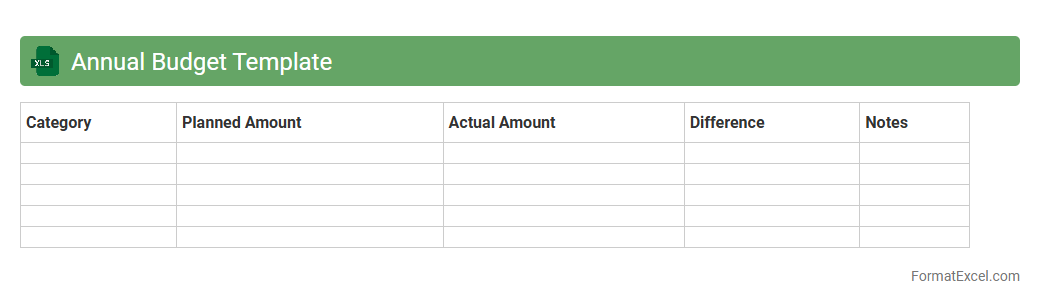

Annual Budget Template

An

Annual Budget Template Excel document is a structured spreadsheet designed to help individuals or organizations plan and track their income, expenses, and financial goals over a fiscal year. It provides a clear overview of monthly and yearly financial allocations, enabling better decision-making and resource management. Using this template improves financial discipline, aids in identifying cost-saving opportunities, and ensures alignment with strategic objectives.

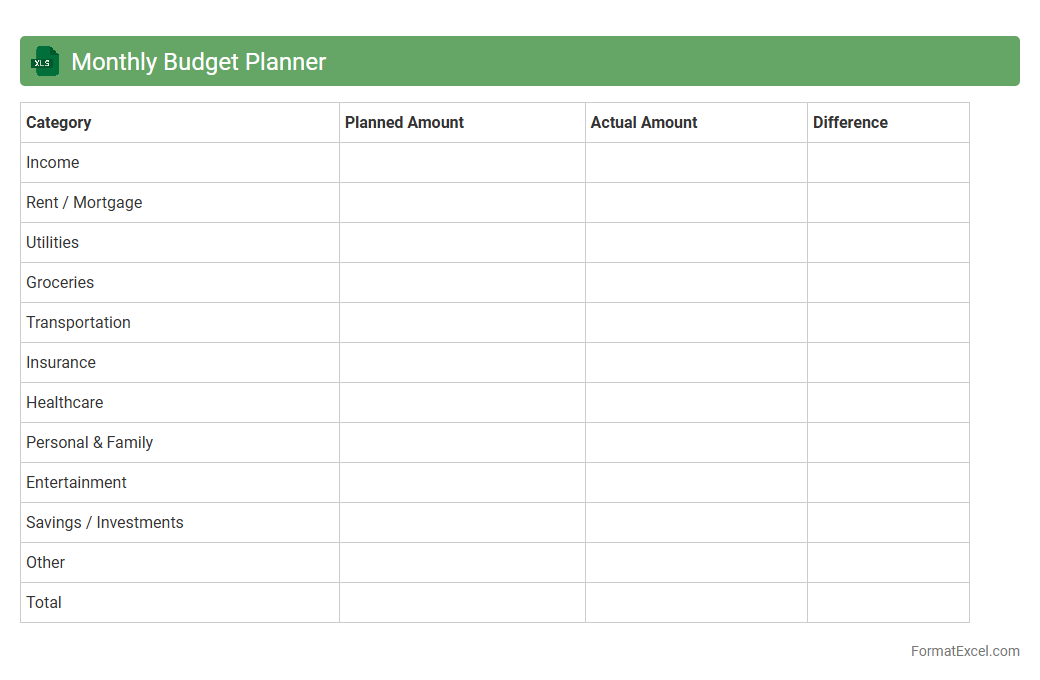

Monthly Budget Planner

A

Monthly Budget Planner Excel document is a structured spreadsheet designed to track and manage income, expenses, and savings on a monthly basis. It allows users to set financial goals, categorize spending, and analyze budget variances to maintain control over personal or business finances. Using this tool improves financial discipline, enhances decision-making, and helps avoid overspending.

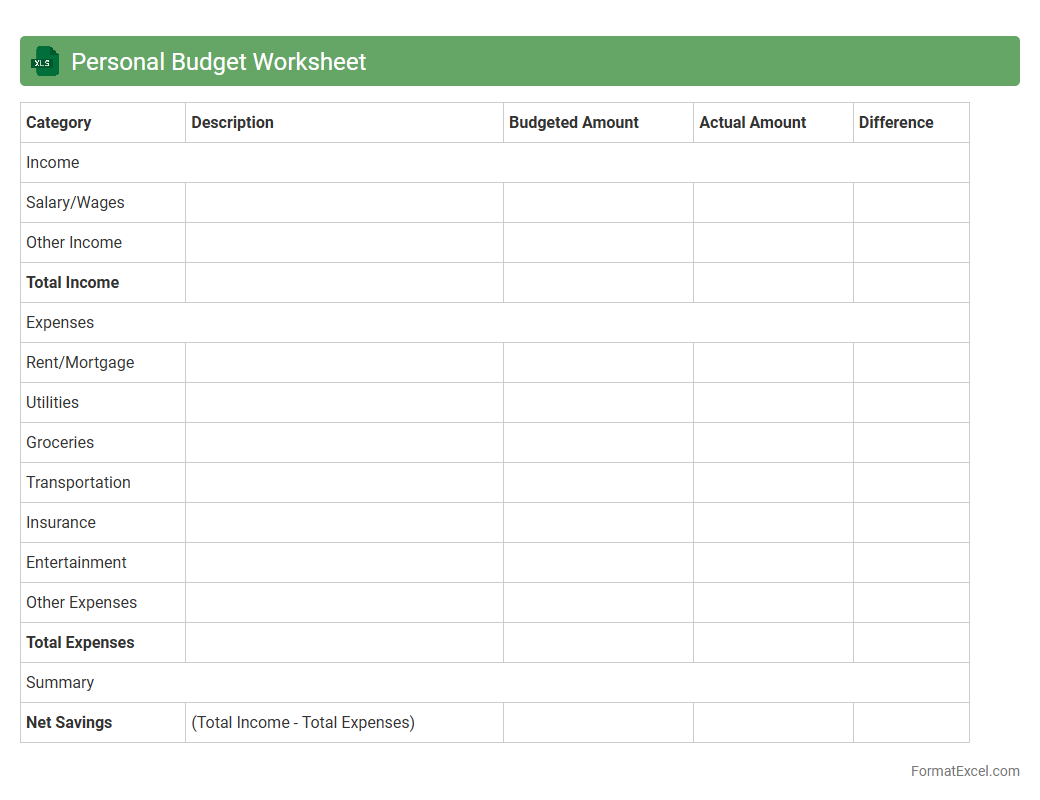

Personal Budget Worksheet

A

Personal Budget Worksheet Excel document is a structured spreadsheet designed to track income, expenses, and savings efficiently. It helps users monitor their financial habits, identify spending patterns, and plan for future financial goals with ease. By organizing financial data in one place, this tool supports better budgeting decisions and improves overall money management.

Departmental Budget Tracker

A

Departmental Budget Tracker Excel document is a financial management tool designed to monitor and control expenditures within specific departments. It helps track budget allocations, actual spending, and remaining funds in real-time, enabling precise financial planning and preventing overspending. This tool enhances transparency, improves accountability, and supports data-driven decision-making for effective resource allocation.

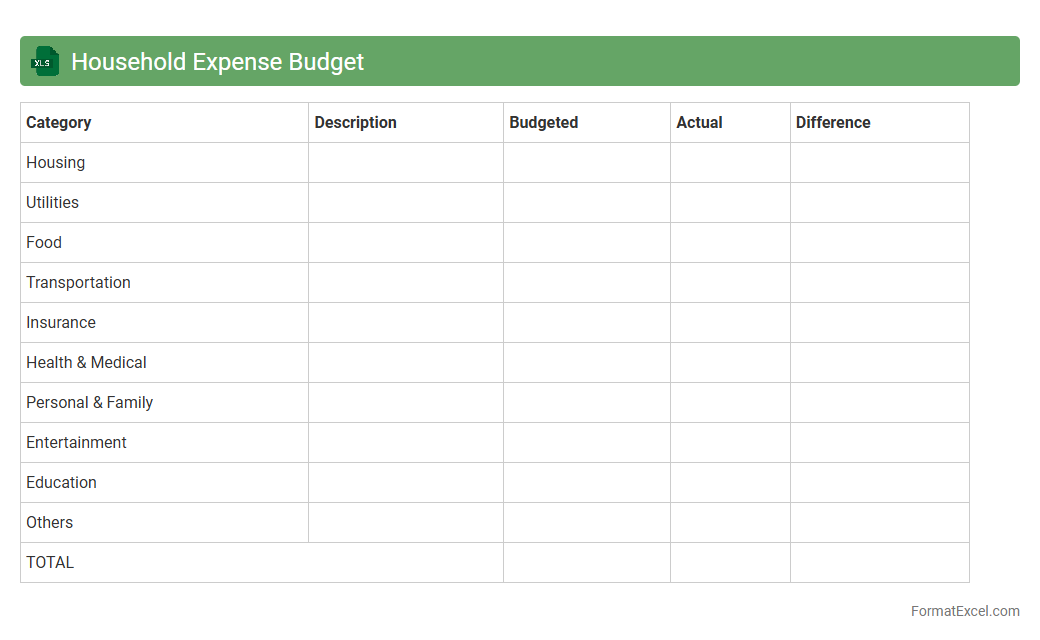

Household Expense Budget

A

Household Expense Budget Excel document is a structured spreadsheet designed to track and manage monthly income and expenditures, helping users categorize costs such as utilities, groceries, and entertainment. It allows for detailed financial analysis, enabling individuals to identify spending patterns, control unnecessary expenses, and plan savings effectively. By using formulas and charts, this tool facilitates clear visualization of cash flow, aiding in smarter financial decisions and long-term budget planning.

Event Budget Spreadsheet

An

Event Budget Spreadsheet Excel document is a comprehensive tool designed to track and manage all financial aspects of an event, including expenses, income, and allocations. It provides a clear overview of budget categories such as venue, catering, marketing, and logistics, enabling accurate cost control and efficient resource allocation. Utilizing this spreadsheet helps prevent overspending, ensures transparency, and facilitates better financial planning for successful event execution.

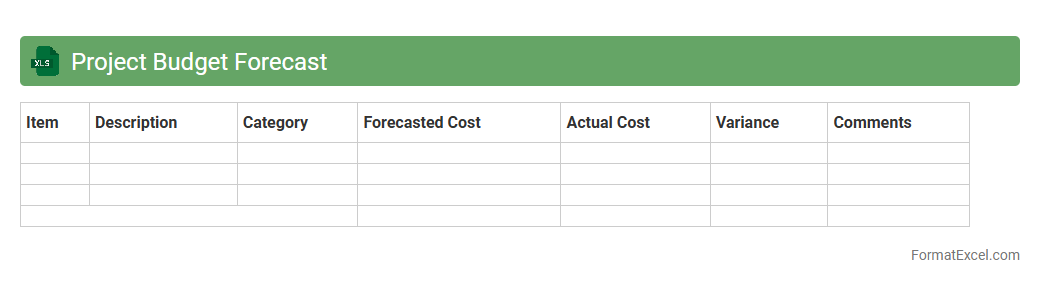

Project Budget Forecast

A

Project Budget Forecast Excel document is a spreadsheet tool designed to estimate and track anticipated project expenses and revenues over time. It helps project managers allocate resources efficiently, monitor financial performance, and identify potential budget overruns before they occur. Utilizing this document improves decision-making and ensures projects stay aligned with financial goals.

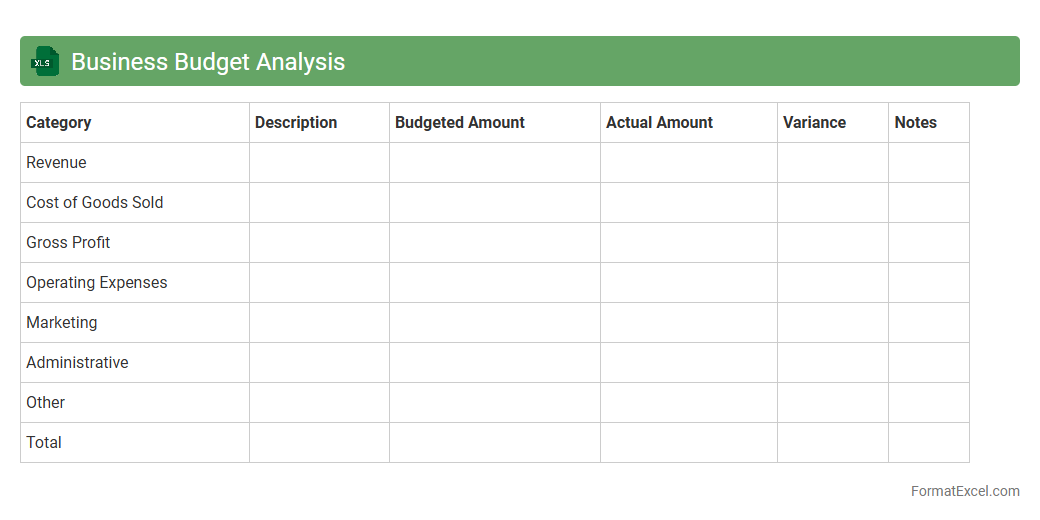

Business Budget Analysis

A

Business Budget Analysis Excel document is a comprehensive tool designed to track, manage, and evaluate financial performance by comparing actual expenses and revenues against budgeted amounts. It helps businesses identify variances, optimize resource allocation, and make informed decisions to improve profitability. Using this document enhances financial transparency, supports strategic planning, and ensures better control of cash flow and operational costs.

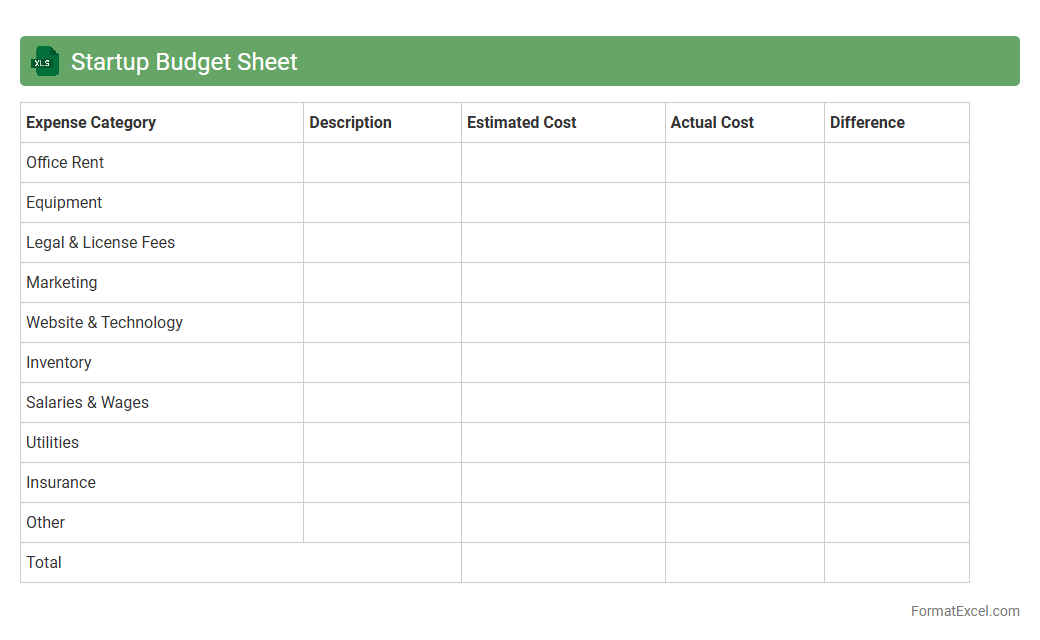

Startup Budget Sheet

A

Startup Budget Sheet Excel document is a financial planning tool designed to help entrepreneurs outline and manage their initial expenses and revenue projections. It organizes costs such as equipment, marketing, salaries, and operational expenses, enabling accurate cash flow forecasting. Using this sheet promotes efficient resource allocation and informed decision-making, crucial for maintaining financial stability during the early phases of a startup.

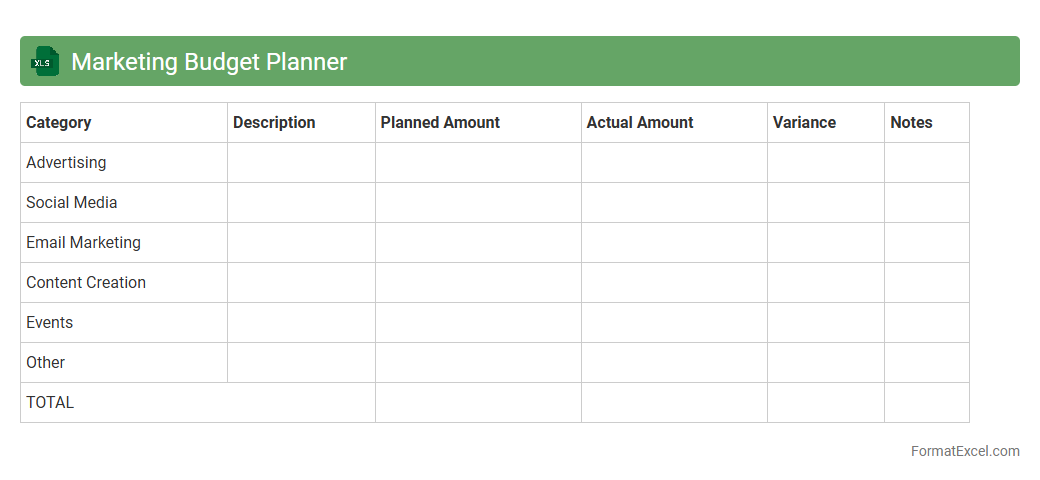

Marketing Budget Planner

A

Marketing Budget Planner Excel document is a structured spreadsheet designed to help businesses allocate, track, and manage marketing expenses effectively. It provides a clear overview of planned versus actual spending across various marketing channels, ensuring budget adherence and optimized resource allocation. This tool enhances financial transparency and aids in making informed decisions to maximize return on investment (ROI) in marketing campaigns.

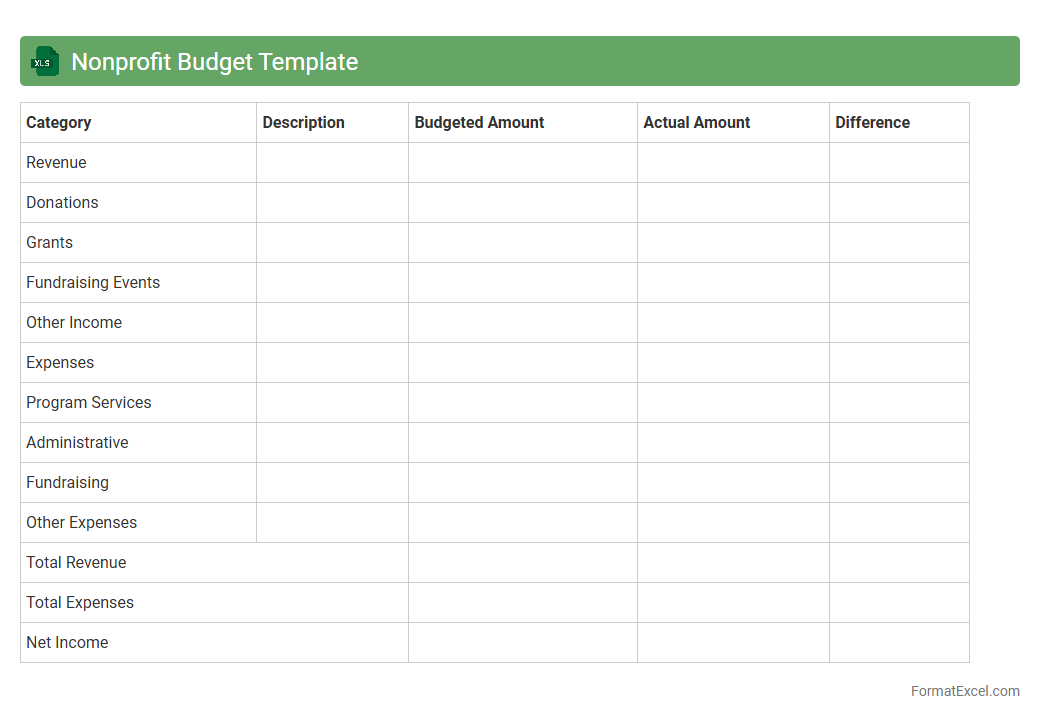

Nonprofit Budget Template

A

Nonprofit Budget Template Excel document is a structured spreadsheet designed to help organizations plan, track, and manage their financial resources effectively. It provides categories for income, expenses, and funding sources, allowing for clear visualization of budget allocations and financial forecasting. This tool is essential for maintaining transparency, ensuring fiscal responsibility, and supporting strategic decision-making within nonprofit operations.

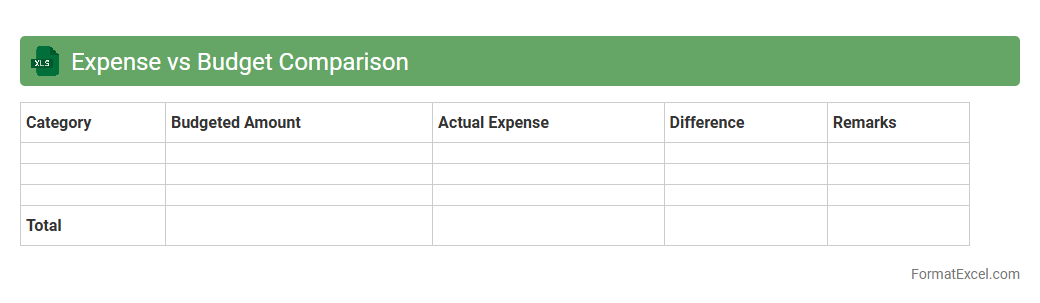

Expense vs Budget Comparison

An

Expense vs Budget Comparison Excel document tracks actual spending against planned budgets, helping identify variances and control costs effectively. It enables users to monitor financial performance, allocate resources accurately, and make informed decisions to avoid overspending. This tool is essential for businesses and individuals aiming to maintain financial discipline and achieve budgeting goals.

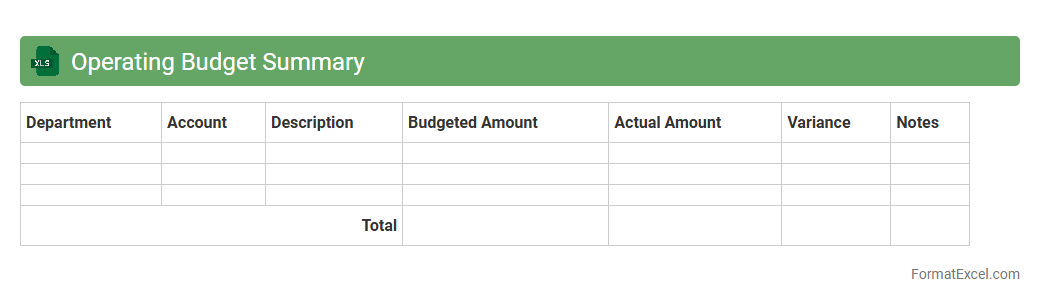

Operating Budget Summary

An

Operating Budget Summary Excel document consolidates projected revenues and expenses to provide a clear financial overview for a specific period. It helps organizations track budget performance, identify cost-saving opportunities, and make informed financial decisions. This tool enhances budgeting accuracy and supports strategic planning by offering real-time data analysis and reporting capabilities.

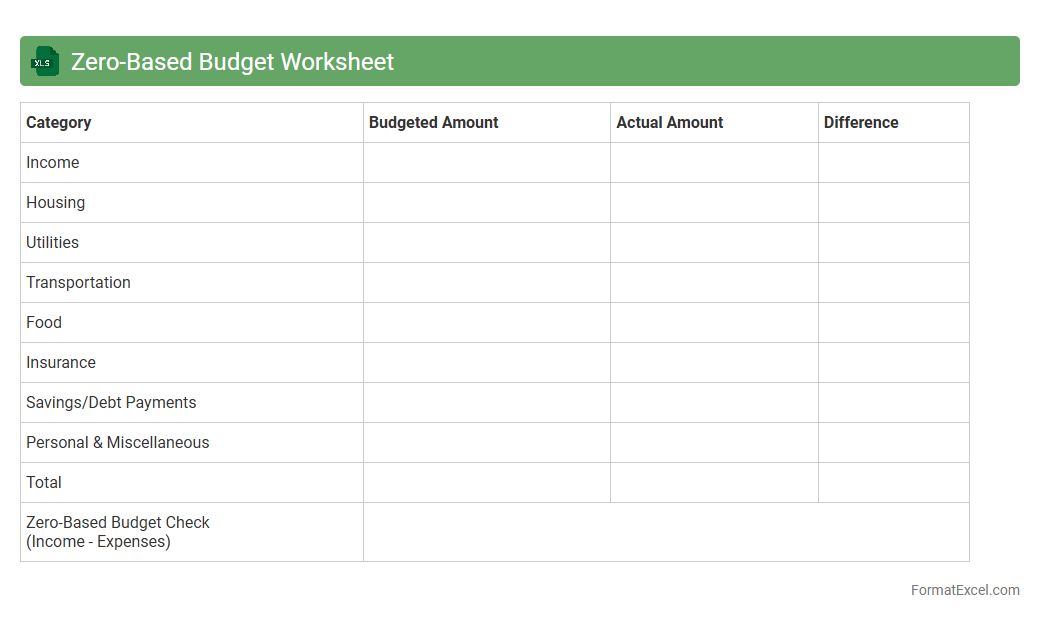

Zero-Based Budget Worksheet

A

Zero-Based Budget Worksheet in Excel is a financial tool that helps individuals or businesses allocate every dollar of income to specific expenses, savings, or debt payments, ensuring the total income minus expenditures equals zero. This method promotes precise financial planning by preventing overspending and encouraging mindful allocation of resources. Using this document enhances budget transparency, improves cash flow management, and supports achieving financial goals effectively.

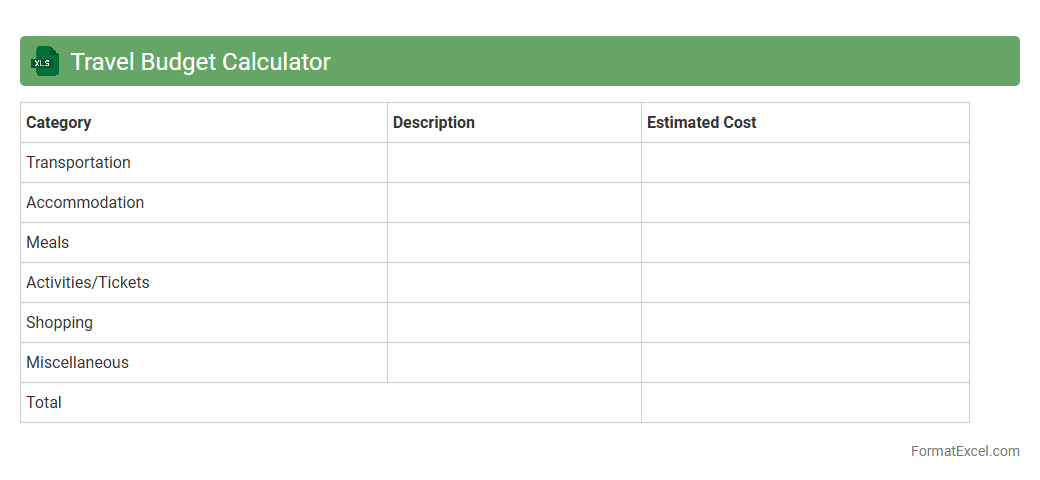

Travel Budget Calculator

A

Travel Budget Calculator Excel document is a tool designed to help users plan and manage their travel expenses efficiently by organizing costs such as accommodation, transportation, meals, and activities in a structured spreadsheet format. It enables accurate budget tracking, expense categorization, and forecasting, reducing the risk of overspending during trips. This calculator is invaluable for travelers seeking to maximize their financial control and ensure a stress-free travel experience.

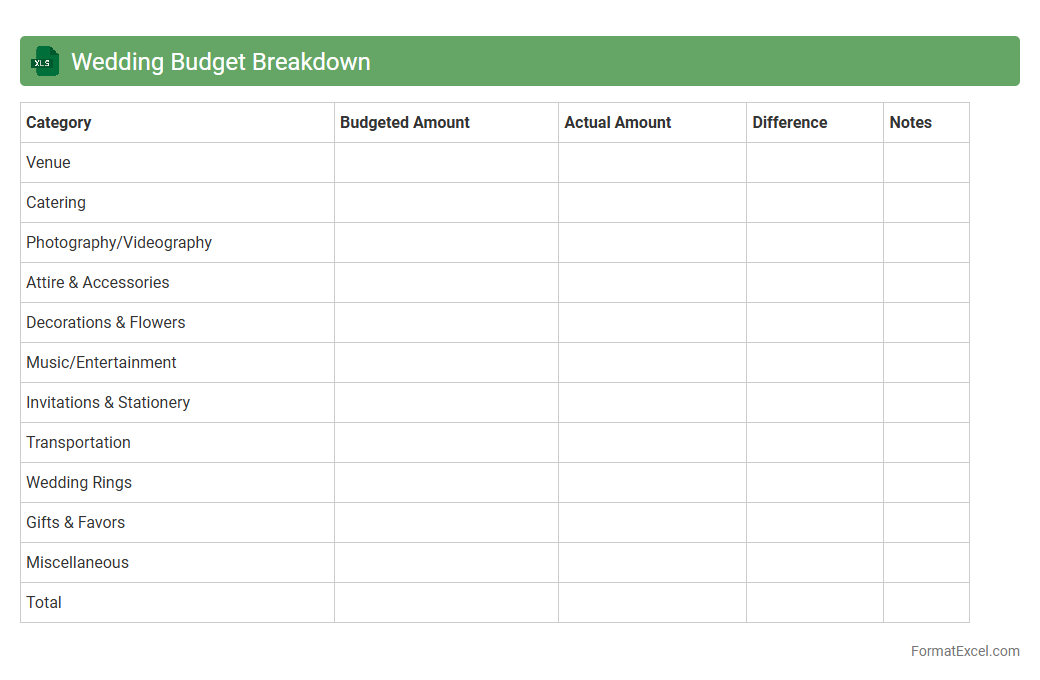

Wedding Budget Breakdown

A

Wedding Budget Breakdown Excel document organizes all wedding expenses into clear categories, making financial planning manageable and transparent. It helps track costs such as venue, catering, attire, and decorations, ensuring no detail is overlooked and overspending is avoided. This tool provides a comprehensive overview of the total budget, payments made, and remaining balances, facilitating effective money management for a stress-free wedding preparation.

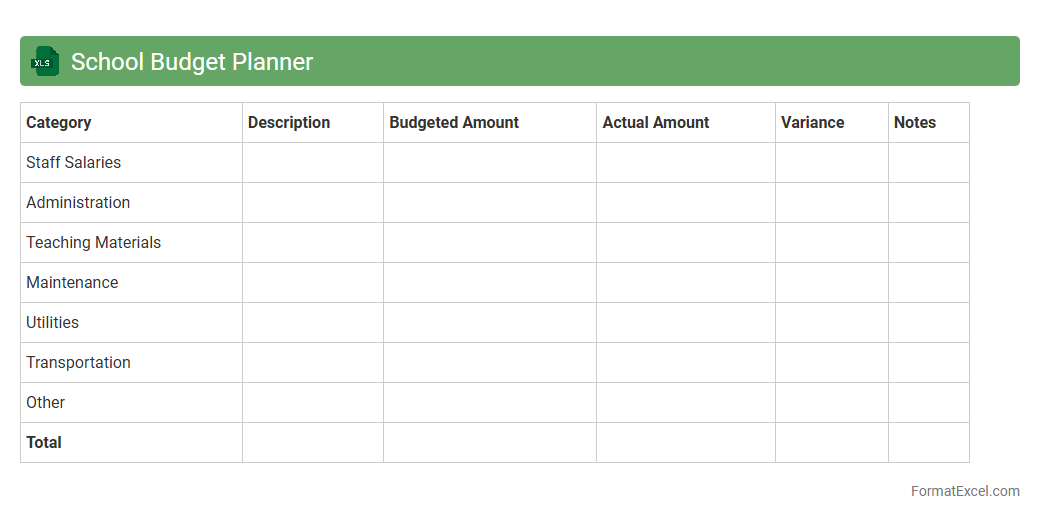

School Budget Planner

A

School Budget Planner Excel document is a comprehensive tool designed to organize and track school financial resources efficiently. It allows educators and administrators to allocate funds, monitor expenses, and forecast future budgets with clarity and accuracy. Using this planner facilitates informed decision-making, ensuring optimal use of available resources and maintaining financial transparency.

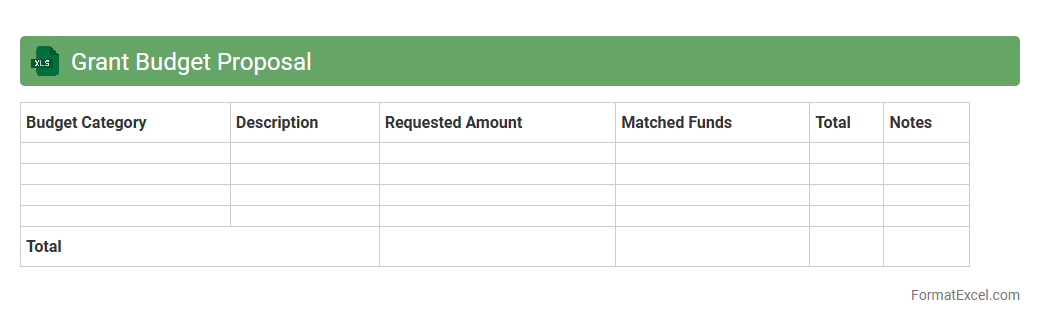

Grant Budget Proposal

A

Grant Budget Proposal Excel document is a structured spreadsheet designed to outline detailed financial plans for grant applications, including estimated costs, funding sources, and expense categories. It helps organizations organize and present their budget clearly to funding agencies, ensuring transparency and accuracy in financial requests. Utilizing this tool streamlines budget preparation, facilitates financial tracking, and increases the likelihood of securing grant approval.

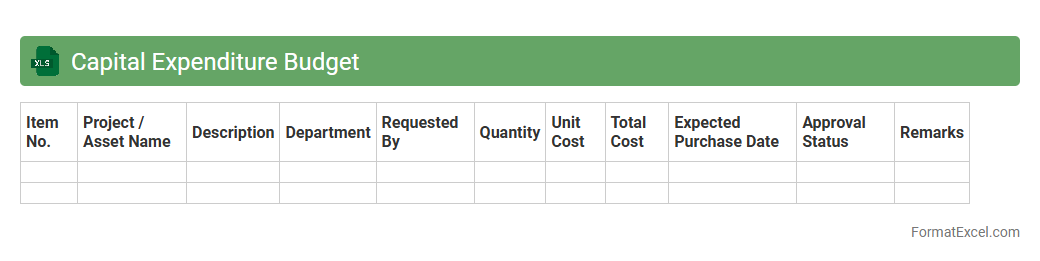

Capital Expenditure Budget

A

Capital Expenditure Budget Excel document is a financial planning tool used to forecast and manage large investments in assets like equipment, property, or infrastructure. It helps organizations allocate funds efficiently, track spending against planned budgets, and ensure long-term strategic growth. This document improves decision-making by providing clear visibility into anticipated capital costs and cash flow requirements.

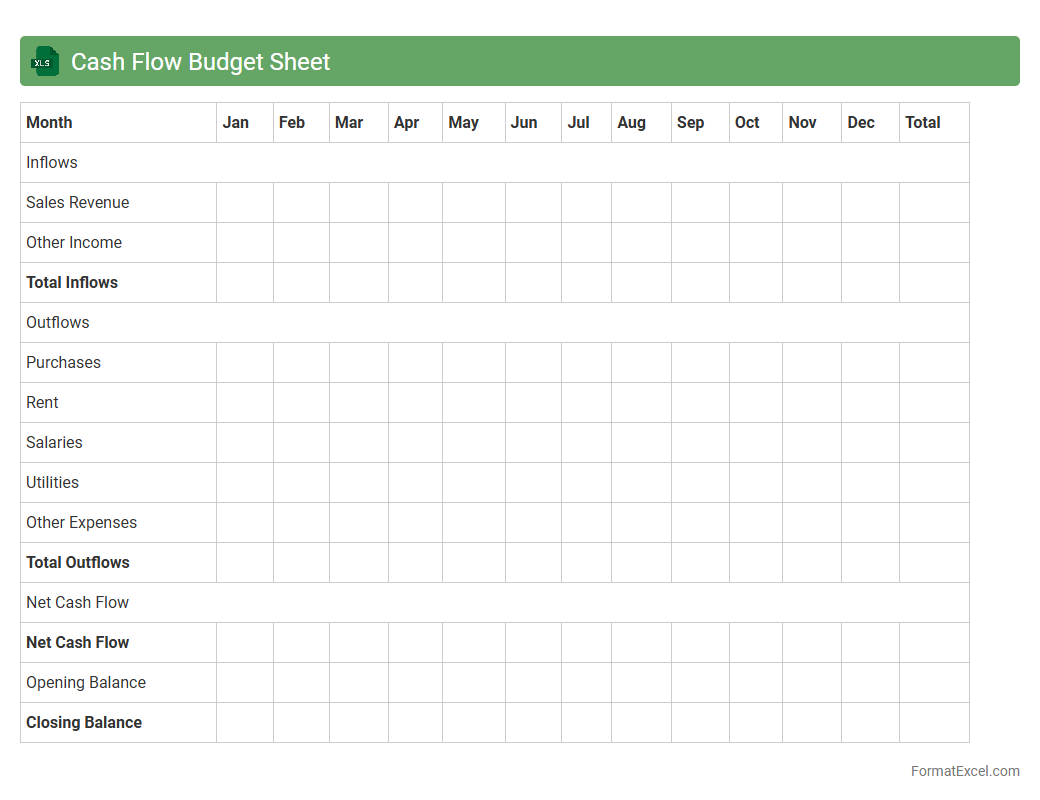

Cash Flow Budget Sheet

A

Cash Flow Budget Sheet in Excel is a financial tool that tracks and forecasts the inflow and outflow of cash within a specific period. It helps businesses and individuals manage liquidity by ensuring they have enough cash to cover expenses and avoid shortfalls. Using this document improves financial planning, aids in identifying potential cash deficits, and supports better decision-making for investments and expenditures.

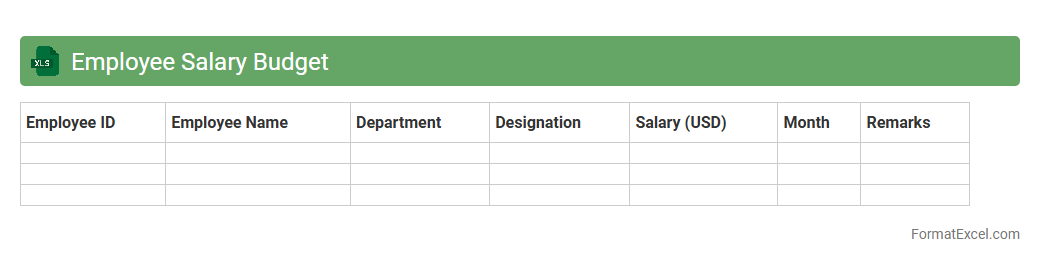

Employee Salary Budget

An

Employee Salary Budget Excel document is a structured spreadsheet designed to plan, track, and manage employee compensation expenses within an organization. It allows HR and finance teams to allocate salary resources efficiently, forecast payroll costs, and ensure budget compliance while adjusting for raises, bonuses, and new hires. By providing clear visibility into salary distributions and projections, this tool supports informed decision-making and financial planning.

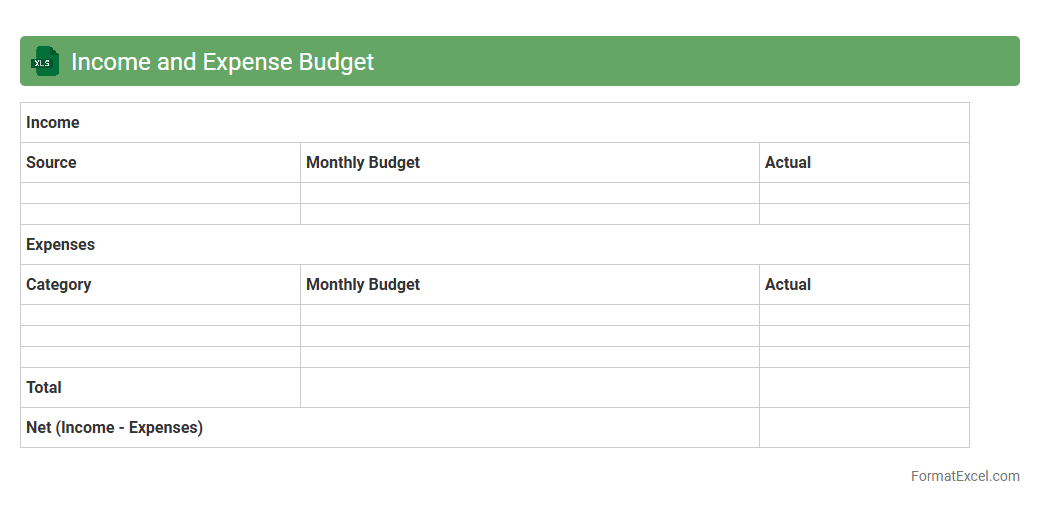

Income and Expense Budget

An

Income and Expense Budget Excel document is a financial planning tool used to track and manage personal or business revenues and expenditures. It helps users organize income sources and categorize expenses, providing a clear overview of cash flow and enabling better financial decision-making. By regularly updating this budget, individuals and organizations can monitor spending patterns, control costs, and achieve their savings or financial goals effectively.

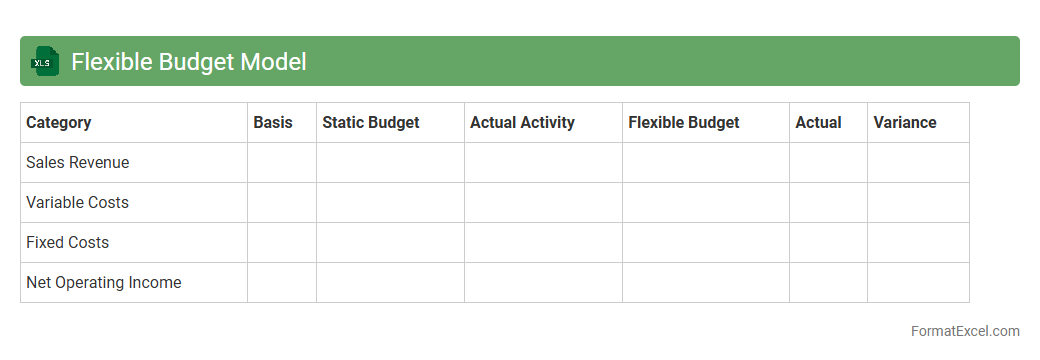

Flexible Budget Model

A

Flexible Budget Model in Excel allows businesses to create adaptable financial plans that adjust based on varying levels of activity or sales volume. This dynamic tool helps track actual performance against budgeted targets, enhancing accuracy in cost control and forecasting. By using Excel's calculation and data visualization features, users can quickly analyze budget variances and make informed decisions to optimize resource allocation.

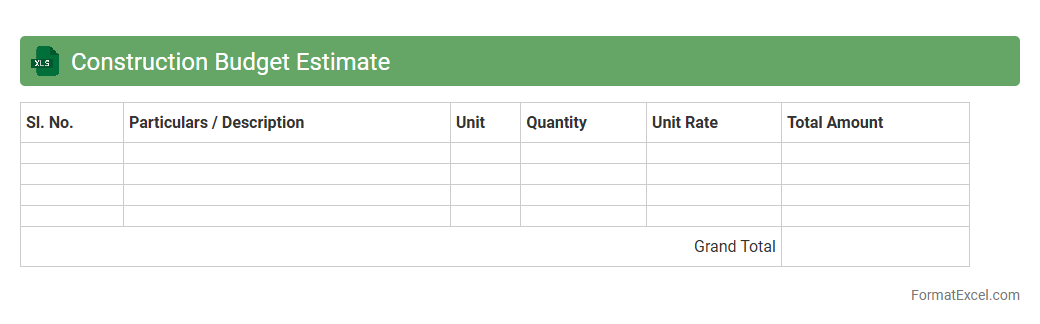

Construction Budget Estimate

A

Construction Budget Estimate Excel document is a detailed spreadsheet tool designed to forecast and track the costs associated with a construction project, including materials, labor, equipment, and contingencies. It helps project managers and contractors plan financial resources effectively, monitor expenses in real-time, and ensure the project stays within the approved budget. By providing clear visibility into cost distribution, this document minimizes the risk of overspending and supports informed decision-making throughout the construction process.

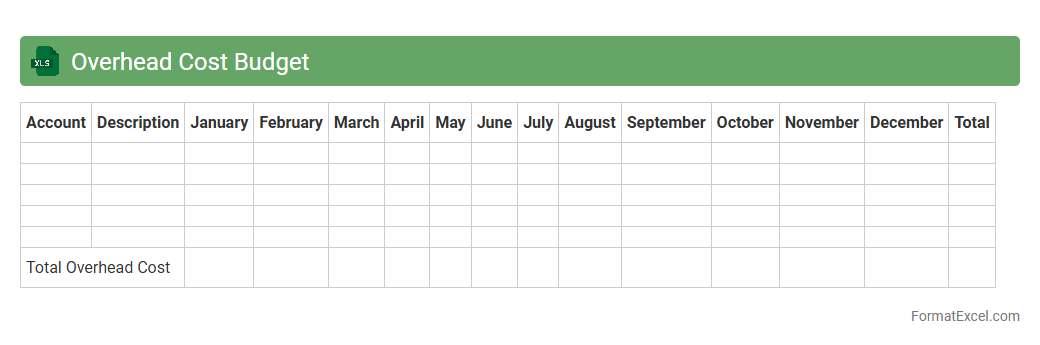

Overhead Cost Budget

The

Overhead Cost Budget Excel document is a detailed financial planning tool that helps businesses track and manage indirect expenses such as utilities, rent, and administrative costs. It enables accurate forecasting and control of overhead expenditures by organizing data into clear categories and providing formulas for automatic calculations. This tool is essential for improving cost efficiency, supporting budgeting decisions, and ensuring financial stability in business operations.

Introduction to Budget Format in Excel

The budget format in Excel provides a structured way to track income and expenses efficiently. It allows users to organize financial data clearly for better decision-making. Excel's flexibility makes it a top choice for individuals and businesses alike.

Importance of Using Excel for Budgeting

Using Excel for budgeting ensures precise calculations and easy data manipulation. The platform supports automated updates and real-time tracking of financial goals. This reduces errors and provides a comprehensive overview of finances.

Key Components of an Excel Budget Sheet

A robust Excel budget sheet includes income sources, expense categories, and savings targets. The expense tracking section is crucial for monitoring outflows thoroughly. Proper categorization helps in analyzing spending patterns effectively.

Step-by-Step Guide to Creating a Budget Format in Excel

Start by listing all income and expense categories in columns. Next, input estimated and actual figures to compare budget versus spending. Using formulas, calculate totals and variances for ongoing tracking.

Essential Excel Formulas for Budget Management

Key formulas include SUM for totals, IF for conditional calculations, and VLOOKUP for data retrieval. These formulas enhance automation and accuracy in budget tracking. Mastering them simplifies financial analysis.

Customizing Your Excel Budget Template

Adjust the template by adding categories or columns relevant to your financial situation. Use conditional formatting to highlight budget overruns dynamically. Customization ensures the budget fits your unique financial needs.

Visualizing Budgets with Charts and Graphs

Excel's chart tools help visualize income, expenses, and savings trends clearly. Using pie charts and bar graphs provides quick insights into budget allocation. Visual representation aids better financial decision-making.

Common Mistakes in Excel Budgeting and How to Avoid Them

Avoid missing entries and outdated information to maintain accuracy. Incorrect formula usage can skew results, so double-check your calculations. Regular updates prevent discrepancies and keep budgets reliable.

Free and Paid Excel Budget Templates

Both free and premium Excel templates offer various features to suit budget needs. Free versions provide basic functionality, while paid templates include advanced tracking and analysis tools. Choose one that matches your budgeting complexity.

Tips for Maintaining and Updating Your Excel Budget

Regularly input financial transactions to keep the budget current. Review your budget monthly to adjust for changes in income or expenses. Consistent updates ensure the budget remains a useful financial management tool.