Account Number

An

Account Number Excel document is a spreadsheet that organizes and records unique numerical identifiers assigned to various financial accounts. This document facilitates efficient tracking, management, and reconciliation of account-related transactions, helping businesses and individuals maintain accurate financial records. It enhances data accessibility and supports automated calculations, reducing errors and saving time in financial analysis.

Transaction Date

The

Transaction Date in an Excel document refers to the specific date when a financial or business transaction occurs, recorded in a date format within a spreadsheet. This data point is essential for tracking the timing of sales, purchases, or other financial activities, enabling users to analyze transaction patterns over time. Accurate transaction dates facilitate effective financial reporting, budgeting, and auditing by providing chronological context to the recorded data.

Description

A

Description Excel document is a structured spreadsheet that organizes detailed information about various data points, products, or processes in a clear and concise manner. It enhances data management by allowing users to easily analyze, filter, and visualize key information, improving decision-making and productivity. This tool is especially useful for tracking project progress, inventory details, or customer information in professional and business environments.

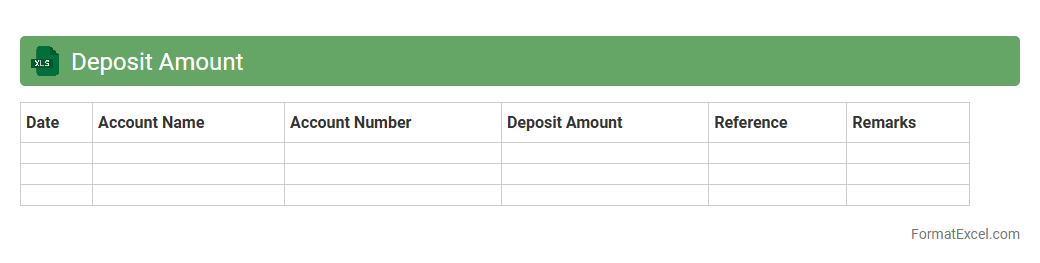

Deposit Amount

A

Deposit Amount Excel document is a spreadsheet used to systematically record and track financial deposits made into accounts over time. It helps users maintain accurate financial records, monitor transaction histories, and analyze cash flow for budgeting or auditing purposes. This tool enhances financial organization and supports data-driven decision-making by providing clear visibility into deposit patterns.

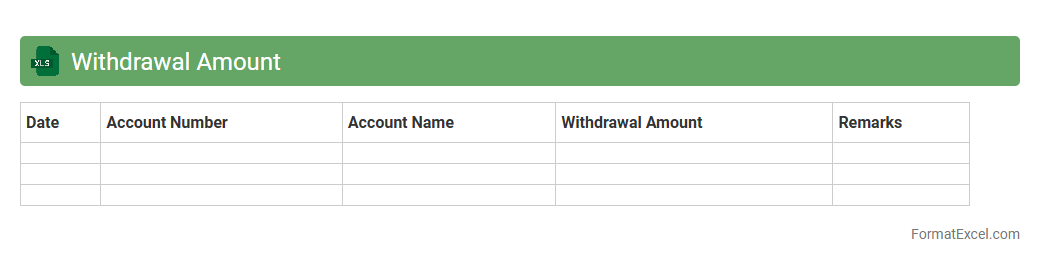

Withdrawal Amount

The

Withdrawal Amount Excel document is a structured spreadsheet designed to track and manage withdrawals from financial accounts, helping users maintain accurate records of cash flow. It enables efficient monitoring of transaction dates, amounts, and balances, which supports budgeting and financial planning efforts. By providing clear visibility into withdrawal patterns, this document assists individuals and businesses in making informed financial decisions.

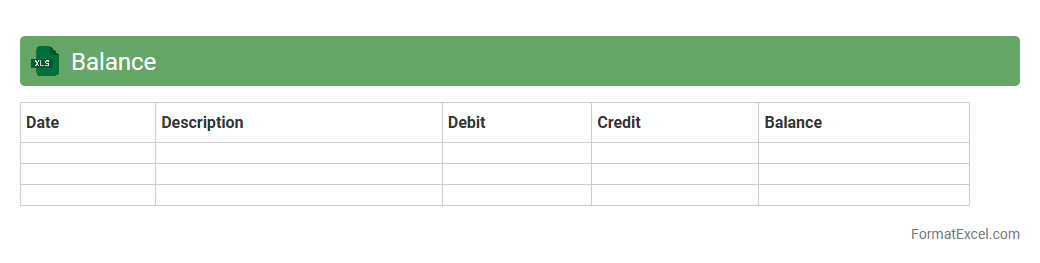

Balance

A

Balance Excel document is a spreadsheet designed to track and manage financial balances, including assets, liabilities, and equity. It allows users to organize financial data systematically, making it easier to monitor cash flow, prepare budgets, and generate financial reports. Using this tool enhances accuracy in financial analysis and supports informed decision-making for both personal and business finances.

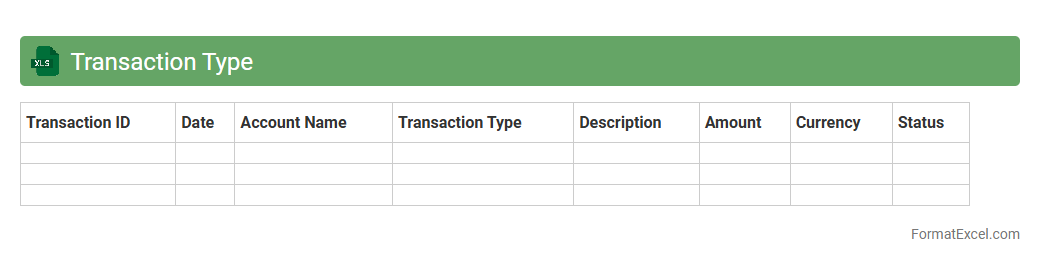

Transaction Type

A

Transaction Type Excel document organizes various financial transaction categories such as sales, purchases, refunds, and transfers, allowing for streamlined data entry and analysis. It helps businesses track and categorize financial activities efficiently, improving accuracy in reporting and decision-making. Using this document enhances financial transparency and simplifies auditing processes.

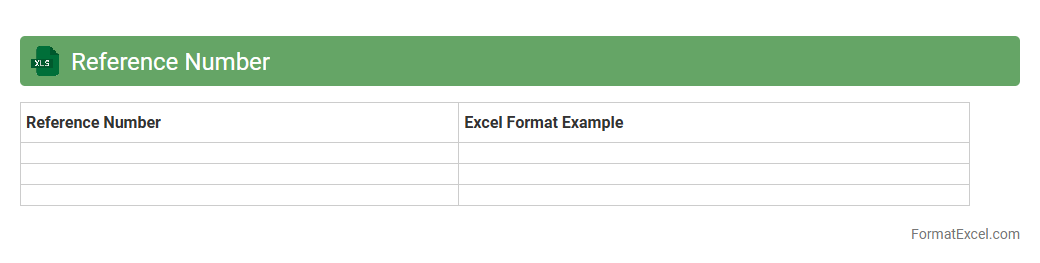

Reference Number

A

Reference Number Excel document is a spreadsheet used to assign unique identifiers to records or transactions, facilitating efficient tracking and organization. This system enhances data management by reducing errors and making retrieval of specific entries faster and more accurate. It is particularly useful in inventory control, project management, and financial auditing where precise identification is crucial.

Account Holder Name

An

Account Holder Name Excel document is a spreadsheet that organizes and stores the names of individuals or entities associated with specific account numbers, facilitating easy data management and retrieval. It is essential for businesses, banks, and financial institutions to track account details accurately, ensuring efficient customer service, transaction verification, and audit compliance. This document streamlines administrative tasks, reduces errors, and supports data analysis related to account management.

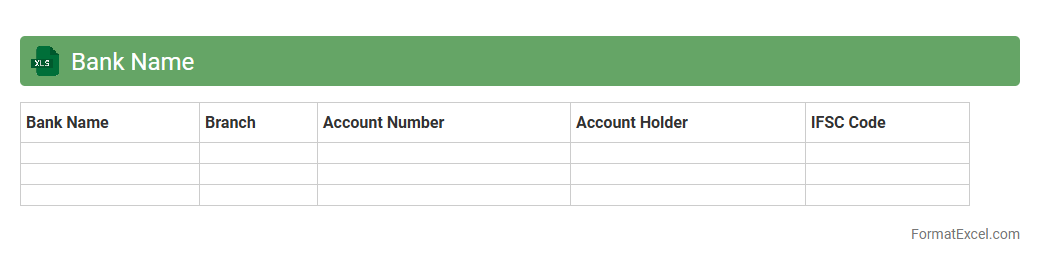

Bank Name

A

Bank Name Excel document is a structured spreadsheet listing various banks, including details like branch locations, contact information, and SWIFT codes. This document is useful for quickly referencing bank details during financial transactions, account management, or business planning. It enhances efficiency by consolidating essential banking data in one accessible format, reducing the need for manual searches.

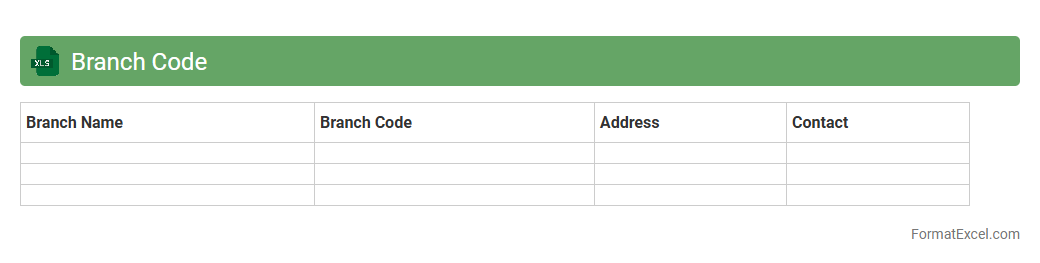

Branch Code

A

Branch Code Excel document is a structured spreadsheet containing unique identification codes for various bank branches, facilitating easy reference and management. It helps organizations and individuals quickly identify specific branches for transactions, improving accuracy in financial processes and customer service. This document is essential for streamlining operations like fund transfers, account verification, and maintaining organized banking records.

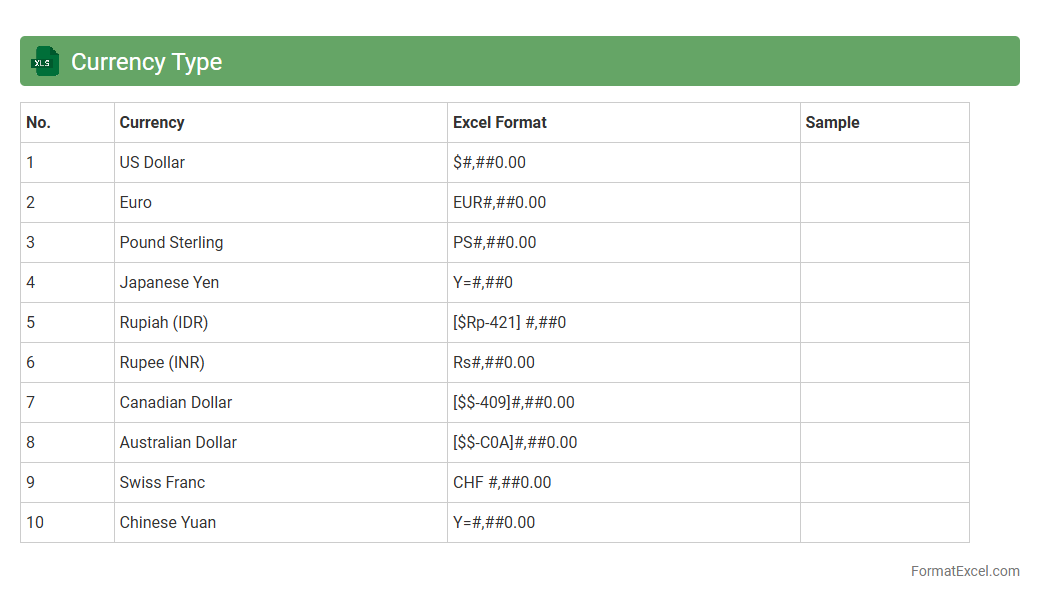

Currency Type

A

Currency Type Excel document is a spreadsheet specifically formatted to handle various currency formats, allowing users to input, calculate, and convert monetary values accurately. It is useful for financial analysis, budgeting, and reporting in multi-currency environments by automatically applying exchange rates and maintaining consistency in currency representation. This type of document enhances efficiency and accuracy when working with international financial data.

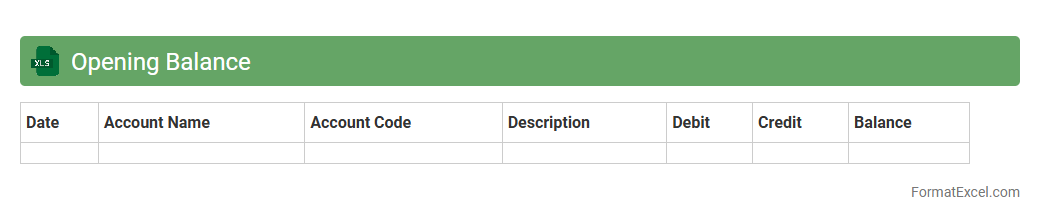

Opening Balance

The

Opening Balance in an Excel document refers to the initial amount of funds or inventory recorded at the start of a financial period. It serves as the foundation for tracking all subsequent transactions, ensuring accurate accounting and financial analysis. This balance helps businesses and individuals maintain control over their financial records by providing a clear starting point for monitoring cash flow, assets, and liabilities throughout the reporting period.

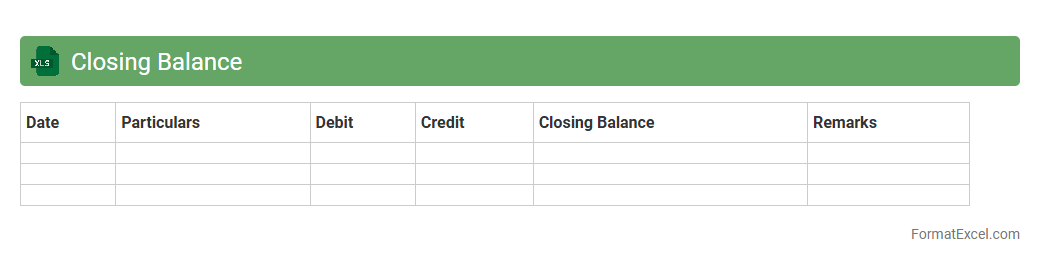

Closing Balance

A

Closing Balance Excel document is a financial record that summarizes the ending balance of accounts at the close of a specific period, essential for tracking cash flow, bank balances, and ledger summaries. It provides an accurate snapshot of financial health, enabling businesses to reconcile accounts, prepare financial statements, and make informed budgeting decisions. Utilizing this document enhances financial transparency, reduces errors, and facilitates efficient audit processes.

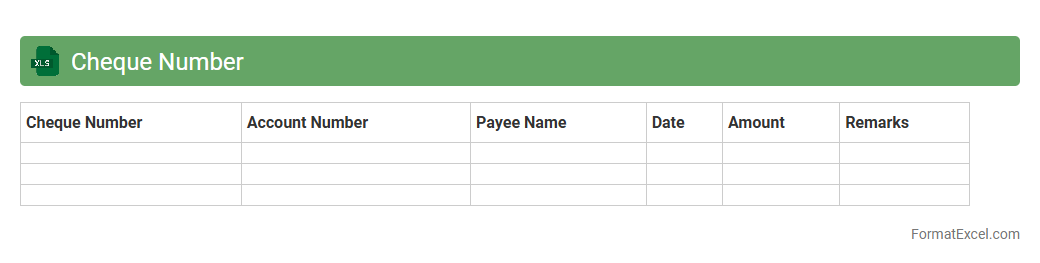

Cheque Number

A

Cheque Number Excel document is a spreadsheet designed to track and organize cheque numbers along with associated transaction details, enabling efficient financial record-keeping. It helps prevent errors such as duplicate cheque usage and simplifies reconciliation processes by offering a clear overview of issued and cleared cheques. This tool enhances accuracy in accounting and supports better cash flow management for businesses and individuals.

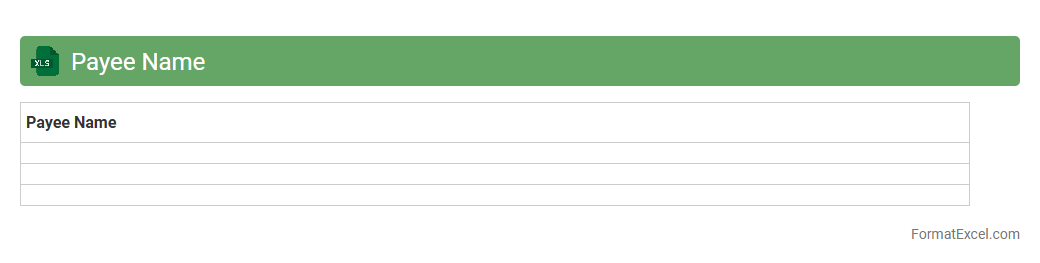

Payee Name

A

Payee Name Excel document is a spreadsheet that organizes and records the names of individuals or entities receiving payments. It serves as a centralized database for tracking payment recipients, simplifying financial management and ensuring accurate transaction records. This document is useful for streamlining payroll, vendor payments, and auditing processes, enhancing transparency and efficiency in financial operations.

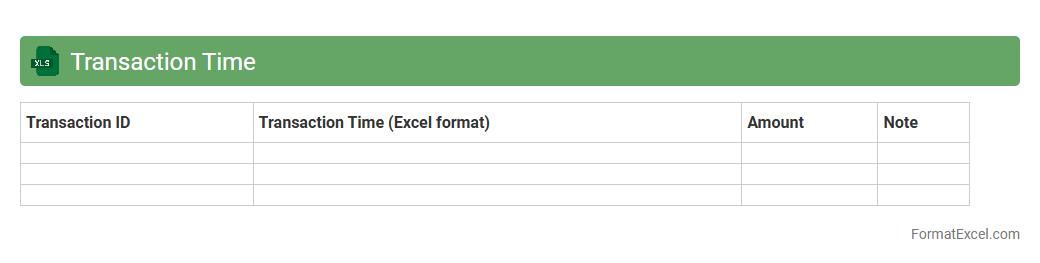

Transaction Time

A

Transaction Time Excel document records the precise timestamps of business transactions, enabling accurate tracking and analysis of operational activities. It helps organizations monitor process efficiency, identify delays, and ensure compliance with time-sensitive workflows. This data-driven approach improves decision-making and optimizes resource allocation.

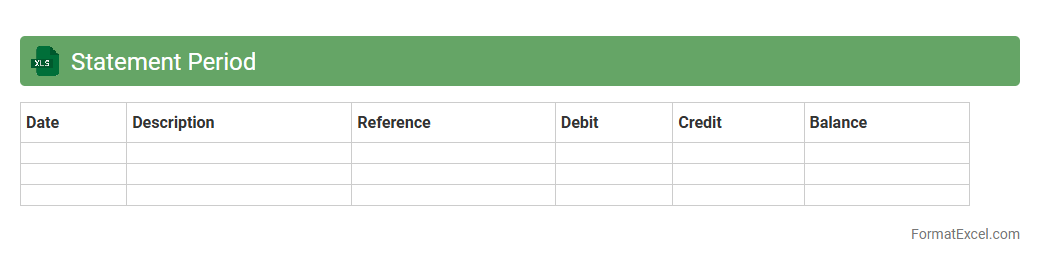

Statement Period

A

Statement Period Excel document records financial transactions within a specific timeframe, enabling easy tracking of expenses and income. It helps users reconcile bank statements, monitor cash flow, and analyze spending patterns effectively. By organizing data methodically, it ensures accurate financial reporting and better budgeting decisions.

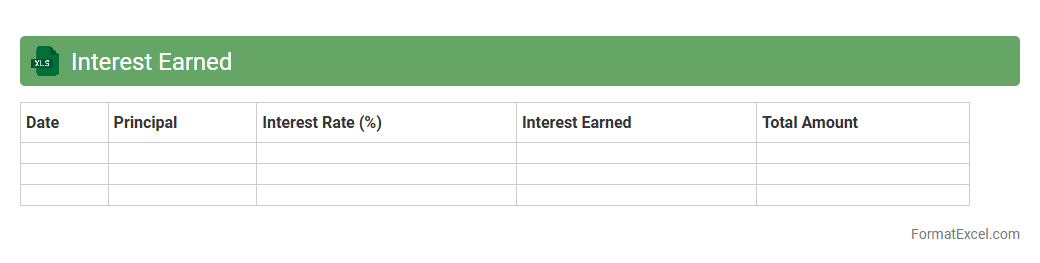

Interest Earned

An

Interest Earned Excel document tracks the interest accrued on various financial accounts, such as savings, investments, or loans. It helps users analyze earnings over time, compare different interest rates, and forecast future financial growth. This organized data supports informed decision-making for budgeting, investing, and financial planning.

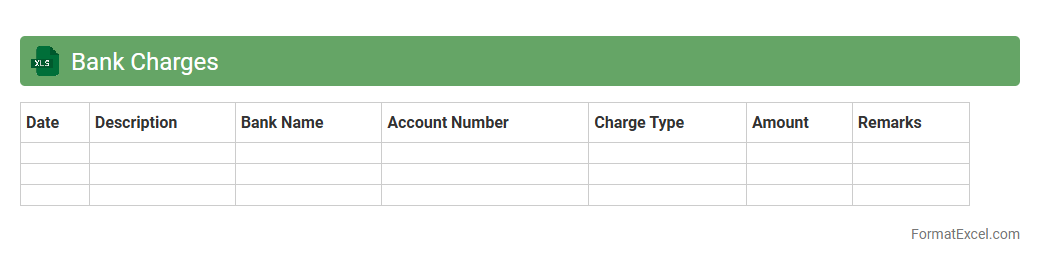

Bank Charges

A

Bank Charges Excel document is a detailed spreadsheet used to track and analyze fees imposed by banks on various transactions, such as maintenance fees, ATM charges, and overdrafts. It helps individuals and businesses monitor their expenses, identify unnecessary charges, and manage their finances more effectively. By providing a clear overview of bank-related costs, this tool supports better budgeting and financial decision-making.

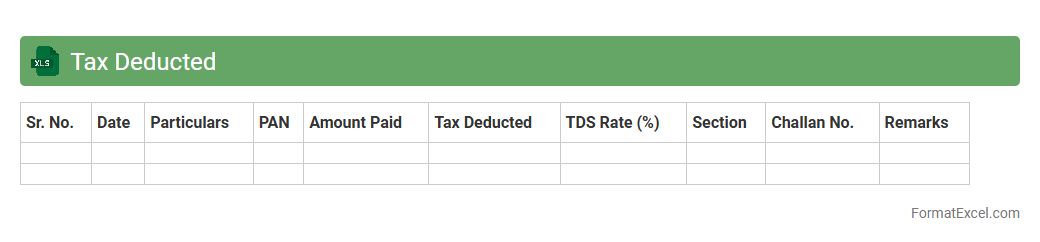

Tax Deducted

A

Tax Deducted Excel document is a structured spreadsheet used to record and calculate tax deductions from various incomes, ensuring accurate tracking of withheld taxes. It helps individuals and businesses maintain organized financial records, facilitates easy calculation of tax liabilities, and simplifies the preparation of tax returns. This document enhances compliance with tax regulations and improves financial transparency by providing a clear overview of all tax-deducted transactions.

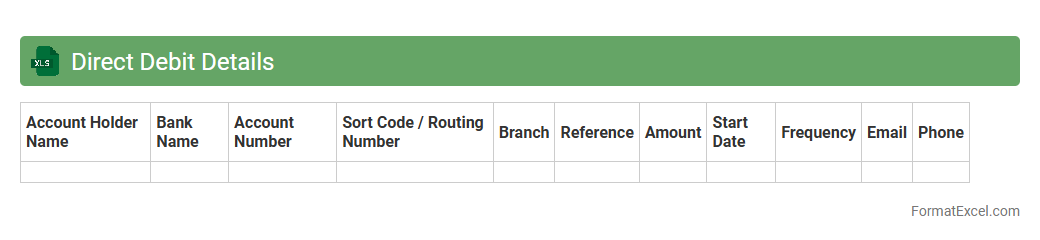

Direct Debit Details

The

Direct Debit Details Excel document is a structured file that records essential payment information such as customer bank accounts, payment amounts, and collection dates for automated transactions. This document streamlines financial management by enabling accurate tracking, reconciliation, and processing of recurring payments with minimal manual intervention. It improves cash flow forecasting, reduces errors in collections, and enhances overall efficiency in managing subscription or service fee payments.

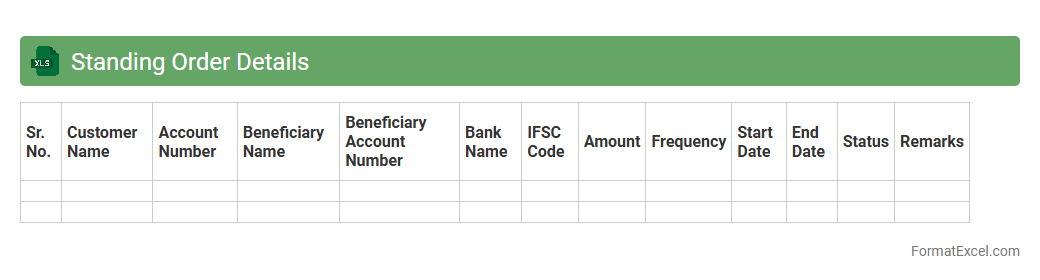

Standing Order Details

The

Standing Order Details Excel document is a structured spreadsheet that records recurring payment instructions, including beneficiary information, payment amounts, and schedules. It allows efficient tracking and management of regular transactions, ensuring timely and accurate payments without manual intervention. This document is essential for maintaining financial discipline, minimizing errors, and improving cash flow forecasting in businesses and personal finance management.

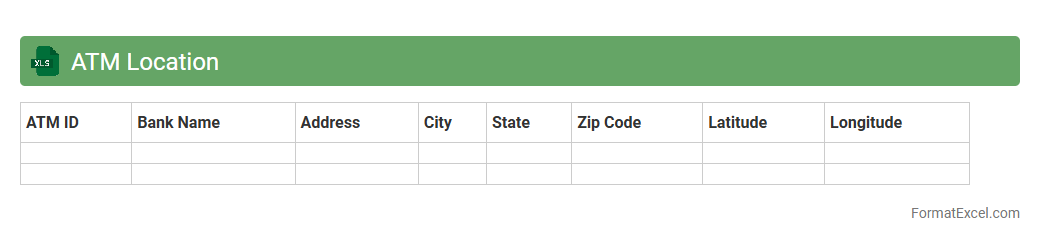

ATM Location

An

ATM Location Excel document is a structured spreadsheet that contains detailed information about automated teller machine (ATM) sites, including addresses, geographic coordinates, operating hours, and service types. This document is useful for businesses and individuals to efficiently plan cash access points, analyze market coverage, and optimize routing for cash replenishment or customer visits. Utilizing this data streamlines decision-making processes related to financial services, enhancing convenience and operational efficiency.

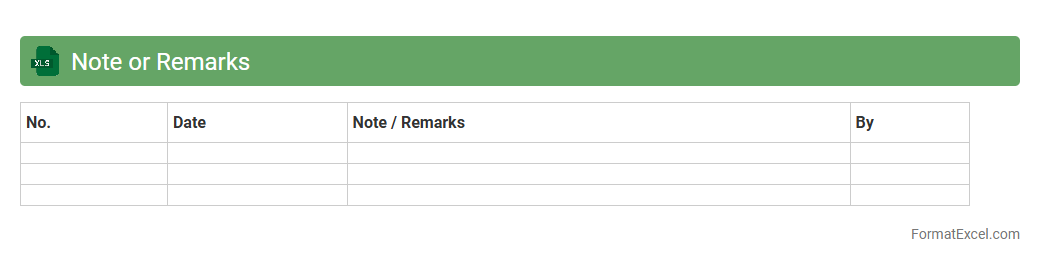

Note or Remarks

A

Note or Remarks section in an Excel document serves as a vital tool for adding additional context, explanations, or instructions related to the data without altering the main content. It helps users communicate important details, track changes, or provide clarifications that improve data accuracy and collaboration. This feature enhances document usability by making the information more comprehensive and easier to understand for all stakeholders.

Introduction to Bank Statement Record Format in Excel

Bank statement records in Excel provide a structured way to track financial transactions efficiently. Utilizing Excel enhances data management by allowing easy sorting and filtering of transactions. Understanding the bank statement record format is crucial for accurate financial analysis.

Key Components of a Bank Statement

A typical bank statement includes transaction dates, descriptions, debit and credit amounts, and running balances. These components help in reconciling accounts and monitoring cash flow. The transaction details are central to identifying each entry uniquely.

Essential Excel Columns for Bank Records

Important columns include Date, Description, Reference Number, Debit, Credit, and Balance. Proper column setup ensures clarity and ease of tracking transactions over time. The Balance column maintains a continuous record of account status.

Standardized Formatting Guidelines

Using consistent date formats, currency symbols, and text alignment improves readability. Employing table styles in Excel helps maintain a uniform appearance across all records. Standardization minimizes confusion when reviewing financial data.

Data Entry Best Practices

Always input data accurately and double-check entries to avoid errors. Use dropdown lists and data validation tools to ensure consistency in input formats. Following best practices ensures the integrity of financial records.

Sample Bank Statement Template in Excel

A sample template typically includes pre-set columns for transactions and formulas for balance calculations. Templates save time and reduce effort by providing a ready-to-use structure. Utilizing these templates promotes efficient financial record-keeping.

Tips for Automating Bank Statement Records

Excel features like macros and Power Query can automate repetitive tasks such as data import and balance updates. Automation reduces manual work and increases accuracy in record maintenance. Leveraging Excel automation tools optimizes workflow efficiency.

Common Errors to Avoid in Excel Formatting

Avoid mismatched date formats, incorrect formulas, and inconsistent currency symbols. Such errors can lead to inaccurate financial reports and difficulties in reconciliation. Prevention of these mistakes preserves the accuracy of bank statements.

Security and Confidentiality Measures

Protect sensitive bank data by password-protecting Excel files and restricting access. Implementing encryption and backing up data regularly safeguards against breaches. Ensuring data confidentiality is vital for financial privacy.

Exporting and Sharing Bank Statements from Excel

Export bank statements as PDFs or CSV files for easy sharing with stakeholders or financial institutions. Ensure the format selected preserves all critical data and formatting. Proper export techniques facilitate secure and accessible document distribution.