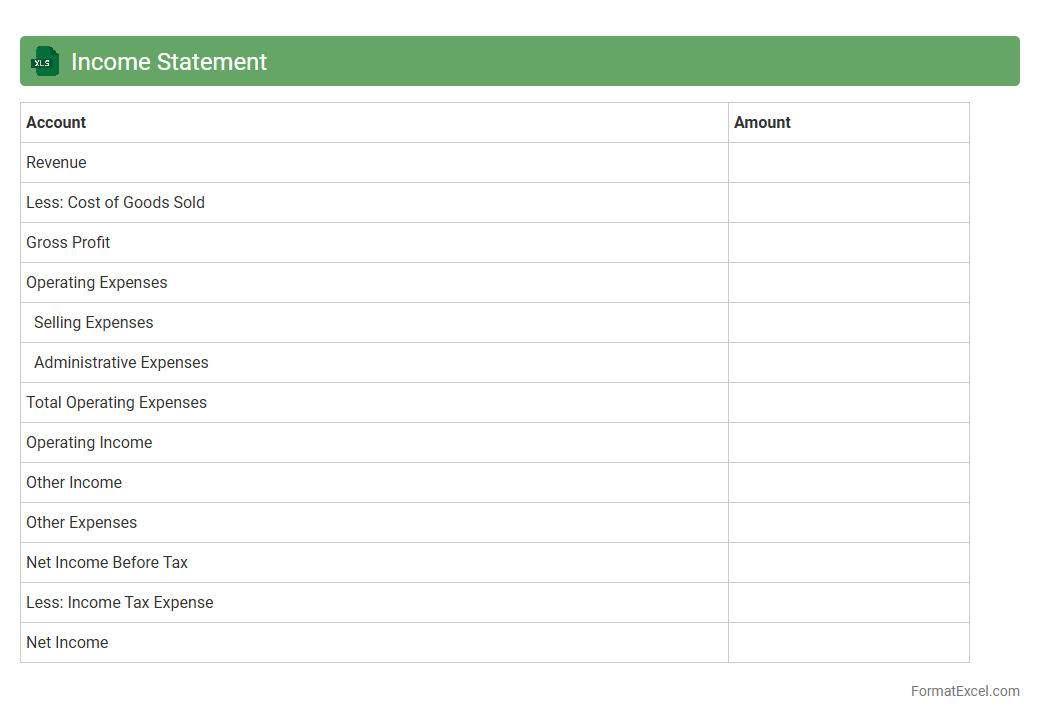

Income Statement

An

Income Statement Excel document is a spreadsheet tool designed to organize and analyze financial data, detailing revenues, expenses, and net profit over a specific period. It helps businesses and individuals track profitability, make informed budgeting decisions, and evaluate financial performance efficiently. By automating calculations and facilitating scenario analysis, this document enhances accuracy and supports strategic planning.

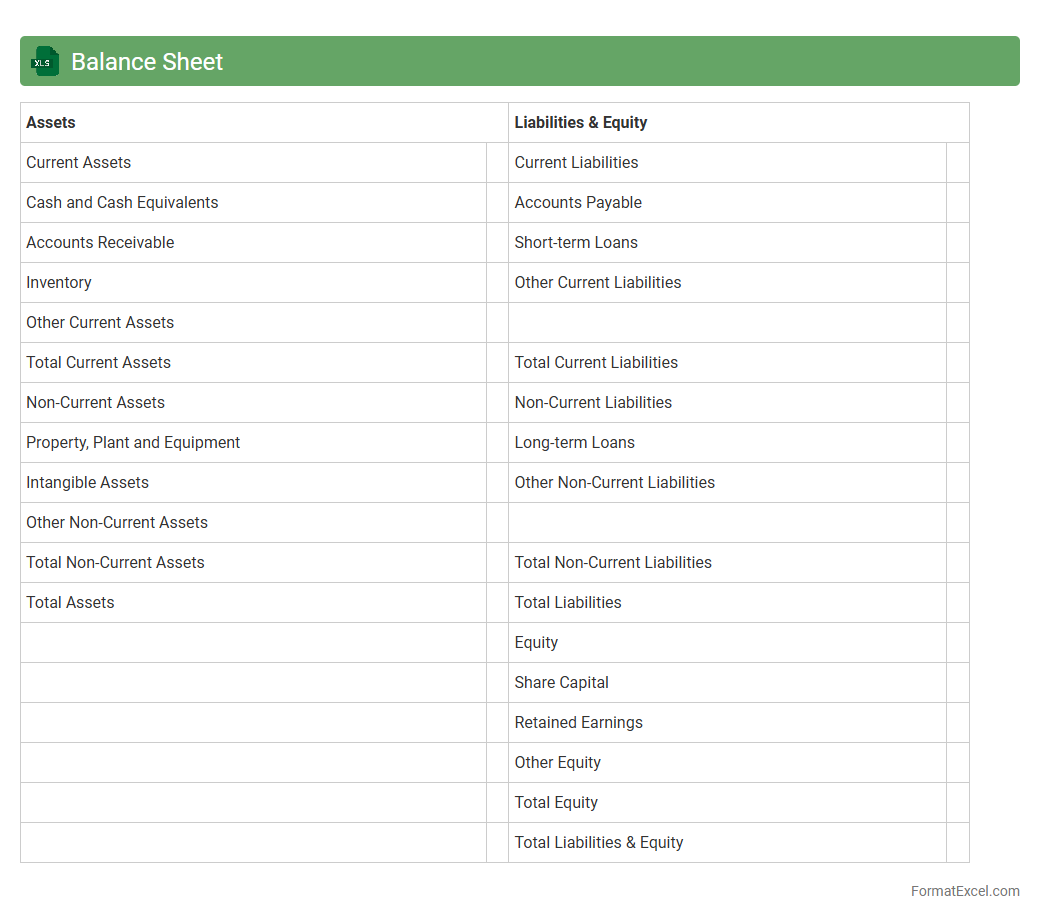

Balance Sheet

A

Balance Sheet Excel document is a financial tool that organizes and presents a company's assets, liabilities, and equity in a structured spreadsheet format. It allows businesses to easily track their financial position at a specific point in time, ensuring accurate data entry and real-time updates. This document is essential for financial analysis, budgeting, and decision-making by providing clear visibility into a company's financial health.

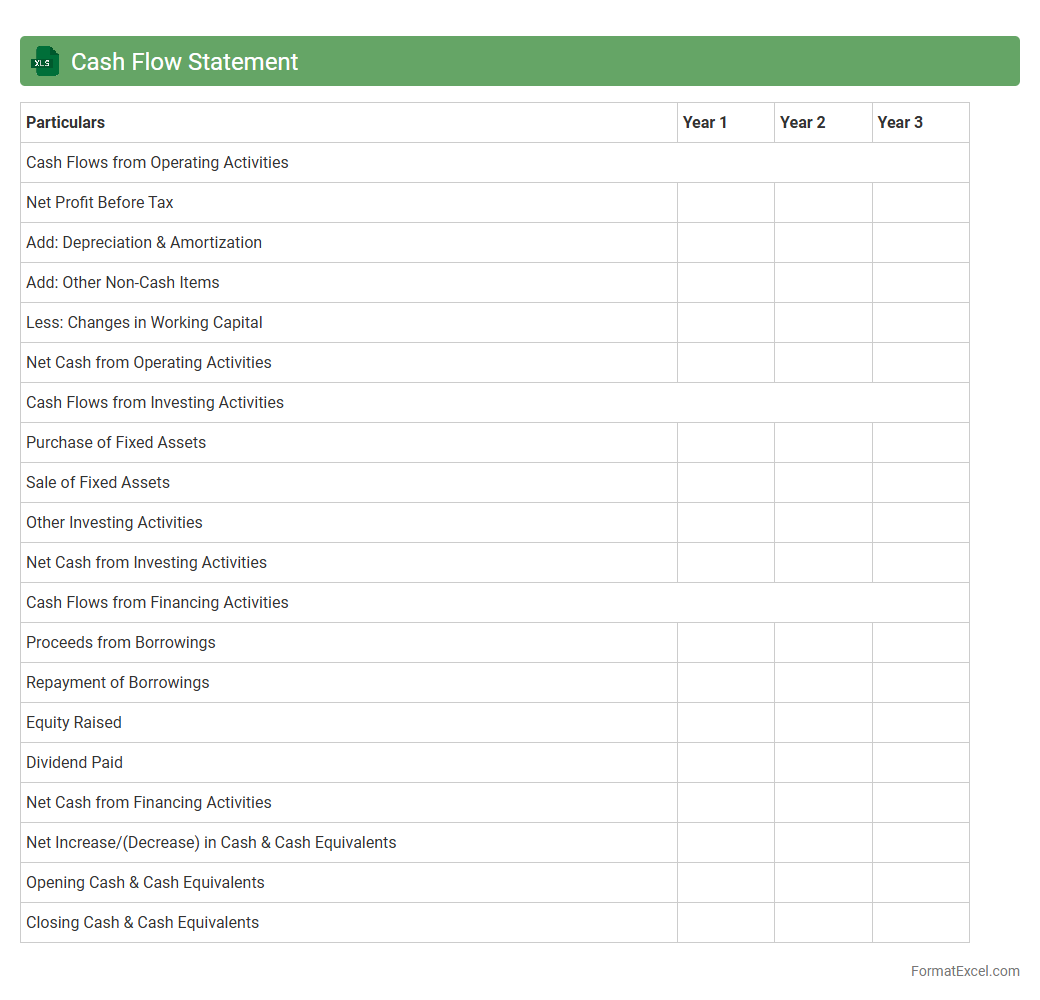

Cash Flow Statement

A

Cash Flow Statement Excel document is a financial tool used to track the inflows and outflows of cash within a business over a specific period. It helps in analyzing the liquidity, operational efficiency, and financial health by detailing cash generated from operating, investing, and financing activities. This document is essential for budgeting, forecasting cash needs, and making informed financial decisions to ensure sustainable business growth.

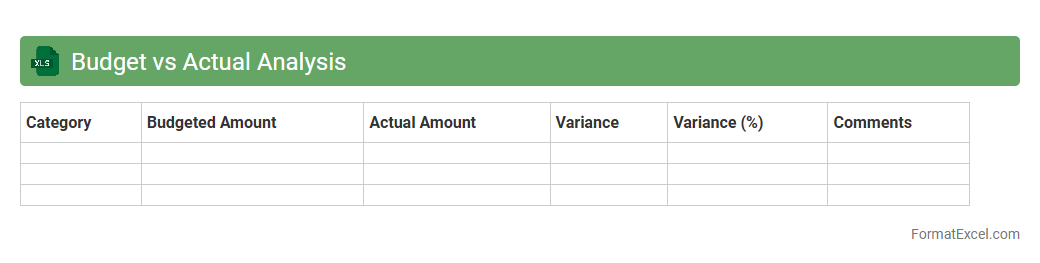

Budget vs Actual Analysis

A

Budget vs Actual Analysis Excel document tracks and compares planned financial projections against actual performance, highlighting variances in revenue, expenses, and profits. This analysis enables businesses to identify discrepancies, control costs, and make informed decisions to improve financial management. By using this tool, organizations can enhance budgeting accuracy and ensure alignment with financial goals.

Personal Net Worth Tracker

A

Personal Net Worth Tracker Excel document is a tool designed to help individuals systematically record and analyze their assets and liabilities to calculate their overall financial health. This spreadsheet facilitates tracking changes in net worth over time, offering clear insights into spending habits, investment growth, and debt reduction progress. Using this data-driven approach empowers users to make informed financial decisions and achieve long-term wealth-building goals.

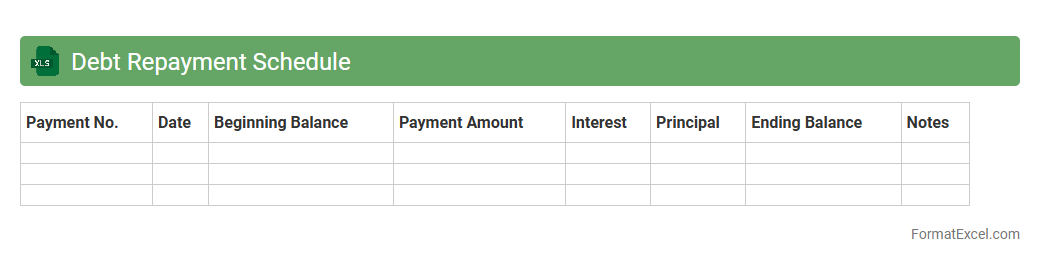

Debt Repayment Schedule

A

Debt Repayment Schedule Excel document is a structured spreadsheet designed to track and plan the repayment of loans or debts over a specific period. It details payment amounts, due dates, interest rates, and remaining balances, enabling users to visualize their debt reduction progress clearly. This tool helps individuals and businesses manage cash flow effectively, avoid missed payments, and strategize accelerated debt payoff to save on interest costs.

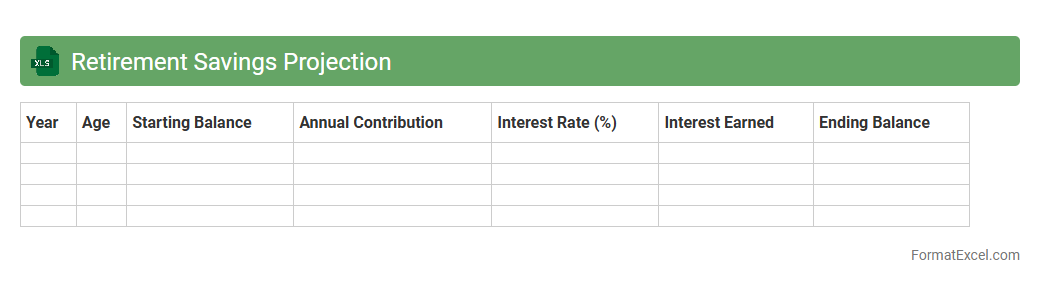

Retirement Savings Projection

A

Retirement Savings Projection Excel document estimates future retirement funds by analyzing current savings, expected contributions, interest rates, and inflation. It helps users visualize potential financial outcomes, enabling informed decisions for adequate retirement planning. This tool is essential for setting realistic retirement goals and adjusting saving strategies accordingly.

Investment Portfolio Tracker

An

Investment Portfolio Tracker Excel document is a digital tool designed to organize, monitor, and analyze various investment assets such as stocks, bonds, and mutual funds in one place. It helps investors track real-time portfolio performance, calculate returns, and manage asset allocation efficiently. Using this tracker enhances decision-making by providing clear insights into investment growth, risk levels, and diversification.

Expense Tracker

An

Expense Tracker Excel document is a digital tool designed to monitor and record daily, weekly, or monthly expenditures systematically. It helps users categorize expenses, analyze spending patterns, and maintain budgets efficiently, empowering better financial decisions and preventing overspending. By offering customizable templates and real-time summaries, this tool simplifies financial management for individuals and businesses alike.

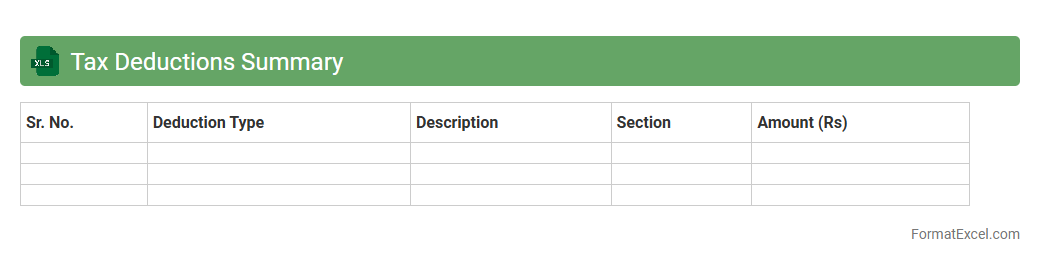

Tax Deductions Summary

A

Tax Deductions Summary Excel document organizes and consolidates all deductible expenses, enabling precise tracking of tax-deductible items throughout the fiscal year. This tool simplifies calculating total deductions, ensuring accurate tax filings and maximizing potential refunds or savings. By providing a clear overview of deductible categories, it assists individuals and businesses in maintaining compliance and optimizing their tax planning strategies.

Emergency Fund Tracker

An

Emergency Fund Tracker Excel document is a financial tool designed to help individuals monitor and manage their savings for unexpected expenses. It allows users to set target amounts, track monthly contributions, and analyze progress over time to ensure they have adequate funds during emergencies. This organized approach promotes financial security and reduces stress by providing clear visibility into emergency savings status.

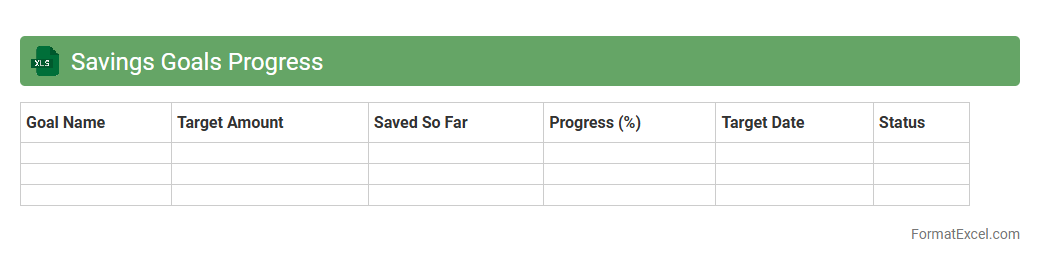

Savings Goals Progress

The

Savings Goals Progress Excel document is a structured tool designed to track and visualize your savings targets over time, allowing for clear monitoring of financial milestones. It helps users break down large financial objectives into manageable increments, providing motivation and accountability through detailed progress charts and customizable timelines. This document enhances personal financial planning by offering actionable insights into spending habits and encouraging consistent savings behavior.

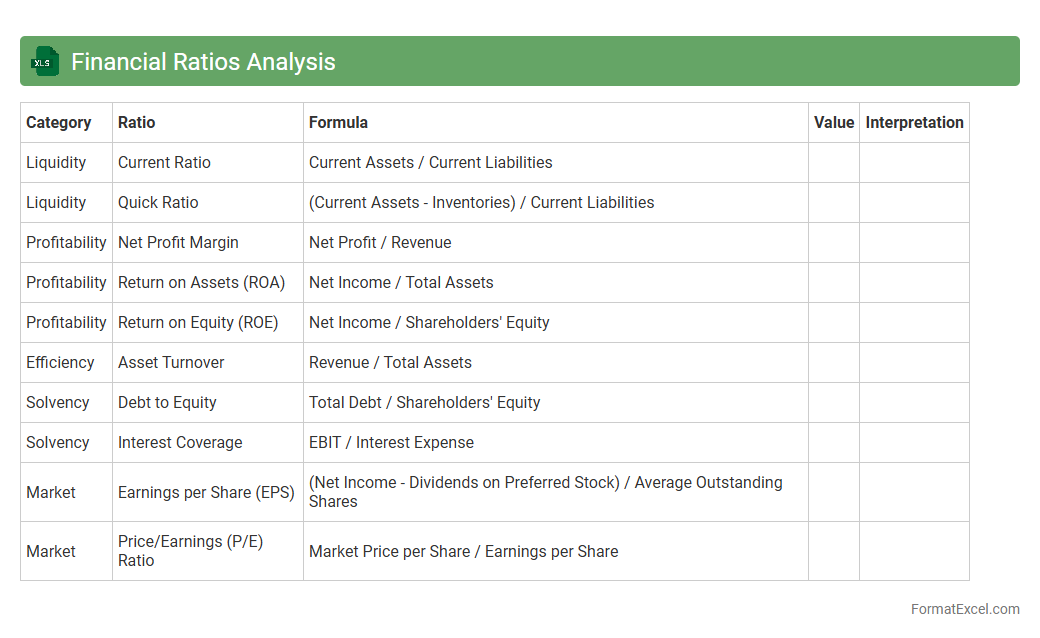

Financial Ratios Analysis

Financial Ratios Analysis excel document is a powerful tool that organizes and calculates key financial metrics such as liquidity, profitability, and solvency ratios to assess a company's performance. This document enables investors, managers, and analysts to quickly interpret financial health, identify trends, and make informed decisions based on accurate and comparative data. Using a

Financial Ratios Analysis Excel sheet streamlines the evaluation process, saving time while enhancing the precision of financial assessments.

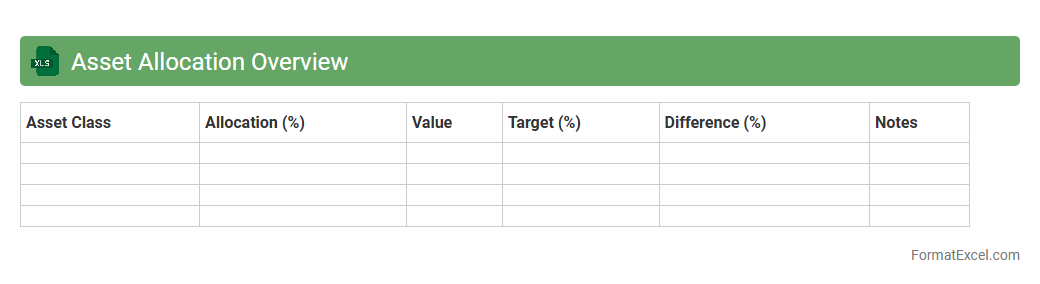

Asset Allocation Overview

The

Asset Allocation Overview Excel document provides a detailed breakdown of investments across various asset classes, helping investors visualize portfolio diversification and risk distribution. It is useful for tracking performance, rebalancing assets, and ensuring investment strategies align with financial goals. By presenting data in a clear, customizable format, it enables informed decision-making and efficient portfolio management.

Charitable Contributions Tracker

A

Charitable Contributions Tracker Excel document is a structured tool designed to record and organize donations made to various charities throughout the year. It helps individuals and organizations maintain accurate records for tax deduction purposes, ensuring compliance with IRS regulations and simplifying year-end financial reviews. By tracking donation dates, amounts, and recipient details, this spreadsheet enhances financial transparency and supports efficient budget planning for future charitable giving.

College Savings Tracker

The

College Savings Tracker Excel document is a financial tool designed to monitor and manage contributions toward a college fund. It provides a clear overview of savings progress, helping users stay on track with their educational financial goals by tracking deposits, interest earned, and target amounts. This organized approach ensures effective planning and timely adjustments to meet future college expenses efficiently.

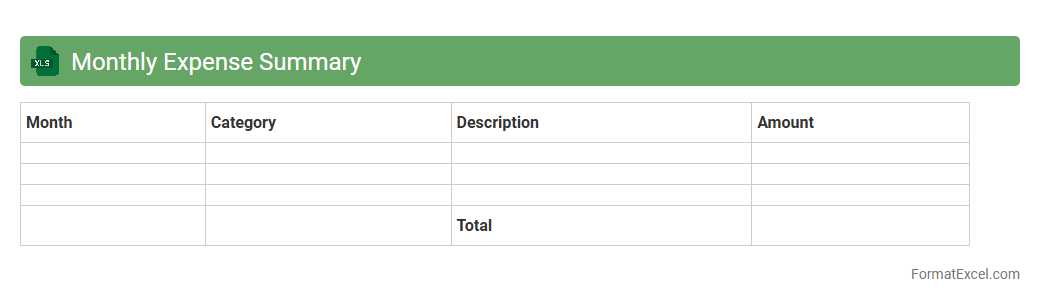

Monthly Expense Summary

The

Monthly Expense Summary Excel document is a structured tool designed to track and categorize all expenses incurred within a month, providing clear insights into spending patterns. It helps users identify areas where costs can be minimized and supports budget management by presenting detailed expenditure data in an easily understandable format. This document is essential for improving financial decision-making and maintaining control over personal or business finances.

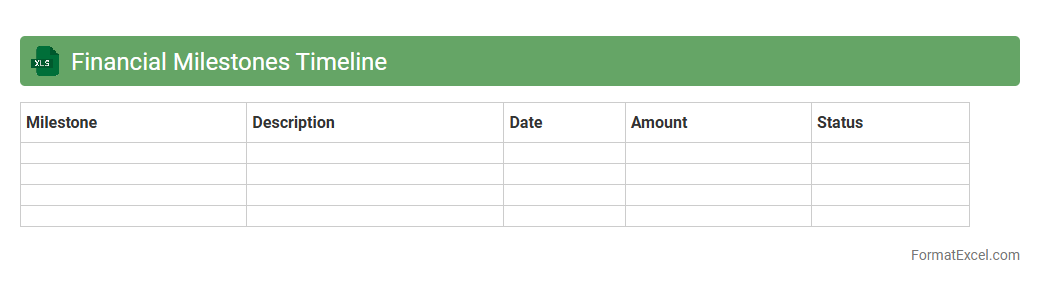

Financial Milestones Timeline

A

Financial Milestones Timeline Excel document is a structured spreadsheet designed to track key financial goals and deadlines over a specified period. It helps individuals and businesses organize and monitor progress on budget targets, investment plans, debt repayments, and revenue benchmarks. This tool enhances financial planning by providing clear visualization of upcoming milestones, enabling timely adjustments and informed decision-making.

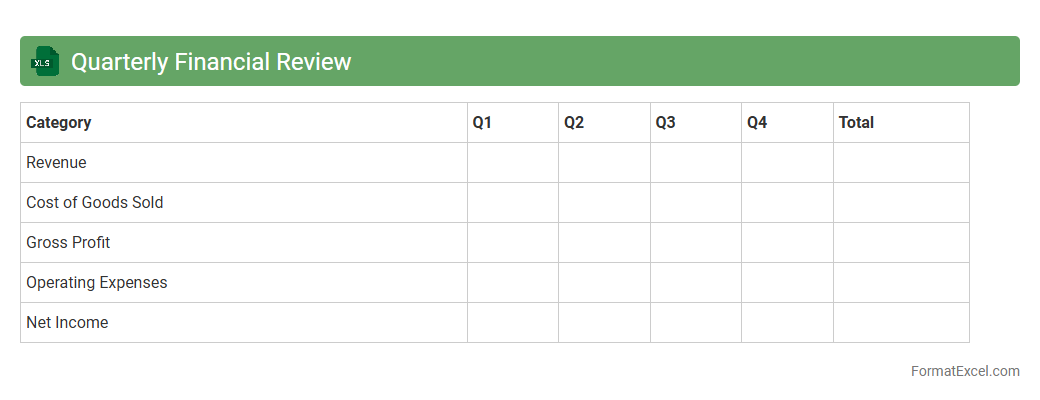

Quarterly Financial Review

A

Quarterly Financial Review Excel document is a structured spreadsheet designed to track and analyze a company's financial performance every three months, including revenue, expenses, profits, and key financial ratios. It provides clear visibility into financial trends, enabling timely identification of potential issues and areas for cost optimization. Using this document helps businesses make informed strategic decisions by offering a comprehensive snapshot of financial health and operational efficiency.

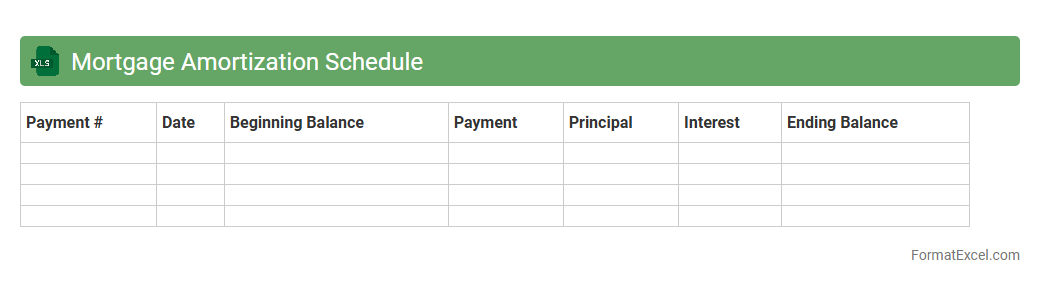

Mortgage Amortization Schedule

A

Mortgage Amortization Schedule Excel document is a detailed table that breaks down each mortgage payment into principal and interest components over the loan term. It allows homeowners to track the gradual payoff of their mortgage balance, visualize interest costs, and plan their finances effectively. Using this schedule helps optimize repayment strategies and improves understanding of long-term financial commitments.

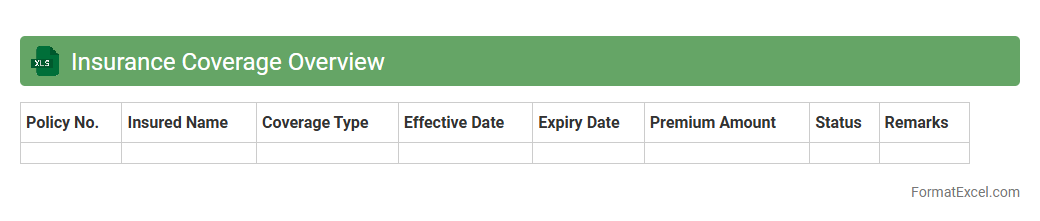

Insurance Coverage Overview

The

Insurance Coverage Overview Excel document provides a comprehensive summary of insurance policies, including coverage types, limits, premiums, and expiration dates. It helps users track and manage multiple insurance plans efficiently, ensuring all necessary protections are active and up-to-date. This tool is essential for risk management and financial planning by offering clear visibility into insurance status and gaps.

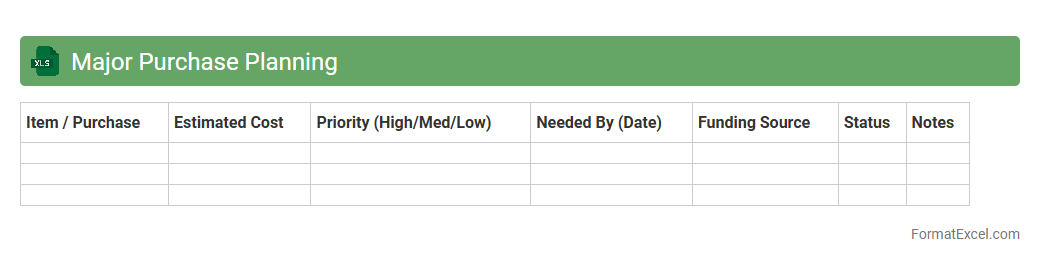

Major Purchase Planning

The

Major Purchase Planning Excel document serves as a comprehensive tool to organize and track significant expenditures, ensuring financial discipline and strategic decision-making. By detailing purchase timelines, budgets, and priorities, it helps users avoid impulse buying and manage cash flow efficiently. This spreadsheet enhances transparency and accountability, making it easier to forecast expenses and align purchases with long-term financial goals.

Health Savings Account Tracker

A

Health Savings Account Tracker Excel document is a digital tool designed to help individuals manage and monitor their HSA contributions, expenses, and balances efficiently. It provides a clear overview of deposits, withdrawals, and medical expense reimbursements, ensuring accurate record-keeping for tax purposes. Using this tracker simplifies financial planning by offering real-time insights into available funds for qualified healthcare costs.

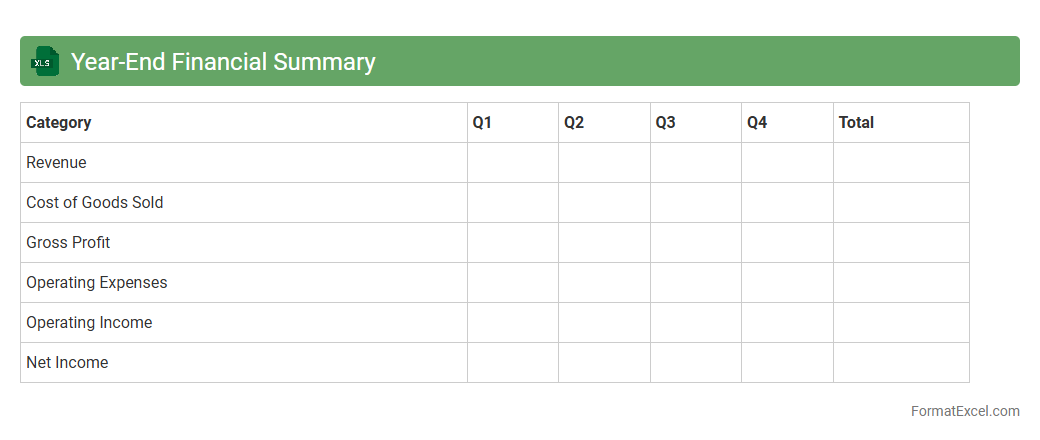

Year-End Financial Summary

A

Year-End Financial Summary Excel document consolidates all financial transactions, including income, expenses, assets, and liabilities, over a fiscal year. It enables accurate analysis of a company's financial health, supports tax preparation, and assists in strategic planning. This document enhances decision-making by providing a clear, organized view of annual financial performance.

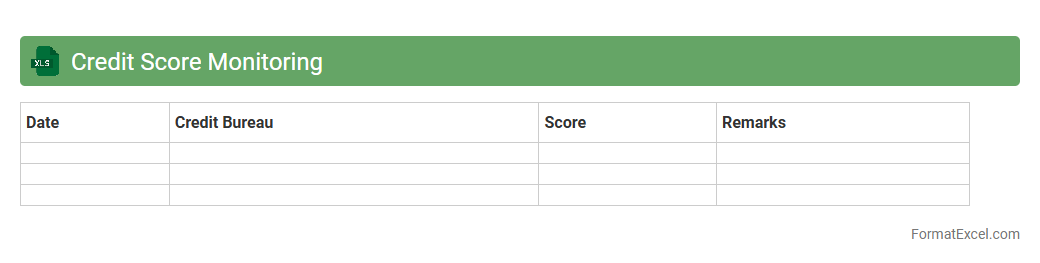

Credit Score Monitoring

A

Credit Score Monitoring Excel document is a tool designed to track and analyze changes in your credit score over time, providing a clear record of factors influencing your credit health. It helps users identify trends, detect potential errors, and make informed financial decisions by visualizing data from credit reports. Regular use of this document supports proactive credit management, improving the ability to maintain or enhance creditworthiness.

Introduction to Financial Planner Formats

Financial planner formats in Excel provide a structured way to manage personal or business finances efficiently. These formats help organize data into understandable sections for better financial planning. Excel's flexibility allows users to customize planners to fit unique financial goals.

Key Features of Excel Financial Planners

Excel financial planners typically include features like budget tracking, expense categorization, and goal setting. These tools rely heavily on formulas and charts to give a clear financial overview. Advanced planners use conditional formatting and pivot tables for dynamic data analysis.

Essential Components of a Financial Planner Spreadsheet

The core components include income sheets, expense trackers, savings goals, and debt repayment plans. Each section helps users monitor different financial aspects, ensuring comprehensive budget management. Proper labeling and categorization are crucial for ease of use and accuracy.

Step-by-Step Guide to Creating a Financial Planner in Excel

Start by setting up income and expense categories in separate sheets or columns. Use Excel formulas such as SUM, IF, and VLOOKUP to automate calculations and data summaries. Finally, incorporate charts and conditional formatting to visualize financial data clearly.

Recommended Templates for Excel Financial Planners

Popular Excel templates include monthly budget planners, debt reduction planners, and investment trackers. These templates save time by providing a pre-built structure tailored for different financial needs. Selecting the right template enhances your financial management efficiency.

Customizing Your Financial Plan Layout

Personalize your Excel financial planner by adjusting categories, colors, and fonts to suit your preferences. Adding interactive elements like drop-down lists increases usability and helps avoid data entry errors. A customized layout ensures the planner aligns perfectly with your financial goals.

Tracking Income and Expenses in Excel

Accurately recording all sources of income and every expense is essential for effective budgeting. Use separate columns or sheets to classify transactions and use Excel functions to calculate totals automatically. This process improves visibility over cash flow and helps control spending habits.

Automating Financial Calculations with Excel Formulas

Formulas like SUM, AVERAGE, and IF statements automate data aggregation and conditional calculations. Automating these tasks reduces errors and saves time in managing repetitive financial calculations. Mastery of Excel formulas is key to creating a highly functional financial planner.

Tips for Maintaining and Updating Your Excel Financial Planner

Regularly update your financial planner with new transactions and review formulas for accuracy. Backup your file frequently and consider cloud storage for access across multiple devices. Consistent maintenance ensures your financial data remains reliable and up to date.

Downloadable Free Financial Planner Excel Templates

Many websites offer free Excel financial planner templates tailored for budgeting, debt tracking, and investment planning. Downloading these templates provides a solid foundation to start your personalized planner. Utilizing free resources can enhance your financial organization without upfront costs.