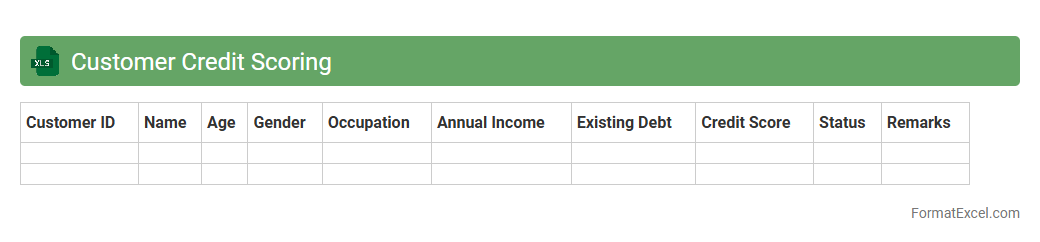

Customer Credit Scoring

Customer Credit Scoring Excel document is a tool designed to evaluate and quantify the creditworthiness of customers using financial data and scoring models. It streamlines decision-making by providing a clear, data-driven assessment of risk, helping businesses minimize defaults and optimize credit approvals. The

credit scoring model embedded in the Excel sheet allows for efficient risk management and improved financial forecasting.

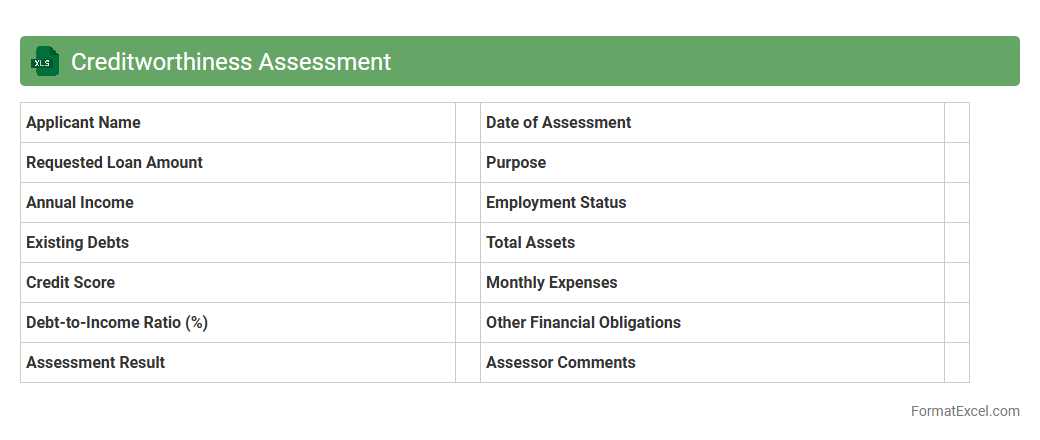

Creditworthiness Assessment

A

Creditworthiness Assessment Excel document is a structured tool that systematically evaluates an individual's or business's financial stability by analyzing key data such as income, debts, credit history, and repayment capacity. It helps lenders and financial institutions quickly interpret credit risk and make informed decisions regarding loan approvals or credit limits. Utilizing this document enhances accuracy, efficiency, and consistency in credit evaluation processes, reducing the likelihood of defaults.

Credit Limit Evaluation

The

Credit Limit Evaluation Excel document is a tool designed to assess the maximum credit amount that can be safely extended to customers based on their financial history and payment behavior. It helps businesses reduce financial risk by analyzing key metrics such as payment terms, outstanding balances, and credit scores. This enables informed decision-making, ensures timely credit approvals, and supports effective cash flow management.

Financial Statement Analysis

A

Financial Statement Analysis Excel document organizes and evaluates key financial data such as balance sheets, income statements, and cash flow statements to assess a company's performance and financial health. This tool helps users identify trends, calculate financial ratios like liquidity, profitability, and solvency, and make informed decisions on investments or business strategies. It streamlines data management and visualization, making complex financial information easier to interpret and compare over time.

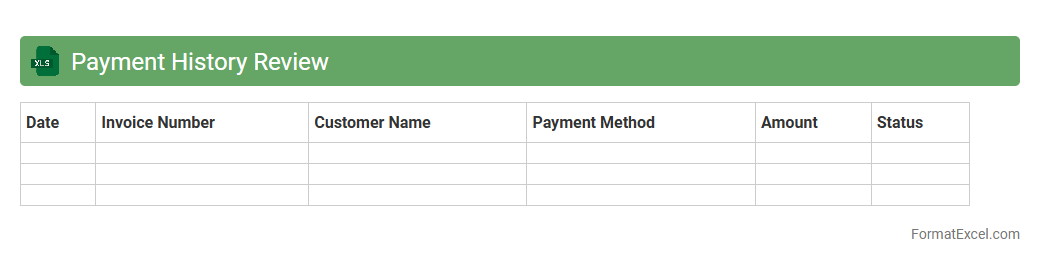

Payment History Review

A

Payment History Review Excel document tracks and organizes all past financial transactions, enabling users to analyze payment patterns, identify discrepancies, and ensure accurate record-keeping. It is useful for budgeting, forecasting cash flow, and maintaining transparent financial management. This document aids businesses and individuals in verifying payment statuses and improving overall financial accountability.

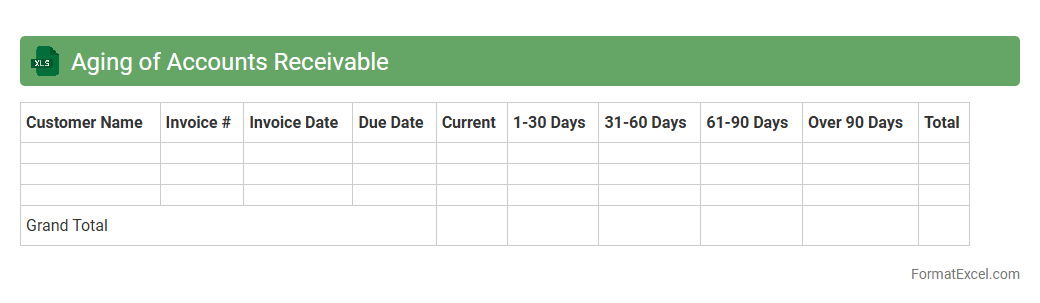

Aging of Accounts Receivable

An

Aging of Accounts Receivable Excel document categorizes outstanding invoices by their due dates, typically breaking them down into periods such as 0-30, 31-60, and 61+ days overdue. This tool helps businesses identify overdue payments, assess the credit risk associated with customers, and improve cash flow management by prioritizing collection efforts. Utilizing this document enhances financial control and ensures timely follow-up on delinquent accounts, reducing bad debt and improving overall liquidity.

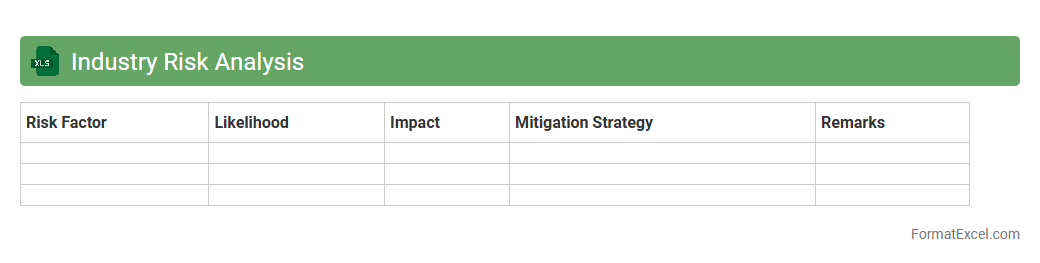

Industry Risk Analysis

An

Industry Risk Analysis Excel document systematically organizes and evaluates potential risks within a specific industry, enabling businesses to identify vulnerabilities and assess their impact. This tool facilitates data-driven decision-making by consolidating risk factors, probability assessments, and mitigation strategies in an accessible, customizable format. Using this document enhances strategic planning, helps manage uncertainties, and supports compliance with regulatory requirements.

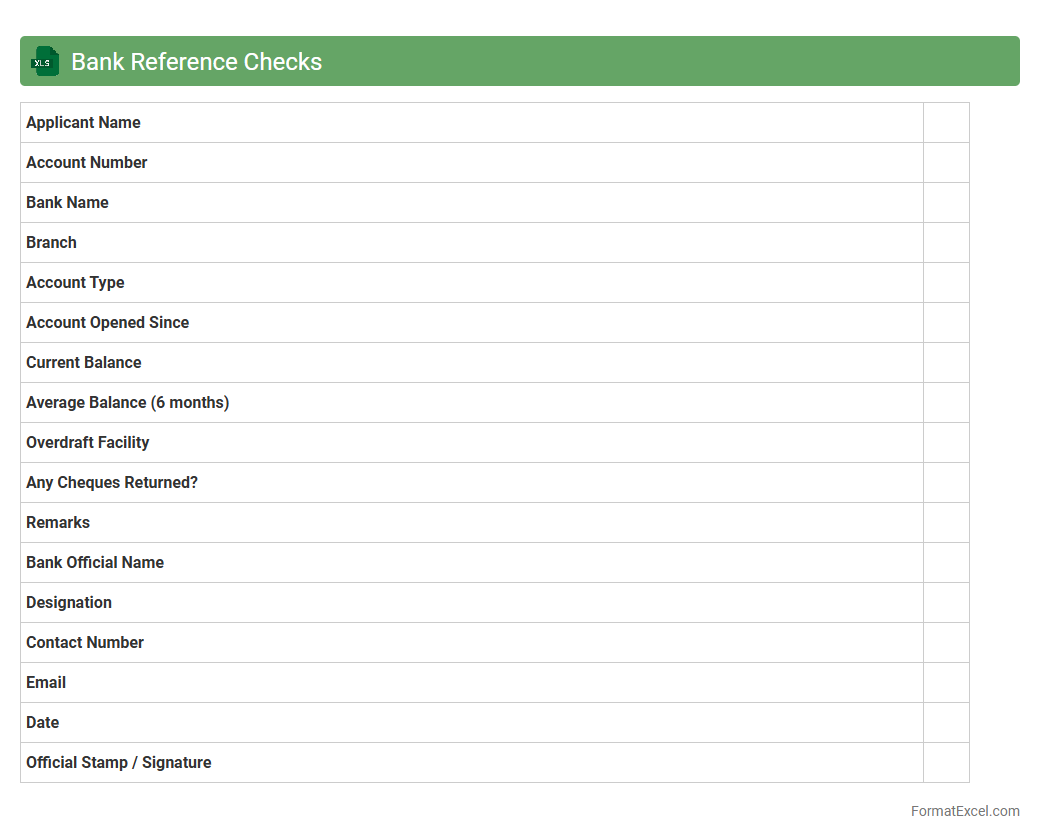

Bank Reference Checks

A

Bank Reference Checks Excel document is a structured template used to record and analyze the creditworthiness and financial history of clients or partners by compiling data from various bank references. This document facilitates quick access to verified banking information such as credit scores, loan history, and transaction records, enhancing risk assessment accuracy. Utilizing this tool streamlines decision-making processes in lending, procurement, and partnership evaluations by providing clear, organized, and reliable financial insights.

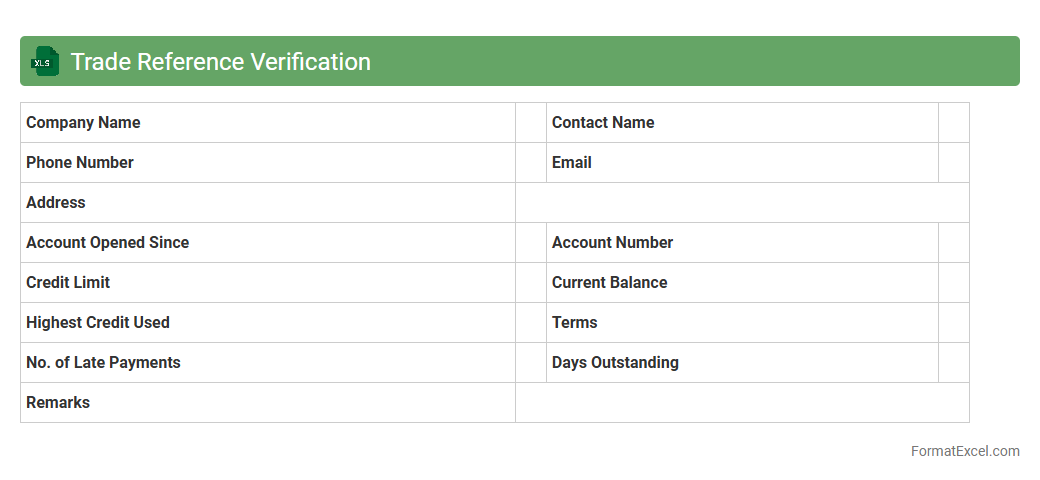

Trade Reference Verification

A

Trade Reference Verification Excel document is a structured tool used to systematically collect and organize verification data concerning business creditworthiness from trade partners. It enables efficient tracking of payment histories, credit limits, and reliability assessments, which are crucial for making informed credit decisions and minimizing financial risks. This document streamlines the verification process, enhancing accuracy and ensuring consistency in evaluating potential and existing clients.

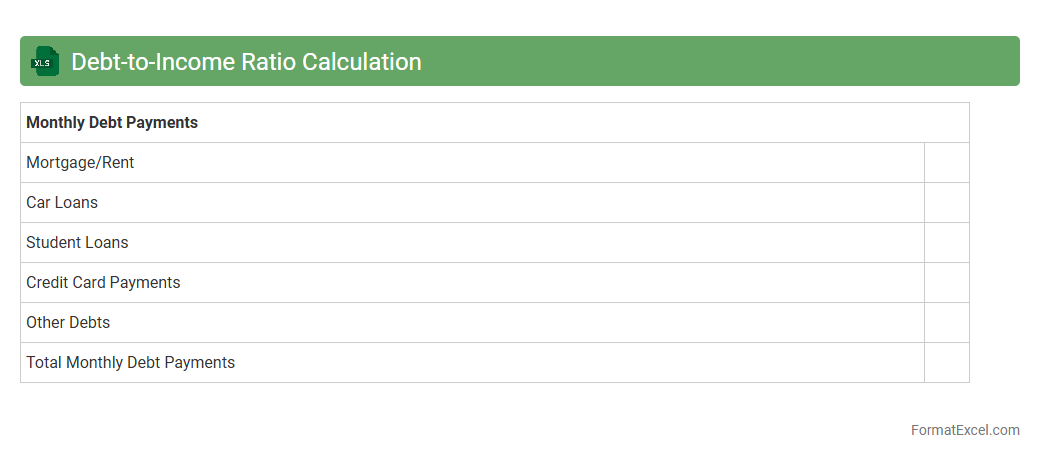

Debt-to-Income Ratio Calculation

A

Debt-to-Income Ratio Calculation Excel document helps individuals and financial professionals evaluate the proportion of monthly debt payments to monthly income, providing a clear picture of financial health. This tool simplifies complex calculations, allowing users to quickly assess their borrowing capacity and manage debt more effectively. Accurate ratio analysis supports informed decision-making for loan approvals, budgeting, and long-term financial planning.

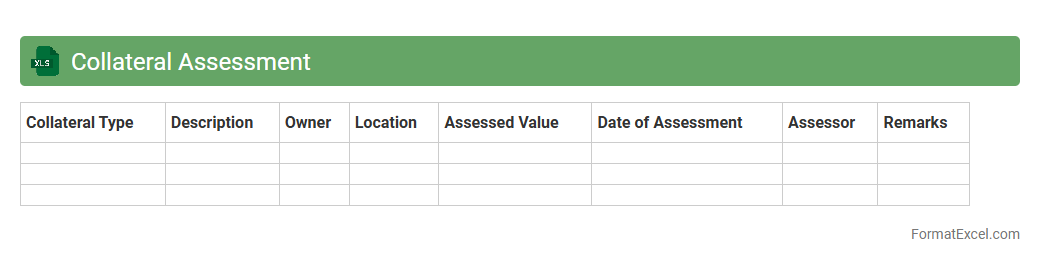

Collateral Assessment

A

Collateral Assessment Excel document systematically evaluates the value and condition of assets pledged as security for loans, enabling accurate risk analysis and informed lending decisions. It consolidates critical data such as asset descriptions, market values, depreciation, and legal status into a structured format for easy review and comparison. This tool enhances transparency, supports compliance with regulatory requirements, and streamlines the credit approval process by providing a clear overview of collateral quality.

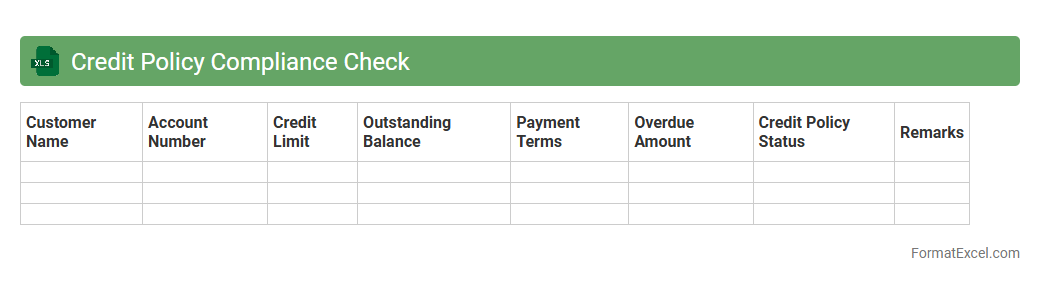

Credit Policy Compliance Check

The

Credit Policy Compliance Check Excel document is a structured tool designed to evaluate adherence to an organization's credit policies by systematically reviewing credit applications and accounts. It helps identify deviations from established credit standards, ensuring risk mitigation and promoting financial discipline. By providing clear checkpoints and documented evidence, this tool supports informed decision-making and enhances regulatory compliance.

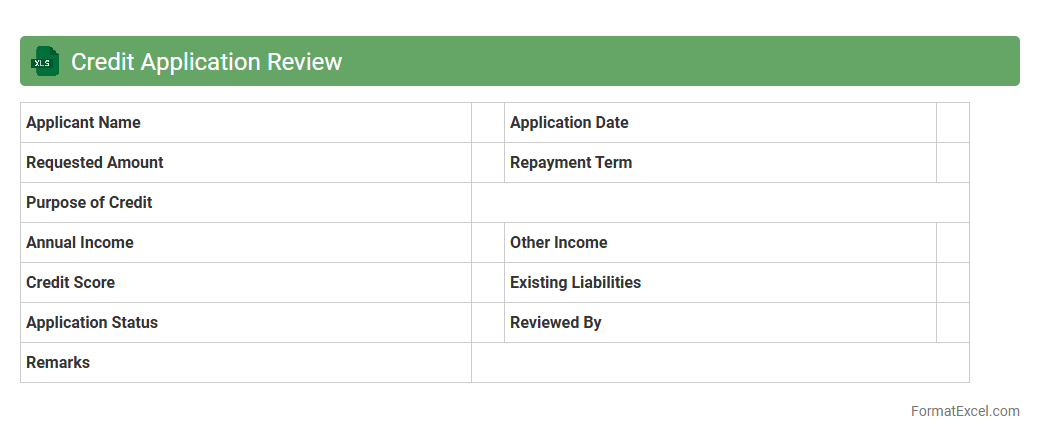

Credit Application Review

A

Credit Application Review Excel document is a structured spreadsheet used to systematically evaluate and document credit applications. It helps track applicant information, credit scores, financial history, and decision status, enabling efficient assessment of creditworthiness. Utilizing this document improves accuracy, streamlines the review process, and supports informed lending decisions.

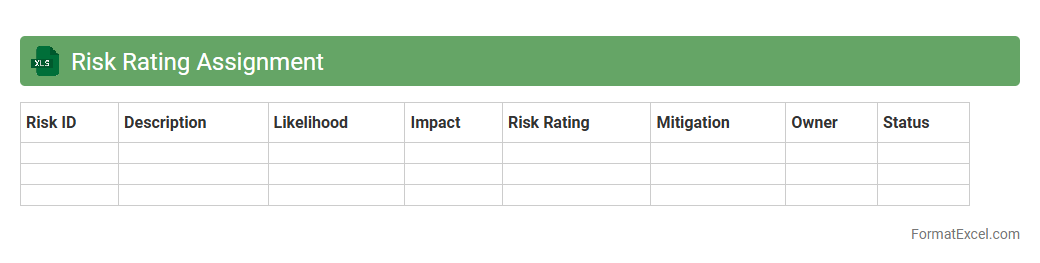

Risk Rating Assignment

The

Risk Rating Assignment Excel document serves as a systematic tool for evaluating and categorizing potential risks by assigning numerical or qualitative scores based on their likelihood and impact. This structured assessment enables organizations to prioritize risks effectively, facilitating informed decision-making and resource allocation for mitigation strategies. By providing a clear and organized overview, the document enhances risk management processes and promotes proactive responses to potential threats.

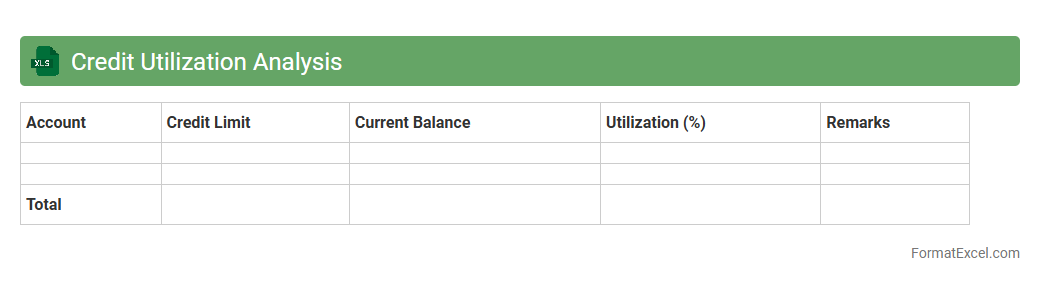

Credit Utilization Analysis

Credit Utilization Analysis Excel document is a powerful tool designed to monitor and evaluate

credit utilization ratios by comparing total credit used against available credit limits. It helps individuals and businesses assess their borrowing efficiency, optimize credit scores, and avoid potential financial risks caused by excessive debt. By providing clear visualizations and automated calculations, this document improves financial decision-making and enhances overall credit management strategies.

Cash Flow Analysis

A

Cash Flow Analysis Excel document is a financial tool that tracks incoming and outgoing cash transactions to provide a clear overview of an individual's or business's liquidity status. It helps identify cash surplus or deficits, enabling better budgeting, forecasting, and decision-making. Utilizing this analysis supports effective financial planning, ensuring sufficient funds for operational needs and strategic investments.

Credit Bureau Report Analysis

A

Credit Bureau Report Analysis Excel document systematically organizes and interprets credit report data from major credit bureaus, enabling users to identify credit patterns, discrepancies, and risk factors. This tool helps in evaluating creditworthiness by providing clear visual insights into payment history, outstanding debts, and credit inquiries. Utilizing this analysis enhances financial decision-making, supports risk management, and improves loan approval processes.

Concentration Risk Evaluation

The

Concentration Risk Evaluation Excel document is a specialized tool designed to identify and measure the extent of risk exposure due to over-reliance on a single client, sector, or geographic area. It allows organizations to quantitatively assess their vulnerability by aggregating data and visualizing concentrations that could impact financial stability. Using this document aids in making informed decisions to diversify risk and enhance portfolio resilience.

Credit Exposure Monitoring

A

Credit Exposure Monitoring Excel document is a tool designed to track and analyze the credit risk associated with various counterparties or clients by capturing data such as outstanding balances, credit limits, and payment history. It helps organizations identify potential overexposure, manage credit limits effectively, and make informed decisions to minimize financial risk. By providing real-time insights and structured data, this document enhances credit risk management and supports proactive financial control.

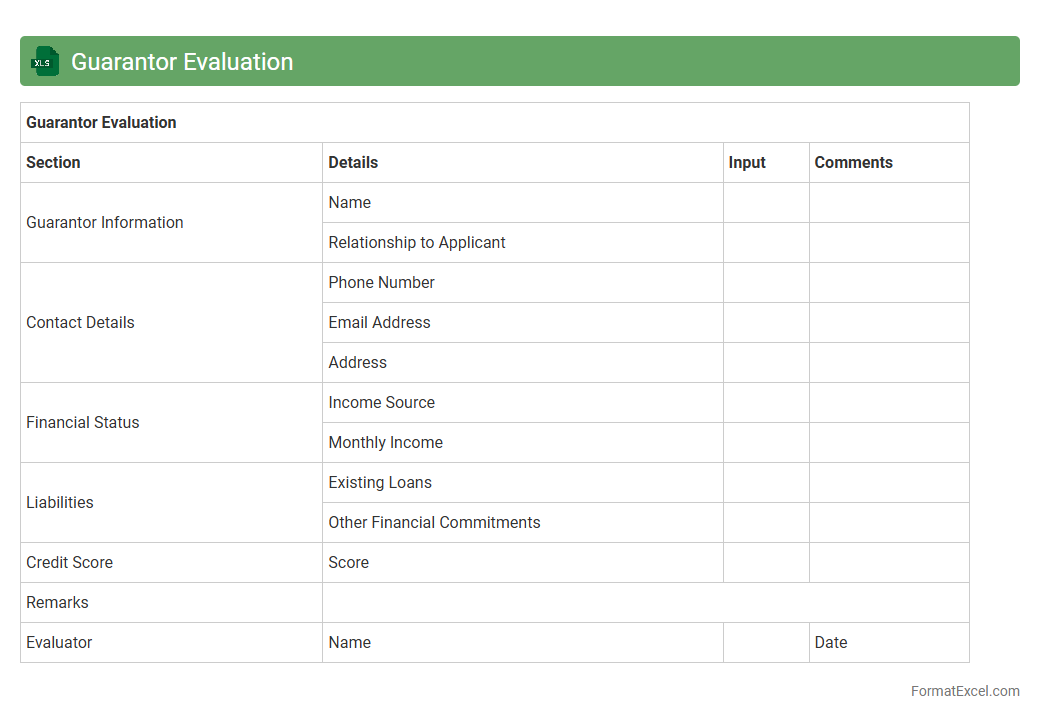

Guarantor Evaluation

The

Guarantor Evaluation Excel document serves as a comprehensive tool for assessing the creditworthiness and risk levels associated with guarantors in financial agreements. It organizes key financial indicators, payment histories, and risk scores to facilitate informed decision-making and streamline the approval process. This document enhances accuracy in risk assessment, improves loan recovery strategies, and supports compliance with regulatory standards.

Covenant Compliance Tracking

The

Covenant Compliance Tracking Excel document is a specialized tool designed to monitor and ensure adherence to contractual covenants in financial agreements. It systematically records key compliance metrics, deadlines, and covenant thresholds, enabling users to avoid potential breaches and penalties. This tool is essential for maintaining transparency, managing risk, and facilitating timely decision-making in loan management and corporate governance.

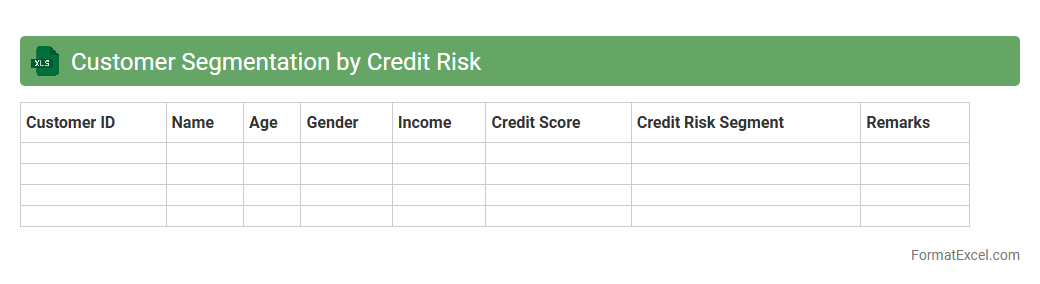

Customer Segmentation by Credit Risk

The

Customer Segmentation by Credit Risk Excel document categorizes customers based on their creditworthiness using financial metrics and credit history data. This allows businesses to tailor marketing strategies, improve risk management, and optimize loan approvals by identifying high-risk and low-risk segments. Utilizing this tool enhances decision-making accuracy and supports targeted financial planning for better resource allocation and reduced default rates.

Credit Approval Workflow Tracking

The

Credit Approval Workflow Tracking Excel document is a tool designed to monitor and manage the stages of credit application approvals efficiently. It provides a clear overview of each application's status, responsible personnel, and key deadlines, ensuring transparency and accountability throughout the approval process. By using this document, organizations can reduce processing time, minimize errors, and improve communication among credit teams.

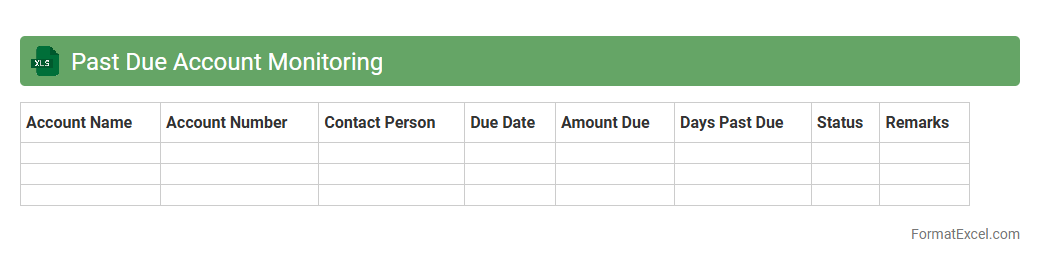

Past Due Account Monitoring

The

Past Due Account Monitoring Excel document is a powerful tool designed to track and manage overdue customer payments systematically. It helps businesses identify delinquent accounts quickly, assess outstanding balances, and prioritize collection efforts to improve cash flow. By providing clear visual insights and organized data, this document streamlines credit management and reduces financial risks.

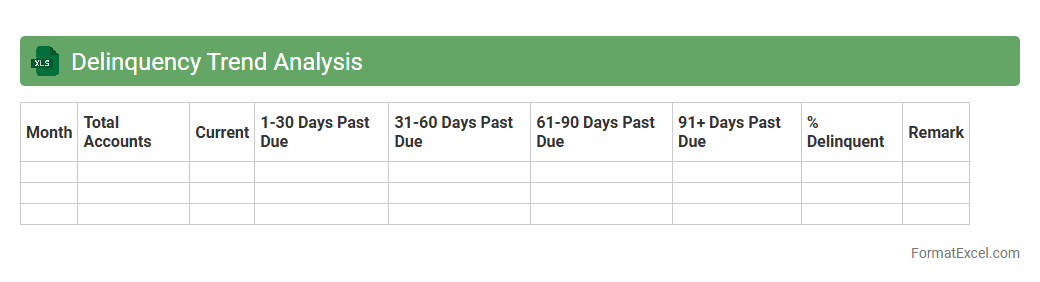

Delinquency Trend Analysis

Delinquency Trend Analysis Excel document is a powerful tool designed to track and evaluate patterns in late payments or defaults over time. By organizing data into clear charts and tables, it helps identify fluctuations in delinquency rates, enabling businesses to implement targeted credit risk management strategies. This comprehensive analysis supports better decision-making, improves cash flow forecasting, and minimizes financial losses.

Delinquency Trend Analysis enhances understanding of customer payment behaviors and aids in proactive risk mitigation.

Introduction to Credit Analysis in Excel

Credit analysis in Excel involves evaluating a borrower's creditworthiness using a structured spreadsheet model. It provides a systematic approach for organizing financial data and performing risk assessments. Mastering the credit analysis process in Excel helps streamline lending decisions efficiently.

Key Components of a Credit Analysis Format

A solid credit analysis format includes borrower information, financial statements, ratio analysis, and risk grading. Each component plays a crucial role in assessing the borrower's repayment capacity. Integrating these key components ensures a comprehensive credit evaluation.

Essential Data Inputs for Credit Evaluation

Gathering accurate financial data such as income statements, balance sheets, and cash flow data is essential. Additional inputs include credit history, payment records, and collateral details. These essential data inputs form the foundation for reliable credit analysis.

Structuring the Excel Credit Analysis Template

Organize the Excel template into clearly defined sections for inputs, calculations, and results presentation. Use separate sheets for raw data, analytical formulas, and summary reports to maintain clarity. A well-structured Excel template enhances usability and accuracy.

Financial Ratio Calculations and Interpretation

Calculate key financial ratios like debt-to-equity, current ratio, and interest coverage to gauge credit risk. Interpreting these ratios provides insights into liquidity, solvency, and profitability. Effective use of financial ratios supports informed credit decisions.

Incorporating Credit Scoring Models

Credit scoring models assign numerical scores to borrowers based on various risk factors. Integrating these models into Excel can improve objectivity and consistency in credit evaluation. Implementing a robust credit scoring mechanism refines risk assessment.

Visualizing Data with Charts and Graphs

Utilize Excel's charting tools to create visual representations of financial trends and risk metrics. Graphs help communicate complex credit data clearly to stakeholders. Effective data visualization aids quick understanding and decision-making.

Risk Assessment and Grading Criteria

Develop clear risk grading criteria based on financial health and repayment capacity. Assign risk levels such as low, medium, or high to classify borrowers accurately. Consistent risk assessment ensures objective evaluation and portfolio management.

Automating Credit Analysis with Excel Functions

Leverage Excel functions like IF statements, VLOOKUP, and conditional formatting to automate calculations and data checks. Automation reduces manual errors and speeds up the credit analysis process. Using Excel automation increases efficiency and reliability.

Best Practices for Maintaining Credit Analysis Spreadsheets

Regularly update data, validate formulas, and back up spreadsheets to maintain integrity. Implement version control and document changes for transparency and audit purposes. Adhering to best practices safeguards the accuracy and usability of credit analyses.