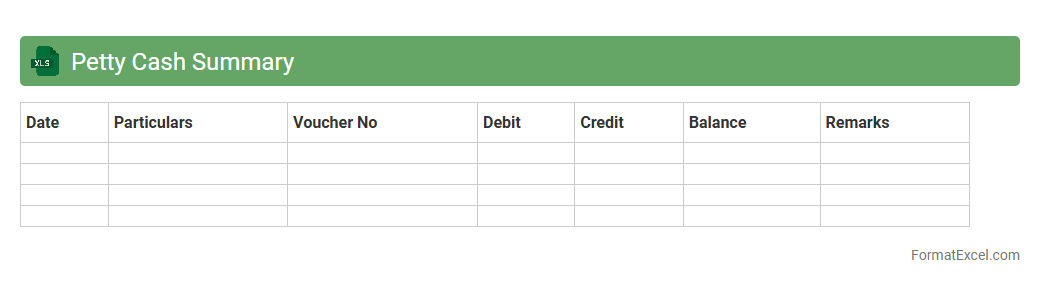

Petty Cash Summary

A

Petty Cash Summary Excel document is a financial record used to track small, incidental expenses within an organization. It consolidates all petty cash transactions, providing transparency and easy monitoring of cash outflows and balances. This tool helps maintain accurate accounting, prevent misuse, and ensure effective budget management for minor expenditures.

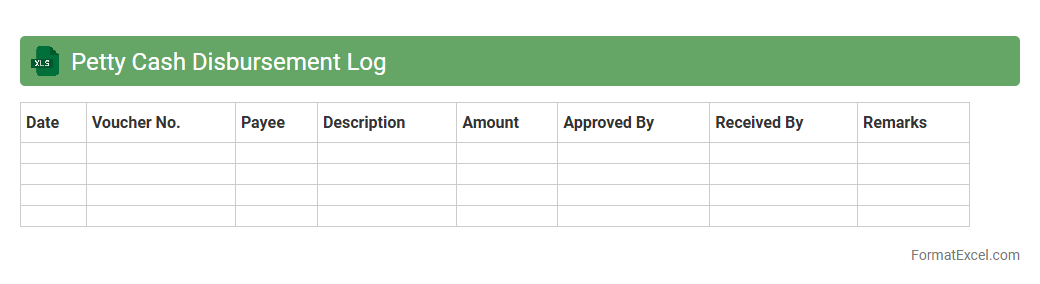

Petty Cash Disbursement Log

A

Petty Cash Disbursement Log Excel document is a tool used to track small cash expenses made within an organization. It records details such as date, amount, purpose, and recipient, ensuring accurate monitoring of petty cash usage. This log helps maintain financial accountability, simplifies auditing, and prevents misuse of funds.

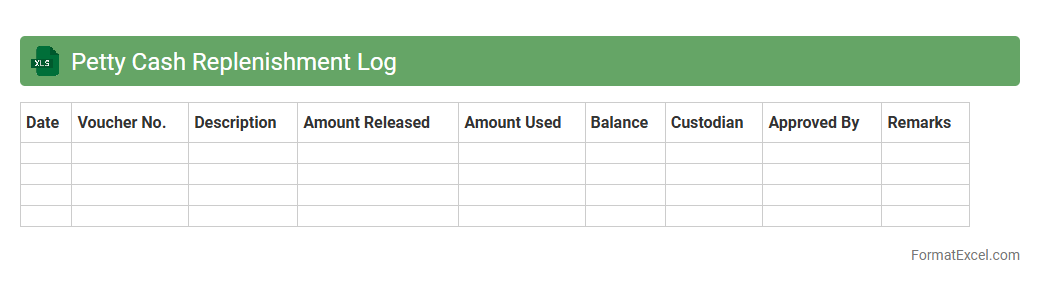

Petty Cash Replenishment Log

The

Petty Cash Replenishment Log Excel document is a financial tool designed to track small cash expenditures and the process of replenishing the petty cash fund. It helps maintain accurate records of disbursements, receipts, and remaining balances, ensuring transparent and efficient cash management. Using this log reduces errors, enhances accountability, and simplifies auditing within organizations.

Petty Cash Voucher Tracker

A

Petty Cash Voucher Tracker Excel document is a tool designed to record, monitor, and manage small cash expenses within an organization. It helps maintain accurate records of petty cash disbursements by categorizing vouchers, tracking balances, and ensuring transparency in cash handling. This tracker improves financial control, reduces errors, and simplifies auditing processes for petty cash transactions.

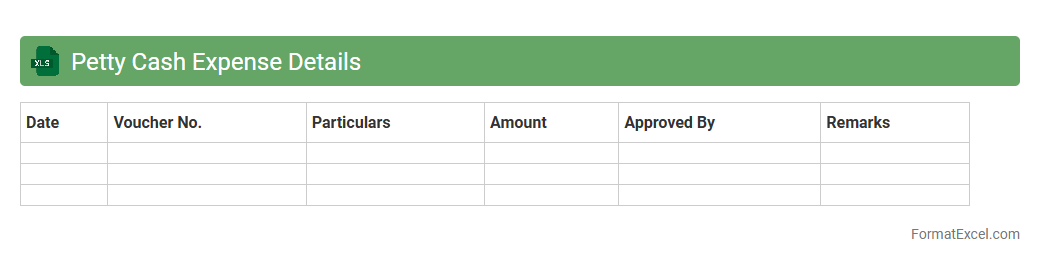

Petty Cash Expense Details

The

Petty Cash Expense Details Excel document is a comprehensive record used to track small, everyday business expenditures that are paid out of the petty cash fund. It allows businesses to maintain clear and organized financial records by detailing each expense's date, amount, purpose, and recipient. This document is useful for monitoring cash flow, ensuring accountability, and simplifying the reconciliation process during financial audits.

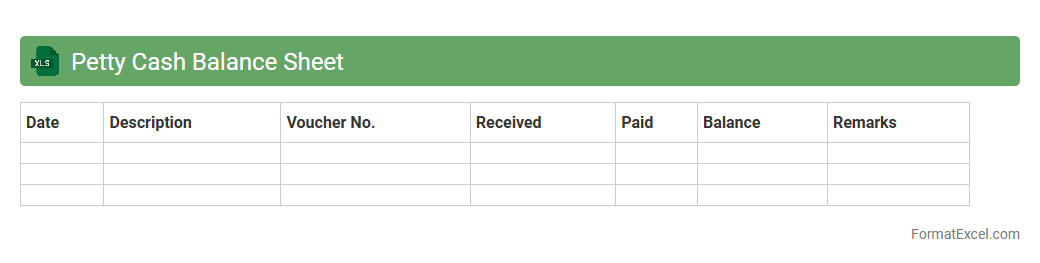

Petty Cash Balance Sheet

A

Petty Cash Balance Sheet Excel document is a financial tool designed to track small cash transactions and maintain accurate records of petty cash expenses. It helps in monitoring cash inflows and outflows, ensuring transparency and accountability in office or business petty cash management. Utilizing this Excel sheet streamlines cash reconciliation processes, reduces errors, and provides a clear overview of available petty cash at any given time.

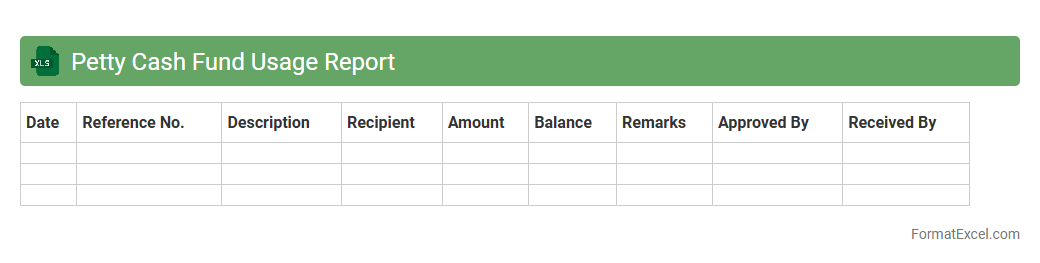

Petty Cash Fund Usage Report

The

Petty Cash Fund Usage Report Excel document tracks small cash expenditures within an organization, ensuring transparent and accurate financial management. It helps monitor petty cash disbursements, categorize expenses, and reconcile the remaining cash balance for accountability and auditing purposes. Using this report enhances financial control, prevents misuse of funds, and streamlines the expense reporting process.

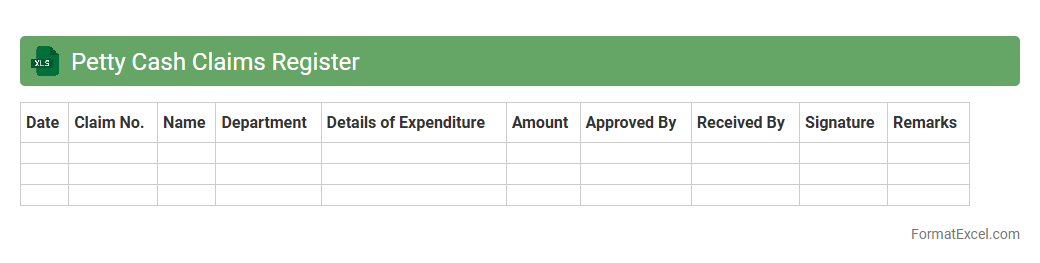

Petty Cash Claims Register

The

Petty Cash Claims Register Excel document systematically records all small cash expenses and reimbursements within an organization, ensuring accurate tracking of petty cash usage. It helps maintain transparency, prevents misuse of funds, and simplifies reconciliation during audits by providing a clear, organized log of each transaction. This tool is essential for efficient financial management and accountability in managing minor business expenditures.

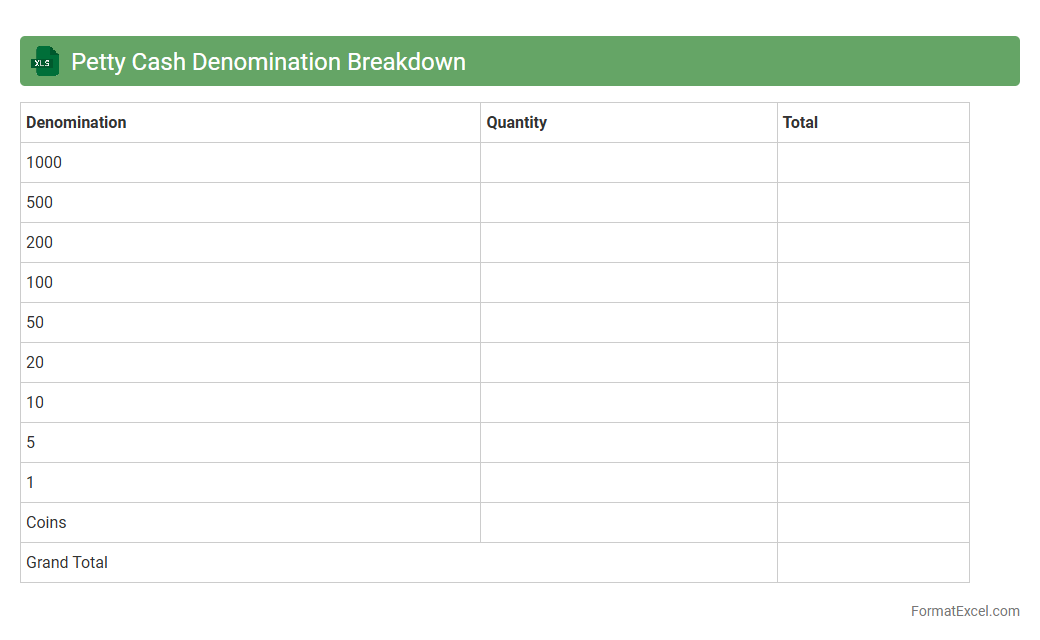

Petty Cash Denomination Breakdown

A

Petty Cash Denomination Breakdown Excel document organizes and lists the various currency denominations in a petty cash fund, providing clear visibility into the amount held in each bill or coin type. This breakdown facilitates accurate tracking, reconciliation, and management of small cash expenses within an organization, ensuring transparency and preventing shortages or discrepancies. By using this tool, businesses can efficiently maintain control over minor financial transactions and enhance overall cash management processes.

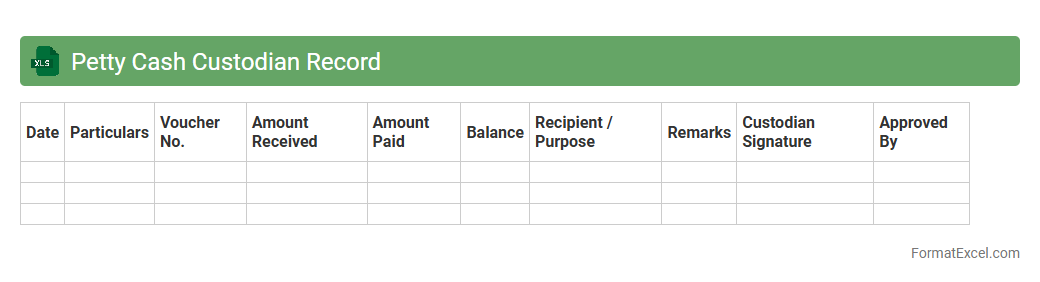

Petty Cash Custodian Record

A

Petty Cash Custodian Record Excel document is a detailed log used to track small cash transactions managed by the petty cash custodian within an organization. It records disbursements, replenishments, and balances, ensuring accurate financial control and transparency over minor expenses. This document helps maintain accountability, simplifies auditing processes, and aids in budgeting by providing clear insights into everyday cash usage.

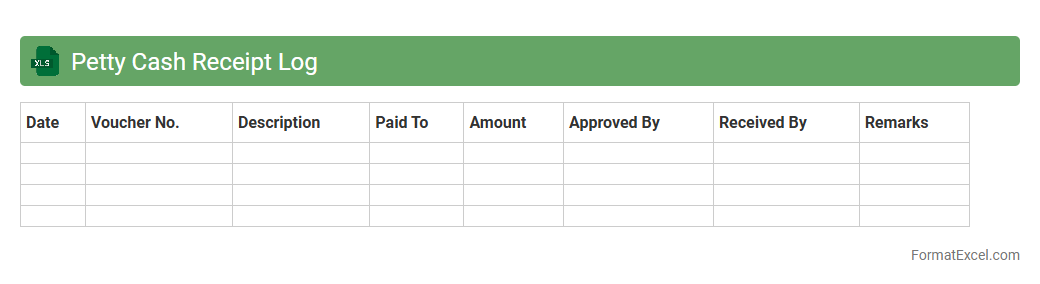

Petty Cash Receipt Log

A

Petty Cash Receipt Log Excel document is a structured tool used to record and track all small cash expenditures within an organization. It helps maintain transparency and accuracy by documenting transaction dates, amounts, purposes, and receipt details, ensuring proper reconciliation of petty cash funds. This log enhances financial control, simplifies auditing processes, and prevents misuse or loss of cash.

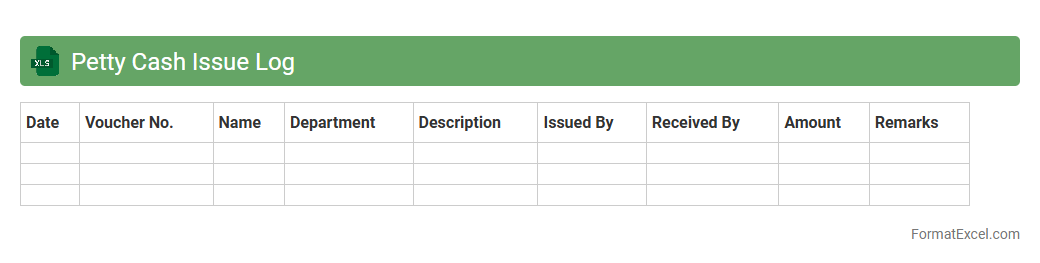

Petty Cash Issue Log

The

Petty Cash Issue Log Excel document is a detailed record-keeping tool that tracks small cash expenses within an organization. It helps monitor petty cash disbursements, ensures accountability, and simplifies reconciliation by maintaining clear entries of date, purpose, amount, and recipient. This log enhances financial transparency and aids in budget management by preventing unauthorized spending and facilitating easier audits.

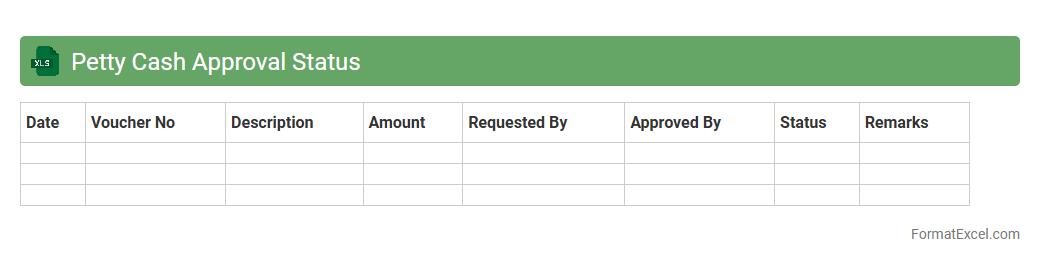

Petty Cash Approval Status

The

Petty Cash Approval Status Excel document tracks and records the authorization process of small cash expenses within an organization, ensuring transparency and accountability. It provides a clear overview of approval stages, dates, and responsible personnel, which facilitates efficient financial management and prevents misuse of funds. This tool helps streamline petty cash reconciliation and supports accurate budgeting and auditing efforts.

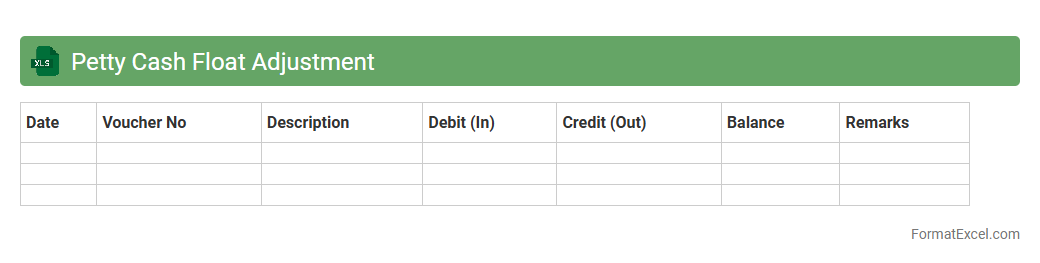

Petty Cash Float Adjustment

The

Petty Cash Float Adjustment Excel document is a financial tool designed to track and manage small cash expenditures within an organization, ensuring accurate reconciliation of petty cash funds. It helps maintain transparency by recording inflows and outflows, adjusting the cash float to reflect real-time balances, and preventing discrepancies in petty cash accounts. This document enhances financial control, simplifies audit processes, and supports efficient budget monitoring for minor operational expenses.

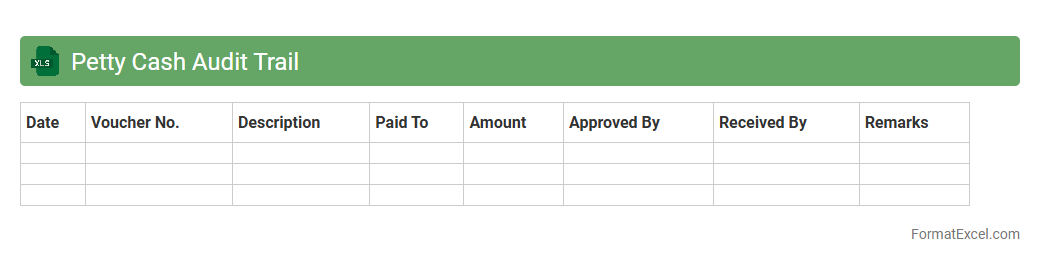

Petty Cash Audit Trail

A

Petty Cash Audit Trail Excel document tracks all transactions related to small, daily cash expenses, providing detailed records of withdrawals, expenditures, and replenishments. It enhances financial transparency and accountability by enabling easy verification and reconciliation of petty cash funds. This tool helps prevent discrepancies and supports efficient internal control within an organization.

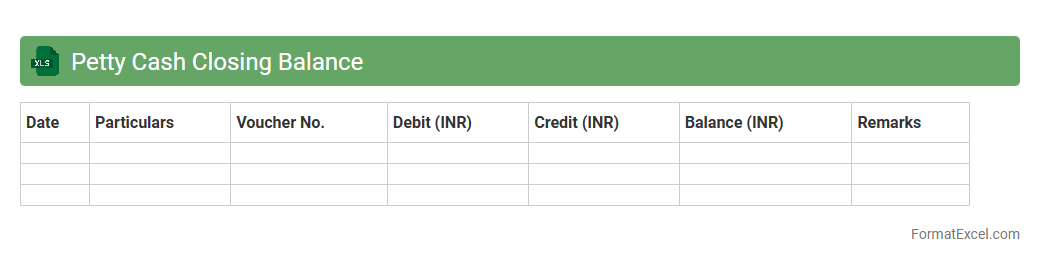

Petty Cash Closing Balance

The

Petty Cash Closing Balance Excel document tracks the remaining cash in a petty cash fund at the end of a specific period, ensuring accurate financial records. It helps businesses monitor daily cash expenses and reconcile the total fund, preventing discrepancies and unauthorized usage. This tool streamlines cash management, supports budget control, and enhances transparency in small cash transactions.

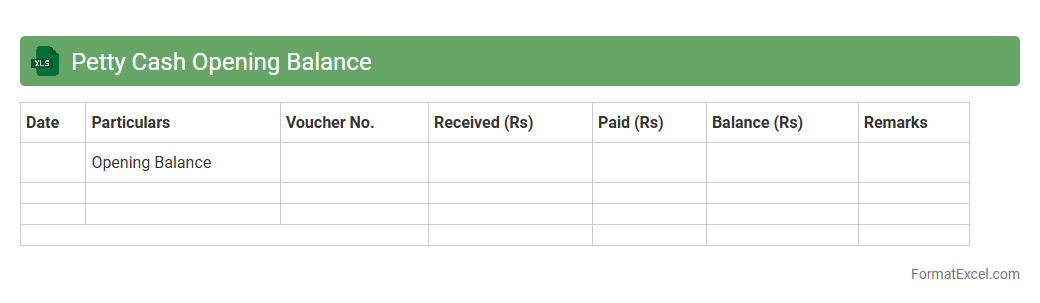

Petty Cash Opening Balance

The

Petty Cash Opening Balance Excel document records the initial amount of cash available at the start of a financial period, providing a clear foundation for tracking small, everyday business expenses. It helps maintain accurate financial control by ensuring that all petty cash transactions are documented and reconciled against the opening balance. This document is essential for budgeting, auditing, and preventing discrepancies in cash management practices.

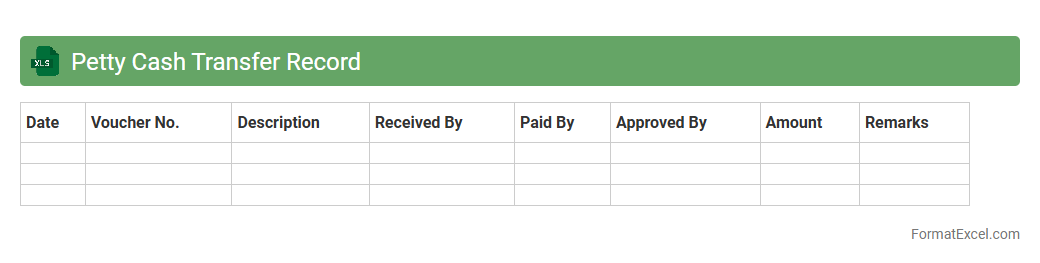

Petty Cash Transfer Record

A

Petty Cash Transfer Record Excel document is a financial tracking tool used to record small cash transactions within an organization. It helps maintain accurate records of petty cash inflows and outflows, ensuring accountability and transparency in managing minor expenses. This document streamlines expense monitoring, simplifies reconciliation processes, and supports effective budget control for everyday operational costs.

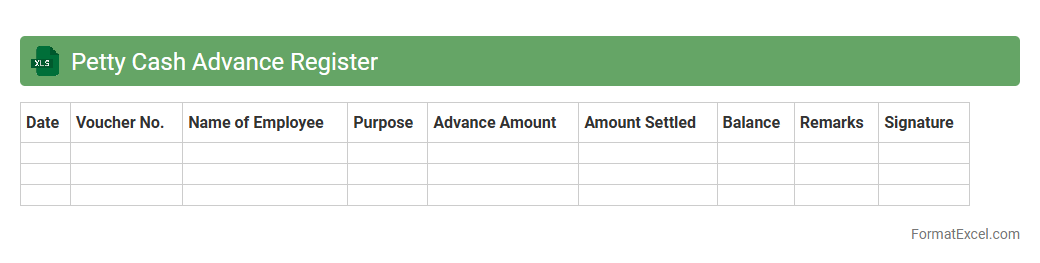

Petty Cash Advance Register

The

Petty Cash Advance Register Excel document serves as a systematic record of all petty cash transactions, tracking advances, expenditures, and balances. It enhances financial control by providing transparency and accountability for small cash disbursements within an organization. This tool simplifies reconciliation processes and aids in maintaining accurate budgeting and auditing.

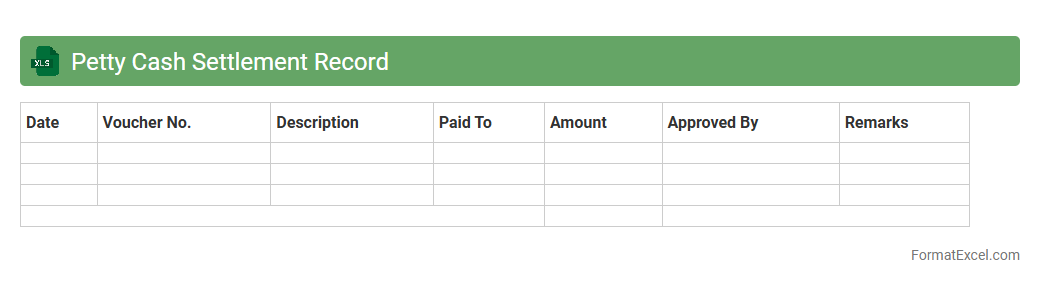

Petty Cash Settlement Record

The

Petty Cash Settlement Record Excel document is a detailed ledger used to track small cash expenses and reimbursements within an organization. It helps maintain accurate financial records by documenting each petty cash transaction, ensuring transparency and accountability in managing funds. This tool streamlines the reconciliation process, making it easier to monitor expenditures and prevent discrepancies.

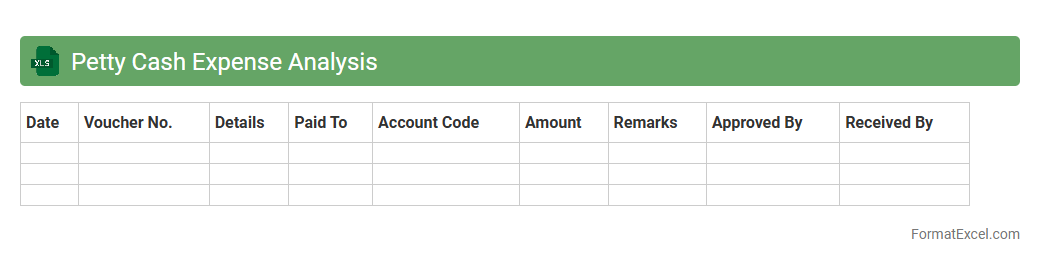

Petty Cash Expense Analysis

Petty Cash Expense Analysis Excel document is a tool designed to track and categorize small, day-to-day business expenses efficiently. It helps organizations maintain accurate records of minor expenditures, ensuring better financial oversight and control. Using this

Petty Cash Expense Analysis document enables businesses to monitor spending patterns, identify discrepancies, and streamline budget management.

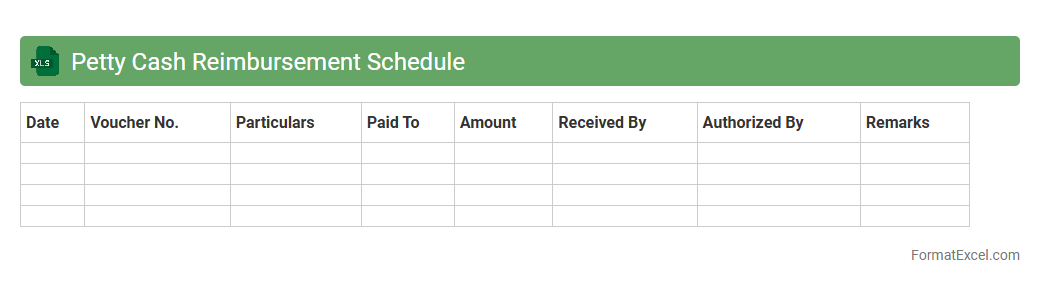

Petty Cash Reimbursement Schedule

A

Petty Cash Reimbursement Schedule Excel document is a tool designed to track and manage small cash expenses within an organization. It helps streamline the process of requesting and approving reimbursements by documenting each petty cash transaction, date, amount, and purpose in a clear and organized format. Utilizing this schedule improves financial transparency, reduces errors, and ensures efficient cash flow management for minor operational costs.

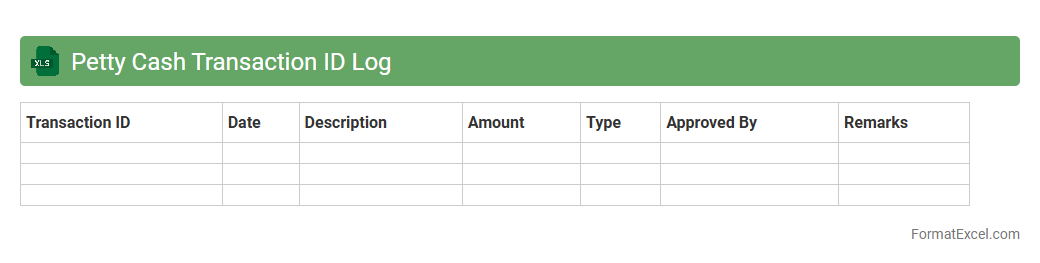

Petty Cash Transaction ID Log

The

Petty Cash Transaction ID Log Excel document is a detailed record-keeping tool designed to track all petty cash transactions within an organization. It enables efficient monitoring of small cash expenses by assigning unique transaction IDs, ensuring accuracy and accountability in financial management. This log helps prevent errors and fraud while simplifying reconciliation processes and maintaining transparency in petty cash handling.

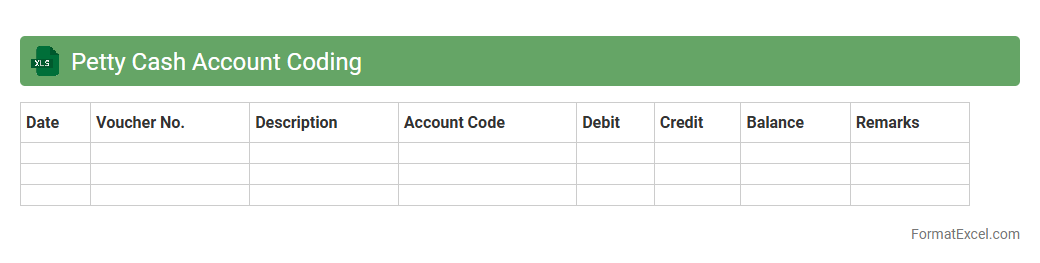

Petty Cash Account Coding

A

Petty Cash Account Coding Excel document is a spreadsheet tool designed to categorize and track small cash expenses systematically within an organization. It streamlines the process of recording petty cash transactions by assigning specific codes to different expense types, improving accuracy and ease of reconciliation. Using this document enhances financial control, reduces errors, and provides a clear audit trail for petty cash management.

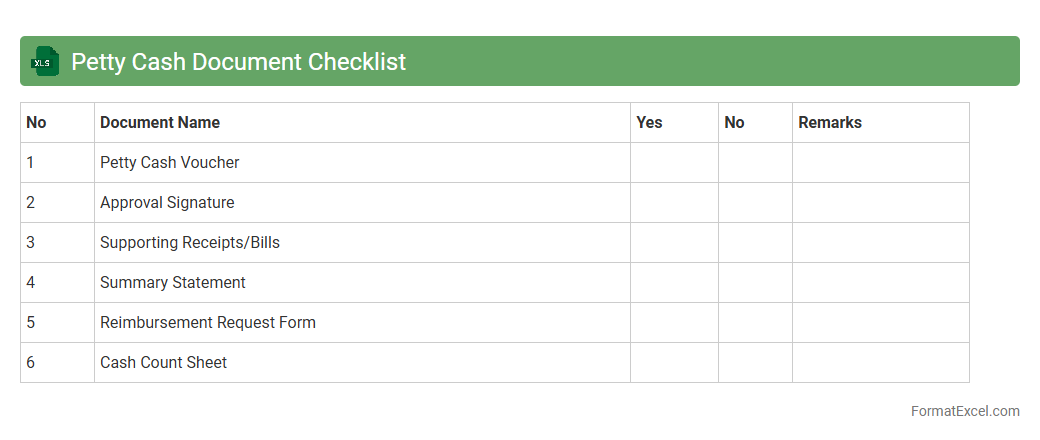

Petty Cash Document Checklist

The

Petty Cash Document Checklist Excel document streamlines the management and tracking of small cash expenditures within an organization. It helps ensure all petty cash transactions are properly documented, categorized, and reconciled to prevent discrepancies and maintain financial accuracy. This tool enhances accountability by providing a structured format for recording receipts, approvals, and balances.

Introduction to Petty Cash Management

Petty cash management involves handling small, incidental expenses within an organization. Efficient management ensures smooth daily operations without frequent bank transactions. A well-maintained petty cash register tracks these minor expenses accurately.

Importance of a Petty Cash Register

The petty cash register provides a transparent record of all small cash disbursements and receipts. It helps prevent misuse and ensures accountability in handling cash. Proper documentation is essential for internal controls.

Key Components of a Petty Cash Register Format

A typical petty cash register includes date, description, amount, payment method, and balance columns. This format organizes transactions systematically for easy reference and auditing. Incorporating a balance column is critical for tracking the remaining cash.

Benefits of Using Excel for Petty Cash Registers

Excel offers flexibility, real-time calculations, and customization options for petty cash management. It enables quick updates and generates reports effortlessly. Using Excel reduces errors compared to manual record-keeping.

Essential Columns for a Petty Cash Register in Excel

Key columns to include are Date, Description, Voucher Number, Amount In, Amount Out, and Balance. These columns provide a clear trail of petty cash transactions. Accurate data entry in these fields ensures reliable financial tracking.

Step-by-Step Guide to Creating a Petty Cash Register in Excel

Start by setting up column headers and formatting cells for currency. Use formulas to calculate running balances automatically. Regularly update entries to maintain accuracy and avoid discrepancies.

Sample Petty Cash Register Format (Excel Template)

A sample template typically features organized rows and columns with pre-set formulas. This helps users quickly enter expenses and monitor cash flow. Templates save time and promote consistent record-keeping practices.

Tips for Maintaining Accuracy in Petty Cash Records

Always reconcile the petty cash balance with recorded transactions daily or weekly. Store receipts and verify entries regularly to avoid errors. Implementing a reconciliation process strengthens record accuracy.

Common Mistakes to Avoid in Petty Cash Management

Common errors include missing receipts, delayed updates, and poor documentation. Avoid mixing personal and business expenses to maintain clear records. Consistency and diligence prevent financial discrepancies.

Downloadable Petty Cash Register Excel Template

Accessible downloadable Excel templates streamline petty cash management for businesses of all sizes. These templates come with built-in formulas and structured formats for ease of use. Utilizing a downloadable template enhances efficiency and accuracy.