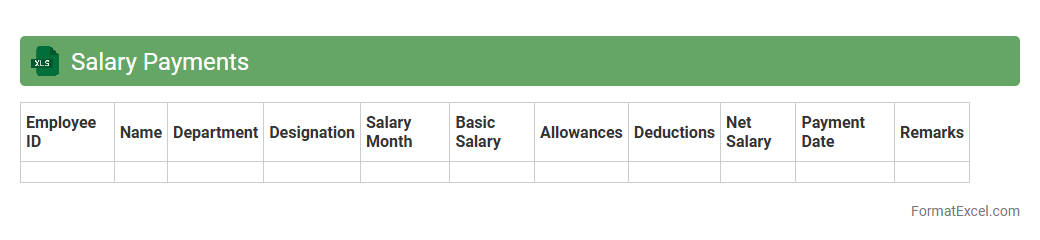

Salary Payments

A

Salary Payments Excel document is a structured spreadsheet used to record, calculate, and track employee salaries, deductions, taxes, and bonuses efficiently. It facilitates accurate payroll management by automating calculations and maintaining organized records for each pay period. This tool helps businesses ensure timely salary disbursements, maintain compliance with tax regulations, and generate detailed payment reports for financial analysis.

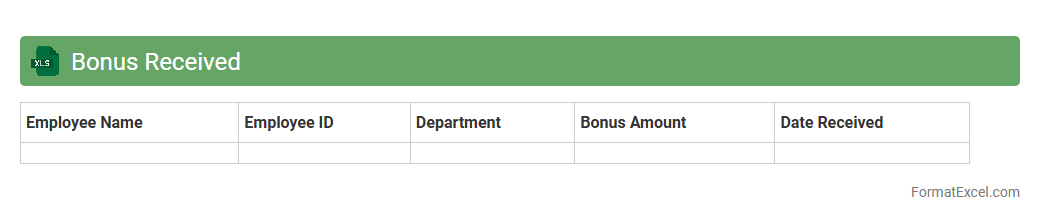

Bonus Received

The

Bonus Received Excel document is a structured spreadsheet designed to track and record bonuses earned by employees or recipients over a specific time period. It helps in maintaining accurate financial records, facilitates timely bonus calculations, and supports payroll management by organizing data such as bonus amounts, dates, and related employee information. This document improves transparency, aids in performance analysis, and ensures efficient communication between HR and finance departments.

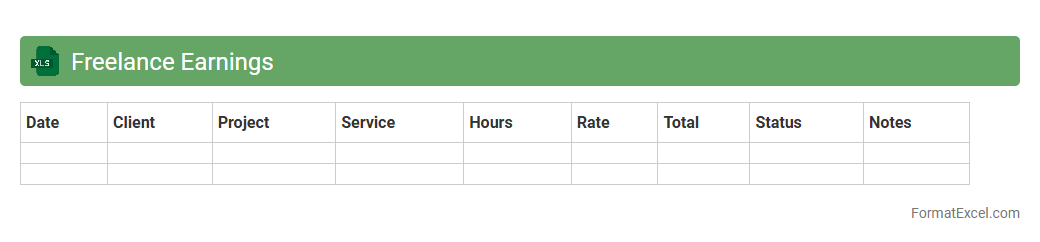

Freelance Earnings

A

Freelance Earnings Excel document is a spreadsheet tool designed to track income, expenses, and project details for freelance professionals. It helps users organize financial data by client, date, and payment status, enabling accurate income monitoring and tax preparation. This document enhances financial management by providing clear insights into earning patterns and cash flow stability.

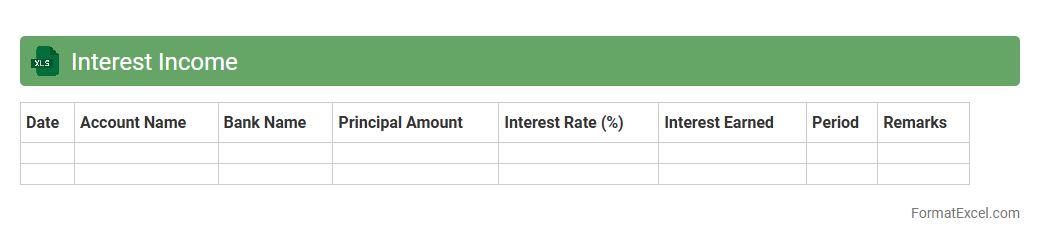

Interest Income

An

Interest Income Excel document is a financial tool designed to record, calculate, and track earnings generated from interest-bearing assets such as savings accounts, bonds, and loans. It helps users efficiently organize data, perform accurate interest computations, and analyze income trends over time for better financial decision-making. This document supports budgeting, tax preparation, and investment performance evaluation by providing clear insights into interest revenue streams.

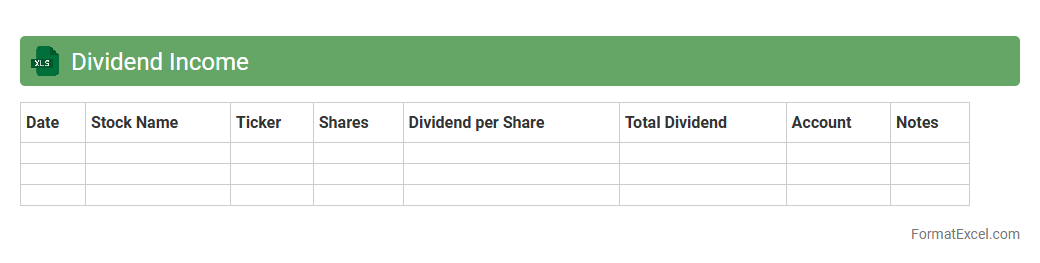

Dividend Income

A

Dividend Income Excel document is a spreadsheet designed to track and analyze dividend payments from various investments, providing a clear overview of income streams. It helps investors monitor dividend schedules, calculate total earnings, and assess portfolio performance over time. This document is essential for effective financial planning and maximizing passive income through dividend investments.

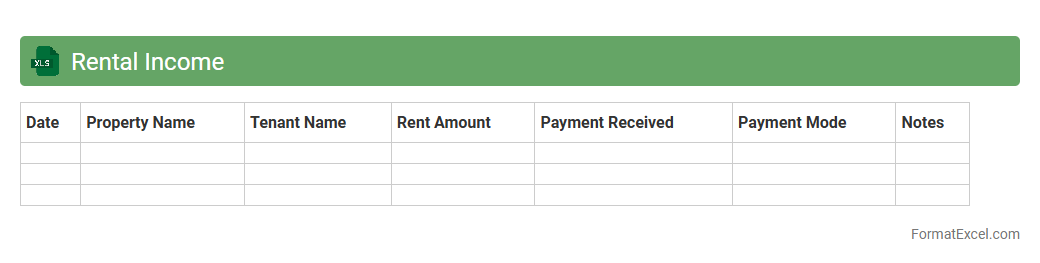

Rental Income

A

Rental Income Excel document is a spreadsheet designed to track and manage rental property earnings, expenses, and profitability. It helps landlords and property managers organize monthly rent payments, monitor cash flow, and generate financial reports for tax purposes. Using this tool improves budgeting accuracy and facilitates informed decision-making for rental property investments.

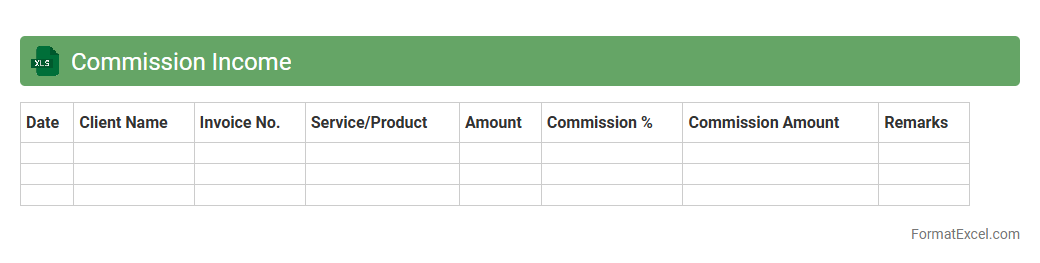

Commission Income

The

Commission Income Excel document tracks earnings generated from sales or services, detailing individual commissions, rates, and payment dates. It helps businesses monitor revenue streams, calculate total commissions accurately, and streamline financial reporting. This tool is essential for payroll management, budgeting, and ensuring transparency in compensation processes.

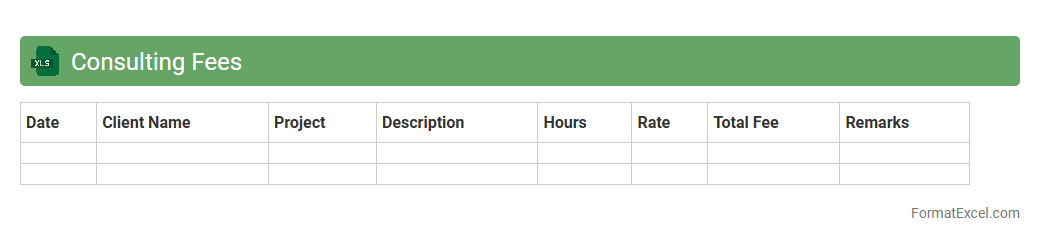

Consulting Fees

A

Consulting Fees Excel document is a structured spreadsheet designed to track, calculate, and manage payments made to consultants. It streamlines the process of monitoring invoices, hourly rates, and total compensation, ensuring accuracy and transparency in financial records. This tool enhances budgeting efficiency and simplifies financial reporting for businesses working with external consultants.

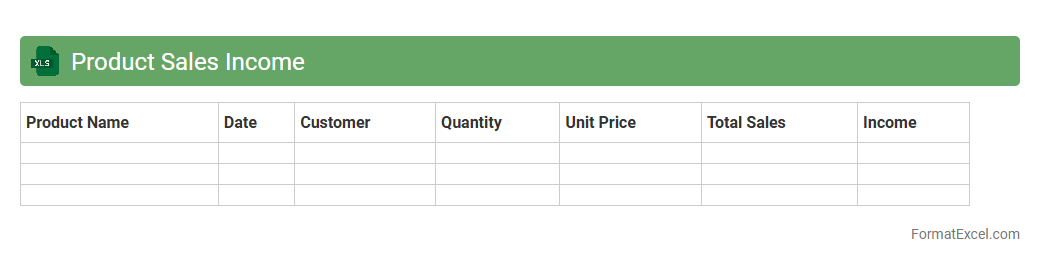

Product Sales Income

A

Product Sales Income Excel document is a structured spreadsheet used to track and analyze revenue generated from product sales over specific periods. It helps businesses monitor sales performance, calculate total income, and identify trends or best-selling products for strategic decision-making. By organizing sales data efficiently, it supports accurate financial reporting and improves inventory and marketing management.

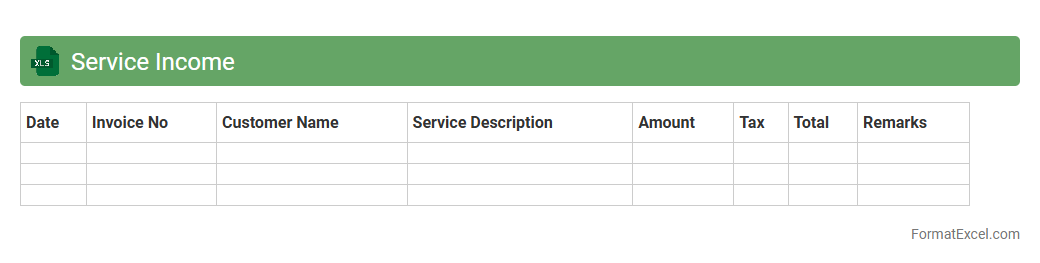

Service Income

A

Service Income Excel document is a structured spreadsheet used to record, track, and analyze income generated from various services provided by a business or individual. It helps in organizing financial data by date, client, service type, and amount, facilitating accurate revenue monitoring and reporting for accounting and tax purposes. Utilizing this document improves financial management, enhances decision-making, and ensures compliance with financial regulations.

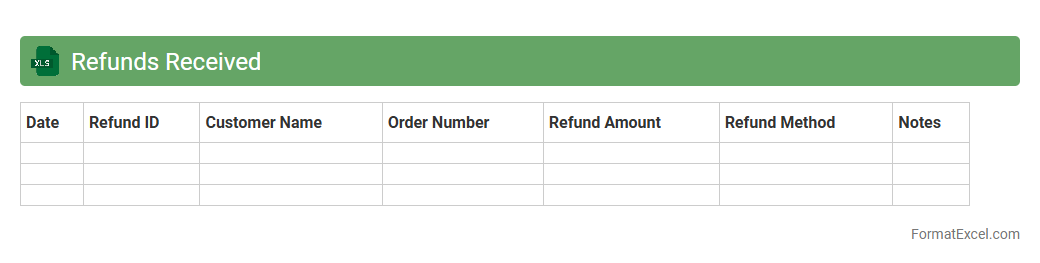

Refunds Received

The

Refunds Received Excel document is a detailed record that tracks all financial refunds processed and received by a business or individual. It helps in maintaining accurate financial statements, streamlines reconciliation of accounts, and provides clear visibility into cash flow related to returned payments. Utilizing this document improves transparency and supports effective financial management and auditing processes.

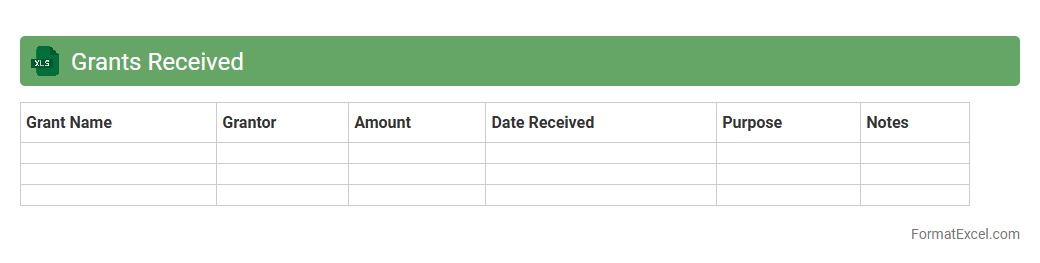

Grants Received

The

Grants Received Excel document is a detailed record of funds awarded from various sources, including government agencies, foundations, and private organizations. It helps track grant amounts, deadlines, and usage, ensuring accurate financial management and reporting. This document is essential for monitoring funding status, facilitating budget planning, and supporting compliance with grant requirements.

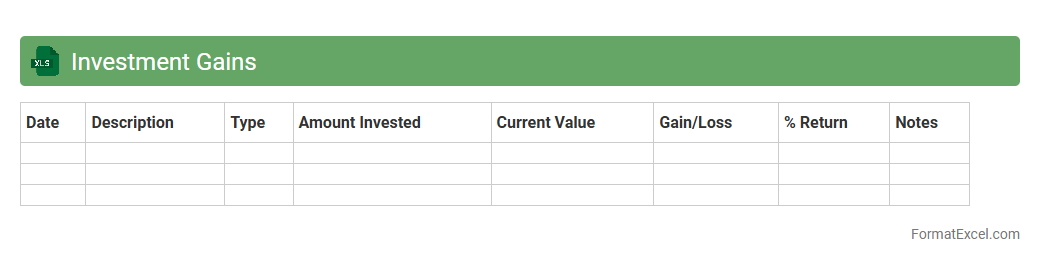

Investment Gains

The

Investment Gains Excel document is a structured spreadsheet designed to track and analyze the performance of various investments over time. It helps users calculate profits, monitor portfolio growth, and make informed financial decisions by providing clear visualizations and detailed records of asset appreciation. This tool is essential for investors aiming to optimize returns and manage risk effectively.

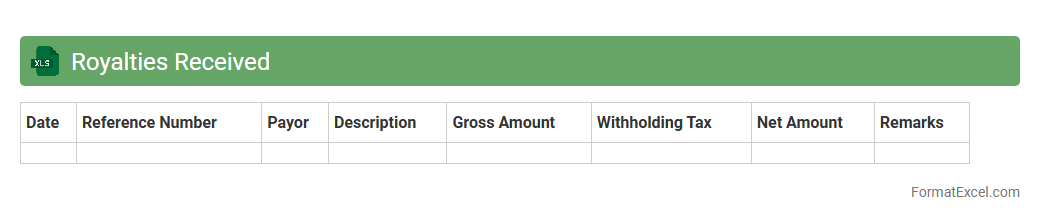

Royalties Received

The

Royalties Received Excel document is a comprehensive spreadsheet designed to track and manage royalty payments from various sources with detailed entries including payer information, payment dates, amounts, and associated contracts. This tool is useful for individuals and businesses to efficiently monitor income streams, ensure accurate record-keeping, and facilitate financial analysis for forecasting future royalties. By consolidating all royalty data in one place, it aids in identifying trends, ensuring compliance with agreements, and simplifying tax preparation processes.

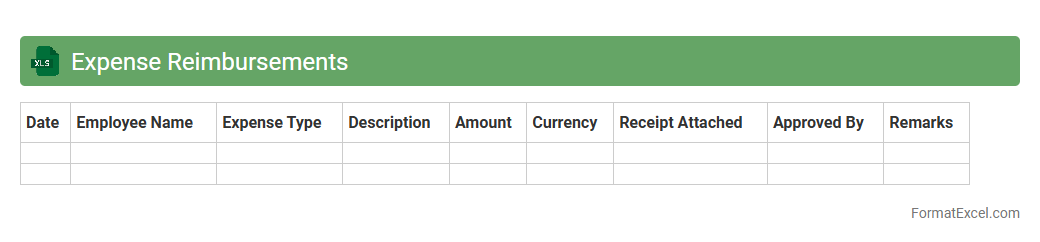

Expense Reimbursements

An

Expense Reimbursements Excel document is a structured spreadsheet designed to track and manage business or personal expense claims efficiently. It allows users to record expenditure details, attach receipts, and calculate totals automatically, ensuring accurate reimbursement processes. This tool enhances financial transparency, streamlines accounting workflows, and aids in budget control by providing clear visibility of reimbursed amounts.

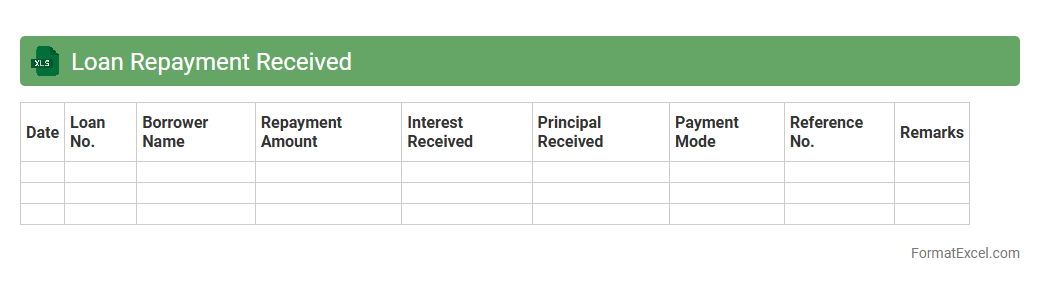

Loan Repayment Received

The

Loan Repayment Received Excel document is a detailed record that tracks all payments made towards outstanding loans, including dates, amounts, and payer information. It is useful for maintaining accurate financial records, ensuring timely loan servicing, and analyzing repayment patterns to manage cash flow effectively. This document aids in verifying payment compliance and supports transparent communication between lenders and borrowers.

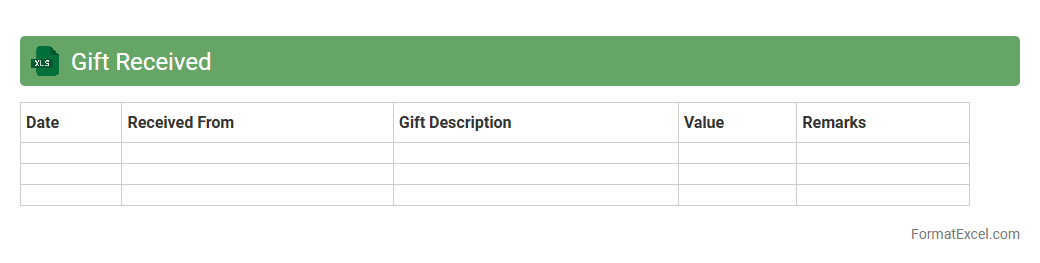

Gift Received

The

Gift Received Excel document is a structured spreadsheet used to record and track all gifts received, including details such as donor information, gift type, value, and date of receipt. It helps organizations maintain accurate records for financial reporting, compliance with tax regulations, and donor relationship management. By organizing gift data efficiently, this document enhances transparency and facilitates strategic planning for future fundraising efforts.

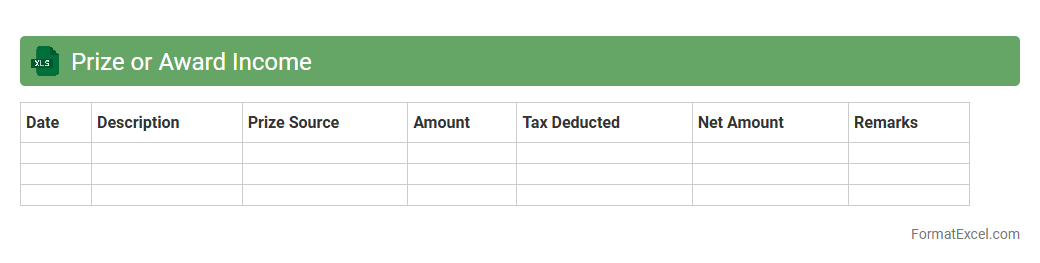

Prize or Award Income

A

Prize or Award Income Excel document is a structured spreadsheet designed to record and analyze income received from various prizes and awards. It helps users track monetary gains, categorize income sources, and ensure accurate financial reporting for tax and budgeting purposes. This document is essential for maintaining organized records and facilitating effective financial management.

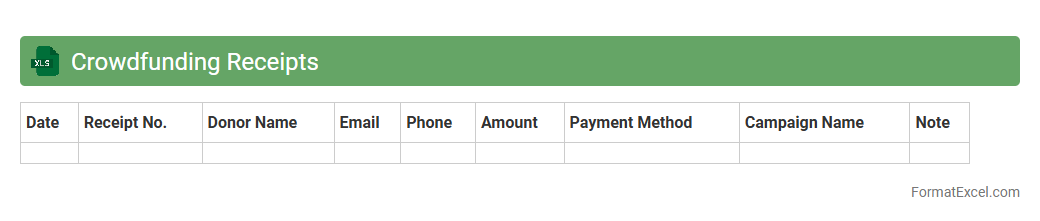

Crowdfunding Receipts

A

Crowdfunding Receipts Excel document is a structured spreadsheet used to record and organize all payment receipts from crowdfunding campaigns, including donor details, amounts, and dates. This tool helps in tracking contributions efficiently, ensuring transparency and accuracy in financial reporting. It streamlines the management of crowdfunding funds, making it easier to generate summaries for audits and donor communications.

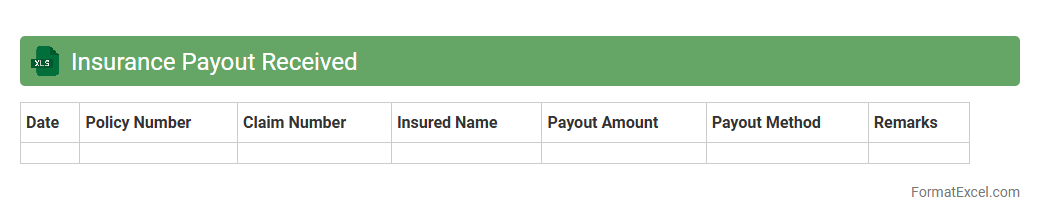

Insurance Payout Received

The

Insurance Payout Received Excel document is a detailed record that tracks payments received from insurance claims, organizing key data such as claim numbers, payout amounts, dates, and policyholder details. It is useful for efficiently managing financial reconciliation, ensuring accurate accounting, and providing a clear audit trail for insurance settlements. This document helps businesses and individuals monitor claim statuses and verify received payments, improving transparency and financial control.

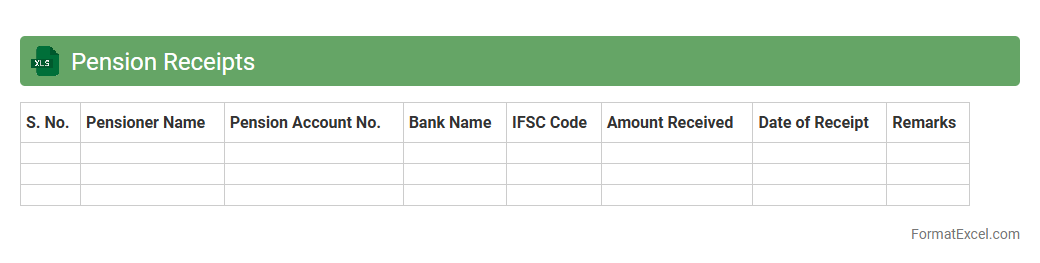

Pension Receipts

A

Pension Receipts Excel document is a structured spreadsheet used to record and track pension income payments systematically. It helps individuals and organizations maintain accurate financial records, ensuring easy monitoring of pension amounts, payment dates, and sources. This document streamlines pension management, supports tax filing, and provides quick access to historical payment data for effective financial planning.

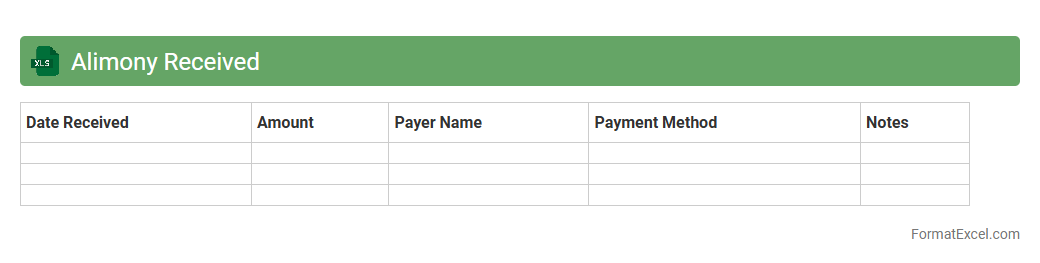

Alimony Received

An

Alimony Received Excel document is a structured spreadsheet designed to track and manage alimony payments systematically. It allows individuals to record payment dates, amounts, payer details, and outstanding balances, ensuring accurate financial management and legal compliance. This document is useful for budgeting, tax reporting, and providing clear evidence of alimony receipts in any legal or financial review.

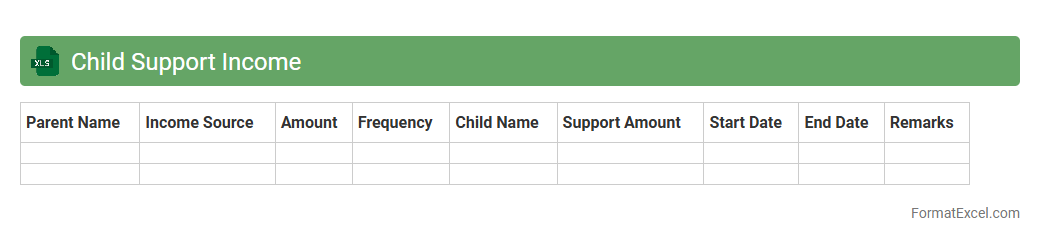

Child Support Income

The

Child Support Income Excel document is a structured spreadsheet designed to track and calculate child support payments efficiently. It organizes income sources, payment schedules, and amounts, enabling accurate record-keeping and financial planning for both custodial and non-custodial parents. This tool helps ensure transparency, simplifies legal compliance, and supports effective management of child support obligations.

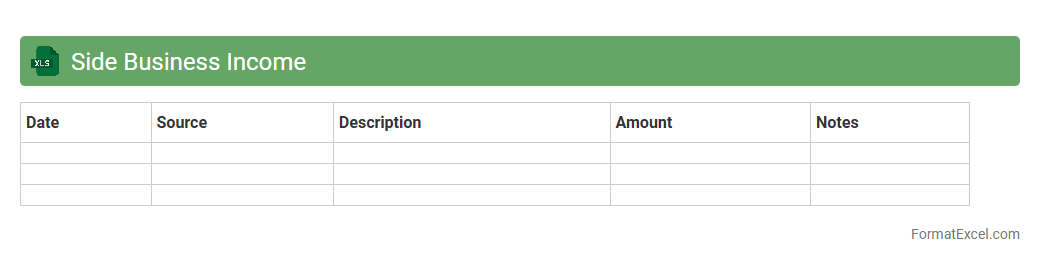

Side Business Income

A

Side Business Income Excel document is a structured spreadsheet designed to track and manage earnings from part-time ventures or freelance work. It helps users systematically record income sources, expenses, and calculate net profits, providing clear financial insights. This tool is invaluable for budgeting, tax preparation, and optimizing the profitability of supplementary income streams.

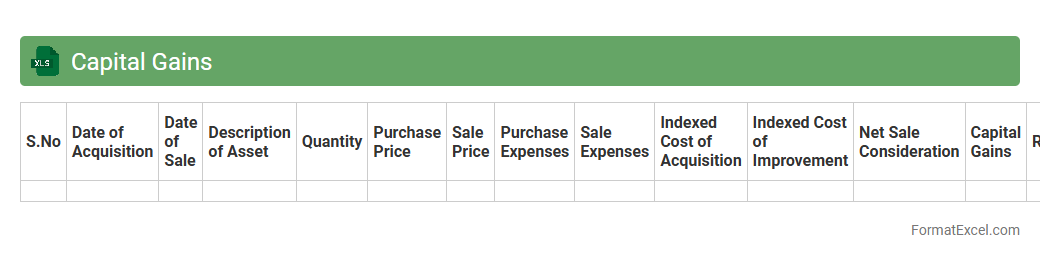

Capital Gains

A

Capital Gains excel document is a spreadsheet tool designed to track and calculate profits made from the sale of assets like stocks, real estate, or other investments. It helps in organizing purchase dates, sale dates, acquisition costs, and sale prices to accurately determine taxable gains or losses. This document is useful for simplifying tax reporting and ensuring compliance with financial regulations.

Introduction to Income Record Formats in Excel

An Income Record Format in Excel is a structured worksheet designed to log and monitor all sources of income efficiently. Excel's flexibility allows users to customize layouts to fit individual tracking needs. This format helps in accurate financial management and reporting.

Importance of Structured Income Tracking

Structured income tracking ensures every revenue stream is documented systematically, improving financial clarity. It aids in budgeting, tax preparation, and business analysis. Consistent tracking with a structured format reduces errors and oversight.

Key Components of an Income Record

Essential components include date, income source, amount, payment method, and remarks. These fields provide comprehensive details for each income transaction. Proper inclusion of key components enhances record accuracy.

Best Excel Templates for Income Recording

Several ready-made Excel templates facilitate quick setup, such as weekly or monthly income trackers. These templates come with pre-built formulas and charts for automatic calculations. Choosing the best Excel templates saves time and increases efficiency.

Step-by-Step Guide to Creating an Income Record

Start by defining columns, input sample data, and apply formulas for totals and summaries. Format cells for currency and dates to maintain consistency. Following a step-by-step guide ensures a functional income record.

Essential Columns for Income Record Sheets

Create columns like Date, Income Source, Amount, Category, and Payment Mode to capture all necessary data. Including a status or verification column enhances tracking completeness. Well-organized essential columns support detailed financial insights.

Customizing Income Record Formats for Your Needs

Tailor your income record by adding or removing columns based on specific income types and reporting requirements. Use Excel features like conditional formatting and filters for better data visualization. Customizing formats allows for personalized income management.

Tips for Maintaining Accurate Income Records

Regularly update your income records and reconcile them with bank statements. Double-check entries for errors to maintain data integrity. Adopting these accuracy tips ensures reliable financial documentation.

Common Mistakes to Avoid in Income Record Excel Files

Avoid neglecting backups, inconsistent data entry, and overlooking validation rules. Incorrect formula usage can also lead to false totals. Awareness of common mistakes helps maintain accurate income records.

Downloadable Sample Income Record Excel Templates

Downloadable templates offer a quick and easy start for managing income data effectively. Many templates include customizable features suited for both personal and business use. Utilizing a sample income record template can streamline your income tracking process.