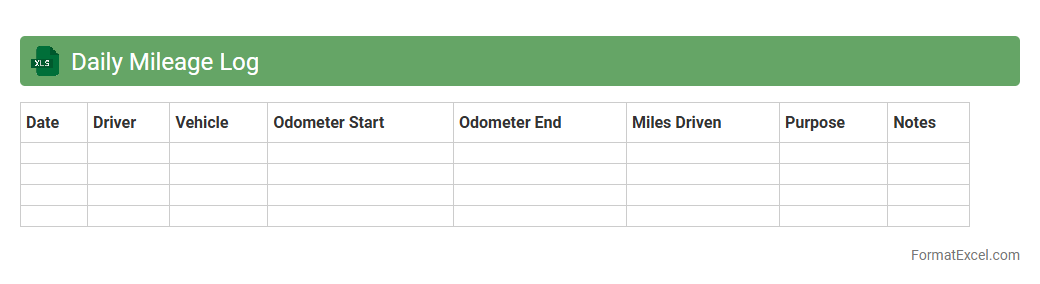

Daily Mileage Log

A

Daily Mileage Log Excel document is a structured spreadsheet used to record and track daily vehicle mileage for business or personal purposes. It helps in maintaining accurate records for expense reimbursement, tax deductions, and fuel efficiency analysis. By organizing trip details such as date, start and end locations, and miles driven, it simplifies accountability and financial reporting.

Vehicle Usage Tracking

A

Vehicle Usage Tracking Excel document systematically records and monitors vehicle mileage, fuel consumption, maintenance schedules, and trip details. It helps businesses and individuals optimize fleet management by identifying patterns of usage, reducing operational costs, and ensuring timely servicing. This organized data supports informed decision-making, improves vehicle efficiency, and enhances overall transportation accountability.

Trip Distance Tracker

The

Trip Distance Tracker Excel document is a powerful tool designed to record and calculate the distances traveled during trips, enabling accurate mileage tracking for personal or business use. By organizing trip data in a structured format, it helps users monitor travel patterns, manage fuel expenses, and simplify reimbursement processes. This systematic approach enhances efficiency in travel management and supports precise reporting for tax deductions or expense claims.

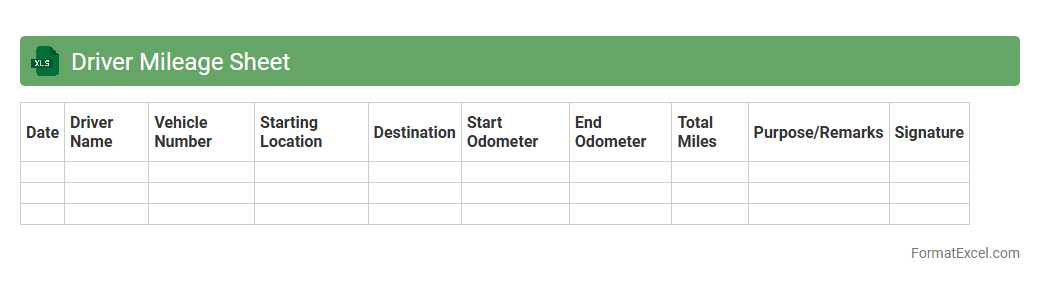

Driver Mileage Sheet

A

Driver Mileage Sheet Excel document is a digital tool designed to track and record the distance traveled by drivers during their trips, including details such as start and end locations, dates, and vehicle information. This spreadsheet helps businesses monitor fuel expenses, calculate reimbursements, and maintain accurate records for tax purposes. Efficient management of mileage data through this document enhances accountability, optimizes route planning, and supports compliance with regulatory requirements.

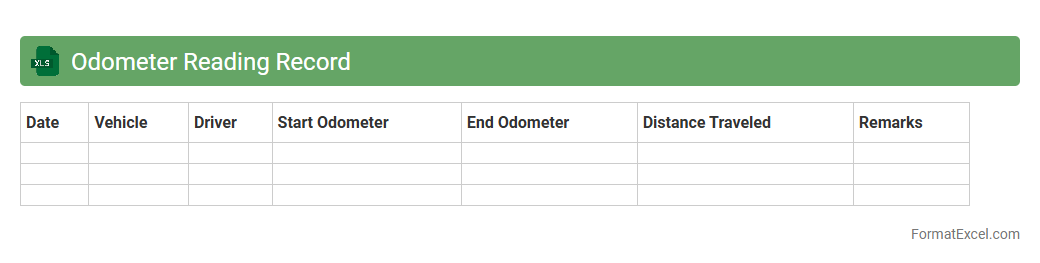

Odometer Reading Record

An

Odometer Reading Record Excel document is a digital spreadsheet designed to systematically track and log vehicle mileage over time, ensuring accurate monitoring of travel distance. This record is essential for managing maintenance schedules, calculating fuel efficiency, and verifying usage for business or tax purposes. By organizing data clearly, it aids in reducing errors and streamlining reporting processes for fleet management or personal vehicle use.

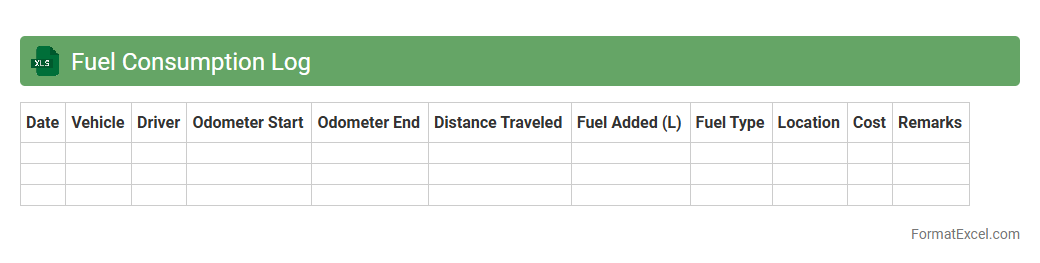

Fuel Consumption Log

A

Fuel Consumption Log Excel document is a structured spreadsheet designed to record and track fuel usage over time for vehicles or machinery. It helps monitor fuel efficiency, identify patterns of fuel waste, and manage fuel expenses effectively. Using this log enables better budgeting, reduces operational costs, and supports environmental sustainability efforts.

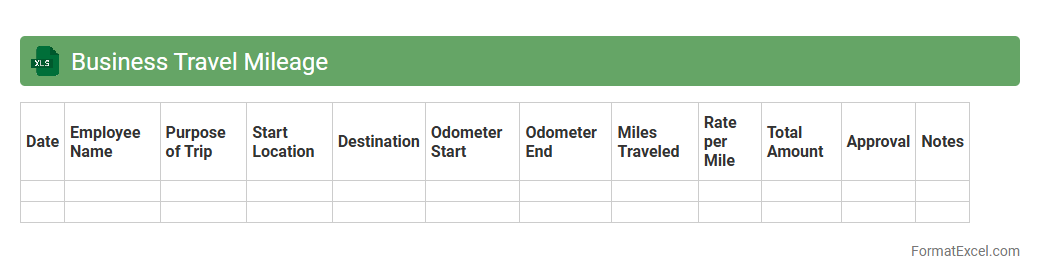

Business Travel Mileage

A

Business Travel Mileage Excel document is a structured spreadsheet used to accurately record and calculate the distances traveled for work-related trips. It helps track miles driven, reimbursable amounts, and travel dates, ensuring precise expense reporting and compliance with tax regulations. Utilizing this document simplifies mileage management, improves financial accountability, and supports efficient business travel reimbursement processes.

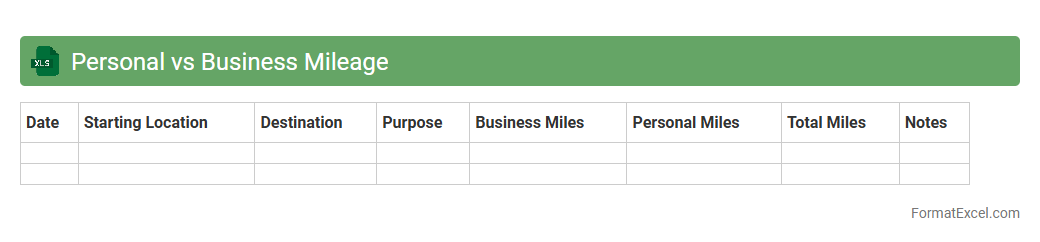

Personal vs Business Mileage

A

Personal vs Business Mileage Excel document is a spreadsheet designed to accurately track and differentiate miles driven for personal and business purposes. This tool helps users maintain detailed records for tax deductions, expense reimbursements, and overall vehicle usage analysis. By effectively organizing mileage data, it simplifies tax reporting and ensures compliance with IRS guidelines.

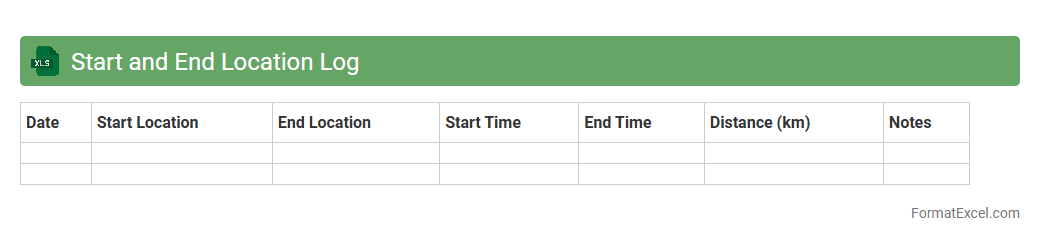

Start and End Location Log

The

Start and End Location Log Excel document is a structured spreadsheet that records the geographical points and timestamps where activities or trips begin and conclude. This log is essential for tracking route efficiency, monitoring travel times, and analyzing movement patterns to optimize operations. Businesses and individuals use this data to enhance planning, ensure accountability, and improve resource allocation based on accurate location-based insights.

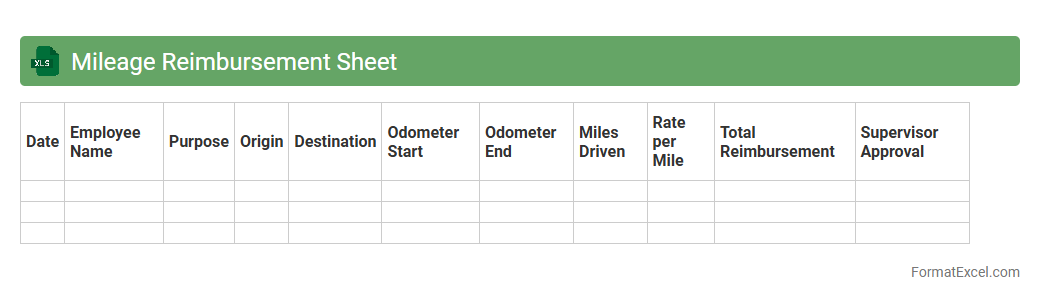

Mileage Reimbursement Sheet

A

Mileage Reimbursement Sheet Excel document is a structured template used to accurately track, calculate, and document miles traveled for business purposes. It streamlines expense reporting by automatically computing reimbursement amounts based on mileage rates set by organizations or government standards. This tool enhances financial transparency and ensures precise compensation for travel-related costs, helping businesses maintain organized records for tax and auditing requirements.

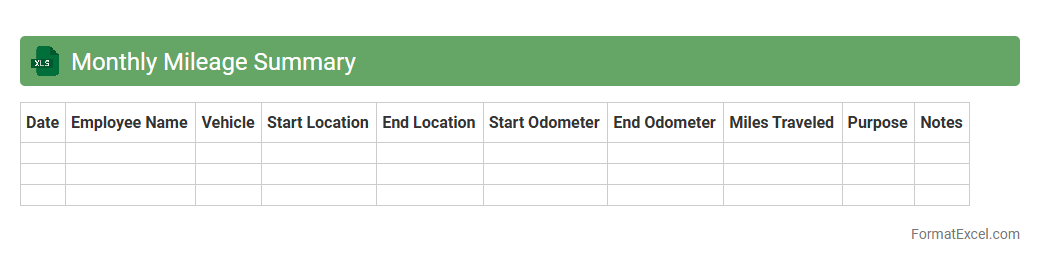

Monthly Mileage Summary

A

Monthly Mileage Summary excel document records and calculates the total distance traveled by a vehicle or multiple vehicles within a month, organizing data such as dates, routes, and mileage. It is essential for tracking fuel expenses, monitoring vehicle usage, and supporting reimbursement claims for business travel. This summary helps optimize fleet management, improve budgeting accuracy, and ensure compliance with tax regulations.

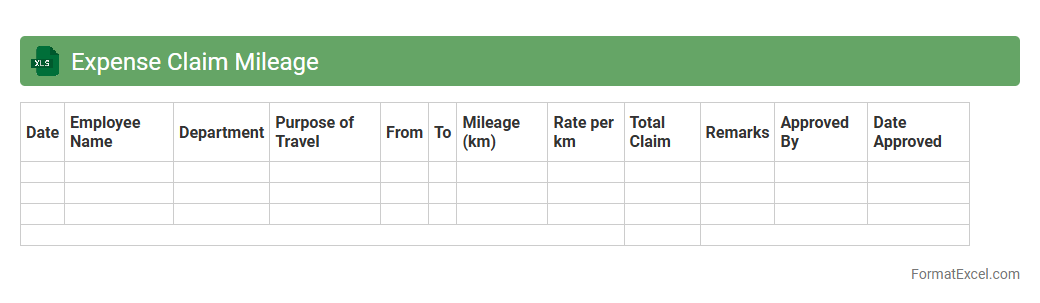

Expense Claim Mileage

An

Expense Claim Mileage Excel document is a structured spreadsheet that tracks and calculates mileage expenses incurred during business travel. It helps users accurately record distances traveled, apply appropriate reimbursement rates, and generate precise claims for refund or accounting purposes. This tool streamlines expense reporting, ensures compliance with company policies, and simplifies the accounting process.

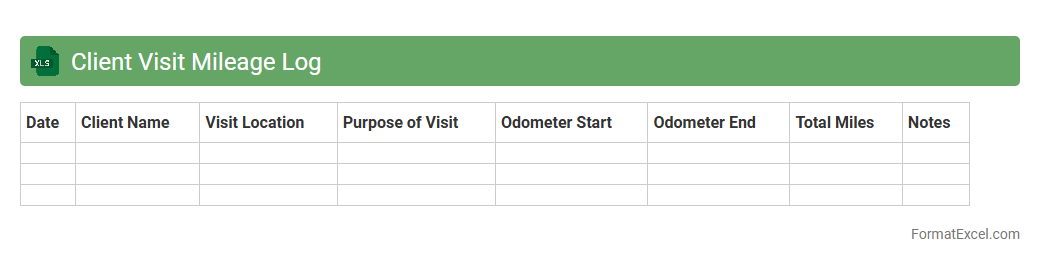

Client Visit Mileage Log

A

Client Visit Mileage Log Excel document is a structured spreadsheet designed to track and record the miles traveled during client visits, ensuring accurate mileage reimbursement and expense management. It helps businesses maintain detailed records of travel distances, dates, client names, and purposes of visits, facilitating efficient expense reporting and tax deductions. This organized log streamlines financial tracking, improves accountability, and supports budget planning for travel-related costs.

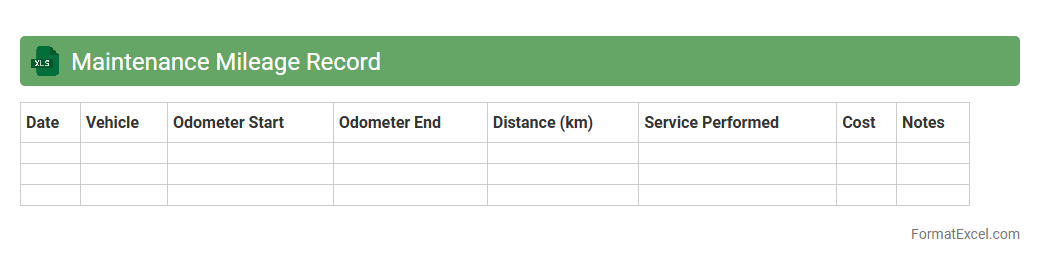

Maintenance Mileage Record

A

Maintenance Mileage Record Excel document is a structured spreadsheet used to track vehicle mileage alongside scheduled maintenance tasks, ensuring timely service. It helps monitor usage patterns and anticipate necessary repairs, effectively reducing the risk of unexpected breakdowns and costly downtime. By maintaining accurate mileage records, fleet managers and vehicle owners can optimize maintenance schedules and enhance overall vehicle lifespan.

Commute Mileage Tracker

The

Commute Mileage Tracker Excel document is a practical tool designed to record and calculate the distance traveled during daily commutes, helping users monitor their travel expenses accurately. By organizing trip data such as dates, starting points, destinations, and mileage, it simplifies expense tracking for tax deductions or reimbursement purposes. This tool enhances financial management by providing clear, precise records essential for budgeting and reporting commute-related costs.

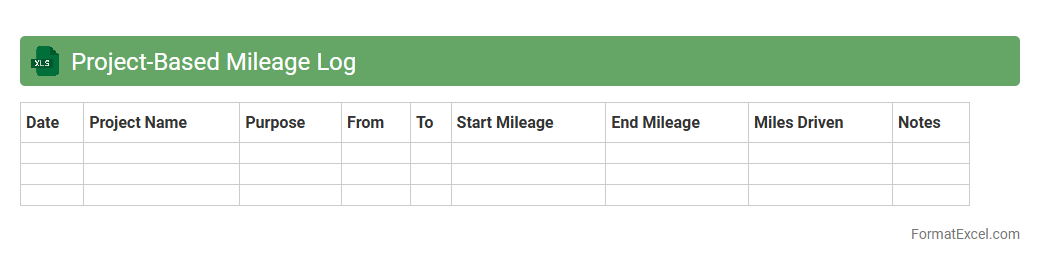

Project-Based Mileage Log

A

Project-Based Mileage Log Excel document is a structured tool designed to track and record vehicle mileage associated with specific projects. It helps users accurately allocate travel expenses for budgeting, reimbursement, and tax deduction purposes by organizing data project-wise. This log enhances financial management and accountability by providing clear, itemized mileage records linked to individual projects.

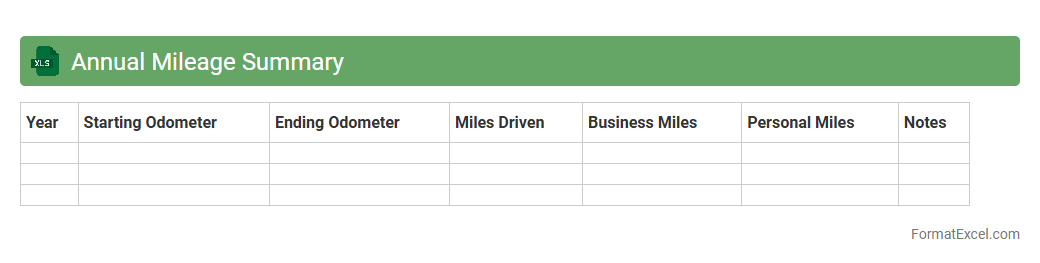

Annual Mileage Summary

The

Annual Mileage Summary Excel document compiles and tracks total vehicle mileage accumulated over a year, helping users monitor travel distances for personal or business purposes. This organized data facilitates expense reporting, tax deductions, and fleet management by providing clear and accurate mileage records. It also enables effective budgeting and maintenance scheduling by highlighting usage patterns.

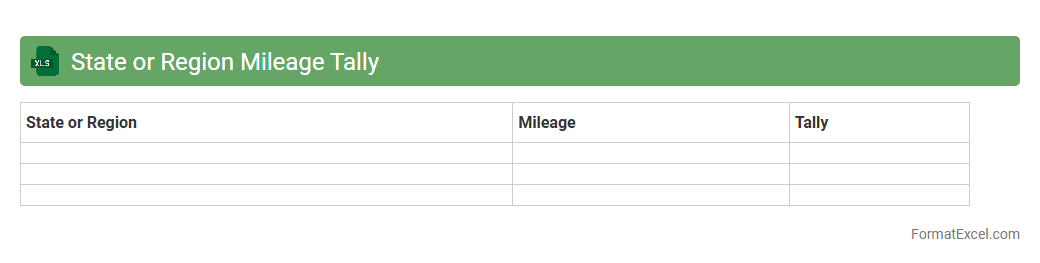

State or Region Mileage Tally

A

State or Region Mileage Tally Excel document is a detailed spreadsheet used to record and calculate the distances traveled within specific states or regions, streamlining mileage tracking for business, tax, or reimbursement purposes. It helps users maintain accurate and organized travel logs by automatically summing miles driven in different areas, ensuring compliance with tax regulations and simplifying expense reporting. This tool is especially valuable for professionals such as sales representatives, delivery drivers, and consultants who need precise mileage records to maximize deductions and optimize travel efficiency.

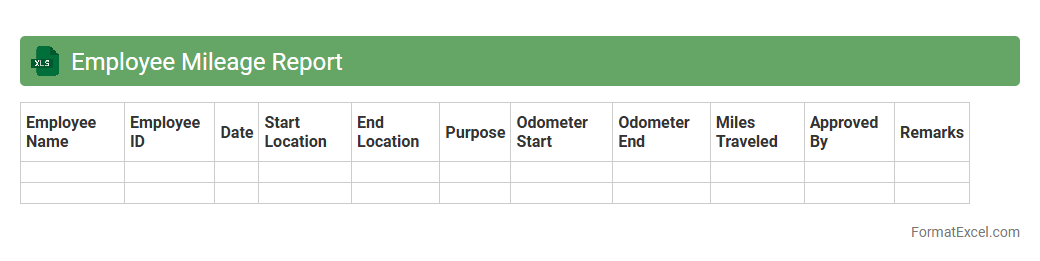

Employee Mileage Report

An

Employee Mileage Report Excel document records the distance traveled by employees for work-related purposes, capturing data such as trip dates, start and end locations, and total miles. This report helps organizations accurately calculate mileage reimbursements, ensuring compliance with company policies and tax regulations. It also aids in expense tracking and budget management by providing clear, organized documentation of travel activities.

Job Site Mileage Tracker

A

Job Site Mileage Tracker Excel document is a tool designed to accurately record and calculate the distance traveled to various work locations, enabling efficient tracking of travel expenses. It helps businesses monitor employee travel for job sites, ensuring proper reimbursement and reducing mileage-related discrepancies. This tracker enhances financial accountability and streamlines the reporting process for tax deductions or expense claims.

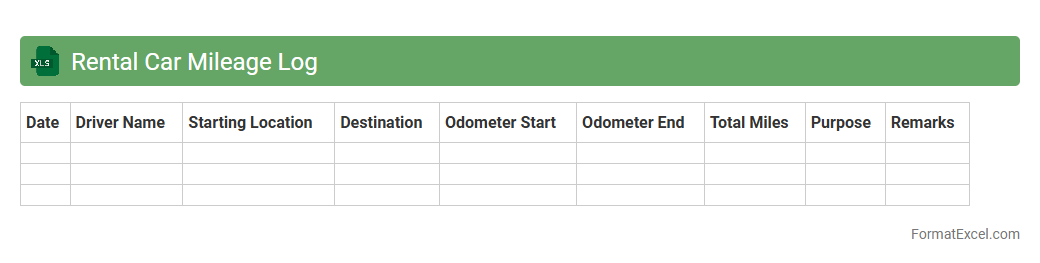

Rental Car Mileage Log

A

Rental Car Mileage Log Excel document is a structured spreadsheet designed to track the distance traveled during rental car usage. It records starting and ending odometer readings, trip dates, and mileage for accurate expense reporting and reimbursement. This log helps users maintain detailed records for tax deductions, business expense management, and ensuring compliance with company policies.

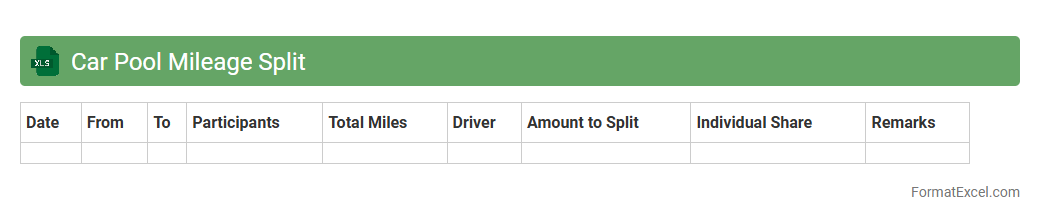

Car Pool Mileage Split

The

Car Pool Mileage Split Excel document is a tool designed to calculate and distribute travel expenses among multiple carpool participants based on the distance each person travels. This spreadsheet simplifies the process of fairly dividing fuel costs and other mileage-related expenses, ensuring transparency and accuracy. Utilizing this document helps save time, reduces disputes, and promotes cost-effective carpooling.

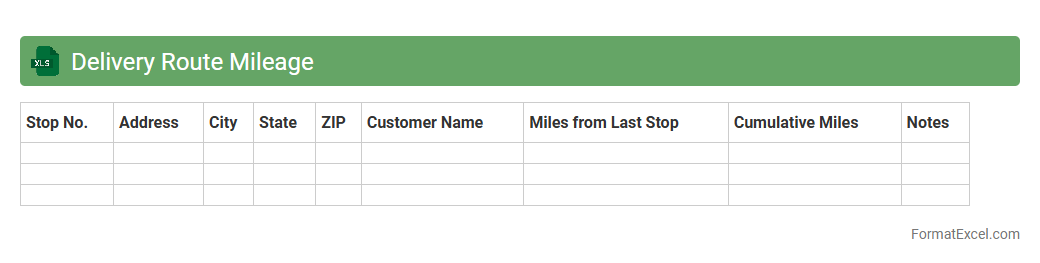

Delivery Route Mileage

A

Delivery Route Mileage Excel document is a spreadsheet designed to track and calculate the distances covered in delivery routes, helping logistics managers optimize travel efficiency. It consolidates route information, start and end points, and total miles traveled, enabling businesses to reduce fuel costs and improve delivery times. Using this data-driven tool enhances route planning accuracy and supports performance analysis for fleet management.

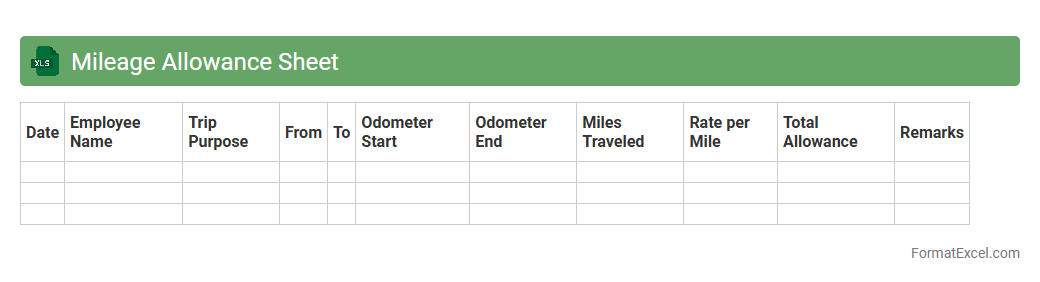

Mileage Allowance Sheet

A

Mileage Allowance Sheet Excel document is a structured spreadsheet used to record and calculate vehicle travel expenses based on distance traveled for business purposes. It helps users track mileage accurately, ensuring proper reimbursement and compliance with company mileage policies or tax regulations. By automating calculations and maintaining detailed records, this tool simplifies expense reporting and financial management.

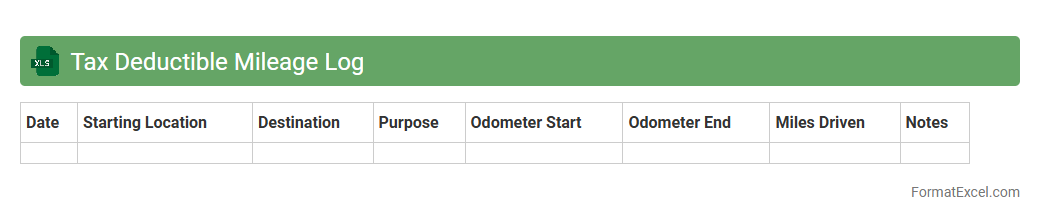

Tax Deductible Mileage Log

A

Tax Deductible Mileage Log Excel document is a digital tool designed to accurately record and track business-related vehicle mileage for tax deduction purposes. It helps users organize trip details such as dates, distances, destinations, and purposes, ensuring compliance with IRS regulations and simplifying tax filing. Using this log can maximize mileage deductions while providing clear records in case of an audit.

Introduction to Mileage Record Format

The mileage record format in Excel is a structured way to document travel distances for business, tax, or reimbursement purposes. It organizes trip details into a clear, easy-to-read format. Using Excel enhances accessibility and customization for various mileage tracking needs.

Importance of Tracking Mileage in Excel

Tracking mileage accurately in Excel helps ensure precise reimbursement and tax deductions. It provides a digital, organized method to keep long-term records with minimal effort. Excel's flexibility supports detailed travel histories vital for compliance and financial management.

Essential Columns for Mileage Records

A typical mileage log should include date, starting point, destination, purpose, and miles driven. Including columns for odometer readings and reimbursement rates improves accuracy. These fields collectively capture the necessary information to calculate total mileage and expenses.

Step-by-Step Guide to Creating a Mileage Log

Start by opening a new Excel worksheet and labeling essential columns. Enter sample data to verify layout and add formulas for automatic mileage calculations. Save the template for repeated use to streamline future entries and maintain consistency.

Sample Mileage Record Template in Excel

A sample template includes rows for trip details and columns such as Date, Start Location, End Location, Purpose, and Miles. It often includes automated fields for total monthly mileage and reimbursement amounts. This ready-to-use format speeds up data entry and reporting.

Customizing Your Mileage Spreadsheet

Enhance your mileage log by adding personalized categories, conditional formatting, or dropdown menus for trip purposes. Customizing columns according to your needs improves usability and accuracy. Excel's versatility lets you tailor your spreadsheet for various tracking scenarios.

Mileage Calculation Formulas in Excel

Use formulas like =EndOdometer-StartOdometer to compute trip mileage automatically. Sum totals with =SUM() to keep running mileage tallies. These formulas eliminate manual calculations, reducing errors and saving time.

Tips for Accurate Data Entry

Always double-check odometer readings and enter data immediately after trips to ensure accuracy. Using predefined dropdown lists for trip purposes minimizes input mistakes. Regularly reviewing entries helps maintain a reliable mileage record.

Exporting and Sharing Mileage Reports

Excel allows you to export mileage logs as PDFs or CSV files for easy sharing with employers or tax professionals. Use the print feature to generate hard copies when needed. Digital sharing ensures quick distribution and professional record keeping.

Best Practices for Maintaining Mileage Logs

Maintain consistency by updating your mileage log regularly, ideally daily or weekly. Back up files frequently to prevent data loss and keep supporting documents for each trip. Reliable logs ensure compliance and simplify auditing processes.