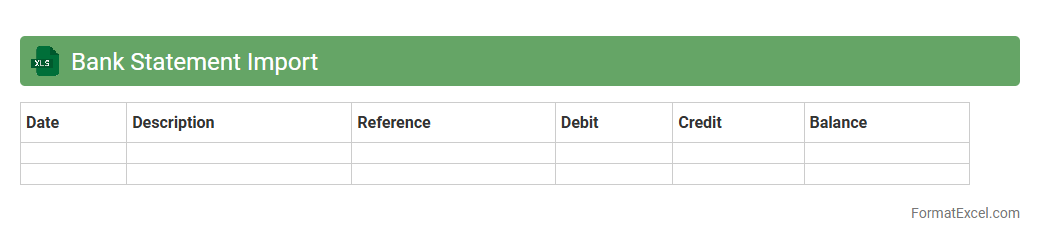

Bank Statement Import

A

Bank Statement Import Excel document is a file format designed to streamline the process of uploading bank transaction data into accounting or financial software. It enables businesses to automate reconciliation, track expenses, and monitor cash flow efficiently by converting complex bank statements into a structured spreadsheet format. This tool significantly reduces manual data entry errors and saves time, enhancing overall financial management accuracy.

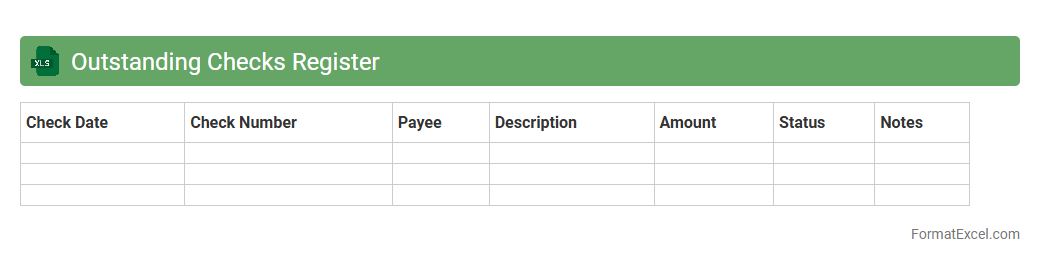

Outstanding Checks Register

An

Outstanding Checks Register Excel document is a financial tool used to track checks that have been issued but have not yet cleared the bank. It helps maintain accurate cash flow records by identifying pending payments, preventing overdrafts, and reconciling bank statements efficiently. By monitoring outstanding checks, businesses and individuals ensure better cash management and avoid accounting discrepancies.

Deposits in Transit Tracking

A

Deposits in Transit Tracking Excel document helps monitor and manage deposits that have been recorded in cash ledgers but not yet reflected in the bank statement. It ensures accurate reconciliation between the accounting records and bank statements, preventing discrepancies and potential cash flow errors. This tool streamlines financial oversight, improves transparency, and supports timely decision-making for effective cash management.

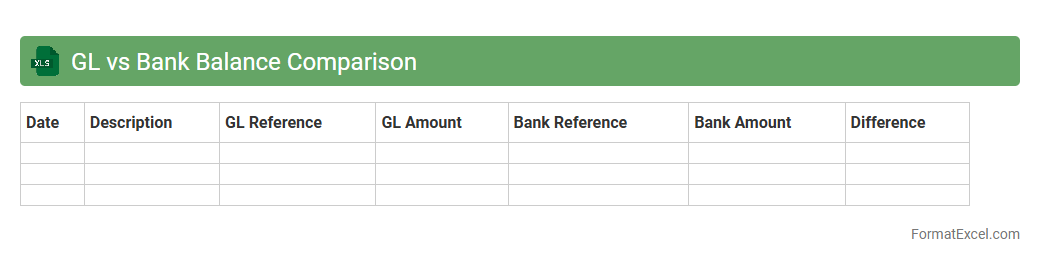

GL vs Bank Balance Comparison

The

GL vs Bank Balance Comparison Excel document is a financial reconciliation tool that helps identify discrepancies between the general ledger (GL) and bank statements. It ensures accuracy in financial records by highlighting unmatched transactions, enabling timely corrections and preventing errors in cash flow reporting. This comparison is crucial for maintaining reliable accounting data and improving overall financial control.

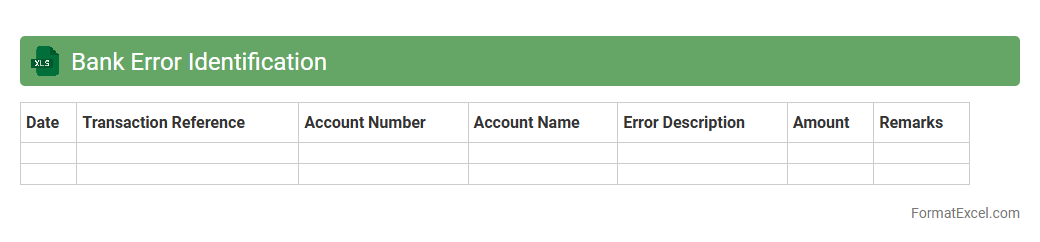

Bank Error Identification

A

Bank Error Identification Excel document is a spreadsheet designed to systematically track and reconcile discrepancies in bank transactions, helping users identify errors such as unauthorized charges, duplicate payments, or incorrect amounts. This tool enhances financial accuracy by allowing detailed comparison between bank statements and internal records, facilitating quick error detection and resolution. Employing this document improves financial management, reduces risk of fraud, and ensures that accounting records remain precise and reliable.

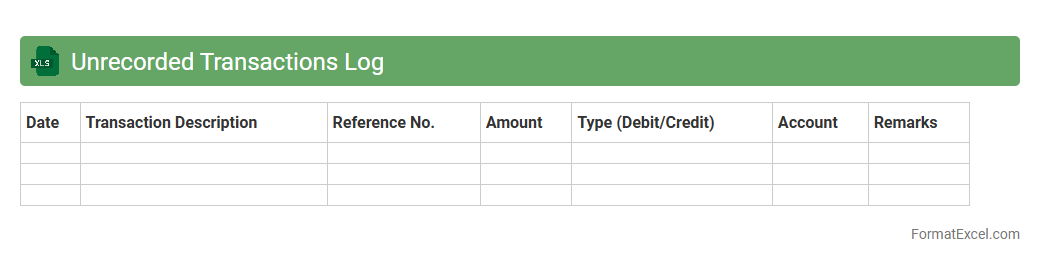

Unrecorded Transactions Log

An

Unrecorded Transactions Log Excel document is a structured tool used to systematically track financial transactions that have not yet been entered into the accounting system. It helps maintain accurate financial records by providing a clear overview of pending entries, ensuring no transactions are overlooked during audits or month-end reconciliations. This log enhances financial transparency, improves internal control, and supports timely decision-making by highlighting discrepancies and outstanding transactions.

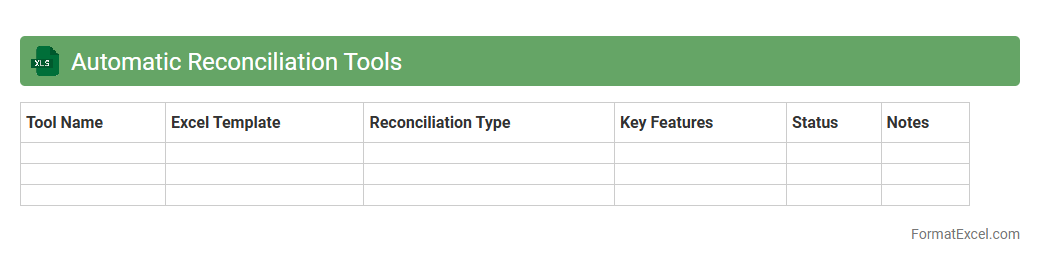

Automatic Reconciliation Tools

Automatic Reconciliation Tools Excel document serves as a powerful software solution designed to streamline the process of matching and verifying financial transactions across different accounts. This tool significantly reduces manual errors and saves valuable time by automating the comparison of bank statements, invoices, and internal records. Utilizing

automatic reconciliation ensures greater accuracy, improved compliance, and enhanced financial reporting efficiency for businesses.

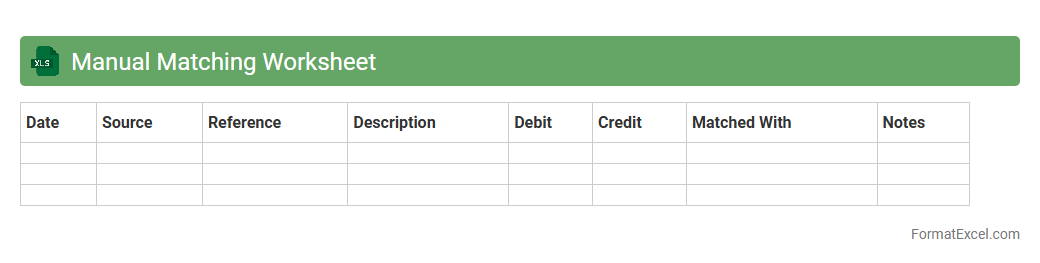

Manual Matching Worksheet

A

Manual Matching Worksheet in Excel is a tool used to reconcile and verify information between two or more datasets, ensuring accuracy and consistency. It allows users to systematically compare records, identify discrepancies, and make necessary adjustments to maintain data integrity in accounting, inventory management, or data analysis processes. This worksheet enhances efficiency by providing a structured format for manual review and correction of data entries.

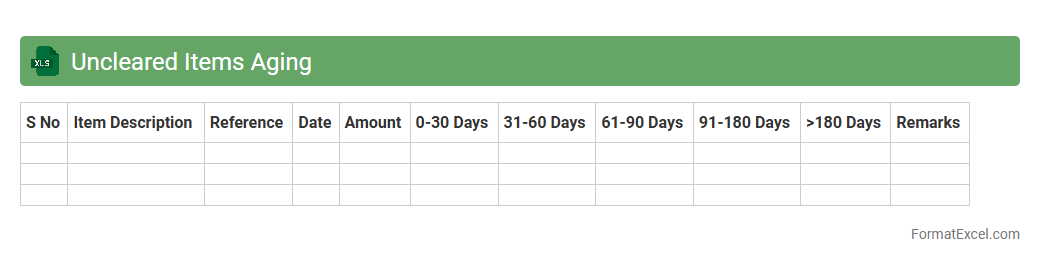

Uncleared Items Aging

The

Uncleared Items Aging Excel document is a financial tool that tracks outstanding transactions over specific time periods, helping identify delayed payments or uncleared entries in accounts receivable or payable. By categorizing these items based on their age, it enables businesses to monitor overdue amounts, improve cash flow management, and prioritize collection efforts effectively. This document supports accurate reconciliation and enhances financial transparency by highlighting discrepancies and aging trends in outstanding balances.

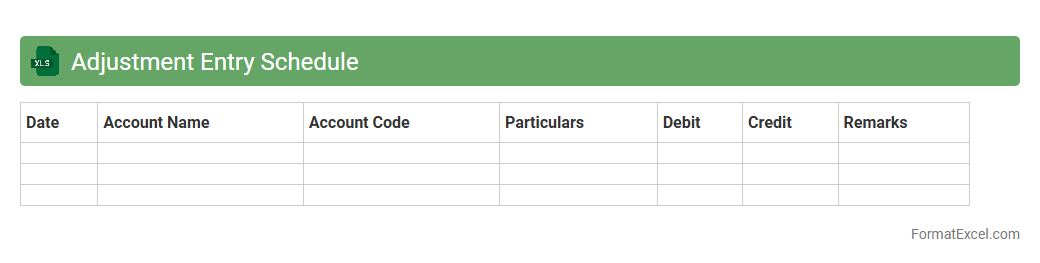

Adjustment Entry Schedule

An

Adjustment Entry Schedule Excel document is a financial tool used to systematically record and track accounting adjustments made within a specific period. It helps ensure accuracy in financial statements by organizing debit and credit entries, reconciling discrepancies, and facilitating audit compliance. By providing a clear overview of adjustments, it aids businesses in maintaining transparent and accurate financial records for better decision-making.

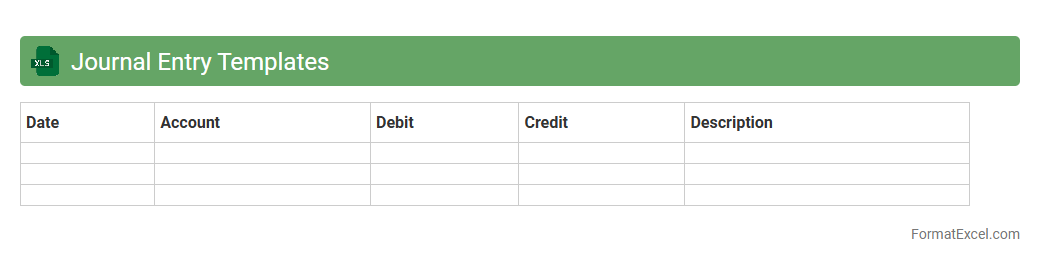

Journal Entry Templates

A

Journal Entry Templates Excel document is a structured spreadsheet designed to record financial transactions systematically, ensuring accuracy and consistency in bookkeeping. It streamlines the process of entering debits and credits, making it easier to maintain organized accounting records and generate reports. This template enhances efficiency by reducing errors and saving time in financial data management for businesses and individuals.

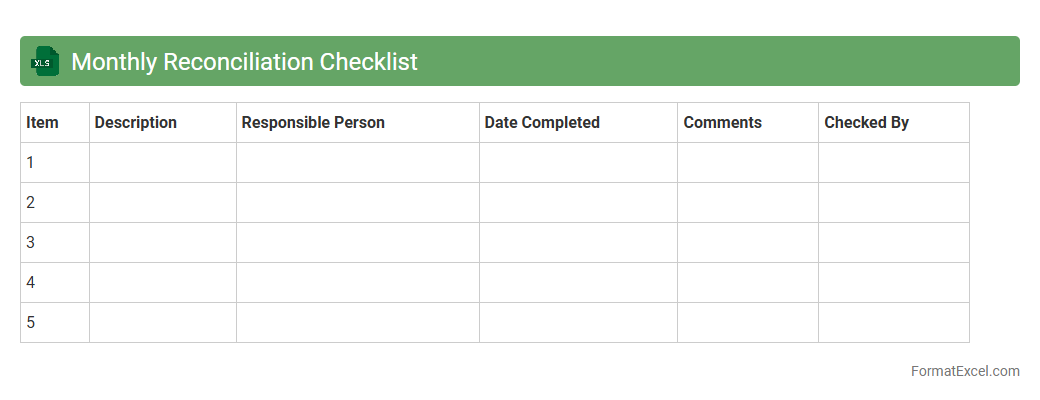

Monthly Reconciliation Checklist

A

Monthly Reconciliation Checklist Excel document is a structured tool designed to systematically verify and balance financial records against bank statements or internal accounts each month. It enhances accuracy by ensuring all transactions are accounted for and discrepancies are identified promptly, reducing financial errors and promoting transparency. This checklist is invaluable for maintaining up-to-date financial integrity, supporting audit processes, and streamlining month-end closing activities.

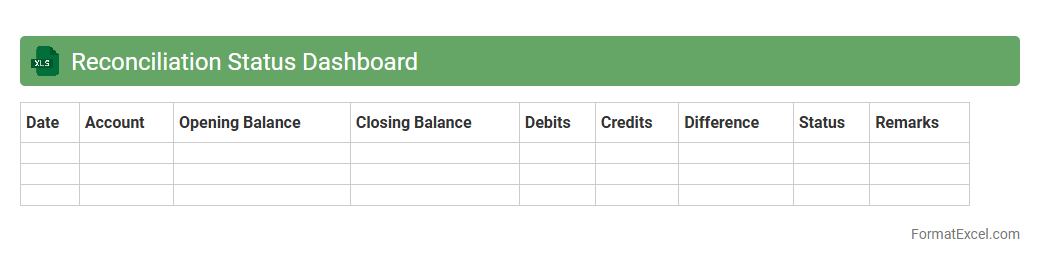

Reconciliation Status Dashboard

The

Reconciliation Status Dashboard Excel document provides a clear visual summary of financial reconciliations, highlighting discrepancies and completion rates across accounts. It enables teams to track the status of reconciliation processes in real-time, ensuring accuracy and timely resolution of errors. This tool enhances financial oversight, streamlines audit preparation, and supports compliance efforts by consolidating critical data into a single, easy-to-analyze interface.

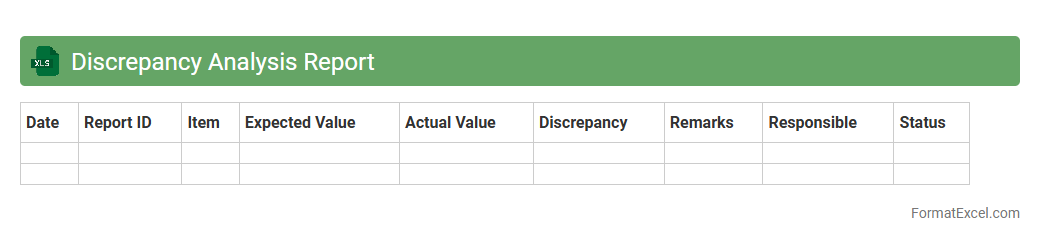

Discrepancy Analysis Report

A

Discrepancy Analysis Report Excel document identifies differences between actual and expected data by comparing multiple data sets or records. It highlights inconsistencies, errors, or mismatches, enabling businesses to pinpoint areas requiring correction or further investigation. This report is essential for maintaining data accuracy, improving financial audits, and streamlining operational processes.

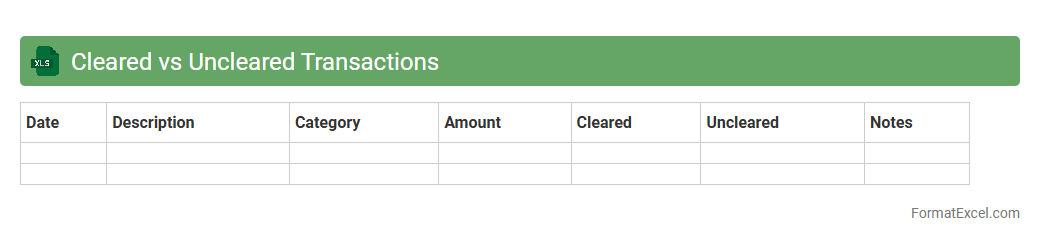

Cleared vs Uncleared Transactions

A

Cleared vs Uncleared Transactions Excel document is a financial tool used to track and reconcile bank transactions by distinguishing between cleared (processed) and uncleared (pending) items. This document helps businesses maintain accurate cash flow records, identify discrepancies, and streamline bank reconciliation processes. It enhances financial management by providing clear visibility into outstanding payments and deposits, ensuring effective cash control and reporting.

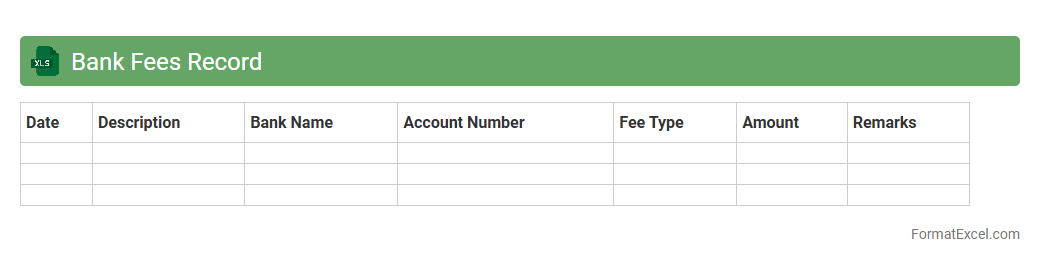

Bank Fees Record

A

Bank Fees Record Excel document is a structured spreadsheet designed to track and organize bank charges, including maintenance fees, transaction fees, and service charges. It helps businesses and individuals monitor their expenses, identify patterns, and manage cash flow effectively by providing clear visibility of all bank-related costs. Utilizing this document enhances financial planning and ensures accurate reconciliation of bank statements.

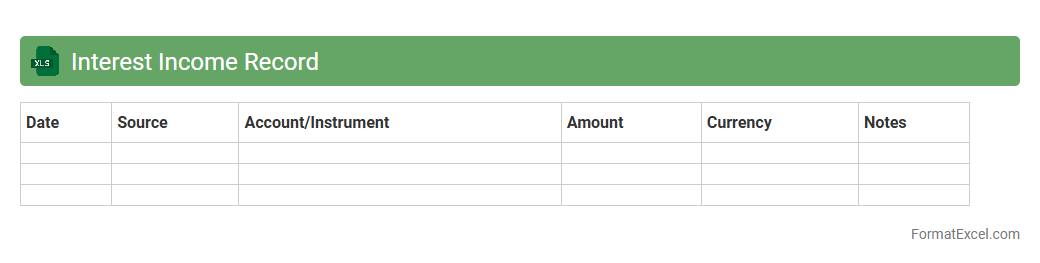

Interest Income Record

An

Interest Income Record Excel document systematically tracks interest earned from various financial accounts, such as savings, investments, and loans. It helps individuals and businesses monitor income streams, calculate total interest accrued over specific periods, and prepare accurate financial statements or tax reports. Using this document improves financial organization, ensures compliance with tax regulations, and supports strategic decision-making based on reliable interest income data.

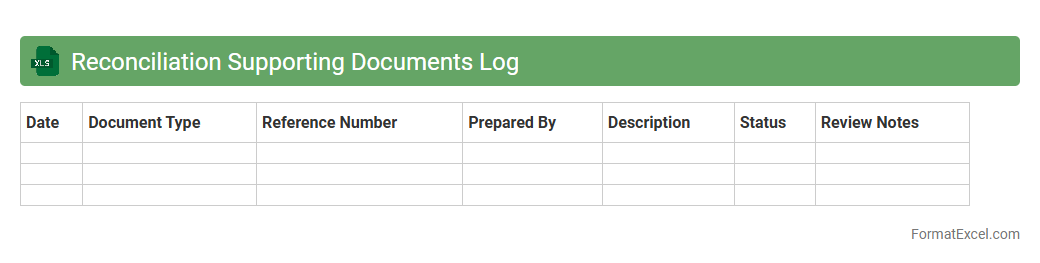

Reconciliation Supporting Documents Log

The

Reconciliation Supporting Documents Log Excel document is a structured tool designed to track and organize all essential files and evidence needed during the reconciliation process. It ensures accuracy and transparency by maintaining a detailed record of transactions, discrepancies, and their resolutions, facilitating efficient audits and reviews. This log enhances financial control and accountability by centralizing documentation, making it easier to validate balances and support compliance requirements.

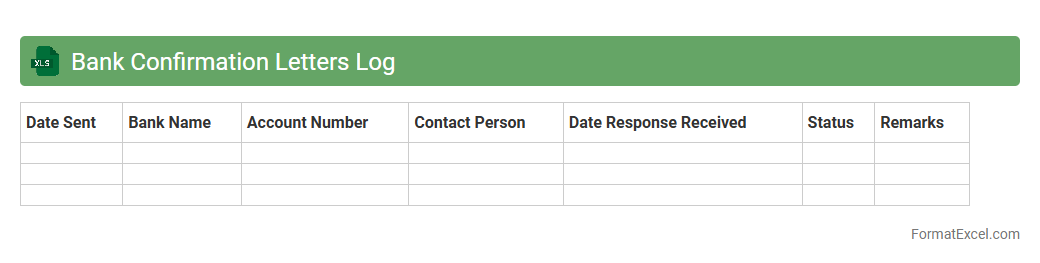

Bank Confirmation Letters Log

A

Bank Confirmation Letters Log Excel document is a structured record used to track and manage confirmation letters received from banks during financial audits and reconciliations. It helps ensure accuracy by providing a centralized database of correspondence details such as dates, reference numbers, and the status of each confirmation request. This log streamlines audit processes, enhances communication with financial institutions, and supports compliance by maintaining organized and easily accessible documentation.

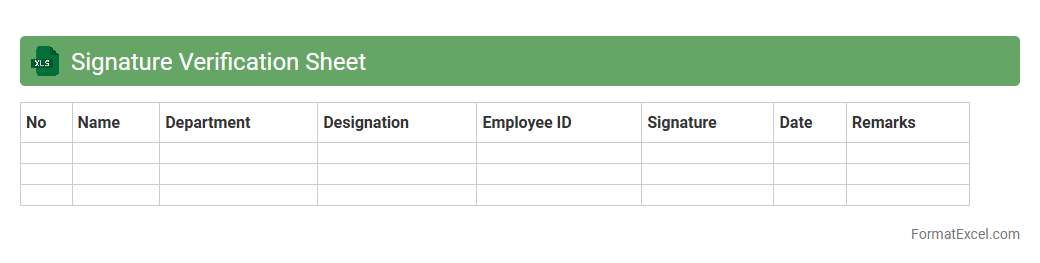

Signature Verification Sheet

A

Signature Verification Sheet Excel document is a structured tool used to systematically record and verify signatures for authenticity and compliance purposes. It helps organizations maintain accurate records, detect forgeries, and ensure that authorization processes are reliable. By using this sheet, businesses can streamline verification workflows, reduce errors, and enhance overall security in document handling.

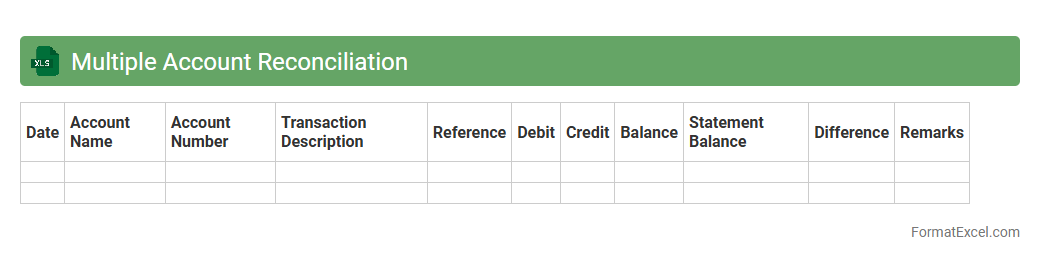

Multiple Account Reconciliation

A

Multiple Account Reconciliation Excel document is a financial tool designed to compare and match transactions across various bank accounts, credit cards, or financial platforms to ensure accuracy and consistency in records. It helps identify discrepancies, prevent errors, and streamline the month-end closing process by consolidating data in a single, easy-to-manage spreadsheet. This document is essential for businesses and individuals seeking efficient cash flow management and financial transparency.

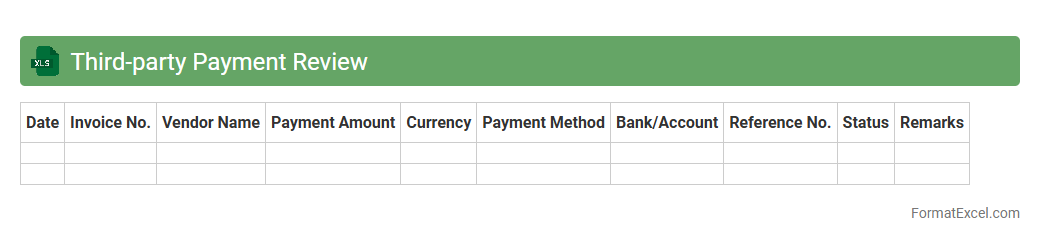

Third-party Payment Review

The

Third-party Payment Review Excel document is a structured spreadsheet used to track, validate, and analyze payments made to external vendors or service providers. It helps ensure accuracy by cross-referencing invoices, payment dates, and amounts, reducing the risk of errors and fraud in financial transactions. This document is essential for improving financial transparency, enhancing audit readiness, and facilitating timely reconciliations.

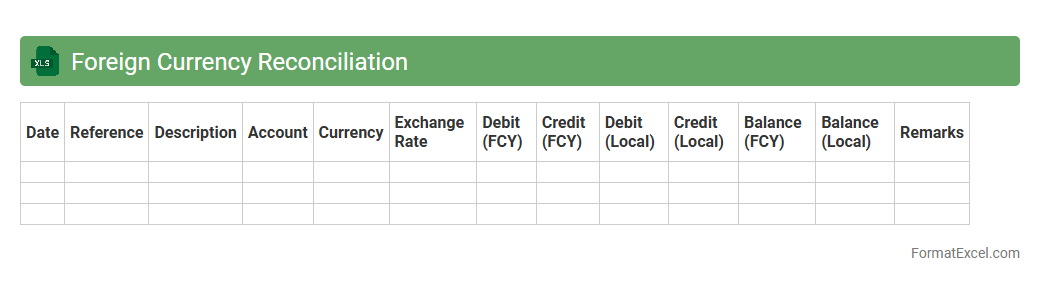

Foreign Currency Reconciliation

A

Foreign Currency Reconciliation Excel document is a financial tool designed to compare and align transactions recorded in different currencies with corresponding bank statements or ledgers. It helps businesses identify discrepancies due to currency fluctuations, exchange rates, or recording errors, ensuring accurate financial reporting and compliance. This document is useful for maintaining transparent accounts, simplifying audits, and supporting informed decision-making in multinational operations.

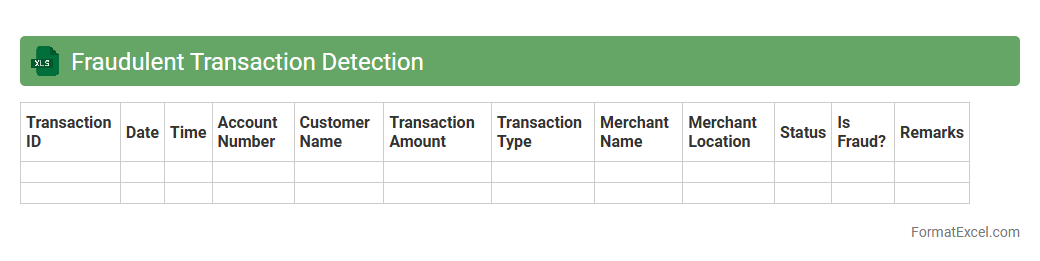

Fraudulent Transaction Detection

A

Fraudulent Transaction Detection Excel document is a tool designed to identify suspicious financial activities by analyzing transaction patterns, flagging anomalies such as unusual amounts or repeated transactions. It leverages formulas, pivot tables, and conditional formatting to highlight potential fraud, enabling quicker and more accurate decision-making. This document is useful for businesses and financial institutions to minimize losses, improve audit accuracy, and ensure regulatory compliance.

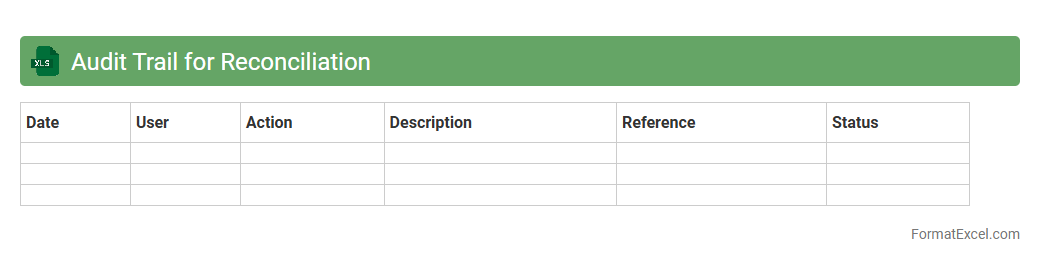

Audit Trail for Reconciliation

An

Audit Trail for Reconciliation Excel document records all changes, entries, and actions taken during the reconciliation process, providing a transparent history of transactions and adjustments. It enhances accuracy by allowing users to verify and trace discrepancies, ensuring accountability and compliance with regulatory standards. This tool facilitates efficient error detection and supports thorough financial reviews, making reconciliation processes more reliable and auditable.

Introduction to Bank Reconciliation

Bank reconciliation is a crucial process in accounting that ensures the accuracy of financial records by comparing the company's ledger with bank statements. It helps identify discrepancies such as unrecorded transactions or errors. A well-structured bank reconciliation improves financial integrity and transparency.

Importance of Bank Reconciliation in Accounting

Bank reconciliation plays a vital role in detecting fraud, errors, and omissions within financial records. It provides assurance that the cash balances reported are accurate and reliable. Maintaining regular bank reconciliation enhances overall financial control and decision-making.

Essential Components of a Bank Reconciliation Format

A comprehensive bank reconciliation format includes the opening balance, deposits, withdrawals, outstanding checks, and bank fees. These components facilitate the systematic comparison of both records. Ensuring all elements are present is critical to an effective reconciliation format.

Step-by-Step Guide to Creating a Bank Reconciliation in Excel

Start by listing the bank statement balances and company ledger balances side by side in Excel. Next, account for outstanding checks and deposits in transit, then calculate adjusted balances. This step-by-step method ensures a clear and accurate bank reconciliation process.

Downloadable Bank Reconciliation Excel Template

A downloadable bank reconciliation Excel template simplifies the reconciliation process by providing pre-built formulas and structured layouts. It saves time and reduces errors in manual calculations. Utilizing a template ensures consistency and accuracy in your accounting tasks.

How to Customize Your Bank Reconciliation Format in Excel

Customize your bank reconciliation format in Excel by adding columns for specific transaction types or notes. Modify formulas to fit unique business needs and reporting requirements. Tailoring the Excel format enhances its usability and relevance for your accounting processes.

Common Errors in Bank Reconciliation and How to Avoid Them

Frequent errors include missing transactions, incorrect amounts, and timing differences between records. Avoid these by thorough verification and regular updates to the reconciliation sheet. Identifying common bank reconciliation errors helps maintain precise financial records.

Automating Bank Reconciliation Using Excel Functions

Excel functions like VLOOKUP, SUMIF, and conditional formatting can automate matching transactions and flag discrepancies. Automation reduces manual work and accelerates the reconciliation process. Leveraging Excel's automation functions increases efficiency and accuracy.

Tips for Accurate and Efficient Bank Reconciliation

Reconcile your accounts regularly, maintain detailed documentation, and review discrepancies promptly. Use Excel shortcuts and validation rules to minimize errors and save time. Following these tips ensures effective and error-free bank reconciliation.

Final Review and Best Practices for Bank Reconciliation in Excel

Conduct a final review to confirm all balances align between the bank statement and ledger. Keep backups of reconciliation files and ensure transparency in your adjustments. Adopting best practices in Excel-based bank reconciliation supports accurate financial reporting and control.