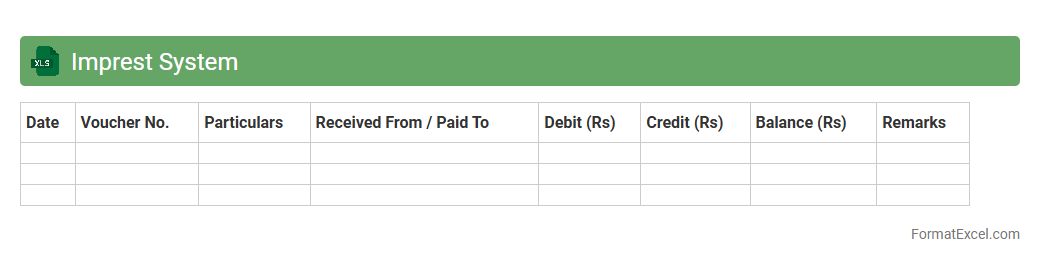

Imprest System

An

Imprest System Excel document is a financial tool used to manage and track petty cash or small cash advances within an organization. It helps maintain accurate records of cash inflows and outflows by automatically calculating balances, thus ensuring transparency and accountability. Utilizing this system enhances efficient cash management, reduces errors, and simplifies the reconciliation process.

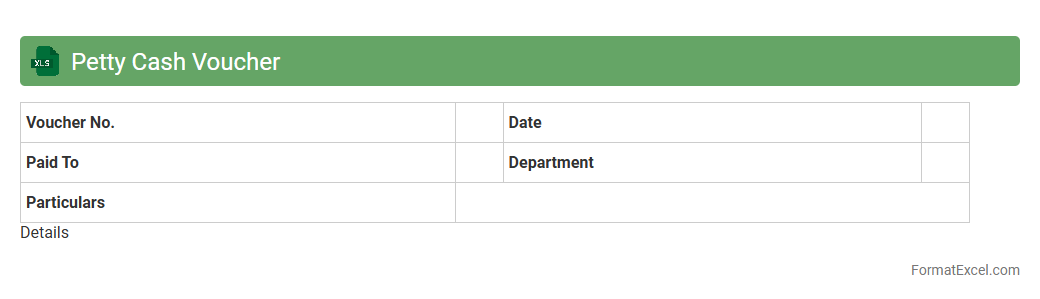

Petty Cash Voucher

A

Petty Cash Voucher Excel document is a spreadsheet tool designed to record and track small, everyday cash expenses within an organization. It helps maintain accurate financial records by documenting details such as date, amount, purpose, and authorization of each petty cash transaction. Using this document enhances transparency, simplifies reconciliation, and ensures efficient management of minor cash disbursements.

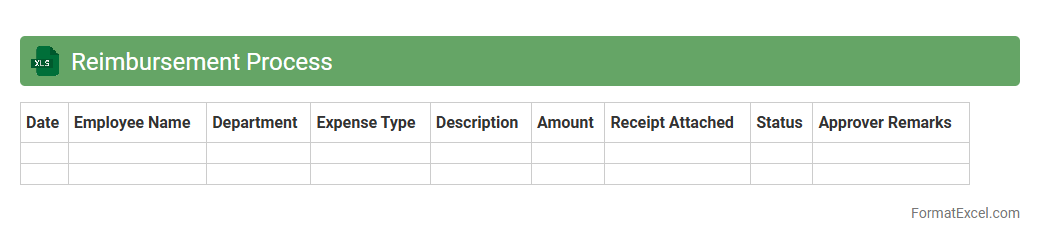

Reimbursement Process

The

Reimbursement Process Excel document streamlines tracking and managing expense claims, providing a clear and organized format for submission, approval, and payment. It helps ensure accuracy by automating calculations and maintaining a detailed record of all transactions, reducing errors and delays. This tool enhances financial transparency and accountability, making it easier for both employees and finance teams to monitor reimbursement status and maintain compliance.

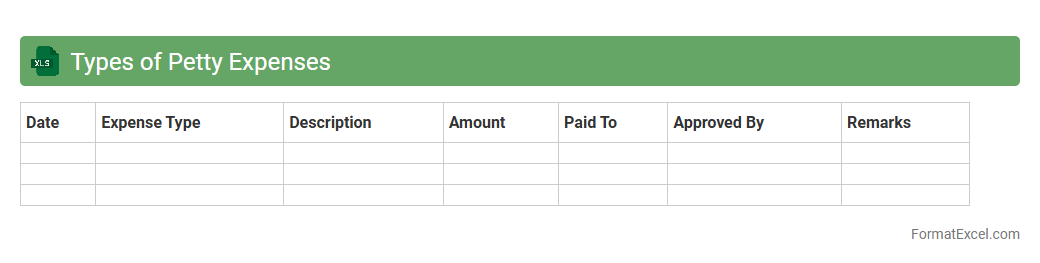

Types of Petty Expenses

The

Types of Petty Expenses Excel document categorizes and tracks small day-to-day business expenditures such as office supplies, travel reimbursements, and minor repairs. It streamlines financial management by providing clear visibility into spending patterns, aiding in budgeting and expense control. This tool enhances accuracy in bookkeeping and simplifies the reconciliation process during financial audits.

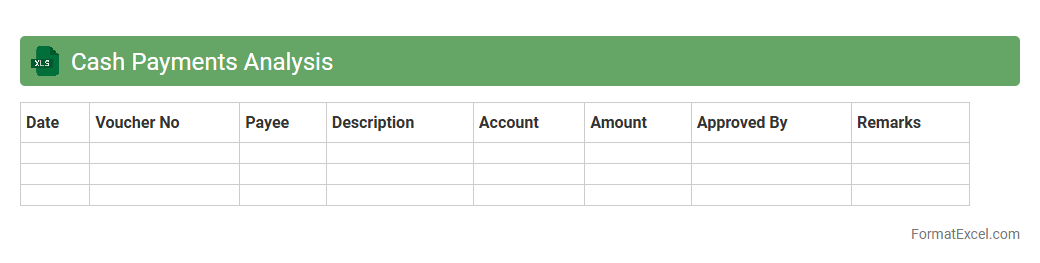

Cash Payments Analysis

The

Cash Payments Analysis Excel document is a comprehensive tool designed to track, categorize, and analyze cash disbursements within a business or organization. By providing detailed insights into cash outflows, it helps identify spending patterns, optimize cash management, and improve budgeting accuracy. This analysis supports better financial decision-making and enhances overall cash flow visibility.

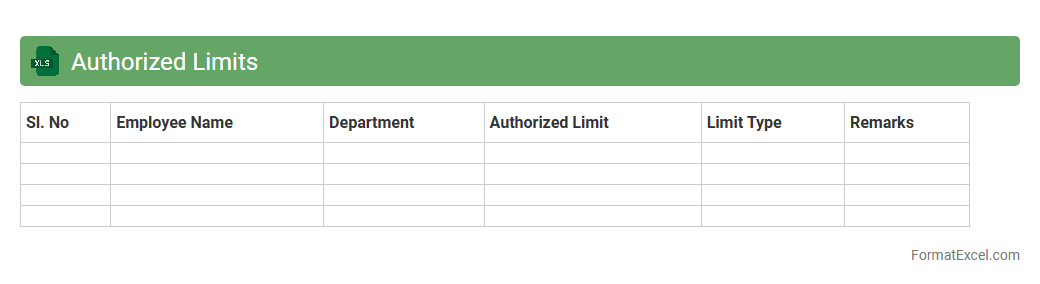

Authorized Limits

The

Authorized Limits Excel document is a structured file that outlines predefined spending or operational limits approved by management within an organization. It serves as a crucial control mechanism to prevent unauthorized expenditures, ensuring compliance with internal policies and regulatory requirements. By clearly defining these thresholds, the document enhances financial oversight and streamlines decision-making processes across departments.

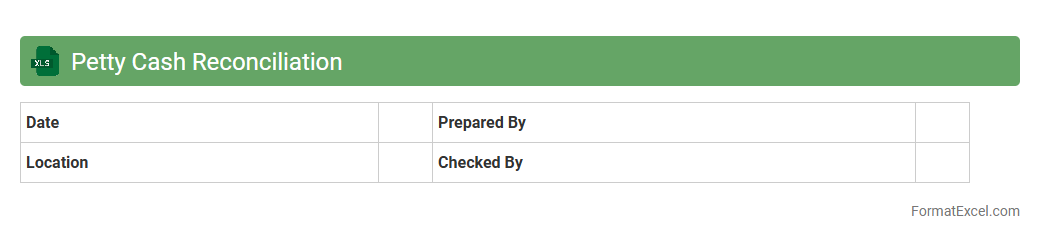

Petty Cash Reconciliation

A

Petty Cash Reconciliation Excel document is a specialized spreadsheet designed to track and verify small cash expenditures within an organization. It helps ensure accurate recording of petty cash transactions by comparing recorded expenses against the remaining cash balance, reducing the risk of discrepancies or fraud. Using this tool streamlines financial audits and improves accountability in managing daily cash flow.

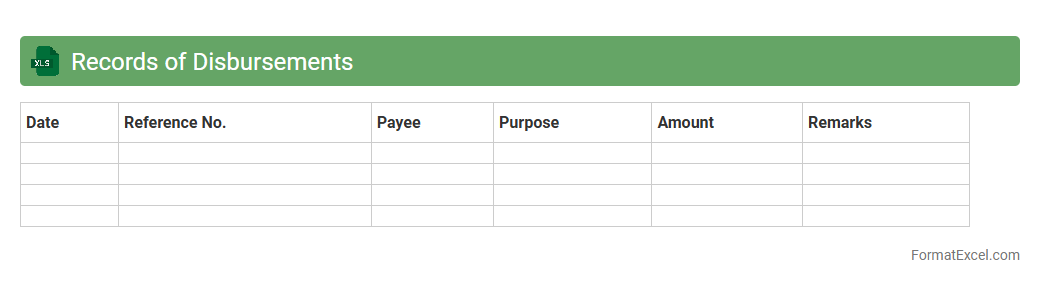

Records of Disbursements

The

Records of Disbursements Excel document is a structured financial record that tracks all outgoing payments and expenses within an organization or personal budget. It provides detailed entries, including dates, payees, amounts, and payment methods, enabling accurate monitoring and reconciliation of financial activities. This document is essential for maintaining financial accountability, preparing budgets, and generating reports for auditing and decision-making purposes.

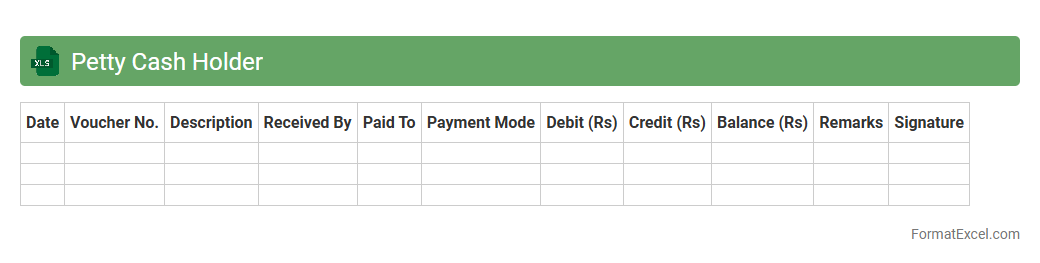

Petty Cash Holder

The

Petty Cash Holder Excel document is a financial tool designed to track and manage small cash expenses within an organization. It helps maintain accurate records of petty cash receipts, disbursements, and balances, ensuring transparency and accountability. This document streamlines expense reconciliation, reduces errors, and facilitates efficient cash flow management for minor operational costs.

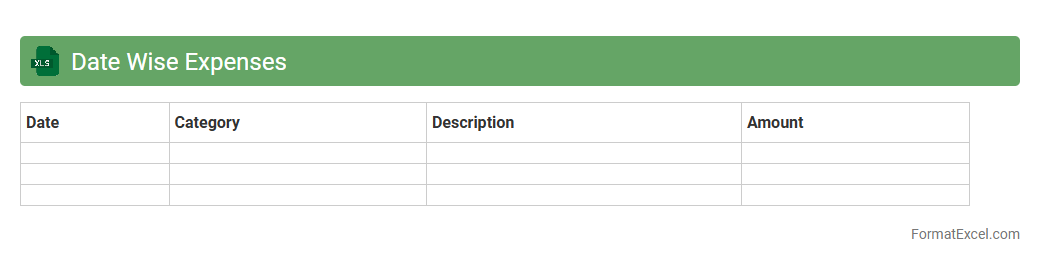

Date Wise Expenses

A

Date Wise Expenses Excel document is a spreadsheet designed to record and organize expenses according to specific dates, allowing for easy tracking and analysis of spending patterns over time. This tool helps users monitor daily, weekly, or monthly expenditures, identify trends, and manage budgets more effectively. By categorizing expenses date-wise, it simplifies financial planning and enhances decision-making based on accurate and timely expense data.

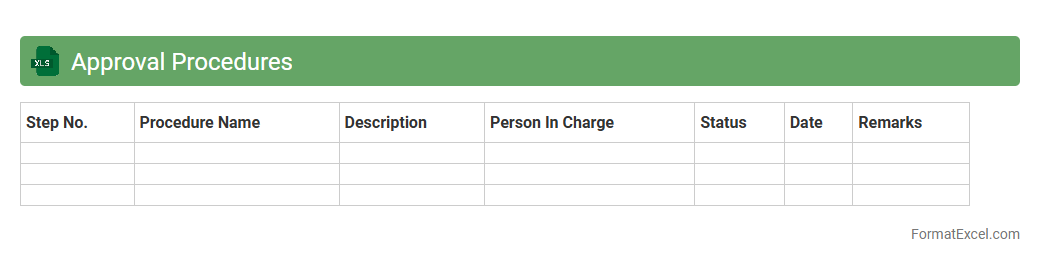

Approval Procedures

An

Approval Procedures Excel document is a structured tool designed to streamline and track the process of obtaining necessary approvals within an organization. It helps in documenting each step, assigning responsible individuals, and monitoring deadlines, which enhances transparency and accountability. By using this Excel document, teams can ensure compliance with internal policies and reduce delays in decision-making.

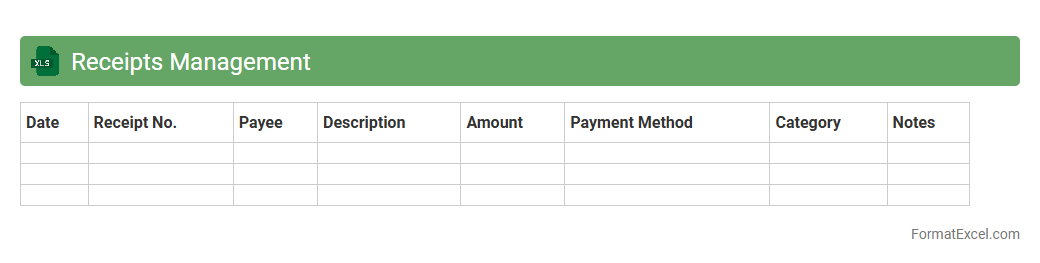

Receipts Management

A

Receipts Management Excel document is a digital tool designed to organize and track financial receipts efficiently. It helps users categorize expenses, monitor spending patterns, and maintain accurate financial records for budgeting or tax purposes. By automating calculations and providing a clear overview of transactions, it enhances financial transparency and simplifies expense reconciliation.

Expense Categorization

An

Expense Categorization Excel document is a structured spreadsheet designed to organize and classify various expenses into defined categories such as utilities, groceries, transportation, and entertainment. This tool helps users track spending patterns, identify cost-saving opportunities, and maintain better control over personal or business budgets. By analyzing categorized expenses, users can make informed financial decisions and improve overall financial management efficiency.

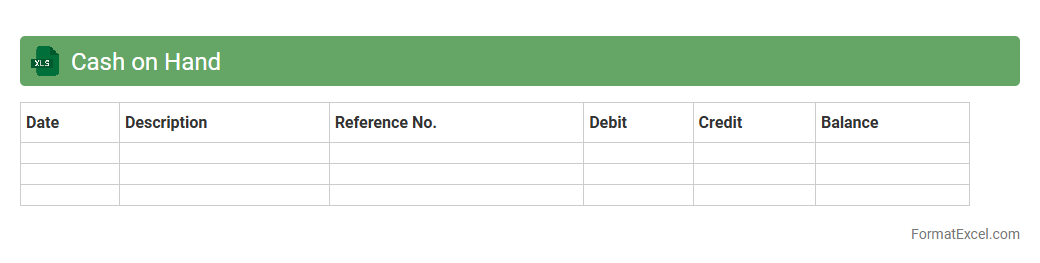

Cash on Hand

A

Cash on Hand Excel document is a financial tool used to track and manage the amount of physical cash available at any given time, helping individuals or businesses maintain accurate cash flow records. It provides a clear snapshot of daily cash transactions, including inflows and outflows, ensuring efficient cash management and preventing discrepancies. Using this document enhances financial planning, aids in budgeting, and supports timely decision-making by offering real-time visibility into available liquidity.

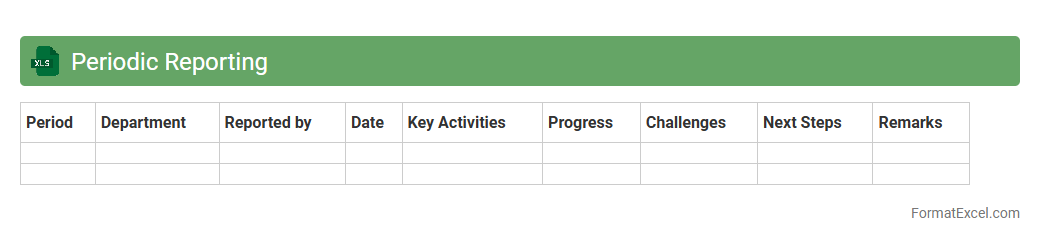

Periodic Reporting

A

Periodic Reporting Excel document is a structured spreadsheet designed to systematically collect, analyze, and present data at regular intervals, enhancing decision-making processes. It allows businesses to track key performance indicators (KPIs), monitor trends over time, and generate consistent reports that facilitate transparency and accountability. Utilizing this tool improves data accuracy and efficiency, enabling teams to quickly identify issues and implement timely improvements.

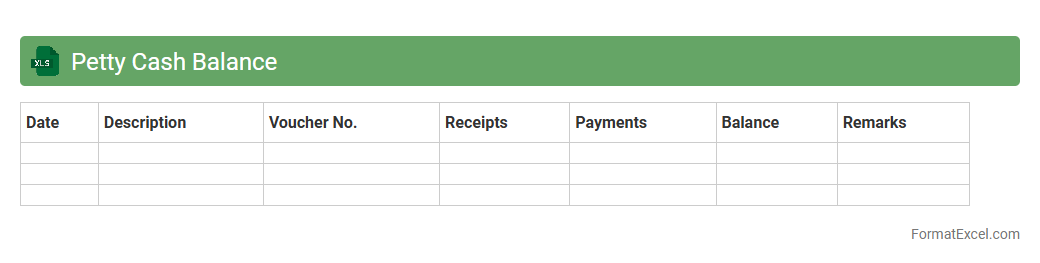

Petty Cash Balance

A

Petty Cash Balance Excel document tracks small cash expenditures and remaining funds within an organization, ensuring accurate record-keeping and financial control. It helps monitor daily cash flow, prevent overspending, and simplifies the reconciliation process at the end of accounting periods. This tool is essential for maintaining transparency and accountability in managing minor operational expenses.

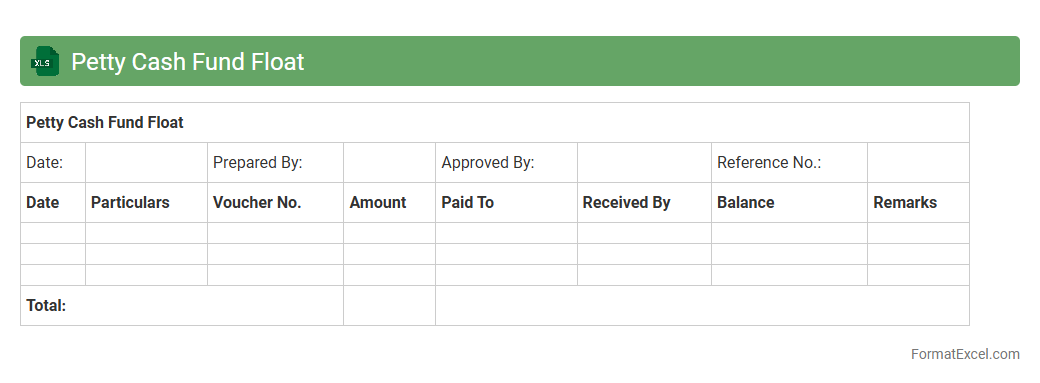

Petty Cash Fund Float

A

Petty Cash Fund Float Excel document tracks small, everyday business expenses and maintains accurate records of cash disbursements. It helps ensure accountability, simplifies reconciliation, and prevents overspending by organizing transaction details and remaining balances. Utilizing this tool enhances financial control and streamlines petty cash management for businesses.

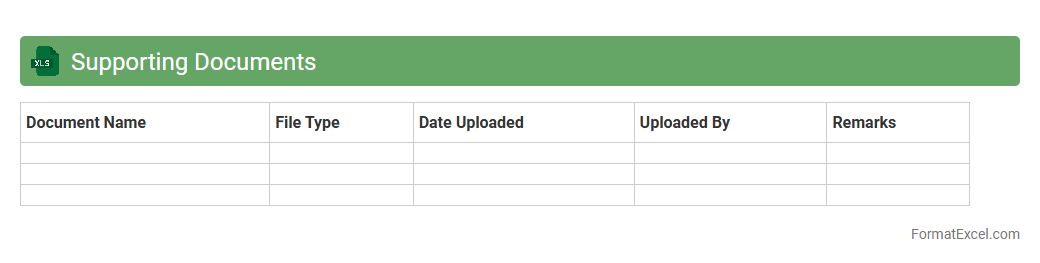

Supporting Documents

The

Supporting Documents Excel document serves as a centralized repository to organize, track, and reference essential files related to projects, expenses, or compliance requirements. It enhances efficiency by enabling quick access to invoices, receipts, contracts, and other critical documents, reducing the risk of missing or misplaced information. This structured approach streamlines audit processes and improves overall data management within organizations.

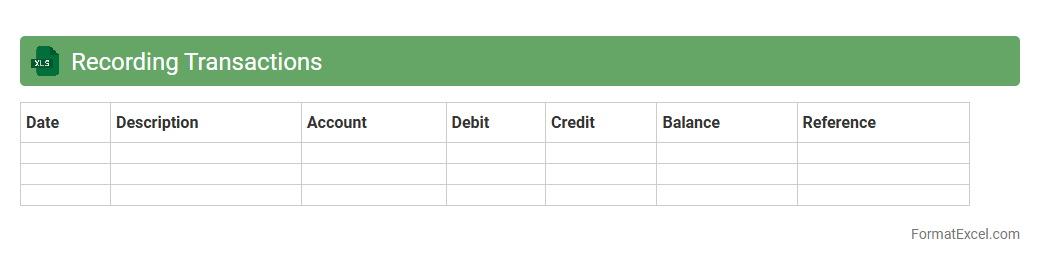

Recording Transactions

A

Recording Transactions Excel document is a spreadsheet designed to systematically document financial activities such as sales, purchases, receipts, and payments. This tool helps businesses and individuals maintain accurate financial records, enabling efficient tracking of income and expenses for budgeting and auditing purposes. By organizing transaction data in a clear format, it simplifies financial analysis and supports informed decision-making.

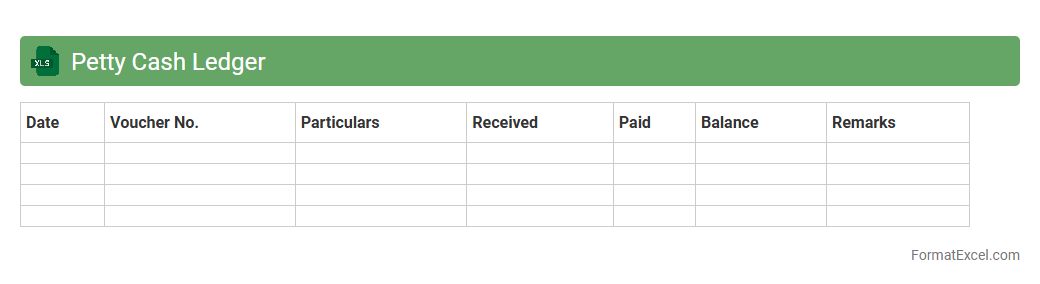

Petty Cash Ledger

A

Petty Cash Ledger Excel document is a digital tool used to record and track small, everyday expenses within an organization. It helps maintain accurate financial records by categorizing transactions, monitoring cash flow, and ensuring accountability for petty cash disbursements. Using this ledger enhances budgeting efficiency and simplifies reconciliation processes.

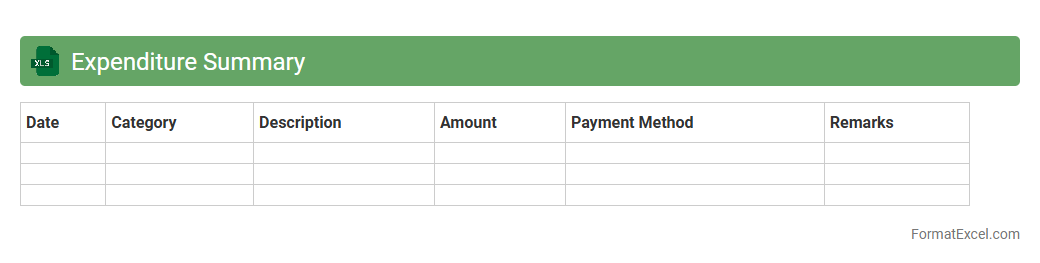

Expenditure Summary

An

Expenditure Summary Excel document is a structured file used to track and categorize financial outflows in a detailed and organized manner. It helps businesses and individuals monitor spending patterns, manage budgets effectively, and identify areas for cost reduction. Utilizing this document enhances financial analysis by providing clear visibility into expenses, ensuring better financial decision-making and planning.

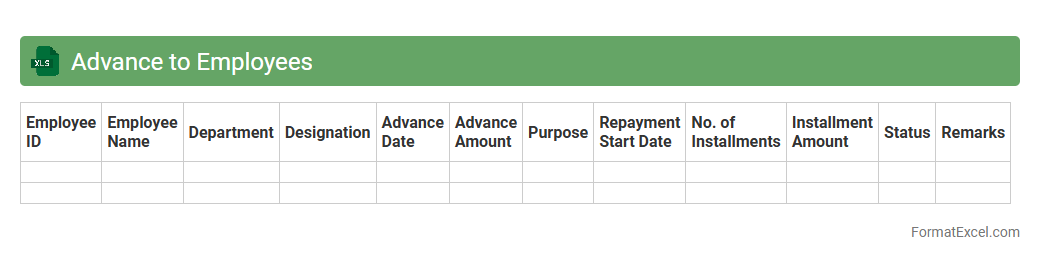

Advance to Employees

The

Advance to Employees Excel document is a structured financial record used to track the amounts of money given to employees as advances against their salaries or expenses. It helps manage and monitor repayments, ensuring accurate accounting and preventing discrepancies in employee reimbursements. This tool is essential for maintaining transparent financial operations and simplifying payroll adjustments related to employee advances.

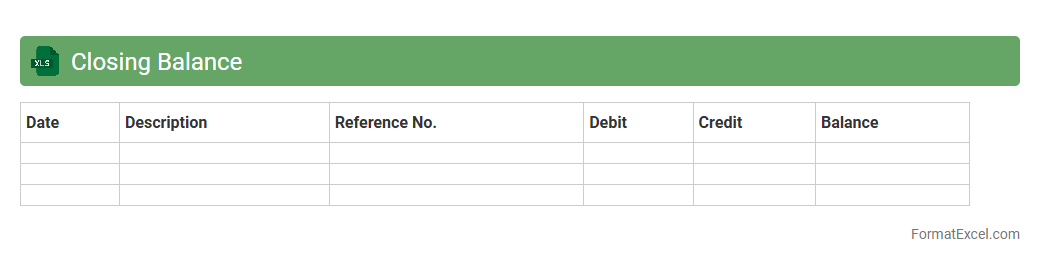

Closing Balance

A

Closing Balance Excel document tracks the final amount in an account after all debits and credits have been accounted for within a specific period. It is useful for financial analysis, ensuring accurate bookkeeping, and preparing balance sheets by providing a clear snapshot of available funds or liabilities. Businesses and individuals rely on this document to monitor cash flow, reconcile accounts, and make informed financial decisions.

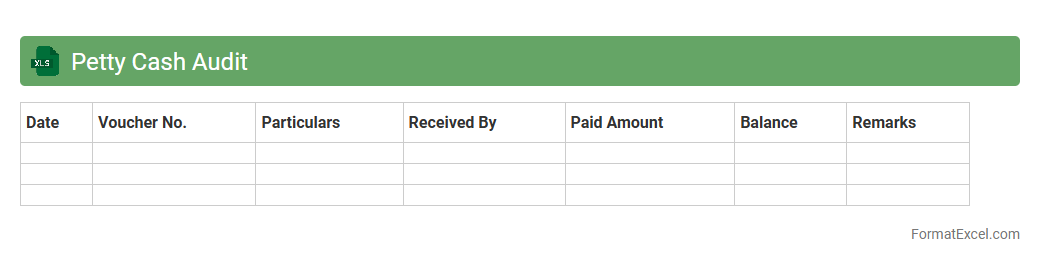

Petty Cash Audit

A

Petty Cash Audit Excel document is a spreadsheet tool designed to track and verify small cash transactions within an organization, ensuring accuracy and accountability. It helps businesses monitor expenses, reconcile cash on hand, and detect discrepancies quickly. Utilizing this document enhances financial control and supports comprehensive audit trails for petty cash management.

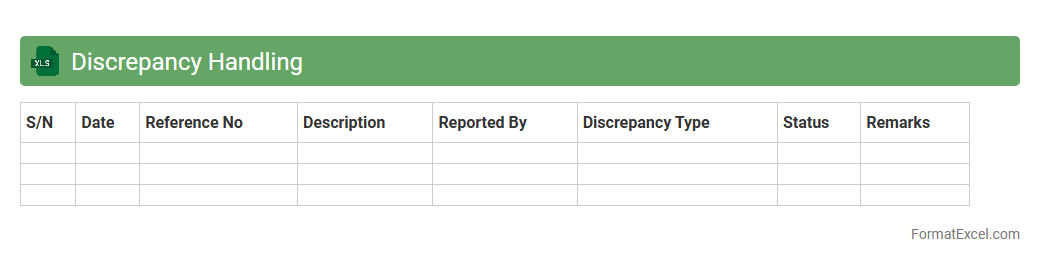

Discrepancy Handling

A

Discrepancy Handling Excel document is a tool used to systematically identify, track, and resolve inconsistencies or errors within data sets, transactions, or inventory records. It helps organizations maintain data accuracy by providing clear documentation of discrepancies, enabling efficient communication and corrective actions. Utilizing this document enhances operational transparency, reduces errors, and supports better decision-making through accurate and up-to-date information management.

Introduction to Petty Cash Book

A Petty Cash Book is a financial record used to track small, everyday expenses within a business. It helps organize minor payments that don't require issuing checks or going through formal accounts payable. Maintaining this book ensures transparency and control over petty cash usage.

Importance of Maintaining a Petty Cash Book

Maintaining aPetty Cash Book is crucial for effective cash management and accountability. It helps prevent misuse of funds and provides a clear audit trail for minor transactions. This practice supports accurate financial reporting and budget control.

Key Components of a Petty Cash Book Format

The key components include Date, Description, Voucher Number, Amount Paid, Amount Received, and Balance. These elements help record each petty cash transaction accurately. A well-structured format enhances ease of use and reduces errors.

Advantages of Using Excel for Petty Cash Management

Excel offers flexibility, automation, and accessibility for managing petty cash records. Users can easily calculate balances, categorize expenses, and generate reports with Excel formulas and features. This improves efficiency and accuracy in record-keeping.

Essential Columns in an Excel Petty Cash Book

Essential columns include Date, Particulars, Voucher Number, Amount Paid, Amount Received, and Running Balance. These columns capture detailed information, enabling precise tracking of petty cash flow. Including a Remarks column may also aid in clarifying transactions.

Step-by-Step Guide to Creating a Petty Cash Book in Excel

Start by setting up the columns for Date, Description, Voucher Number, Amount Paid, Amount Received, and Balance. Use formulas to calculate the running balance after each transaction automatically. Format the sheet for readability and include drop-down menus for common expense categories.

Sample Petty Cash Book Format in Excel

A sample format typically features a structured table with headers and pre-configured formulas. It allows users to input transactions effortlessly while automatically updating balances. Downloadable templates often serve as a practical starting point for customization.

Tips for Effective Petty Cash Bookkeeping in Excel

Regularly update entries and reconcile petty cash with actual cash on hand. Use data validation to reduce errors and employ filters to analyze transactions easily. Backup your Excel file frequently to prevent data loss.

Common Mistakes to Avoid in Petty Cash Management

Avoid neglecting to record transactions promptly or losing receipts. Failing to reconcile balances consistently can lead to discrepancies. Overlooking petty cash limits may result in unauthorized expenditures.

Downloadable Petty Cash Book Excel Templates

Many websites offer free downloadable Excel templates for petty cash books that are customizable and user-friendly. Templates often include built-in formulas and formatting to simplify bookkeeping. Utilizing these resources can save time and improve accuracy.