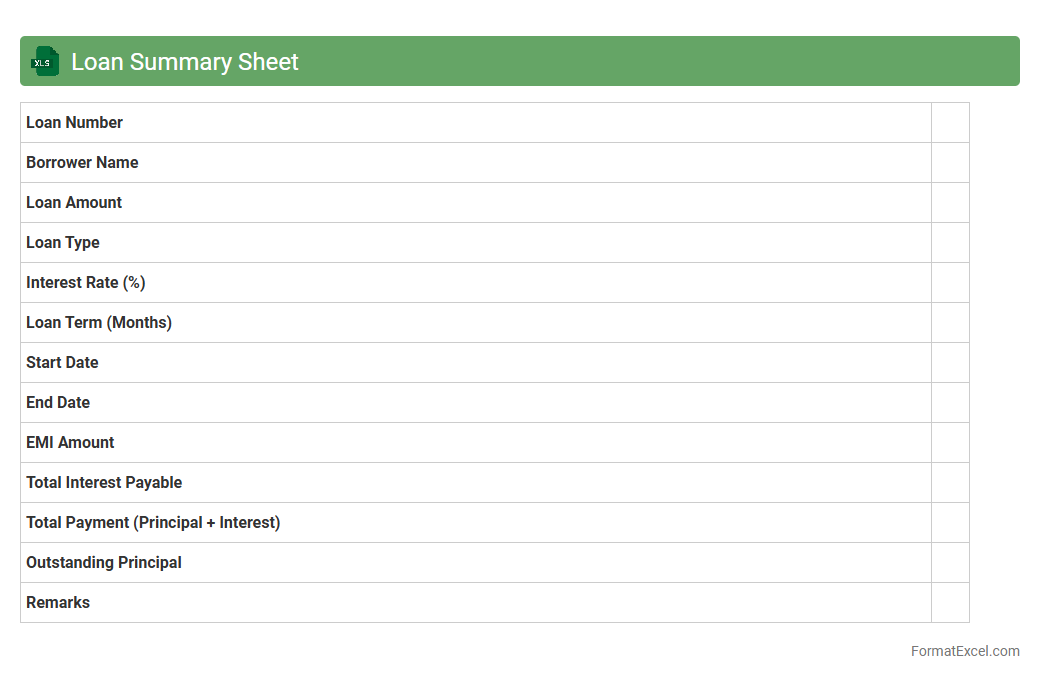

Loan Summary Sheet

A

Loan Summary Sheet Excel document consolidates all critical loan details such as principal amount, interest rates, repayment schedules, and outstanding balances into a single, easy-to-understand format. This sheet enables borrowers and lenders to track loan performance, monitor payment progress, and forecast future financial obligations efficiently. It serves as a powerful tool for financial planning, budgeting, and ensuring transparency in loan management.

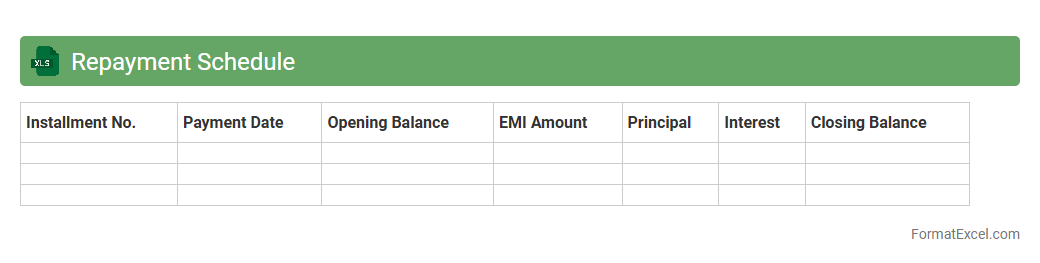

Repayment Schedule

A

Repayment Schedule Excel document is a structured spreadsheet that outlines the timeline and amounts for loan repayments, including principal and interest components. It helps borrowers and lenders track payment due dates, outstanding balances, and total interest paid, enhancing financial planning and cash flow management. This tool ensures transparency and accountability throughout the loan tenure, reducing the risk of missed payments or financial discrepancies.

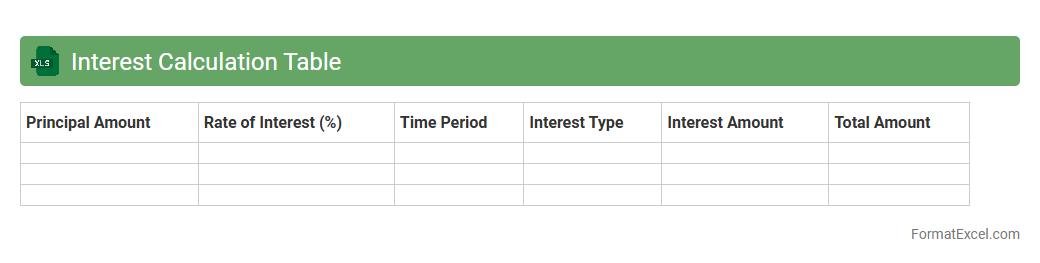

Interest Calculation Table

An

Interest Calculation Table in Excel is a structured spreadsheet used to compute interest amounts over time based on principal, rate, and period parameters. It is particularly useful for tracking loan repayments, savings growth, or investment returns by providing clear, customizable breakdowns of interest accrued at regular intervals. This tool enhances financial planning and decision-making by enabling users to visualize and adjust interest scenarios efficiently.

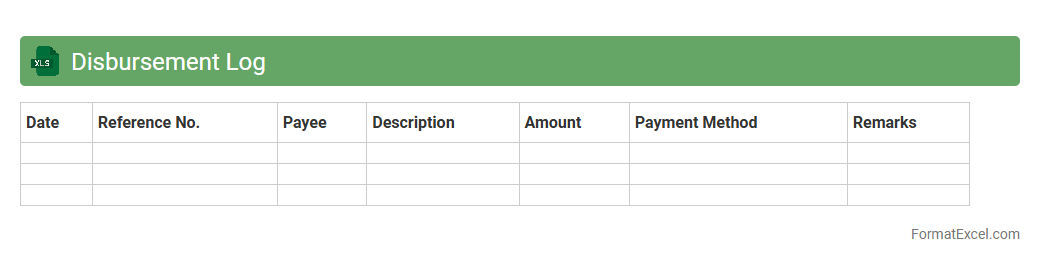

Disbursement Log

A

Disbursement Log Excel document is a detailed record that tracks all outgoing payments and expenses within an organization, providing transparency and accountability. It helps in monitoring cash flow, ensuring accurate financial reporting, and facilitating budget management by organizing dates, amounts, payees, and payment methods efficiently. Utilizing this log enables businesses to prevent errors, detect discrepancies early, and streamline the audit process for financial compliance.

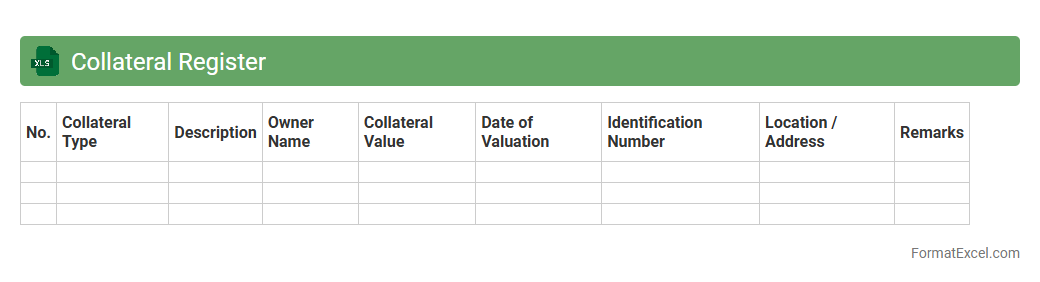

Collateral Register

A

Collateral Register Excel document is a structured spreadsheet used to record and track all assets pledged as collateral against loans or credit facilities. It enables efficient management of asset details, including descriptions, valuations, ownership, and lien information, ensuring transparency and ease of reference for financial institutions and borrowers. This document is essential for mitigating credit risk and maintaining accurate records throughout the loan lifecycle.

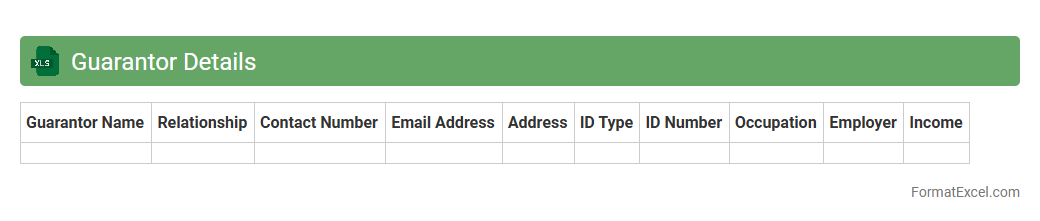

Guarantor Details

A

Guarantor Details Excel document systematically records essential information about guarantors, including their contact details, financial status, and identification data. This organized format facilitates quick access and verification, enhancing the efficiency of credit risk assessment and loan approval processes. Maintaining accurate guarantor records in Excel helps ensure accountability and streamlines communication between lenders and borrowers.

Payment Receipt Tracker

A

Payment Receipt Tracker Excel document is a tool used to systematically record and organize payment transactions, ensuring accurate financial tracking. It helps monitor received payments, outstanding balances, and payment dates, reducing errors and improving cash flow management. By providing a clear overview of financial activity, it supports efficient accounting and enhances decision-making for businesses and individuals.

Loan Covenants Tracker

The

Loan Covenants Tracker Excel document is a specialized tool designed to monitor and manage loan agreement conditions efficiently. It helps borrowers and lenders ensure compliance with financial ratios, payment schedules, and other contractual obligations, reducing the risk of covenant breaches. This tool enhances financial transparency, enables timely corrective actions, and supports effective loan portfolio management.

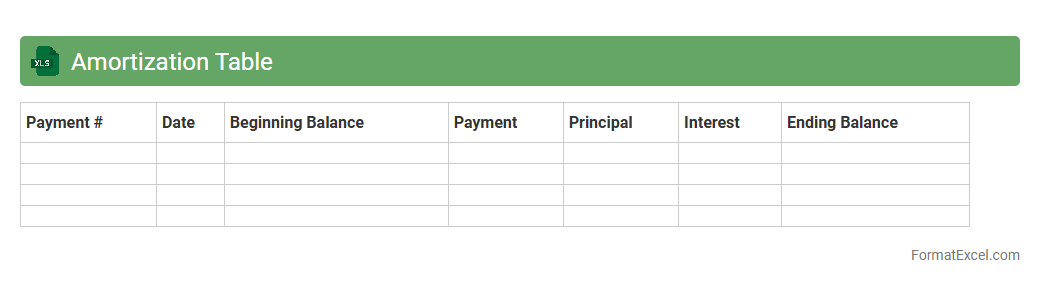

Amortization Table

An

Amortization Table Excel document is a detailed schedule that breaks down each loan payment into principal and interest components over the loan term. It helps users track outstanding loan balances, understand the impact of payments on reducing debt, and plan finances effectively. This tool is essential for managing mortgages, car loans, or personal loans by providing clear visibility into repayment progress and interest costs.

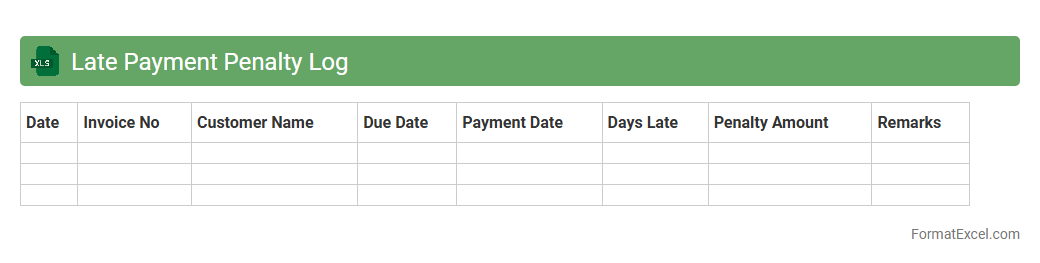

Late Payment Penalty Log

The

Late Payment Penalty Log Excel document is a structured tool designed to track overdue payments and calculate associated penalties efficiently. It helps businesses monitor payment deadlines, enforce penalty policies, and maintain accurate financial records, reducing revenue loss due to delayed payments. This log improves cash flow management by providing clear visibility into outstanding debts and penalty statuses.

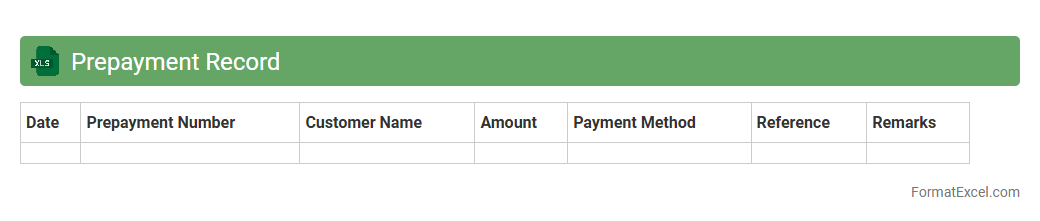

Prepayment Record

The

Prepayment Record Excel document serves as a detailed ledger tracking all advance payments made before receiving goods or services, helping businesses monitor cash flow and maintain accurate financial records. It allows users to easily update, analyze, and reconcile prepayment transactions, ensuring transparency and accountability in financial management. This tool is essential for avoiding duplicate payments and forecasting budget needs effectively.

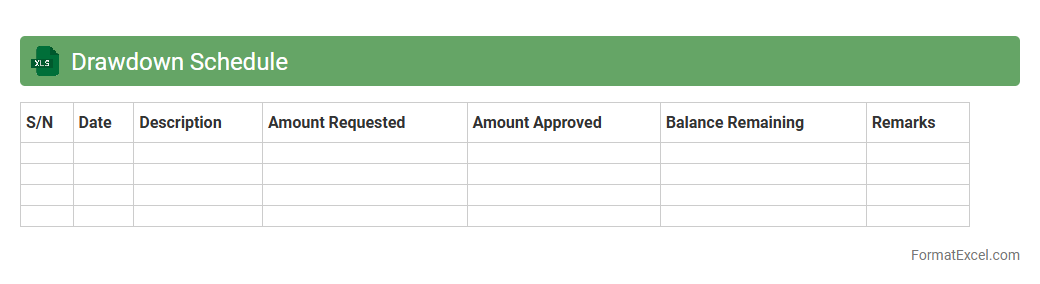

Drawdown Schedule

A

Drawdown Schedule Excel document outlines the planned and actual disbursement of funds over a specific period, providing a clear timeline for capital usage in projects or investments. It helps track cash flow, ensuring that funds are drawn efficiently and budgets are adhered to, minimizing financial risk. This schedule enables better financial planning and accountability by offering transparent insights into fund allocation and timing.

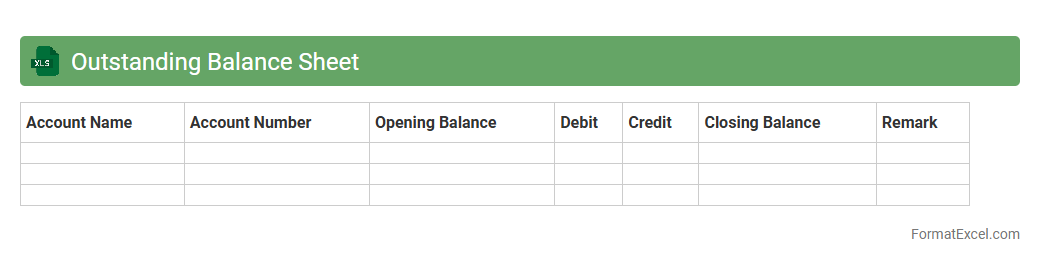

Outstanding Balance Sheet

An

Outstanding Balance Sheet Excel document is a detailed financial record summarizing a company's assets, liabilities, and equity at a specific point in time. It enables businesses to track unpaid debts and manage cash flow effectively by highlighting outstanding obligations. Using this document in Excel allows for easy updates, data analysis, and financial forecasting to support informed decision-making.

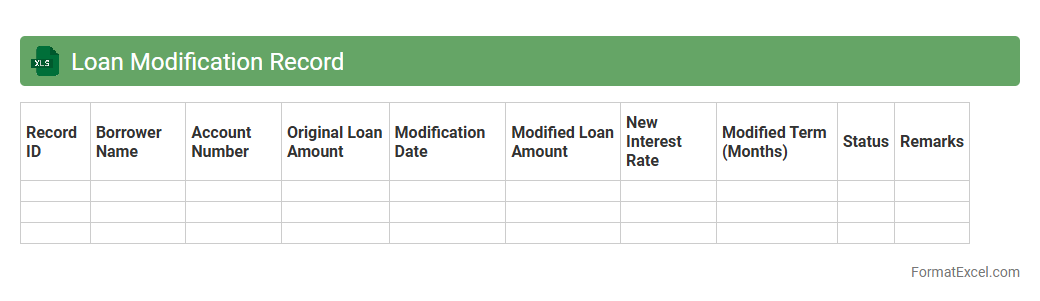

Loan Modification Record

A

Loan Modification Record Excel document is a spreadsheet that tracks changes made to loan terms, including interest rates, payment schedules, and loan durations. It helps lenders and borrowers monitor modifications systematically, ensuring accurate record-keeping and facilitating financial analysis. This document is essential for maintaining transparency and managing loan portfolios effectively.

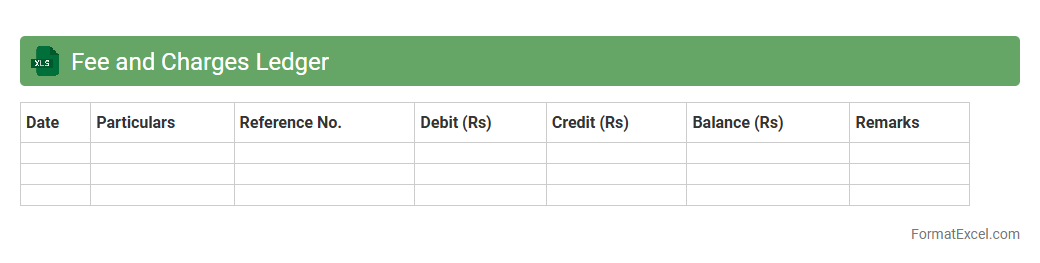

Fee and Charges Ledger

A

Fee and Charges Ledger excel document systematically records all financial transactions related to fees and charges, ensuring accurate tracking of payments, outstanding dues, and adjustments. It enables efficient management of financial data, simplifies reconciliation processes, and helps maintain transparency in billing practices. By organizing this information in a structured format, it supports timely decision-making and enhances accountability in financial operations.

Loan Maturity Tracker

A

Loan Maturity Tracker Excel document is a specialized tool designed to monitor the due dates of various loans, ensuring timely repayments and avoiding defaults. It organizes loan details such as principal amounts, interest rates, and maturity dates in a clear format, allowing users to manage cash flow and financial planning effectively. By providing reminders and summaries, this tracker helps individuals and businesses stay on top of their financial obligations and optimize loan management strategies.

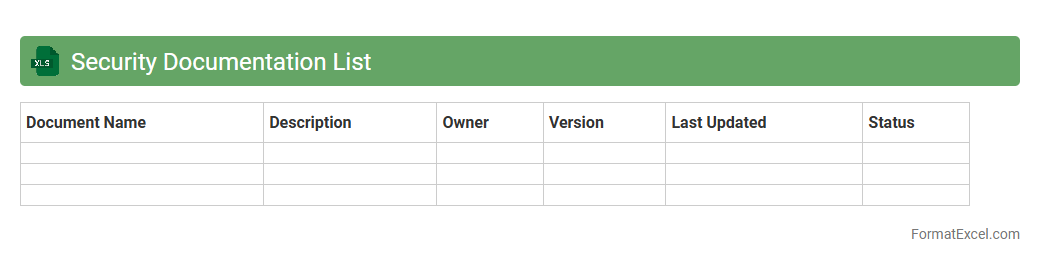

Security Documentation List

A

Security Documentation List Excel document is a structured file that catalogues all security-related documents within an organization, including policies, procedures, audits, and compliance records. It helps teams quickly locate essential security materials, track document versions, ownership, and update schedules, ensuring consistent adherence to cybersecurity standards. This tool enhances risk management and regulatory compliance by providing a centralized reference for all security documentation.

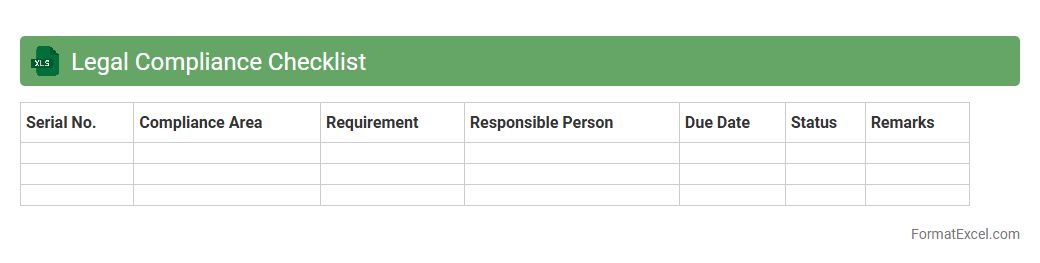

Legal Compliance Checklist

A

Legal Compliance Checklist Excel document is a structured tool designed to help organizations track and ensure adherence to relevant laws and regulations. It provides a clear overview of compliance requirements, deadlines, and responsible parties, reducing the risk of legal penalties. Using this checklist enhances operational efficiency by organizing critical compliance tasks in an easy-to-update, accessible format.

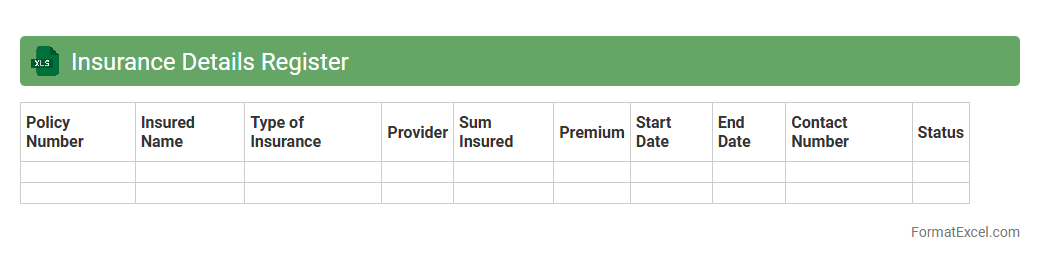

Insurance Details Register

An

Insurance Details Register Excel document systematically records all policy information, including insurer names, policy numbers, coverage types, and renewal dates. It helps individuals and businesses efficiently track insurance coverage, ensuring timely premium payments and easy access during claims or audits. This organized approach minimizes risks associated with missing deadlines or incomplete information, supporting better financial planning and risk management.

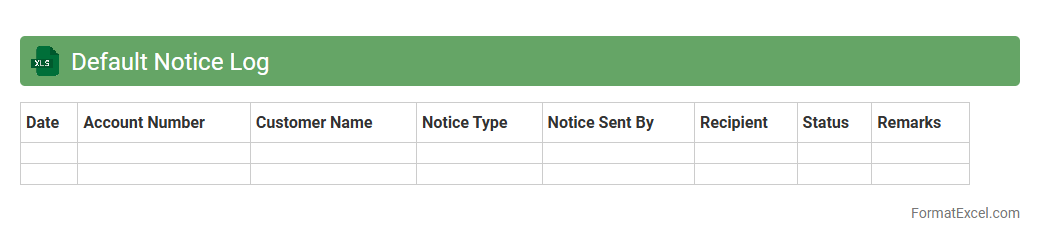

Default Notice Log

The

Default Notice Log Excel document is a structured tool used for tracking and managing default notices issued to clients or vendors. It helps organizations monitor outstanding defaults, document key dates, and ensures timely follow-up actions to mitigate risks. This log enhances accountability and streamlines communication across teams.

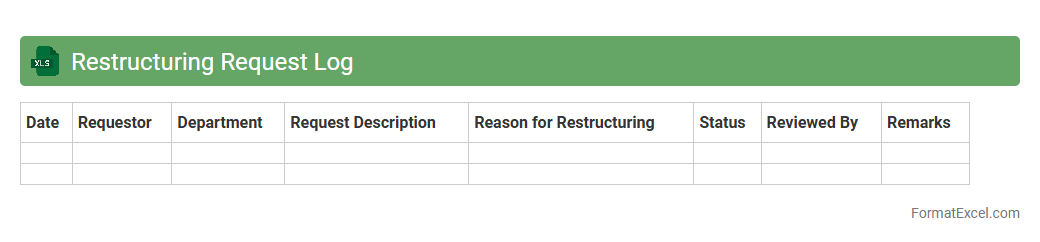

Restructuring Request Log

The

Restructuring Request Log Excel document is a comprehensive tool designed to track, manage, and analyze all requests related to organizational or project restructuring. It helps maintain a clear record of each request's status, priority, and responsible parties, enabling efficient monitoring and timely decision-making. By utilizing this log, teams can improve communication, streamline workflows, and ensure accountability throughout the restructuring process.

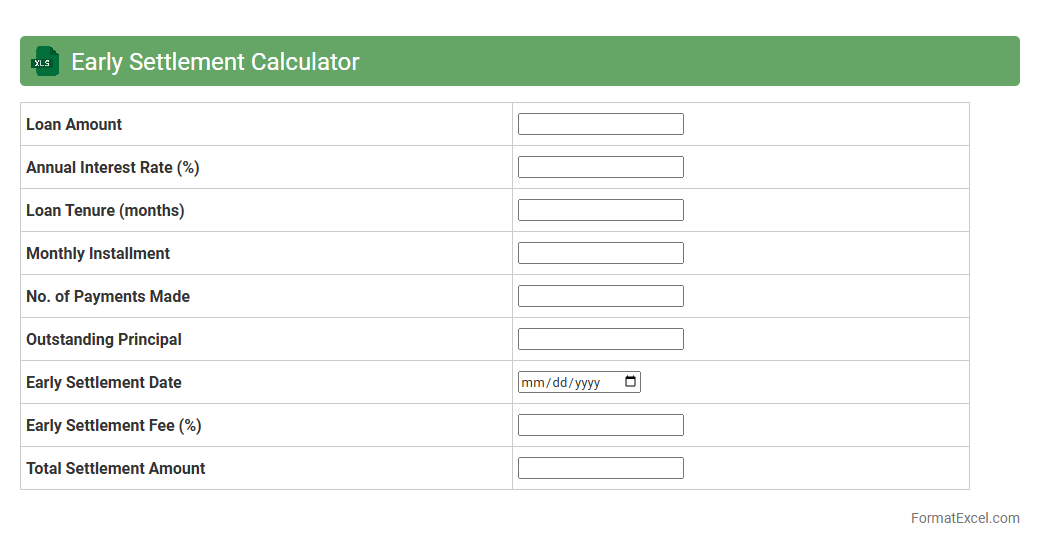

Early Settlement Calculator

The

Early Settlement Calculator Excel document is a financial tool designed to help users accurately calculate the benefits and costs associated with settling a loan or debt before its due date. It provides detailed insights into interest savings, outstanding balances, and potential penalties by automating complex calculations based on loan terms and payment schedules. This calculator aids borrowers in making informed decisions to minimize overall interest payments and optimize their repayment strategy efficiently.

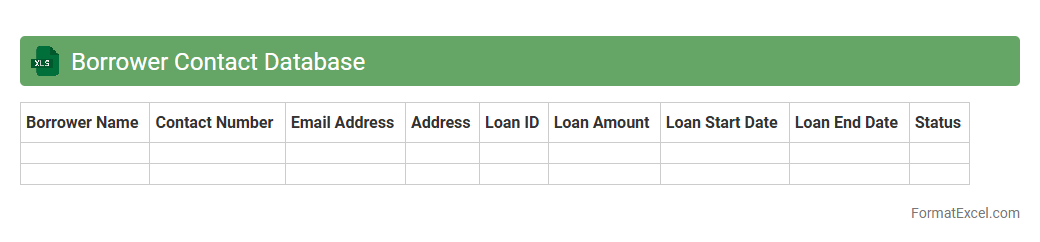

Borrower Contact Database

The

Borrower Contact Database Excel document is a structured collection of borrower information, including names, phone numbers, email addresses, and loan details. It helps streamline communication, track repayment schedules, and manage loan portfolios effectively. This tool enhances organization and improves follow-up efficiency, ensuring timely borrower interactions and better financial oversight.

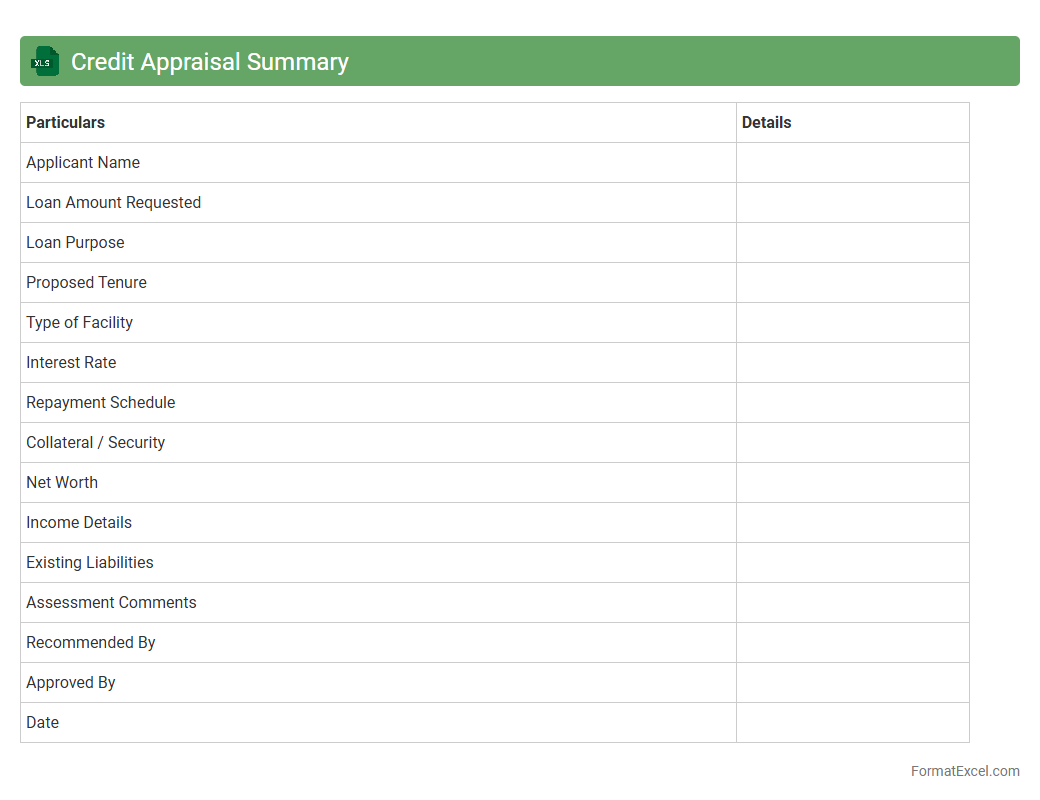

Credit Appraisal Summary

A

Credit Appraisal Summary Excel document consolidates key financial data and creditworthiness evaluations for loan applicants, enabling streamlined decision-making for lenders. It organizes critical information such as income, liabilities, credit scores, and repayment capacity, allowing quick assessment of risk levels. This tool enhances efficiency by providing a clear, concise overview that supports consistent and objective credit approvals.

Approval Workflow Tracker

An

Approval Workflow Tracker Excel document is a tool designed to monitor and manage the progress of approval processes within an organization. It helps streamline the review and authorization stages by providing a clear overview of pending, approved, and rejected requests, thereby enhancing transparency and accountability. Utilizing this tracker improves efficiency by reducing bottlenecks, ensuring deadlines are met, and facilitating timely decision-making.

Introduction to Loan Agreement Formats

A loan agreement format provides a structured template to document the terms and conditions between a lender and borrower. Using a standardized format ensures clarity and reduces misunderstandings. Excel is a popular tool for creating these agreements due to its flexibility and ease of use.

Importance of Accurate Loan Agreements

Accurate loan agreements protect both parties by clearly defining repayment terms, interest rates, and obligations. A well-drafted document minimizes the risk of disputes and legal complications. Precision in the agreement enhances transparency and trust between lender and borrower.

Benefits of Using Excel for Loan Agreements

Excel offers powerful features like formulas and customizable templates that streamline loan agreement creation. It allows automatic calculation of interest, payment schedules, and outstanding balances. Using Excel improves efficiency and reduces human error in data handling.

Key Components of a Loan Agreement in Excel

Critical elements include loan amount, interest rate, repayment period, payment schedule, and borrower/lender information. Each component must be clearly defined to avoid ambiguity. Excel allows easy incorporation and adjustment of these components as needed.

Step-by-Step Guide to Creating a Loan Agreement in Excel

Start by setting up input fields for borrower details, loan amount, interest rate, and term. Use Excel formulas to calculate payment schedules and totals automatically. Finally, format the sheet for readability and ensure all legal terms are included.

Essential Sections to Include in Your Excel Format

Include sections like loan details, repayment terms, interest calculation methods, default clauses, and signatures. These sections cover all necessary information to ensure legal enforceability. Clear segmentation helps users quickly find relevant information.

Common Mistakes to Avoid in Loan Agreement Excel Templates

Avoid neglecting precise formula setup, unclear terms, and omission of signatures. Overlooking these can lead to miscalculations and enforcement issues. Always double-check for accuracy and completeness before finalizing.

Downloadable Loan Agreement Excel Format Templates

Many websites offer free downloadable loan agreement templates in Excel format for quick use. These templates can be customized to suit specific loan conditions. Using a pre-made template saves time and ensures compliance with standard practices.

Legal Considerations for Loan Agreements in Excel

Ensure your Excel loan agreement complies with local laws and includes necessary legal disclaimers. Electronic signatures may require additional validation depending on jurisdiction. Consulting a legal expert is advisable to confirm enforceability.

Frequently Asked Questions about Loan Agreement Excel Formats

Common questions include how to calculate interest in Excel, customizing templates, and validating signatures. Clear answers help users effectively utilize Excel for loan documentation. Regularly updating FAQ sections ensures ongoing user support.