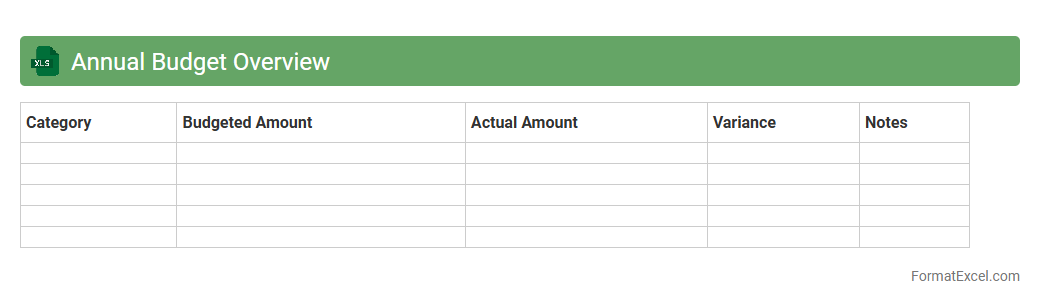

Annual Budget Overview

An

Annual Budget Overview Excel document provides a detailed summary of projected income and expenses over a fiscal year, enabling efficient financial planning and management. It helps track spending against budgeted amounts, identify cost-saving opportunities, and ensure alignment with financial goals. Using this tool enhances decision-making by offering clear visibility into cash flows, resource allocation, and potential financial risks.

Monthly Expense Tracker

A

Monthly Expense Tracker Excel document is a tool designed to record, categorize, and analyze monthly financial expenditures. By providing a clear overview of spending habits, it helps users identify areas to reduce costs, improve budgeting accuracy, and enhance overall financial management. This tracker promotes disciplined saving and informed decision-making by enabling users to compare expenses against income efficiently.

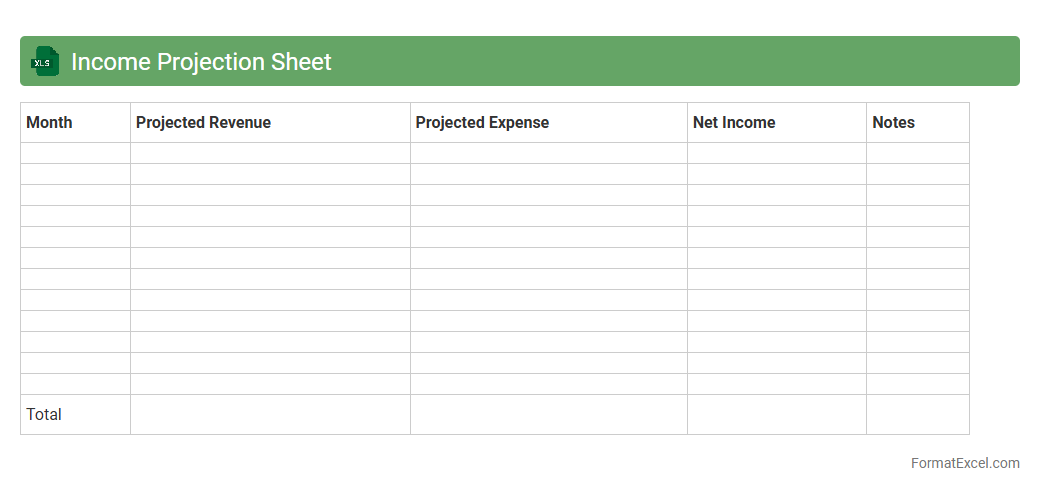

Income Projection Sheet

An

Income Projection Sheet Excel document is a financial tool designed to forecast future income by organizing and analyzing expected revenue streams over a specific period. It helps individuals and businesses plan budgets, manage cash flow, and set realistic financial goals by providing a clear view of projected earnings. Utilizing this document enhances strategic decision-making, ensuring more accurate financial planning and resource allocation.

Savings Goal Tracker

The

Savings Goal Tracker Excel document is a powerful tool designed to help individuals monitor and manage their savings progress effectively. By inputting targets, contributions, and timelines, users can visualize their financial growth through charts and summaries, ensuring better financial discipline. This tracker enhances budgeting habits and motivates consistent savings by providing clear insights into achieving specific monetary goals.

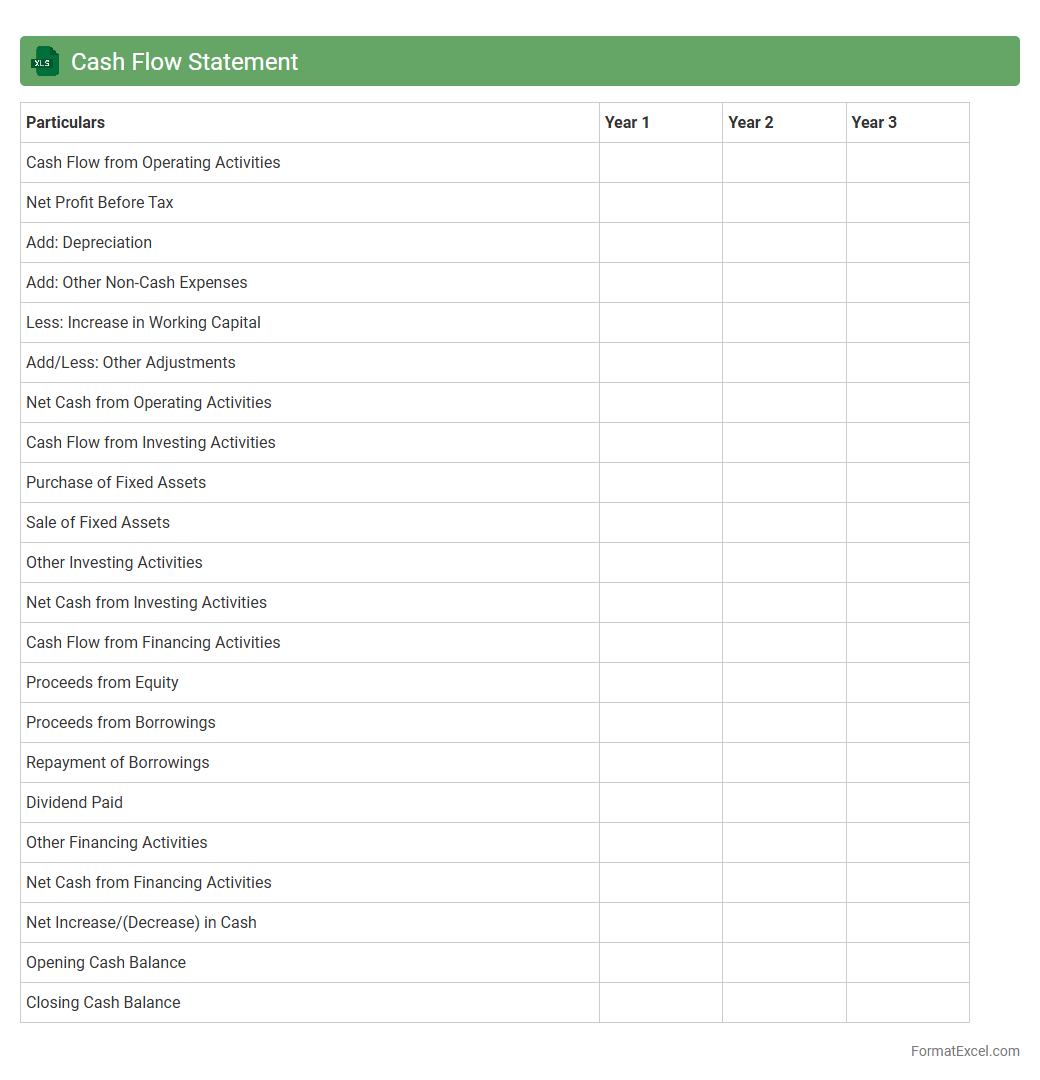

Cash Flow Statement

A

Cash Flow Statement Excel document is a financial tool designed to track the inflows and outflows of cash within a business over a specific period. It helps users analyze operating, investing, and financing activities to understand liquidity and cash management effectively. This organized format enables better forecasting, budgeting, and decision-making by providing clear visibility into cash availability.

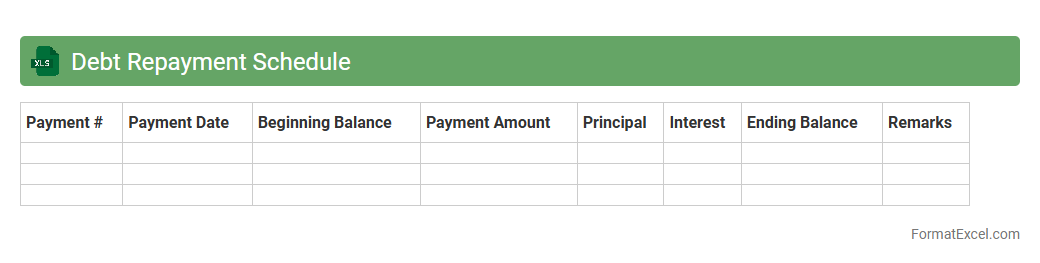

Debt Repayment Schedule

A

Debt Repayment Schedule Excel document is a spreadsheet tool designed to track and manage loan payments, interest calculations, and outstanding balances over time. It helps individuals and businesses organize their debt obligations systematically, providing clear insights into payment due dates and total repayment amounts. This document enhances financial planning by allowing users to forecast cash flow requirements and reduce debt efficiently.

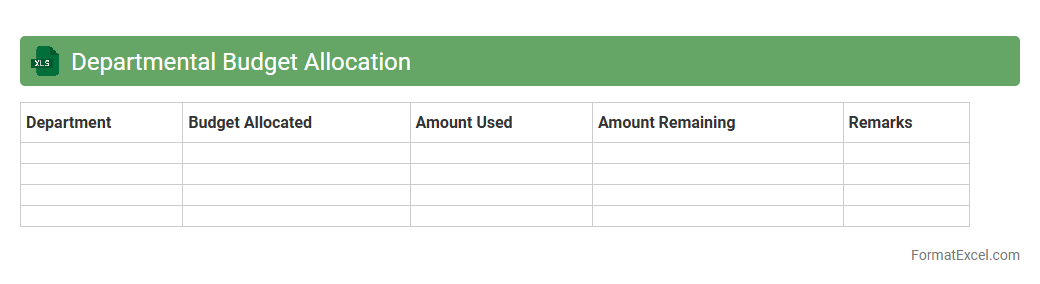

Departmental Budget Allocation

A

Departmental Budget Allocation Excel document is a structured spreadsheet designed to organize and track financial resources assigned to various departments within an organization. It helps in monitoring expenditures against allocated funds, ensuring efficient utilization of budgets, and providing clear visibility into spending patterns. This tool supports strategic financial planning, aids in identifying cost-saving opportunities, and enhances accountability across departments.

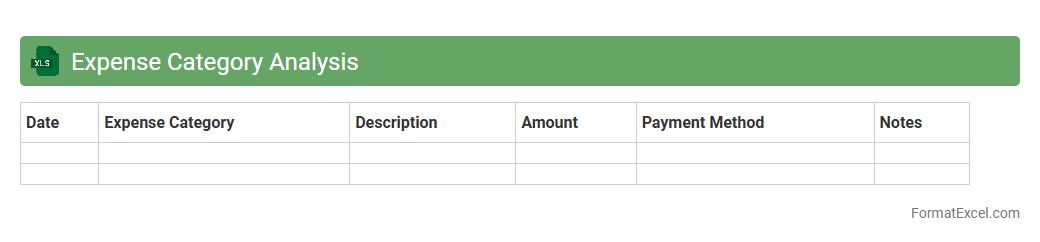

Expense Category Analysis

Expense Category Analysis Excel document is a powerful tool designed to organize and analyze spending data by categorizing expenses into distinct groups such as utilities, salaries, and marketing. This document enables businesses to identify spending patterns, control costs effectively, and optimize budget allocation based on detailed insights. Utilizing

Expense Category Analysis supports informed financial decision-making and enhances overall budget management efficiency.

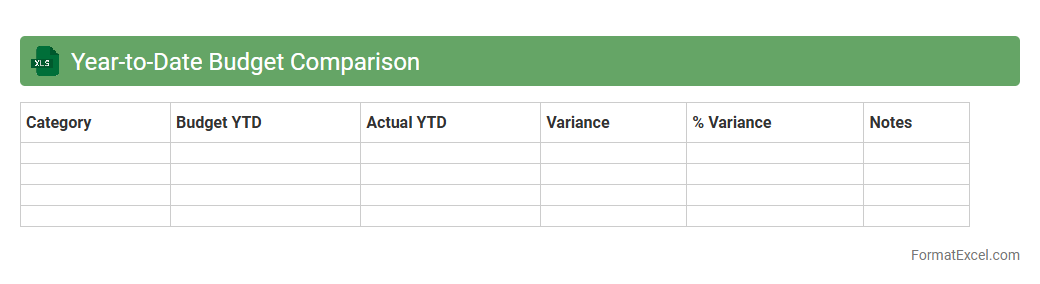

Year-to-Date Budget Comparison

A

Year-to-Date Budget Comparison Excel document tracks actual expenses and revenues against budgeted amounts from the start of the fiscal year to the current date, providing a clear view of financial performance over time. It helps identify variances, enabling timely adjustments to spending and resource allocation to stay on track with financial goals. Businesses and organizations use this tool to monitor cash flow, forecast future financial needs, and improve budgeting accuracy.

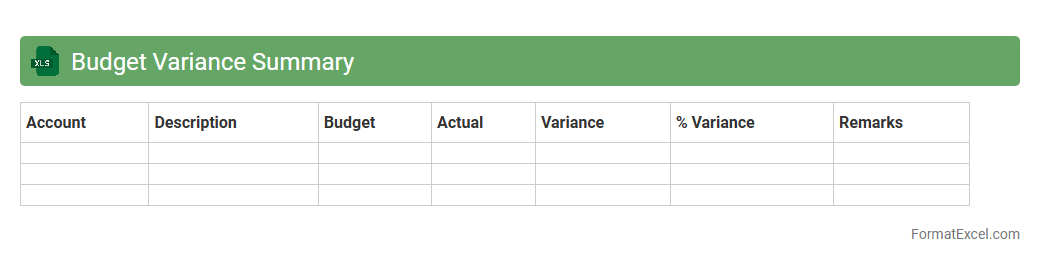

Budget Variance Summary

A

Budget Variance Summary Excel document is a financial tool that compares actual spending against planned budget figures, highlighting differences to identify areas of overspending or underspending. It provides clear insights into financial performance, enabling organizations to make informed decisions, optimize resource allocation, and improve future budget planning. This summary helps maintain financial control by tracking deviations in real-time and supporting proactive management adjustments.

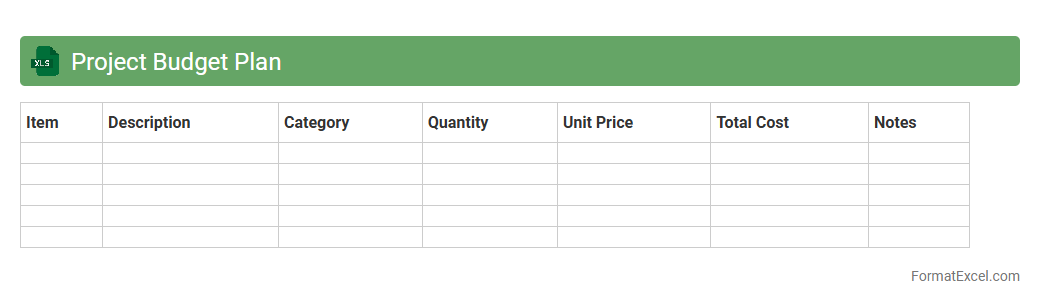

Project Budget Plan

A

Project Budget Plan Excel document is a structured spreadsheet used to outline and manage the financial aspects of a project, including estimated costs, resource allocation, and expense tracking. It helps project managers monitor spending in real-time, ensuring the project stays within the allocated budget and identifying potential financial risks early. By providing clear visibility into expenses and forecasts, it facilitates informed decision-making and efficient resource management.

Rolling Forecast Tracker

A

Rolling Forecast Tracker Excel document is a dynamic financial tool designed to continuously update projections based on actual performance and changing market conditions. It enables businesses to monitor key financial metrics such as revenue, expenses, and cash flow over a moving time horizon, typically 12 to 18 months, improving budgeting accuracy and strategic planning. This tracker supports effective decision-making by providing real-time insights and helping to quickly adjust forecasts in response to operational changes.

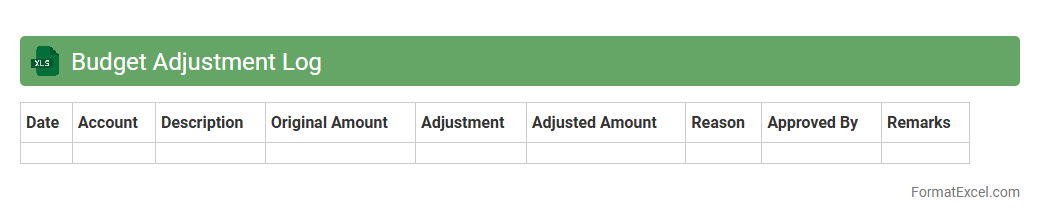

Budget Adjustment Log

The

Budget Adjustment Log Excel document is a structured tool designed to track and record all changes made to a project or organizational budget, ensuring transparency and accuracy. It allows users to document adjustment dates, reasons, amounts, and the impact on overall financial planning, facilitating effective budget management. This log is useful for comparing planned versus actual expenditures, identifying spending trends, and providing a clear audit trail for financial reviews and decision-making.

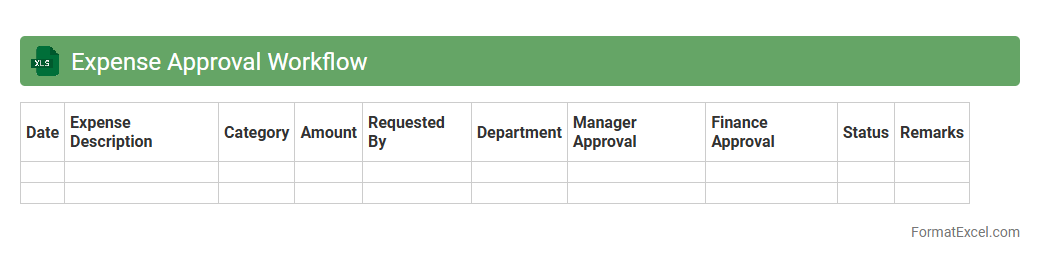

Expense Approval Workflow

An

Expense Approval Workflow Excel document is a structured tool designed to streamline and automate the process of submitting, reviewing, and approving business expenses. It provides clear visibility and accountability by tracking expense reports, approval statuses, and related financial data in one centralized spreadsheet. This workflow improves efficiency, reduces errors, and ensures compliance with company policies, ultimately saving time and enhancing financial control.

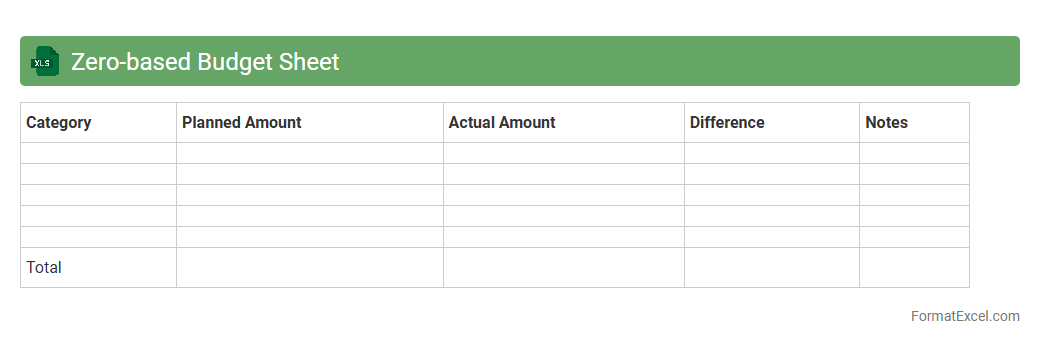

Zero-based Budget Sheet

A

Zero-based Budget Sheet Excel document is a financial planning tool that allocates every dollar of income to specific expenses, savings, or debt repayment, ensuring the income minus expenses equals zero. It helps users meticulously track spending, avoid overspending, and prioritize financial goals by assigning funds intentionally rather than carrying previous budget balances forward. This method improves financial discipline, promotes savings, and offers clear visibility into monthly cash flow management.

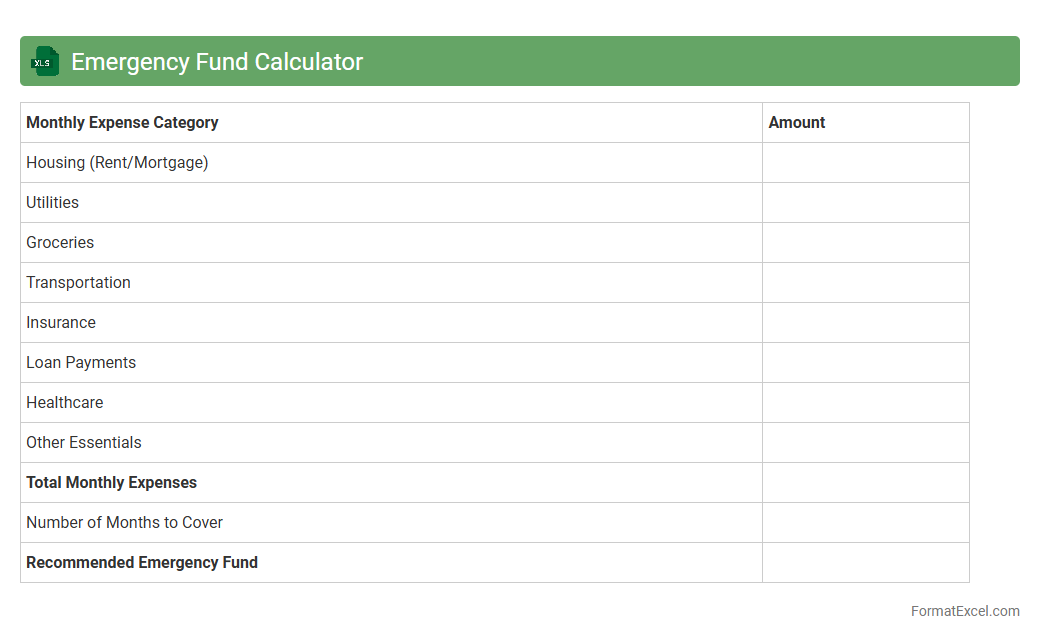

Emergency Fund Calculator

An

Emergency Fund Calculator Excel document is a financial tool designed to help individuals estimate the amount of money needed to cover unexpected expenses or financial emergencies. It allows users to input variables such as monthly expenses, desired coverage duration, and income stability to accurately determine a personalized emergency fund target. This tool is useful for enhancing financial preparedness, providing a clear savings goal, and supporting informed budgeting decisions.

Recurring Payments Tracker

The

Recurring Payments Tracker Excel document is a tool designed to monitor and manage regular financial obligations such as subscriptions, utilities, and loan payments. It helps users keep track of due dates, amounts, and payment statuses, reducing the risk of missed payments and late fees. By providing a clear overview of recurring expenses, this tracker aids in budgeting and financial planning for both individuals and businesses.

Grant Funding Tracker

The

Grant Funding Tracker Excel document is a comprehensive tool designed to organize and monitor grant applications, deadlines, and funding statuses in one centralized spreadsheet. It helps users efficiently manage multiple funding opportunities by tracking submission dates, awarded amounts, and reporting requirements. This streamlined approach improves grant management accuracy and ensures timely follow-ups, maximizing the potential for successful funding.

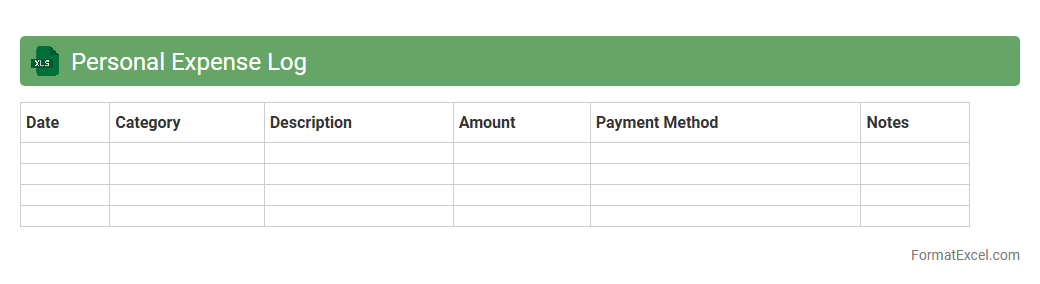

Personal Expense Log

A

Personal Expense Log Excel document is a digital tool designed to track and categorize individual financial transactions, helping users monitor their spending habits efficiently. By recording daily expenses, it enables better budgeting, identification of unnecessary costs, and improved financial planning. This organized approach aids in achieving financial goals and maintaining control over personal finances.

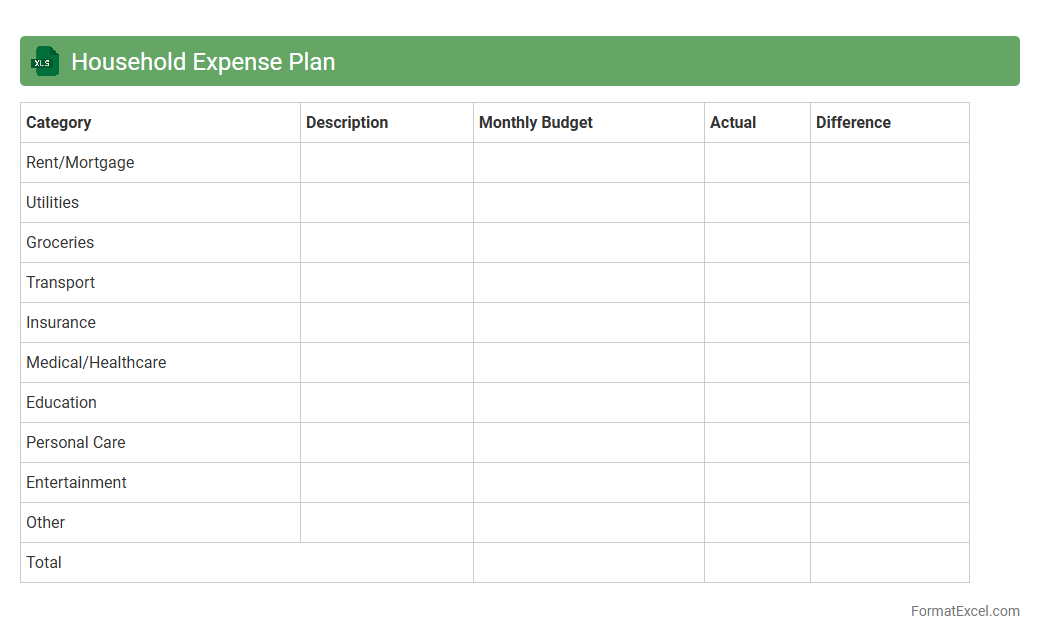

Household Expense Plan

A

Household Expense Plan Excel document is a structured spreadsheet designed to track and manage personal or family expenses efficiently. It organizes income sources, categorizes expenditures, and provides clear visualization of budgeting patterns, making it easier to identify saving opportunities and control spending. This tool is essential for achieving financial discipline and planning future expenses effectively.

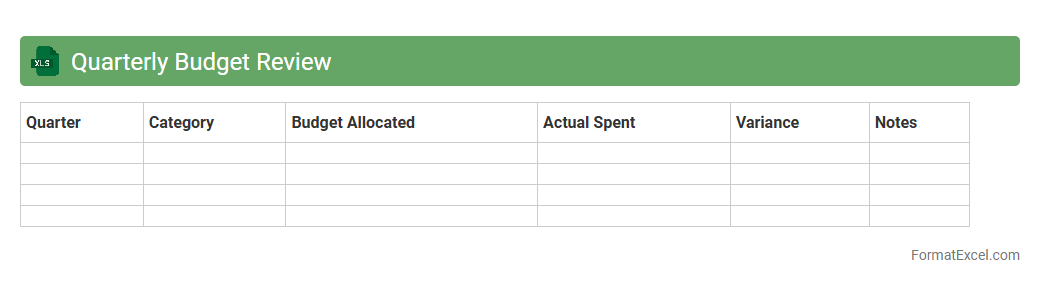

Quarterly Budget Review

A

Quarterly Budget Review Excel document is a financial tool designed to track, analyze, and compare actual expenses against budgeted amounts over a three-month period. It helps businesses identify spending patterns, highlight variances, and make informed decisions to optimize resource allocation. Utilizing this document enhances financial accountability and supports strategic planning by providing clear insights into fiscal performance.

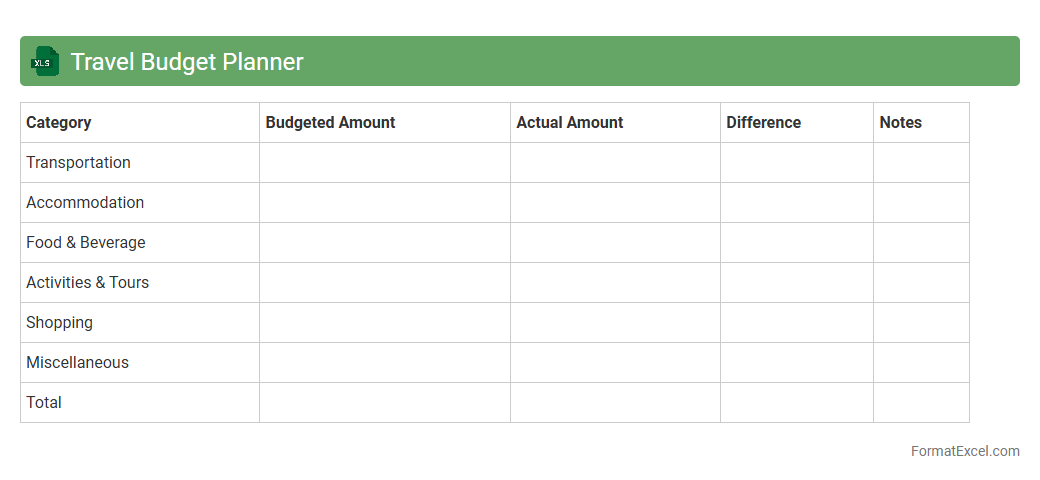

Travel Budget Planner

A

Travel Budget Planner Excel document is a customizable spreadsheet designed to help organize and track travel expenses effectively. It allows users to allocate funds for transportation, accommodation, meals, and activities, ensuring better financial control and preventing overspending. By providing a clear overview of all costs, this tool enhances decision-making and streamlines travel preparation.

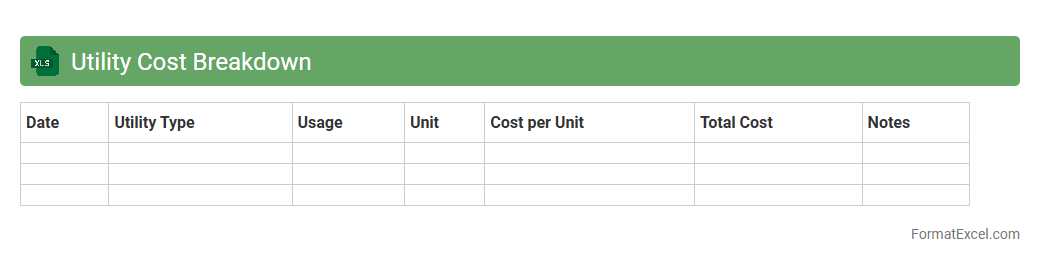

Utility Cost Breakdown

A

Utility Cost Breakdown Excel document systematically organizes and categorizes expenses related to utilities such as electricity, water, gas, and waste management. This tool helps track monthly consumption patterns, identify cost-saving opportunities, and budget accurately for utility expenses. By providing clear visibility into utility spending, it enables individuals and businesses to optimize resource usage and reduce unnecessary costs.

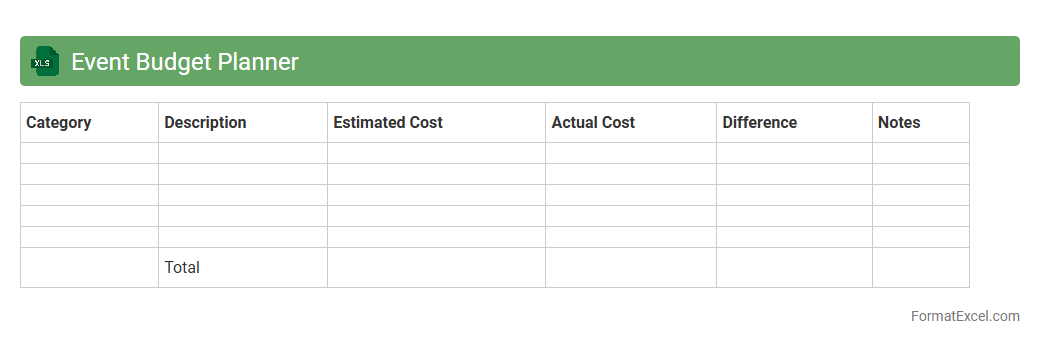

Event Budget Planner

The

Event Budget Planner Excel document is a comprehensive tool designed to organize and manage all financial aspects of an event, including expenses, revenues, and allocations across various categories. It helps users track costs in real time, ensuring that spending stays within the planned budget, and provides clear visual summaries such as charts and tables for better financial decision-making. Using this planner improves financial accuracy, reduces the risk of overspending, and streamlines the entire event budgeting process.

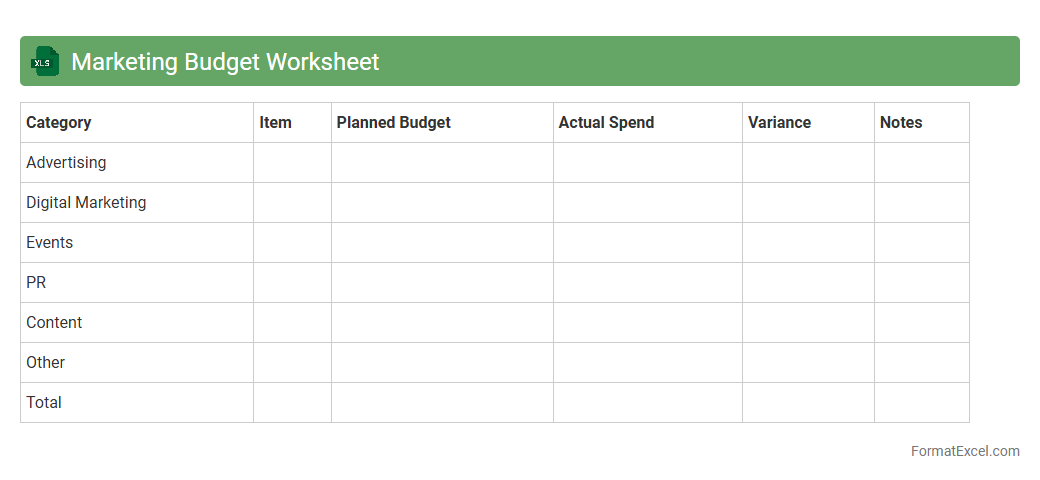

Marketing Budget Worksheet

A

Marketing Budget Worksheet Excel document is a structured tool designed to help businesses plan, track, and manage their marketing expenses effectively. It allows users to allocate budget across various campaigns and channels, ensuring optimal resource utilization and preventing overspending. By providing clear visibility into marketing expenditures, this worksheet supports better financial decision-making and enhances campaign performance analysis.

Introduction to Budget Planner Format in Excel

A Budget Planner Format in Excel is a structured spreadsheet designed to help users organize and manage their finances efficiently. It enables tracking of income, expenses, and savings goals in one accessible place. Using Excel's flexibility, individuals or businesses can tailor their budget to meet unique financial needs.

Key Features of an Effective Budget Planner

An effective budget planner includes clear categorization of income and expenses, real-time updates, and automatic calculations. It should provide visual insights through charts or graphs for better financial analysis. User-friendly navigation and periodic summaries make long-term tracking more manageable.

Essential Components of a Budget Spreadsheet

Core components include income sources, fixed and variable expenses, savings goals, and monthly summaries. A detailed budget spreadsheet must also incorporate columns for actual versus planned amounts to track disparities. Including formulas for totals and variance improves accuracy and insight.

Step-by-Step Guide to Setting Up Your Excel Budget Planner

Begin by defining categories and timelines within your spreadsheet, then input estimated income and expenses. Next, apply formulas to calculate totals, differences, and percentages automatically. Finalize by formatting cells for clarity and adding conditional formatting for alerts on overspending.

Best Excel Functions for Budget Planning

Key Excel functions include SUM for totals, IF for conditional calculations, and VLOOKUP to reference categories efficiently. Functions like AVERAGE and COUNTIF can analyze spending patterns over time. These built-in tools streamline budget maintenance and reporting.

Customizing Categories and Expense Tracking

Customizing your budget categories allows for precise tracking of diverse expenses such as utilities, groceries, and entertainment. Adding subcategories helps in identifying detailed spending trends. Excel's filtering and sorting options enhance data management and review.

Incorporating Income and Expense Forecasts

Forecasting future income and expenses improves planning accuracy and financial preparedness. Use historical data and trend analysis within Excel to build predictive models. This foresight aids in adjusting budgets proactively to avoid deficits.

Tips for Maintaining an Accurate Excel Budget

Regularly updating your budget planner and reconciling it with bank statements ensures data accuracy. Avoid entering estimated figures without validation and back up your spreadsheet frequently. Establishing a consistent review schedule promotes disciplined financial management.

Sample Budget Planner Templates in Excel

Sample templates provide a starting point with pre-built structures and formulas tailored for various budgeting needs. Using these templates can save time and inspire customization ideas suitable for your unique situation. Many templates include visual dashboards for quick financial snapshots.

Downloadable Resources and Further Reading

Accessing downloadable Excel budget planners and guides enhances your budgeting skills and efficiency. Numerous websites offer free and premium templates along with tutorials to maximize Excel's features. Continual learning through articles and videos supports ongoing financial literacy growth.