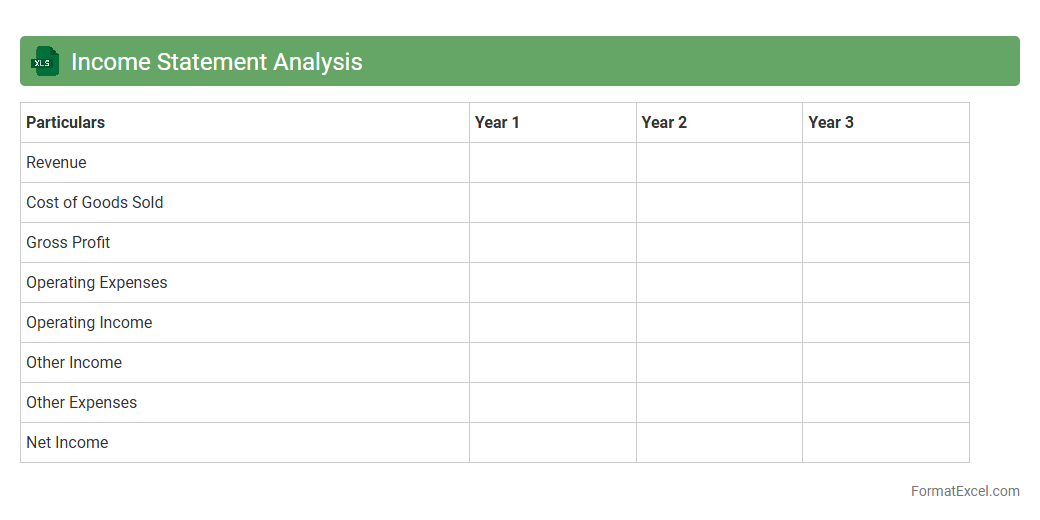

Income Statement Analysis

An

Income Statement Analysis Excel document organizes and evaluates financial data to assess a company's profitability over a specific period. It enables users to identify revenue trends, expense patterns, and net income fluctuations, thus facilitating informed decision-making. This tool is essential for investors, managers, and analysts aiming to optimize financial performance and strategize for future growth.

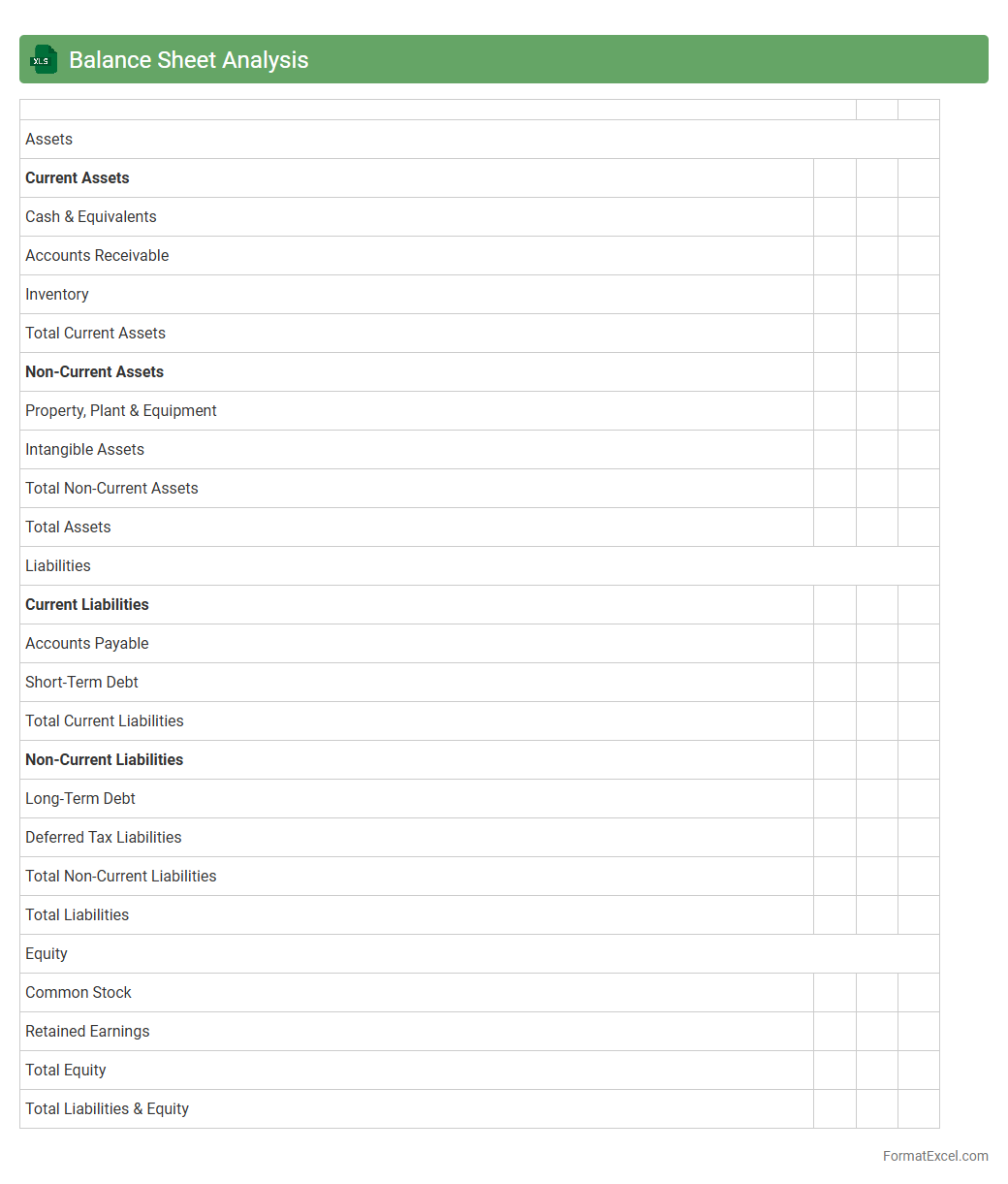

Balance Sheet Analysis

A

Balance Sheet Analysis Excel document is a structured spreadsheet designed to organize and evaluate a company's financial position by detailing assets, liabilities, and shareholders' equity. It enables users to quickly calculate key financial ratios such as debt-to-equity, current ratio, and return on equity, providing insights into liquidity, solvency, and overall financial health. This tool is useful for investors, analysts, and management to make informed decisions based on accurate and accessible financial data.

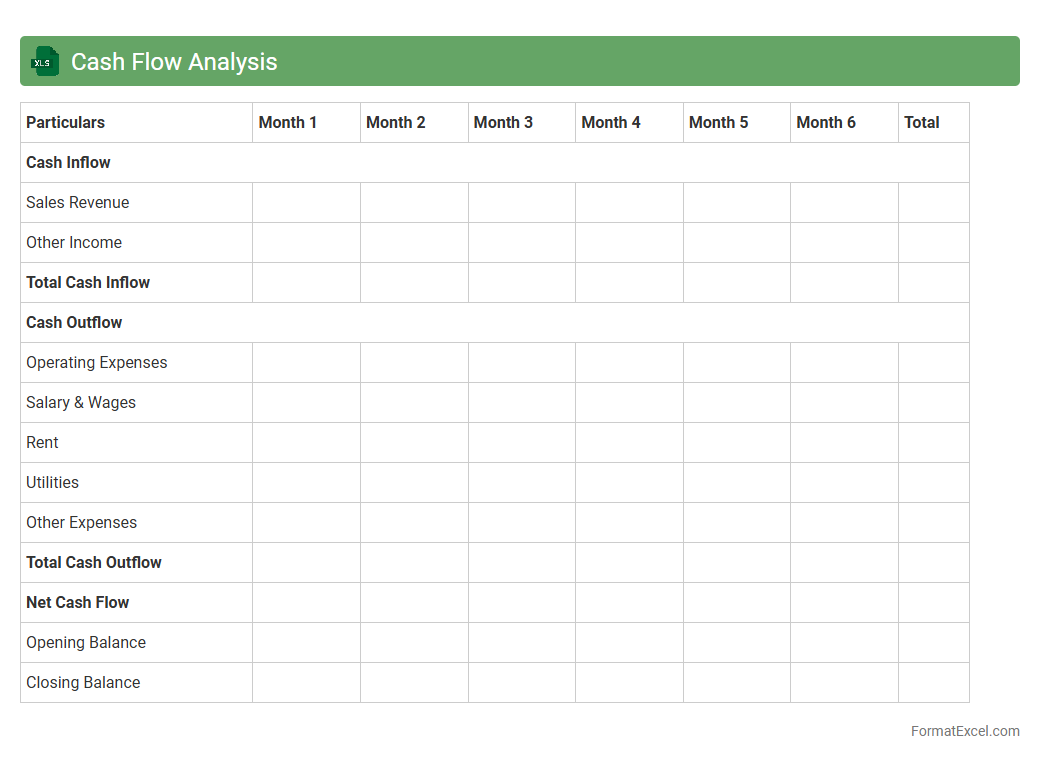

Cash Flow Analysis

A

Cash Flow Analysis Excel document systematically tracks and organizes inflows and outflows of cash within a specified period, providing a clear snapshot of a company's liquidity. It helps businesses forecast future cash positions, manage expenses, and ensure sufficient funds are available for operational needs. Utilizing this tool improves financial decision-making by highlighting periods of surplus or shortfall, aiding in effective budgeting and investment planning.

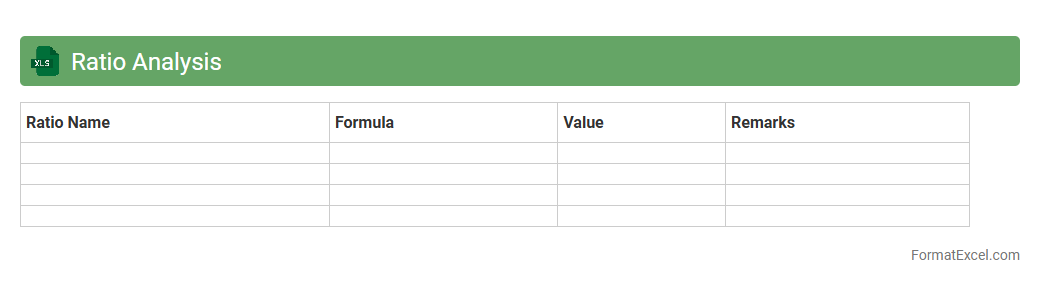

Ratio Analysis

Ratio Analysis Excel document is a tool that organizes and calculates financial ratios like liquidity, profitability, and efficiency, providing clear insights into a company's performance. It enables users to quickly assess financial health, identify trends, and make informed decisions based on key metrics such as current ratio, return on equity, and debt-to-equity ratio. Using

Ratio Analysis in Excel streamlines the process of evaluating business viability and comparing financial data across periods or competitors.

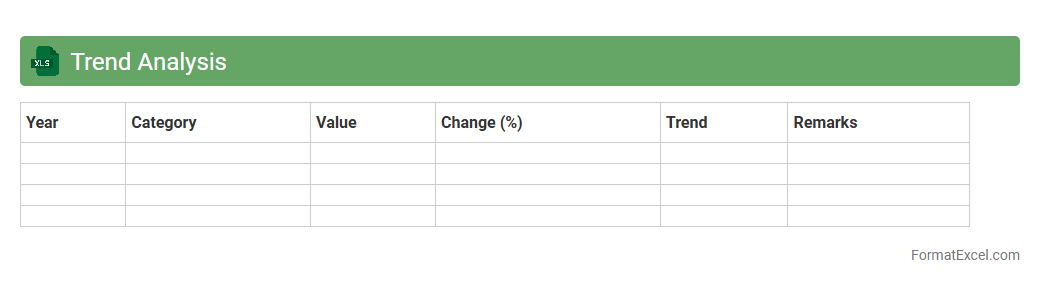

Trend Analysis

A

Trend Analysis Excel document is a data tool that tracks changes and patterns over time within a dataset, enabling users to visualize and interpret shifts in performance, sales, or other key metrics. It helps businesses identify growth opportunities, forecast future outcomes, and make informed decisions by presenting historical data trends clearly through charts and tables. This analytical approach enhances strategic planning and risk management by highlighting consistent behaviors and anomalies.

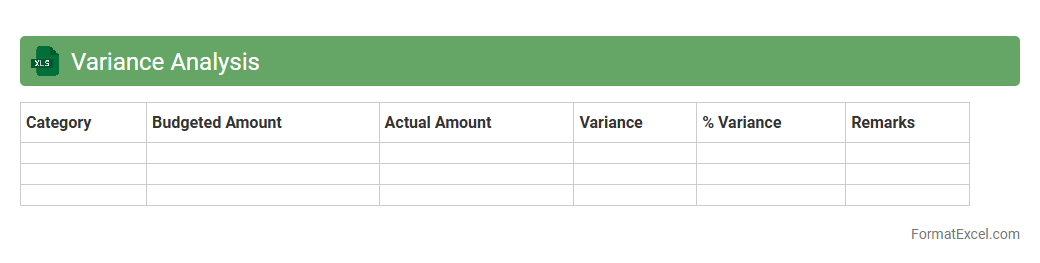

Variance Analysis

Variance Analysis Excel document is a powerful financial tool designed to compare actual performance against budgeted figures, identifying deviations in costs, revenues, or other key metrics. This analysis helps businesses pinpoint areas of inefficiency or unexpected expenses, enabling informed decision-making and improved budget control. Using

Variance Analysis in Excel enhances accuracy and clarity in financial management by providing detailed insights through customizable spreadsheets and formulas.

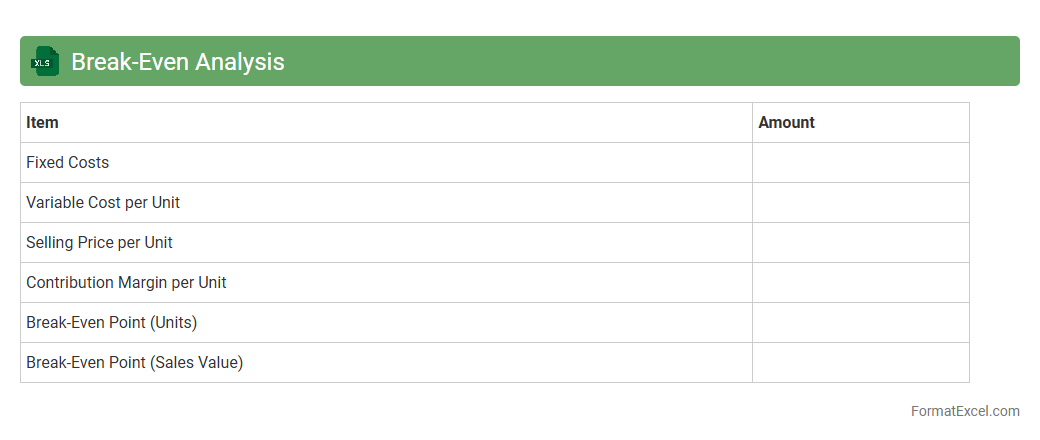

Break-Even Analysis

A

Break-Even Analysis Excel document calculates the point where total revenue equals total costs, helping businesses identify when they will start generating profit. It visualizes fixed costs, variable costs, and sales revenue in an easy-to-understand format, enabling informed decision-making. This tool is essential for budgeting, pricing strategy, and financial planning to optimize business performance.

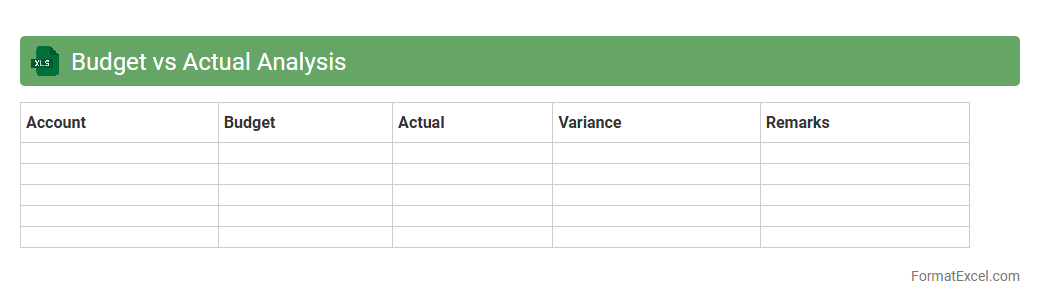

Budget vs Actual Analysis

Budget vs Actual Analysis Excel documents provide a detailed comparison between planned financial goals and actual performance, highlighting variances to improve financial control. This tool helps organizations track expenses and revenues precisely, facilitating informed decision-making and ensuring adherence to budgets. By using

Budget vs Actual Analysis, businesses can identify cost overruns, optimize resource allocation, and enhance overall financial planning accuracy.

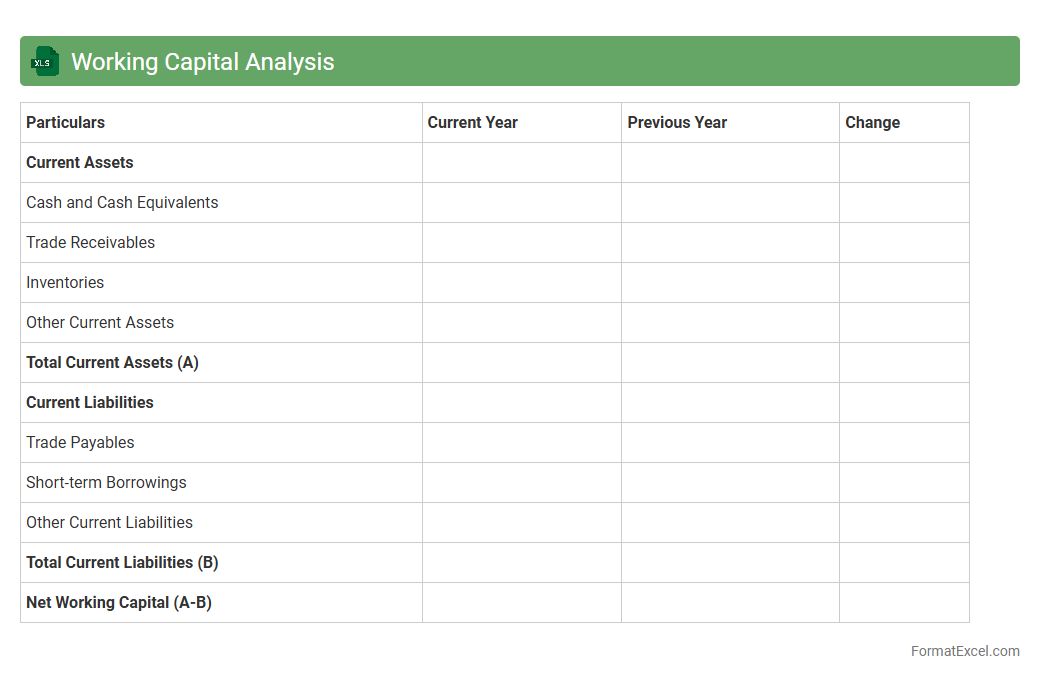

Working Capital Analysis

Working Capital Analysis Excel document is a financial tool designed to evaluate a company's short-term liquidity by examining current assets and liabilities. It helps businesses identify their ability to meet immediate obligations, optimize cash flow, and improve operational efficiency. Using a

Working Capital Analysis template enhances decision-making by providing clear insights into the company's financial health.

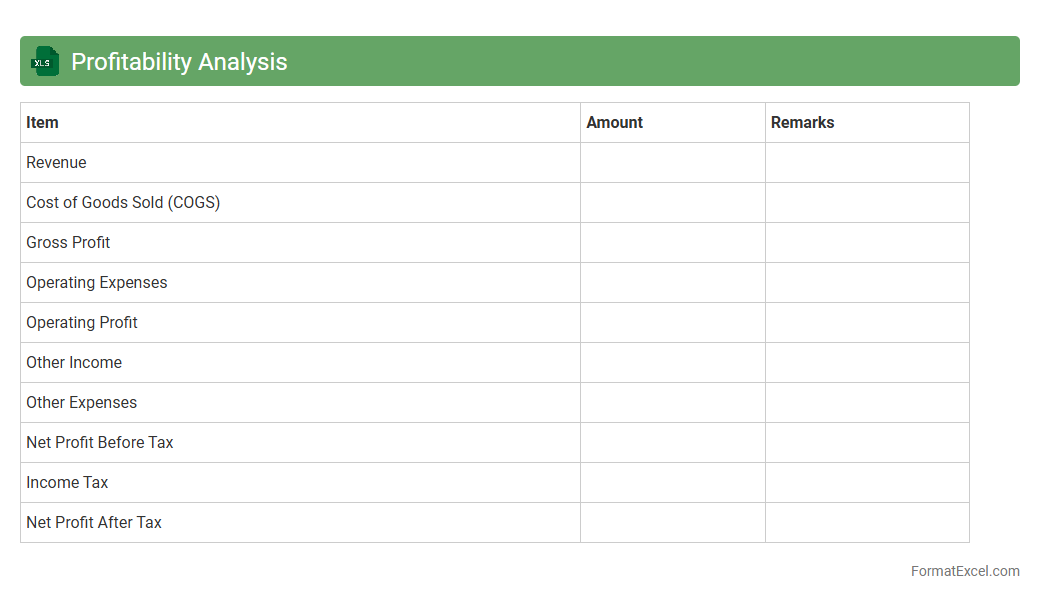

Profitability Analysis

Profitability Analysis in an

Excel document is a structured tool designed to evaluate the financial performance of a business by calculating revenues, costs, and profit margins across products, services, or departments. This analysis helps identify the most and least profitable areas, enabling data-driven decisions to optimize resource allocation and improve overall profitability. Utilizing Excel's built-in formulas and pivot tables enhances the accuracy and efficiency of tracking key metrics, making it indispensable for strategic planning and financial forecasting.

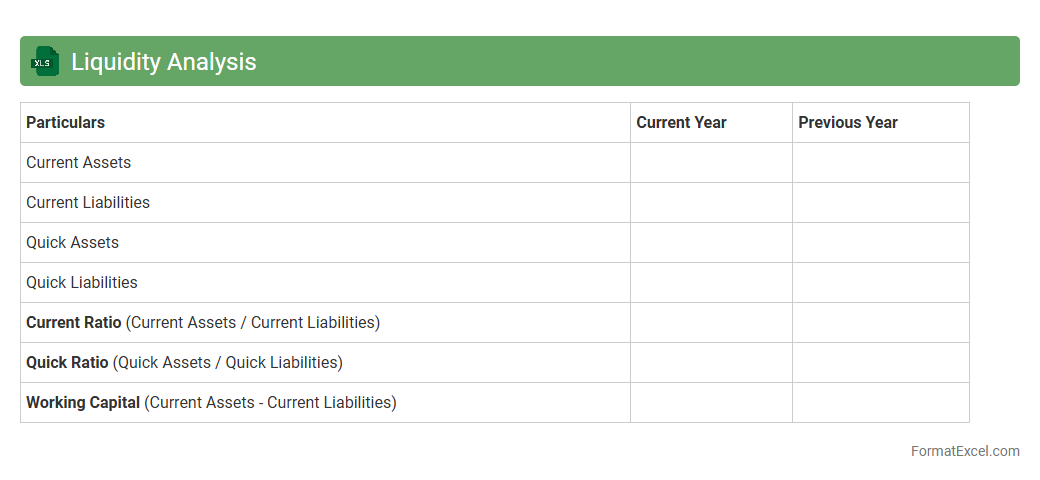

Liquidity Analysis

A

Liquidity Analysis Excel document is a financial tool designed to assess a company's ability to meet its short-term obligations by analyzing current assets and liabilities. It helps businesses and investors evaluate cash flow, working capital, and overall financial health by organizing key metrics such as the current ratio, quick ratio, and cash conversion cycle. This analysis supports informed decision-making related to credit management, operational efficiency, and investment strategies.

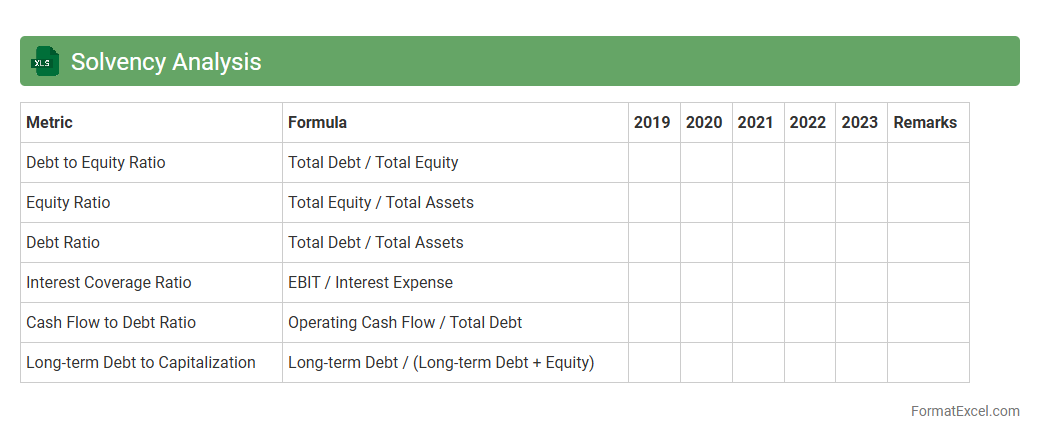

Solvency Analysis

Solvency Analysis Excel documents are spreadsheets designed to evaluate a company's ability to meet its long-term financial obligations by assessing key ratios such as debt-to-equity and interest coverage. These tools provide a clear overview of a firm's financial health, helping stakeholders make informed decisions about credit risk and investment potential. Using a

Solvency Analysis Excel document allows efficient data organization, automated calculations, and visual representation of solvency metrics for better financial planning and risk management.

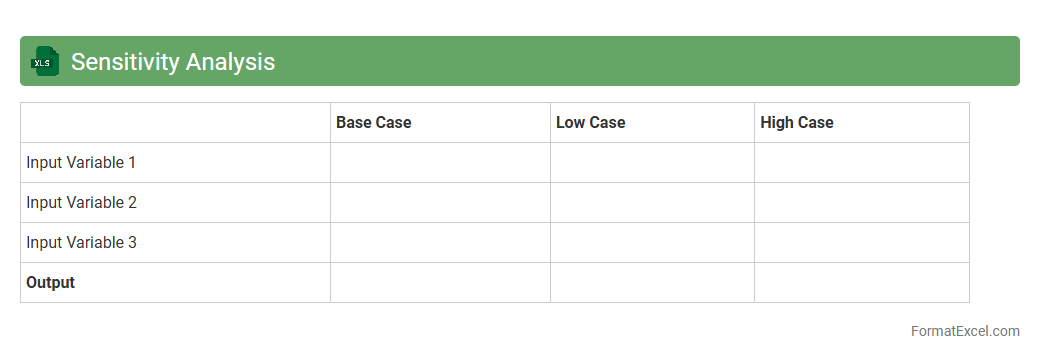

Sensitivity Analysis

Sensitivity Analysis in Excel is a powerful technique used to assess how changes in input variables impact the output of a model or decision-making process. This

financial modeling tool helps users identify key drivers, evaluate risks, and make informed decisions by testing different scenarios efficiently. It is especially useful for budgeting, forecasting, and investment analysis, providing clarity and confidence in uncertain conditions.

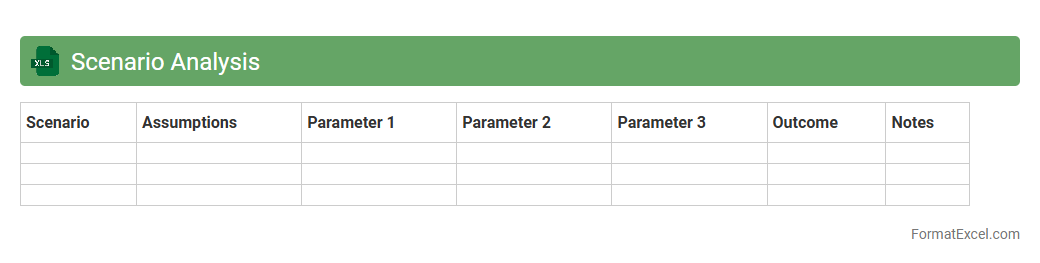

Scenario Analysis

A

Scenario Analysis Excel document enables users to evaluate multiple financial or business outcomes by adjusting key variables within a spreadsheet model. It is useful for forecasting potential impacts of different decisions, managing risks, and identifying optimal strategies under varying conditions. This tool enhances decision-making by providing clear visualizations of best-case, worst-case, and most likely scenarios based on quantitative data.

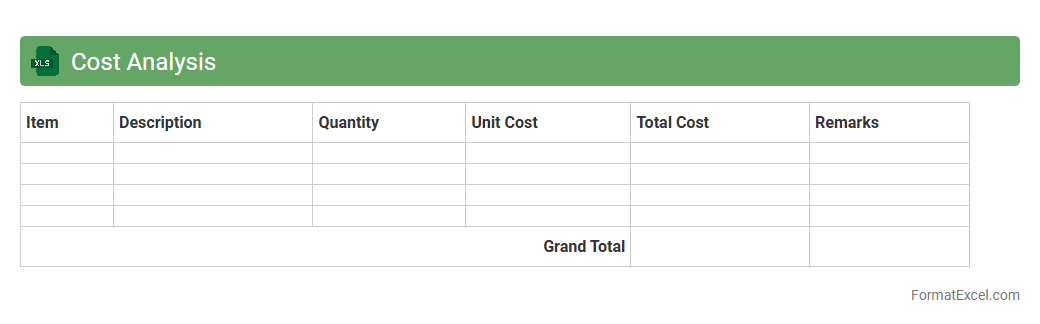

Cost Analysis

A

Cost Analysis Excel document is a spreadsheet tool designed to systematically record, analyze, and interpret various expenses involved in a project or business operation. It helps identify cost drivers, compare budgeted versus actual expenses, and facilitates informed decision-making by highlighting potential areas for savings and efficiency improvements. This document is essential for accurate financial tracking, budget optimization, and strategic planning.

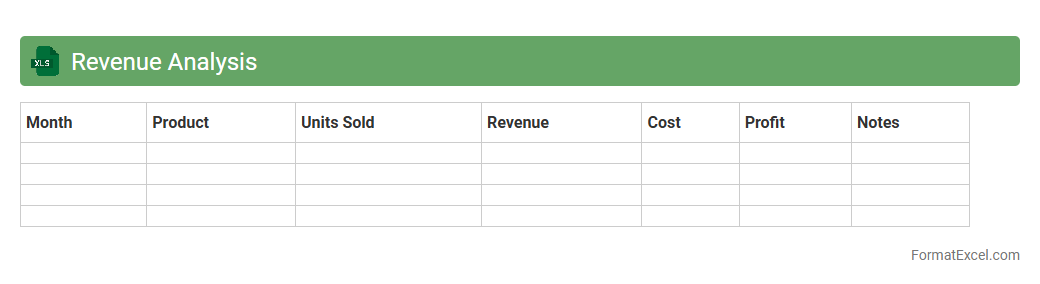

Revenue Analysis

A

Revenue Analysis Excel document is a detailed financial tool that tracks and evaluates income streams over specific periods, enabling businesses to identify trends and forecast future earnings. It consolidates sales data, customer segments, and pricing strategies into organized charts and pivot tables for easy interpretation. Utilizing this document helps optimize decision-making processes by highlighting revenue drivers and pinpointing areas for growth or cost reduction.

EBITDA Analysis

An

EBITDA Analysis Excel document is a financial tool designed to calculate and evaluate a company's Earnings Before Interest, Taxes, Depreciation, and Amortization. This analysis helps in assessing operational profitability by excluding non-operational expenses and accounting policies, enabling clearer insight into cash flow generation. Businesses use this document to compare performance across periods, benchmark against competitors, and support investment or lending decisions.

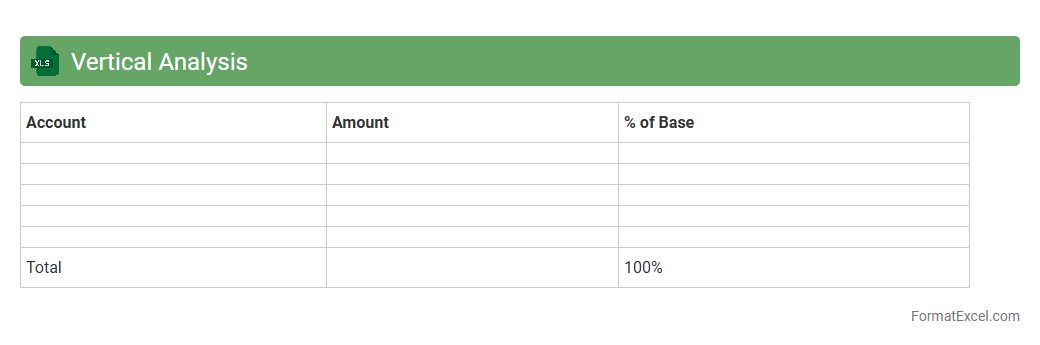

Vertical Analysis

Vertical Analysis in an Excel document refers to a financial technique that expresses each item in a financial statement as a percentage of a base figure, such as total sales or total assets. This method allows for detailed comparisons across different periods or companies by standardizing financial data, making trends and anomalies easier to identify. Using Vertical Analysis

streamlines decision-making by providing clear insights into financial performance and cost structure, enhancing budgeting and forecasting accuracy.

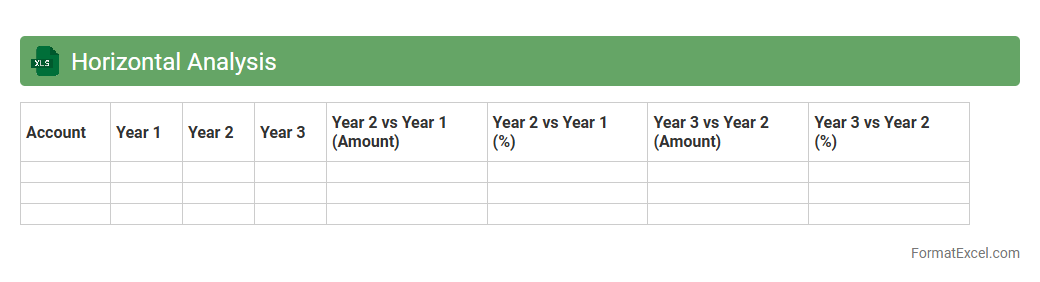

Horizontal Analysis

Horizontal Analysis in an Excel document involves comparing financial data across multiple periods to identify trends and growth patterns. This method highlights increases or decreases in specific accounts, enabling businesses to assess performance and make informed decisions. Utilizing Excel's built-in formulas and functions streamlines the process, making the analysis accurate and efficient for financial planning.

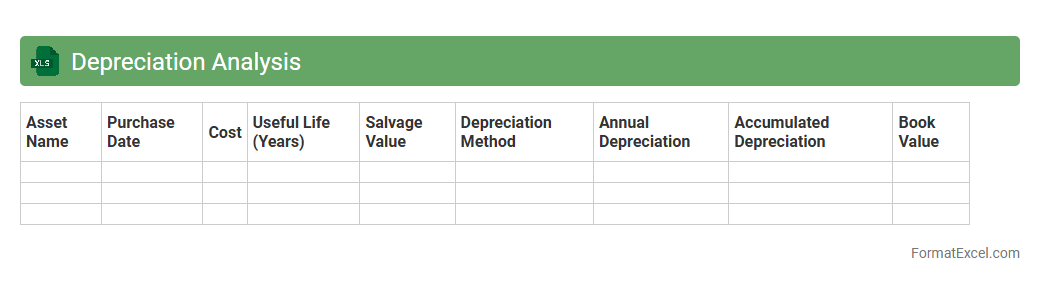

Depreciation Analysis

A

Depreciation Analysis Excel document is a financial tool that tracks the reduction in value of assets over time, utilizing formulas to calculate depreciation expenses accurately. This document helps businesses manage asset lifecycles, forecast expenses, and improve budgeting by providing clear visibility into asset value decline. By automating complex calculations, it enhances decision-making related to capital investments and tax planning.

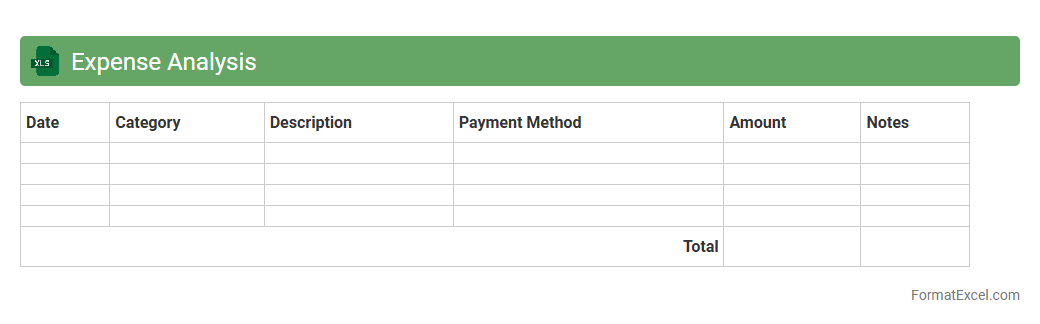

Expense Analysis

An

Expense Analysis Excel document is a tool designed to track, categorize, and visualize spending patterns over time. It helps users identify cost-saving opportunities by providing detailed insights into monthly and annual expenditures. By organizing financial data efficiently, it enables better budget management and informed decision-making for both personal and business finances.

Financial Statement Comparison

A

Financial Statement Comparison Excel document organizes and analyzes financial data from multiple periods or entities, enabling clear visualization of trends, variances, and performance metrics. This tool facilitates informed decision-making by highlighting key changes in income, expenses, assets, and liabilities, allowing businesses to identify growth opportunities and areas needing improvement. It enhances accuracy and efficiency in financial reporting, supporting strategic planning and stakeholder communication.

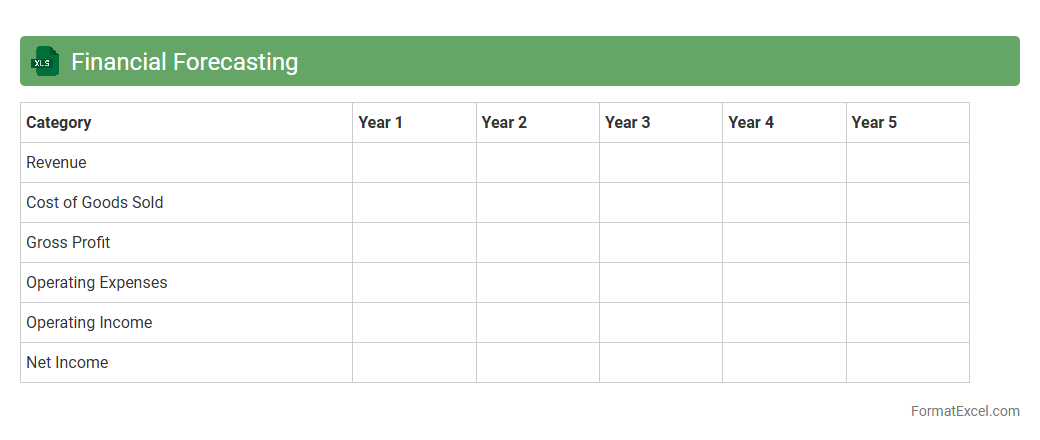

Financial Forecasting

A

Financial Forecasting Excel document is a spreadsheet tool that helps project future revenues, expenses, and cash flows based on historical data and assumptions. It enables businesses to create detailed financial models for budgeting, planning, and decision-making, enhancing accuracy and efficiency in financial management. This document is essential for anticipating financial performance, identifying potential risks, and strategizing for growth.

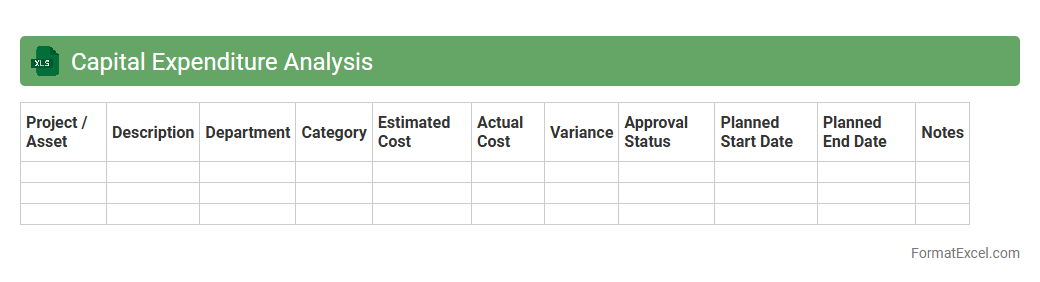

Capital Expenditure Analysis

Capital Expenditure Analysis in an Excel document involves evaluating the costs and benefits associated with long-term investments such as property, equipment, or infrastructure. This analysis helps organizations make informed decisions by projecting cash flows, calculating return on investment (ROI), and prioritizing projects based on financial viability. Using

Capital Expenditure Analysis in Excel enhances accuracy, simplifies complex calculations, and supports strategic planning for sustainable growth.

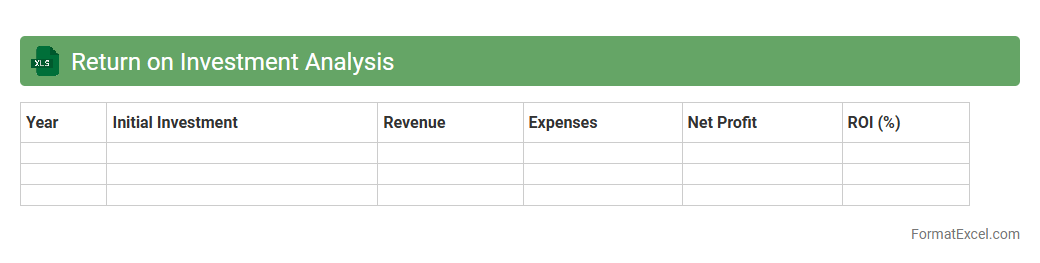

Return on Investment Analysis

Return on Investment (ROI) Analysis Excel document is a powerful tool designed to calculate and evaluate the profitability of an investment by comparing the net returns to the initial cost. It helps businesses and individuals make informed decisions by providing a clear visualization of financial gains and losses, enabling quick assessment of different investment options. Using this

ROI Analysis Excel document streamlines financial planning, enhances budget management, and supports strategic growth through data-driven insights.

Introduction to Financial Analysis in Excel

Financial analysis in Excel involves leveraging spreadsheet tools to evaluate a company's financial health and performance. Excel enables users to organize data, perform calculations, and generate meaningful insights through charts and reports. The financial analysis process is essential for informed decision-making and strategic planning.

Importance of a Structured Financial Analysis Format

A structured format ensures consistency, accuracy, and ease of interpretation in financial reports. It helps analysts systematically compare financial positions across different periods or companies. Maintaining a standardized financial analysis layout improves communication and data integrity.

Key Components of a Financial Analysis Spreadsheet

Critical elements include income statements, balance sheets, cash flow statements, and ratio calculations. These components collectively provide a comprehensive view of financial performance. Including dynamic data tables enables quick updates and scenario analysis.

Setting Up Financial Statement Templates

Templates streamline data entry and maintain uniformity across reports, reducing errors and manual effort. Properly formatted templates should align with accounting standards and corporate reporting requirements. Using pre-designed Excel templates accelerates the analysis process effectively.

Common Excel Functions for Financial Analysis

Functions like SUM, VLOOKUP, IF, and PMT are integral for aggregating data, performing lookups, conditional checks, and loan calculations. Mastery of these formulas enhances analytical precision and efficiency. The Excel functions toolkit enables complex financial computations with ease.

Steps to Build a Financial Analysis Model in Excel

Begin by importing financial data, then create linked statements and calculate key metrics. Model validation and scenario testing are critical to ensure reliability. A well-constructed financial model provides actionable insights and forecasting capabilities.

Standard Financial Ratios and Their Calculations

Common ratios include profitability, liquidity, efficiency, and leverage metrics that gauge organizational health. Each ratio offers unique insight into performance aspects like solvency and asset utilization. Understanding financial ratios is crucial for stakeholder analysis and benchmarking.

Best Practices for Data Visualization in Excel

Utilize charts, sparklines, and conditional formatting to highlight trends and anomalies clearly. Clean design and appropriate chart types enhance report readability and viewer engagement. Effective data visualization aids in quicker interpretation of complex financial data.

Tips for Automating Financial Reports in Excel

Leverage macros, pivot tables, and Power Query to automate repetitive tasks and data refreshes. Automation increases productivity and minimizes human error in report generation. Implementing Excel automation techniques optimizes reporting workflows significantly.

Sample Financial Analysis Format Template

A sample template includes sections for input data, financial statements, ratio analysis, and visual summaries. It serves as a practical starting point for customizing detailed financial analysis workbooks. Using a well-structured financial analysis template ensures comprehensive and coherent reporting.