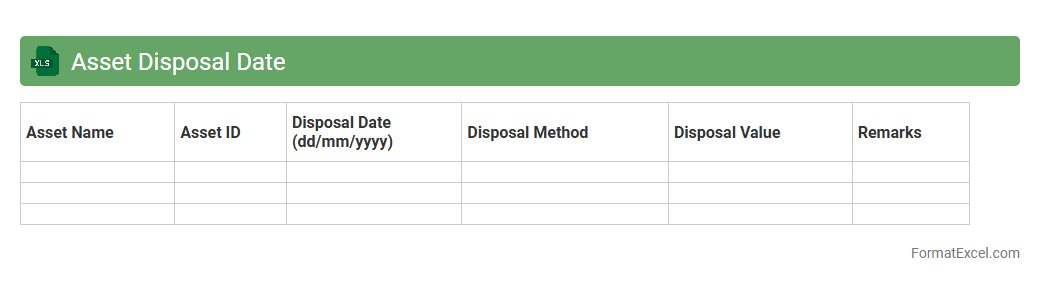

Asset Disposal Date

The

Asset Disposal Date Excel document tracks the scheduled removal or retirement dates of assets, helping organizations manage their asset lifecycle efficiently. It enables users to monitor when assets are due for disposal, ensuring compliance with accounting standards and optimizing financial reporting. This tool aids in planning asset replacement, minimizing depreciation losses, and maintaining accurate fixed asset registers.

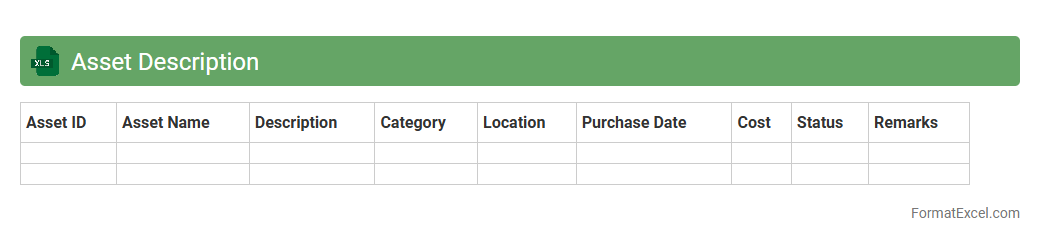

Asset Description

An

Asset Description Excel document is a structured spreadsheet that catalogs detailed information about physical or digital assets, including specifications, locations, and maintenance records. It streamlines asset management by providing a centralized database that enhances tracking, reporting, and decision-making processes. This document is essential for optimizing resource allocation, ensuring compliance, and improving overall operational efficiency.

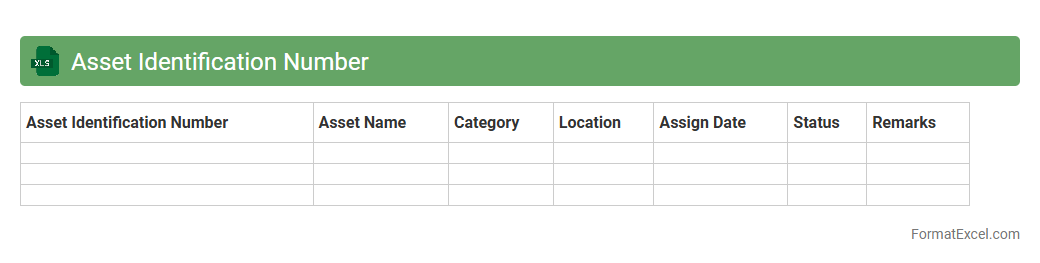

Asset Identification Number

An

Asset Identification Number (AIN) Excel document is a structured spreadsheet used to catalog and track physical or digital assets by assigning unique identification numbers to each item. This document streamlines inventory management, facilitates asset tracking, and improves accountability by providing a centralized record that can be easily updated and accessed. Businesses and organizations benefit from enhanced operational efficiency and reduced loss or misplacement of valuable assets through consistent use of an AIN Excel document.

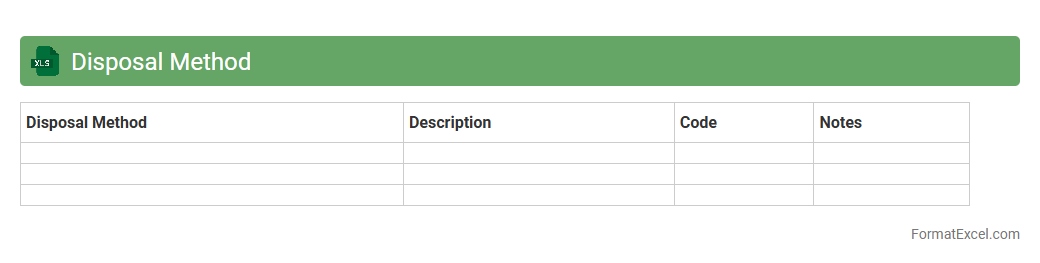

Disposal Method

A

Disposal Method Excel document is a spreadsheet designed to track and manage the disposal processes of assets or materials within an organization. It helps record details such as asset identification, disposal methods, dates, and approval statuses, ensuring compliance with regulatory standards and internal policies. This document streamlines asset lifecycle management, reduces errors, and provides valuable data for auditing and decision-making purposes.

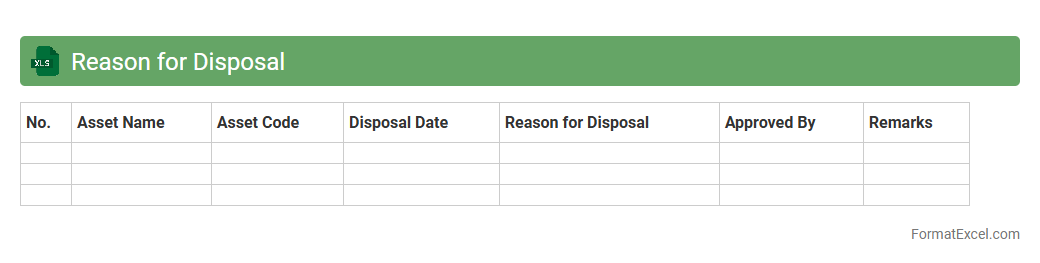

Reason for Disposal

The

Reason for Disposal Excel document systematically records the causes behind the disposal of assets, enabling accurate tracking and analysis. It helps organizations identify patterns in asset decommissioning, improve inventory management, and support compliance with regulatory requirements. Utilizing this document enhances decision-making by providing clear insights into asset lifecycle and operational efficiency.

Original Purchase Date

The

Original Purchase Date Excel document records the initial acquisition dates of assets or products, enabling accurate tracking of warranty periods and depreciation schedules. This information is crucial for managing inventory, scheduling maintenance, and ensuring timely replacements or upgrades. Utilizing this document helps streamline financial planning and improves compliance with accounting standards.

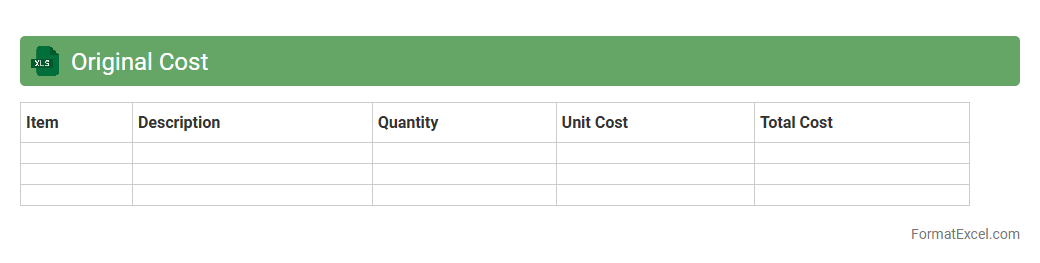

Original Cost

An

Original Cost Excel document is a spreadsheet tool designed to track the initial purchase price of assets or inventory, helping organizations maintain accurate financial records. It facilitates cost analysis, budgeting, and depreciation calculations by providing clear data on historical expenditures. Using this document enhances decision-making by allowing for precise cost comparisons and financial forecasting.

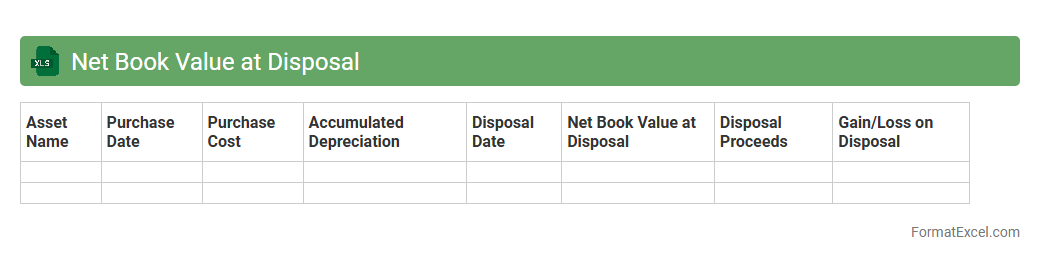

Net Book Value at Disposal

The

Net Book Value at Disposal Excel document calculates the remaining value of an asset after accounting for depreciation and accumulated costs before its sale or disposal. This tool helps businesses determine accurate financial outcomes from disposing of assets by providing clear insights into asset worth and potential gains or losses. Using this document enhances asset management efficiency and supports informed decision-making in accounting and financial reporting.

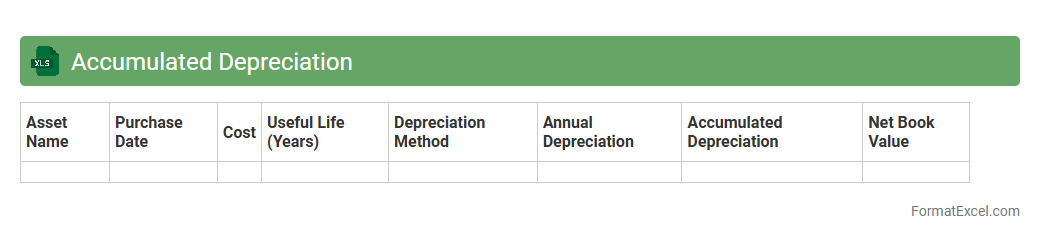

Accumulated Depreciation

An

Accumulated Depreciation Excel document is a financial record that tracks the total depreciation expense charged on fixed assets over time. It helps businesses monitor asset value reduction, plan for replacements, and accurately report net book value in financial statements. Using this document improves asset management efficiency and supports better decision-making in budgeting and tax preparation.

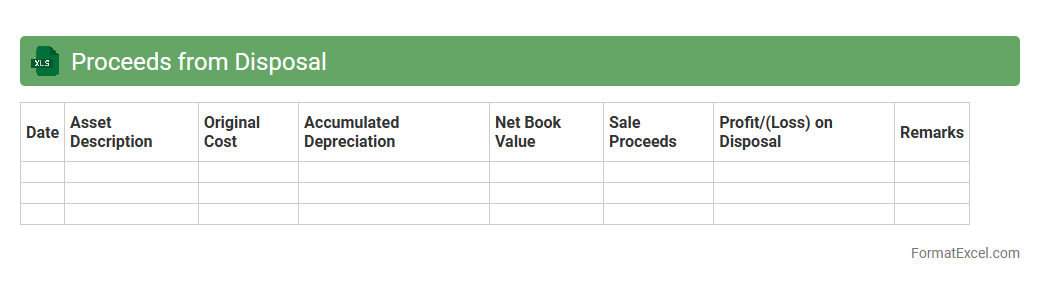

Proceeds from Disposal

The

Proceeds from Disposal Excel document tracks the financial returns generated from selling assets, providing clear insights into net gains or losses. It is useful for monitoring asset liquidation, ensuring accurate accounting of disposal transactions, and supporting effective financial planning and decision-making. By organizing disposal proceeds data, the document enhances transparency and simplifies reporting for audits and management reviews.

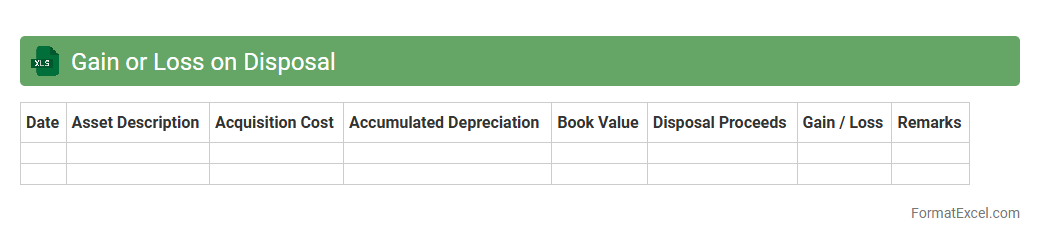

Gain or Loss on Disposal

A

Gain or Loss on Disposal Excel document records the financial outcome when an asset is sold or discarded, calculating the difference between the asset's book value and its sale price. This tool is essential for accurately tracking the impact of asset disposals on company profitability and ensuring compliance with accounting standards. It enables businesses to analyze asset performance, optimize decision-making, and maintain precise financial records for reporting and auditing purposes.

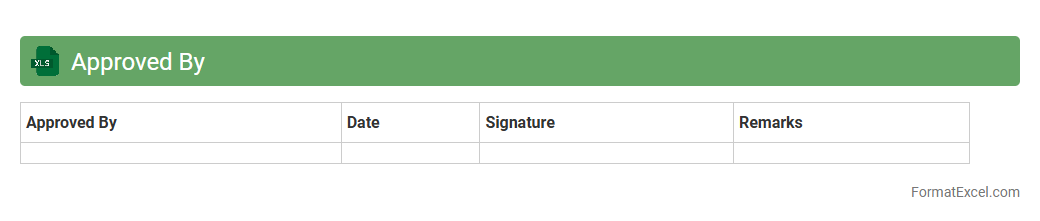

Approved By

An

Approved By Excel document serves as a verified record where approvals from designated authorities are documented systematically, ensuring accountability and traceability in workflows. This type of document streamlines project management, contract validation, and financial authorizations by providing clear, auditable evidence of consent. Utilizing an Approved By Excel sheet enhances organizational efficiency and compliance, reducing errors and miscommunications in multi-step approval processes.

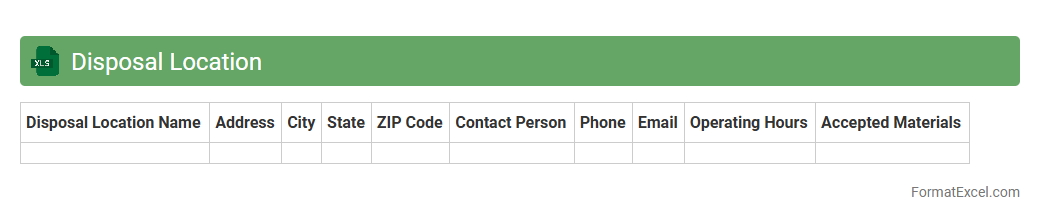

Disposal Location

A

Disposal Location Excel document is a digital spreadsheet used to track and manage sites designated for disposing of waste or unwanted materials. It allows organizations to record detailed information such as location addresses, types of waste accepted, regulatory compliance status, and operational hours, facilitating efficient waste management and regulatory adherence. This document streamlines decision-making processes by providing a centralized, accessible database that enhances environmental responsibility and operational efficiency.

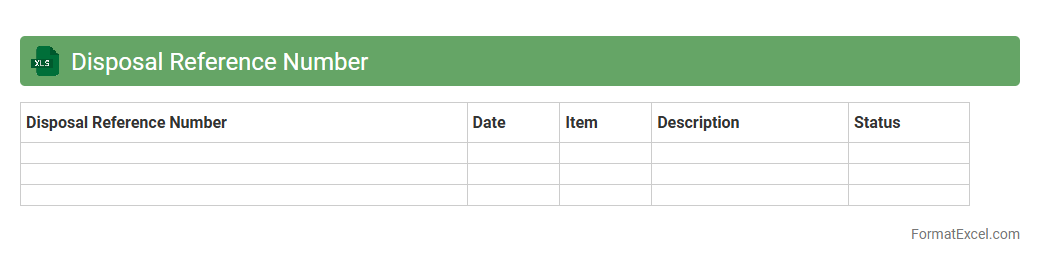

Disposal Reference Number

A

Disposal Reference Number Excel document is a structured spreadsheet used to track and manage the disposal of assets, inventory, or waste materials efficiently. It enables organizations to record unique identification numbers corresponding to each disposal event, ensuring accurate documentation and compliance with regulatory requirements. This document facilitates streamlined audit trails, enhances accountability, and simplifies reporting processes in asset management or environmental compliance systems.

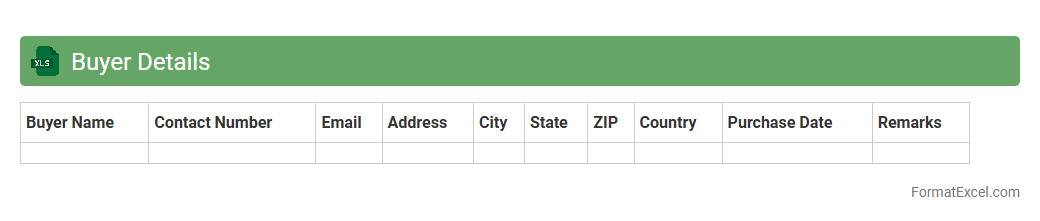

Buyer Details

The Buyer Details Excel document contains comprehensive information about customers, including contact data, purchase history, and payment preferences, enabling efficient tracking and management of client relationships. This

structured dataset helps businesses analyze buying patterns, forecast demand, and tailor marketing strategies to increase sales. By organizing buyer information systematically, the document streamlines communication and enhances decision-making processes in sales and customer service departments.

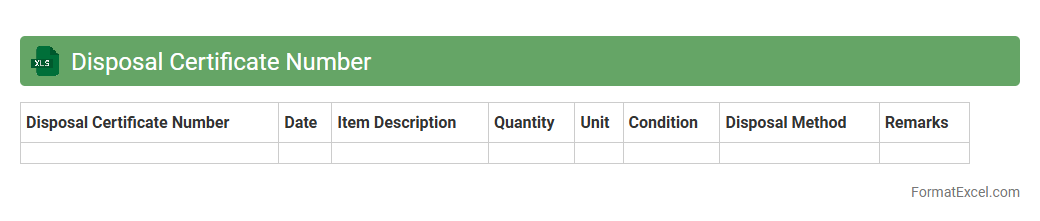

Disposal Certificate Number

The

Disposal Certificate Number Excel document serves as a systematic record of certificates issued for the disposal of assets, ensuring compliance with legal and organizational requirements. This document streamlines verification processes, facilitates audit tracking, and provides easy access to disposal histories, enhancing transparency and accountability. By maintaining accurate and organized disposal certificate data, businesses can efficiently manage asset lifecycle and regulatory reporting.

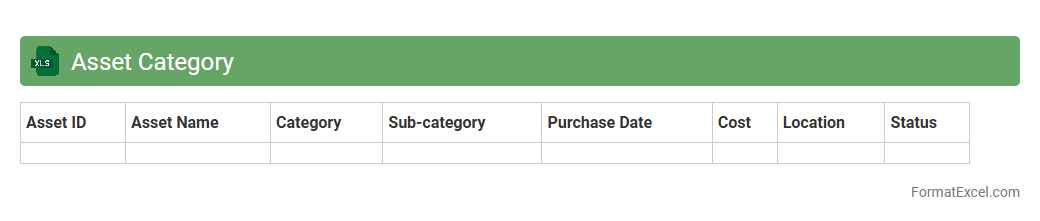

Asset Category

An

Asset Category Excel document is a structured spreadsheet used to categorize and manage various types of assets such as equipment, vehicles, or real estate. It enables efficient tracking of asset details, depreciation, and maintenance schedules, facilitating accurate financial reporting and decision-making. This document enhances organizational asset management by providing clear visibility and control over asset allocation and lifecycle.

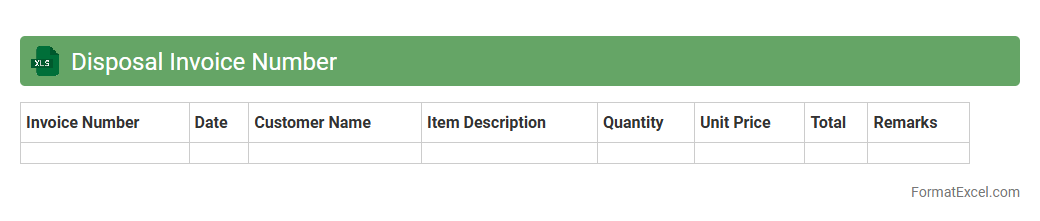

Disposal Invoice Number

A

Disposal Invoice Number Excel document is a structured spreadsheet used to record and track invoice numbers related to the disposal of assets or goods. It helps businesses maintain accurate financial records, streamline asset management, and ensure compliance with accounting standards. By organizing disposal transactions in one place, this document enhances auditing efficiency and supports effective decision-making.

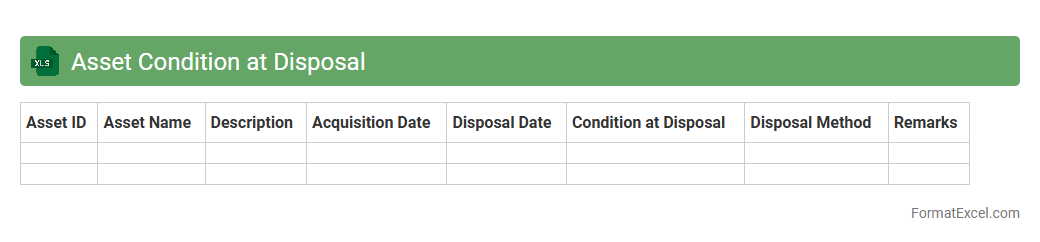

Asset Condition at Disposal

The

Asset Condition at Disposal Excel document systematically records the state of assets at the time they are disposed of, enabling precise tracking of wear, damage, or obsolescence. This data supports accurate financial reporting, helps identify patterns of asset degradation, and informs strategic decisions on asset replacement or maintenance. Utilizing this document enhances transparency, reduces unexpected costs, and optimizes asset lifecycle management within organizations.

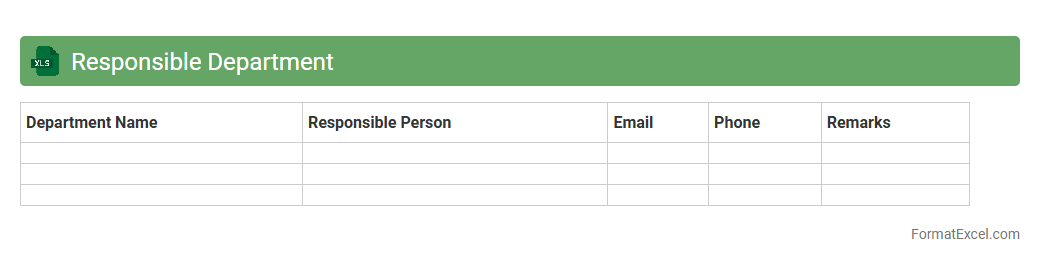

Responsible Department

The

Responsible Department Excel document serves as a centralized tool to assign, track, and manage departmental responsibilities within an organization. It enhances accountability by clearly outlining tasks, deadlines, and responsible parties, improving workflow efficiency and project management. Utilizing this document enables teams to monitor progress, identify bottlenecks, and ensure timely completion of objectives across all departments.

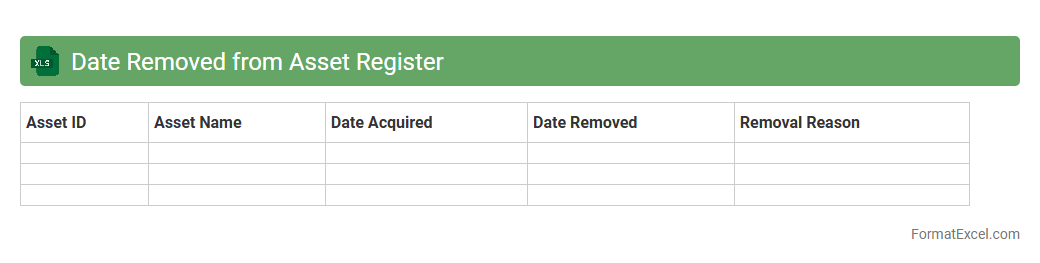

Date Removed from Asset Register

The

Date Removed from Asset Register in an Excel document records the specific date when an asset is officially taken out of service or disposed of. This information helps maintain accurate asset tracking, ensuring compliance with accounting standards and providing clear audit trails. Tracking the removal date aids in asset lifecycle management, budget planning, and depreciation calculations.

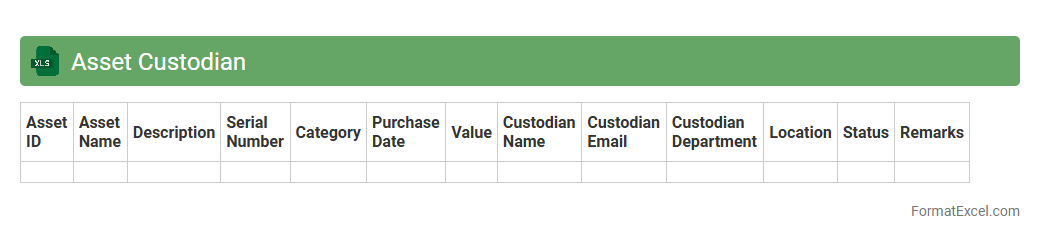

Asset Custodian

The

Asset Custodian Excel document is a centralized tool designed to track and manage physical and digital assets within an organization, ensuring accurate accountability and streamlined asset maintenance. It provides detailed logs of asset allocations, condition statuses, and custodian responsibilities, facilitating efficient auditing and compliance processes. Using this document improves asset visibility, reduces loss or misplacement, and enhances overall operational control.

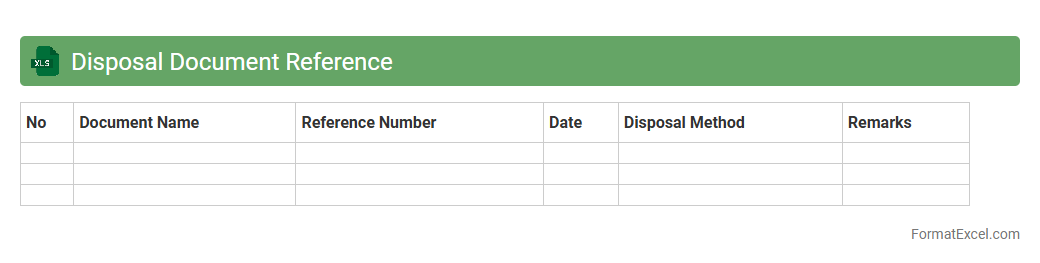

Disposal Document Reference

The

Disposal Document Reference Excel document serves as a centralized record for tracking the disposal of assets, materials, or inventory within an organization. It helps streamline compliance with regulatory requirements by maintaining detailed information such as asset IDs, disposal dates, methods, and approvals. This document enhances transparency and audit readiness, ensuring effective management and accountability of disposed items.

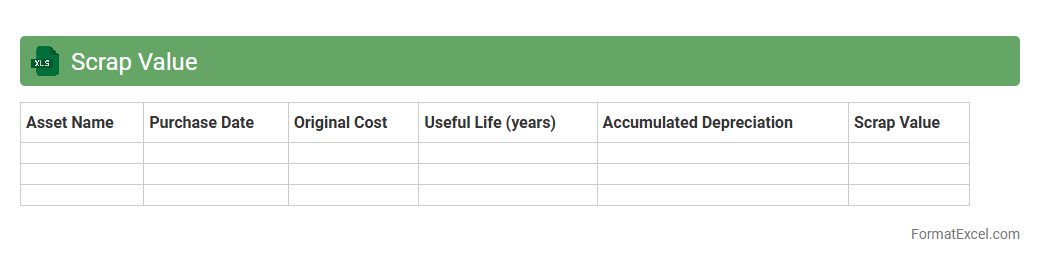

Scrap Value

A

Scrap Value Excel document is a financial tool used to calculate the residual value of an asset after its useful life ends. It helps businesses estimate the amount they can recover from selling or disposing of equipment, machinery, or materials. This document streamlines asset management decisions and supports accurate financial planning by tracking depreciation and end-of-life asset values efficiently.

Notes or Comments

Notes or Comments in an Excel document are annotations attached to specific cells, allowing users to add explanations, reminders, or feedback without altering the actual data. These features enhance collaboration by providing contextual information that improves understanding and communication among team members. Using

Excel Comments helps maintain clarity in complex spreadsheets, ensuring data accuracy and facilitating efficient review processes.

Introduction to Asset Disposal Register

An Asset Disposal Register is a document used to record the disposal of company assets systematically. It helps track discarded or sold assets for accounting and auditing purposes. This register ensures transparency and compliance with financial regulations.

Importance of Asset Disposal Records

Maintaining accurate asset disposal records safeguards a business from financial discrepancies and legal issues. It aids in calculating depreciation, tax adjustments, and verifying asset life cycles. Proper management of disposal information improves overall asset control.

Key Components of an Asset Disposal Register

The key components include asset identification, disposal date, disposal method, and financial details. Each entry should detail the reason for disposal and authorization status. Accurate components ensure the asset disposal process remains clear and auditable.

Essential Columns for Excel Register

An Excel register typically includes columns like Asset ID, Description, Purchase Date, Disposal Date, Disposal Method, and Disposal Value. Each column allows easy entry and retrieval of asset disposal information. Clear column headers improve data accuracy and usability.

Sample Asset Disposal Register Format in Excel

A sample format features structured rows with headers for assets disposed of, dates, and financials. Conditional formatting can highlight completed or pending disposals. This format provides an effective template for asset tracking in Excel.

Step-by-Step Guide to Creating the Register

Start by opening Excel and setting up column headers for key asset details. Enter past asset disposals and format the sheet for clarity and ease of use. Following a methodical approach ensures a comprehensive asset disposal register.

Best Practices for Data Entry and Maintenance

Always verify information before entering into the register and update promptly after disposal events. Secure the Excel file with access controls to prevent unauthorized edits. Consistent reviews maintain the accuracy and reliability of the asset disposal data.

Common Mistakes to Avoid in Asset Registers

Avoid missing disposal dates, incomplete entries, and inaccurate financial details that may compromise records. Double-check data inputs to reduce errors and maintain trustworthiness. Proper validation controls help prevent common asset register mistakes.

Downloadable Asset Disposal Register Excel Template

A downloadable Excel template offers a ready-to-use format pre-filled with necessary columns and formulas. It simplifies the process for businesses managing multiple asset disposals. Using a template ensures consistency and saves setup time.

Frequently Asked Questions (FAQs)

FAQs address common concerns like update frequency, handling asset exchanges, and disposal authorization. They guide users to maintain compliant and efficient asset disposal practices. Reviewing these answers enhances understanding of the asset disposal register system.