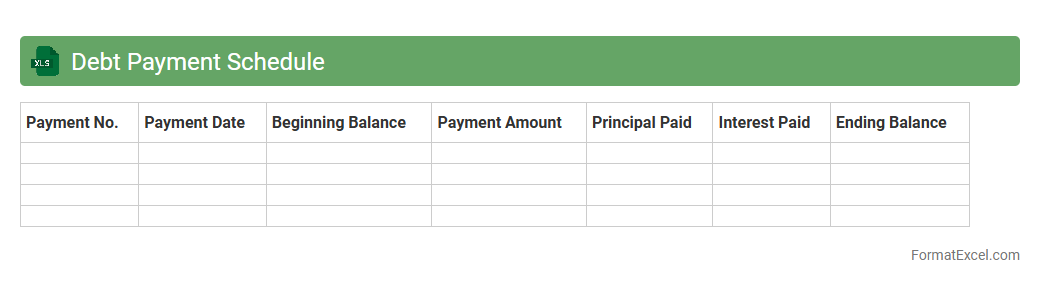

Debt Payment Schedule

A

Debt Payment Schedule Excel document is a structured spreadsheet used to track loan repayments, detailing payment dates, amounts, outstanding balances, and interest calculations. It helps individuals and businesses effectively manage debt by providing clear visibility on payment deadlines and financial obligations. This tool supports budgeting, avoiding late fees, and planning for future cash flow needs.

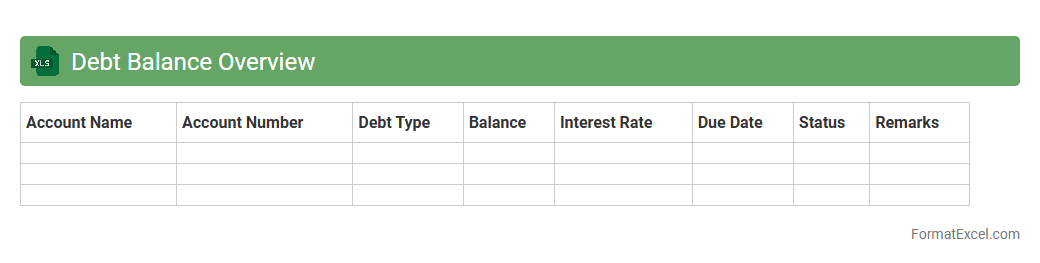

Debt Balance Overview

The

Debt Balance Overview Excel document provides a comprehensive summary of all outstanding debts, including principal amounts, interest rates, and payment schedules. It enables users to track liabilities in real-time, analyze debt trends, and make informed financial decisions to optimize cash flow and reduce interest expenses. This tool is essential for effective debt management and strategic financial planning.

Interest Rate Tracker

An

Interest Rate Tracker Excel document is a spreadsheet designed to monitor and analyze fluctuating interest rates over time. It helps users compare loan rates, mortgage rates, and savings account yields, enabling better financial decision-making. By organizing data systematically, it allows for quick identification of trends and optimal timing for financial actions.

Monthly Repayment Log

The

Monthly Repayment Log Excel document is a structured spreadsheet designed to track loan repayments each month, including payment dates, amounts, and outstanding balances. It helps individuals and businesses maintain accurate records of their financial obligations, ensuring timely payments and preventing missed deadlines. This tool enhances financial management by providing clear visibility into repayment schedules and cash flow planning.

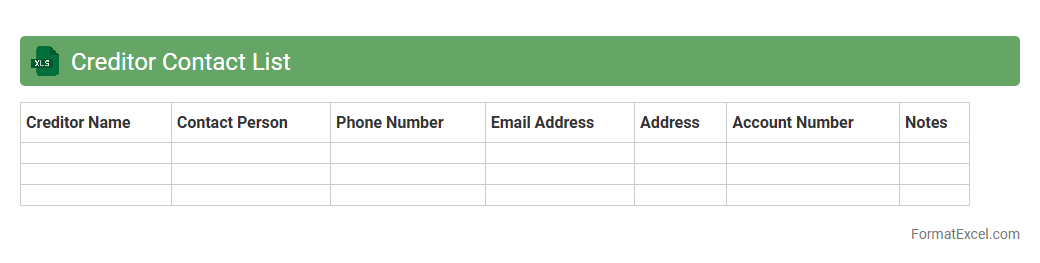

Creditor Contact List

A

Creditor Contact List Excel document is a structured spreadsheet that contains detailed information about creditors, including names, phone numbers, email addresses, and payment terms. This list is useful for efficiently managing communication with creditors, tracking outstanding debts, and ensuring timely payments. It enhances organization and helps in maintaining strong financial relationships by providing quick access to essential creditor information.

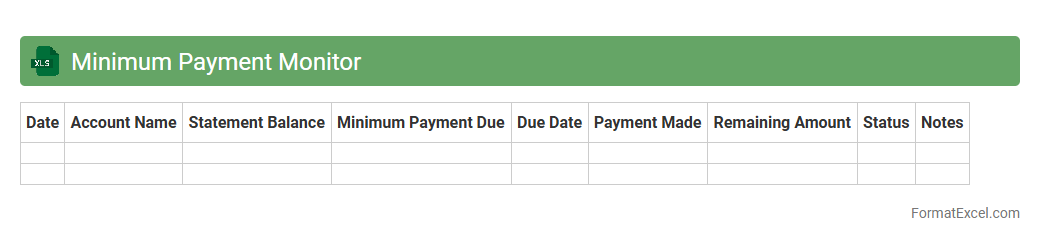

Minimum Payment Monitor

The

Minimum Payment Monitor Excel document is a financial tool designed to track and manage credit card or loan minimum payments efficiently. It helps users avoid missed payments by providing a clear overview of due dates, amounts, and outstanding balances, thereby improving credit score management and preventing late fees. This monitoring system supports better budgeting and financial discipline by highlighting upcoming obligations in a simple, organized spreadsheet format.

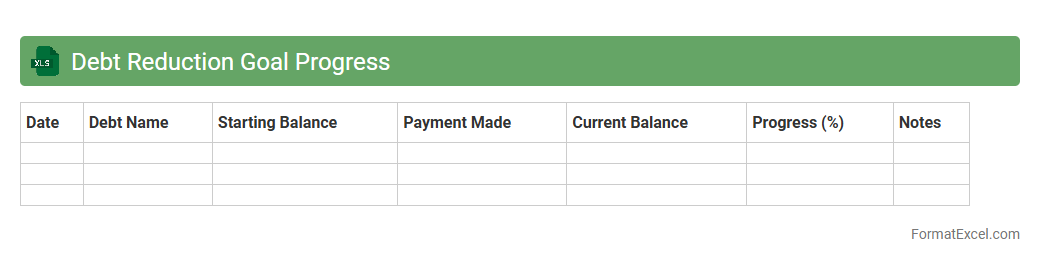

Debt Reduction Goal Progress

The

Debt Reduction Goal Progress Excel document is a powerful financial tool designed to track and visualize your journey toward paying off debts efficiently. It helps monitor outstanding balances, monthly payments, and interest rates, enabling users to stay motivated and make informed decisions about budget adjustments. Utilizing this document enhances financial discipline by providing clear insights into progress and projected debt-free timelines.

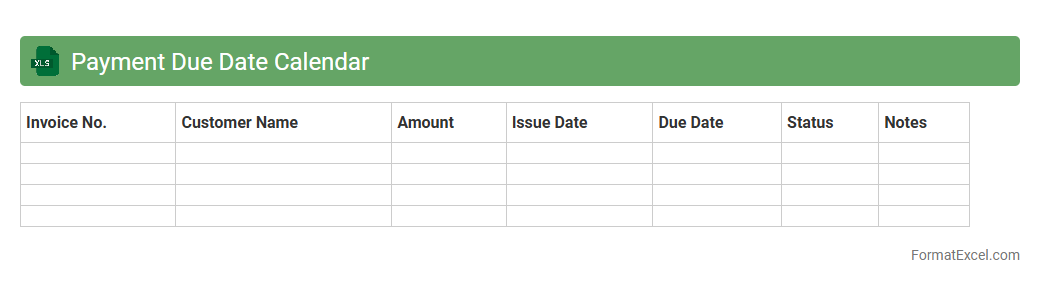

Payment Due Date Calendar

The

Payment Due Date Calendar Excel document is a tool designed to track and manage payment deadlines efficiently, ensuring that all bills and invoices are paid on time. It helps users avoid late fees, maintain good credit scores, and streamline financial planning by providing clear visibility of upcoming payment obligations. This calendar enhances organization and reduces the risk of missed payments through timely reminders and easy-to-update records.

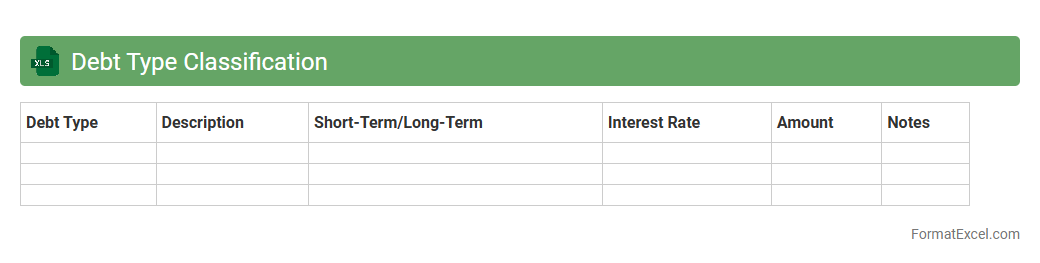

Debt Type Classification

The

Debt Type Classification Excel document categorizes various forms of debt such as secured, unsecured, short-term, and long-term liabilities, allowing for detailed financial analysis. It enables businesses to track debt characteristics, interest rates, maturity dates, and repayment schedules, enhancing budget planning and risk management. Utilizing this classification helps improve credit management strategies and supports accurate financial reporting for stakeholders.

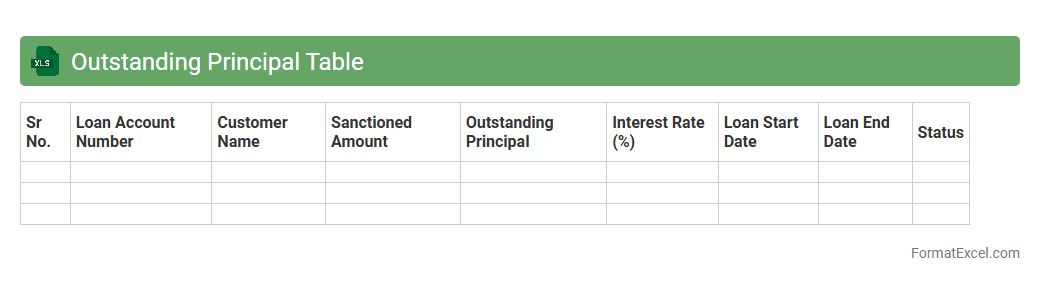

Outstanding Principal Table

The

Outstanding Principal Table excel document is a detailed financial tool that tracks the remaining principal balance on loans or debts over time. It is crucial for managing amortization schedules, enabling users to accurately monitor payment progress and calculate interest liabilities. This document improves financial planning by providing transparency on outstanding loan amounts, helping businesses and individuals optimize debt repayment strategies.

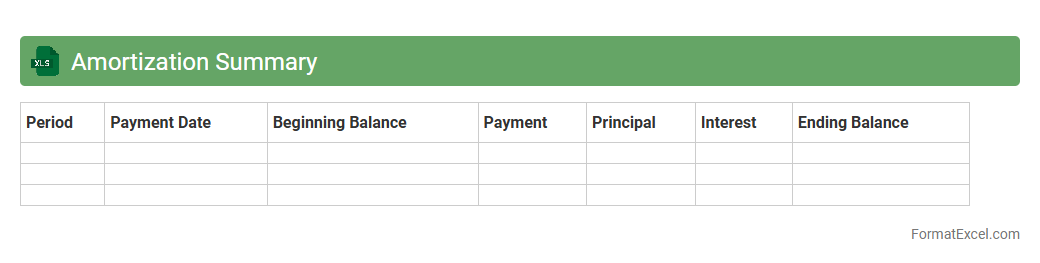

Amortization Summary

An

Amortization Summary Excel document is a detailed financial tool that outlines the schedule of loan payments, breaking down each installment into principal and interest components over the loan term. It is essential for understanding how much of each payment reduces the principal balance versus interest costs, providing clear visibility into the remaining loan balance at any point in time. This summary aids in effective financial planning, ensuring accurate tracking of debt repayment progress and facilitating informed decisions about refinancing or early loan repayment.

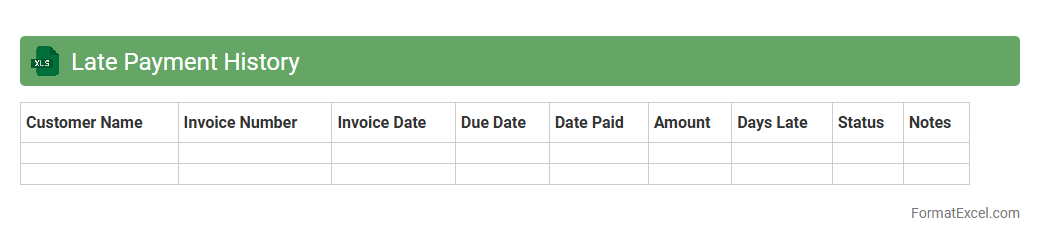

Late Payment History

A

Late Payment History Excel document is a spreadsheet used to track and analyze instances of overdue payments by customers or clients, listing dates, amounts, and payment status. This document helps businesses identify payment trends, assess credit risks, and improve cash flow management by providing clear records of past payment behavior. Utilizing this tool enables timely follow-ups on delinquent accounts and supports informed financial decision-making.

Debt Consolidation Tracker

The

Debt Consolidation Tracker Excel document is a powerful tool designed to organize and manage multiple debts by consolidating them into a single, manageable payment plan. It helps users track balances, interest rates, payment schedules, and progress over time, providing a clear overview of their financial obligations. By utilizing this tracker, individuals can effectively reduce interest costs, avoid missed payments, and accelerate debt repayment for improved financial health.

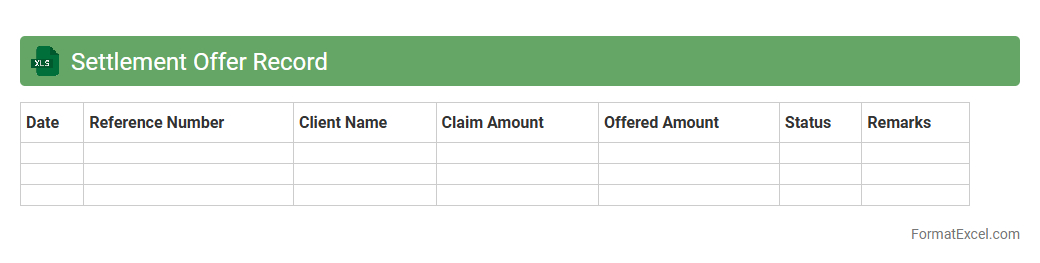

Settlement Offer Record

The

Settlement Offer Record Excel document is a structured file used to track and manage settlement offers in financial or legal transactions. It organizes offer details such as amounts, parties involved, deadlines, and status updates, enabling efficient monitoring and quick decision-making. This centralized record helps improve transparency, reduces errors, and streamlines communication between stakeholders.

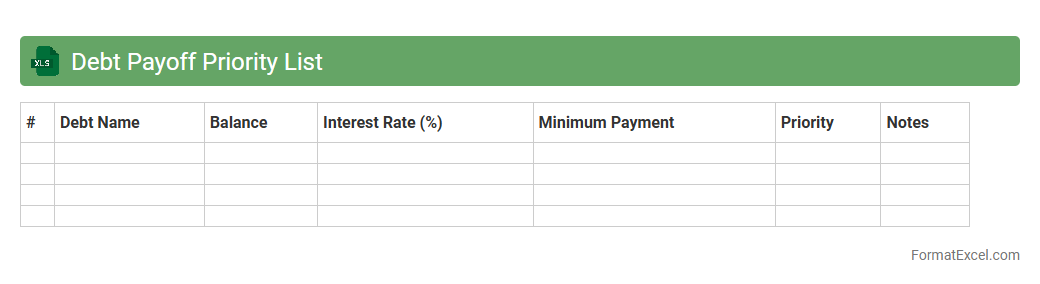

Debt Payoff Priority List

A

Debt Payoff Priority List Excel document organizes multiple debts by interest rate, balance, or payoff timeline to help users focus payments strategically. This tool allows clear visualization of outstanding obligations, enabling efficient allocation of funds to reduce total interest costs and accelerate debt freedom. Using this prioritized list improves financial planning, motivation, and progress tracking toward becoming debt-free.

Monthly vs. Total Interest Paid

A

Monthly vs. Total Interest Paid Excel document tracks the distribution of interest payments over time and cumulatively for loans or investments. It helps users analyze how much interest is paid each month compared to the total interest paid, providing clarity on financial obligations and aiding in budgeting and loan management. This tool is essential for optimizing repayment strategies and understanding the long-term cost implications of borrowing.

Snowball Method Tracker

The

Snowball Method Tracker Excel document is a financial tool designed to help individuals systematically pay off their debts by focusing on smaller balances first. It organizes debt details, tracks payments, and calculates the decreasing balance over time, enabling users to visualize their progress clearly. This method promotes motivation and financial discipline, making debt management more efficient and structured.

Avalanche Method Tracker

The

Avalanche Method Tracker Excel document is a financial tool designed to help users efficiently manage and pay off debts by targeting the highest interest rates first. It visually organizes debt information, calculates payoff timelines, and tracks progress, enabling better decision-making and motivation. By using this tracker, individuals can optimize their debt repayment strategy, potentially saving on interest and achieving financial freedom faster.

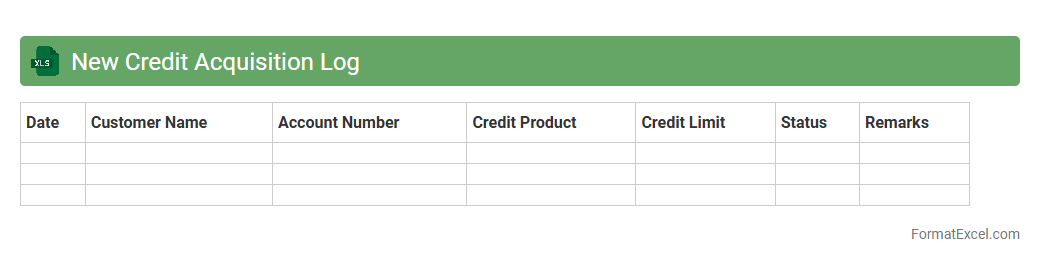

New Credit Acquisition Log

The

New Credit Acquisition Log Excel document is a comprehensive tool designed to track and manage newly acquired credit accounts efficiently. It allows users to monitor key details such as account opening dates, credit limits, payment statuses, and account types, facilitating better financial oversight. This organized record supports improved credit portfolio management and aids in timely decision-making for credit risk assessment and strategy planning.

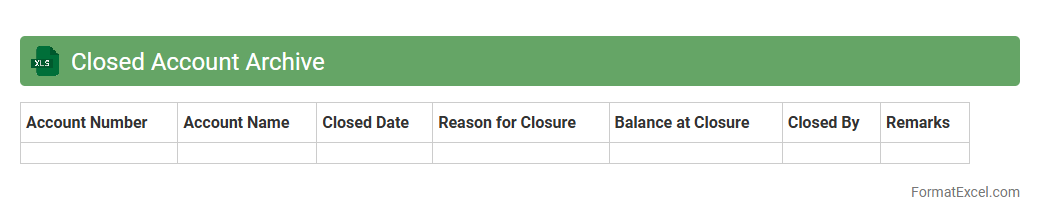

Closed Account Archive

A

Closed Account Archive Excel document is a structured spreadsheet used for storing historical data on accounts that have been closed, providing a detailed record of past transactions, balances, and account statuses. It is useful for auditing purposes, financial analysis, and regulatory compliance, allowing businesses to efficiently retrieve and review inactive account information. This document facilitates data organization, enhances transparency, and supports informed decision-making by preserving an accessible archive of closed accounts.

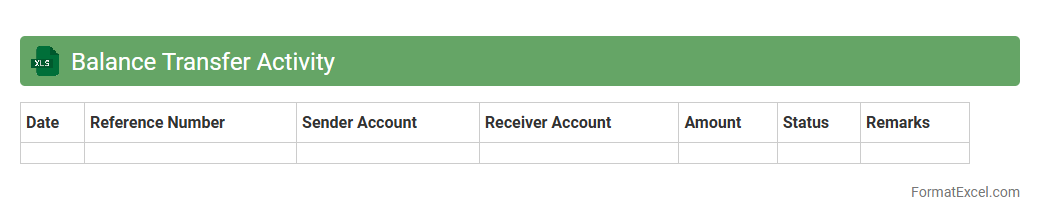

Balance Transfer Activity

The

Balance Transfer Activity Excel document tracks and records all fund transfers between accounts, providing clear visibility into transaction details such as dates, amounts, and account sources. It helps streamline financial management by enabling accurate monitoring and reconciliation of transferred balances, reducing errors and improving cash flow control. Utilizing this document enhances budgeting efficiency and supports informed decision-making for maintaining account health.

Refinancing Tracker

The

Refinancing Tracker Excel document is a specialized spreadsheet designed to monitor and manage loan refinancing details, including interest rates, payment schedules, and outstanding balances. It helps users analyze refinancing options, compare current loans with new offers, and calculate potential savings. This tool streamlines decision-making by providing clear financial insights, improving budget management, and optimizing debt repayment strategies.

Credit Utilization Rate Tracker

The

Credit Utilization Rate Tracker Excel document monitors the ratio of credit used to total available credit across all credit accounts, helping individuals maintain a healthy credit score. By accurately tracking monthly credit utilization percentages, users can make informed decisions to avoid exceeding recommended limits, typically under 30%, which positively impacts credit health. This tool provides clear data visualization and automated calculations, ensuring better management of credit behavior and improved financial planning.

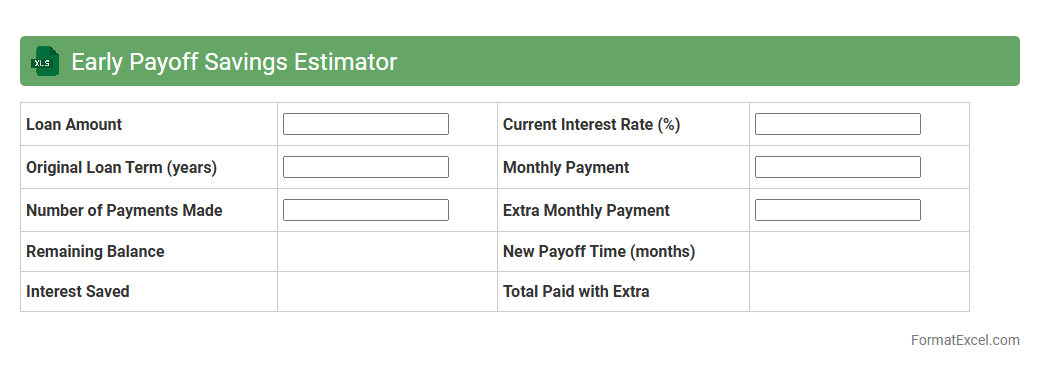

Early Payoff Savings Estimator

The

Early Payoff Savings Estimator Excel document calculates the interest savings and reduced loan duration when making extra payments on a loan. It helps users visualize the financial benefits of paying off debts faster by providing detailed amortization schedules and savings breakdowns. This tool is essential for making informed decisions on debt management and optimizing repayment strategies.

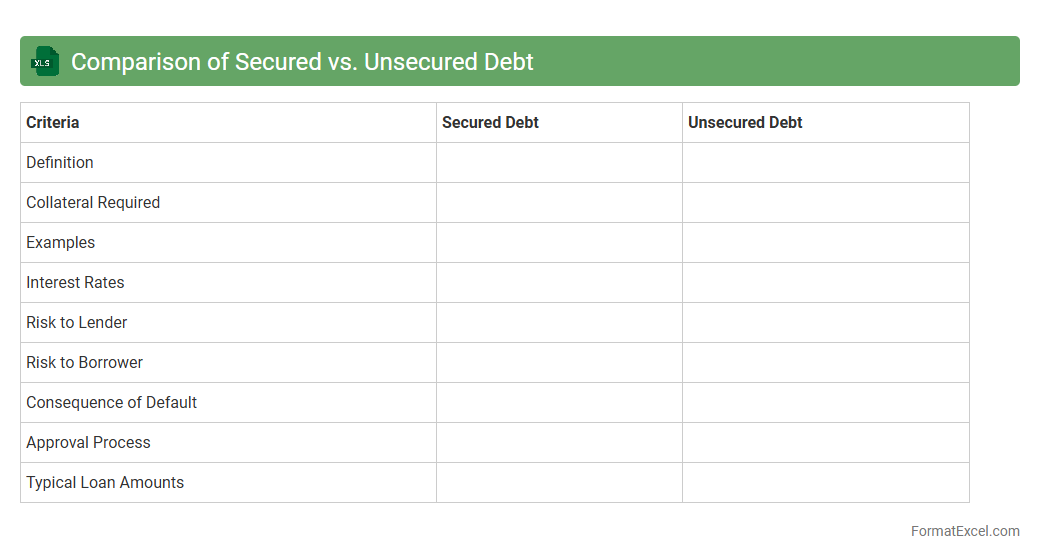

Comparison of Secured vs. Unsecured Debt

The

Comparison of Secured vs. Unsecured Debt Excel document provides a detailed analysis of the differences, benefits, and risks associated with secured and unsecured debts. It helps users clearly distinguish factors such as interest rates, collateral requirements, loan terms, and default implications, enabling informed financial decision-making. This tool is essential for individuals and businesses to evaluate their borrowing options effectively and manage debt strategically.

Introduction to Debt Tracker Formats

Debt tracker formats serve as structured tools to monitor and manage outstanding debts efficiently. Utilizing organized layouts allows users to keep track of payments, interest, and balances in one place. A well-designed debt tracker enhances financial clarity and aids in debt repayment planning.

Benefits of Using Excel for Debt Tracking

Excel offers flexibility, ease of access, and robust functions for tracking debts effectively. Users can customize spreadsheets to suit individual financial situations and update information in real time. Excel's ability to integrate formulas and charts makes it an ideal platform for debt tracking.

Key Features of an Effective Debt Tracker

An effective debt tracker includes clear input fields, automatic calculations, and visual progress indicators. It should provide sections for due dates, payment amounts, interest rates, and balance updates. The most important attribute of any debt tracker is its accuracy in reflecting current debt status.

Essential Columns for a Debt Tracker Spreadsheet

Important columns include creditor name, total debt, interest rate, monthly payment, and remaining balance. Including due dates and payment status columns helps in timely payments and avoiding penalties. These essential columns form the backbone of an organized debt tracker.

Step-by-Step Guide to Creating a Debt Tracker in Excel

Start by opening a new spreadsheet and labeling columns with debt-related information. Input initial debt amounts and set formulas to calculate interest and balances dynamically. Incorporate conditional formatting to highlight overdue payments, ensuring your debt tracker remains informative and actionable.

Customizing Debt Tracker Templates in Excel

Templates can be adjusted by adding columns, changing headers, or modifying formulas to fit personal financial needs. Format cells for currency and dates to ensure data consistency and clarity. Customization enhances the usability and personal relevance of the tracker.

Automating Debt Calculations with Excel Formulas

Excel formulas such as SUM, IF, and PMT enable automatic computation of totals, due amounts, and payment schedules. Using these formulas reduces manual errors and saves time while maintaining up-to-date information. Automation is key for an efficient debt tracking system.

Visualizing Debt Progress with Excel Charts

Charts like line graphs and pie charts display payment trends and debt reduction over time visually. Visual aids help quickly assess financial health and motivate timely payments. Effective debt trackers incorporate visualizations to track progress at a glance.

Tips for Maintaining an Accurate Debt Tracker

Regularly update payment information and review formulas to prevent errors. Back up your spreadsheet and use password protection to secure sensitive financial data. Consistency and security are crucial for maintaining an accurate debt tracker.

Downloadable Debt Tracker Excel Template

Free and customizable debt tracker templates are available for download to streamline your debt management process. These templates offer a ready-made structure with built-in formulas and formatting. Utilizing a downloadable template can jumpstart efficient debt tracking efforts immediately.