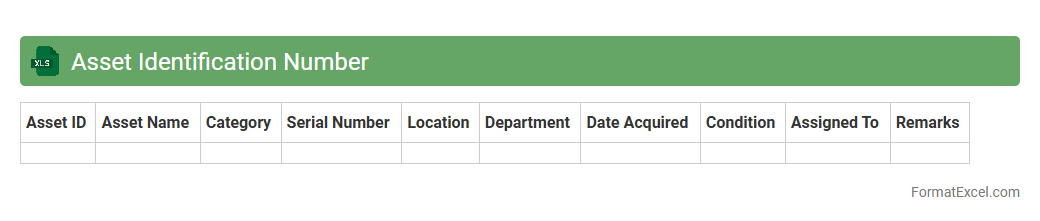

Asset Identification Number

An

Asset Identification Number Excel document serves as a structured spreadsheet used to catalog and manage unique identifiers assigned to company assets, such as equipment, machinery, or IT devices. This document facilitates efficient tracking, maintenance scheduling, and auditing by consolidating asset details like purchase date, location, and condition in an easily accessible format. Leveraging this Excel tool enhances inventory control, reduces asset loss, and supports accurate financial reporting and compliance.

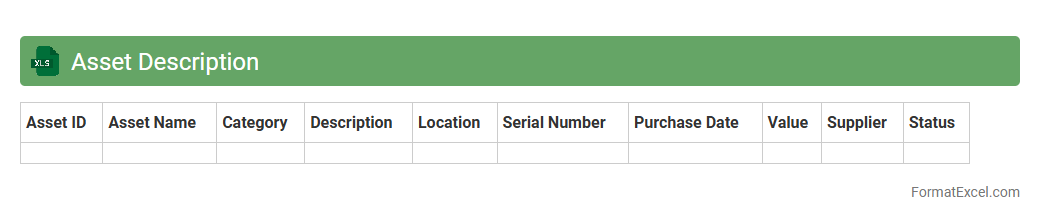

Asset Description

An

Asset Description Excel document organizes detailed information about assets, including specifications, locations, and maintenance schedules, in a structured format. It enhances asset management by enabling easy tracking, updating, and analysis, which improves decision-making and operational efficiency. Companies use this document to maintain accurate records, streamline audits, and optimize resource allocation for asset lifecycle management.

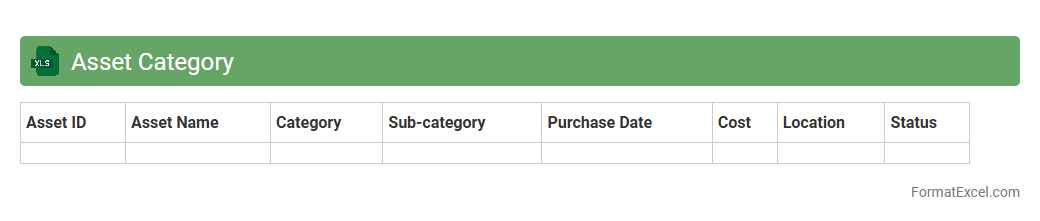

Asset Category

An

Asset Category Excel document organizes assets into specific groups based on characteristics such as type, value, or usage, enabling streamlined asset management. It allows users to track, analyze, and report on assets efficiently, improving decision-making and financial planning. By maintaining a clear structure of asset categories, organizations can optimize maintenance schedules and ensure accurate accounting compliance.

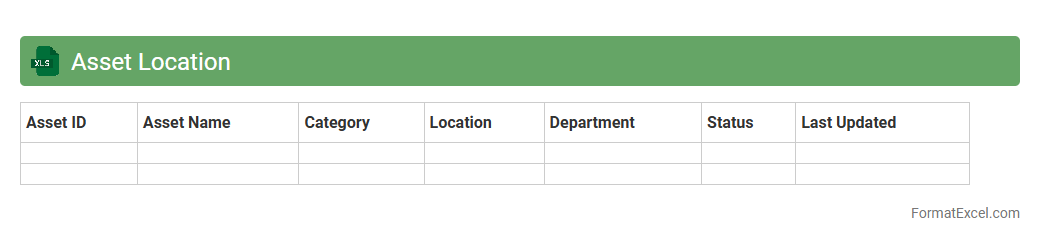

Asset Location

An

Asset Location Excel document is a structured spreadsheet used to record and track physical or digital assets along with their specific locations. It provides a centralized and easily accessible reference that helps organizations manage inventory, optimize resource allocation, and streamline maintenance processes. By maintaining accurate location data, businesses reduce the risk of asset loss and improve operational efficiency.

Purchase Date

A

Purchase Date Excel document is a spreadsheet that records the exact dates when transactions or purchases are made, enabling precise tracking of buying activities over time. It helps businesses manage inventory, monitor supplier performance, and analyze purchasing trends to optimize budgeting and cash flow. By organizing purchase dates effectively, companies can enhance accountability and support timely decision-making processes.

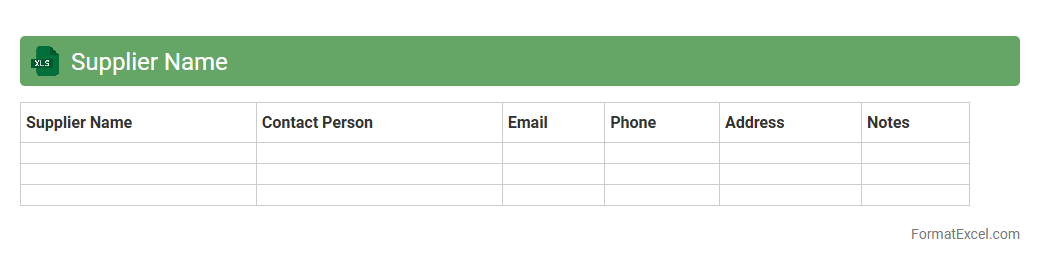

Supplier Name

A

Supplier Name Excel document is a structured spreadsheet containing detailed information about suppliers, including names, contact details, product categories, and transaction history. This document helps streamline procurement processes by enabling quick access to vendor data, facilitating supplier evaluation and comparison. It improves supply chain management efficiency, supports accurate record-keeping, and aids in tracking supplier performance and compliance.

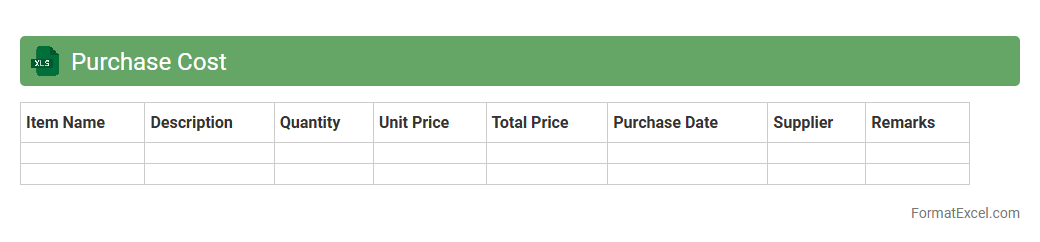

Purchase Cost

A

Purchase Cost Excel document is a detailed spreadsheet that tracks the expenses associated with acquiring goods or services, including item prices, taxes, shipping fees, and supplier details. It helps businesses monitor and control procurement budgets, ensuring cost efficiency and accuracy in financial planning. By analyzing this data, companies can identify cost-saving opportunities and improve supplier negotiations.

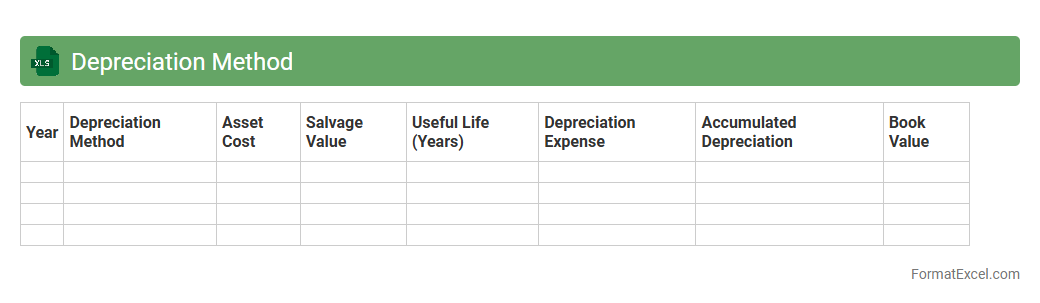

Depreciation Method

A

Depreciation Method Excel document is a spreadsheet tool designed to calculate asset depreciation using various accounting methods such as straight-line, declining balance, or sum-of-the-years'-digits. It enables accurate tracking of an asset's value reduction over time, facilitating better financial reporting and tax compliance. Businesses use this document to forecast expenses, manage budgets, and optimize asset utilization by understanding the impact of depreciation on their financial statements.

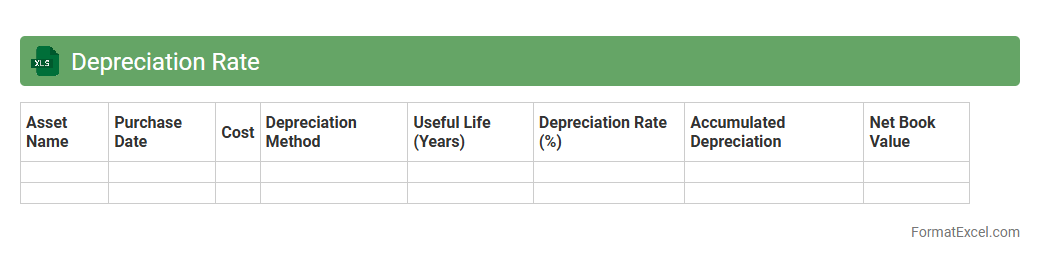

Depreciation Rate

A

Depreciation Rate Excel document is a spreadsheet tool designed to calculate the reduction in value of an asset over time, using various depreciation methods like straight-line or declining balance. It helps businesses track the book value of assets for accurate financial reporting and tax purposes. By automating these calculations, the document improves efficiency and ensures consistency in asset management.

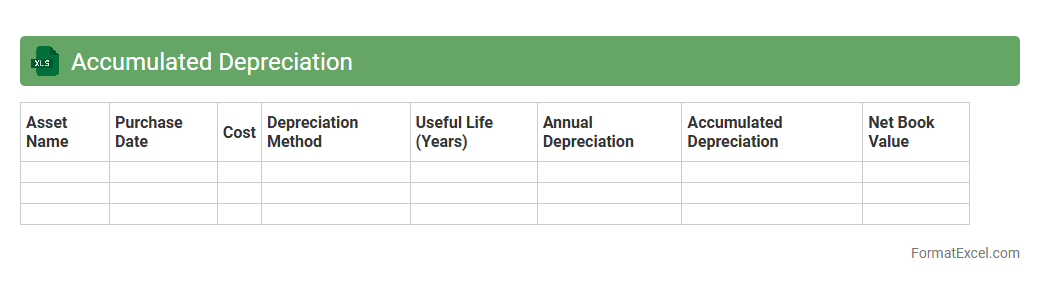

Accumulated Depreciation

An

Accumulated Depreciation Excel document tracks the total depreciation of assets over time, providing a clear view of asset value reduction in financial statements. It helps organizations calculate accurate book values, aiding in effective asset management and tax reporting. Using this document improves financial analysis, budgeting, and decision-making by offering precise historical depreciation data.

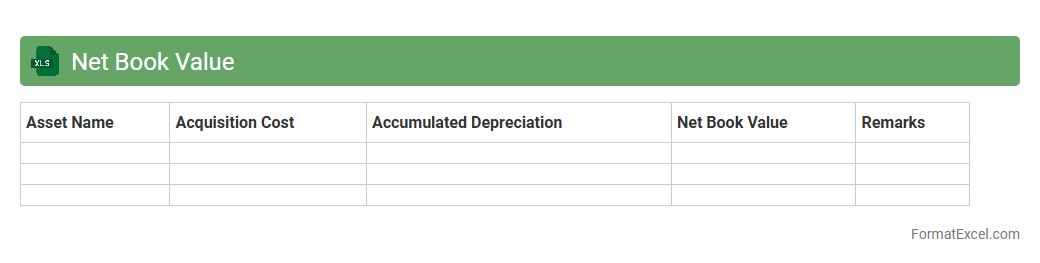

Net Book Value

Net Book Value Excel document is a financial tool designed to calculate and track the

net book value of assets by subtracting accumulated depreciation from the original purchase cost. This document helps businesses maintain accurate asset records, monitor depreciation schedules, and make informed decisions about asset management and investments. It provides clarity on the current value of fixed assets, essential for accounting, reporting, and tax purposes.

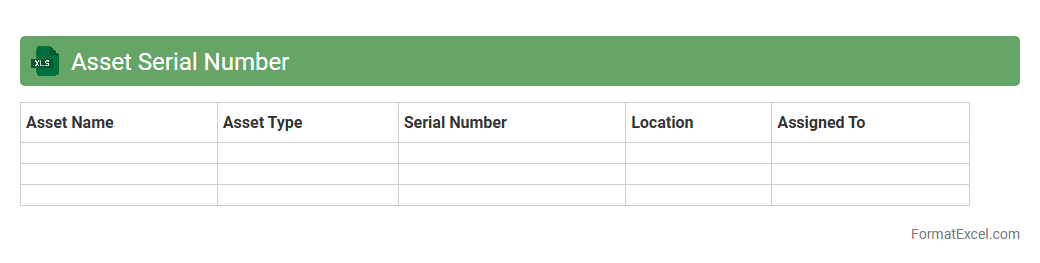

Asset Serial Number

An

Asset Serial Number Excel document is a structured spreadsheet used to catalog and track unique identifiers assigned to physical or digital assets, ensuring precise management and maintenance records. This document facilitates quick asset retrieval and verification, improves inventory accuracy, and supports efficient auditing processes by providing clear visibility of each item's serial number, status, and history. Organizations leverage this tool to minimize asset loss, streamline warranty claims, and optimize resource allocation through enhanced data organization and accessibility.

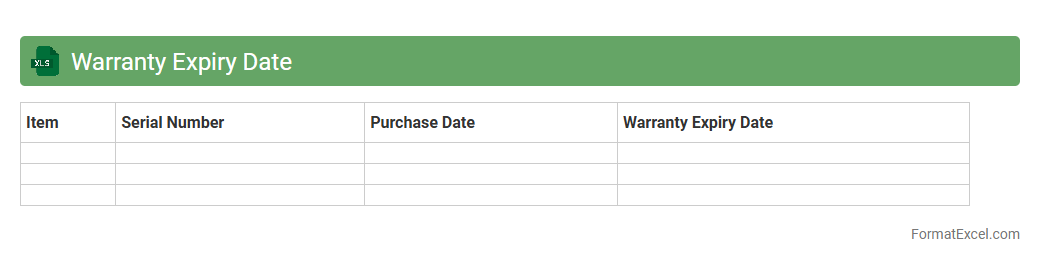

Warranty Expiry Date

The

Warranty Expiry Date Excel document is a tool designed to track the expiration dates of warranties on products, equipment, or services. It helps users manage and monitor warranty periods efficiently, preventing missed claims and reducing potential repair or replacement costs. By organizing warranty information in a clear, accessible format, this document ensures timely action and better asset management.

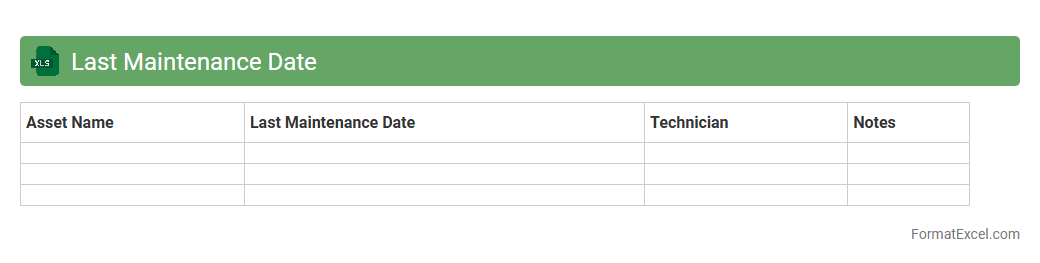

Last Maintenance Date

The

Last Maintenance Date Excel document records the most recent dates when equipment or assets underwent maintenance, ensuring accurate tracking and scheduling. This tool is essential for preventive maintenance, helping organizations avoid unexpected breakdowns and optimize asset lifespan. By analyzing this data, businesses can improve operational efficiency and reduce costly downtime.

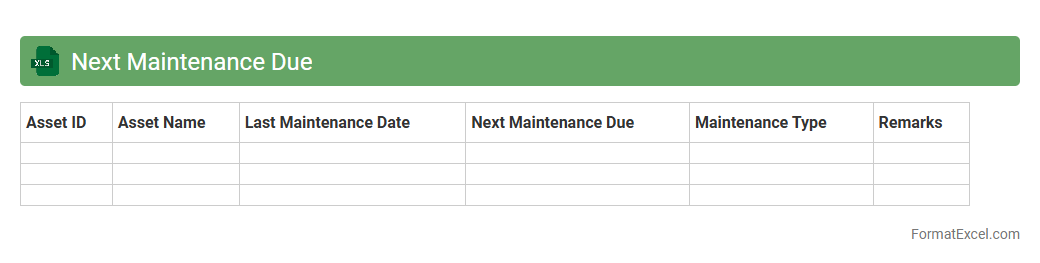

Next Maintenance Due

The

Next Maintenance Due Excel document is a structured tool designed to track and schedule upcoming maintenance tasks for equipment or systems. It helps organizations ensure timely servicing, reduce downtime, and extend the lifespan of assets by providing clear visibility into maintenance deadlines. By consolidating maintenance data in one centralized spreadsheet, it enhances operational efficiency and supports proactive asset management.

Disposal Date

A

Disposal Date Excel document is a spreadsheet used to track and manage the scheduled disposal dates of assets, inventory, or documents, ensuring compliance with organizational policies and regulatory requirements. It helps users efficiently plan asset lifecycle management, reduce storage costs, and prevent legal risks associated with holding outdated or unnecessary items. By maintaining accurate disposal dates, businesses can optimize resource allocation and improve overall operational efficiency.

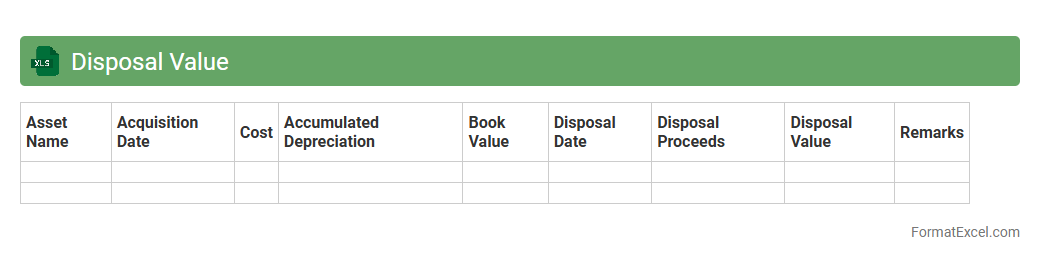

Disposal Value

A

Disposal Value Excel document is a financial tool used to estimate the residual or salvage value of an asset at the end of its useful life. It helps businesses accurately forecast the expected return from selling or disposing of an asset, aiding in depreciation calculations and investment decisions. This document is useful for asset management, budgeting, and improving the accuracy of financial planning.

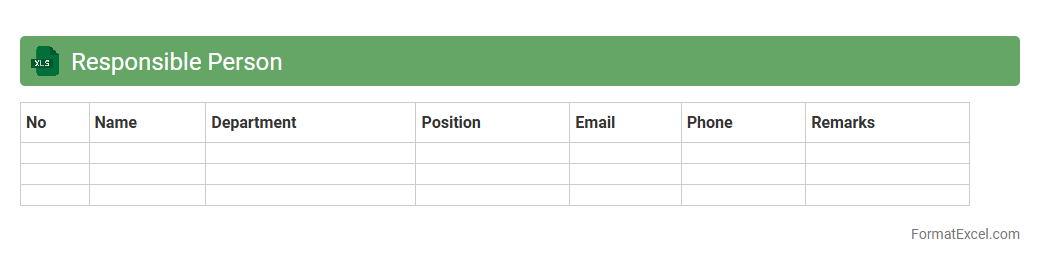

Responsible Person

The

Responsible Person Excel document is a tool designed to track and organize roles, tasks, and accountability within a project or organization. It helps clearly assign responsibilities, ensuring transparency and efficient workflow management by documenting who is accountable for specific actions. This document improves communication, reduces confusion, and enhances team coordination by providing a centralized overview of duties.

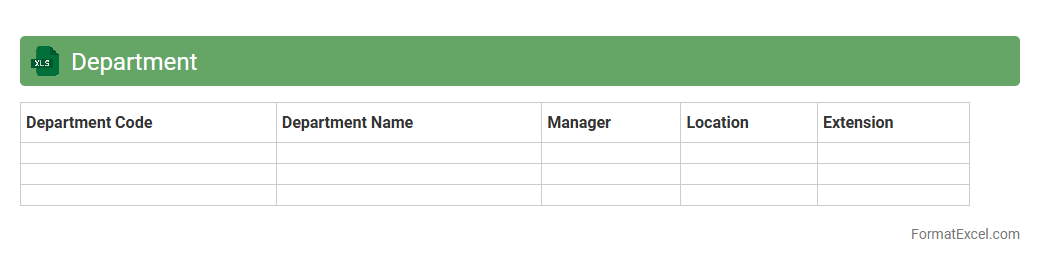

Department

A

Department Excel document is a structured spreadsheet designed to organize, analyze, and manage data related to specific departments within an organization. It streamlines tasks such as budgeting, resource allocation, performance tracking, and reporting, improving operational efficiency and decision-making. By centralizing departmental data, it enhances transparency and facilitates collaboration across teams.

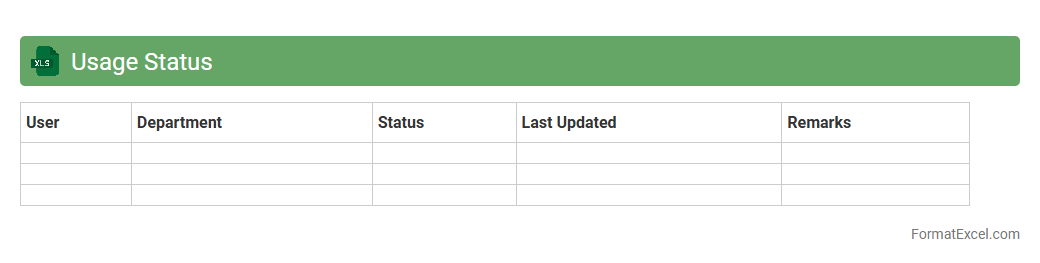

Usage Status

A

Usage Status Excel document is a spreadsheet that tracks and analyzes the consumption or utilization of resources, materials, or services over a specific period. It provides detailed insights into usage patterns, enabling efficient monitoring, cost management, and informed decision-making. This document is essential for businesses to optimize resource allocation and improve operational efficiency.

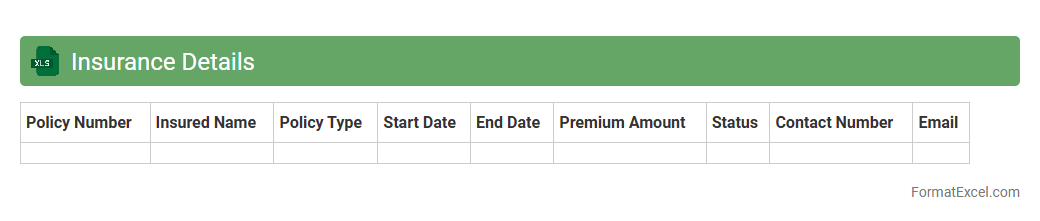

Insurance Details

The

Insurance Details Excel document is a structured spreadsheet that records comprehensive information about various insurance policies, including policy numbers, coverage types, premium amounts, and renewal dates. It helps users efficiently manage and track their insurance portfolios, ensuring timely payments and easy access to critical policy information. This tool is invaluable for both individuals and businesses to maintain organized records, minimize risks, and facilitate quick decision-making during claims or renewals.

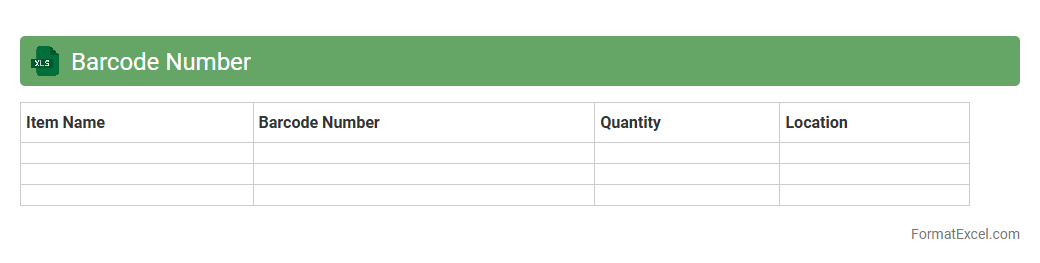

Barcode Number

A

Barcode Number Excel document is a spreadsheet that organizes and stores barcode numbers for inventory, sales, or asset tracking. It streamlines data management by allowing quick lookup, sorting, and filtering of barcode information, improving operational efficiency. Businesses use it to reduce errors, speed up transactions, and maintain accurate records across various products or assets.

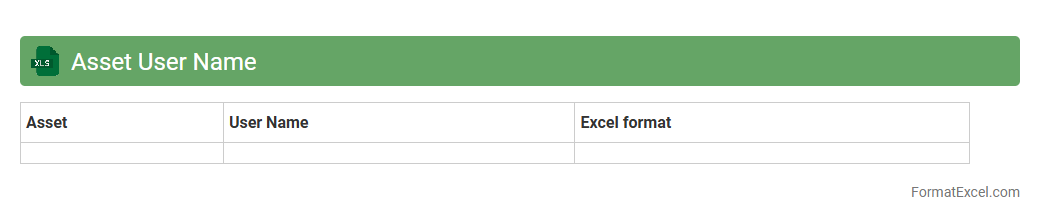

Asset User Name

The

Asset User Name Excel document is a specialized spreadsheet designed to organize and track user information associated with various assets within an organization. It allows efficient management of asset assignments, ensuring accountability and facilitating quick identification of responsible individuals. By maintaining accurate user data, this document enhances asset control, improves audit readiness, and supports streamlined IT and operational workflows.

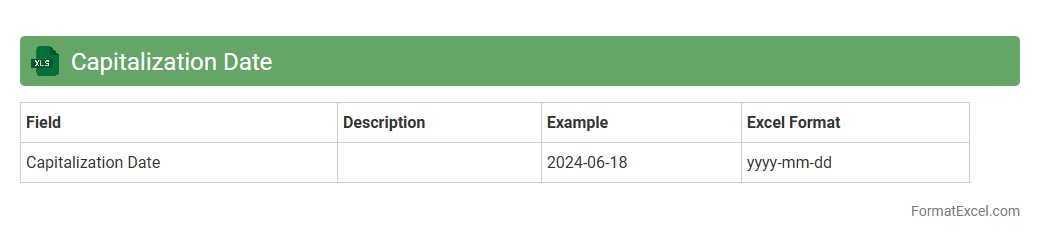

Capitalization Date

The

Capitalization Date Excel document serves as a critical tool for tracking the exact date when an asset is capitalized, ensuring accurate financial reporting and compliance with accounting standards. It enables businesses to calculate depreciation schedules, manage asset lifecycles, and align tax benefits with the correct fiscal periods. Utilizing this document enhances precision in asset management and supports thorough audit trails for internal and external reviews.

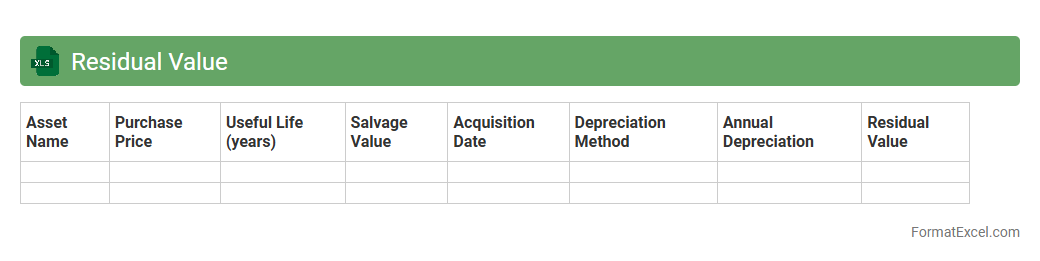

Residual Value

A

Residual Value Excel document calculates the remaining value of an asset after depreciation over time, aiding in accurate financial planning and asset management. It helps businesses estimate future asset worth, optimize depreciation schedules, and make informed decisions on asset replacement or disposal. Utilizing this tool enhances budgeting accuracy and supports compliance with accounting standards.

Introduction to Fixed Asset Register Format in Excel

The Fixed Asset Register format in Excel is a structured spreadsheet used to track company assets systematically. It helps businesses monitor asset details including purchase date, cost, and depreciation. Utilizing Excel for this register offers flexibility and accessibility for asset management.

Importance of Maintaining a Fixed Asset Register

Maintaining a fixed asset register ensures accurate recording and valuation of assets for financial and tax purposes. It facilitates effective asset management, preventing loss and aiding in maintenance scheduling. This register also supports compliance with accounting standards and auditing requirements.

Key Components of a Fixed Asset Register

The core components of a fixed asset register include asset description, acquisition date, cost, depreciation method, and current value. These elements provide a comprehensive overview of each asset's lifecycle. Proper inclusion of these components aids in precise tracking and reporting.

Essential Columns for Excel Fixed Asset Register

Essential columns in an Excel fixed asset register include Asset ID, Description, Purchase Date, Cost, Depreciation Rate, Accumulated Depreciation, and Net Book Value. These columns help organize and calculate asset data efficiently. They form the backbone of an effective asset tracking system.

Sample Fixed Asset Register Excel Template

A sample fixed asset register template in Excel offers a ready-made layout with predefined columns and formulas. This template simplifies setup and ensures consistency in asset data entry. It serves as a practical starting point for businesses managing assets digitally.

Steps to Set Up a Fixed Asset Register in Excel

To set up a fixed asset register in Excel, start by defining the necessary columns based on your assets. Input initial asset data, then use formulas to calculate depreciation and net book value automatically. Regular updates ensure the register remains accurate and useful.

Customizing Your Asset Register for Business Needs

Customizing your fixed asset register involves adding fields relevant to your industry, such as location or maintenance schedules. Tailoring allows for enhanced tracking and better decision-making. This adaptability makes the register a valuable tool across diverse business environments.

Tips for Automating Calculations and Depreciation

Automate calculations in Excel by using built-in functions like SUM and IF, and apply formulas for depreciation methods such as straight-line or reducing balance. This ensures consistency and reduces manual errors. Automated depreciation tracking improves financial accuracy and saves time.

Common Mistakes to Avoid in Asset Tracking

Common mistakes include incomplete data entry, neglecting updates, and improper categorization of assets. Avoiding these errors maintains the integrity of your fixed asset register. Accurate tracking prevents financial discrepancies and simplifies audits.

Best Practices for Updating and Securing Your Excel Register

Regularly update asset information to reflect acquisitions, disposals, and depreciation changes. Secure your Excel register with password protection and backups to prevent unauthorized access and data loss. These measures safeguard your valuable asset management data effectively.