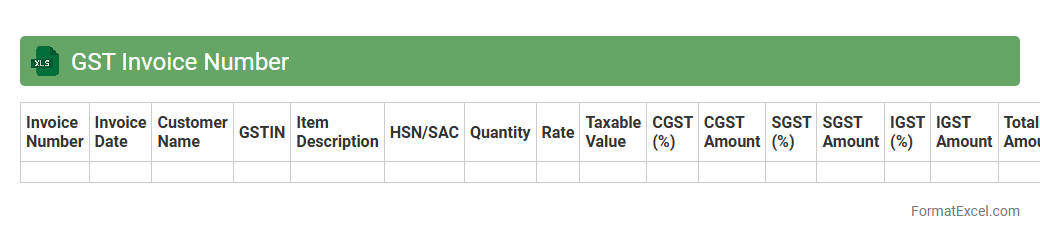

GST Invoice Number

A

GST Invoice Number Excel document is a spreadsheet used to systematically record and track Goods and Services Tax (GST) invoice numbers for businesses. It helps maintain accurate financial records, simplifies audit processes, and ensures compliance with tax regulations by organizing invoice data efficiently. This document is essential for managing GST returns and reconciling tax payments effectively.

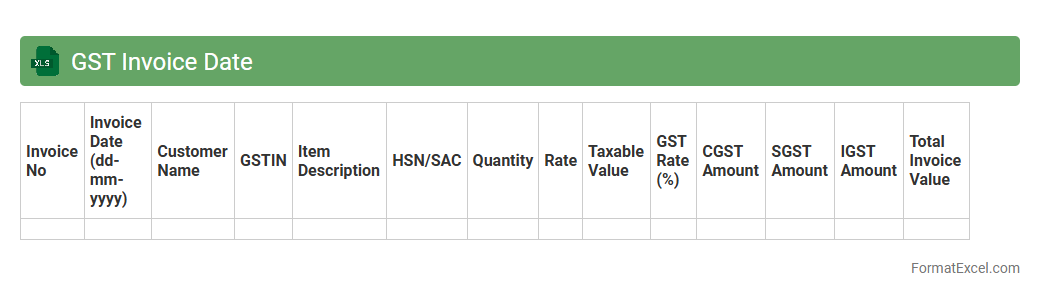

GST Invoice Date

A

GST Invoice Date Excel document is a spreadsheet that records the dates of goods and services tax invoices issued or received, facilitating accurate tracking and compliance with tax regulations. This document helps businesses monitor invoice timelines for filing GST returns, ensuring timely tax payments and avoiding penalties. It also aids in organizing financial data for audits and improving overall tax management efficiency.

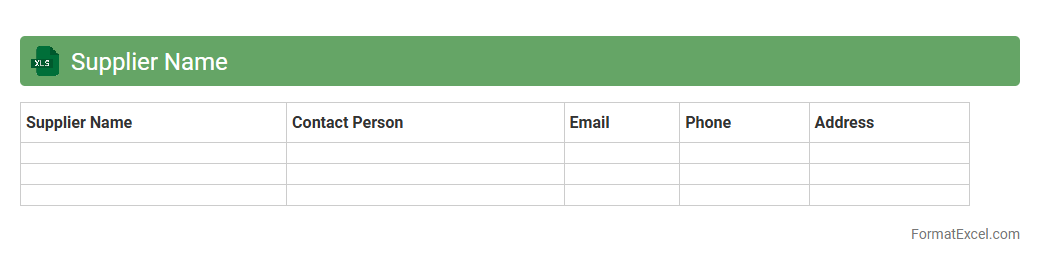

Supplier Name

The

Supplier Name Excel document is a structured spreadsheet that lists detailed information about suppliers, including company names, contact details, and product offerings. It serves as a centralized database to streamline procurement processes, vendor management, and communication with suppliers. Utilizing this document improves accuracy in tracking supplier relationships and enhances efficiency in sourcing and ordering activities.

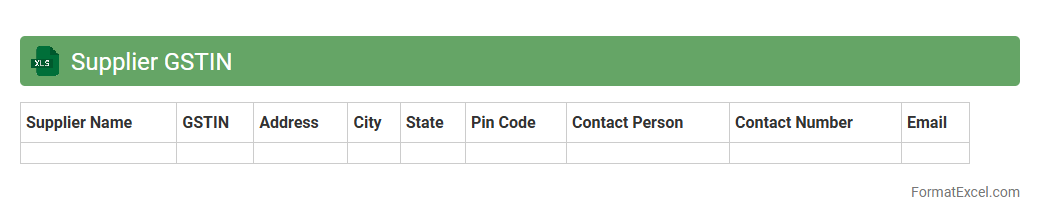

Supplier GSTIN

A

Supplier GSTIN Excel document is a structured spreadsheet containing the Goods and Services Tax Identification Numbers (GSTIN) of various suppliers, along with related data such as supplier names, addresses, and GST registration status. This document is essential for businesses to maintain accurate tax records, verify supplier compliance, and streamline the filing of GST returns. It helps in ensuring that input tax credits are claimed correctly and reduces errors during tax audits or reconciliations.

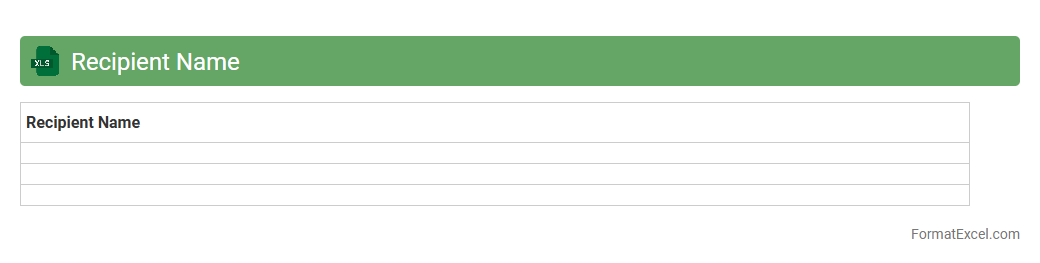

Recipient Name

The

Recipient Name Excel document is a structured spreadsheet used to organize and manage names of individuals or entities receiving communications, payments, or shipments. It enhances accuracy by reducing errors in data entry and streamlines the process of sending personalized correspondence or tracking transactions. This document is essential for businesses and organizations aiming to improve efficiency in handling large volumes of recipient information.

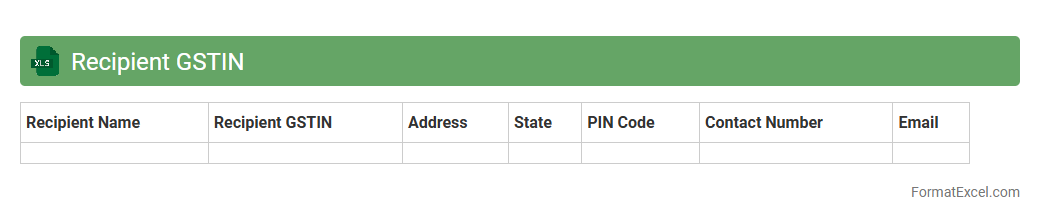

Recipient GSTIN

The

Recipient GSTIN Excel document contains a comprehensive list of Goods and Services Tax Identification Numbers (GSTIN) allotted to registered recipients, enabling businesses to verify the authenticity of their trade partners. This document streamlines compliance by facilitating the accurate matching of invoices with GST returns, reducing errors and the risk of fraud. It serves as a vital tool for maintaining transparency and ensuring adherence to GST regulations during transactions.

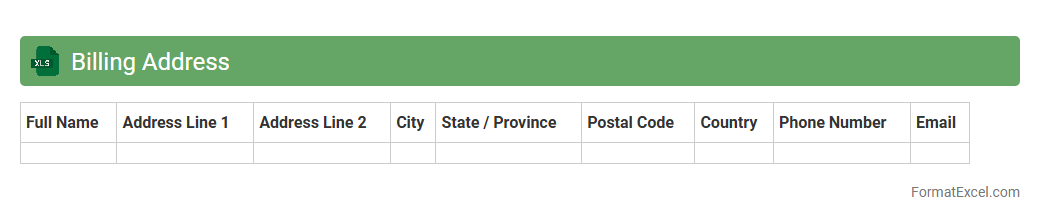

Billing Address

A

Billing Address Excel document is a structured spreadsheet used to store and organize detailed billing addresses for customers, clients, or vendors. It streamlines the invoicing process by ensuring accurate address information for billing and shipping purposes, reducing errors and delays in payment processing. This document enhances financial management and customer communication by providing a centralized, easily accessible record of essential billing details.

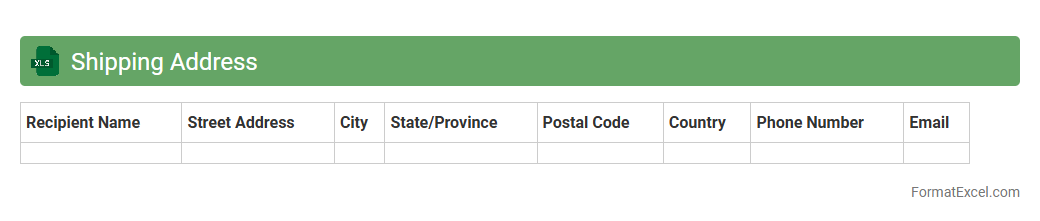

Shipping Address

A

Shipping Address Excel document is a structured spreadsheet that organizes recipient details such as names, street addresses, cities, states, postal codes, and contact numbers. This document streamlines the shipping process by ensuring accurate and efficient delivery, reducing errors and delays in logistics operations. It is especially useful for businesses managing bulk shipments, enabling easy data sorting, filtering, and integration with shipping software.

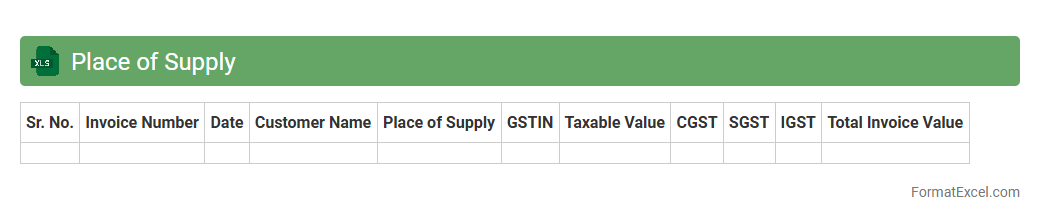

Place of Supply

The

Place of Supply Excel document is a comprehensive tool used to systematically determine the location where goods or services are supplied, crucial for accurate tax calculations under GST and VAT regimes. It helps businesses comply with regional tax laws by categorizing supplies based on destination, thus simplifying tax reporting and invoicing processes. This document enhances efficiency in managing multi-state transactions, reducing errors and ensuring adherence to jurisdiction-specific tax regulations.

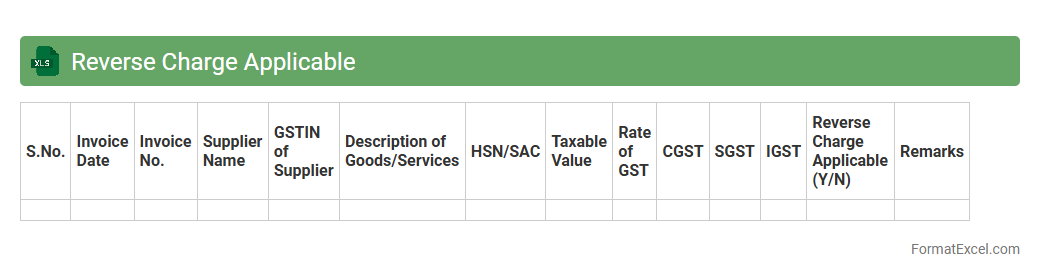

Reverse Charge Applicable

The

Reverse Charge Applicable Excel document is a specialized tool designed to track and manage transactions where the tax liability shifts from the supplier to the recipient under GST regulations. It helps businesses accurately calculate input tax credits and ensures compliance with tax authorities by organizing reverse charge details efficiently. This document streamlines accounting processes, reduces errors, and simplifies the preparation of tax returns related to reverse charge mechanisms.

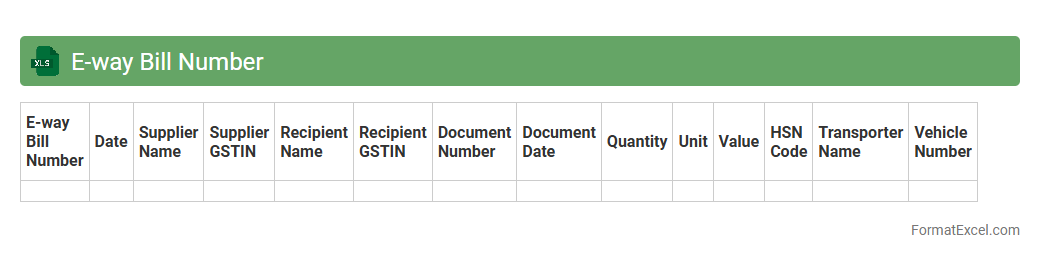

E-way Bill Number

The

E-way Bill Number Excel document is a digital file that compiles the unique identification numbers generated for every e-way bill during the movement of goods. It streamlines tracking and management of shipments, enabling businesses to efficiently verify transportation legality and compliance with GST regulations. This document aids in quick reference, data analysis, and ensures smooth audits by maintaining organized records of all e-way bill numbers.

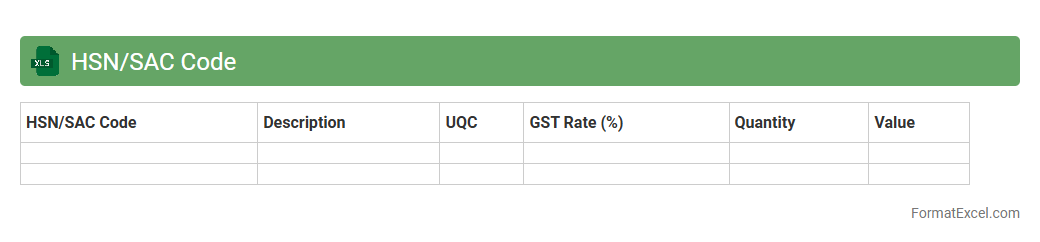

HSN/SAC Code

An

HSN/SAC Code Excel document is a structured spreadsheet containing Harmonized System of Nomenclature (HSN) and Service Accounting Codes (SAC), which classify goods and services for tax purposes under GST. This document is essential for businesses to accurately determine applicable GST rates, ensuring compliance and simplifying invoice generation. It aids in efficient tax filing, reduces errors in tax classification, and streamlines inventory management by categorizing products and services systematically.

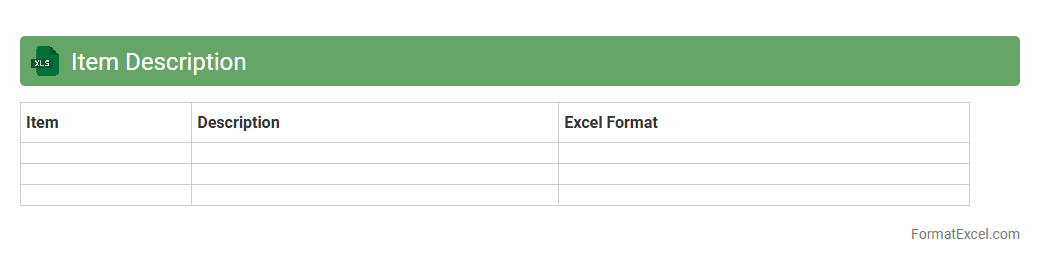

Item Description

An

Item Description Excel document is a structured spreadsheet containing detailed information about products or inventory items, including names, specifications, quantities, and prices. It helps businesses maintain accurate records, streamline inventory management, and facilitate efficient communication between suppliers, sales, and procurement teams. Using this document improves organization, reduces errors in order processing, and supports data-driven decision-making.

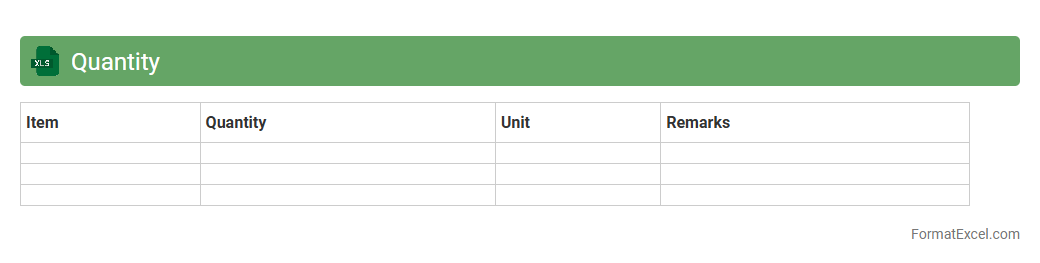

Quantity

A

Quantity Excel document is a spreadsheet used to organize, calculate, and analyze quantities of materials, resources, or items in projects and inventory management. It helps streamline cost estimation, budgeting, and procurement by providing clear, accurate data in a structured format. This tool improves efficiency by reducing errors and enabling quick updates to quantities as project needs evolve.

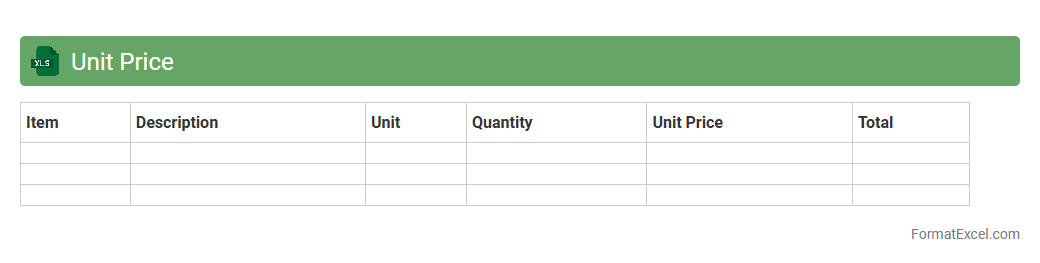

Unit Price

A

Unit Price Excel document is a spreadsheet that organizes and calculates the cost per unit of goods or services, enabling precise budgeting and cost control. It helps businesses and individuals analyze expenses by breaking down total prices into manageable, comparable units, improving decision-making in purchasing and inventory management. This tool streamlines financial planning and enhances transparency in cost assessments across various projects or sales activities.

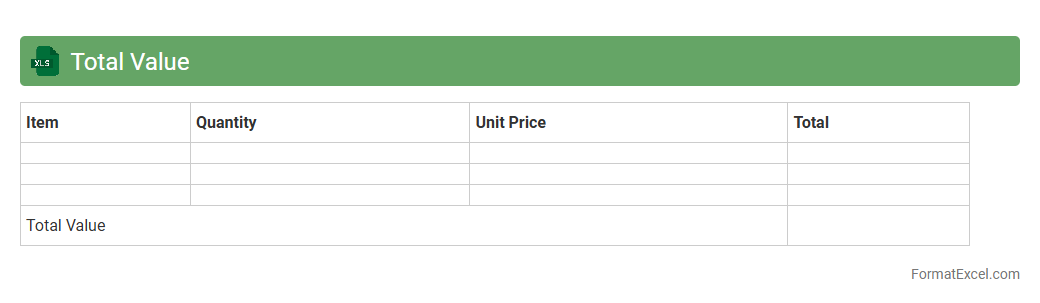

Total Value

The

Total Value Excel document is a comprehensive spreadsheet designed to calculate and consolidate the overall worth of assets, investments, or projects by aggregating individual values. It is useful for efficiently tracking financial performance, budgeting, and informed decision-making by providing clear insights into total monetary impact. This tool streamlines data analysis, allowing users to monitor changes in value dynamically and optimize resource allocation.

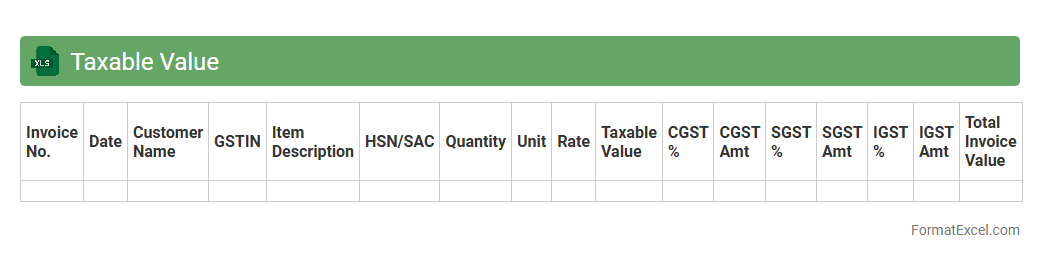

Taxable Value

A

Taxable Value Excel document is a detailed spreadsheet that calculates the portion of an asset or transaction subject to taxation based on applicable laws and rates. It streamlines tax assessments by organizing data such as purchase price, exemptions, deductions, and applicable tax rates, offering clear insights into the exact taxable amount. This tool enhances accuracy in financial reporting, ensures compliance with tax regulations, and aids in efficient tax planning and decision-making.

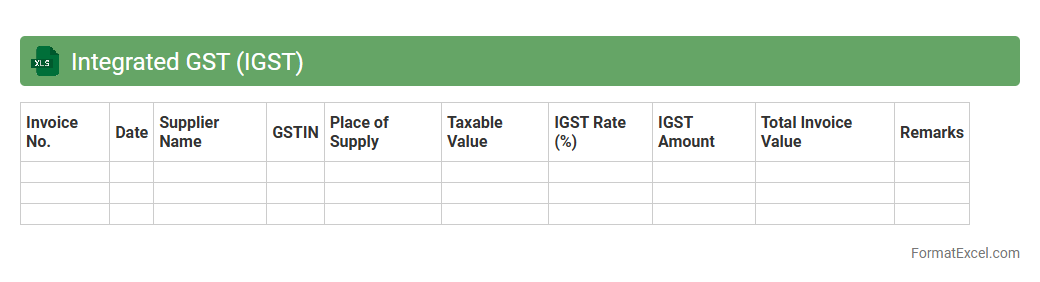

Integrated GST (IGST)

An

Integrated GST (IGST) Excel document is a structured spreadsheet designed to record and calculate inter-state GST transactions efficiently. It automates the computation of IGST liabilities, helping businesses maintain accurate tax compliance and streamline filing processes. This document enhances transparency and simplifies reconciliation of GST payments across different states.

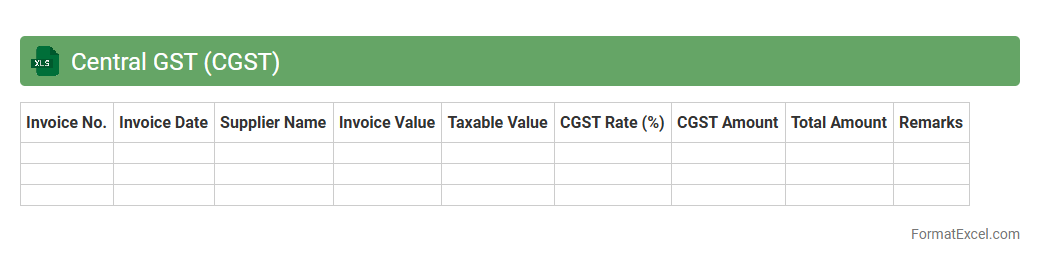

Central GST (CGST)

The

Central GST (CGST) excel document is a structured spreadsheet used for recording, calculating, and managing Central Goods and Services Tax transactions accurately. It helps businesses track CGST liabilities, claim input tax credits, and prepare GST returns efficiently, ensuring compliance with tax regulations. Utilizing this tool streamlines tax data organization, reduces errors, and simplifies audit processes.

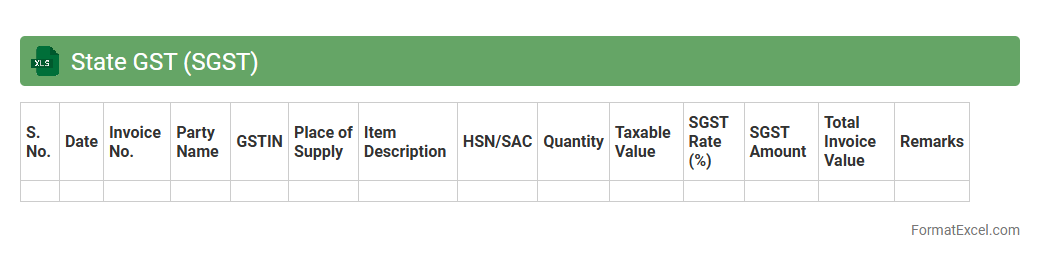

State GST (SGST)

The

State GST (SGST) excel document is a structured spreadsheet designed to record and manage state-level Goods and Services Tax transactions efficiently. It simplifies tax calculations, tracks input tax credits, and helps ensure compliance with state tax regulations. This document is invaluable for businesses to maintain accurate tax records, streamline filing processes, and avoid penalties.

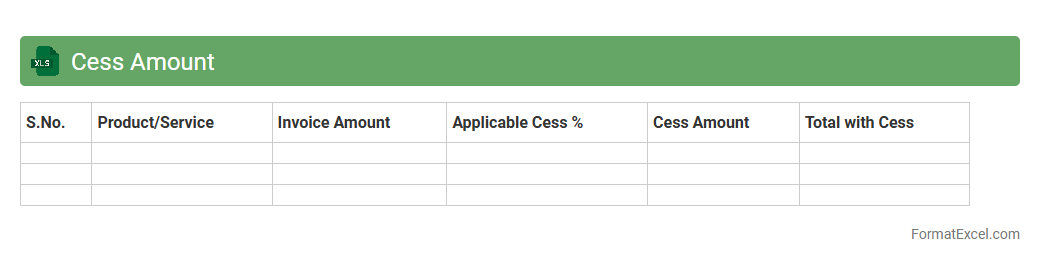

Cess Amount

A

Cess Amount Excel document is a structured spreadsheet used to calculate and track various cess charges imposed on goods or services, such as education cess or health cess, as per government regulations. It is useful for accurately managing tax liabilities, ensuring compliance, and streamlining financial reporting by consolidating cess computations in one place. This tool enhances efficiency in accounting processes and aids businesses in transparent tax management.

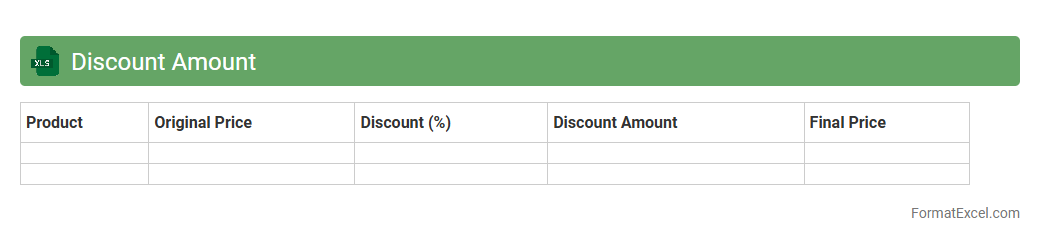

Discount Amount

A

Discount Amount Excel document is a spreadsheet designed to calculate and track discounts applied to products or services, helping businesses manage pricing strategies efficiently. It automates the process of determining discount values based on percentage or fixed amounts, reducing errors and saving time in financial analysis. This tool is essential for sales forecasting, budget planning, and ensuring accurate invoicing in various industries.

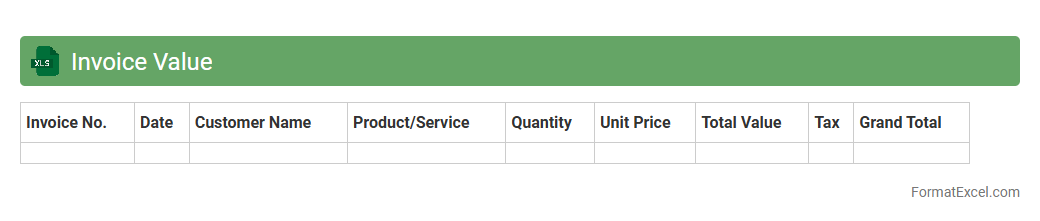

Invoice Value

An

Invoice Value Excel document is a spreadsheet used to calculate, track, and manage the total amount payable for goods or services listed on invoices. This tool helps businesses maintain accurate financial records, streamline payment processes, and analyze transaction values for budgeting and reporting purposes. Utilizing such a document improves efficiency in financial management and ensures clarity in invoice processing.

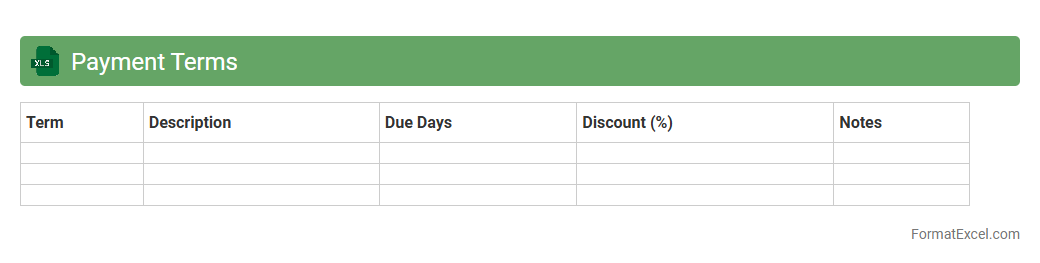

Payment Terms

A

Payment Terms Excel document is a structured spreadsheet that outlines the conditions under which payments are to be made between buyers and sellers, including due dates, discounts for early payment, and penalties for late payments. It streamlines financial planning and cash flow management by clearly defining timelines and expectations, reducing misunderstandings and disputes. Businesses use this document to ensure consistent payment processes and improve liquidity forecasting.

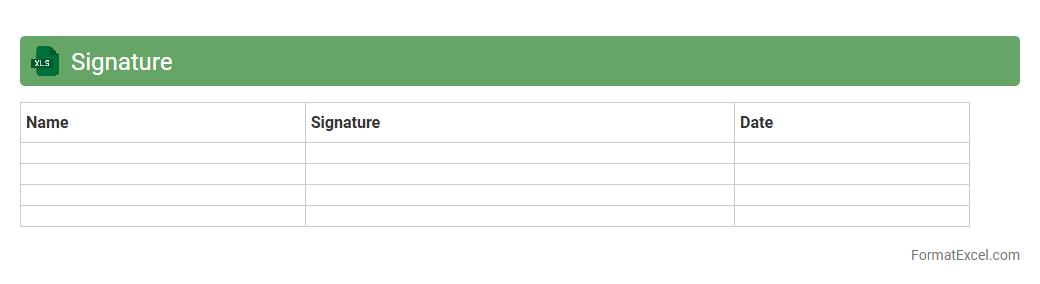

Signature

A

Signature Excel document is a digital file that integrates electronic signatures within an Excel spreadsheet, enabling secure and verifiable approval or authorization directly on data entries. This tool streamlines workflows by eliminating the need for printing, signing, and scanning, thus enhancing efficiency in business processes such as contracts, financial reports, and compliance tracking. It ensures data integrity and accountability, making it invaluable for teams and organizations aiming to maintain secure and audit-ready documentation.

Introduction to GST Invoice

A GST invoice is a crucial document for businesses registered under the Goods and Services Tax regime. It serves as proof of supply and is mandatory for tax compliance. Proper formatting ensures clarity and legal validity in transactions.

Importance of GST Invoice Compliance

Compliance with GST invoice rules helps businesses avoid penalties and facilitates smooth tax credit claims. Accurate invoices ensure transparency between suppliers and buyers. Maintaining compliant invoices is vital for audits and regulatory checks.

Key Components of a GST Invoice

Key elements include the seller's and buyer's details, GSTIN, invoice number, date, description of goods or services, HSN/SAC codes, taxable value, tax rates, and total amount. Each component must be clear and accurate for legal adherence. Missing or incorrect information can lead to rejection by tax authorities.

Benefits of Using Excel for GST Invoicing

Excel offers flexibility and easy customization for creating GST invoices. It allows for quick calculations using formulas and can be easily stored or printed. Using Excel templates reduces manual errors and speeds up the invoicing process.

Step-by-Step Guide to Creating a GST Invoice in Excel

Begin by setting up the invoice header with business details and GSTIN. Next, add fields for invoice number, date, and customer information. Finally, include itemized lists with quantities, prices, tax rates, and calculate totals using Excel formulas.

Essential Fields in a GST Invoice Format (Excel)

Essential fields include seller and buyer names, addresses, GSTINs, invoice number, date, item descriptions, HSN/SAC codes, quantity, rate, taxable value, CGST, SGST, IGST, and total amount. Proper inclusion of these fields ensures accuracy and legal compliance. An organized structure aids in faster processing and verification.

Sample GST Invoice Format in Excel

A typical GST invoice sample includes a professional layout with clearly labeled sections and calculated tax fields. It provides a reference for businesses to maintain standardization. An ideal sample demonstrates precise tax computations and detailed item descriptions with a clean design.

Common Mistakes to Avoid in GST Excel Invoices

Avoid errors such as incorrect GSTIN, missing invoice numbers, improper tax calculations, and absence of HSN/SAC codes. Checking formulas and validating customer details help prevent mistakes. Ensuring attention to detail is critical for a valid GST invoice.

Automation Tips for GST Invoicing in Excel

Utilize Excel features like macros and data validation to automate repetitive tasks. Use drop-down lists for item selection and built-in formulas for tax calculations. Automation enhances accuracy and saves time, making GST invoicing efficient.

Download Free GST Invoice Format Excel Template

Free Excel templates for GST invoices are available online, providing ready-to-use formats tailored to GST norms. These templates include formulas and pre-set fields to streamline invoicing. Downloading a free GST invoice template helps businesses quickly comply with tax regulations.