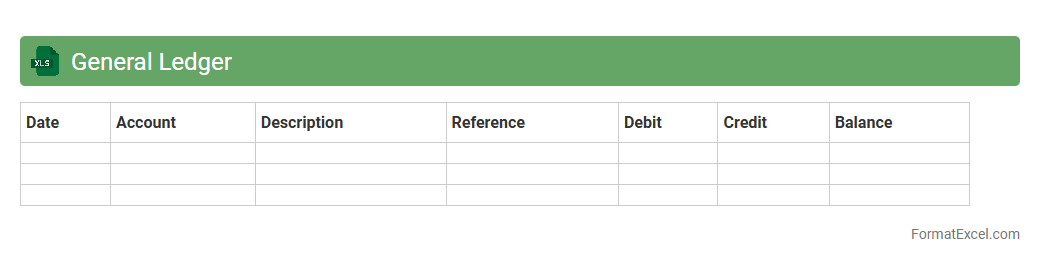

General Ledger

A

General Ledger Excel document is a detailed record of all financial transactions within an organization, organized by accounts. It is essential for tracking income, expenses, assets, and liabilities, enabling accurate financial reporting and analysis. Using this document helps businesses maintain transparency, ensure compliance, and make informed budgeting decisions.

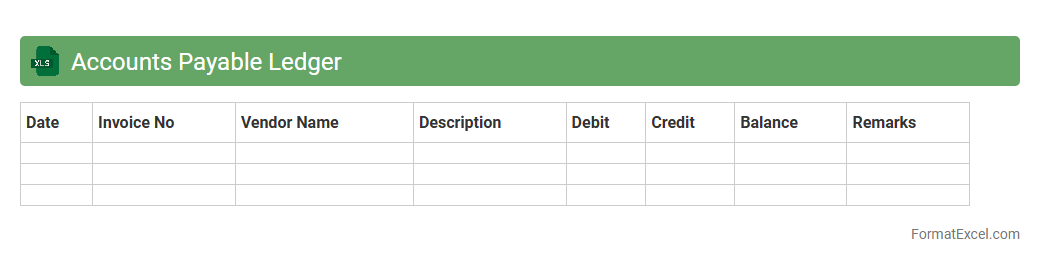

Accounts Payable Ledger

An

Accounts Payable Ledger Excel document is a detailed record that tracks all outstanding payments a company owes to its suppliers and vendors. It provides a clear overview of due dates, payment amounts, and vendor details, enabling efficient management of cash flow and timely invoice settlements. Using this ledger ensures accurate financial tracking, reduces errors, and supports stronger supplier relationships by preventing missed or late payments.

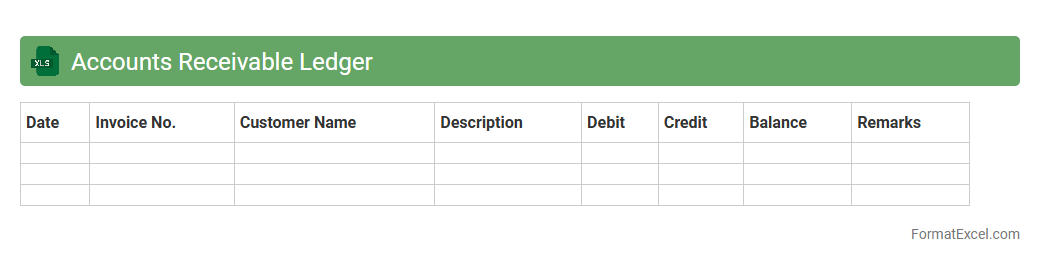

Accounts Receivable Ledger

The

Accounts Receivable Ledger Excel document is a detailed record of all outstanding customer invoices and payments, tracking amounts owed to a business. It enables efficient management of credit sales, helps monitor payment statuses, and improves cash flow forecasting by providing a clear overview of receivables. Utilizing this ledger reduces errors, facilitates timely follow-ups on overdue accounts, and supports accurate financial reporting.

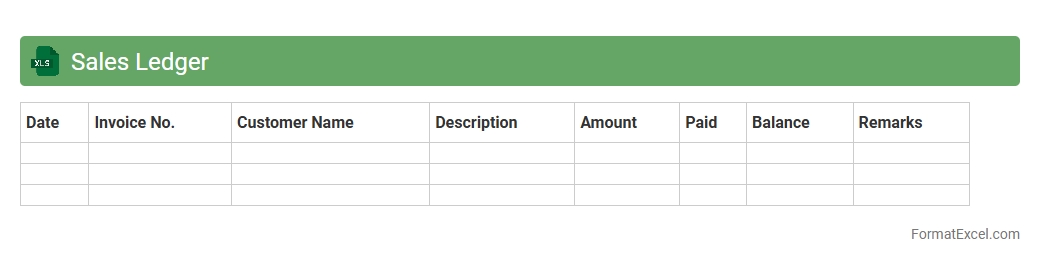

Sales Ledger

A

Sales Ledger Excel document is a digital spreadsheet used to systematically record and track all sales transactions, including customer details, invoice numbers, dates, and payment statuses. It serves as an essential tool for businesses to manage accounts receivable, monitor cash flow, and generate financial reports efficiently. Using this document enhances accuracy in sales data management and supports informed decision-making for sales strategies and credit control.

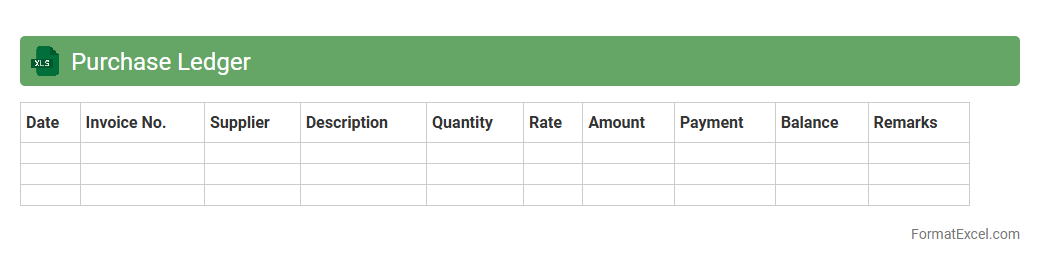

Purchase Ledger

A

Purchase Ledger Excel document is a structured spreadsheet used to record and manage a company's accounts payable, detailing supplier invoices, payments, and outstanding balances. It streamlines financial tracking by providing clear visibility on purchase transactions, enabling accurate cash flow management and budgeting. Business owners and accountants rely on this tool to maintain organized records and ensure timely payments, reducing the risk of errors and improving financial accountability.

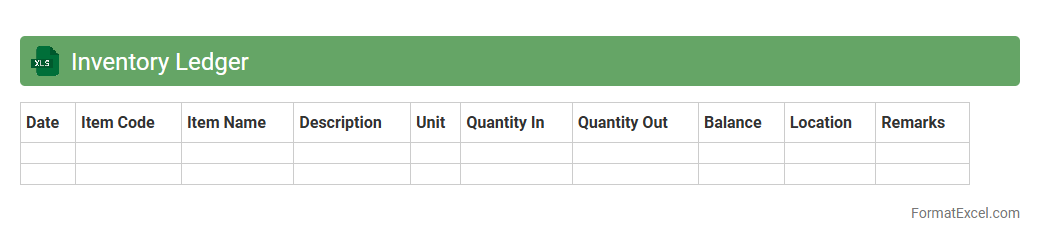

Inventory Ledger

An

Inventory Ledger Excel document is a digital tool designed to systematically track and manage stock levels, purchases, sales, and product movements within a business. It offers real-time visibility into inventory status, enabling accurate forecasting, reducing stockouts, and optimizing reorder points. Using this ledger enhances operational efficiency by maintaining organized records that simplify auditing and financial reporting processes.

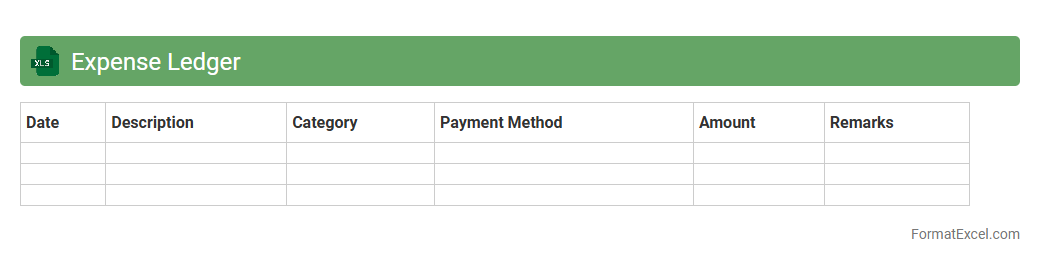

Expense Ledger

An

Expense Ledger Excel document is a digital spreadsheet designed to record, organize, and track financial transactions related to expenses. It helps individuals and businesses maintain accurate records for budgeting, financial analysis, and tax preparation. By providing a clear overview of spending patterns, this tool improves financial management and decision-making processes.

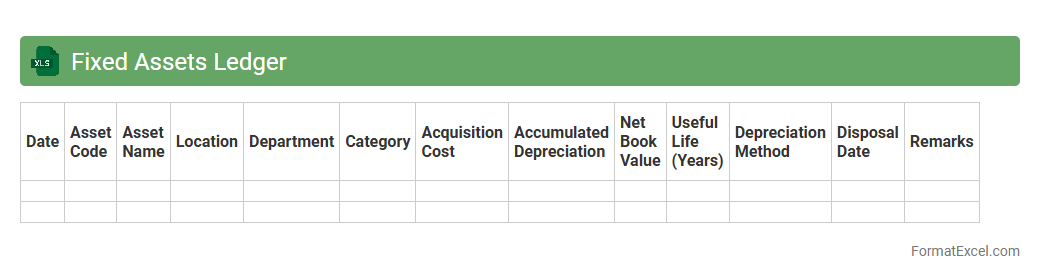

Fixed Assets Ledger

A

Fixed Assets Ledger Excel document is a structured spreadsheet used to record, track, and manage an organization's fixed assets such as machinery, vehicles, and buildings. It provides detailed information including acquisition dates, costs, depreciation schedules, and asset locations, enabling accurate financial reporting and asset management. This tool helps businesses maintain compliance with accounting standards and optimize asset utilization by facilitating regular audits and budget planning.

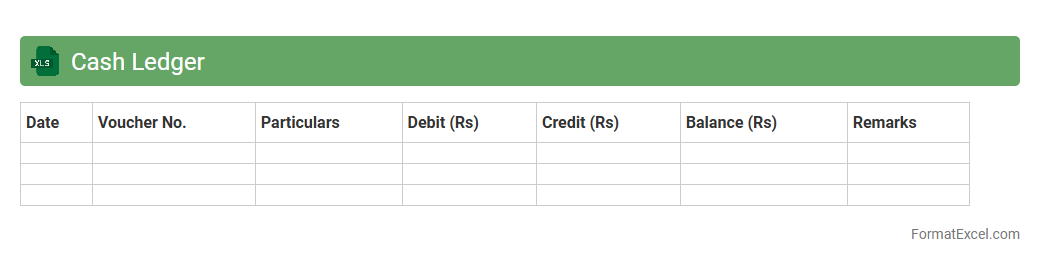

Cash Ledger

A

Cash Ledger Excel document is a digital record-keeping tool that tracks all cash transactions, including receipts and payments, in an organized and transparent manner. It helps businesses and individuals monitor cash flow, maintain accurate financial records, and facilitate easier auditing and budgeting. By using this document, users can efficiently manage daily cash operations, reduce errors, and make informed financial decisions.

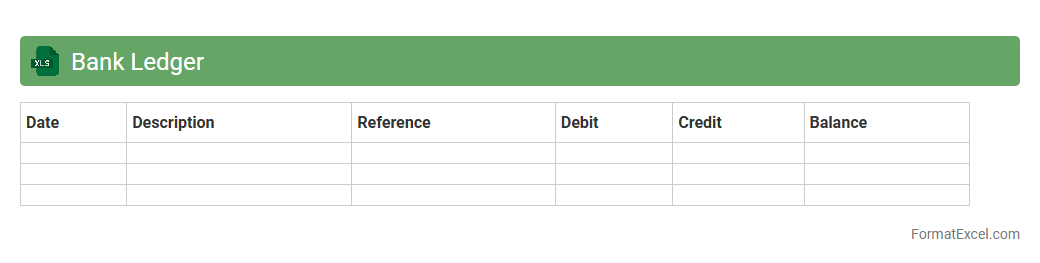

Bank Ledger

A

Bank Ledger Excel document is a digital spreadsheet designed to record and track all financial transactions within a bank account, including deposits, withdrawals, and transfers. It helps users maintain organized and accurate financial records, enabling easy reconciliation of bank statements and effective cash flow management. By providing a clear overview of inflows and outflows, it supports budgeting, expense tracking, and financial decision-making.

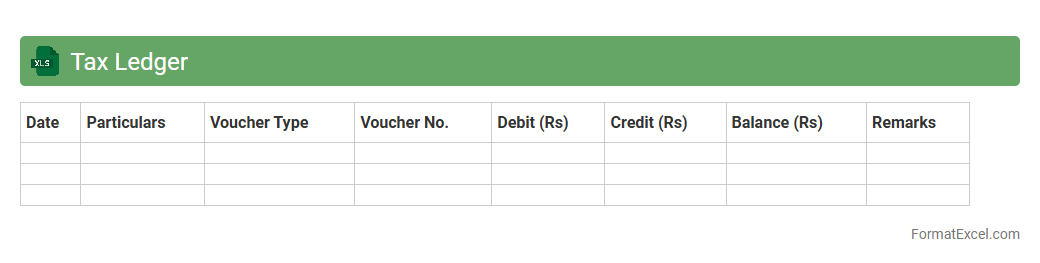

Tax Ledger

A

Tax Ledger Excel document is an organized spreadsheet that records all tax-related transactions, including payments, deductions, and liabilities. This tool helps individuals and businesses maintain accurate tax records, ensuring compliance with tax regulations and simplifying the filing process. It enables efficient tracking of tax payments and outstanding amounts, reducing errors and facilitating better financial planning.

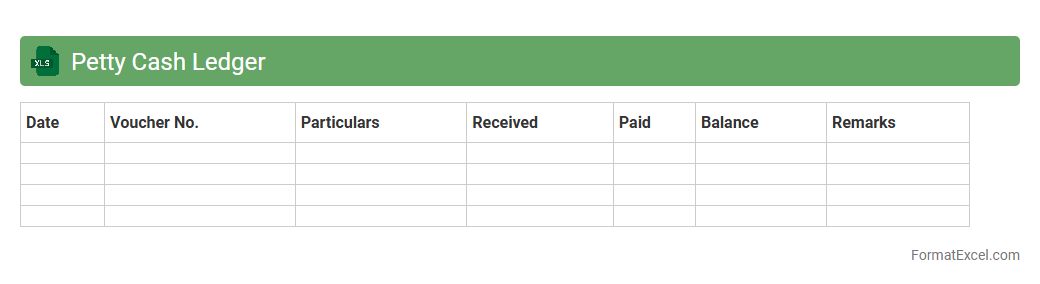

Petty Cash Ledger

A

Petty Cash Ledger Excel document is a financial record-keeping tool that helps track small, everyday expenses within a business or organization. It allows users to monitor cash inflows and outflows, ensuring accurate management of petty cash funds. This ledger improves expense accountability and simplifies reconciliation processes by providing a clear, organized overview of petty cash transactions.

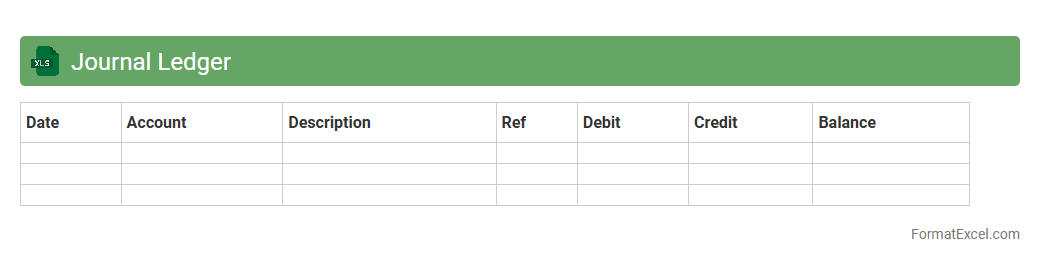

Journal Ledger

A

Journal Ledger Excel document is a digital tool designed to record and organize all financial transactions systematically, ensuring accurate bookkeeping. It helps businesses track debits and credits, maintain a clear audit trail, and generate financial statements efficiently. Using Excel's features like formulas and templates enhances accuracy and saves time in managing accounting records.

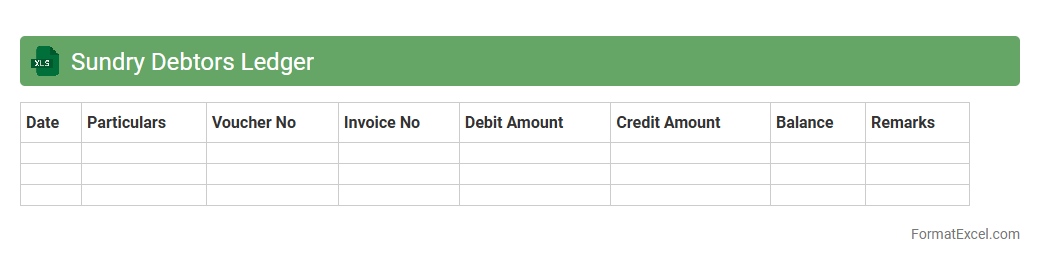

Sundry Debtors Ledger

The

Sundry Debtors Ledger Excel document is a spreadsheet used to track individual customer accounts and outstanding receivables, helping businesses monitor payments and credit balances efficiently. It organizes detailed information such as invoice numbers, dates, amounts due, and payment status, enabling easy reconciliation and timely follow-up on overdue accounts. This tool enhances financial management by providing clear visibility of receivables, improving cash flow forecasting and reducing the risk of bad debts.

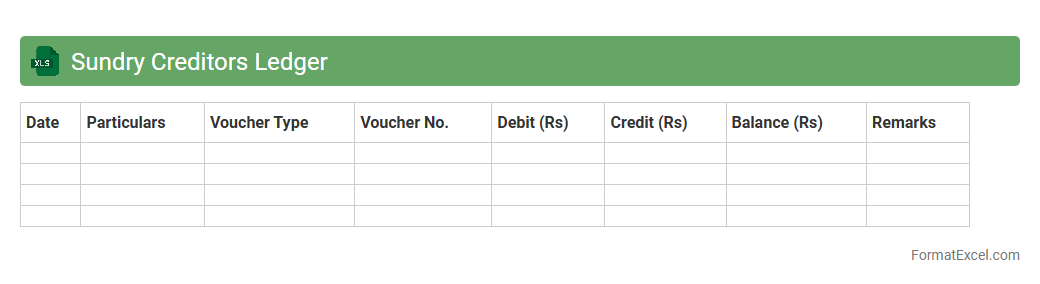

Sundry Creditors Ledger

The

Sundry Creditors Ledger Excel document is a detailed record-keeping tool that tracks all outstanding amounts owed to various small or miscellaneous suppliers. It simplifies managing payables by organizing creditor names, invoice dates, amounts, and payment statuses in one accessible spreadsheet. This ledger enhances financial control and aids timely payments, improving cash flow and supplier relationships.

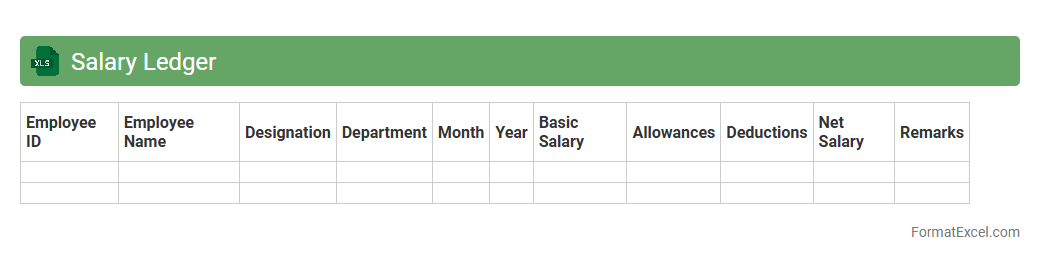

Salary Ledger

A

Salary Ledger Excel document is a detailed financial record used to track employee salaries, deductions, bonuses, and net pay over a specific period. It helps businesses maintain accurate payroll data, ensuring compliance with tax regulations and facilitating timely salary disbursements. This organized format simplifies payroll management and supports transparent financial reporting for audits and decision-making.

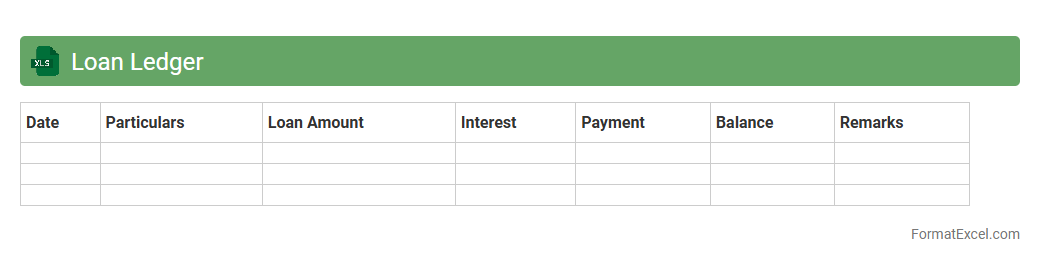

Loan Ledger

A

Loan Ledger Excel document is a spreadsheet tool designed to record and track detailed information about loan transactions, including principal amounts, interest accruals, repayment schedules, and outstanding balances. It helps users maintain organized financial records, monitor loan performance, and generate accurate reports for better decision-making and compliance. By using a Loan Ledger, individuals and businesses can effectively manage cash flow and ensure timely loan repayments.

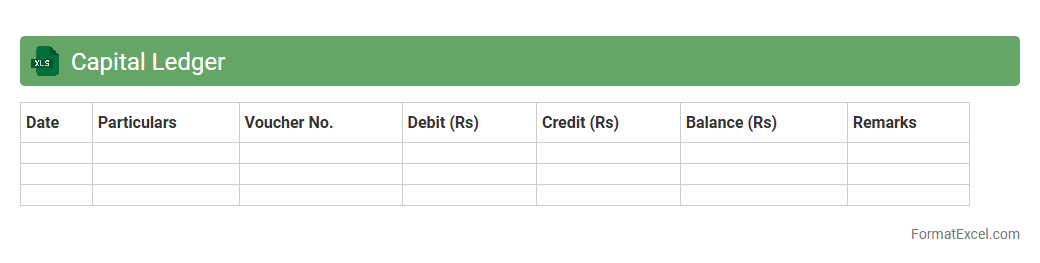

Capital Ledger

A

Capital Ledger Excel document is a financial tool used to systematically record and track capital investments, asset purchases, and equity transactions over time. It provides a clear, organized view of all capital-related entries, enabling accurate monitoring of financial positions and facilitating compliance with accounting standards. This document is essential for investors, accountants, and business managers to analyze capital flows, assess asset values, and make informed financial decisions.

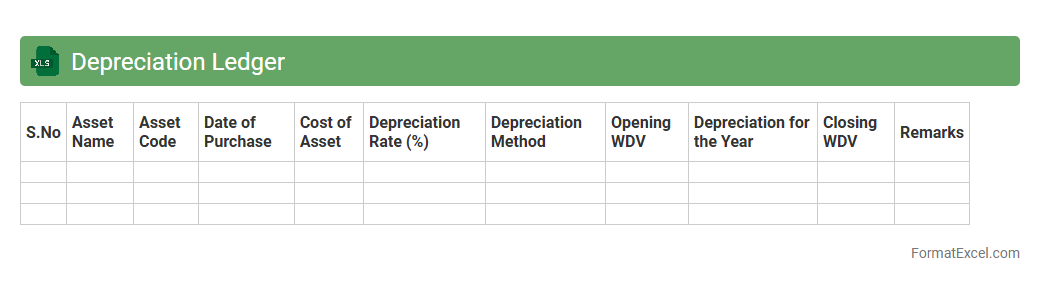

Depreciation Ledger

A

Depreciation Ledger Excel document is a structured spreadsheet used to track and calculate the depreciation of assets over time, providing detailed records of asset value reduction. It helps businesses maintain accurate financial statements by automating calculations based on different depreciation methods like straight-line or declining balance. This tool enhances asset management, budget planning, and compliance with accounting standards efficiently.

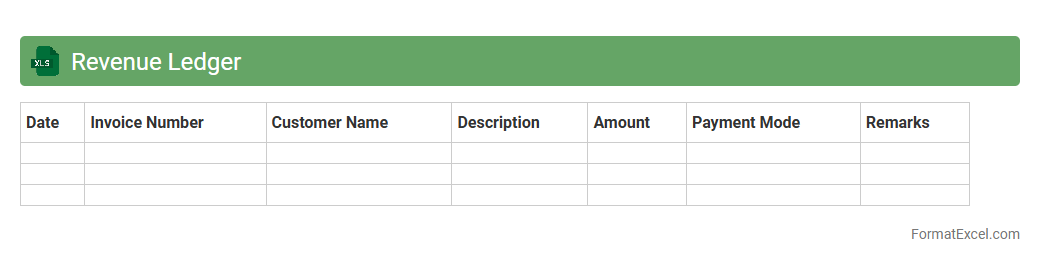

Revenue Ledger

A

Revenue Ledger Excel document is a comprehensive financial record that tracks all income and revenue transactions over a specific period. It helps businesses maintain accurate and organized financial data, facilitating precise revenue analysis and budget planning. By providing clear insights into cash flow, this document supports informed decision-making and enhances financial transparency.

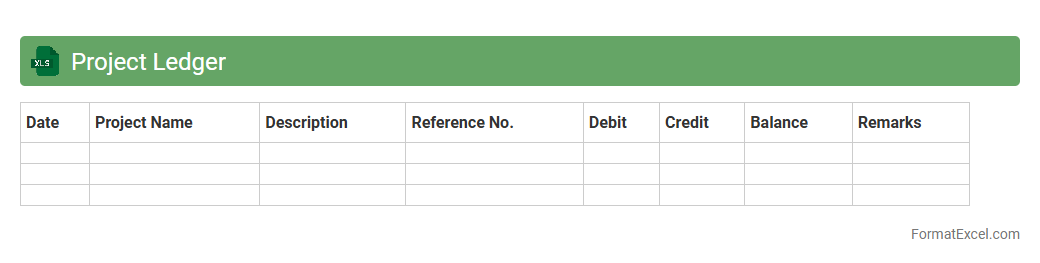

Project Ledger

The

Project Ledger Excel document is a comprehensive tool designed to track and manage all financial transactions, expenses, and resource allocations associated with a project. It provides clear visibility into budget adherence, helps identify cost overruns, and supports accurate forecasting by consolidating data in a structured format. Utilizing this document enhances project accountability, facilitates informed decision-making, and improves overall financial control throughout the project lifecycle.

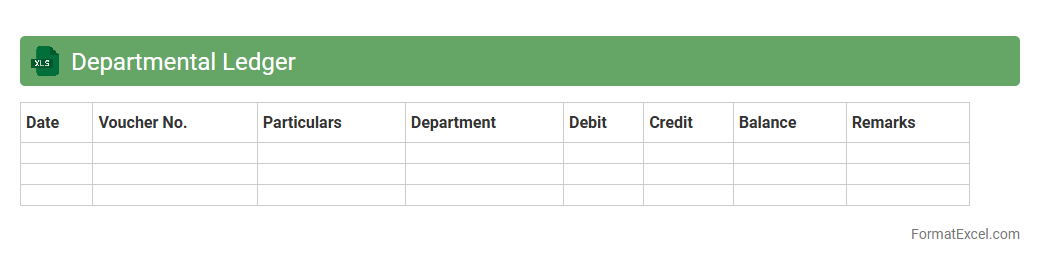

Departmental Ledger

The

Departmental Ledger Excel document is a structured financial record that tracks income, expenses, and budget allocations for individual departments within an organization. It allows for detailed monitoring of each department's financial activities, making it easier to analyze spending patterns and identify cost-saving opportunities. This tool enhances budgeting accuracy and financial accountability by providing clear, organized data accessible in a user-friendly spreadsheet format.

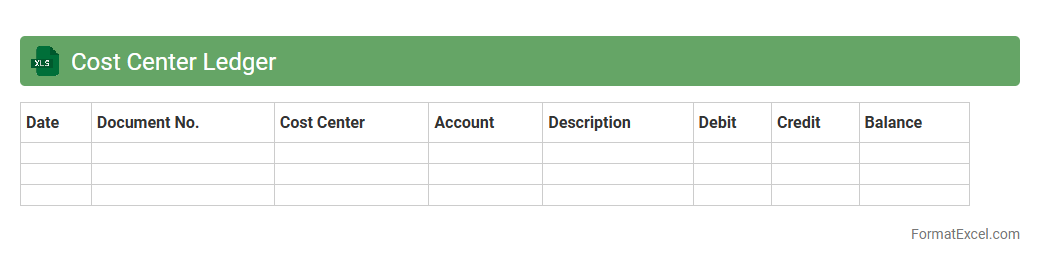

Cost Center Ledger

A

Cost Center Ledger Excel document is a detailed financial record used to track expenses and revenues by specific departments or cost centers within an organization. It enables precise budget monitoring, expense allocation, and financial analysis, helping businesses maintain control over operational costs. This tool is essential for improving cost management, enhancing accountability, and supporting strategic decision-making processes.

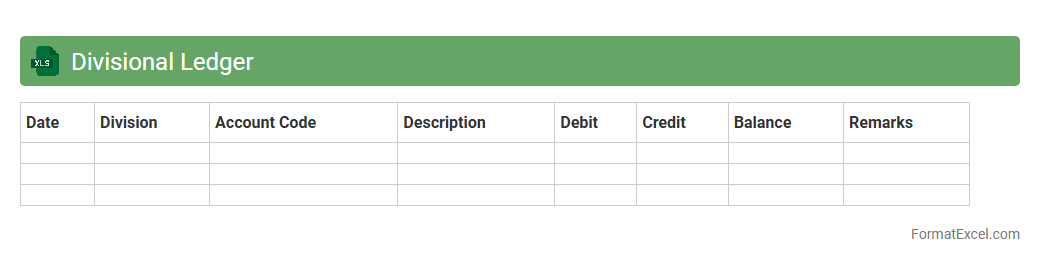

Divisional Ledger

A

Divisional Ledger Excel document is a detailed financial record organized by business divisions or departments, capturing revenues, expenses, and transactions specific to each segment. It is useful for analyzing the financial performance of individual divisions, enabling better budget management and strategic decision-making. This tool enhances transparency, accuracy, and efficiency in tracking divisional financial data within an organization.

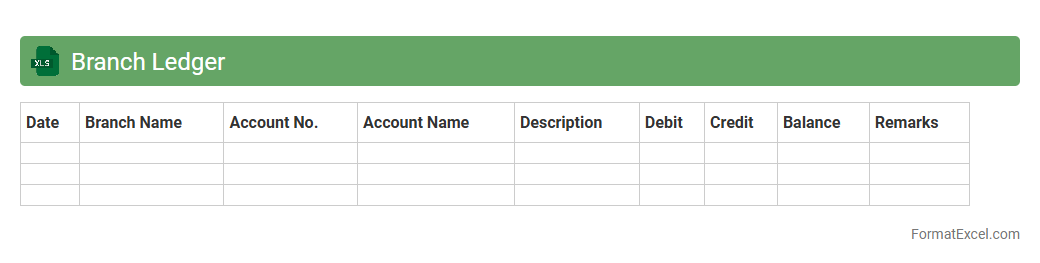

Branch Ledger

A

Branch Ledger Excel document is a structured spreadsheet that records all financial transactions for individual branches of an organization, allowing for detailed tracking of income, expenses, and balances. It is useful for monitoring branch performance, ensuring accurate budget management, and facilitating consolidated financial reporting across multiple locations. This organized approach improves transparency and aids in quick decision-making by providing clear, real-time financial data for each branch.

Introduction to Ledger Format in Excel

The ledger format in Excel is a structured way to record and track financial transactions efficiently. Excel provides flexibility for creating customized ledgers to suit various accounting needs. Understanding this format helps streamline financial data management and reporting.

Importance of Ledgers in Financial Management

Ledgers serve as the backbone of financial management by compiling all financial transactions in one place. This consolidation aids in tracking income, expenses, and maintaining accurate accounts. Proper ledger maintenance ensures transparency and facilitates financial decision-making.

Key Components of an Excel Ledger

Essential components of an Excel ledger include date, description, debit, credit, and balance columns. These elements help record transaction details clearly and calculate ongoing balances. Including these basics ensures a functional financial record-keeping system.

Setting Up a Basic Ledger Template

To set up a basic ledger template, create columns for date, details, debit, credit, and balance. Using Excel's table feature can improve data management and filtering. A well-structured template simplifies transaction entry and monitoring.

Essential Ledger Columns and Their Functions

Each ledger column has a vital role: date for timing, description for transaction details, debit and credit for amounts, and balance for the account status. Understanding these functions is crucial for accurate financial tracking. Proper column usage enhances ledger reliability.

Tips for Customizing Excel Ledger Formats

Customize your ledger by adding columns pertinent to your needs, such as categories or payment methods. Using color coding or conditional formatting helps highlight critical data. These customizations improve readability and usability.

Using Excel Formulas to Automate Ledger Calculations

Employ Excel formulas like SUM, IF, and running balance calculations to automate ledger updates. Automation reduces errors and saves time when managing multiple entries. Mastering these formulas elevates ledger efficiency.

Common Mistakes to Avoid in Excel Ledgers

Avoid errors like incorrect formula references, inconsistent data entry, and neglecting backups. Such mistakes compromise the accuracy and reliability of your ledger. Careful review and validation are essential for maintaining data integrity.

Best Practices for Maintaining Accurate Ledgers

Regularly update entries, reconcile balances, and back up your Excel ledger to ensure precision. Consistency and attention to detail are key practices for successful ledger management. Adopting these habits supports sound financial oversight.

Downloadable Ledger Format Templates in Excel

Many websites offer free downloadable Excel ledger templates designed for various financial tracking purposes. Utilizing these templates can speed up setup and provide a professional starting point. Always customize templates to fit your specific business or personal needs.