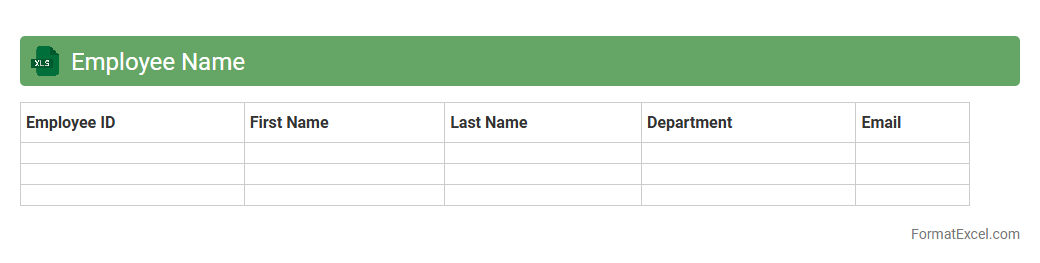

Employee Name

The

Employee Name Excel document is a structured spreadsheet that lists employee names along with relevant details such as IDs, departments, and contact information. It streamlines workforce management by enabling easy sorting, filtering, and updating of employee data. This document enhances organizational efficiency and accuracy in HR tasks like attendance tracking, payroll processing, and performance evaluation.

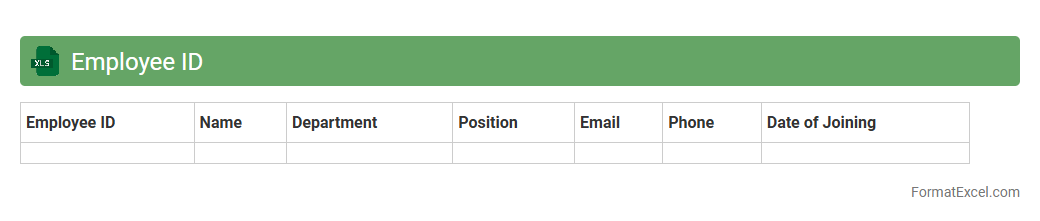

Employee ID

An

Employee ID Excel document is a structured spreadsheet that organizes employee identification numbers alongside relevant personal and job-related information. It helps streamline HR processes, enabling quick retrieval of employee data, accurate record-keeping, and efficient attendance or payroll management. Utilizing this document reduces errors and enhances workforce management by providing a centralized, easily accessible employee database.

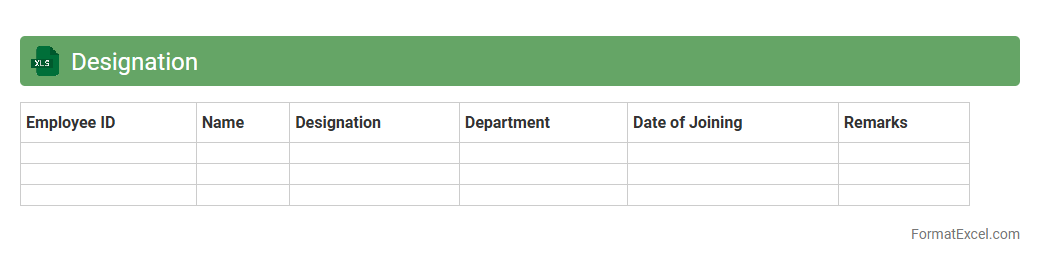

Designation

A

Designation Excel document is a structured spreadsheet used to categorize and manage employee roles within an organization efficiently. It helps HR teams track job titles, departments, and reporting hierarchies, enabling streamlined workforce planning and payroll processing. By organizing designations clearly, this document supports better communication and role clarity across the company.

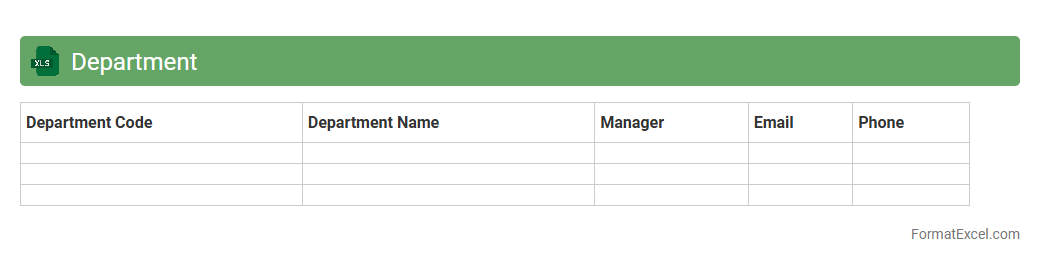

Department

A

Department Excel document is a structured spreadsheet designed to organize, analyze, and manage departmental data efficiently. It helps in tracking budgets, schedules, employee performance, and project progress, facilitating better decision-making and resource allocation. Utilizing this document enhances collaboration across teams by providing clear and accessible information tailored to specific departmental needs.

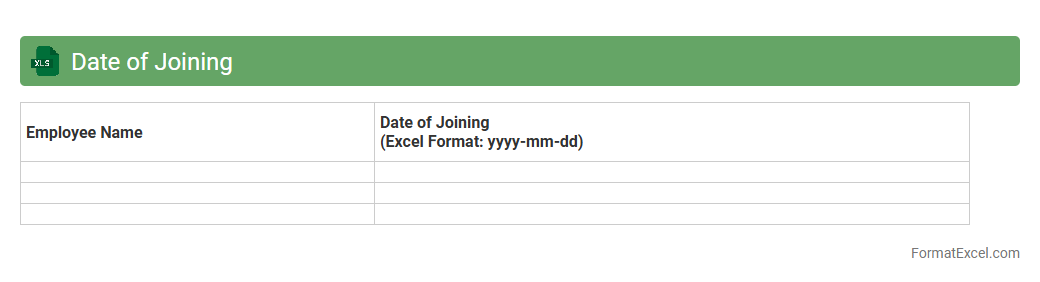

Date of Joining

A

Date of Joining Excel document is a structured spreadsheet that records the exact dates employees began their tenure within an organization. This document helps track employee tenure, calculate benefits eligibility, and streamline HR processes such as payroll and performance evaluations. Maintaining accurate Date of Joining records ensures compliance with labor laws and improves workforce management efficiency.

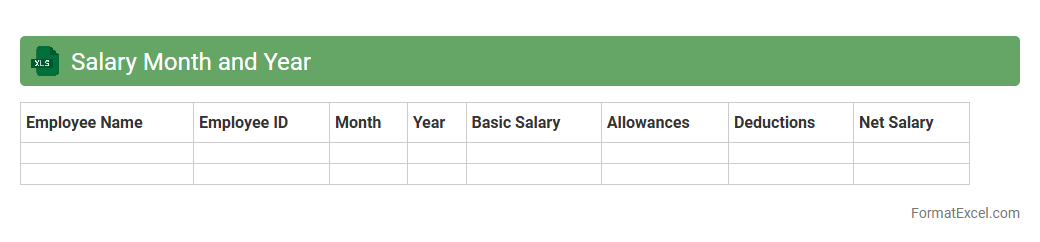

Salary Month and Year

A

Salary Month and Year Excel document is a structured spreadsheet used to record and analyze employee salary data based on specific months and years. It helps organizations track payroll information, manage financial planning, and generate reports for accounting and auditing purposes. This document is essential for maintaining accurate salary records and ensuring compliance with tax and labor regulations.

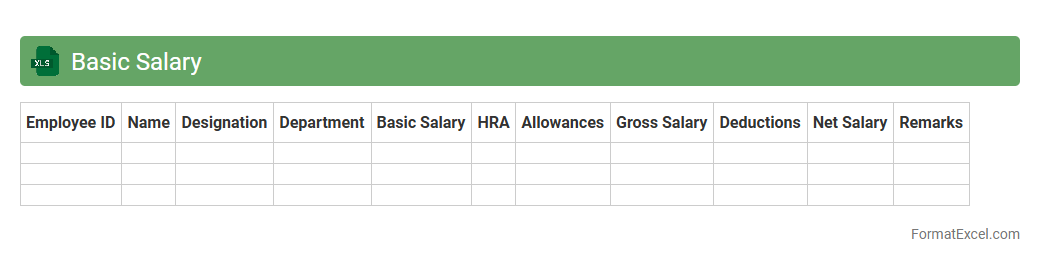

Basic Salary

A

Basic Salary Excel document is a structured spreadsheet used to record, calculate, and analyze employees' fundamental wages before deductions and benefits. It helps businesses maintain accurate payroll records, streamline salary management, and ensure compliance with compensation policies. This tool enhances financial planning by providing clear visibility into salary expenses and facilitating easy updates for changes in pay structures.

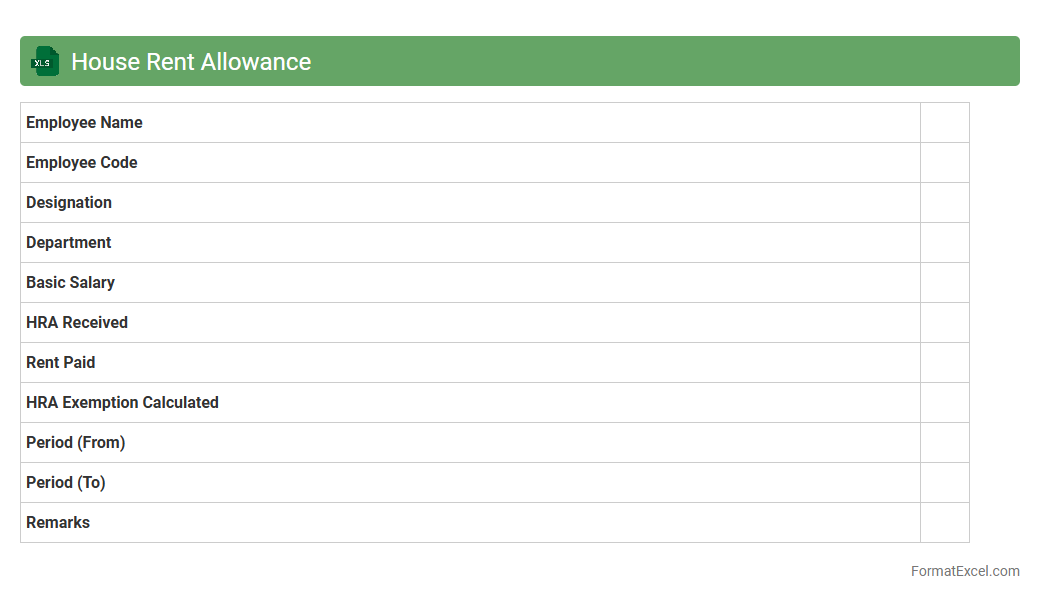

House Rent Allowance

A

House Rent Allowance Excel document is a structured spreadsheet designed to calculate and manage HRA benefits efficiently. It helps employees and employers accurately track rent payments, exemption limits, and taxable amounts for seamless payroll processing. This tool improves financial planning by providing clear insights into HRA components and compliance with tax regulations.

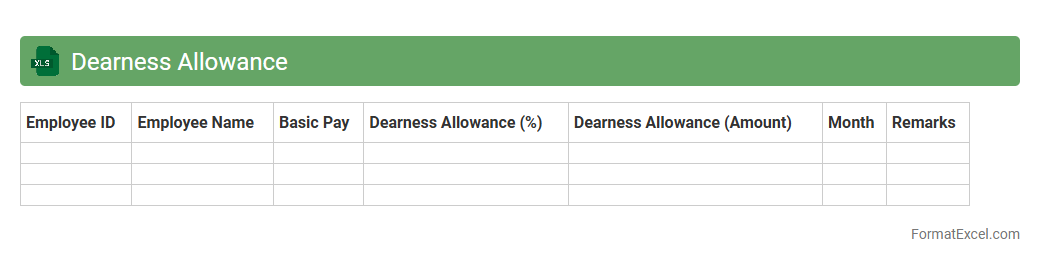

Dearness Allowance

A

Dearness Allowance (DA) Excel document is a specialized spreadsheet designed to calculate and track the periodic adjustments in the cost of living allowance provided to employees. It automates the computation of DA based on formulas linked to inflation indices, ensuring accurate salary updates and financial planning. This tool is invaluable for HR professionals and accountants to maintain compliance with government regulations and streamline payroll management.

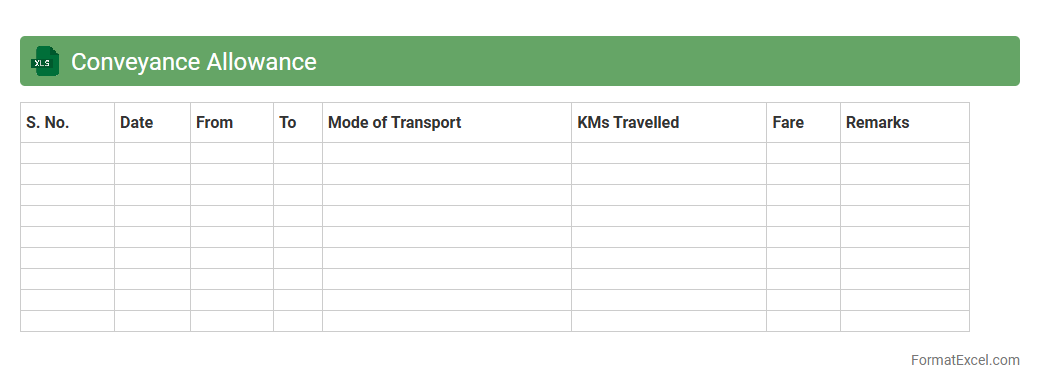

Conveyance Allowance

The

Conveyance Allowance Excel document is a structured spreadsheet designed to calculate and manage transportation reimbursements for employees efficiently. It automates distance tracking, expense entries, and allowance calculations, reducing manual errors and saving time for HR and finance teams. This document ensures transparent and accurate conveyance claims, streamlining payroll processing and enhancing financial record management.

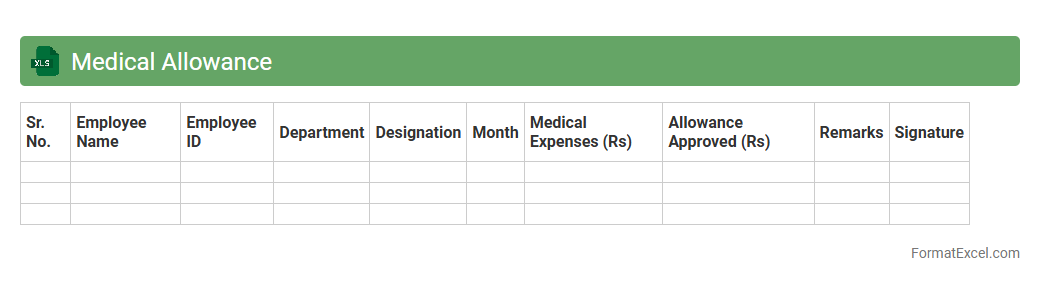

Medical Allowance

A

Medical Allowance Excel document serves as a structured tool to record, track, and manage employee medical reimbursements within an organization. It helps streamline the process of calculating eligible medical expenses, ensuring accurate disbursements aligned with company policies and compliance standards. Utilizing this document enhances financial oversight, reduces errors in claims processing, and simplifies budgeting for healthcare benefits.

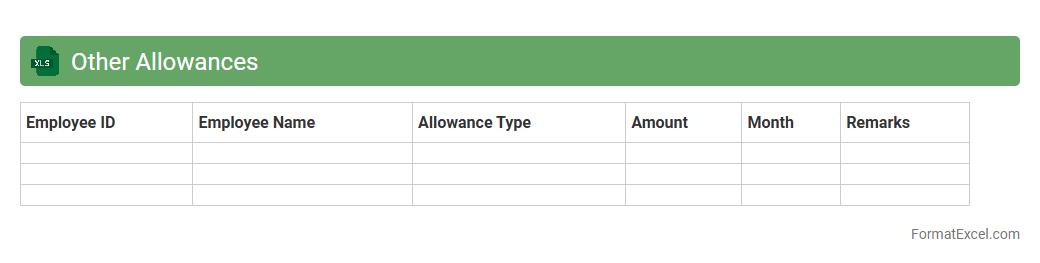

Other Allowances

The

Other Allowances Excel document serves as a comprehensive tool for tracking and managing various employee allowances beyond regular salary components. It enables efficient calculation, organization, and reporting of additional compensation elements such as bonuses, travel reimbursements, and special incentives. Utilizing this document helps maintain accurate financial records, ensures compliance with company policies, and facilitates streamlined payroll processing.

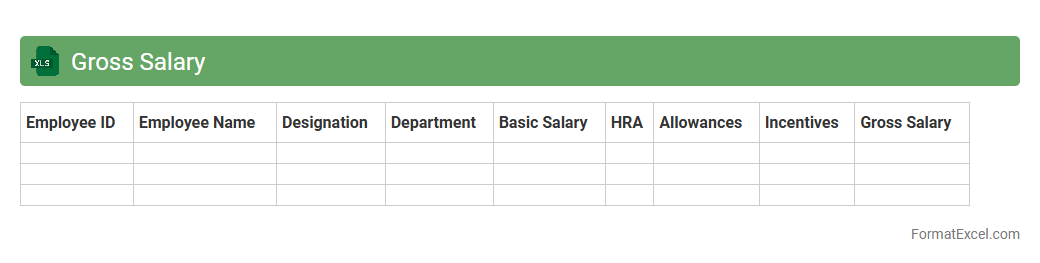

Gross Salary

A

Gross Salary Excel document is a spreadsheet designed to calculate and display an employee's total earnings before deductions such as taxes and insurance. It helps businesses and individuals accurately track monthly or annual salary components including basic pay, allowances, and bonuses. This tool ensures precise payroll management and simplifies financial planning and accounting processes.

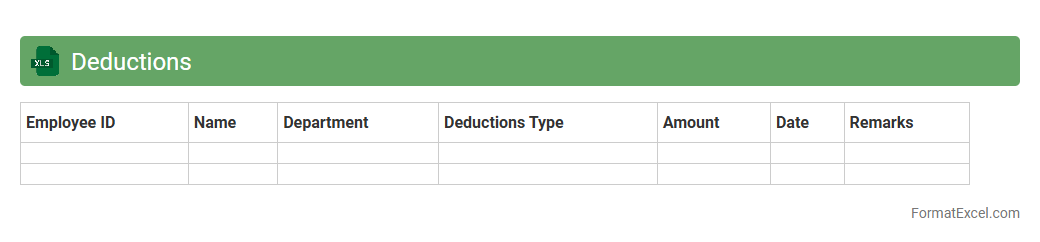

Deductions

A

Deductions Excel document is a structured spreadsheet used to record, calculate, and track various payroll deductions such as taxes, insurance, retirement contributions, and loan repayments. It streamlines financial management by providing clear visibility into the amounts deducted from employees' salaries, ensuring accuracy and compliance with regulatory requirements. This document is essential for payroll processing, budgeting, and generating reports for audits or financial planning.

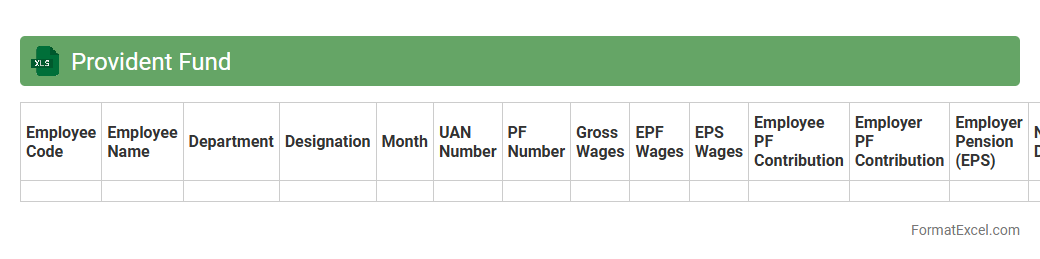

Provident Fund

A

Provident Fund excel document is a spreadsheet tool designed to calculate, track, and manage employees' provident fund contributions and balances over time. It provides accurate financial records, simplifies monthly deduction calculations, and helps monitor accumulated savings for retirement planning. This document is essential for both employers and employees to ensure compliance with provident fund regulations and facilitate transparent fund management.

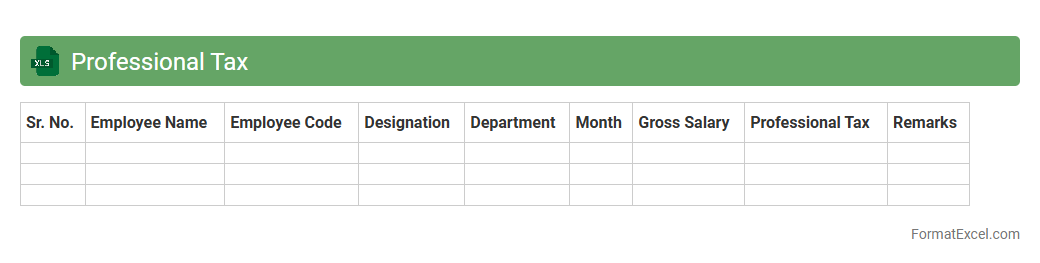

Professional Tax

A

Professional Tax Excel document is a structured spreadsheet used to calculate, track, and manage professional tax liabilities for employees or businesses as per regional tax laws. It simplifies the process of ensuring accurate deductions, compliance with government regulations, and timely payments, reducing errors and administrative burden. This tool helps organizations maintain clear records and generate reports essential for financial audits and statutory submissions.

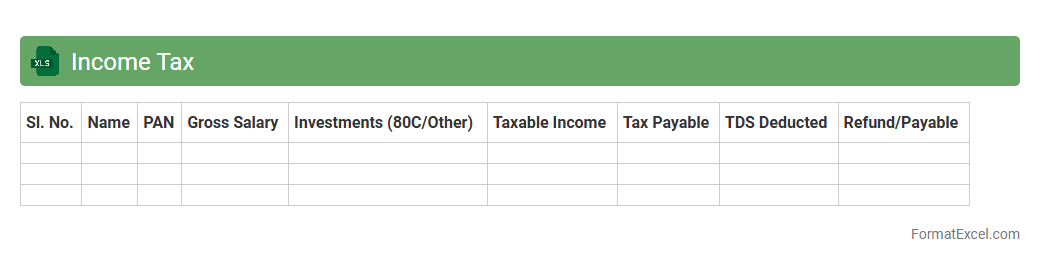

Income Tax

An

Income Tax Excel document is a spreadsheet tool designed to calculate and organize income tax liabilities based on individual or business earnings. It simplifies complex tax computations by automating formula-driven calculations such as deductions, exemptions, and tax slab rates. This document is useful for accurate tax planning, ensuring compliance with tax regulations, and providing a clear record for budgeting and financial analysis.

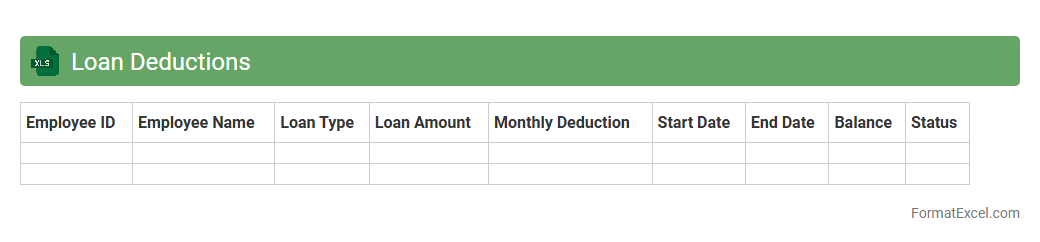

Loan Deductions

A

Loan Deductions Excel document is a spreadsheet designed to track and calculate loan repayment amounts automatically. It helps manage schedules by recording monthly deductions, interest rates, and outstanding balances, ensuring accuracy and timely payments. This tool is useful for both individuals and organizations to maintain clear financial records and avoid errors in loan management.

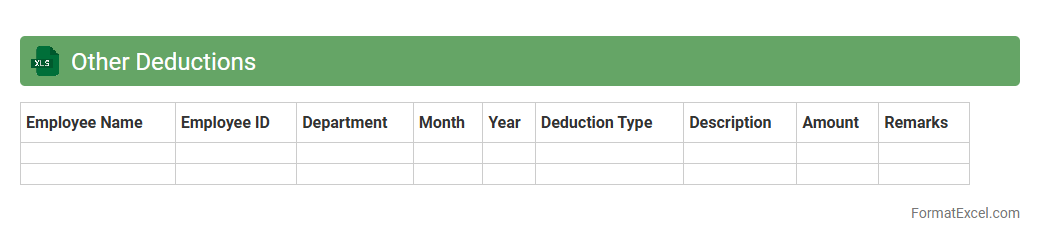

Other Deductions

The

Other Deductions Excel document is a detailed spreadsheet that tracks various non-salary deductions such as taxes, insurance, and loan repayments for employees. It provides a clear and organized view of these deductions, ensuring compliance with financial regulations and accurate payroll management. Using this document helps streamline accounting processes and improves financial transparency within the organization.

Net Salary

A

Net Salary Excel document is a spreadsheet tool designed to calculate the take-home pay of employees by deducting taxes, insurance, and other contributions from the gross salary. It provides a clear breakdown of earnings and deductions, enabling better financial planning and payroll management for both employers and employees. This document streamlines salary calculations, enhances accuracy, and saves time in payroll processing.

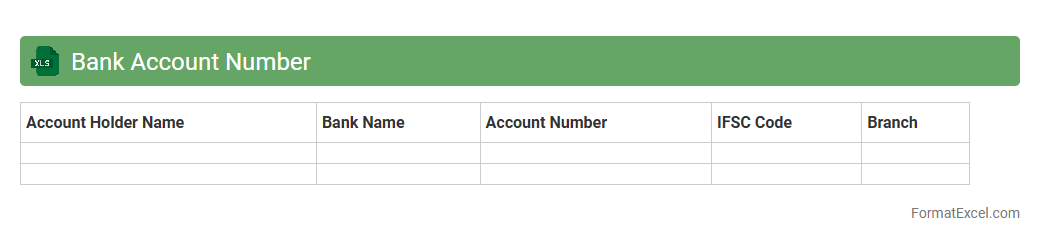

Bank Account Number

A

Bank Account Number Excel document is a structured spreadsheet containing organized records of bank account numbers and related financial data. It streamlines tracking, managing, and verifying multiple accounts efficiently, enhancing accuracy in financial processes. This document serves as a vital tool for businesses and individuals to maintain clear and secure accounts management.

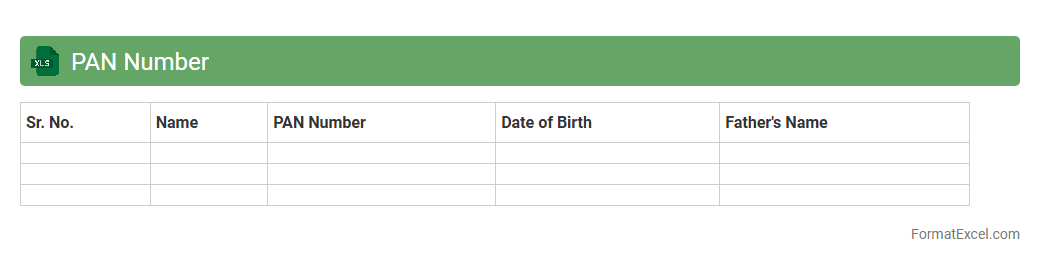

PAN Number

A

PAN Number Excel document is a structured spreadsheet that contains Permanent Account Numbers (PAN) linked with individual or business entities, enabling efficient management and quick access to tax-related information. This document is invaluable for tracking and organizing PAN details during financial audits, tax filings, and compliance checks, reducing errors and saving time. It serves as a centralized resource for businesses and tax professionals to streamline PAN verification processes and maintain accurate records for regulatory purposes.

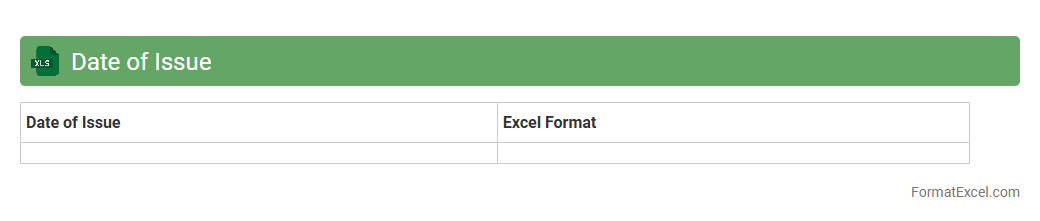

Date of Issue

The

Date of Issue in an Excel document refers to the specific date when a document, invoice, or record was officially created or released. Tracking this date helps ensure accurate record-keeping, timely processing, and compliance with deadlines or contractual obligations. Utilizing the Date of Issue allows businesses to monitor transaction timelines, manage audits efficiently, and maintain organized documentation for reference and reporting.

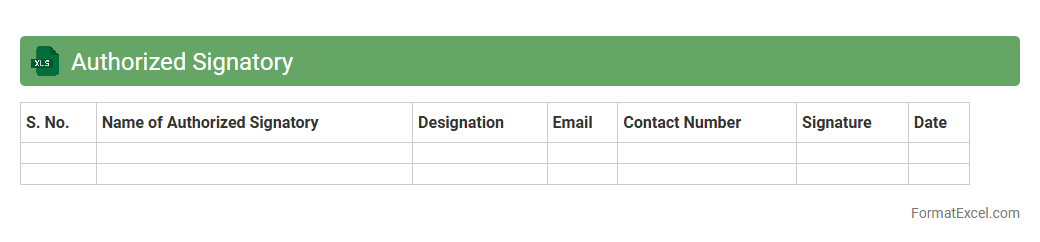

Authorized Signatory

An

Authorized Signatory Excel document is a spreadsheet used to list individuals who have the legal authority to sign documents on behalf of an organization, ensuring proper approval processes. This document helps maintain clarity and accountability by clearly specifying signatories' names, designations, and authorization limits. It is essential for compliance audits, preventing unauthorized transactions, and streamlining administrative workflows.

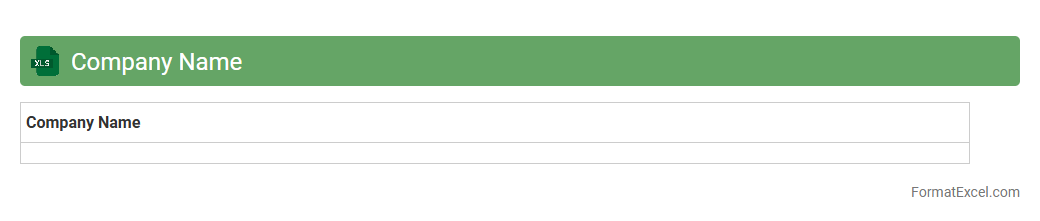

Company Name

The

Company Name Excel document is a structured spreadsheet that organizes vital company information such as employee details, financial records, project timelines, and client data. It enhances data management efficiency by enabling easy sorting, filtering, and analysis of critical business metrics, facilitating informed decision-making. Using this document helps streamline operations, improve collaboration, and maintain accurate, up-to-date records essential for operational success.

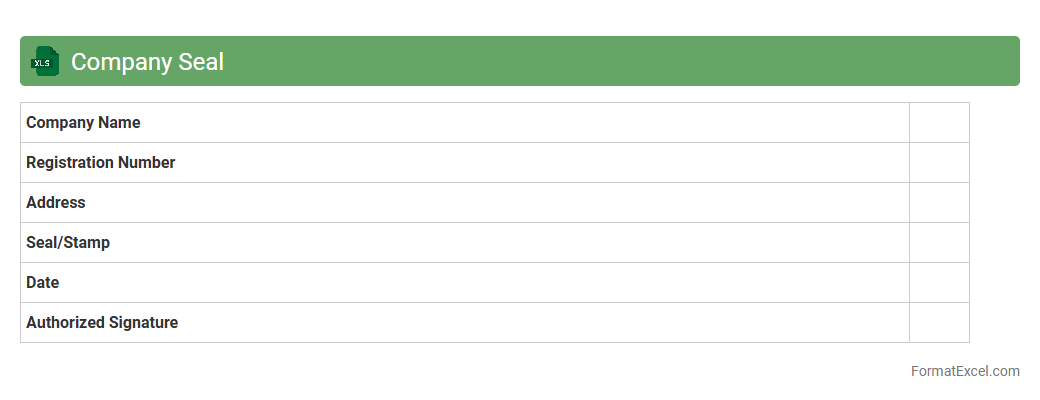

Company Seal

A

Company Seal Excel document is a digital template designed to replicate the official stamp or emblem of a company, used to authenticate documents and agreements. It streamlines the process of endorsing contracts, financial reports, and legal papers by providing a consistent, professional seal image within an accessible spreadsheet format. This tool enhances document validation, ensures compliance, and facilitates efficient record-keeping in corporate operations.

Introduction to Salary Certificate Format in Excel

A salary certificate is an official document issued by an employer to verify an employee's income. Using Excel to format this certificate ensures accuracy and ease of editing. Excel's grid structure and formulas help streamline salary calculations.

Importance of a Salary Certificate

A salary certificate acts as proof of income for various financial and legal purposes such as loan applications and visa processing. It strengthens the credibility of the employee's salary details. This document is vital for both employees and employers to maintain transparency.

Key Elements of a Salary Certificate

The certificate must include the employee's name, designation, salary breakdown, and employer details. Other crucial information includes the certificate issuance date and the authority's signature. These elements ensure the document's authenticity and completeness.

Advantages of Using Excel for Salary Certificates

Excel simplifies the creation and modification of salary certificates with its built-in formulas and templates. It minimizes errors through automated calculations and improves productivity. Additionally, Excel allows easy customization for different employee details.

Step-by-Step Guide to Creating a Salary Certificate in Excel

Begin with setting up a structured table with rows and columns for employee information and salary components. Use Excel formulas to automate gross and net salary calculations. Finally, format the certificate professionally and save it for future use.

Essential Columns and Data Fields

Include columns for employee name, ID, designation, basic pay, allowances, deductions, and net salary. Additional fields like department, date of joining, and payment period add value. Having these data fields ensures a comprehensive salary structure.

Sample Salary Certificate Format in Excel

A typical salary certificate includes the company header, employee details, salary summary, and an authorized signature line. It may also have a statement certifying the authenticity of the salary information. This sample format serves as a practical template for businesses.

Customization Tips for Excel Salary Certificate Templates

Adjust font styles, colors, and layouts to match your company branding. Add fields specific to your organization's salary structure or legal requirements. Using customization improves the professionalism and relevance of the document.

Common Mistakes to Avoid in Salary Certificates

Avoid incomplete or incorrect employee details, absence of official signatures, and unclear salary breakdowns. Ensure all calculations are accurate and the document is dated correctly. Eliminating these mistakes enhances the certificate's validity.

Download Free Salary Certificate Format in Excel

Free downloadable salary certificate templates in Excel are widely available online to simplify documentation processes. These templates can be tailored to suit specific company needs efficiently. Utilizing a free format saves time and ensures standard compliance.