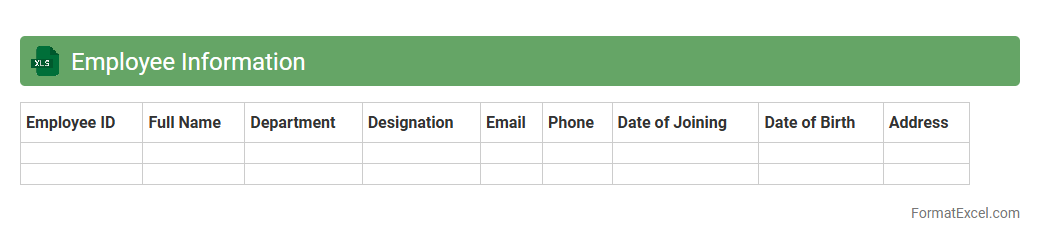

Employee Information

An

Employee Information Excel document is a structured spreadsheet containing vital data such as employee names, job titles, contact details, and employment dates, used for efficient workforce management. This document helps track employee performance, monitor attendance, and streamline HR processes by organizing comprehensive personnel information in one accessible format. It enhances data accuracy, simplifies reporting, and supports decision-making related to human resources.

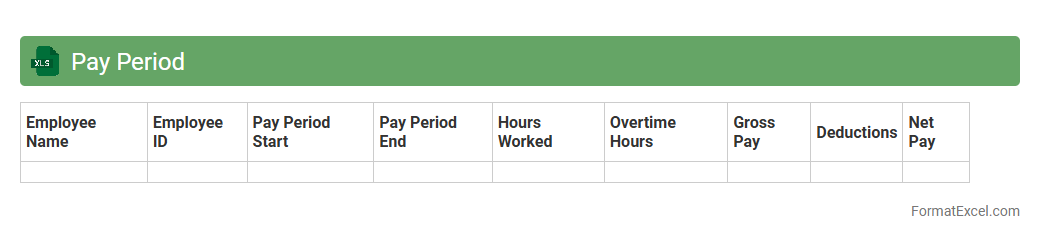

Pay Period

A

Pay Period Excel document is a structured spreadsheet used to track employee work hours, calculate wages, and organize payroll data accurately. It helps streamline payroll processing by providing clear records of start and end dates for pay periods, hours worked, and payment amounts. Utilizing this document ensures timely salary distribution and simplifies financial reporting for businesses.

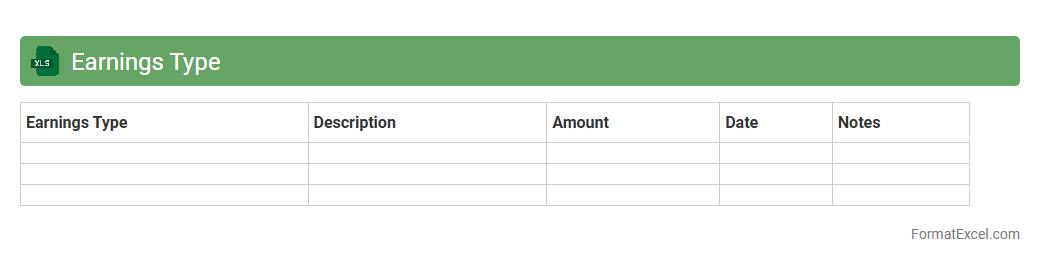

Earnings Type

An

Earnings Type Excel document categorizes various income sources such as salary, bonuses, and commissions for accurate payroll processing and financial analysis. It facilitates streamlined tracking of earnings data, ensuring compliance with tax regulations and aiding in budgeting. Using this document improves clarity in employee compensation management and supports detailed financial reporting.

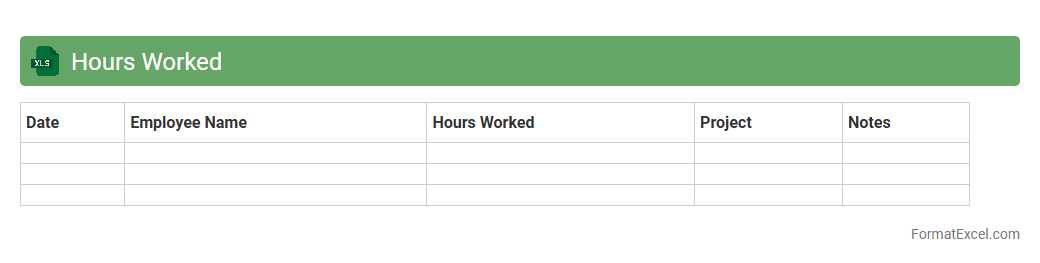

Hours Worked

The

Hours Worked Excel document is a spreadsheet designed to accurately track and calculate the number of hours an employee has worked over a specific period. It helps businesses monitor attendance, manage payroll efficiently, and ensure compliance with labor regulations by providing clear records of time worked. Utilizing this document improves productivity analysis and simplifies time management processes for both employers and employees.

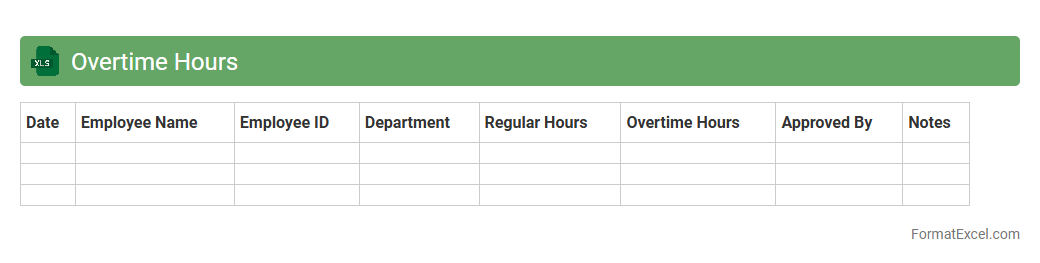

Overtime Hours

An

Overtime Hours Excel document is a digital spreadsheet designed to track and calculate the extra hours employees work beyond their standard schedule. It helps businesses maintain accurate records for payroll processing, ensuring fair compensation and compliance with labor laws. This tool is useful for monitoring employee productivity, managing labor costs, and generating detailed reports for management review.

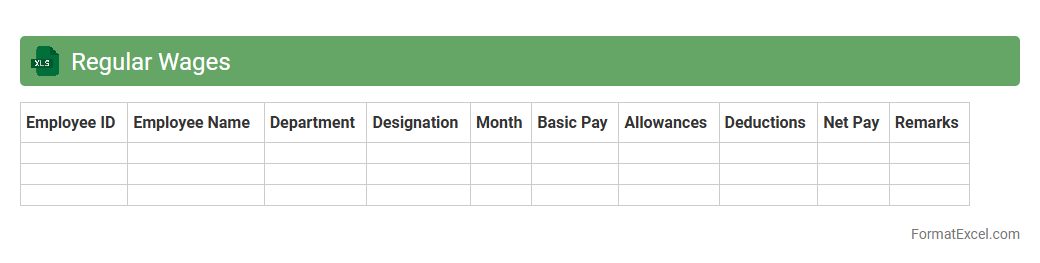

Regular Wages

The

Regular Wages Excel document is a structured spreadsheet that tracks employee salaries, overtime, bonuses, and deductions efficiently. It helps businesses maintain accurate payroll records, ensuring compliance with labor laws and simplifying salary calculations. By using this document, companies can easily analyze wage patterns, forecast expenses, and generate reports for financial audits.

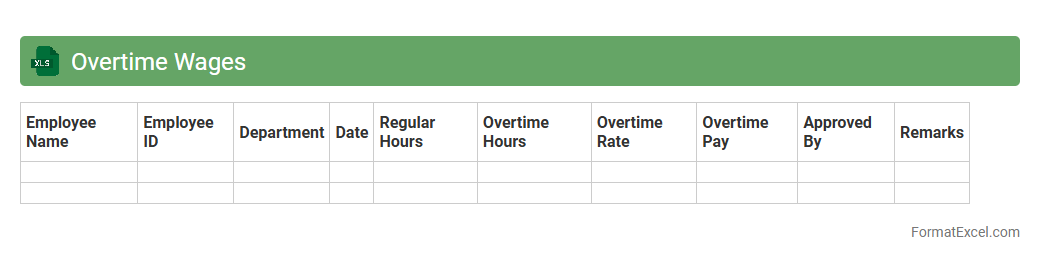

Overtime Wages

An

Overtime Wages Excel document is a spreadsheet designed to calculate and track extra hours worked beyond regular schedules, ensuring accurate compensation. It automates calculations based on hourly rates, overtime multipliers, and total hours, reducing manual errors and saving time. This tool is essential for payroll management, compliance with labor laws, and transparent employee wage reporting.

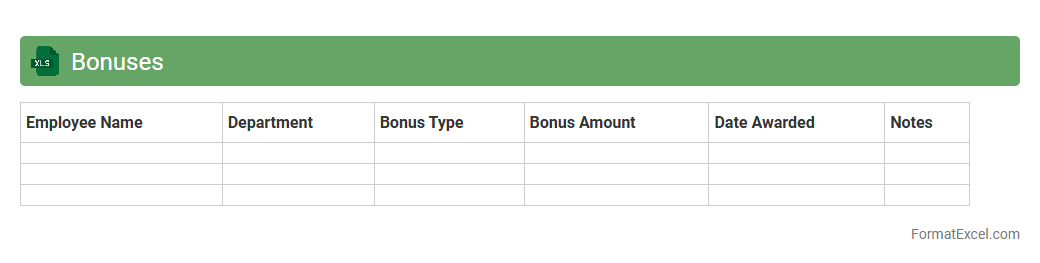

Bonuses

A

Bonuses Excel document is a structured spreadsheet designed to track, calculate, and manage employee bonuses efficiently. It helps businesses monitor performance-based rewards, ensuring transparent and accurate bonus distribution while simplifying financial planning. By organizing bonus data in one place, it enhances decision-making and supports timely compensation adjustments.

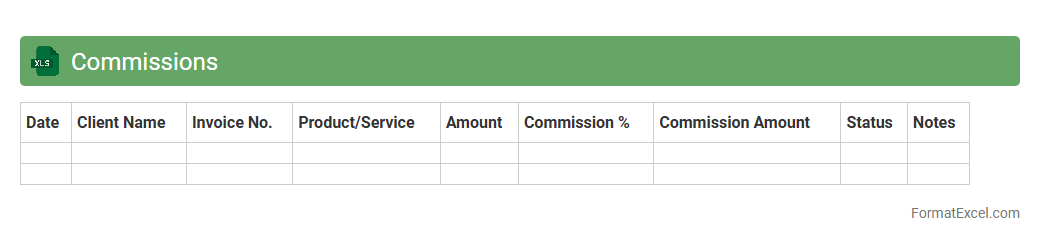

Commissions

A

Commissions Excel document is a structured spreadsheet designed to track and calculate sales commissions earned by employees or agents based on their performance. It streamlines commission management by automating complex calculations, reducing errors, and providing clear insights into earnings and payout schedules. Using this tool improves transparency, enhances financial accuracy, and supports data-driven decision-making for sales incentives.

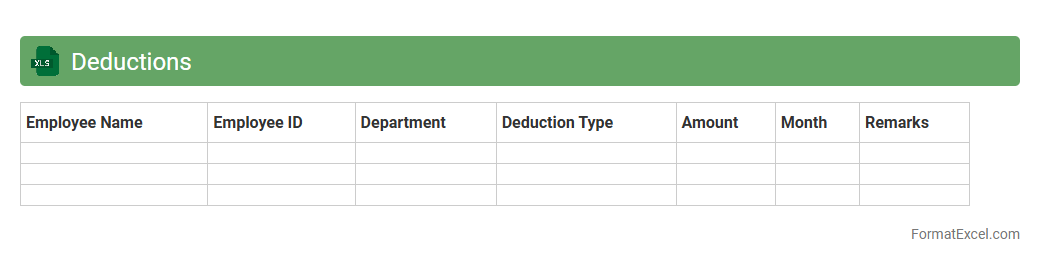

Deductions

A

Deductions Excel document is a spreadsheet used to systematically record and calculate various deductions such as taxes, insurance, and other withholdings from salaries or payments. This document aids in ensuring accurate financial tracking, compliance with payroll regulations, and simplifies the reconciliation process for accountants and HR departments. Utilizing a Deductions Excel sheet enhances transparency and efficiency in managing employee compensation and company expenses.

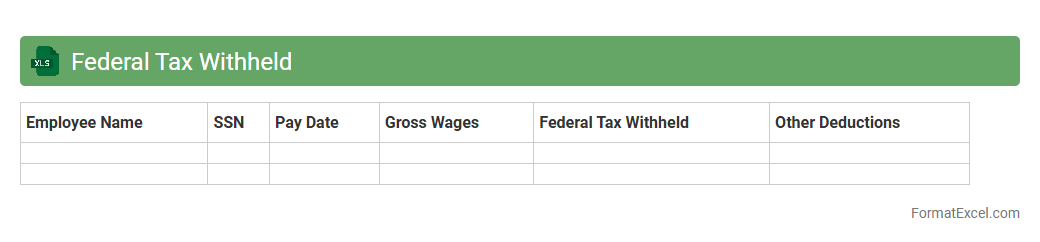

Federal Tax Withheld

A

Federal Tax Withheld Excel document tracks the amount of federal income tax withheld from employee wages or contractor payments throughout the year. This spreadsheet is essential for accurate payroll management, ensuring compliance with IRS regulations and facilitating tax filing by summarizing withheld amounts by pay periods. It helps businesses and individuals avoid underpayment penalties and simplifies year-end tax reporting processes.

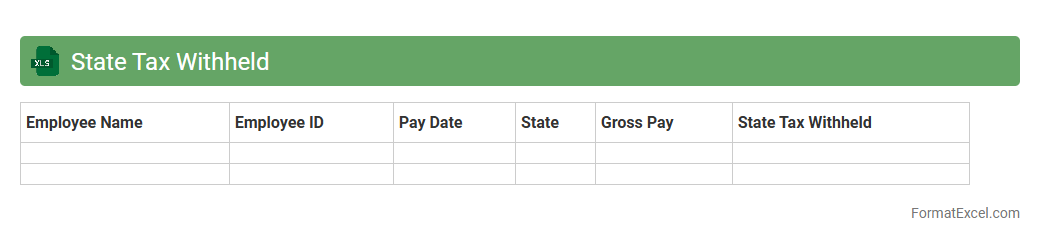

State Tax Withheld

The

State Tax Withheld Excel document tracks the amount of state income tax deducted from employee wages or payments, facilitating accurate tax reporting and compliance. It helps businesses and individuals organize withholding data for payroll, tax filing, and reconciliation purposes. Utilizing this document ensures proper record-keeping, eases tax preparation, and supports timely submission of state tax obligations.

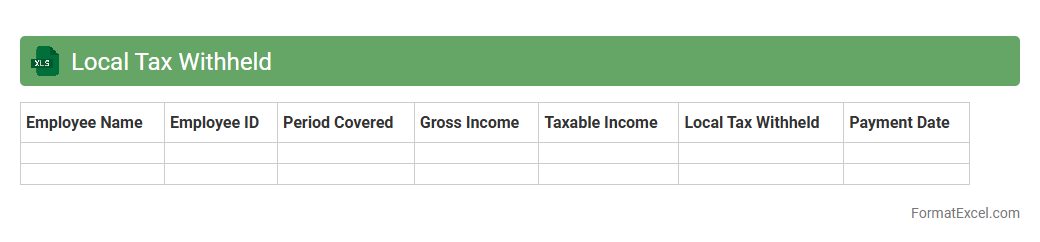

Local Tax Withheld

The

Local Tax Withheld Excel document is a detailed record of taxes deducted at the source on income or payments within a specific jurisdiction. It helps businesses and individuals accurately track their tax obligations, ensuring compliance with local tax laws and simplifying the reconciliation process during tax filing. By organizing withheld amounts, this document aids in efficient financial management and audit readiness.

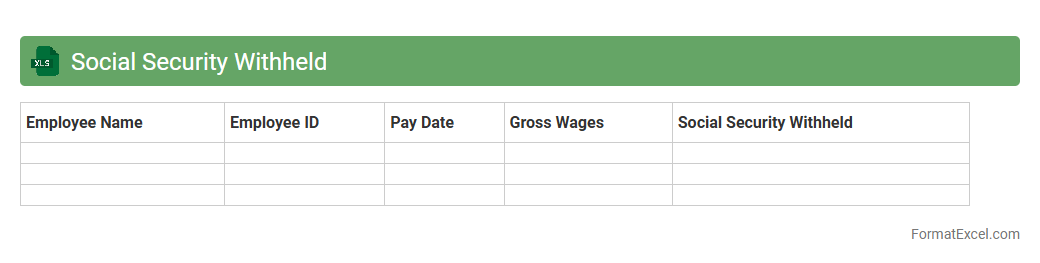

Social Security Withheld

The

Social Security Withheld Excel document is a detailed file that tracks the amounts of Social Security taxes deducted from employees' wages over a specific period. This document is essential for accurate payroll management, tax reporting, and ensuring compliance with IRS regulations. It helps businesses and individuals monitor contributions, reconcile payments, and prepare for tax filings efficiently.

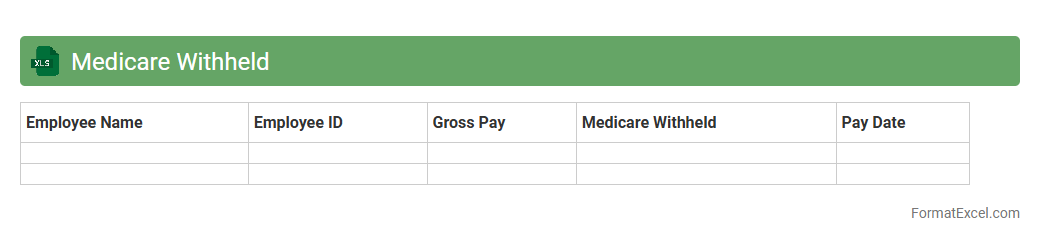

Medicare Withheld

The

Medicare Withheld Excel document is a detailed spreadsheet that tracks Medicare tax deductions from employee wages, ensuring accurate record-keeping and compliance with IRS regulations. It simplifies the verification process for employers and payroll administrators by consolidating withholding data in an organized format, facilitating easier audits and reporting. This document is essential for managing Medicare tax liabilities and maintaining transparent financial records.

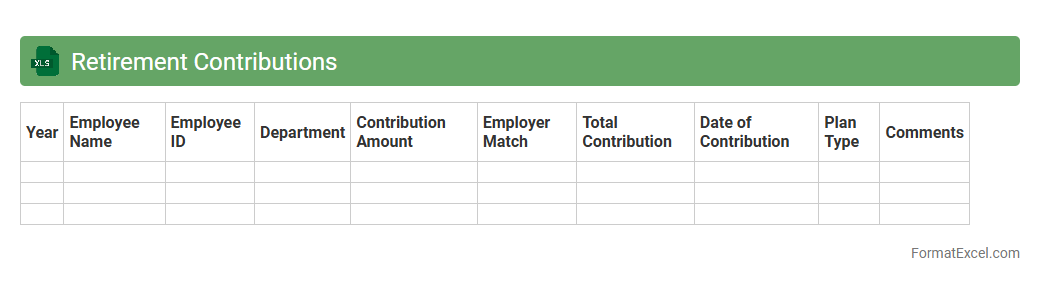

Retirement Contributions

A

Retirement Contributions Excel document is a spreadsheet designed to track and calculate individual or employer contributions towards retirement plans such as 401(k) or IRA accounts. It helps users monitor their savings progress, estimate future retirement funds, and manage annual contribution limits efficiently. This tool enhances financial planning by providing clear insights into contribution trends and potential tax benefits.

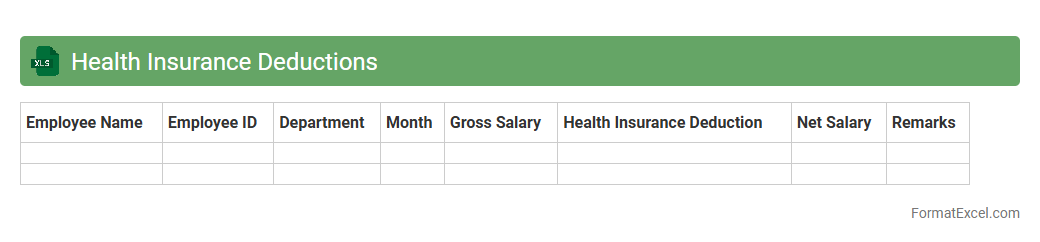

Health Insurance Deductions

A

Health Insurance Deductions Excel document is a structured spreadsheet designed to track and calculate the amounts deducted from employees' salaries for health insurance premiums. This document helps businesses and employees maintain clear records of payments, insurance plan details, and deductions over time, ensuring accurate payroll processing and compliance with tax regulations. It also simplifies financial planning by providing a transparent overview of health insurance costs and contributions.

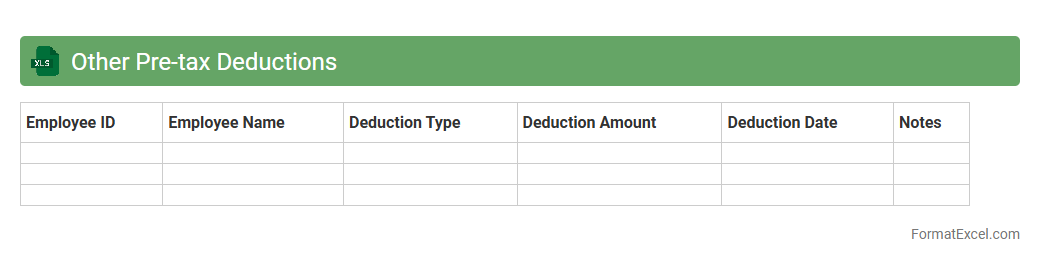

Other Pre-tax Deductions

The

Other Pre-tax Deductions Excel document is a detailed spreadsheet designed to track and manage various employee pre-tax deductions such as health insurance premiums, retirement contributions, and flexible spending accounts. It allows HR and payroll teams to organize, calculate, and report these deductions accurately, ensuring compliance with tax regulations and reducing errors in payroll processing. Using this document streamlines financial management and improves transparency in employee compensation records.

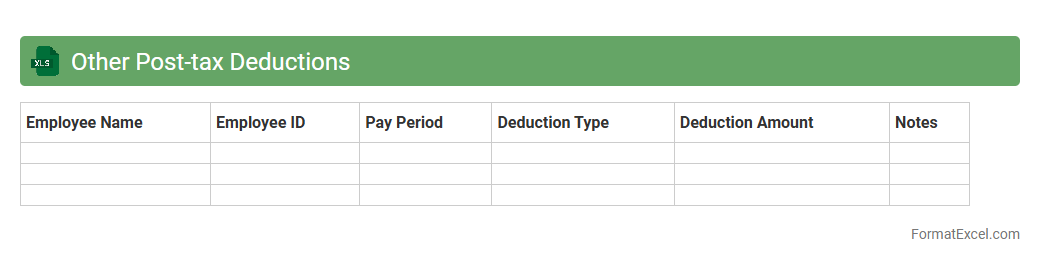

Other Post-tax Deductions

The

Other Post-tax Deductions Excel document is a detailed financial tool used to track and manage employee deductions that occur after tax calculations, such as retirement contributions, health insurance premiums, and loan repayments. This spreadsheet helps organizations ensure accurate payroll processing, streamline deduction management, and maintain compliance with payroll regulations. It enhances transparency and efficiency by providing a clear record of all post-tax deductions for auditing and reporting purposes.

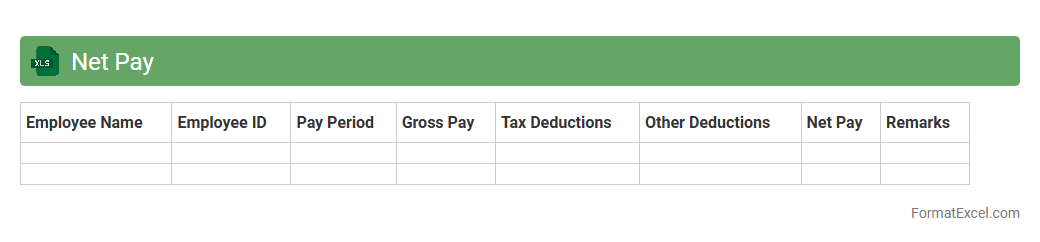

Net Pay

The

Net Pay Excel document is a spreadsheet designed to calculate the exact amount an employee receives after all deductions such as taxes, insurance, and retirement contributions are applied to their gross salary. It streamlines payroll processing by providing a clear breakdown of earnings, deductions, and final take-home pay, ensuring accuracy and transparency. This tool is invaluable for HR departments and finance teams to manage employee compensation efficiently and maintain proper financial records.

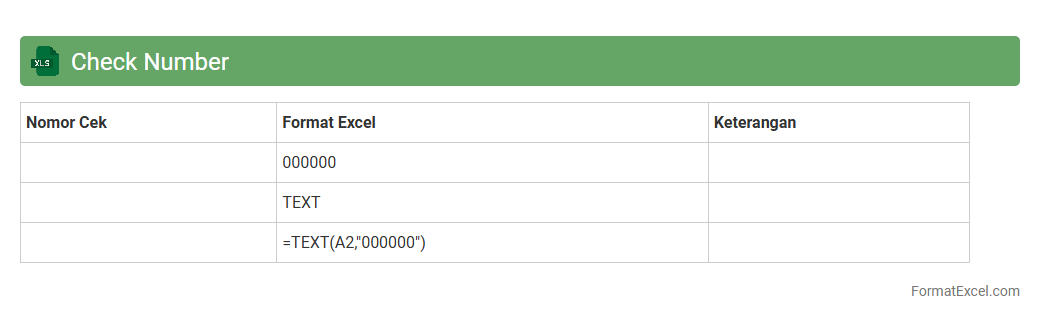

Check Number

A

Check Number Excel document is a spreadsheet designed to record and track check numbers alongside payment details, ensuring accurate financial record-keeping. It helps businesses and individuals monitor issued checks, prevent duplication, and reconcile bank statements effectively. Using this tool improves organization, reduces errors, and enhances overall cash flow management by maintaining transparent transaction histories.

Payment Date

The

Payment Date Excel document serves as a vital financial management tool that tracks scheduled payment deadlines, ensuring timely transactions and preventing late fees. It organizes payment details such as invoice numbers, amounts, and due dates, enhancing cash flow monitoring and budgeting accuracy. Utilizing this document improves financial planning by providing a clear overview of upcoming obligations and facilitating better decision-making.

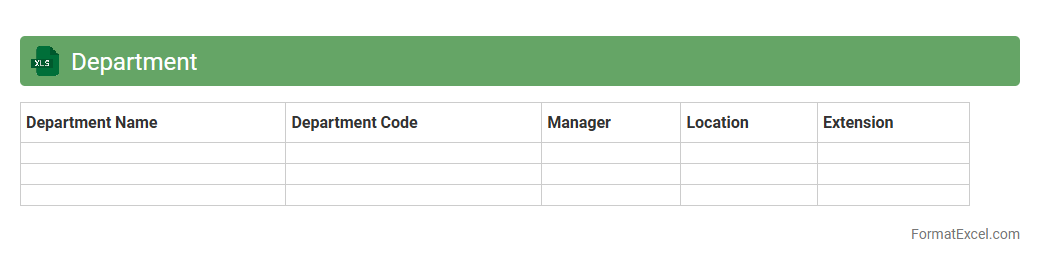

Department

A

Department Excel document is a structured spreadsheet used to organize and analyze data specific to a particular department within an organization. It facilitates efficient tracking of key metrics, budgeting, resource allocation, and performance reports, enhancing departmental productivity and decision-making. By centralizing data in a clear, accessible format, it improves collaboration and streamlines workflow management.

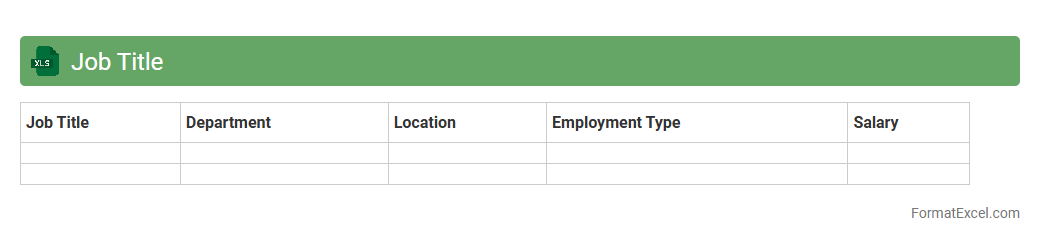

Job Title

A

Job Title Excel document is a structured spreadsheet that organizes and categorizes various job titles within an organization or industry, facilitating easy reference and analysis. It helps streamline recruitment, workforce planning, and job classification by providing clear and standardized job titles that improve communication and reporting. This document is essential for HR professionals and managers to track roles, align job responsibilities, and ensure consistency across departments.

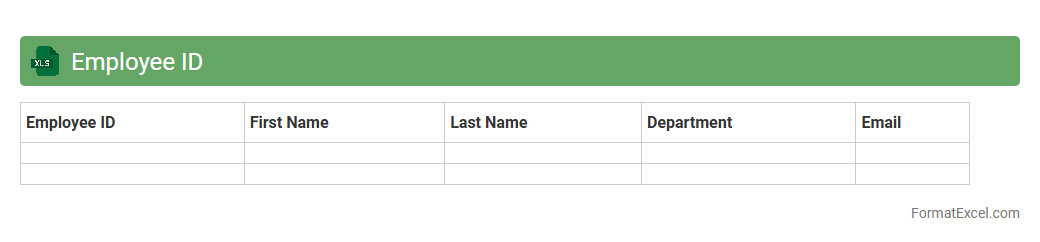

Employee ID

An

Employee ID Excel document is a structured spreadsheet used to record and manage unique identification numbers assigned to each employee within an organization. It helps streamline HR processes by enabling quick access to individual employee records, attendance tracking, payroll management, and performance evaluations. Utilizing this document improves data accuracy and enhances operational efficiency by centralizing employee information in a single, easily accessible format.

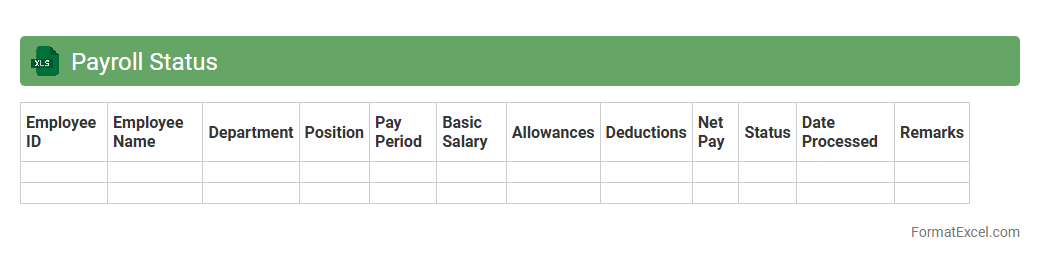

Payroll Status

The

Payroll Status Excel document is a comprehensive tool that tracks employee salary payments, tax deductions, and payment dates in an organized spreadsheet format. It helps businesses maintain accurate financial records, ensures timely payroll processing, and facilitates easy auditing and reporting for compliance purposes. By providing clear visibility into payroll activities, this document streamlines payroll management and reduces errors associated with manual calculations.

Introduction to Payroll Register in Excel

A Payroll Register in Excel is a comprehensive document used by businesses to track employee earnings, deductions, and net pay. It consolidates payroll data efficiently, offering clarity on payment details. Excel's flexibility makes it an ideal tool to manage payroll registers smoothly.

Importance of a Payroll Register for Businesses

A payroll register is crucial for maintaining accurate financial records, ensuring compliance with tax laws, and simplifying audits. It helps businesses manage payroll expenses and employee compensation transparently. Effective payroll registers improve payroll accuracy and reduce errors.

Key Components of a Payroll Register

A typical payroll register includes employee details, gross pay, deductions, taxes, and net pay. These components help track salary calculations and record payment history per payroll period. Proper organization of these elements is vital for payroll accuracy.

Essential Columns in an Excel Payroll Register

The essential columns usually consist of Employee ID, Name, Hours Worked, Hourly Rate, Gross Pay, Deductions, Taxes, and Net Pay. These columns ensure all payroll aspects are recorded precisely. Including these fields aids in systematic data entry and calculation.

Step-by-Step Guide to Creating a Payroll Register Format in Excel

Begin by setting up column headers to cover all payroll elements, then input formulas for automatic calculations. Use Excel's formatting tools to improve readability and accuracy in your payroll register. Save the document regularly to avoid data loss.

Sample Payroll Register Template in Excel

A sample payroll register template provides a ready-made structure with pre-set columns and formulas. Using this template saves time and ensures consistency in payroll tracking. Templates can be customized to suit specific business needs.

Automating Calculations in Payroll Register

Excel allows you to automate calculations such as gross pay and tax deductions using formulas like SUM and IF statements. Automation significantly reduces manual errors and speeds up payroll processing. Mastering these formulas is essential for efficient payroll automation.

Common Mistakes to Avoid in Payroll Register Formatting

Avoid errors such as missing data, incorrect formulas, or inconsistent formatting in your payroll register. These mistakes can lead to payroll discrepancies and financial issues. Thorough review and validation of the register is necessary before finalizing.

Tips for Securing Payroll Data in Excel

Protect your payroll data by using Excel's password protection and restricting access to sensitive files. Encrypting the file and maintaining backups also enhance data security. Secure payroll records prevent unauthorized access and data breaches.

Downloadable Payroll Register Excel Templates

Many websites offer free or paid downloadable payroll register Excel templates designed for various business sizes. These templates are customizable and can be integrated with payroll systems. Using them can simplify payroll management and ensure compliance.