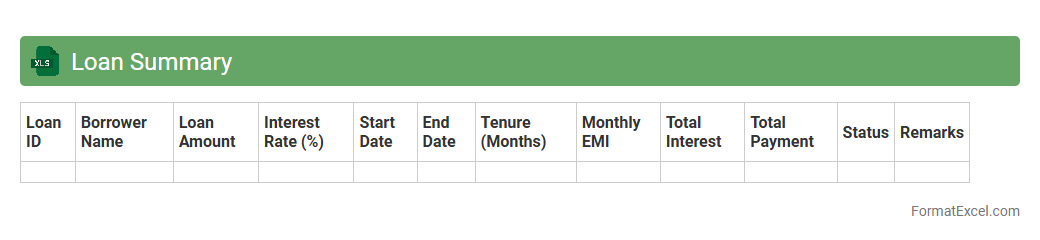

Loan Summary

A

Loan Summary Excel document consolidates all critical loan details such as principal amount, interest rates, payment schedules, and outstanding balances into a clear, organized format. It enables efficient tracking of repayment progress, calculation of interest accrual, and helps in financial planning by offering a comprehensive overview of debt obligations. This tool is essential for borrowers and lenders to monitor loan performance and make informed decisions.

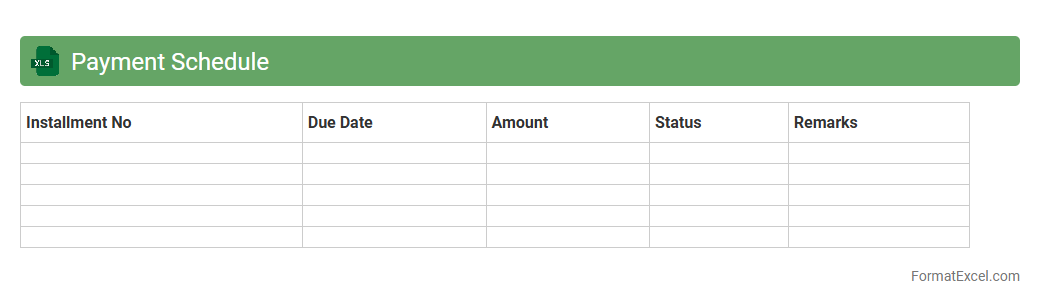

Payment Schedule

A

Payment Schedule Excel document is a spreadsheet that organizes and tracks payment dates, amounts, and recipients in a structured format. It helps businesses and individuals manage cash flow, ensure timely payments, and maintain financial accountability. Using this tool improves financial planning by providing clear visibility into upcoming financial obligations.

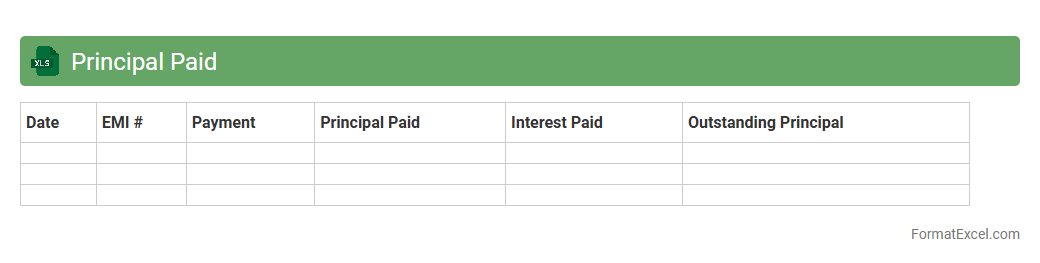

Principal Paid

A

Principal Paid Excel document tracks the payments made toward the principal balance of a loan, distinguishing them from interest payments. This tool is essential for accurately monitoring loan payoff progress, calculating remaining balances, and projecting future payment schedules. It enables users to make informed financial decisions by visualizing how extra payments reduce overall interest costs and shorten loan terms.

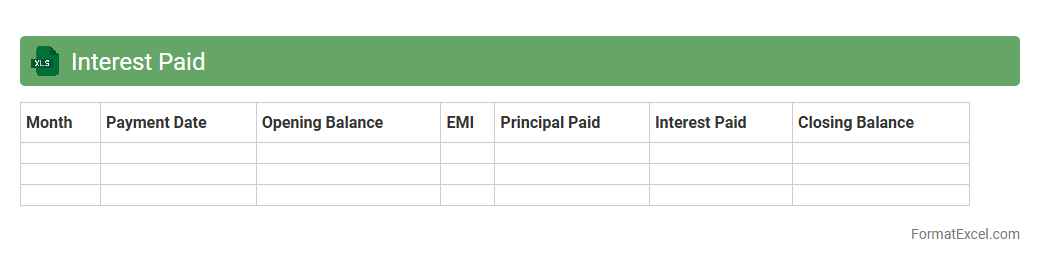

Interest Paid

An

Interest Paid Excel document is a spreadsheet tool designed to track and calculate the interest payments made on loans, mortgages, or other debts over a specified period. It allows users to input principal amounts, interest rates, and payment schedules to generate detailed reports on total interest paid, helping in financial planning and budget management. This document is useful for monitoring loan costs, optimizing repayment strategies, and ensuring accurate accounting for tax or record-keeping purposes.

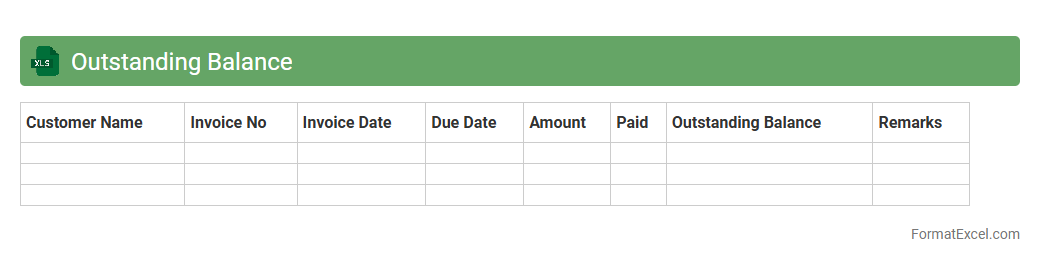

Outstanding Balance

An

Outstanding Balance Excel document is a financial tracking tool that records and monitors unpaid amounts on invoices or loans, providing clear visibility of pending payments. It helps businesses and individuals manage cash flow effectively by consolidating all outstanding dues in one place, enabling timely follow-ups and reducing the risk of defaults. This document also facilitates accurate financial reporting and budgeting by offering detailed insights into receivables or liabilities.

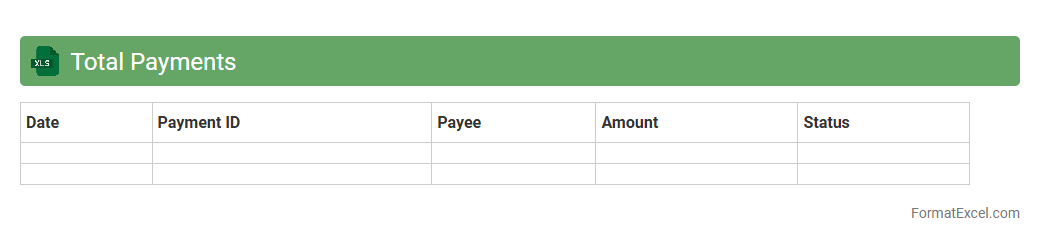

Total Payments

A

Total Payments Excel document is a comprehensive spreadsheet that tracks and summarizes all financial transactions and payments made by an individual or organization. It provides clear visibility into payment dates, amounts, methods, and recipients, enabling efficient financial management and analysis. This document is essential for budgeting, forecasting cash flow, and ensuring timely payment settlements to maintain good financial health.

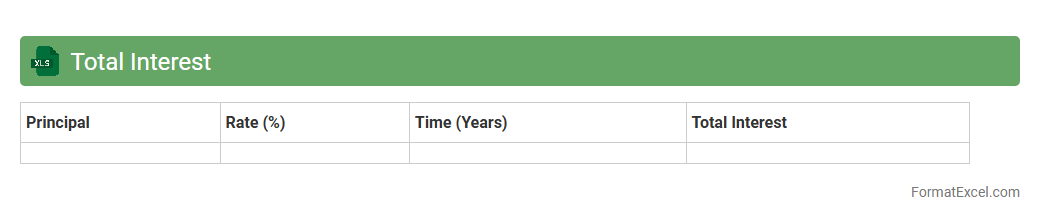

Total Interest

The

Total Interest Excel document is a specialized spreadsheet designed to calculate the total interest paid over the life of a loan by using formulas based on principal, interest rate, and loan duration. It helps users accurately track the cumulative interest cost, enabling better financial planning and loan comparison. This tool is especially useful for budgeting, forecasting loan repayments, and identifying opportunities to save money by choosing different loan terms or prepayment strategies.

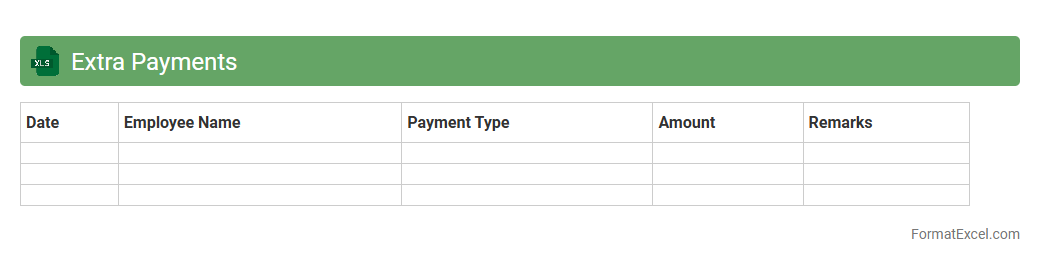

Extra Payments

The

Extra Payments Excel document is a detailed spreadsheet designed to track and manage additional payments beyond regular installments, such as loan prepayments or salary bonuses. It helps users maintain accurate financial records, monitor outstanding balances, and optimize cash flow management by providing clear visibility into all extra transactions. This tool is essential for improving budgeting accuracy and ensuring timely financial decision-making.

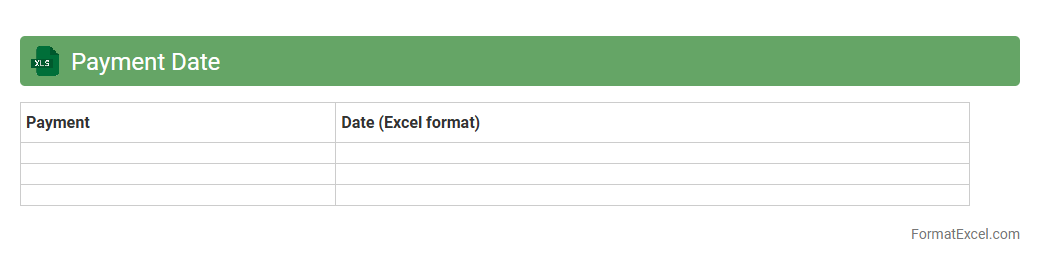

Payment Date

A

Payment Date Excel document is a spreadsheet that tracks scheduled payment dates, amounts, and related financial details for bills, invoices, or payroll. It helps ensure timely payments by providing clear visibility into due dates and cash flow management. This tool is essential for maintaining organized financial records and avoiding late fees or missed payments.

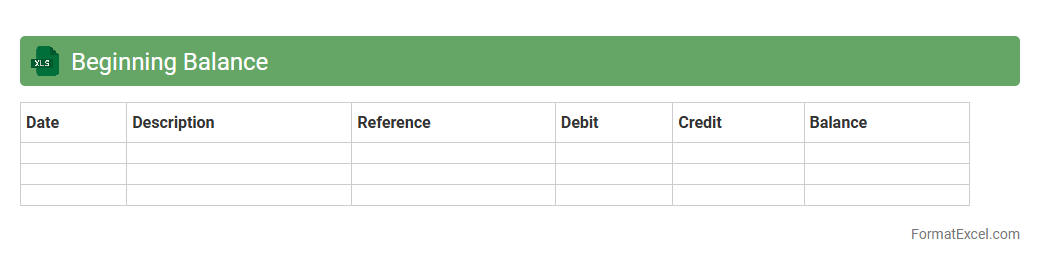

Beginning Balance

A

Beginning Balance Excel document is a financial record that captures the initial amount of money in an account at the start of a specific period. It is useful for tracking the starting point of budgets, reconciliations, and financial forecasts, ensuring accuracy in accounting processes. This document helps users maintain visibility on cash flow and supports effective financial planning and analysis.

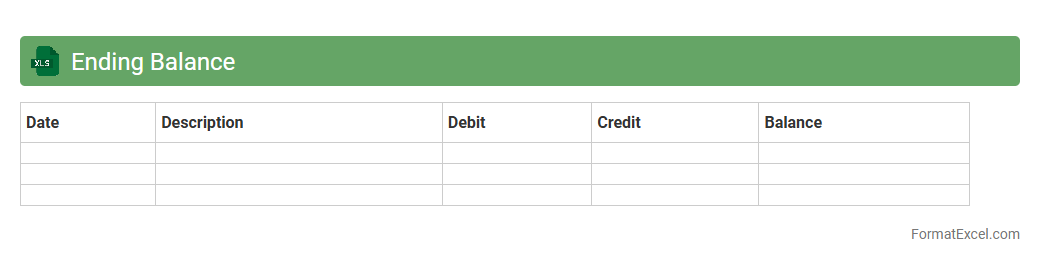

Ending Balance

An

Ending Balance Excel document is a financial record that tracks the final amount remaining in an account after all transactions have been accounted for within a specific period. It helps individuals and businesses monitor cash flow, manage budgets, and ensure accurate financial reporting by providing a clear snapshot of available funds. Using this document enhances financial planning and decision-making by offering precise insights into income, expenses, and overall financial health.

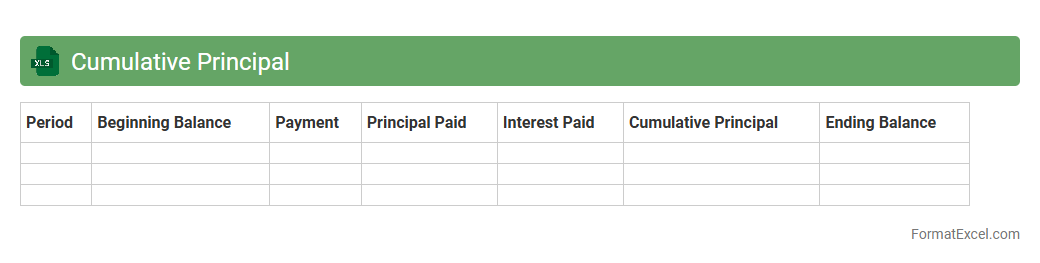

Cumulative Principal

A

Cumulative Principal Excel document tracks the total amount of principal paid over time in loan amortization schedules, providing clear visibility into reducing loan balances. It helps borrowers and financial analysts monitor repayment progress and accurately forecast remaining debt. This tool is essential for managing loans efficiently, budgeting future payments, and assessing interest versus principal contributions.

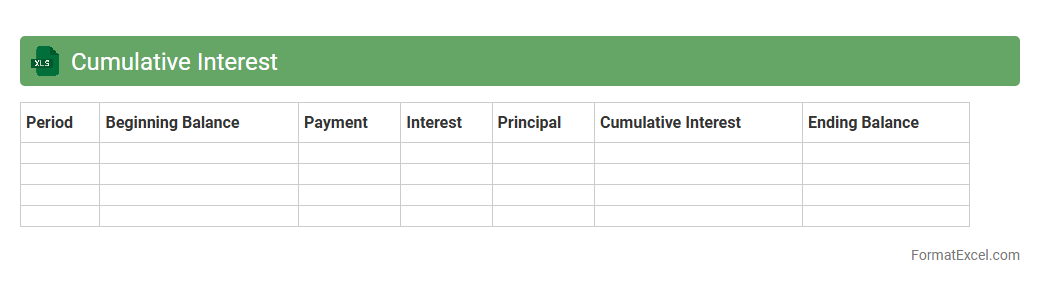

Cumulative Interest

A

Cumulative Interest Excel document tracks the total interest earned or paid over multiple periods on a loan or investment, offering clear visibility into financial growth or cost. It calculates interest by summing periodic amounts, helping users analyze long-term financial commitments and make informed decisions. This tool is essential for comparing loan options, budgeting, and understanding the impact of interest on overall financial planning.

Amortization Table

An

Amortization Table Excel document is a spreadsheet that breaks down loan repayments into detailed schedules showing principal and interest over time. It helps users track payment progress, understand outstanding balances, and plan finances by clearly illustrating how each payment impacts the loan. This tool is essential for borrowers and financial planners to manage loans efficiently and forecast future payment obligations.

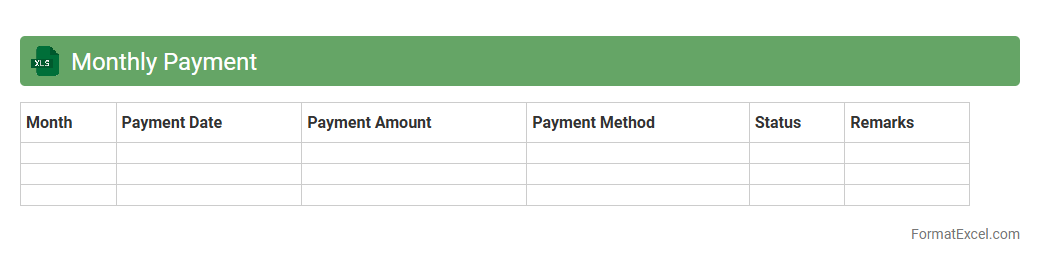

Monthly Payment

A

Monthly Payment Excel document is a spreadsheet designed to track and calculate recurring payments such as loans, rent, or subscriptions. It simplifies financial management by automating payment schedules, interest calculations, and balance updates, providing a clear overview of monthly obligations. This tool enhances budgeting accuracy and helps users avoid missed payments or financial discrepancies.

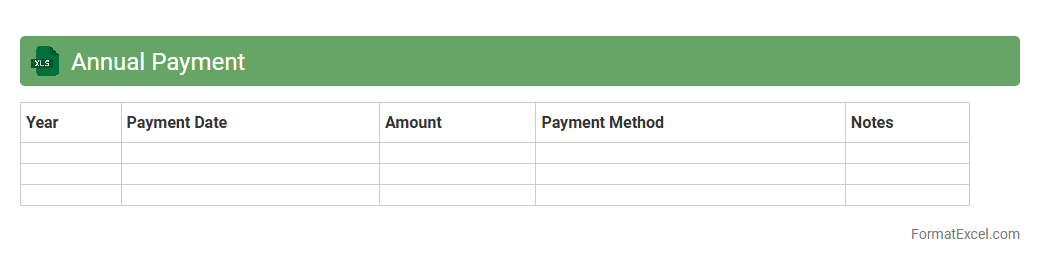

Annual Payment

An

Annual Payment Excel document is a spreadsheet designed to track and manage yearly financial transactions, including payments, invoices, and budget allocations. It helps individuals and businesses monitor cash flow, ensure timely payments, and simplify financial reporting. Utilizing this tool enhances accuracy in financial planning and supports effective decision-making throughout the fiscal year.

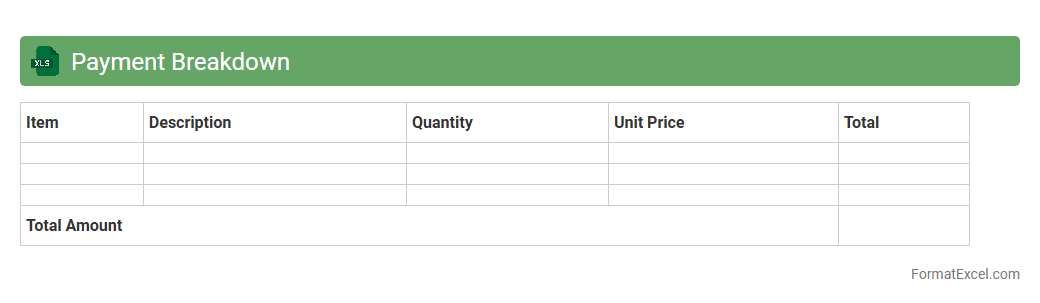

Payment Breakdown

A

Payment Breakdown Excel document itemizes all payments made or received, detailing amounts, dates, and payment methods for clear financial tracking. It helps businesses and individuals maintain accurate records, manage cash flow, and quickly identify discrepancies. This organized format enhances budgeting efficiency and simplifies auditing processes.

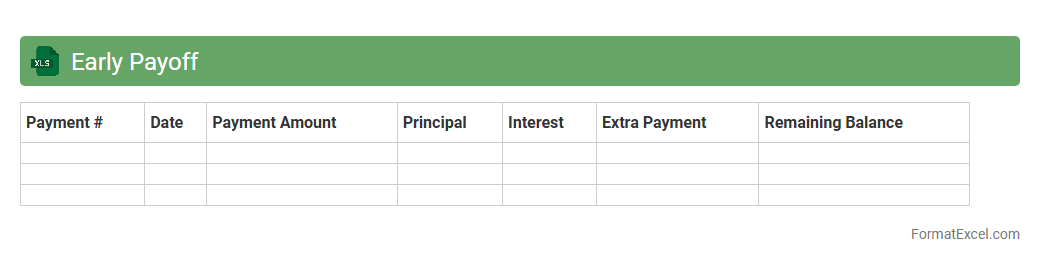

Early Payoff

The

Early Payoff Excel document is a financial tool designed to calculate and track loan repayment schedules when extra payments are made towards the principal balance. It helps users visualize the impact of additional payments on reducing interest costs and shortening the loan term. By providing detailed projections, this document enables informed decisions on accelerating debt payoff and improving financial planning.

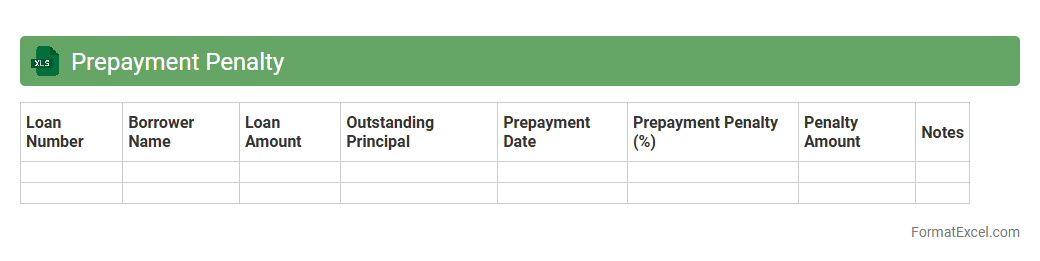

Prepayment Penalty

A

Prepayment Penalty Excel document is a structured spreadsheet designed to calculate and track fees incurred when a loan is paid off early, providing clear visibility into potential financial impacts. It helps users quickly assess the cost of early loan repayment by automating complex calculations based on loan terms and penalty rates. This tool improves financial planning by enabling borrowers to make informed decisions about refinancing or accelerating payments.

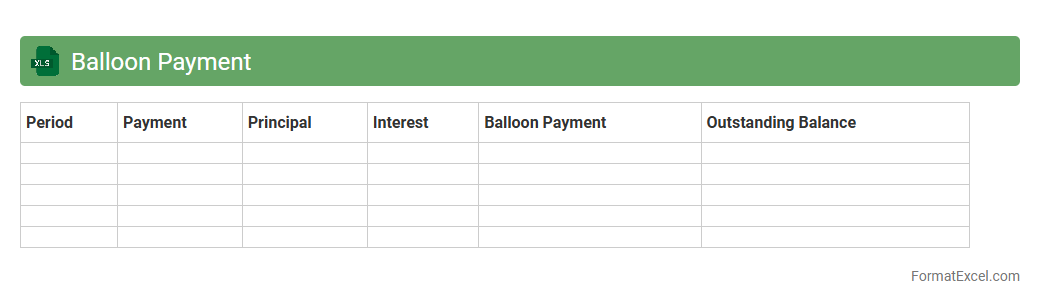

Balloon Payment

A

Balloon Payment Excel document is a financial tool designed to calculate and schedule large final payments in loans or mortgages, where periodic payments are lower and a substantial payment is due at the end. This document is useful for borrowers and lenders to clearly understand payment timelines, interest accumulation, and outstanding balances, enabling effective financial planning and cash flow management. By automating complex calculations, it reduces errors and saves time when evaluating different loan scenarios.

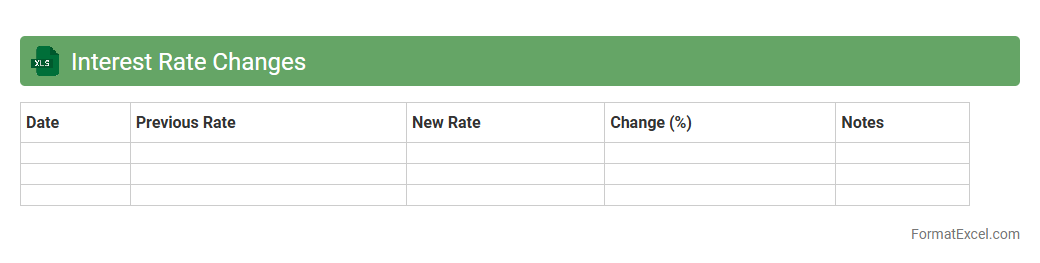

Interest Rate Changes

An

Interest Rate Changes Excel document tracks historical and current fluctuations in interest rates, enabling users to analyze trends and forecast future movements. It is useful for financial planning, investment decisions, and budgeting by providing clear insights into borrowing costs and returns on savings. By organizing complex rate data into an accessible format, it enhances accuracy and efficiency in economic and portfolio management.

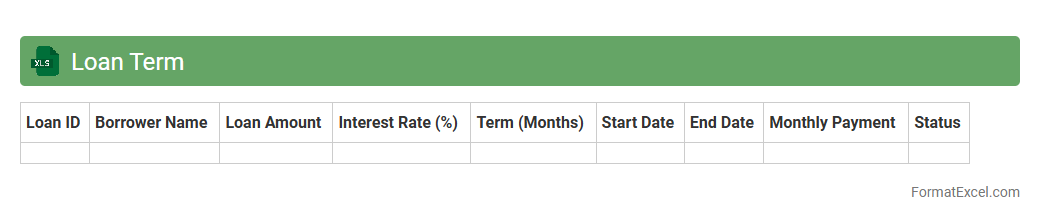

Loan Term

A

Loan Term Excel document is a spreadsheet tool designed to track and calculate the duration, interest rates, payment schedules, and amortization details of a loan. It helps users efficiently manage loan repayment plans by providing clear visibility into payment timelines and outstanding balances. This document is essential for budgeting, financial planning, and ensuring timely loan repayment.

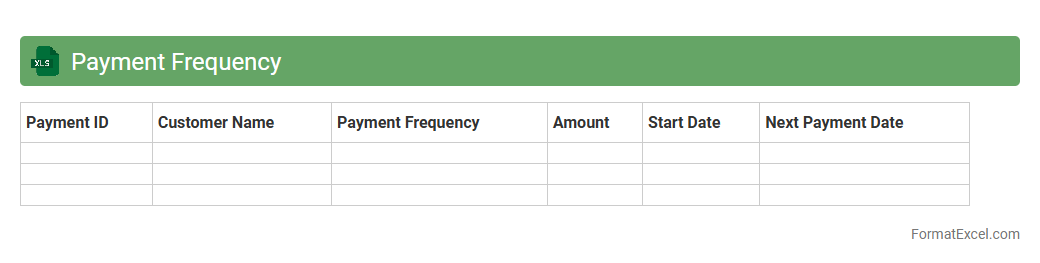

Payment Frequency

A

Payment Frequency Excel document is a spreadsheet tool designed to track and manage the schedule of payments, such as monthly, quarterly, or annual installments. It helps users organize billing cycles, forecast cash flow, and ensure timely payment processing by clearly outlining payment dates and amounts. This document is essential for businesses and individuals aiming to maintain accurate financial records and enhance budget planning efficiency.

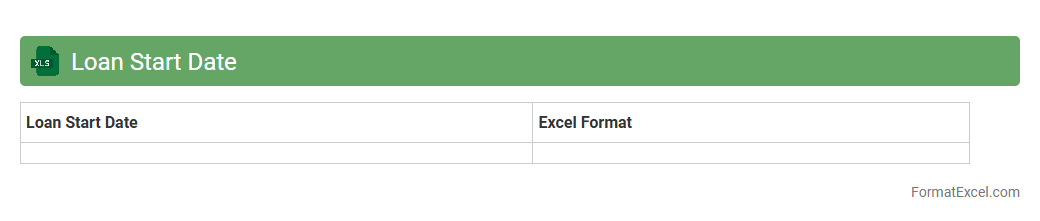

Loan Start Date

The

Loan Start Date Excel document records the exact date a loan agreement becomes active, serving as a critical reference for tracking repayment schedules and calculating interest accrual. This spreadsheet allows users to manage loan timelines efficiently, ensuring timely payments and accurate financial forecasting. By centralizing loan start information, it simplifies monitoring multiple loans and supports compliance with contractual obligations.

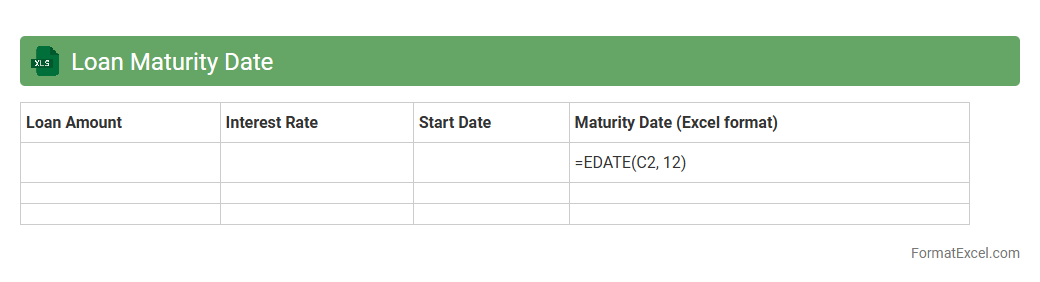

Loan Maturity Date

A

Loan Maturity Date Excel document tracks the exact date when a loan must be fully repaid, allowing users to manage repayment schedules efficiently. It helps borrowers and lenders monitor due dates, ensuring timely payments and avoiding penalties or defaults. By consolidating loan details in a structured format, this tool supports financial planning and improves cash flow management.

Introduction to Loan Amortization Schedules

A loan amortization schedule is a detailed table that outlines each loan payment, breaking down the principal and interest components. It helps borrowers understand how their loan balance decreases over time. This schedule is essential for managing long-term debt effectively.

Importance of Loan Amortization in Financial Planning

Loan amortization plays a crucial role in financial planning by providing clear visibility of payment timelines and interest costs. It enables individuals to budget accurately and plan for loan payoff. Understanding amortization enhances financial discipline and decision-making.

Key Components of an Amortization Schedule

An effective amortization schedule includes the payment date, payment amount, interest portion, principal portion, and remaining balance. These components collectively give a complete picture of loan repayment progression. Accuracy in these details facilitates better loan management.

Benefits of Using Excel for Amortization Calculations

Excel offers a flexible platform to create customizable loan amortization schedules with automated calculations. It saves time and reduces errors compared to manual methods. Additionally, Excel allows easy adjustments to loan terms and payment structures.

Step-by-Step Guide to Creating a Loan Amortization Schedule in Excel

Start by entering loan details like principal, interest rate, and term into Excel. Use formulas to calculate monthly payments and split each payment into interest and principal. Finally, drag formulas down the rows to generate the full amortization schedule.

Essential Formulas for Loan Amortization in Excel

The PMT function calculates fixed loan payments, while IPMT and PPMT functions separate interest and principal portions of each payment. These formulas are fundamental for accurate amortization schedules. Mastering them ensures precise financial analysis.

Customizing Your Amortization Schedule Format

Excel allows customization such as adjusting payment frequency, adding extra payments, or changing date formats. Tailoring the format helps meet specific financial goals and reporting preferences. This flexibility enhances usability and clarity.

Common Mistakes to Avoid in Excel Amortization Templates

Avoid errors like incorrect formula references, inconsistent date ranges, and failing to lock cells with absolute references. These common mistakes can distort the amortization results and mislead financial decisions. Regular checks and testing help maintain accuracy.

Downloadable Loan Amortization Excel Templates

Many websites offer free and paid downloadable Excel templates for loan amortization schedules. These templates speed up the setup process and provide prebuilt formulas. Using reliable templates reduces the risk of calculation errors.

Frequently Asked Questions on Amortization Schedules in Excel

Common queries include how to handle extra payments, how to create bi-weekly schedules, and how to update loan terms mid-schedule. Understanding these FAQs ensures users can optimize their amortization schedules for real-life loan adjustments. Comprehensive guides and tutorials are widely available.