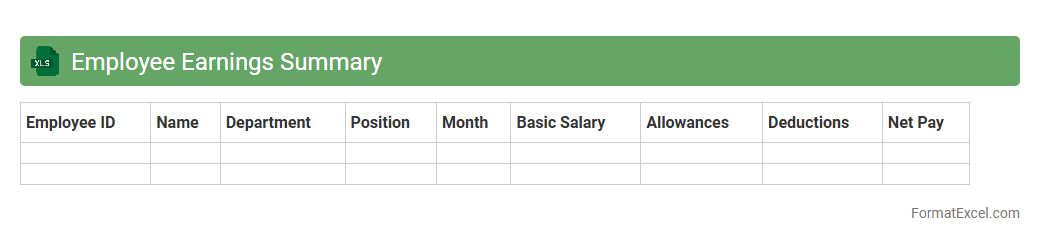

Employee Earnings Summary

An

Employee Earnings Summary Excel document consolidates detailed payroll information, including wages, bonuses, deductions, and net pay, for each employee within a specific period. This organized summary enhances payroll accuracy, simplifies financial reporting, and supports compliance with tax regulations. Having a clear overview in a structured format aids HR and finance teams in making informed decisions regarding compensation management and budgeting.

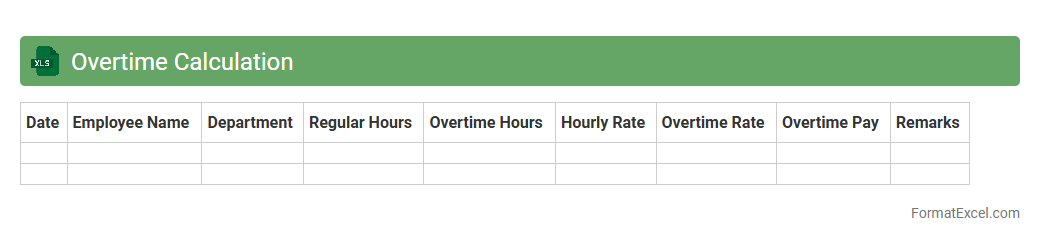

Overtime Calculation

An

Overtime Calculation Excel document is a spreadsheet tool designed to accurately track and compute extra work hours beyond regular shifts. It helps businesses and employees monitor overtime efficiently by automating calculations based on predefined rates and hours logged. This tool improves payroll accuracy, ensures compliance with labor laws, and facilitates clear record-keeping for workforce management.

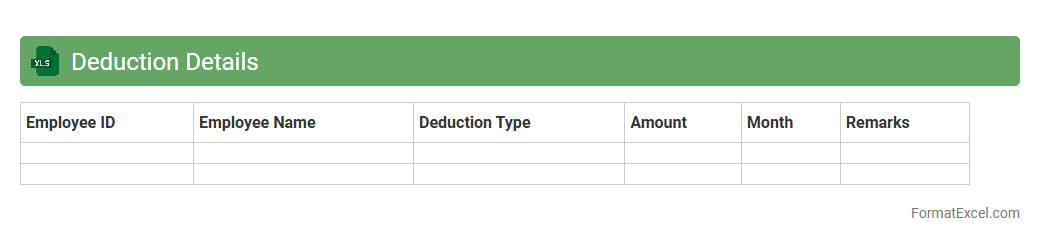

Deduction Details

The

Deduction Details Excel document is a comprehensive spreadsheet that tracks various types of financial deductions such as taxes, insurance, and retirement contributions for employees or clients. It is useful for accurately managing payroll, ensuring compliance with legal requirements, and facilitating seamless financial audits. By organizing deduction data systematically, it enhances transparency and simplifies the reconciliation of accounts.

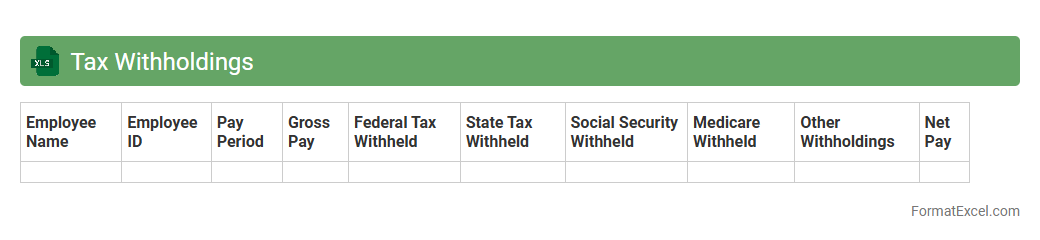

Tax Withholdings

A

Tax Withholdings Excel document is a spreadsheet tool designed to track and calculate the amount of taxes withheld from employees' paychecks throughout the year. It helps individuals and businesses ensure compliance with tax regulations by accurately recording federal, state, and local tax deductions. This document is useful for simplifying payroll management, preparing tax returns, and avoiding underpayment penalties.

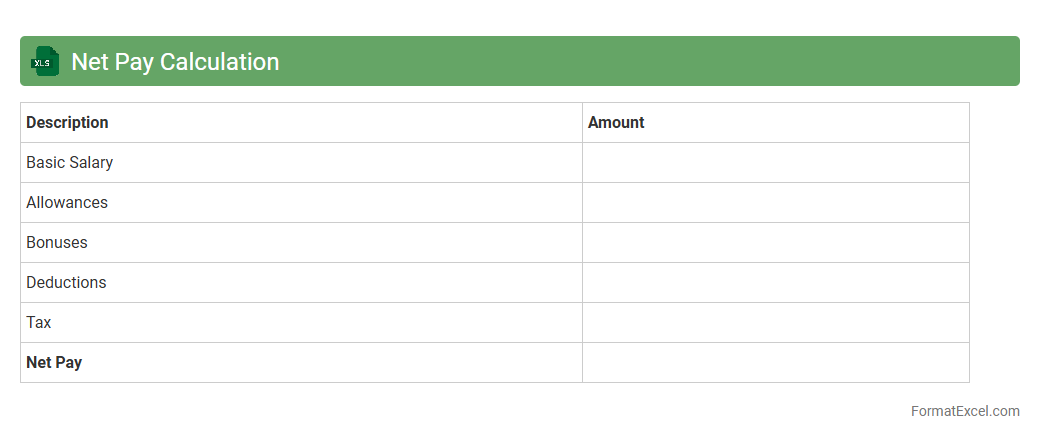

Net Pay Calculation

Net Pay Calculation excel document is a

financial tool designed to accurately compute an employee's take-home salary after deductions such as taxes, insurance, and retirement contributions. It streamlines payroll processing by automating complex calculations, reducing errors, and saving time for HR and finance departments. This document ensures transparency and consistency in salary disbursement, supporting effective financial management and employee satisfaction.

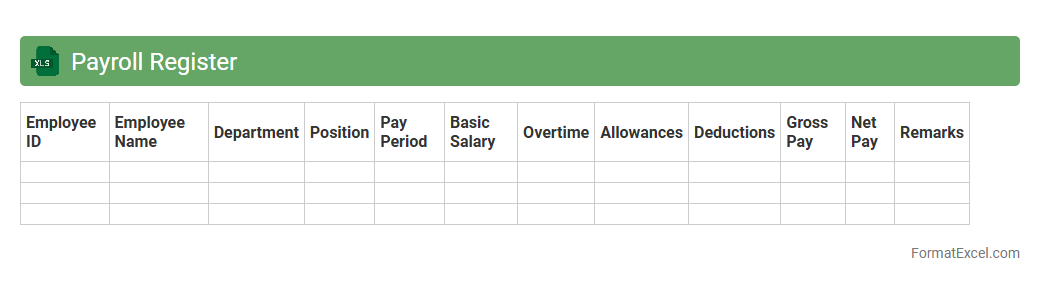

Payroll Register

A

Payroll Register Excel document is a detailed record that tracks employee payroll information, including hours worked, wages, deductions, and net pay. This document streamlines payroll management by consolidating all payment data in one accessible file, facilitating accurate calculations and compliance with tax regulations. Businesses use it to ensure transparent payroll processing, simplify audits, and maintain organized financial records.

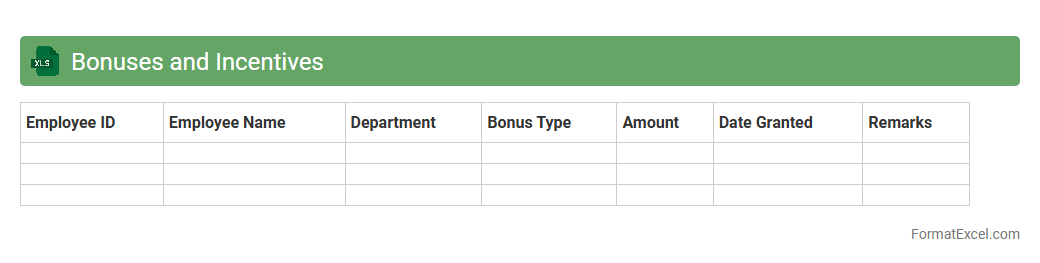

Bonuses and Incentives

A

Bonuses and Incentives Excel document is a structured spreadsheet used to track, calculate, and manage employee rewards based on performance metrics and company goals. It helps organizations streamline payroll processes, ensure accurate bonus distribution, and motivate staff through transparent reward systems. Utilizing this document enhances financial planning, performance analysis, and employee satisfaction by providing clear data on incentive allocations.

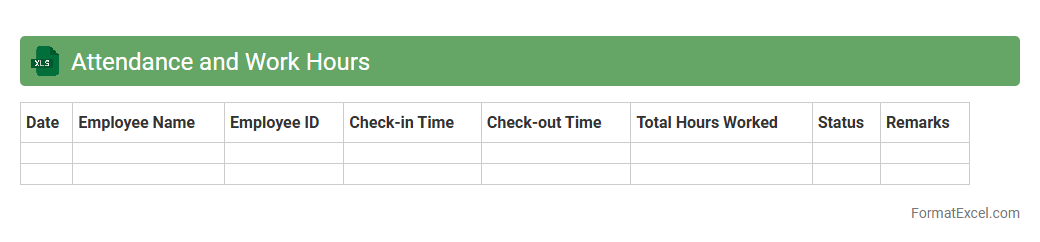

Attendance and Work Hours

An Attendance and Work Hours Excel document is a structured spreadsheet designed to record and track employee attendance, work hours, and overtime efficiently. It helps organizations monitor punctuality, calculate payroll accurately, and ensure compliance with labor regulations by providing clear data visualization and automated summaries. Using this

attendance tracking tool simplifies workforce management, enhances productivity analysis, and supports informed decision-making.

Leave and Absence Tracker

A

Leave and Absence Tracker Excel document is a tool designed to record, monitor, and manage employee leave requests and absences systematically. It helps organizations maintain accurate attendance records, ensures compliance with leave policies, and facilitates payroll adjustments based on employee time off. This tracker improves workforce planning, reduces administrative errors, and enhances overall productivity by providing clear visibility into staff availability.

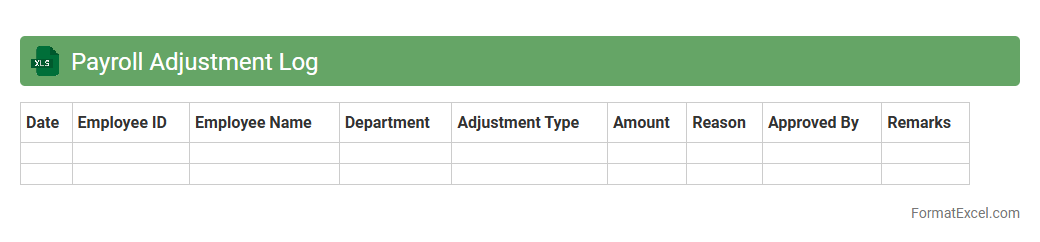

Payroll Adjustment Log

A

Payroll Adjustment Log Excel document systematically tracks modifications in employee salary, deductions, bonuses, or other compensation components to ensure accurate payroll processing. It helps maintain compliance with labor laws, audit requirements, and internal policies by providing a transparent record of changes. Utilizing this log enhances payroll accuracy, reduces errors, and simplifies reconciliation during payroll reviews.

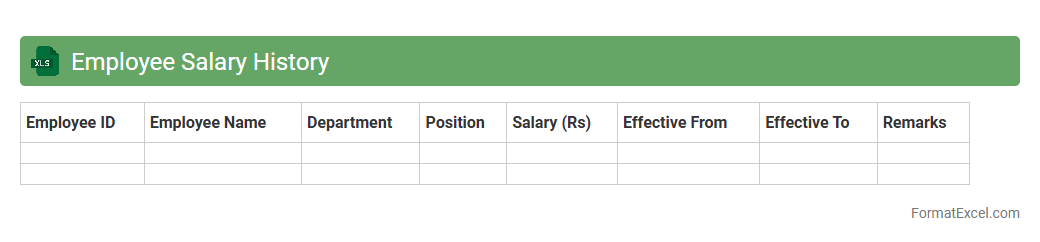

Employee Salary History

An

Employee Salary History Excel document records detailed information about an employee's past and current salary data, including dates of salary changes, amounts, and reasons for adjustments. This tool is useful for HR departments to track compensation trends, manage payroll adjustments accurately, and support budgeting and financial forecasting. It enables easy analysis of salary progression over time, ensuring compliance with company policies and labor regulations.

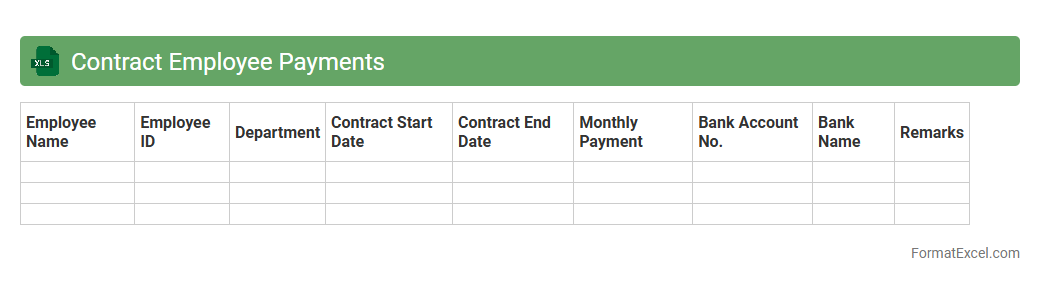

Contract Employee Payments

The

Contract Employee Payments Excel document is a specialized tool designed to track and manage payments made to contract workers efficiently. It consolidates payment details such as hours worked, rates, payment dates, and tax deductions, providing clear insights into financial transactions and ensuring accurate record-keeping. This document enhances budgeting accuracy, simplifies audit processes, and supports timely payments, improving overall contract payroll management.

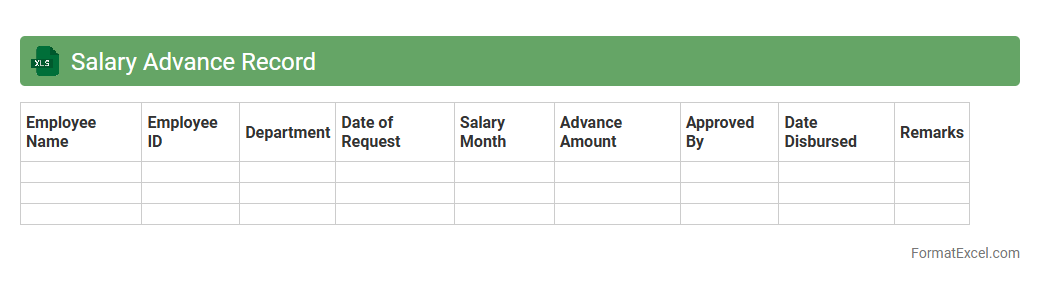

Salary Advance Record

A

Salary Advance Record Excel document systematically tracks employee salary advances, including dates, amounts, and repayment statuses, ensuring accurate financial management. This tool aids employers in monitoring outstanding advances and streamlines payroll adjustments by providing clear and organized data. It enhances transparency and accountability, reducing errors in salary disbursement and improving overall cash flow management.

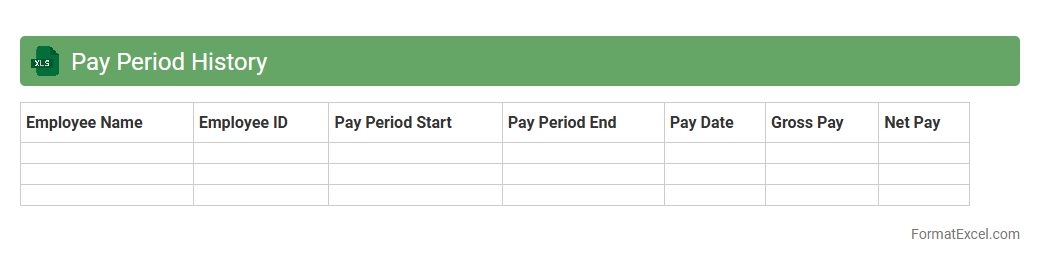

Pay Period History

Pay Period History Excel document is a detailed record of employee work hours, payment dates, and wage calculations for specific pay periods. It enables efficient tracking of payroll accuracy, ensures compliance with labor regulations, and facilitates financial reporting for businesses. Maintaining a

Pay Period History helps streamline payroll processing and supports audit readiness.

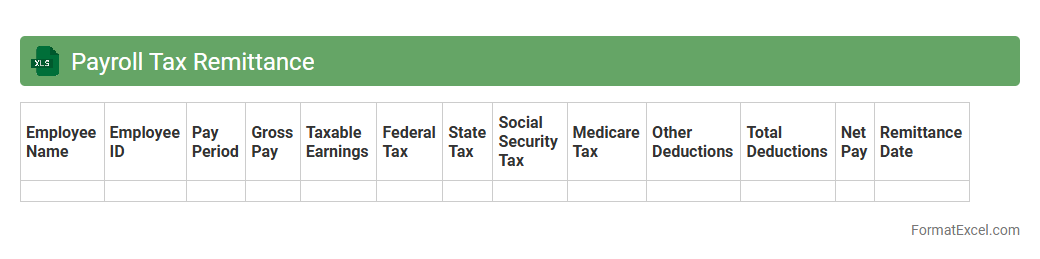

Payroll Tax Remittance

A

Payroll Tax Remittance Excel document is a structured tool designed to calculate, track, and organize payroll taxes owed by employers based on employee earnings. It streamlines the accurate reporting of taxes such as Social Security, Medicare, and federal or state income taxes, ensuring timely and compliant payments to tax authorities. Using this document improves financial accuracy, simplifies tax submissions, and helps avoid penalties related to payroll tax errors.

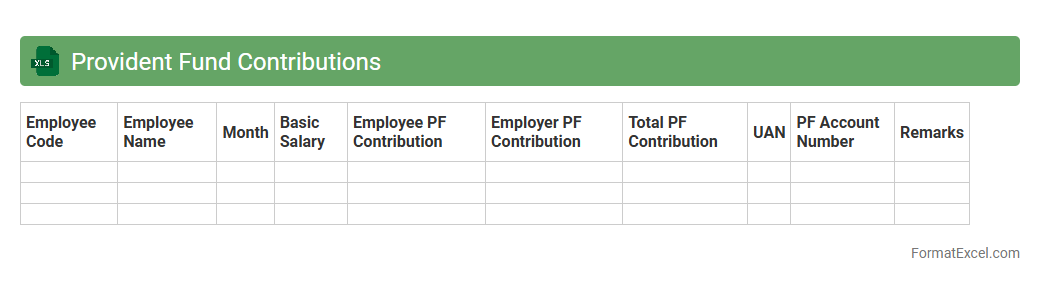

Provident Fund Contributions

A

Provident Fund Contributions Excel document is a structured spreadsheet designed to track employee and employer contributions to the provident fund over specific periods. It enables accurate calculation of deductions, balances, and helps ensure compliance with statutory regulations. Using this document improves financial transparency and simplifies auditing and reporting processes for organizations.

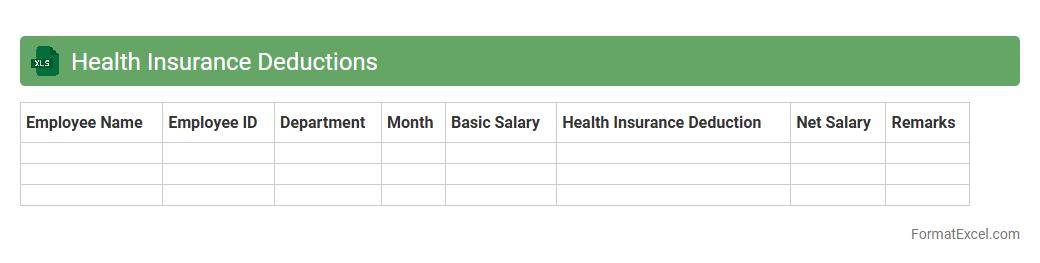

Health Insurance Deductions

The

Health Insurance Deductions Excel document organizes and tracks employee health insurance contributions, simplifying payroll processing and ensuring accurate record-keeping. It allows businesses to monitor deduction amounts, calculate benefits, and maintain compliance with insurance policies efficiently. This tool enhances financial management by providing clear visibility into insurance costs and employee contributions.

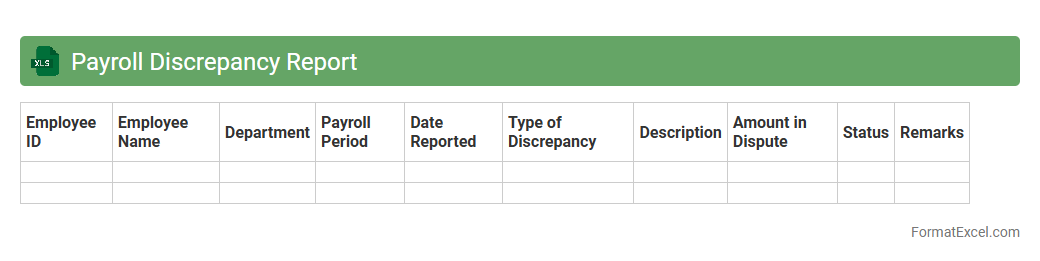

Payroll Discrepancy Report

A

Payroll Discrepancy Report Excel document identifies and highlights inconsistencies between recorded payroll data and actual employee compensation details. This report helps payroll managers detect errors such as incorrect hours, missing payments, or tax calculation issues, ensuring accurate and compliant payroll processing. By systematically resolving discrepancies, organizations minimize financial risks and maintain employee trust.

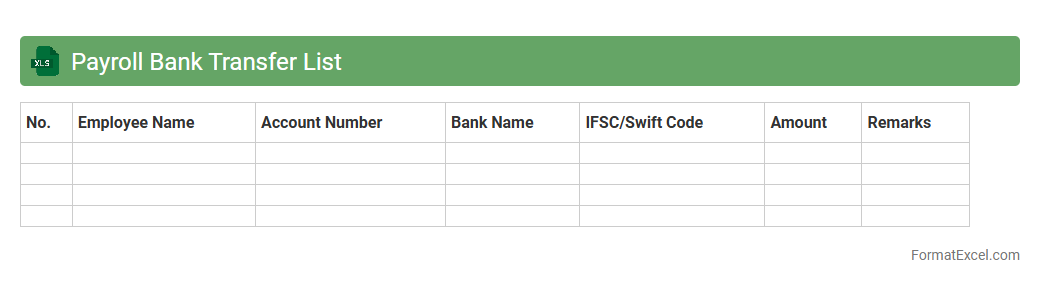

Payroll Bank Transfer List

The

Payroll Bank Transfer List Excel document is a structured file that consolidates employee salary details along with their corresponding bank account information, enabling seamless electronic salary disbursements. It streamlines the payroll process by providing a clear summary of payment amounts, account numbers, and transaction dates, reducing errors and ensuring timely payments. This document is essential for finance teams to efficiently manage bulk salary transfers and maintain accurate financial records.

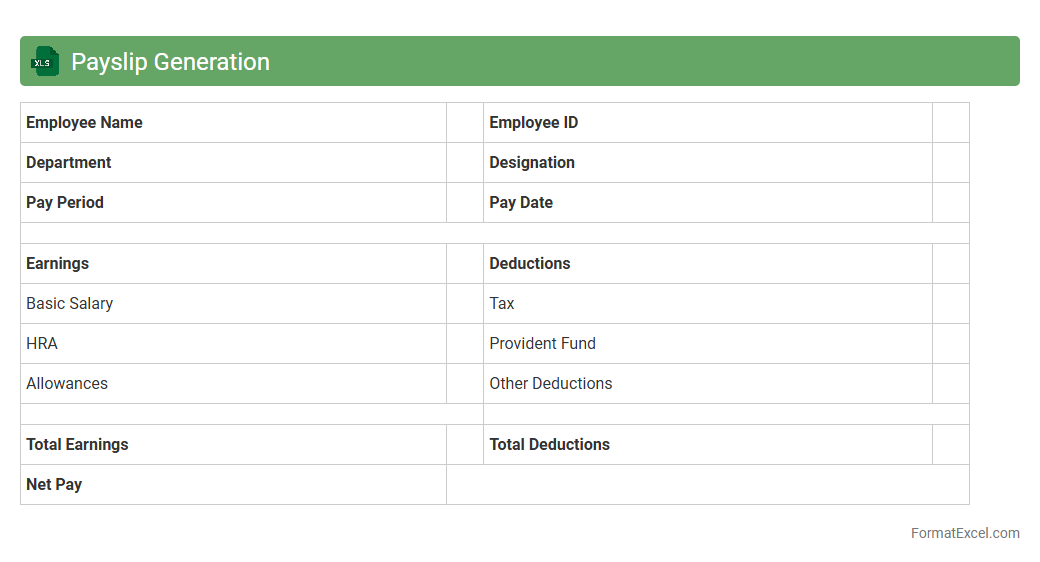

Payslip Generation

A

payslip generation Excel document is a spreadsheet tool designed to calculate and display employee salary details, including basic pay, deductions, taxes, and net pay. It helps automate payroll processes, ensuring accuracy and saving time by organizing data clearly and generating individual payslips efficiently. This tool is essential for maintaining transparent financial records and simplifying monthly salary distribution for businesses of all sizes.

Allowance and Benefits Tracker

An

Allowance and Benefits Tracker Excel document is a tool designed to systematically record, monitor, and manage employee allowances and benefits, ensuring accurate tracking of entitlements and disbursements. It helps organizations maintain transparency, prevent errors in payroll processing, and comply with internal policies or legal requirements related to employee compensation. This tracker improves financial planning by providing clear visibility of ongoing and forecasted costs associated with staff benefits and allowances.

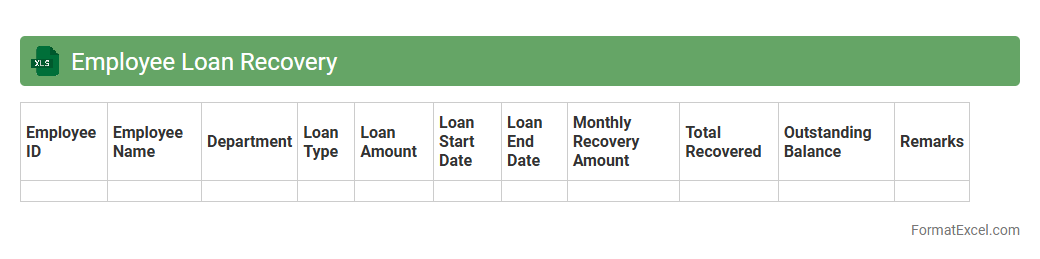

Employee Loan Recovery

The

Employee Loan Recovery Excel document is a structured spreadsheet used to track and manage the repayment of loans given to employees, detailing amounts owed, installment schedules, and recovery status. This tool enhances accuracy in financial record-keeping by automating calculations and providing clear visibility of outstanding balances and payment history. It is useful for HR and finance teams to ensure timely recovery, reduce errors, and maintain transparent loan accounts within the organization.

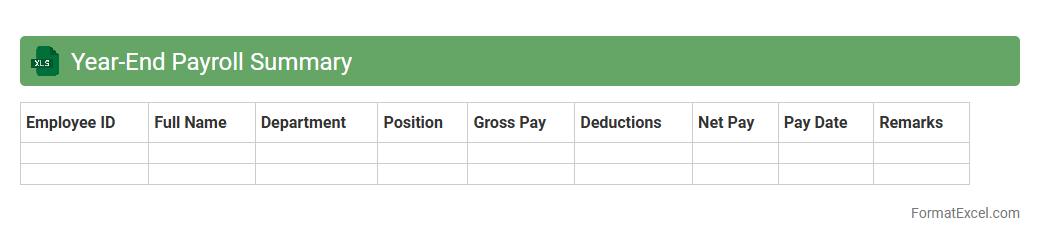

Year-End Payroll Summary

A

Year-End Payroll Summary Excel document consolidates an employee's total earnings, deductions, taxes, and net pay for the entire fiscal year. It is essential for accurate tax reporting, compliance with government regulations, and simplifying the preparation of W-2 forms or similar tax documents. This summary also aids businesses in financial auditing, payroll analysis, and year-over-year compensation comparisons.

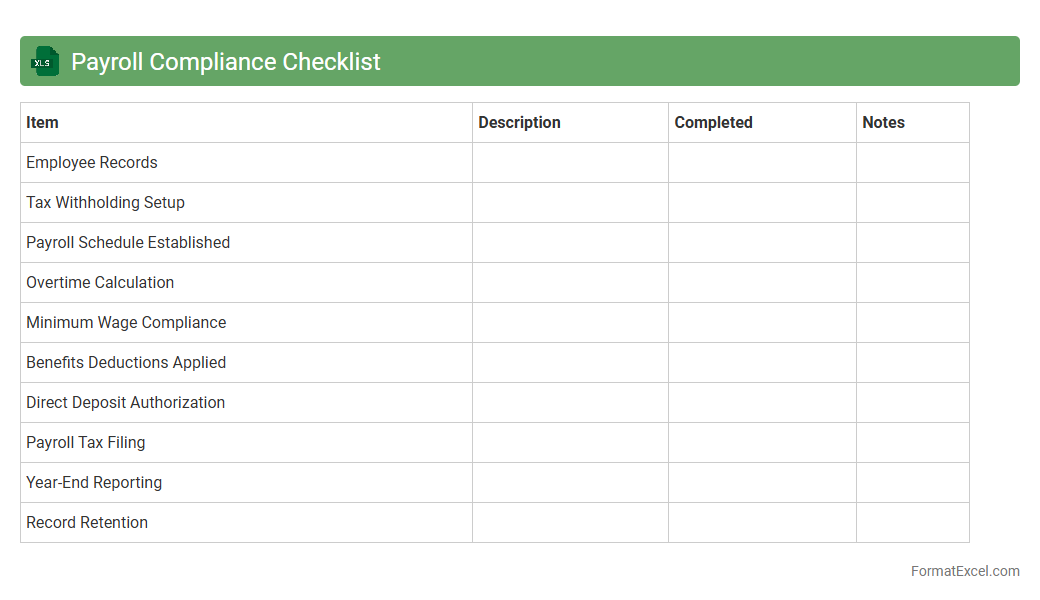

Payroll Compliance Checklist

A

Payroll Compliance Checklist Excel document is a structured tool designed to help businesses ensure adherence to payroll regulations and standards. It organizes key compliance tasks such as tax filings, employee benefits, and wage calculations in an easy-to-follow format, reducing the risk of errors and penalties. Utilizing this checklist improves accuracy, streamlines payroll processes, and supports regulatory accountability for companies of all sizes.

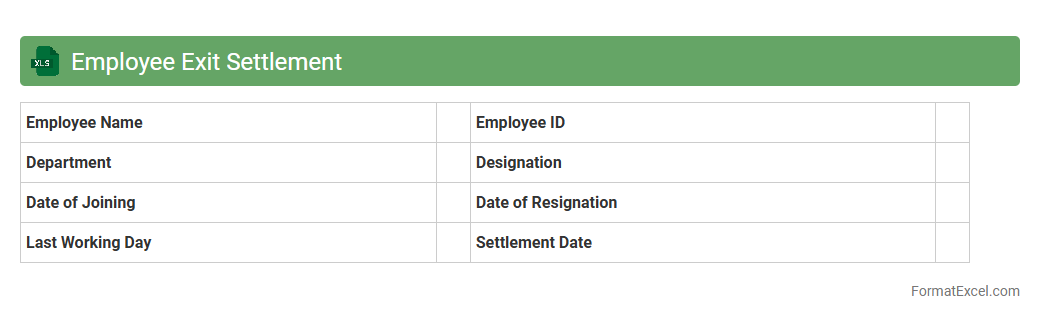

Employee Exit Settlement

The

Employee Exit Settlement Excel document is a comprehensive tool designed to calculate and document final dues owed to an employee upon their departure, including salary, leave encashment, bonuses, and deductions. It streamlines the settlement process by providing accurate financial details, reducing errors, and ensuring compliance with company policies and labor laws. This document is essential for HR and finance teams to maintain transparency, avoid disputes, and facilitate smooth employee offboarding.

Introduction to Payroll Sheet Format in Excel

The Payroll Sheet Format in Excel is a structured template designed to manage employee payments efficiently. It incorporates essential data such as employee details, hours worked, and salary calculations. This format simplifies the payroll process by automating calculations and organizing payroll data systematically.

Importance of Payroll Management

Effective payroll management is crucial for compliance with labor laws and timely employee compensation. It helps prevent errors, reduces financial risks, and improves employee satisfaction. Proper payroll handling also streamlines tax deductions and reporting requirements.

Key Components of a Payroll Sheet

A comprehensive payroll sheet includes employee information, hours worked, pay rates, deductions, and net pay. It should also feature columns for tax withholding and benefit contributions. These components ensure accurate and transparent payroll processing.

Essential Excel Functions for Payroll Calculation

Functions like SUM, IF, VLOOKUP, and ROUND are vital for automating payroll calculations in Excel. They help compute total earnings, conditional deductions, and lookup employee details. Mastering these functions enhances accuracy and efficiency in payroll management.

Step-by-Step Guide to Creating a Payroll Sheet

Begin by setting up columns for employee name, hours, and pay rate. Next, apply Excel formulas to calculate gross pay, deductions, and net pay. Finally, review and protect the sheet to prevent unauthorized edits to sensitive payroll data.

Sample Payroll Sheet Format in Excel

A typical sample payroll sheet contains headers like Employee ID, Name, Hours Worked, Rate, Gross Pay, Taxes, Deductions, and Net Pay. This layout promotes clarity and ease of data entry. Using a sample format accelerates payroll setup and reduces errors.

Customizing Payroll Sheets for Different Business Needs

Payroll sheets can be tailored by adding specific columns for bonuses, commissions, or different deduction types. This customization ensures the payroll system aligns with business-specific compensation policies. Excel's flexibility makes adapting payroll sheets straightforward.

Common Payroll Errors and How to Avoid Them

Frequent errors include miscalculations, missing deductions, and incorrect tax rates. To avoid them, validate formulas, update tax tables regularly, and perform cross-checks. Implementing data validation rules in Excel enhances payroll accuracy.

Tips for Securing Payroll Data in Excel

Protect your payroll sheet by using password encryption and restricting editing permissions. Regularly backup your payroll files to secure data integrity. Employing Excel's protection features ensures sensitive payroll data remains confidential.

Downloadable Payroll Sheet Templates in Excel

Many downloadable templates are available online, offering pre-built payroll formats for various business sizes. These templates save time and provide a reliable starting point for payroll management. Choosing a well-designed template can simplify your payroll process significantly.