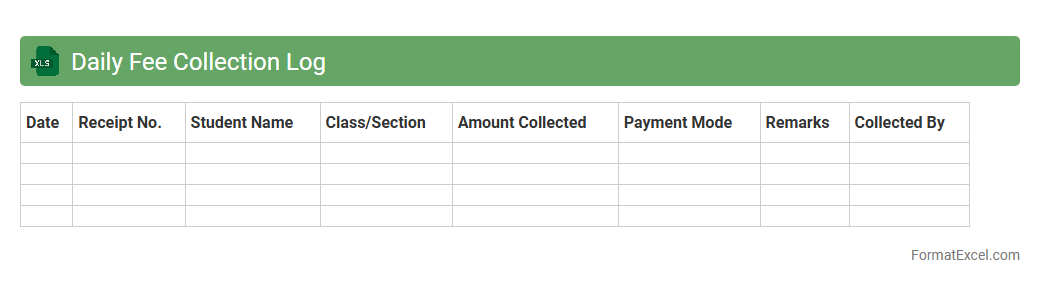

Daily Fee Collection Log

The

Daily Fee Collection Log Excel document is a structured tool designed to record and track daily financial transactions related to fee collections. It allows users to monitor payment dates, payer details, amounts received, and outstanding balances, enabling accurate financial management and transparency. This log helps streamline accounting processes, identify discrepancies quickly, and generate reports for better decision-making and fiscal control.

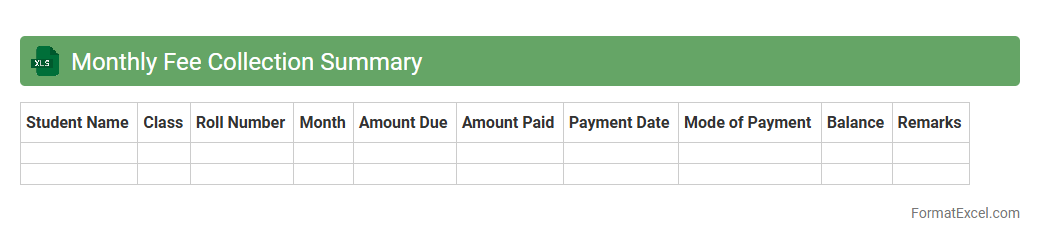

Monthly Fee Collection Summary

The

Monthly Fee Collection Summary Excel document consolidates all payment records for a specified month, providing a clear overview of collected fees, outstanding amounts, and individual payer details. This summary helps organizations track financial inflows efficiently, identify defaulters promptly, and generate accurate reports for accounting and decision-making purposes. Utilizing this document streamlines fee management processes, reduces errors, and enhances transparency in financial operations.

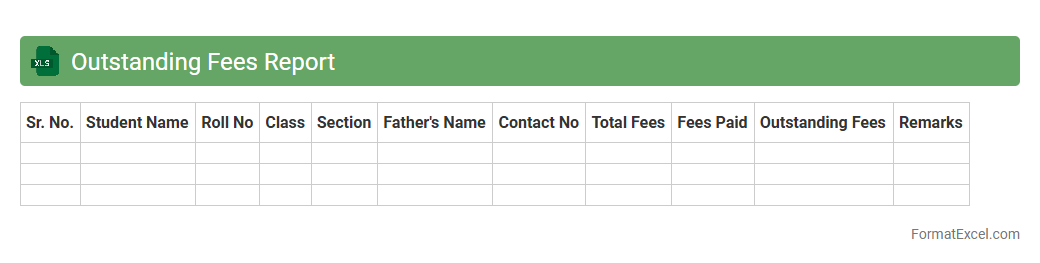

Outstanding Fees Report

The

Outstanding Fees Report Excel document is a financial tool designed to track unpaid fees and invoices efficiently. It helps organizations quickly identify overdue payments, monitor client or customer accounts, and streamline the collections process. By providing clear and organized data, this report enhances financial management and supports timely decision-making.

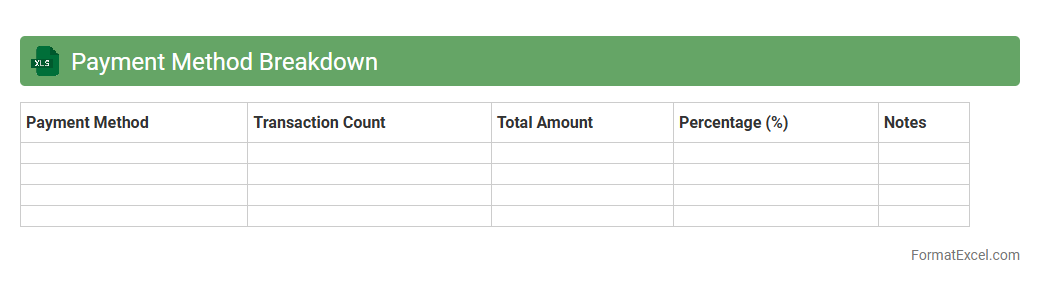

Payment Method Breakdown

The

Payment Method Breakdown Excel document provides a detailed analysis of various payment options used in transactions, including credit cards, debit cards, digital wallets, and bank transfers. It helps businesses track payment trends, identify the most popular methods, and optimize financial operations for improved cash flow management. By offering clear insights into payment preferences, this tool supports better decision-making in marketing strategies and customer service enhancements.

Late Fee Tracking Sheet

A

Late Fee Tracking Sheet Excel document is a tool designed to monitor and record overdue payments, ensuring timely follow-up on outstanding balances. It helps businesses and individuals maintain accurate financial records by automatically calculating late fees based on predefined criteria. Using this sheet improves cash flow management and minimizes revenue loss caused by delayed payments.

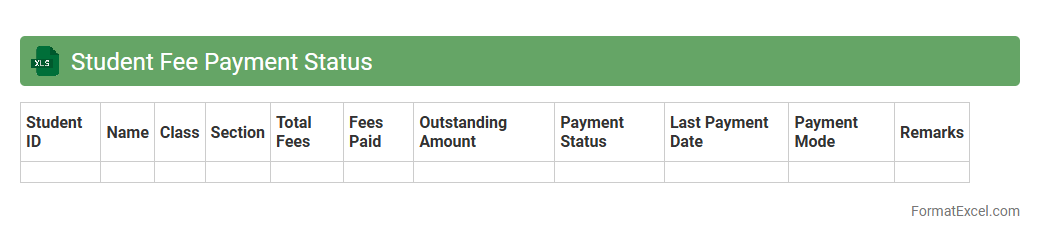

Student Fee Payment Status

The

Student Fee Payment Status Excel document is a detailed record that tracks each student's fee payment history, including amounts paid, due dates, and outstanding balances. It allows educational institutions to efficiently monitor financial transactions, manage tuition collection, and identify defaulters promptly. This document enhances transparency and supports accurate financial reporting, enabling better budget planning and resource allocation.

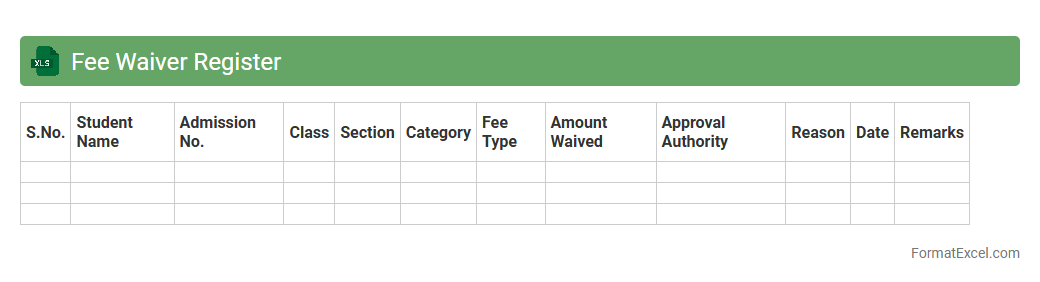

Fee Waiver Register

The

Fee Waiver Register Excel document is a structured file that tracks fee waiver requests, approvals, and related details efficiently. It helps educational institutions or organizations manage financial aid systematically by maintaining clear records of waived fees for auditing and reporting purposes. This document enhances transparency, streamlines data retrieval, and supports informed decision-making regarding fee concessions.

Collection Date Tracker

A

Collection Date Tracker Excel document is a tool designed to monitor and record important collection dates, ensuring timely follow-up on payments or task completions. This tracker helps businesses and individuals manage deadlines efficiently by providing a clear overview of upcoming and overdue collections. It enhances productivity and financial management by reducing missed deadlines and improving cash flow visibility.

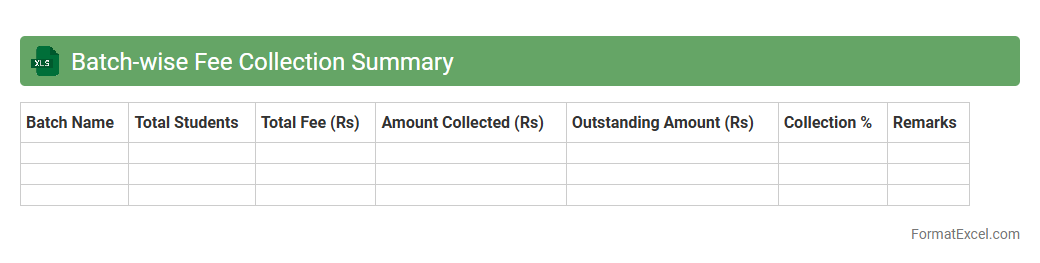

Batch-wise Fee Collection Summary

The

Batch-wise Fee Collection Summary Excel document consolidates fee payments by specific batches, providing a clear overview of collected amounts within defined periods or groups. This summary facilitates tracking payment status, identifying defaulters, and generating financial reports for better cash flow management. By offering detailed batch-level insights, it enables efficient fee reconciliation and informed decision-making for academic or business operations.

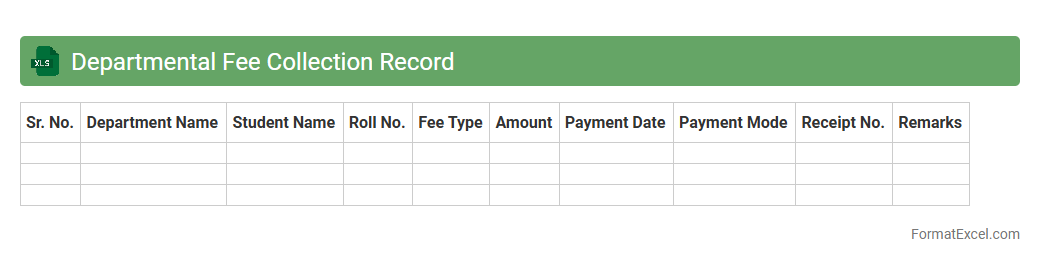

Departmental Fee Collection Record

The

Departmental Fee Collection Record Excel document systematically tracks fee payments across various departments, ensuring accurate and organized financial management. It provides detailed insights into outstanding balances, payment dates, and fee categories, which facilitates efficient monitoring and timely follow-up on dues. Utilizing this record enhances budget planning, streamlines accounting processes, and supports transparent financial reporting within the organization.

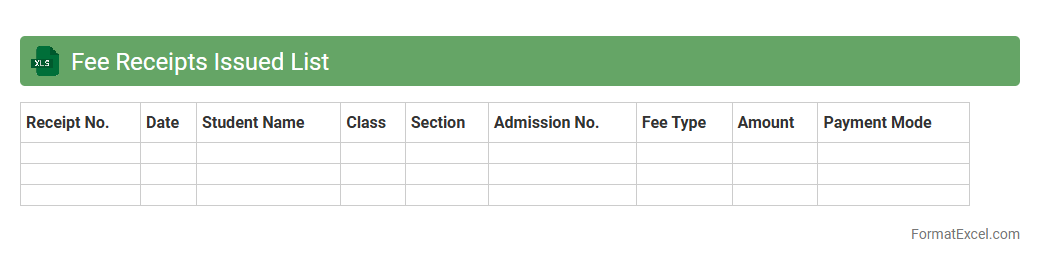

Fee Receipts Issued List

The

Fee Receipts Issued List Excel document is a comprehensive record of all fee payments received, including details such as payer names, dates, amounts, and receipt numbers. This document helps in maintaining transparent financial tracking and simplifies the process of auditing and reconciliation for educational institutions or businesses. It also serves as a quick reference tool for verifying payment status and resolving discrepancies efficiently.

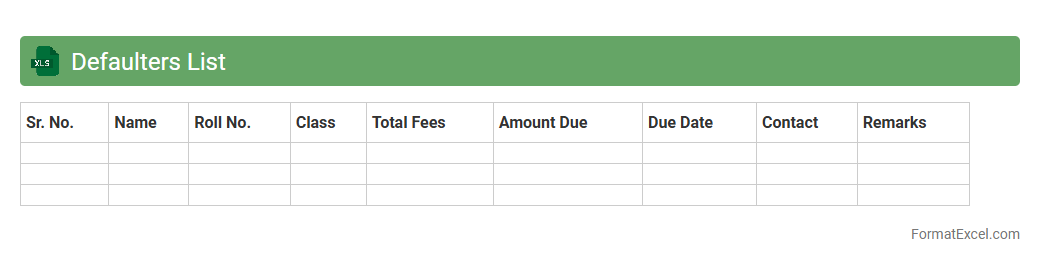

Defaulters List

A

Defaulters List Excel document is a structured spreadsheet that records individuals or entities who have failed to meet financial obligations, such as loan repayments or credit dues. This document is essential for banks, financial institutions, and businesses to track delinquent accounts, analyze risk, and take timely recovery actions. Utilizing this list improves decision-making by providing clear visibility of outstanding defaults and enhances financial management efficiency.

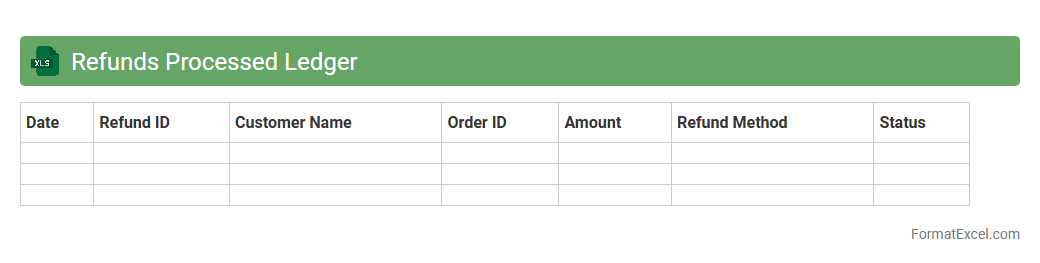

Refunds Processed Ledger

The

Refunds Processed Ledger Excel document is a detailed record that tracks all refunds issued by a business or organization, including dates, amounts, customer information, and transaction IDs. It is useful for maintaining transparency in financial operations, simplifying reconciliation during audits, and ensuring accurate accounting of returned payments. This ledger helps identify refund patterns, manage cash flow efficiently, and improve customer service by providing quick access to refund histories.

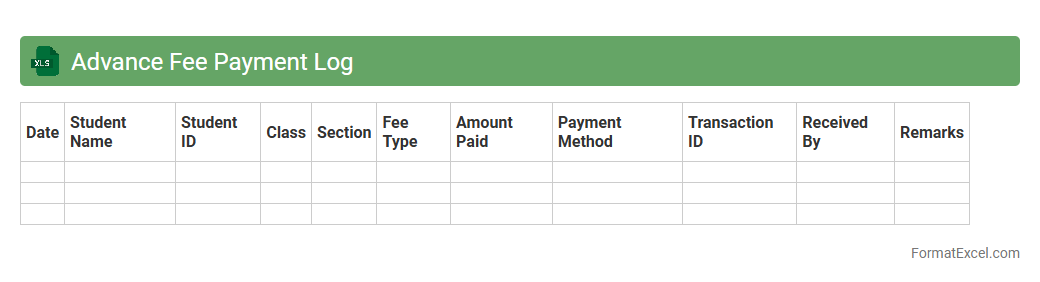

Advance Fee Payment Log

The

Advance Fee Payment Log Excel document systematically records all prepayments made by clients or customers, tracking amounts, dates, and payment methods. This log enhances financial transparency and accuracy by providing an organized ledger for monitoring outstanding fees and managing cash flow efficiently. It serves as a critical tool for businesses to ensure timely reconciliation of advance payments and improve overall accounting practices.

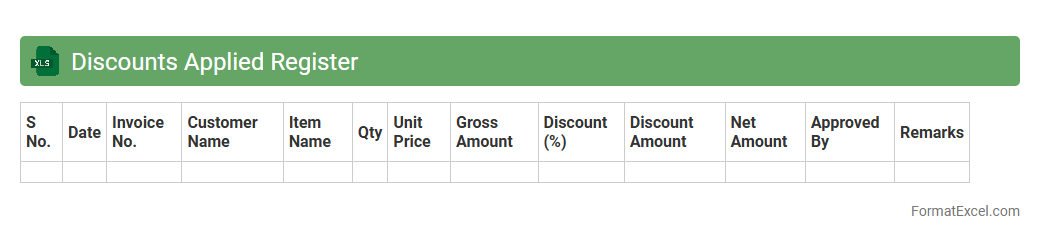

Discounts Applied Register

The

Discounts Applied Register Excel document systematically records all discounts given to customers, including details such as discount type, amount, date, and associated sales transactions. This register helps businesses track and analyze discount trends, ensuring accurate accounting and identifying opportunities for optimizing promotional strategies. Maintaining this document improves financial transparency and supports better decision-making regarding pricing and customer incentives.

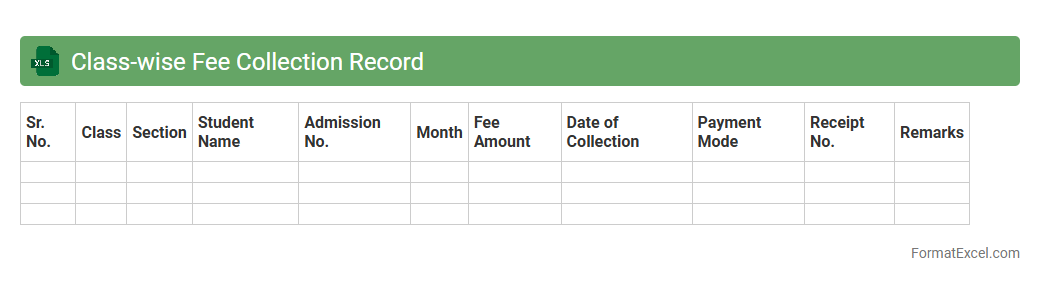

Class-wise Fee Collection Record

The

Class-wise Fee Collection Record Excel document systematically organizes student fee payments by individual classes, enabling efficient tracking and management of financial data in educational institutions. It helps administrators monitor timely fee submissions, identify defaulters, and generate reports for budgeting and audit purposes. This tool ensures transparency and accuracy in fee collection, streamlining the overall financial workflow.

Scholarship Adjustment Tracker

The

Scholarship Adjustment Tracker Excel document is a specialized tool designed to monitor and manage changes in scholarship allocations effectively. It streamlines the process of recording modifications, ensuring accuracy in tracking awarded amounts, adjustments due to eligibility updates, or refund calculations. This document enhances financial oversight and helps educational institutions maintain transparent and organized scholarship records.

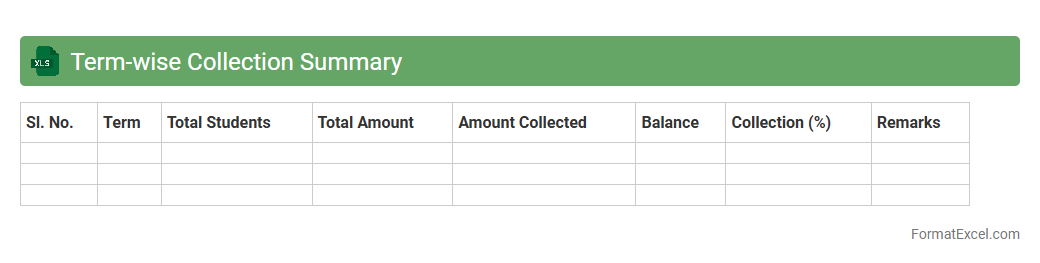

Term-wise Collection Summary

The

Term-wise Collection Summary Excel document provides a detailed breakdown of financial collections segmented by specific time periods or academic terms, enabling efficient tracking and management of revenue streams. It allows organizations to analyze payment trends, identify outstanding dues, and forecast cash flow accurately, enhancing overall financial planning. This document is especially useful for educational institutions or businesses needing to monitor collections on a periodic basis to ensure timely financial reconciliation and reporting.

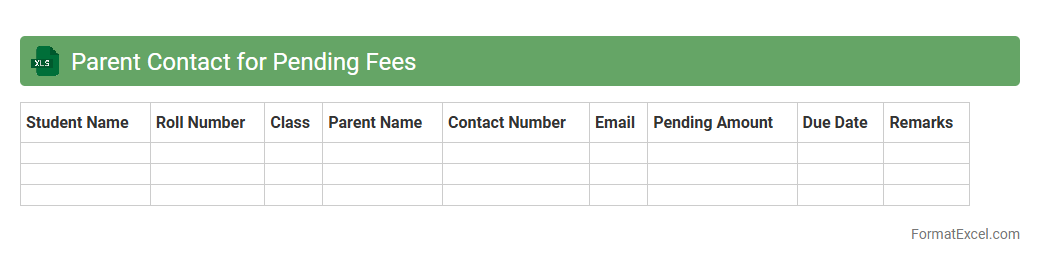

Parent Contact for Pending Fees

The

Parent Contact for Pending Fees Excel document is a comprehensive tool designed to track outstanding school fees and manage communication with parents effectively. It consolidates student fee details, payment statuses, and parent contact information, enabling timely follow-ups and reducing fee defaulters. This document enhances financial transparency and improves the efficiency of fee collection processes.

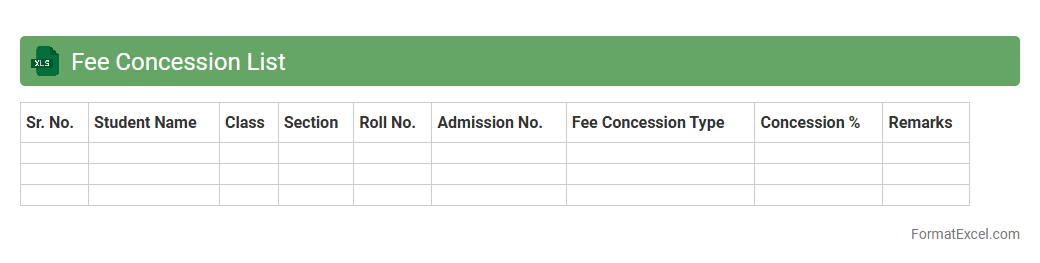

Fee Concession List

The

Fee Concession List Excel document systematically catalogs fee waivers or reductions granted to eligible students, facilitating efficient financial record management. It enables educational institutions to track concession categories, amounts, and beneficiaries accurately, ensuring transparency and easy access to crucial data. This consolidated format enhances decision-making by providing clear insights into the distribution of fee concessions, aiding budget planning and financial reporting.

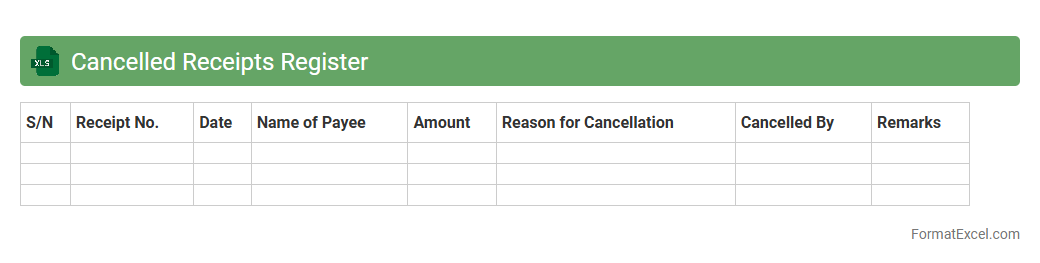

Cancelled Receipts Register

The

Cancelled Receipts Register Excel document is a detailed log used to record all receipts that have been voided or canceled within a specific period. It helps organizations maintain accurate financial records by tracking canceled transactions, preventing discrepancies, and ensuring transparency during audits. This register is essential for reconciling accounts and monitoring irregularities in payment processing.

Partial Payment Tracking

A

Partial Payment Tracking Excel document is a tool designed to monitor and manage payments made in installments toward outstanding invoices or debts. It helps businesses maintain accurate records of payment schedules, amounts paid, and remaining balances, ensuring efficient cash flow management and reducing errors in financial reporting. Utilizing this document improves transparency and accountability in financial transactions, facilitating better decision-making and customer relationship management.

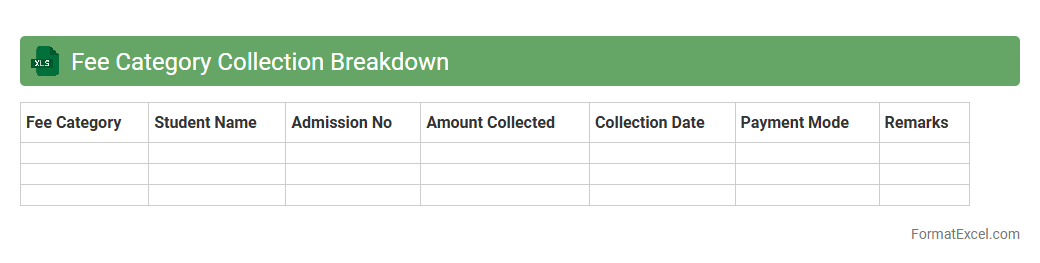

Fee Category Collection Breakdown

The

Fee Category Collection Breakdown Excel document categorizes and summarizes revenue generated from various fee types, allowing businesses to track and analyze payment sources effectively. This breakdown aids in identifying high-performing fee categories and areas requiring attention, facilitating better financial planning and budget allocation. Using this sheet enhances transparency in collection processes and supports decision-making with detailed, organized financial data.

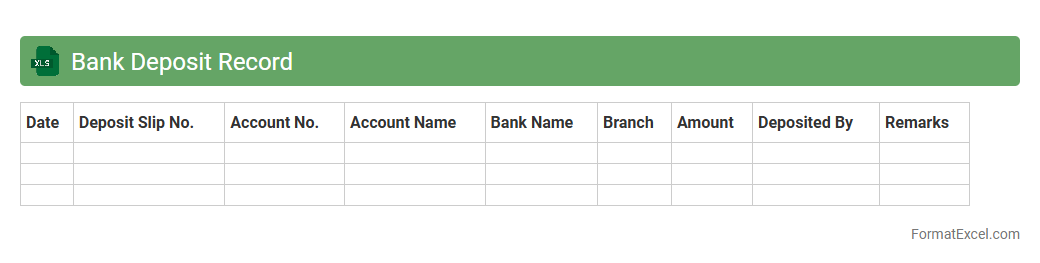

Bank Deposit Record

A

Bank Deposit Record Excel document is a spreadsheet used to systematically track and manage all bank deposit transactions. It helps individuals and businesses maintain accurate financial records, facilitate easy reconciliation with bank statements, and monitor cash flow effectively. Using this document improves financial organization, ensures transparency, and supports informed decision-making for budgeting and auditing purposes.

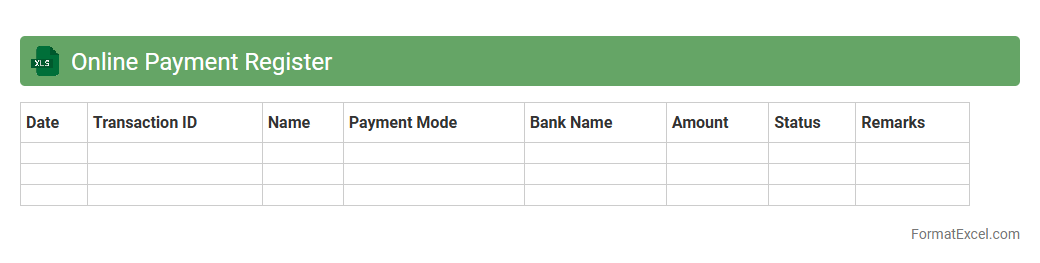

Online Payment Register

An

Online Payment Register Excel document is a digital ledger designed to systematically record and track all online payment transactions. It helps businesses and individuals maintain accurate financial records, monitor payment statuses, and manage cash flow efficiently. By organizing transaction data in a clear, searchable format, it enhances transparency and simplifies auditing processes.

Introduction to Fee Collection Record Management

Fee collection record management is essential for tracking payments efficiently in educational institutions. It ensures transparency and helps in maintaining accurate financial reporting. A well-structured fee collection record is key to smooth administration.

Importance of Accurate Fee Tracking in Institutions

Accurate fee tracking prevents financial discrepancies and supports budgeting efforts. It facilitates timely reminders for overdue payments and enhances trust between institutions and parents. Proper fee tracking is critical for operational stability.

Benefits of Using Excel for Fee Collection Records

Excel offers customizable templates and automated calculations, simplifying fee management. It supports data analysis and easy updates, reducing manual errors. The flexibility of Excel makes it ideal for fee collection records.

Essential Elements of a Fee Collection Record Format

A typical fee collection record includes student names, payment dates, amounts, and payment modes. Also, fields for balance due and receipt numbers improve tracking accuracy. Including these essential elements ensures comprehensive records.

Step-by-Step Guide to Designing an Excel Fee Collection Sheet

Start by creating columns for student ID, fee type, amount paid, and payment date. Use Excel formulas to calculate total fees and outstanding balances automatically. Following a step-by-step guide streamlines the design process.

Sample Fee Collection Record Format in Excel

A sample format includes rows for individual transactions and columns summarizing monthly collections. Conditional formatting highlights overdue payments for quick identification. This sample format provides a practical template to follow.

Tips for Customizing Your Fee Collection Template

Customize templates by adding institution logos and adjusting fields based on specific fee structures. Use drop-down lists for fee categories to maintain data consistency. These customization tips enhance usability and professionalism.

Common Errors to Avoid in Fee Collection Records

Avoid duplicate entries, incorrect payment amounts, and lack of updated records. Regularly reconcile records with bank statements to maintain accuracy. Preventing these common errors ensures reliable financial management.

Automating Calculations and Summaries in Excel

Leverage Excel functions such as SUM, IF, and VLOOKUP to automate fee calculations and identify unpaid fees. Pivot tables can summarize collections by class or fee type quickly. Effective automation saves time and improves record accuracy.

Best Practices for Maintaining Digital Fee Records

Regularly back up Excel files and restrict access to sensitive financial information. Update records promptly after each payment and perform periodic audits. Adopting these best practices fosters secure and efficient fee management.