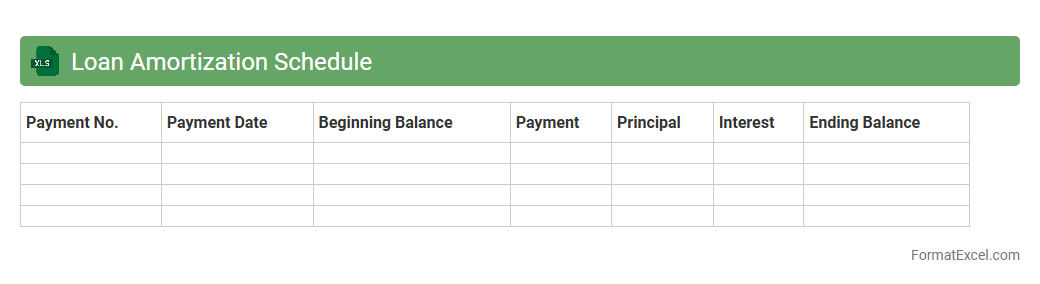

Loan Amortization Schedule

A

Loan Amortization Schedule Excel document is a spreadsheet tool that breaks down each loan payment into principal and interest components over the loan term. It helps users track payment timelines, outstanding balances, and interest costs, enabling more informed financial planning and budgeting. This schedule is essential for understanding loan payoff progress and comparing different loan scenarios effectively.

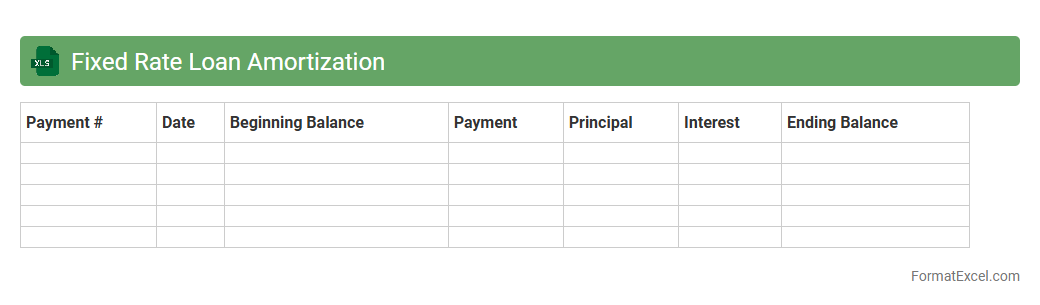

Fixed Rate Loan Amortization

A

Fixed Rate Loan Amortization Excel document is a spreadsheet tool designed to calculate and display the repayment schedule for a loan with a fixed interest rate over a set term. It details each payment's breakdown into principal and interest, helping users track loan balance reduction over time. This document is useful for budgeting, financial planning, and understanding the total cost of borrowing.

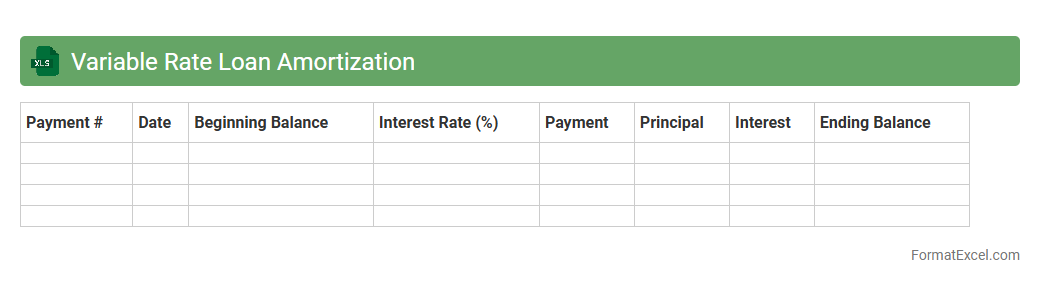

Variable Rate Loan Amortization

A

Variable Rate Loan Amortization Excel document calculates and tracks loan payments that fluctuate based on changing interest rates, providing a detailed payment schedule over the loan term. This tool helps borrowers and financial analysts accurately forecast monthly payments, interest costs, and outstanding balances in dynamic rate environments. It enhances financial planning by allowing users to model different interest rate scenarios and better manage cash flow.

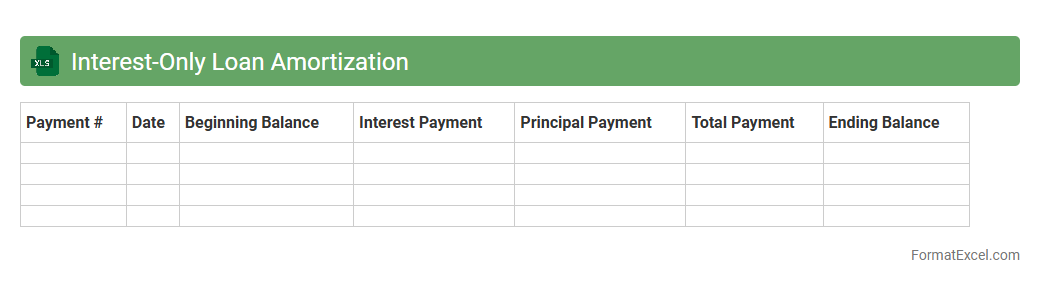

Interest-Only Loan Amortization

An

Interest-Only Loan Amortization Excel document is a financial tool designed to calculate and display the payment schedule for loans where only interest is paid for a certain period before principal repayment begins. It helps borrowers and lenders visualize monthly interest payments, outstanding loan balance, and future principal payments, improving budgeting and financial planning. This document is useful for managing cash flow during the interest-only period and understanding the impact on the overall loan cost.

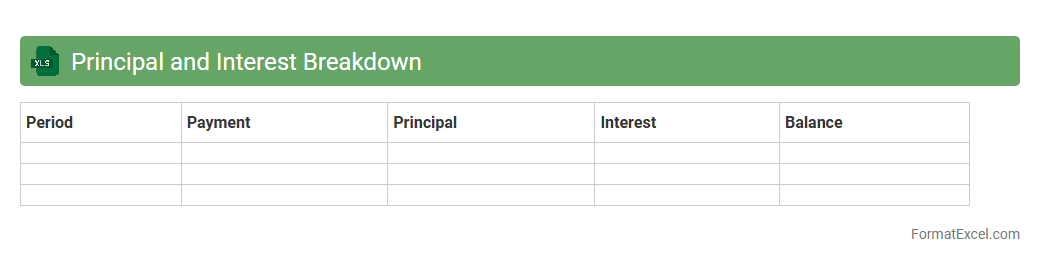

Principal and Interest Breakdown

A

Principal and Interest Breakdown Excel document is a financial tool that details loan repayments by separating the amounts paid towards the loan principal and the interest over time. This breakdown helps users track how much of each payment reduces the loan balance versus the cost of borrowing. It is useful for budgeting, financial planning, and understanding the impact of extra payments on shortening loan terms and reducing total interest paid.

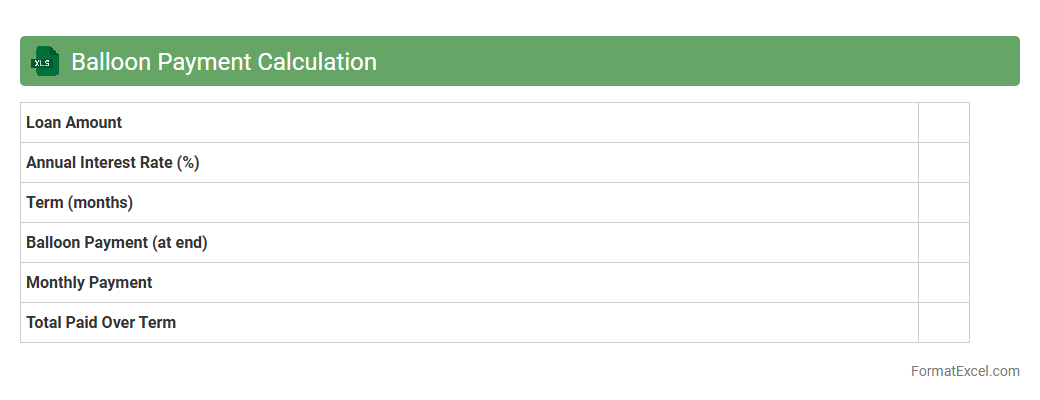

Balloon Payment Calculation

A

Balloon Payment Calculation Excel document is a financial tool designed to compute the final lump sum payment due at the end of a loan term, after making smaller periodic payments. It helps borrowers and lenders accurately estimate the outstanding balance, interest, and payment schedules for loans with balloon features. This document enhances financial planning by providing clarity on loan repayment structures and avoiding unexpected large payments.

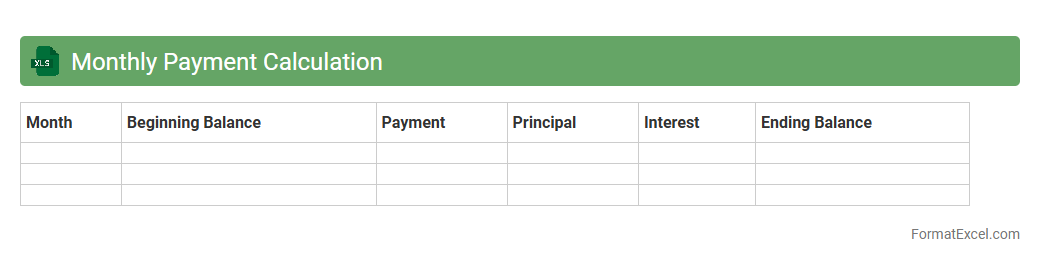

Monthly Payment Calculation

A

Monthly Payment Calculation Excel document is a tool designed to compute monthly loan repayments based on inputs like loan amount, interest rate, and loan term. This document helps users plan their finances by providing clear insights into payment schedules and interest costs, enabling informed budgeting and cash flow management. It is especially useful for tracking mortgage, auto, or personal loan payments efficiently.

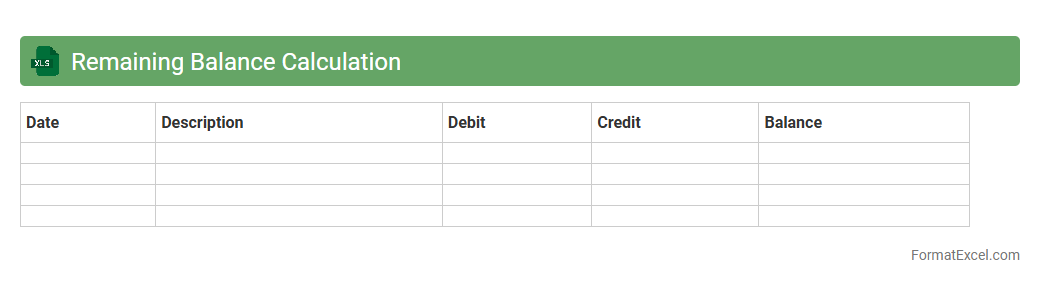

Remaining Balance Calculation

The

Remaining Balance Calculation Excel document is a financial tool designed to track outstanding loan or credit balances after each payment. It helps users accurately monitor their repayment progress by automatically updating the balance based on principal and interest payments. This document is useful for budgeting, ensuring timely payments, and understanding the exact amount owed at any point in time.

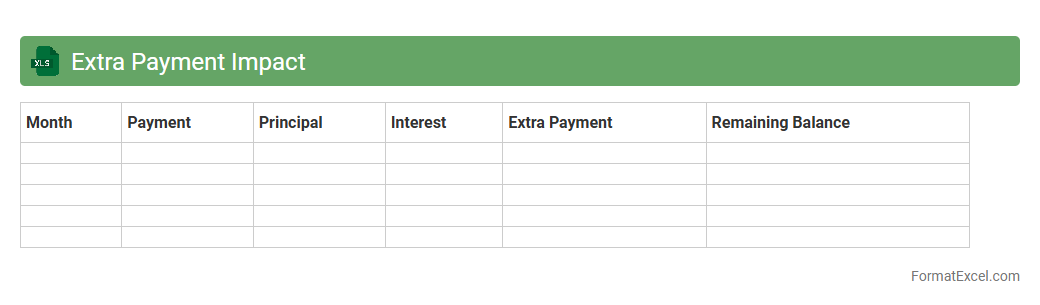

Extra Payment Impact

The

Extra Payment Impact Excel document is a financial tool designed to analyze how additional payments affect loan amortization schedules and overall interest savings. By inputting extra payment amounts and timing, users can visualize faster loan payoff dates and reduced total interest costs. This enables more informed financial planning and strategic debt management.

Early Payoff Tracking

The

Early Payoff Tracking Excel document monitors loan repayments ahead of schedule, highlighting principal reductions and interest savings. It provides a clear overview of payment dates, amounts, and remaining balances, enabling better financial planning and cash flow management. Businesses and individuals can use this tool to optimize debt repayment strategies and minimize overall interest costs effectively.

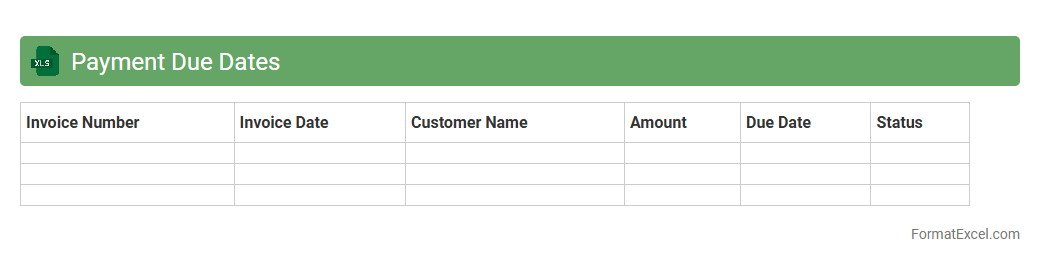

Payment Due Dates

A

Payment Due Dates Excel document is a structured spreadsheet designed to track and manage upcoming payment deadlines efficiently. It helps individuals and businesses avoid late fees by providing clear visibility of invoice dates, payment amounts, and due dates in one organized place. This tool enhances financial planning and ensures timely payments, improving cash flow management and supplier relationships.

Total Interest Paid

The

Total Interest Paid Excel document is a financial tool designed to calculate and track the cumulative interest paid over the life of a loan or mortgage. It helps users analyze repayment schedules, compare different loan options, and make informed decisions to minimize interest expenses. By providing clear insights into interest costs, this document supports effective budgeting and long-term financial planning.

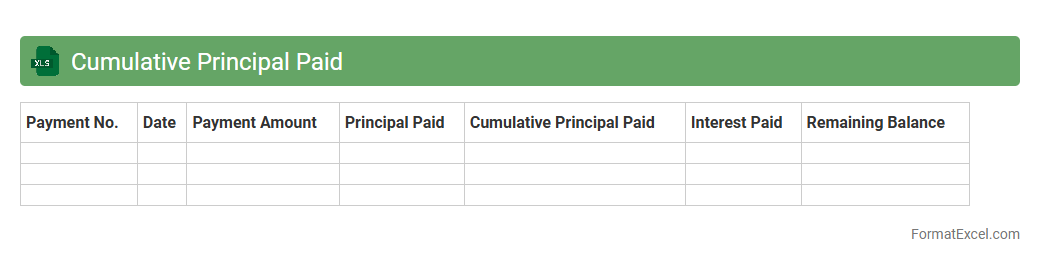

Cumulative Principal Paid

The

Cumulative Principal Paid Excel document tracks the total amount of principal repaid over time on a loan or mortgage, helping users monitor their debt reduction progress. This tool is essential for financial planning, enabling borrowers to assess how much equity they have built and forecast future payments accurately. By providing a clear summary of principal payments, it aids in budgeting and optimizing loan repayment strategies.

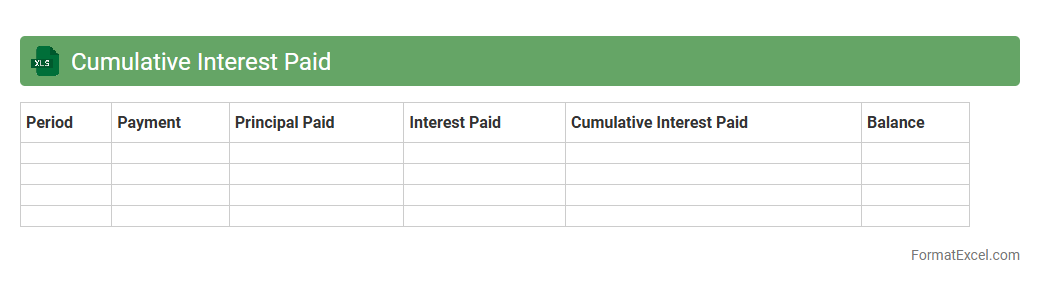

Cumulative Interest Paid

A

Cumulative Interest Paid Excel document calculates the total interest paid over the life of a loan or mortgage by summing interest payments from each period. It helps users track how much interest they have paid to date, enabling better financial planning and loan management. This tool is especially useful for borrowers aiming to understand the cost of credit and explore options for early repayment or refinancing.

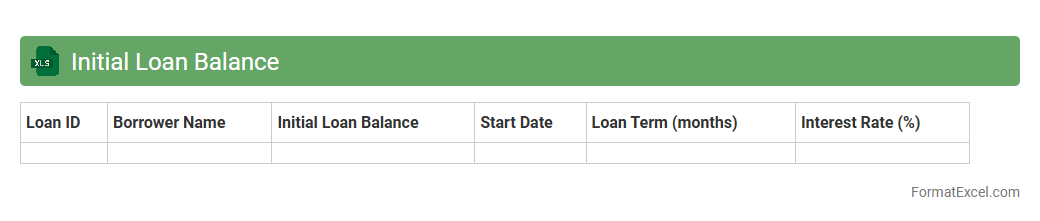

Initial Loan Balance

The

Initial Loan Balance Excel document is a financial tool designed to track the original principal amount of a loan before any payments have been made. It helps lenders and borrowers accurately monitor the starting point of loan repayment schedules, ensuring transparency and proper accounting. This document is essential for calculating interest, amortization, and remaining balances throughout the loan term.

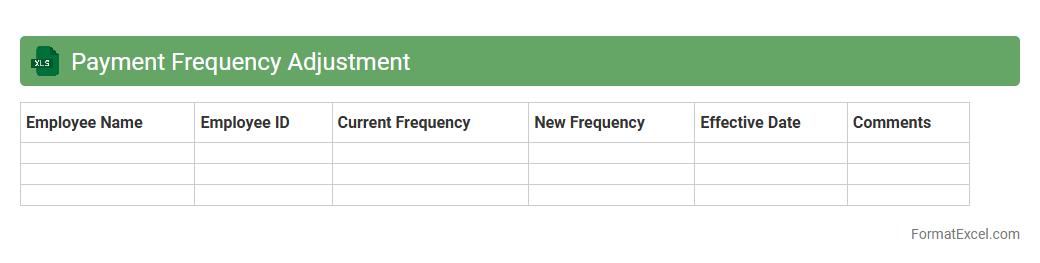

Payment Frequency Adjustment

The

Payment Frequency Adjustment Excel document is a financial tool designed to modify payment schedules by recalculating payment amounts based on changes in frequency, such as switching from monthly to bi-weekly payments. It helps users accurately manage loan repayments, budgeting, and cash flow projections by providing detailed amortization schedules tailored to the new payment intervals. This tool is especially useful for financial planners, mortgage holders, and businesses aiming to optimize payment plans and avoid errors in financial forecasting.

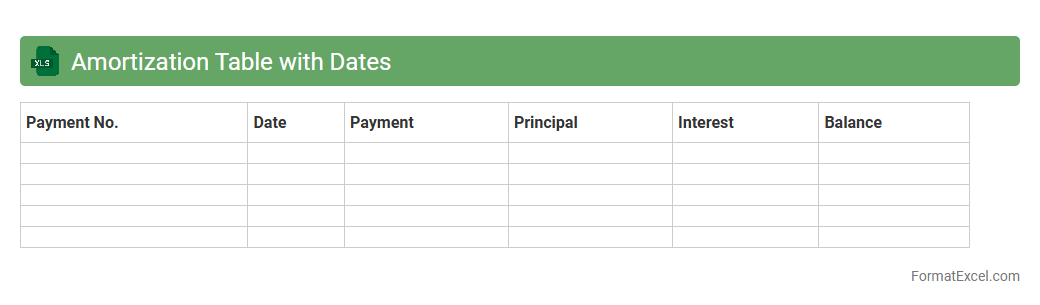

Amortization Table with Dates

An

Amortization Table with Dates in Excel is a detailed schedule showing each loan payment broken down by principal and interest over time, accompanied by exact payment dates. This document allows users to precisely track the declining loan balance, forecast interest payments, and plan finances effectively. Its structured format aids in budgeting, financial analysis, and ensures transparency in loan repayment schedules.

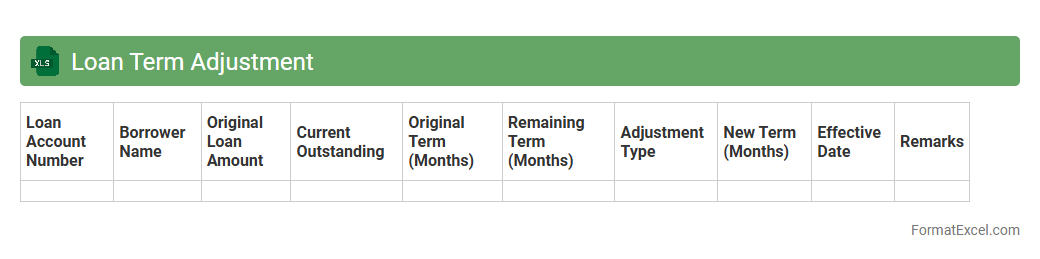

Loan Term Adjustment

A

Loan Term Adjustment Excel document helps users calculate and modify loan repayment schedules, interest rates, and term lengths efficiently. It enables precise financial planning by allowing real-time adjustments to loan parameters, ensuring accurate forecasting of payment amounts and total loan cost. This tool is essential for lenders and borrowers to optimize loan agreements and manage debt effectively.

Outstanding Principal Tracking

The

Outstanding Principal Tracking Excel document is a financial tool designed to monitor remaining loan or debt balances over time, providing clear visibility into the principal amounts still owed. It enables accurate tracking of payment progress, helping borrowers and lenders manage amortization schedules, forecast repayment timelines, and ensure timely settlements. This document improves financial planning and accountability by consolidating key data, reducing errors, and facilitating better decision-making regarding debt management.

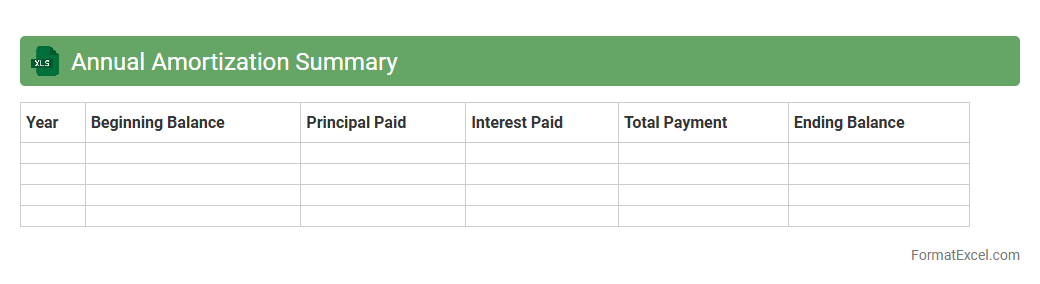

Annual Amortization Summary

An

Annual Amortization Summary Excel document provides a detailed breakdown of loan repayments over the course of a year, showing principal and interest components for each payment period. This summary is essential for tracking outstanding loan balances, forecasting interest expenses, and managing cash flows effectively. It assists individuals and businesses in maintaining financial discipline by offering clear visibility into debt reduction schedules and payment obligations.

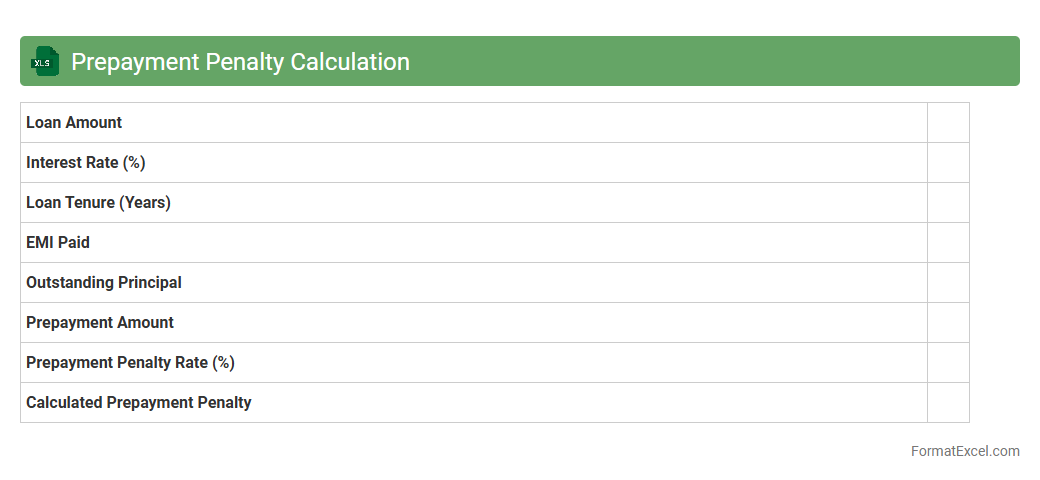

Prepayment Penalty Calculation

A

Prepayment Penalty Calculation Excel document is a financial tool designed to accurately compute the penalties charged when a borrower decides to pay off a loan before its scheduled maturity date. It helps users analyze various loan scenarios, ensuring transparency in early repayment costs and aiding in better financial decision-making. By automating complex calculations, this document saves time and reduces errors, making it invaluable for lenders, borrowers, and financial analysts.

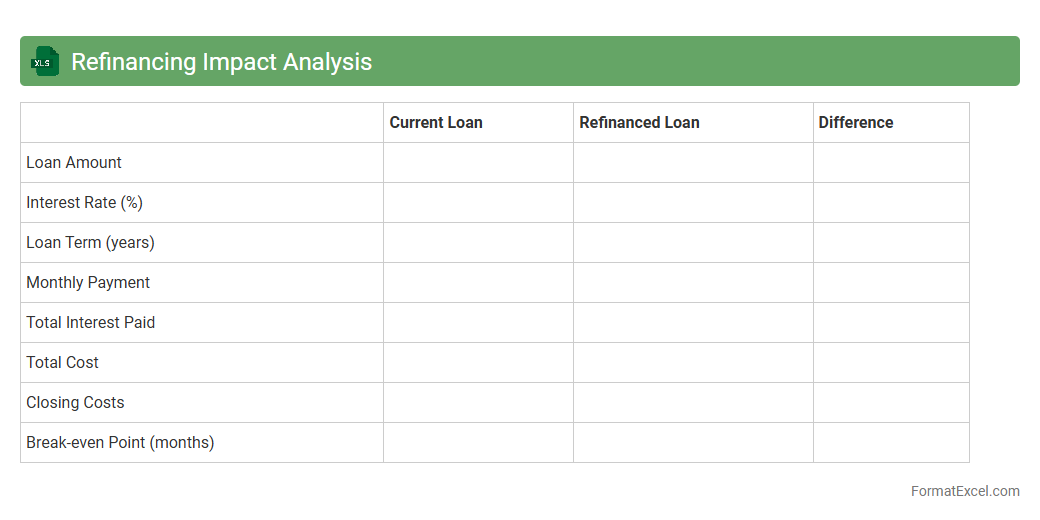

Refinancing Impact Analysis

Refinancing Impact Analysis Excel document is a specialized financial tool designed to evaluate the effects of refinancing on debt structure and cash flow. It helps users compare current loan terms against potential new loans by analyzing interest rates, payment schedules, and total cost savings. This tool is crucial for making informed decisions that optimize financing costs and improve overall financial health.

Refinancing Impact Analysis enhances strategic planning by providing clear, data-driven insights.

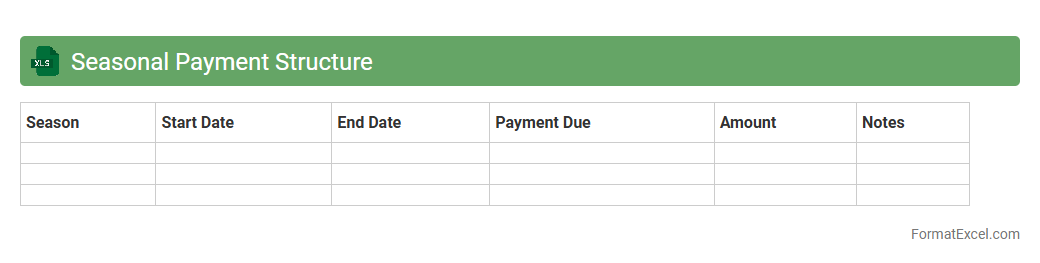

Seasonal Payment Structure

A

Seasonal Payment Structure Excel document organizes payment schedules to align with seasonal variations in income or expenses, allowing accurate budgeting and financial planning. It helps businesses and individuals manage cash flow by clearly outlining payment timelines based on peak and off-peak periods. Using this structured approach improves forecasting accuracy and enhances decision-making for resource allocation throughout the year.

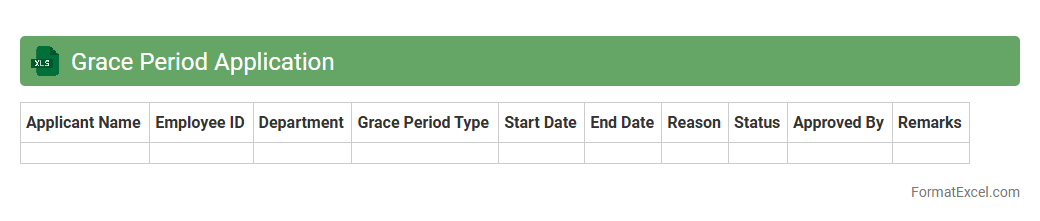

Grace Period Application

The Grace Period Application Excel document is a structured tool designed to track and manage deadlines related to grace periods in various contexts, such as loan repayments or project timelines. It helps users monitor important dates, calculate remaining days, and organize extensions efficiently, reducing the risk of missed deadlines. Utilizing this document enhances time management and ensures compliance with grace period terms, making it an essential resource for financial and administrative planning.

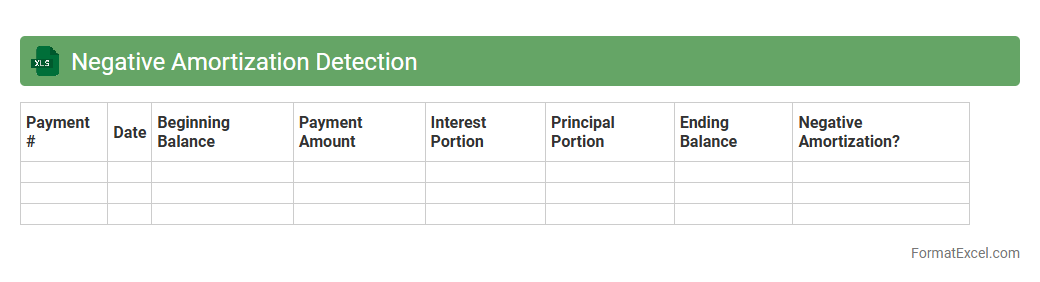

Negative Amortization Detection

The

Negative Amortization Detection Excel document is designed to identify loans where payments are insufficient to cover accruing interest, causing the principal balance to increase. It helps users monitor loan schedules and flag accounts at risk of growing debt due to unpaid interest. This tool is useful for financial analysts and loan officers aiming to mitigate potential loan defaults and ensure accurate financial reporting.

Understanding Loan Amortization

Loan amortization is the process of spreading out a loan into a series of fixed payments over time, combining principal and interest. It helps borrowers understand how each payment impacts their remaining balance. This concept ensures clarity in repayment schedules for both lenders and borrowers.

Benefits of Using Excel for Amortization

Excel offers a flexible platform to create and modify amortization schedules easily, allowing for dynamic adjustments in payment terms. Users can visualize payment timelines, interest costs, and principal reductions. This enhances financial planning and tracking efficiency.

Key Components of a Loan Amortization Schedule

An amortization schedule typically includes the payment number, payment date, payment amount, interest portion, principal portion, and remaining balance. These core elements provide a detailed overview of the loan's progress. Understanding these components is essential for accurate financial management.

Setting Up Your Excel Spreadsheet

Begin by labeling your columns clearly to represent each component of the loan amortization schedule. Organize your spreadsheet for clarity, reserving rows for each payment period. Proper setup ensures seamless formula implementation and easy updates.

Inputting Loan Details in Excel

Enter fundamental loan parameters like principal amount, interest rate, term length, and payment frequency into designated cells. These inputs serve as the basis for all amortization calculations. Accuracy here guarantees reliable schedule outputs.

Creating Formulas for Loan Calculations

Use Excel functions like PMT, IPMT, and PPMT to calculate total payments, interest, and principal portions per period. Incorporate these formulas into your spreadsheet for automatic computation. This automation reduces errors and enhances productivity.

Generating an Amortization Table Automatically

Link your loan details and formulas to create a dynamic amortization table that updates with input changes. This table displays scheduled payments and balances over time. Automation in Excel simplifies ongoing loan monitoring.

Customizing Your Amortization Format in Excel

Modify your spreadsheet by adding charts, conditional formatting, or extra columns like cumulative interest to better visualize loan data. Customization improves user experience and insight. Tailor your format to suit specific financial goals.

Common Mistakes to Avoid in Amortization Schedules

Errors like incorrect formula references, inconsistent payment dates, or neglecting extra payments can lead to inaccurate schedules. Always double-check inputs and formulas. Maintaining precision is crucial for valid loan tracking.

Downloadable Loan Amortization Excel Templates

Pre-built Excel templates provide a ready-to-use structure for creating amortization schedules quickly and accurately. They save time and offer professional formatting. Templates are a great starting point for both beginners and experts.