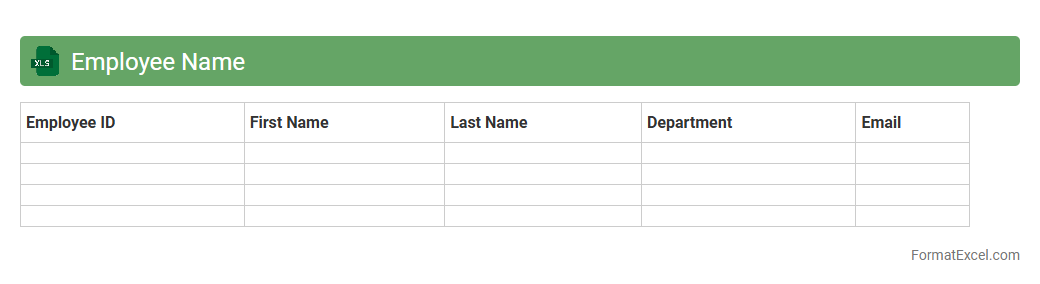

Employee Name

An

Employee Name Excel document is a structured spreadsheet that contains the names of employees within an organization, often alongside related data such as employee ID, department, and contact details. This document helps streamline HR processes, improve payroll accuracy, and facilitate efficient communication by providing a centralized record of personnel information. Using this Excel file enhances data management, enables quick access to employee details, and supports decision-making and reporting tasks for management.

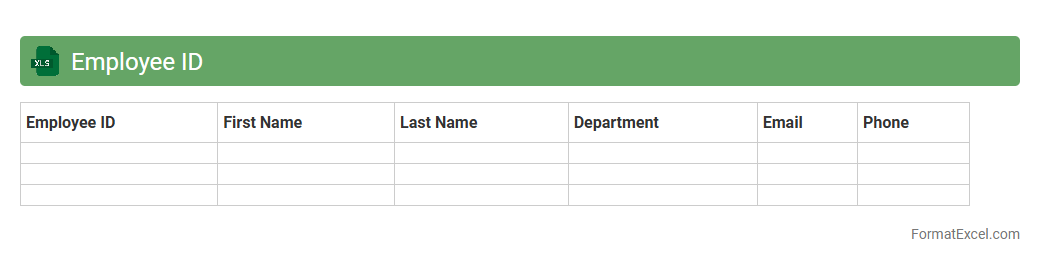

Employee ID

An

Employee ID Excel document is a spreadsheet that organizes unique identification numbers assigned to employees within an organization. This document streamlines workforce management by simplifying the tracking of employee data, payroll processing, and attendance monitoring. Utilizing such a file enhances accuracy in HR operations and facilitates quick access to essential employee information.

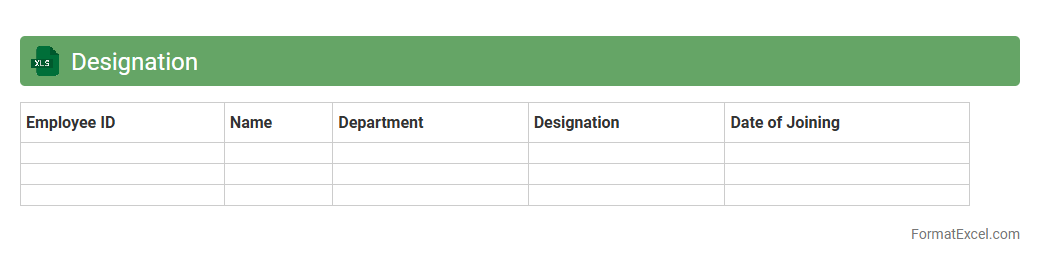

Designation

A

Designation Excel document is a structured spreadsheet used to organize, track, and manage employee job titles and roles within an organization. It enables efficient data handling for HR departments, streamlines reporting, and supports workforce planning by providing clear visibility of employee designations and hierarchical structures. This tool improves accuracy in personnel records and facilitates quick updates, ensuring consistent record-keeping and easy access to role-specific information.

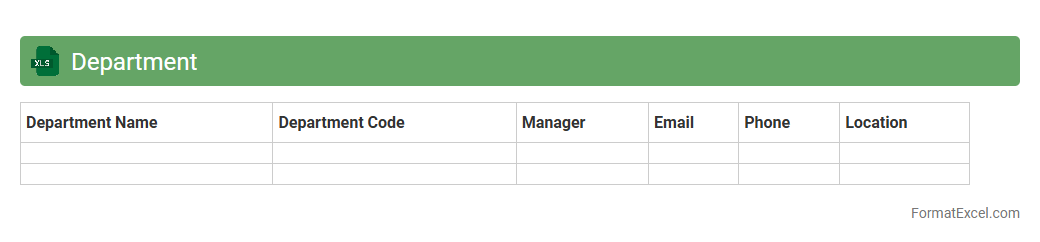

Department

A

Department Excel document is a structured spreadsheet designed to organize, track, and analyze data related to specific departments within an organization. It allows users to efficiently manage budgets, monitor performance metrics, and streamline departmental workflows by providing clear, accessible data visualization and reporting tools. This document enhances decision-making, improves collaboration, and ensures accurate record-keeping across various operational areas.

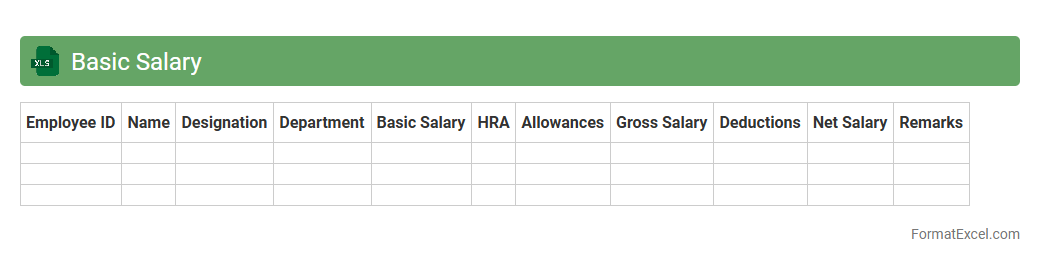

Basic Salary

A

Basic Salary Excel document is a structured spreadsheet that records and calculates employee base salaries, often including fields for employee names, job titles, and salary amounts. It is useful for organizations to efficiently manage payroll, track salary changes, and generate accurate financial reports. This document also helps ensure compliance with wage policies and simplifies the budgeting process for human resource and finance departments.

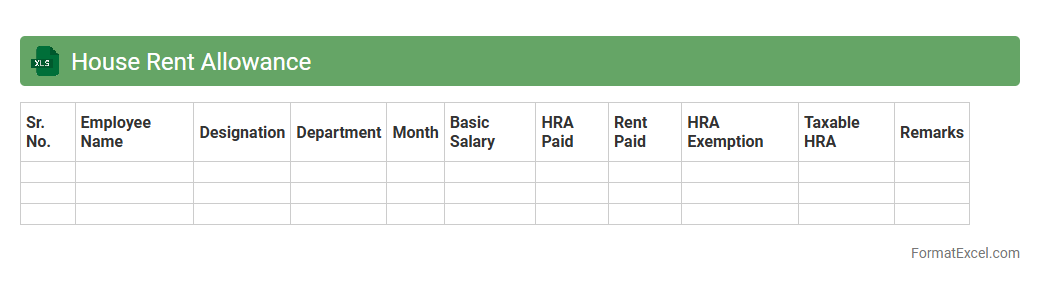

House Rent Allowance

A

House Rent Allowance (HRA) Excel document is a structured spreadsheet designed to calculate and manage HRA components in an employee's salary. It helps track rent payments, exemptions under tax laws, and ensures accurate salary processing by automating complex computations. This tool is essential for both employers and employees to streamline HRA management, optimize tax benefits, and maintain transparent financial records.

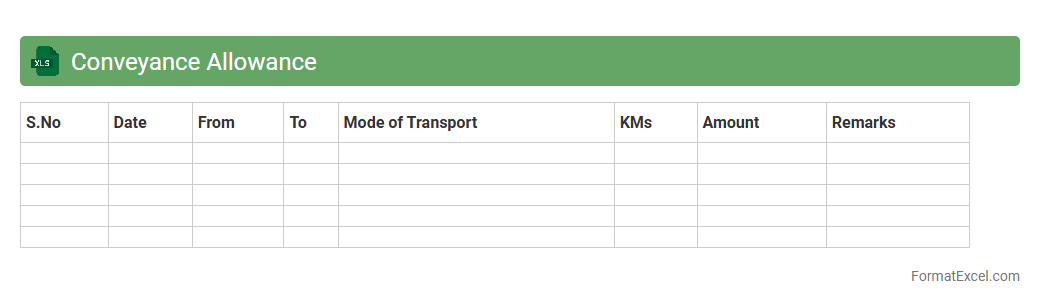

Conveyance Allowance

The

Conveyance Allowance Excel document is a structured spreadsheet designed to record and calculate transportation expenses reimbursed to employees for work-related travel. It streamlines the tracking of mileage, fuel costs, and travel dates, ensuring accurate and efficient management of conveyance allowances. Using this document enhances financial accountability and simplifies payroll processing by providing clear records of allowance claims.

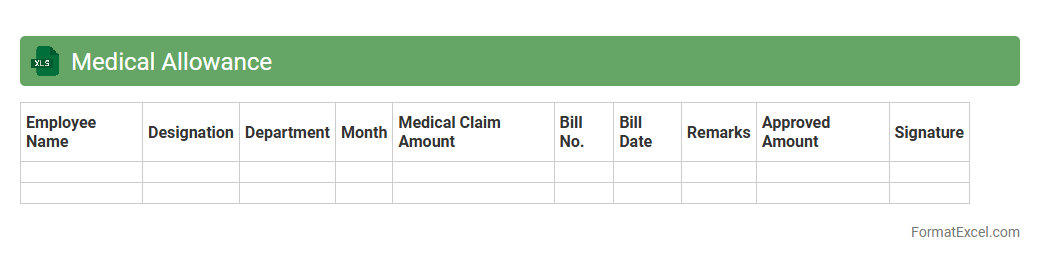

Medical Allowance

The

Medical Allowance Excel document is a structured spreadsheet designed to track and calculate medical reimbursements and allowances efficiently. It helps individuals and organizations organize medical expense records, ensuring accurate claims and budget management. This tool streamlines financial planning related to healthcare costs, promoting transparency and easy access to medical expense data.

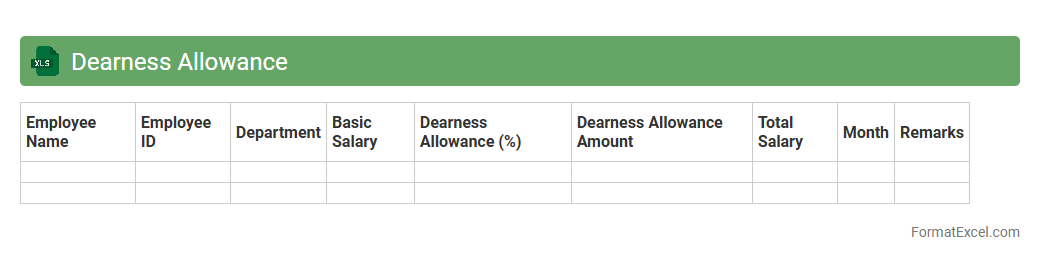

Dearness Allowance

The

Dearness Allowance Excel document is a spreadsheet tool designed to calculate and track the Dearness Allowance (DA) for employees based on prevailing government policies and inflation rates. It helps organizations and individuals accurately compute DA adjustments, ensuring compliance with statutory requirements and transparent salary management. This document streamlines payroll processing, reduces manual errors, and provides clear insights into salary components affected by inflation.

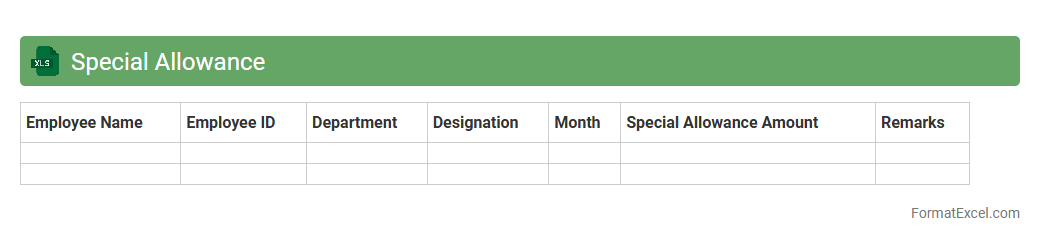

Special Allowance

The

Special Allowance Excel document is a structured spreadsheet designed to track, calculate, and manage various employee allowances beyond standard salary components. It helps organizations ensure accurate payroll processing by automating allowance computations, maintaining records, and generating reports for financial analysis. This tool is essential for optimizing employee compensation management and ensuring compliance with company policies and tax regulations.

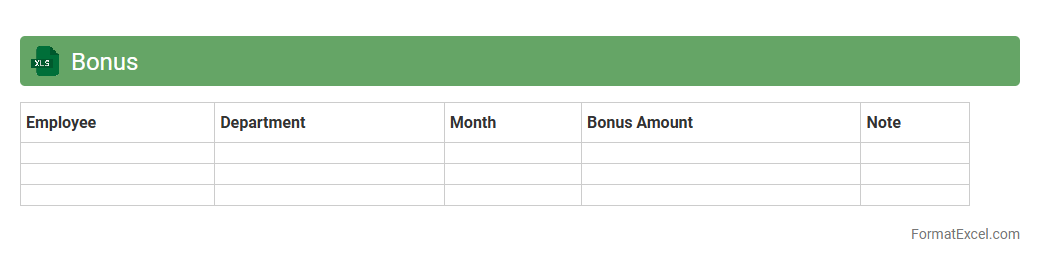

Bonus

A

Bonus Excel document is a spreadsheet designed to calculate, track, and manage employee bonuses efficiently. It automates complex bonus structures by using formulas and functions to ensure accuracy and transparency in reward distribution. This tool enhances payroll management by providing clear records and allowing data-driven decisions to motivate and retain staff.

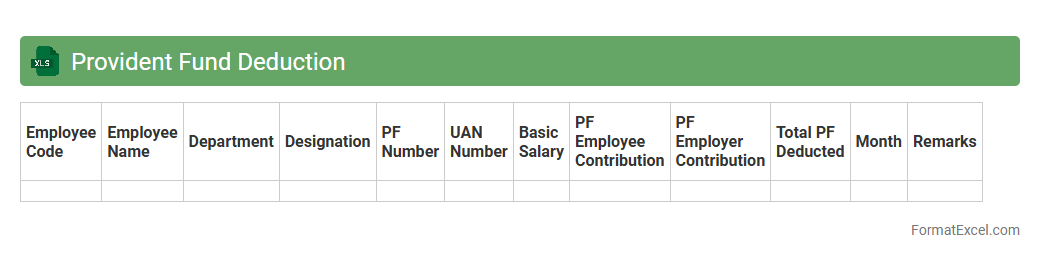

Provident Fund Deduction

A

Provident Fund Deduction Excel document is a spreadsheet used to calculate and track employee contributions towards the Provident Fund, a government-mandated retirement savings scheme. It automates the deduction process by applying predefined rates on employee salaries, ensuring accuracy and compliance with regulatory requirements. This tool is useful for employers and HR professionals to maintain organized records, generate reports, and simplify payroll processing related to retirement benefits.

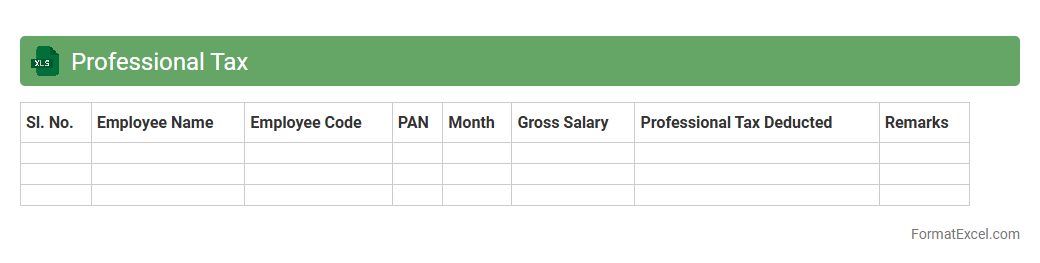

Professional Tax

A

Professional Tax Excel document is a structured spreadsheet designed to calculate and track professional tax deductions accurately for employees or individuals. It simplifies tax compliance by automating the computation based on state-specific rates, ensuring timely payments and reducing errors. This tool is especially useful for HR departments, accountants, and payroll professionals to streamline tax management and maintain organized records.

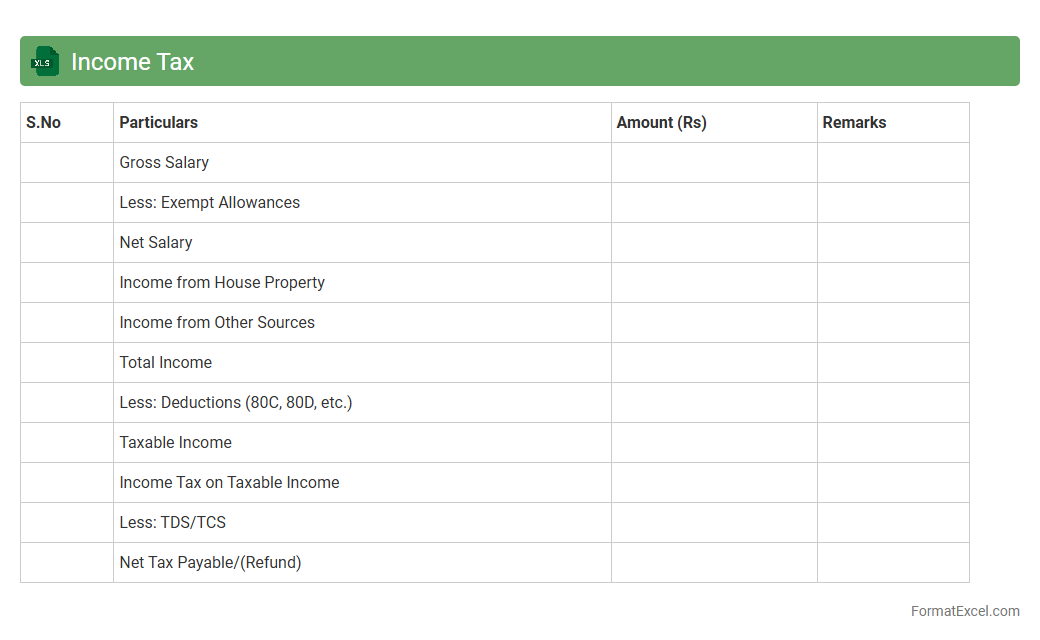

Income Tax

An

Income Tax Excel document is a spreadsheet designed to organize, calculate, and track income tax details efficiently. It helps users input various income sources, deductions, and exemptions to automatically compute tax liabilities based on current tax slabs and rules. This tool simplifies tax planning, ensures accurate tax calculations, and aids in timely filing and financial record-keeping.

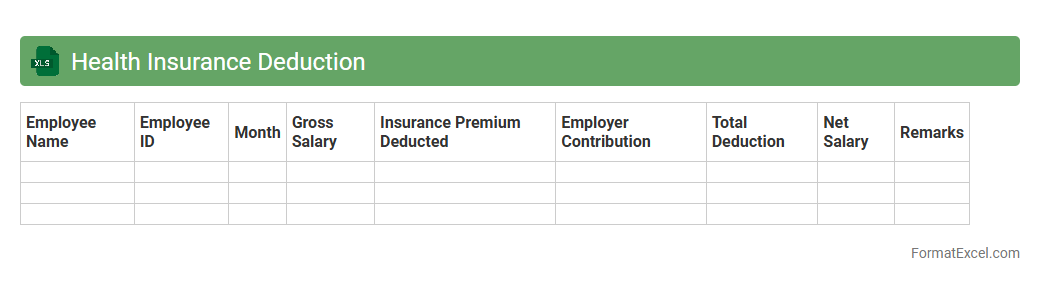

Health Insurance Deduction

A

Health Insurance Deduction Excel document is a spreadsheet designed to track and calculate health insurance premiums deducted from employees' salaries. It helps employers and employees maintain accurate records of deductions for tax purposes, benefits management, and payroll accuracy. Using this tool ensures compliance with financial regulations while simplifying month-to-month tracking of health insurance contributions.

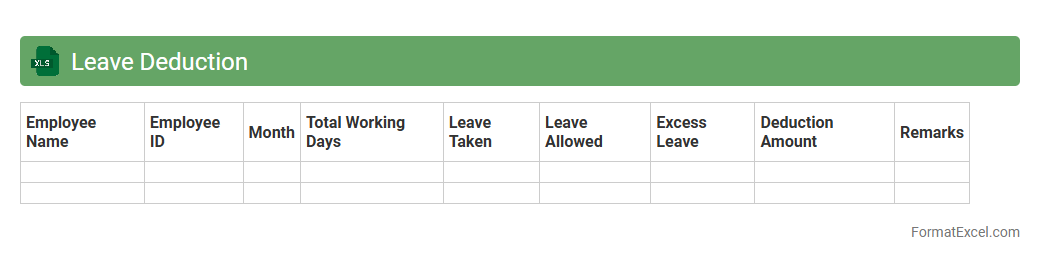

Leave Deduction

A

Leave Deduction Excel document is a spreadsheet tool designed to track and calculate employee leave balances and deductions accurately. It helps HR departments and payroll teams manage leave records systematically, ensuring precise salary adjustments based on leave taken. By automating leave deduction calculations, this document reduces errors, saves time, and improves overall workforce management efficiency.

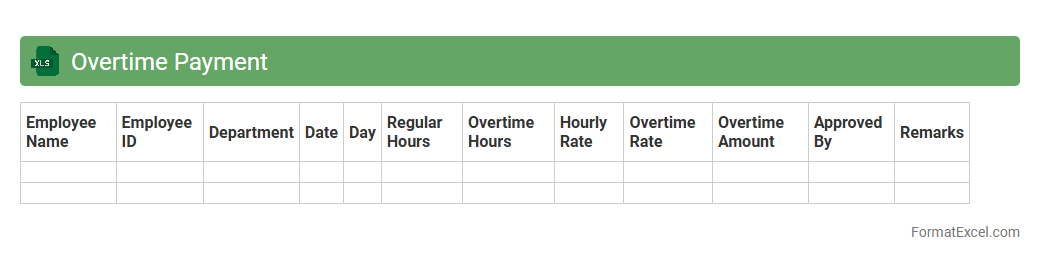

Overtime Payment

An

Overtime Payment Excel document is a spreadsheet designed to calculate and track extra hours worked beyond regular schedules. It helps businesses accurately compute additional wages, ensuring compliance with labor laws and reducing payroll errors. This tool enhances financial transparency and simplifies overtime management for employees and employers alike.

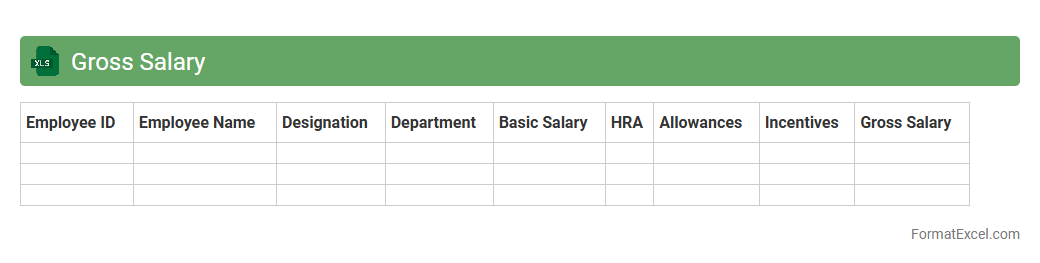

Gross Salary

A

Gross Salary Excel document is a detailed spreadsheet that calculates the total earnings of an employee before deductions such as taxes and social security. This tool helps businesses and individuals accurately track and manage payroll expenses, ensuring compliance with financial regulations. It also facilitates budgeting and financial planning by providing a clear breakdown of income components in one organized platform.

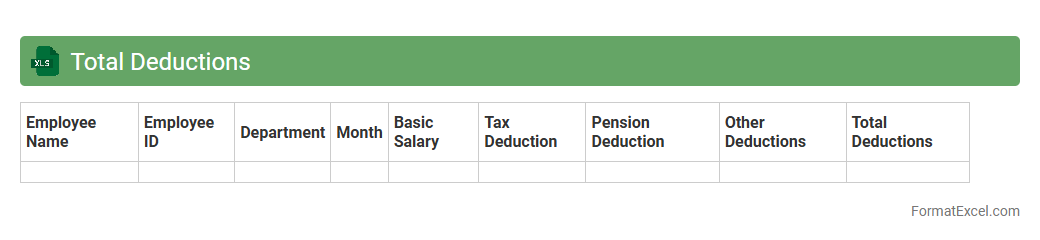

Total Deductions

A

Total Deductions Excel document is a spreadsheet designed to systematically record and calculate various deductions from an individual's or organization's income, such as taxes, insurance premiums, and retirement contributions. It is useful for ensuring accuracy in payroll processing, budgeting, and financial planning by providing a clear overview of all reduction amounts. This tool enhances transparency, helps in compliance with tax regulations, and simplifies the reconciliation of net pay or final amounts after deductions.

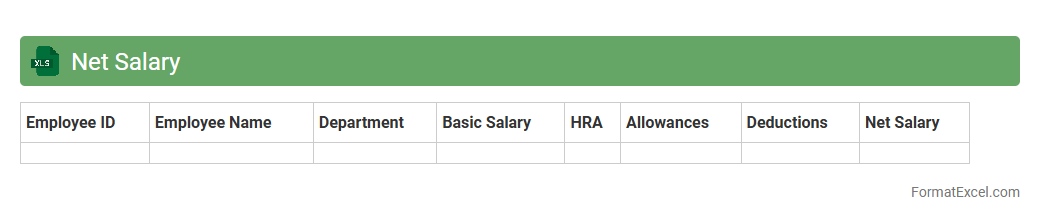

Net Salary

A

Net Salary Excel document calculates the employee's take-home pay after deductions such as taxes, social security, and other contributions. It provides a clear and organized way to track earnings and deductions, enabling accurate financial planning and payroll management. This tool is essential for both employers and employees to ensure transparency and accuracy in salary disbursement.

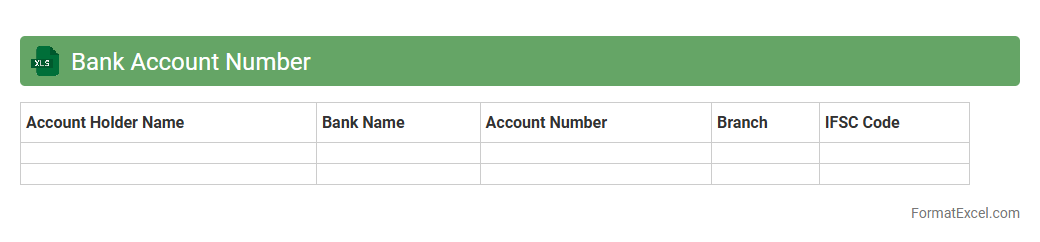

Bank Account Number

A

Bank Account Number Excel document is a spreadsheet file designed to organize and manage multiple bank account numbers efficiently. It allows users to store, sort, and track account details securely in one place, facilitating easy access and financial management. This document is essential for businesses and individuals who need to maintain accurate records of various bank accounts for budgeting, reconciliation, and audit purposes.

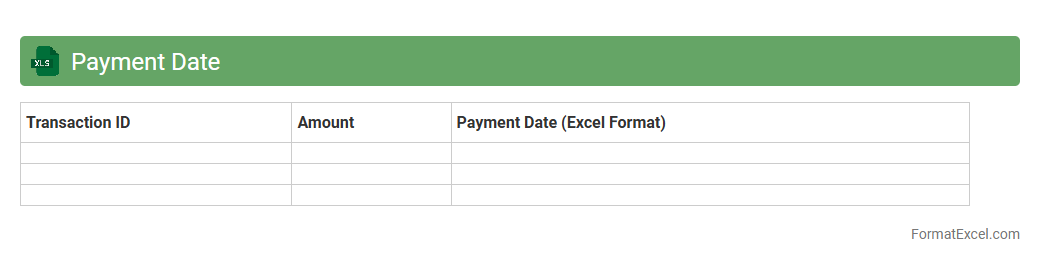

Payment Date

A

Payment Date Excel document is a spreadsheet designed to track and manage payment schedules, due dates, and transaction statuses efficiently. It helps businesses and individuals monitor cash flow, avoid late payments, and ensure timely financial obligations are met. By organizing payment information systematically, it enhances financial planning and reduces errors in payment processing.

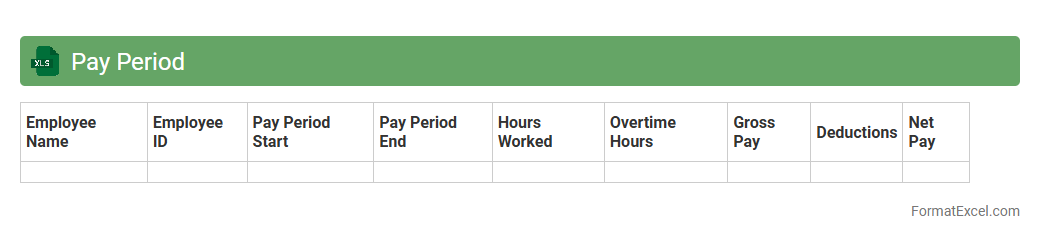

Pay Period

A

Pay Period Excel document is a structured spreadsheet that tracks employee work hours, salary calculations, and payment dates within specific pay intervals. This tool helps ensure accurate payroll processing, simplifies attendance monitoring, and supports compliance with labor laws. By centralizing payroll data, it enhances efficiency and reduces payroll errors for businesses.

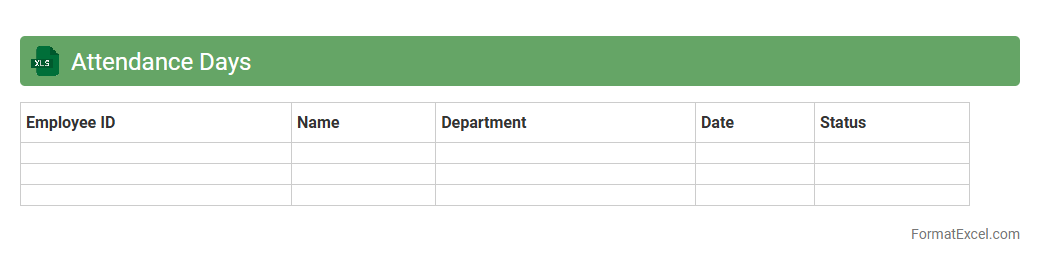

Attendance Days

An

Attendance Days Excel document is a structured spreadsheet used to record and track employee or student attendance over a specified period. It enables efficient monitoring of presence, absences, and leave days, facilitating accurate payroll calculation, performance evaluation, and compliance with organizational policies. This tool enhances time management and ensures transparency in attendance reporting for both individuals and management.

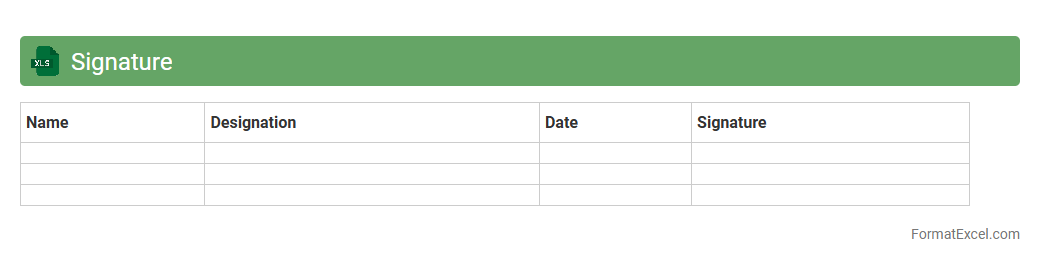

Signature

A

Signature Excel document is an Excel file integrated with digital signature capabilities, allowing users to authenticate and verify data integrity directly within the spreadsheet. This document enhances security by ensuring that the information remains unaltered and trusted, which is essential for contracts, financial reports, and compliance records. Utilizing a Signature Excel document streamlines workflow efficiency and maintains legal accountability in business processes.

Introduction to Employee Salary Slip in Excel

An Employee Salary Slip in Excel is a digital document summarizing an employee's earnings and deductions. It provides transparency and serves as proof of income. Excel offers customizable features for easy salary slip generation.

Importance of a Salary Slip for Employees

A salary slip is a vital document for employees, detailing accurate salary breakdowns. It helps track monthly earnings, taxes, and benefits, fostering trust and clarity. Employers also use it for compliance and record-keeping.

Key Components of a Salary Slip Format

Essential components include employee details, salary components such as basic pay, allowances, deductions, and net pay. A well-structured salary slip ensures clarity and employee understanding. Including tax and provident fund information is also crucial.

Designing an Excel Salary Slip Template

Creating an effective template requires clear layout, defined sections, and consistent formatting. Using Excel tables and cell borders improves readability. Incorporate company logos and input fields for dynamic data entry.

Step-by-Step Guide to Creating a Salary Slip in Excel

Start by entering employee details and salary heads, then apply formulas for calculations. Organize sections logically with proper headings and format cells for currency. Finally, protect the template to prevent accidental edits.

Essential Formulas for Salary Calculations in Excel

Key formulas include SUM for total earnings and deductions, and IF functions for conditional allowances. Calculating net salary requires subtracting total deductions from gross salary. Mastering these formulas ensures accurate slips.

Customizing Salary Slip Format for Different Organizations

Adjust the template to fit specific company policies, salary structures, and branding. Include unique components like bonuses or commissions tailored to the organization. Customization promotes a personalized and professional output.

Downloadable Employee Salary Slip Excel Templates

Various free and paid templates are available online to expedite salary slip preparation. These templates offer prebuilt formulas and standardized layouts. Choose based on organizational needs and ease of use.

Common Mistakes to Avoid in Salary Slip Preparation

Avoid incorrect data entry, missing components, and faulty formula usage. Ensure all deductions and allowances are transparently displayed to prevent disputes. Regularly review the salary slip for accuracy before distribution.

Frequently Asked Questions on Salary Slip in Excel

Common queries include how to automate data entry, include tax calculations, and secure the document. Excel offers tools like dropdown lists, formula auditing, and sheet protection. Understanding these features enhances efficiency in managing salary slips.