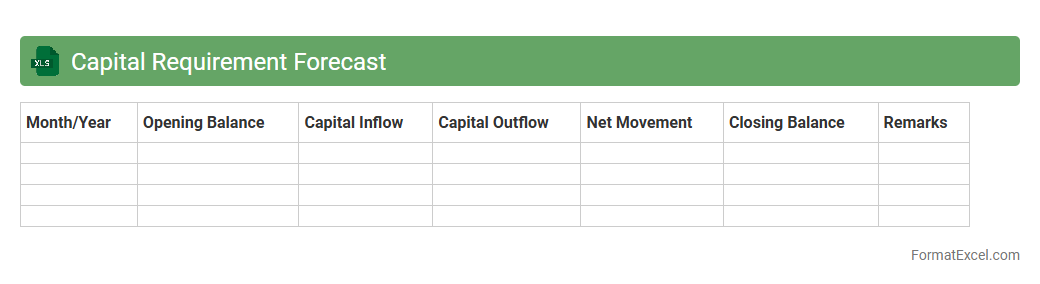

Capital Requirement Forecast

The

Capital Requirement Forecast Excel document is a strategic tool designed to project future financial needs based on various business scenarios and operational plans. It enables organizations to anticipate funding gaps, optimize cash flow management, and ensure regulatory compliance by accurately estimating capital needs over specific periods. Utilizing this forecast enhances decision-making processes, supports risk management, and assists in securing timely investment or credit facilities.

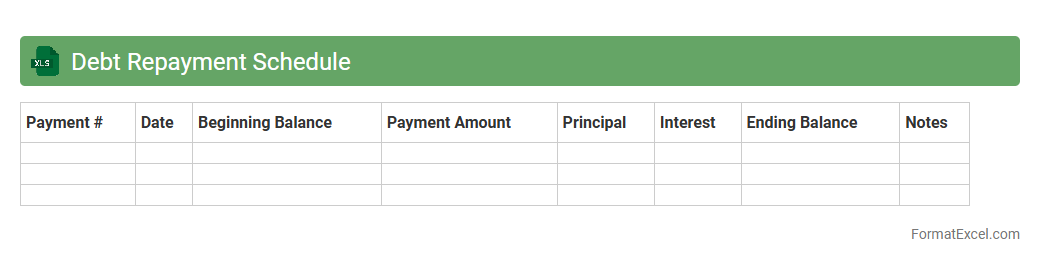

Debt Repayment Schedule

A

Debt Repayment Schedule Excel document is a structured tool that outlines the timeline and amounts required to pay off outstanding debts, including principal and interest. It helps users track payment due dates, manage cash flow efficiently, and avoid late fees or missed payments by providing clear visibility of their financial obligations. This schedule is essential for creating a strategic plan to reduce debt systematically and improve overall financial health.

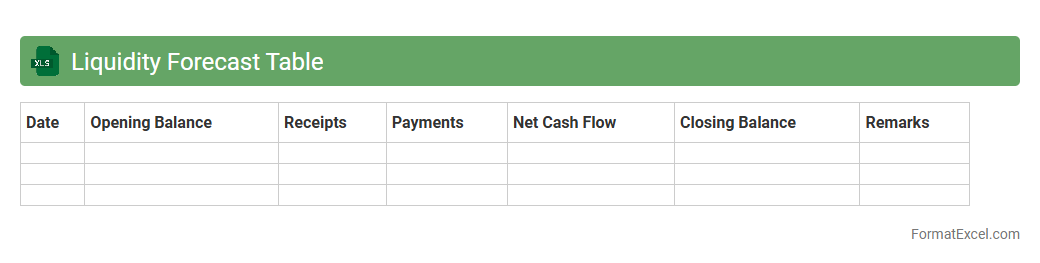

Liquidity Forecast Table

A

Liquidity Forecast Table Excel document helps businesses predict their future cash flow by detailing expected inflows and outflows over a specific period. It enables companies to monitor liquidity positions, ensuring they have enough funds to meet short-term obligations and avoid potential cash shortages. This tool supports strategic financial planning, improves decision-making, and enhances overall cash management efficiency.

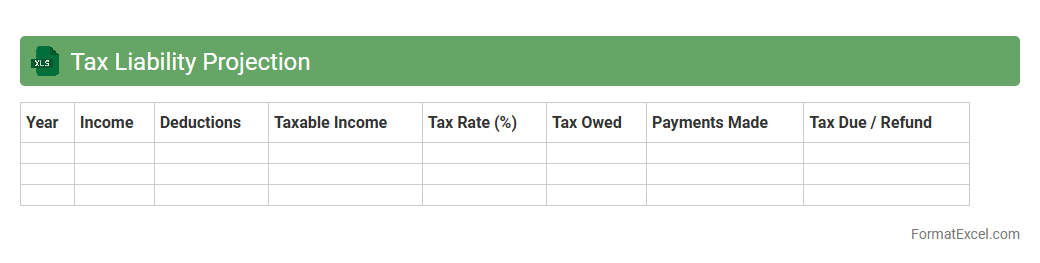

Tax Liability Projection

A

Tax Liability Projection Excel document estimates future tax obligations based on current income, expenses, deductions, and tax rates. It helps individuals and businesses plan finances by providing a clear forecast of potential tax payments, enabling better cash flow management and informed decision-making. Using this tool, users can identify tax-saving opportunities and avoid unexpected liabilities during tax season.

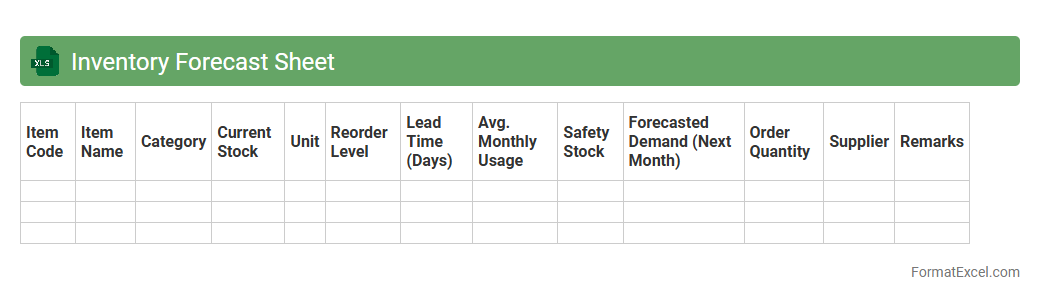

Inventory Forecast Sheet

An

Inventory Forecast Sheet in Excel helps businesses predict future stock needs by analyzing past sales data and trends. This tool optimizes inventory management, reducing stockouts and overstock situations, which saves costs and improves customer satisfaction. It provides clear visualizations and automated calculations, making it easier to plan procurement and maintain optimal inventory levels.

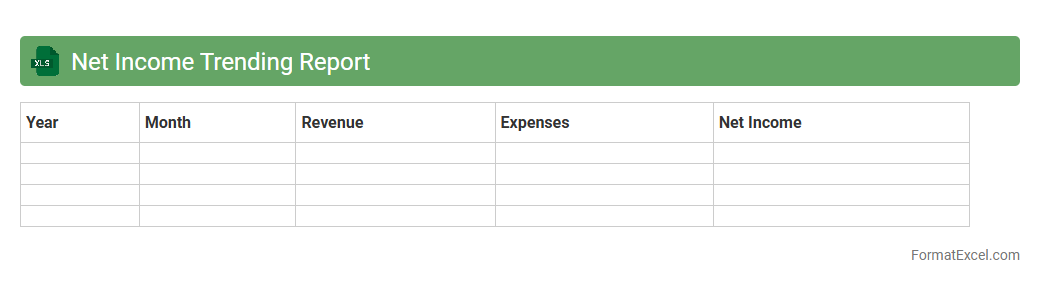

Net Income Trending Report

The

Net Income Trending Report Excel document tracks a company's net income over multiple periods, providing clear visual trends and detailed financial data. This report helps businesses analyze profitability patterns, identify financial strengths or weaknesses, and make informed strategic decisions based on historical performance. Accessing net income trends enables stakeholders to forecast future earnings accurately and optimize budget planning.

Introduction to Financial Forecast Formats

Financial forecast formats serve as blueprints for predicting future business performance. Using a structured format in Excel helps organize data efficiently, making it easier to analyze trends. Understanding the financial forecast format is crucial for accurate and actionable projections.

Importance of Accurate Financial Forecasts

Accurate financial forecasts enable businesses to make informed decisions and plan strategically. They help anticipate cash flow needs, manage risks, and allocate resources effectively. The accuracy of forecasts directly impacts a company's financial stability and growth potential.

Key Components of a Financial Forecast in Excel

A comprehensive financial forecast includes revenue projections, expense estimates, and cash flow analysis. Integrating these elements provides a clear picture of future performance and financial health. Mastering the key components ensures a complete financial forecast that guides business strategy.

Selecting the Right Excel Template

Choosing the appropriate Excel template streamlines the forecasting process and enhances data accuracy. Templates designed for specific industries or financial models can save time and reduce errors. Finding the best-fit Excel template is essential for efficient financial forecasting.

Step-by-Step Guide to Building a Financial Forecast in Excel

Begin by gathering historical financial data and setting realistic assumptions. Next, input data into the chosen template, using Excel formulas to automate calculations. Following a systematic approach ensures a reliable and well-structured financial forecast.

Common Financial Forecasting Methods in Excel

Popular methods include trend analysis, moving averages, and regression models. Excel supports these techniques with built-in functions and data analysis tools. Selecting the right forecasting method depends on your data's characteristics and business goals.

Essential Excel Functions for Forecasting

Functions like FORECAST, TREND, and IF help predict future values based on historical data. Combining these with SUM, AVERAGE, and VLOOKUP enhances your forecasting model's depth and accuracy. Leveraging these Excel functions optimizes the predictive power of your forecasts.

Tips for Visualizing Financial Data in Excel

Utilize charts, graphs, and conditional formatting to present financial data clearly and effectively. Visualization aids in identifying trends, outliers, and potential issues quickly. Effective data visualization improves communication and decision-making.

Best Practices for Maintaining Financial Forecast Accuracy

Regularly update forecasts with actual financial data and review assumptions for relevance. Use sensitivity analysis to understand the impact of variable changes on projections. Adhering to these best practices helps maintain trustworthy and actionable financial forecasts.

Downloadable Financial Forecast Excel Template

Accessing a downloadable Excel template provides a ready-made structure to start forecasting immediately. Ensure the template includes essential sections like income statements, balance sheets, and cash flow projections. Utilizing a downloadable template accelerates your financial planning process.