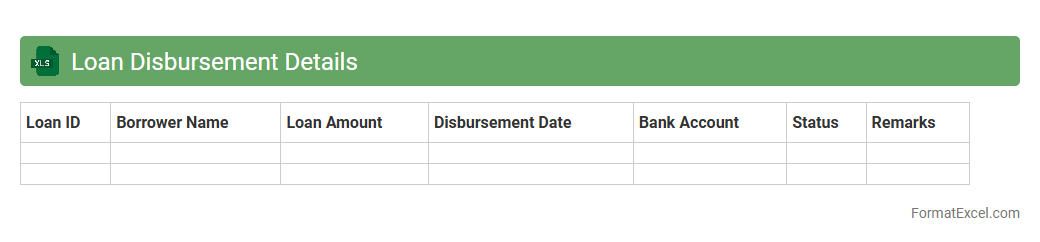

Loan Disbursement Details

The

Loan Disbursement Details Excel document provides a comprehensive record of loan amounts released to borrowers, including dates, installment schedules, and payment status. It helps financial institutions track disbursed funds, monitor repayment progress, and ensure accuracy in loan management. This detailed data supports informed decision-making, risk assessment, and efficient loan portfolio management.

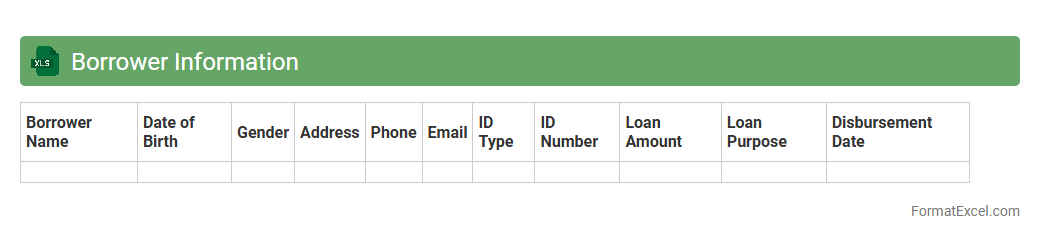

Borrower Information

The

Borrower Information Excel document is a structured spreadsheet that contains detailed data about borrowers, including personal details, loan amounts, repayment schedules, and credit history. It helps financial institutions and lenders efficiently track and analyze borrower data to assess credit risk, monitor loan performance, and streamline decision-making processes. This document enhances accuracy in record-keeping and supports effective communication between stakeholders by providing a comprehensive overview of borrower profiles.

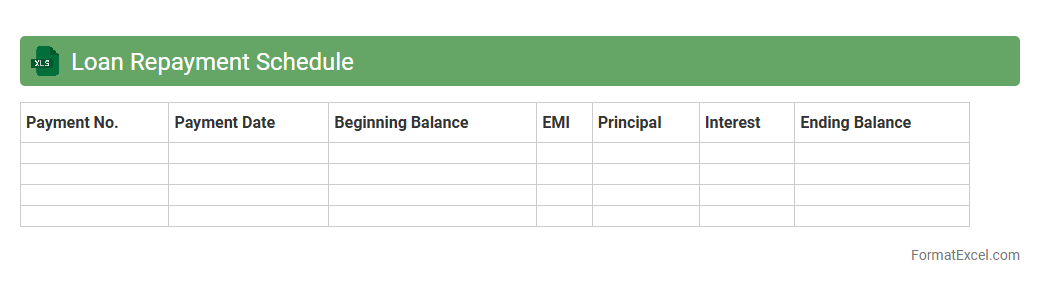

Loan Repayment Schedule

A

Loan Repayment Schedule Excel document is a structured worksheet that outlines the timeline and amounts for repaying a loan, including principal and interest components. It helps borrowers track payment due dates, calculate remaining balances, and plan finances effectively by providing a clear, organized view of loan obligations. This tool enhances financial management by ensuring timely payments and preventing default risks.

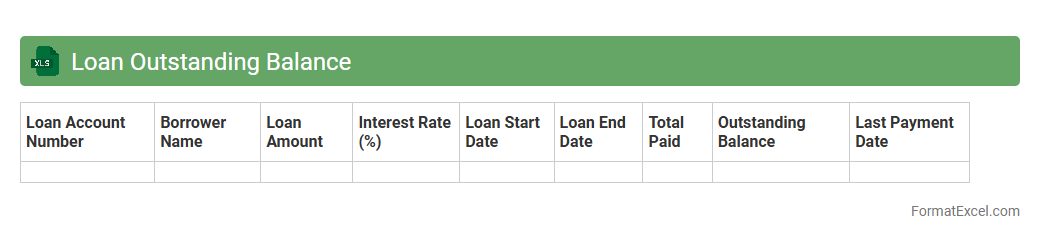

Loan Outstanding Balance

A

Loan Outstanding Balance Excel document is a spreadsheet tool designed to track the remaining principal amount on a loan over time. It helps borrowers and financial analysts monitor repayment progress, calculate interest accurately, and forecast future payment obligations. Utilizing this document enhances financial planning and ensures better loan management by providing clear visibility of current debt status.

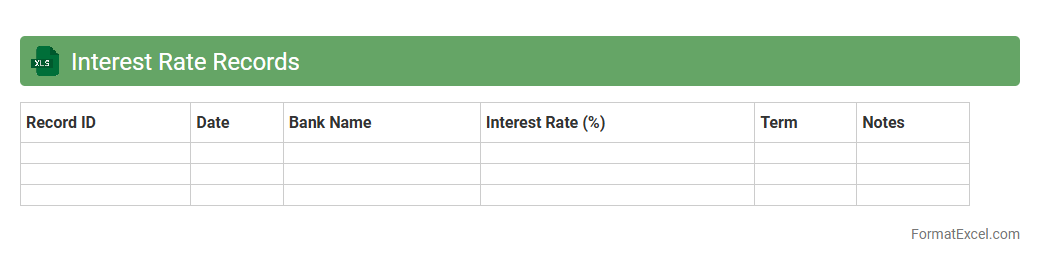

Interest Rate Records

An

Interest Rate Records Excel document systematically tracks historical and current interest rates from various financial sources, enabling users to analyze trends and make informed decisions. It helps businesses, investors, and individuals monitor fluctuations in rates, forecast future changes, and optimize investment or loan strategies. The organized format allows for easy data manipulation, comparison, and reporting, enhancing financial planning accuracy.

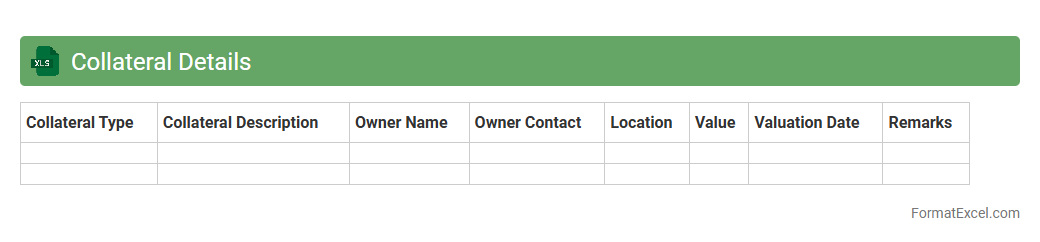

Collateral Details

The

Collateral Details Excel document is a structured file used to track and manage all assets pledged as security for loans or credit. It provides detailed information such as asset descriptions, valuations, ownership status, and lien details, enhancing transparency and facilitating risk assessment. This organized data aids financial institutions in making informed lending decisions and ensures effective monitoring and recovery processes.

Loan Status Tracking

A

Loan Status Tracking Excel document is a structured tool used to monitor and manage the progress of loan applications and repayments. It allows users to systematically record loan amounts, due dates, payment status, and outstanding balances, providing clear visibility into financial obligations. Utilizing this document improves organization, ensures timely payments, and facilitates better financial planning and decision-making.

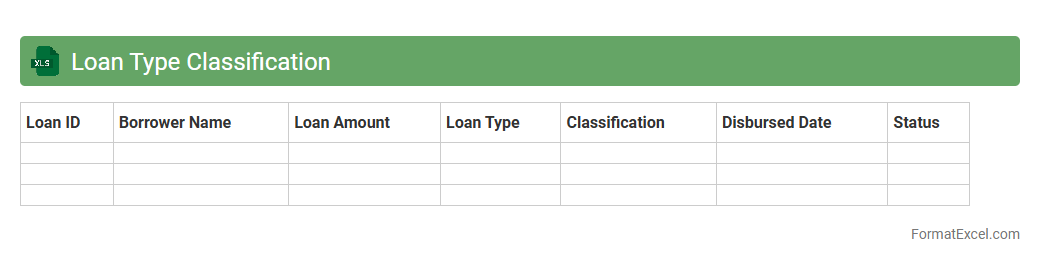

Loan Type Classification

The

Loan Type Classification Excel document categorizes various loan products such as personal, auto, mortgage, and business loans based on specific criteria like interest rates, tenure, and risk profiles. This classification aids financial analysts and loan officers in quickly assessing and comparing loan options, enabling more informed decision-making and efficient portfolio management. By organizing loan data systematically, it improves accuracy in reporting and streamlines the approval process for both lenders and borrowers.

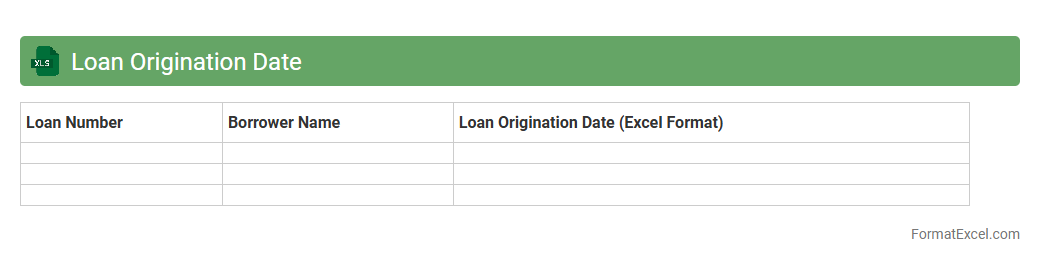

Loan Origination Date

The

Loan Origination Date Excel document records the exact date when a loan is officially issued, serving as a critical reference for tracking loan timelines, interest calculations, and repayment schedules. It enables lenders and borrowers to monitor loan aging, manage amortization, and ensure compliance with contractual terms efficiently. This document proves invaluable for financial analysis, reporting, and maintaining accurate records throughout the loan lifecycle.

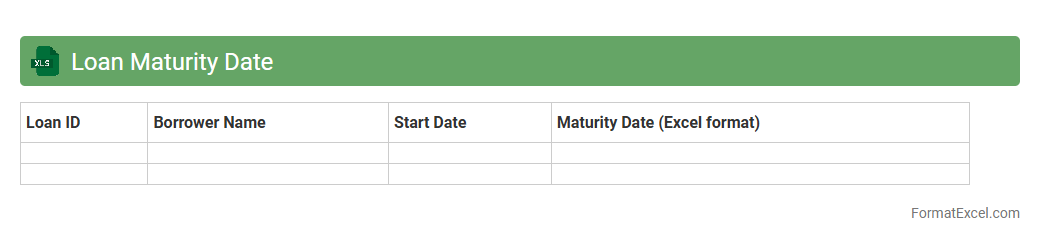

Loan Maturity Date

A

Loan Maturity Date Excel document tracks the exact date when a loan must be fully repaid, helping borrowers and lenders manage repayment schedules efficiently. This tool allows users to organize multiple loans, calculate outstanding balances, and forecast financial obligations with precision. By maintaining clear records in Excel, individuals and businesses can avoid missed deadlines and optimize cash flow planning.

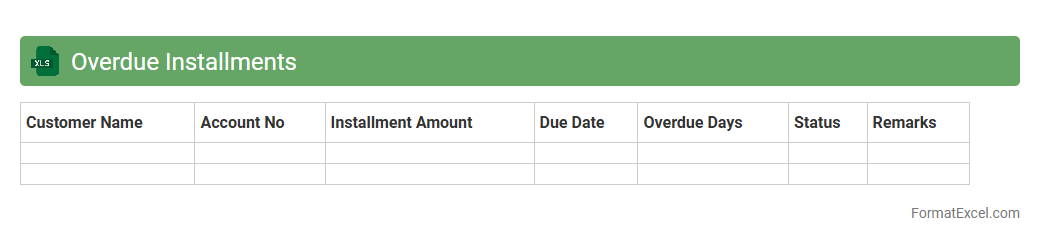

Overdue Installments

The

Overdue Installments Excel document is a financial tracking tool designed to manage and monitor payment schedules by highlighting unpaid or delayed installments. It aids in identifying outstanding debts, improving cash flow management, and facilitating timely follow-ups with clients or customers. By organizing payment data, it enhances financial accountability and helps prevent potential revenue losses due to missed payments.

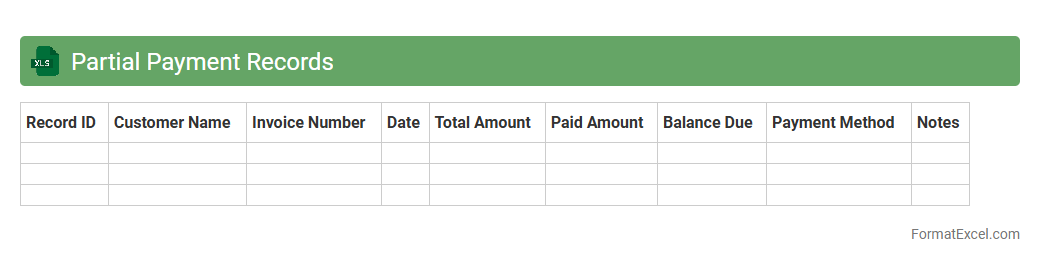

Partial Payment Records

Partial Payment Records excel document is a structured file that tracks

incomplete or installment payments made by customers or clients. It helps businesses monitor outstanding balances, manage cash flow effectively, and ensure accurate financial reporting. Using this document reduces errors in payment reconciliation and enhances transparency in transaction records.

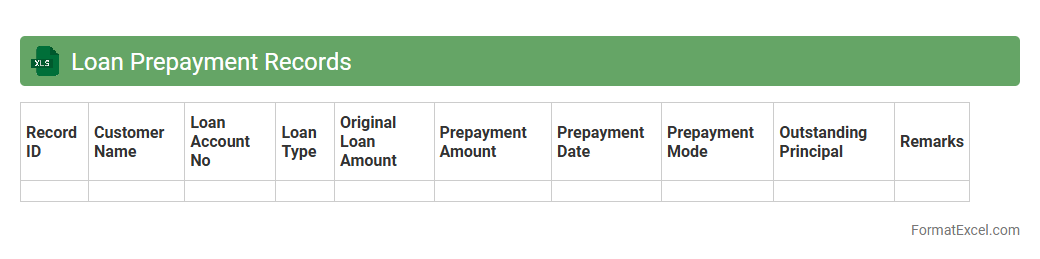

Loan Prepayment Records

A

Loan Prepayment Records Excel document systematically tracks early loan repayments, capturing details such as payment dates, amounts, and remaining balances. This organized data enables borrowers and lenders to monitor prepayments, assess financial impact, and adjust repayment strategies effectively. Utilizing this record enhances transparency and helps in forecasting interest savings and loan term reductions.

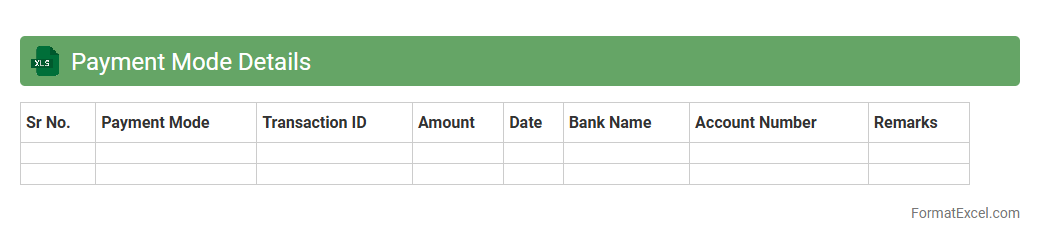

Payment Mode Details

The

Payment Mode Details Excel document systematically records various payment methods such as credit cards, bank transfers, and digital wallets, providing clear visibility into financial transactions. It aids businesses in tracking payment trends, reconciling accounts, and ensuring accurate financial reporting. This organized data supports efficient decision-making and improves overall cash flow management.

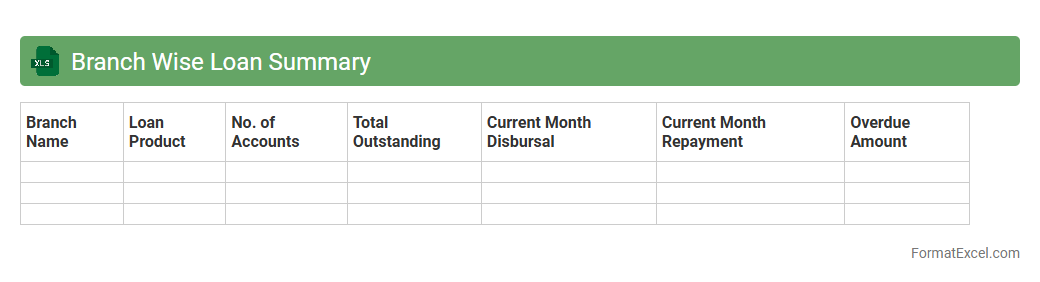

Branch Wise Loan Summary

The

Branch Wise Loan Summary Excel document provides a detailed breakdown of loan disbursements, repayments, and outstanding balances across different branches within an organization. It helps financial managers and decision-makers track branch-level performance, identify trends, and allocate resources efficiently. This summary enables timely loan portfolio assessment and improves overall financial planning and risk management.

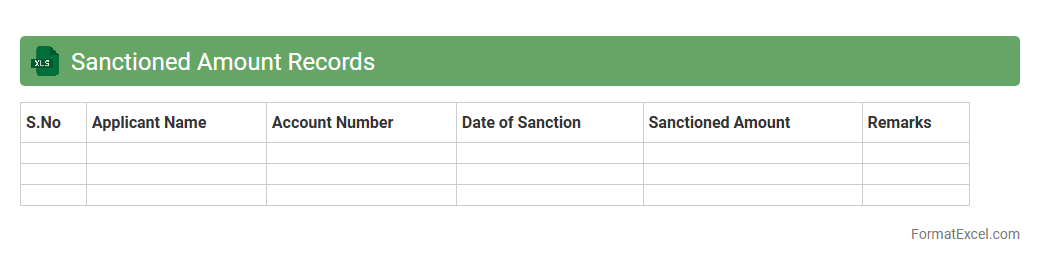

Sanctioned Amount Records

A

Sanctioned Amount Records Excel document systematically tracks approved financial amounts allocated for various projects, loans, or budgets. It is useful for monitoring authorized expenditures, ensuring compliance with financial policies, and facilitating accurate budget management and reporting. This organized data aids in decision-making by providing clear insights into sanctioned funds and their utilization.

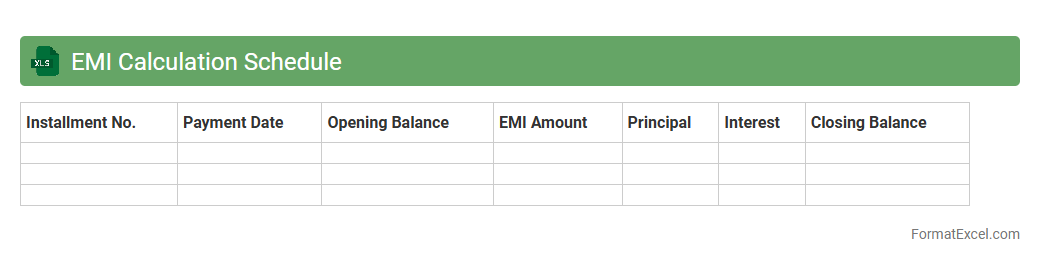

EMI Calculation Schedule

The

EMI Calculation Schedule Excel document is a financial tool designed to compute Equated Monthly Installments for loans by breaking down principal and interest components over the loan tenure. This schedule helps users plan their finances by providing a clear overview of monthly payments, total interest payable, and remaining loan balance at any point in time. It enables effective debt management and facilitates decision-making for loan repayment strategies.

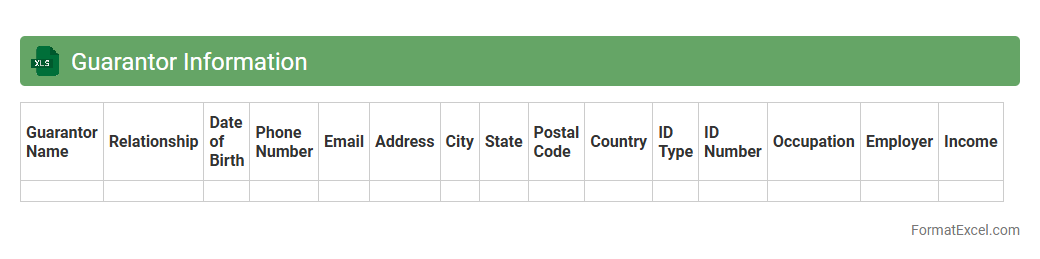

Guarantor Information

The

Guarantor Information Excel document is a structured spreadsheet used to record and manage detailed data of individuals or entities that guarantee loans or financial obligations. It organizes critical information such as guarantor names, contact details, credit history, and agreement terms, enabling efficient tracking and verification processes. This document ensures clarity and accountability in financial transactions by providing easy access to guarantor records for risk assessment and decision-making.

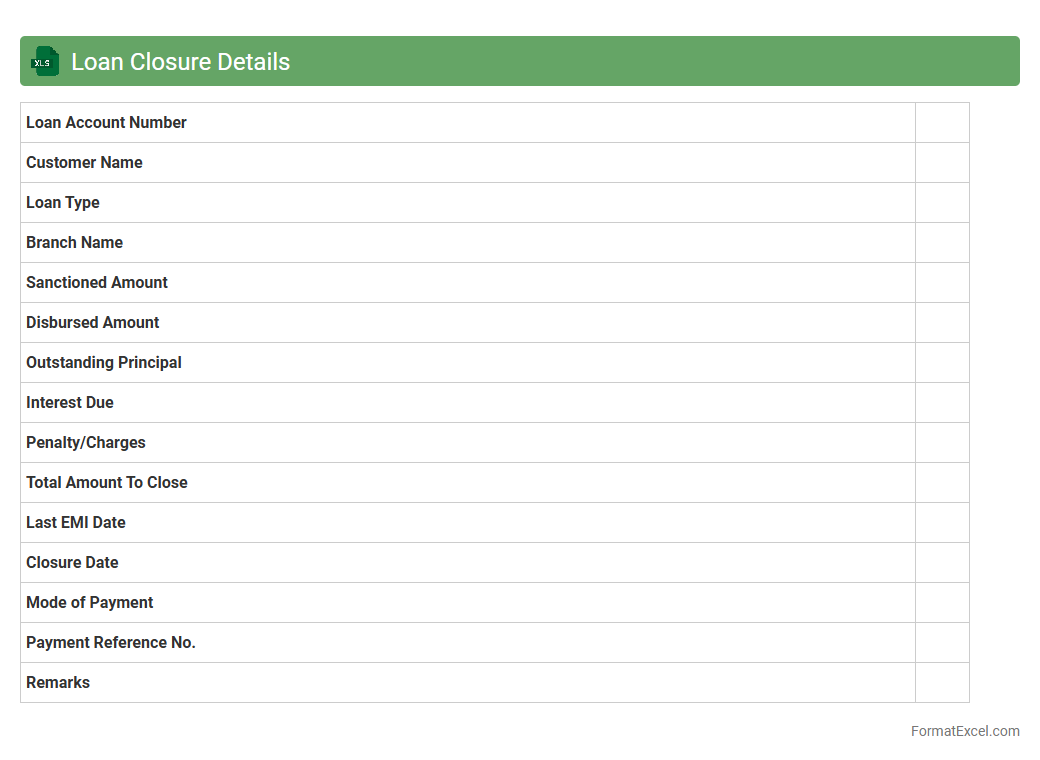

Loan Closure Details

The

Loan Closure Details Excel document tracks comprehensive information about finalized loans, including closure dates, outstanding balances, repayment status, and related charges. This organized data helps financial institutions and borrowers verify loan completion, reconcile accounts, and ensure all terms have been met accurately. Maintaining this document streamlines audit processes, supports transparent financial reporting, and aids in efficient loan portfolio management.

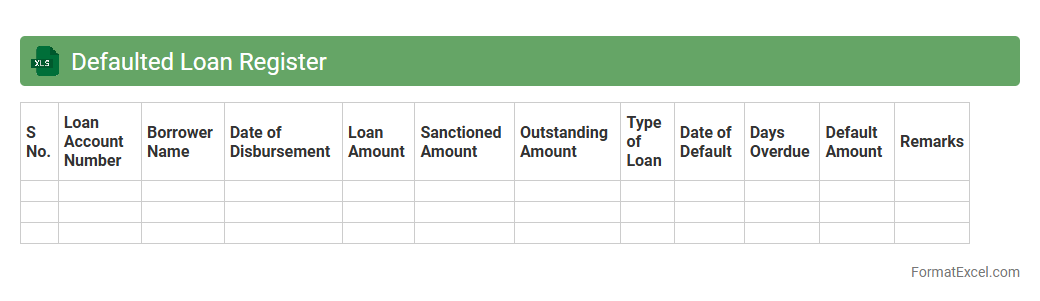

Defaulted Loan Register

The

Defaulted Loan Register Excel document is a detailed record that tracks loans that have missed repayments or have become non-performing. It is useful for monitoring borrower defaults, analyzing risk exposure, and implementing effective debt recovery strategies. This register aids financial institutions in maintaining accurate loan portfolios and enhancing credit management.

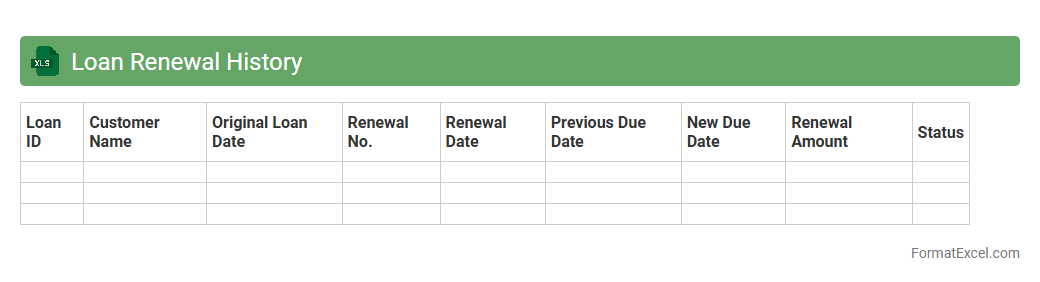

Loan Renewal History

A

Loan Renewal History Excel document tracks the dates, amounts, and terms of each loan renewal, providing a clear record of borrower activity over time. It is useful for analyzing repayment patterns, assessing credit risk, and improving financial decision-making by maintaining organized and accessible historical data. This document aids lenders and borrowers in maintaining transparency and ensuring compliance with loan agreements.

Penalty Charges Record

The

Penalty Charges Record Excel document systematically tracks and organizes all penalty fees incurred, providing clear visibility into outstanding charges and payment histories. It helps businesses monitor compliance, manage financial liabilities, and identify recurring issues that may require attention to reduce future penalties. Using this document enhances financial accuracy and supports strategic decision-making by offering detailed insights into penalty trends and costs.

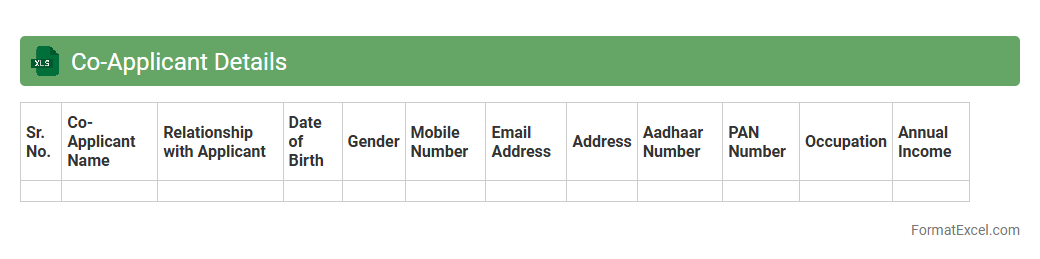

Co-Applicant Details

The

Co-Applicant Details Excel document is a structured spreadsheet that records essential information about co-applicants, including names, contact information, financial details, and relationship to the primary applicant. This document streamlines the process of verifying shared responsibilities and creditworthiness, making it invaluable for loan processing, credit assessments, and joint applications. Having all co-applicant data organized in one place enhances accuracy, speeds up decision-making, and improves overall record management.

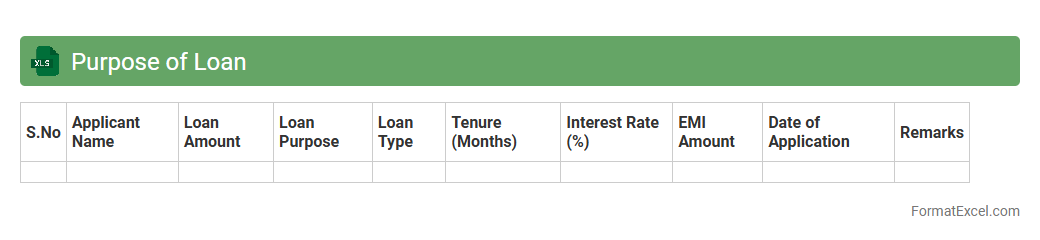

Purpose of Loan

The

Purpose of Loan Excel document organizes and categorizes loan reasons to facilitate clear financial analysis and decision-making. It allows users to track, manage, and visualize loan purposes, improving accuracy in budgeting and reporting. This document is essential for lenders and borrowers to ensure transparency and align loan usage with intended financial goals.

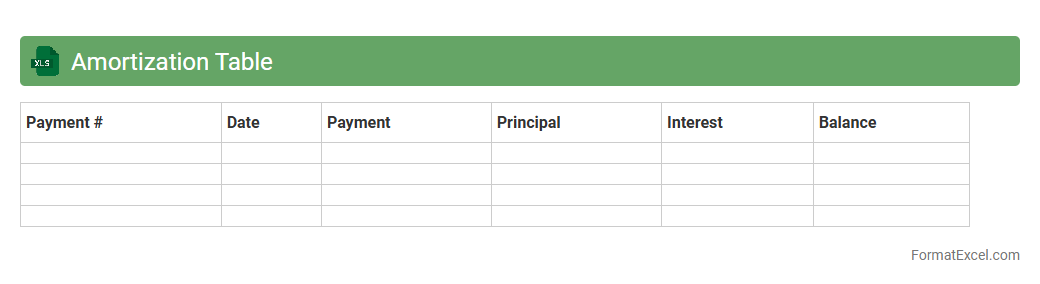

Amortization Table

An

Amortization Table Excel document is a detailed spreadsheet that breaks down loan payments into principal and interest components over the loan term. It helps users track payment schedules, outstanding balances, and interest accrued, enabling better financial planning and loan management. This tool is essential for understanding how each payment impacts overall debt and aids in making informed decisions about early repayments or refinancing.

Introduction to Loan Register Formats

A loan register is a structured format used to systematically record all loan-related transactions. It helps in tracking loan details, repayments, and balances over time. Using a clear format ensures transparency and accurate financial management.

Importance of Maintaining a Loan Register

Maintaining a loan register is crucial for monitoring loan performance and ensuring timely repayments. It provides a consolidated view of all loans, reducing the risk of missed payments or discrepancies. Accurate records aid in financial planning and auditing.

Key Components of a Loan Register in Excel

Essential components include borrower details, loan amount, interest rate, repayment schedule, and outstanding balance. These components form the backbone of a reliable loan register for precise tracking. Proper organization enhances data accessibility and usability.

Step-by-Step Guide to Creating a Loan Register

Start by opening Excel and setting up columns for key loan details. Next, input data systematically and use formulas to calculate balances and interest. A well-structured loan register template simplifies ongoing updates and reporting.

Essential Columns for Loan Register Templates

Typical columns include Loan ID, Borrower's Name, Principal Amount, Interest Rate, EMI Amount, Payment Date, and Balance. These columns ensure comprehensive tracking of each loan's lifecycle. Customizing columns can tailor the register to specific needs.

Sample Loan Register Format in Excel

A sample format usually has rows representing each individual loan and columns capturing all necessary loan details. This sample helps users visualize how to set up and maintain their own registers effectively. Templates are often available for quick start.

Tips for Customizing Your Loan Register

Incorporate conditional formatting to highlight overdue payments or interest changes. Add drop-down menus for consistent data entry and use filters for easy data analysis. Customization enhances the loan register functionality to suit your workflow.

Common Mistakes to Avoid in Loan Registers

Avoid inconsistent data entry, missing dates, and neglecting to update balances continuously. Failure to validate input data can lead to errors and inaccurate loan tracking. Proper attention maintains the accuracy and reliability of the register.

Benefits of Using Excel for Loan Tracking

Excel offers flexibility, computational power, and easy data visualization tools. It automates calculations and simplifies financial analysis with built-in formulas. Using Excel improves efficiency in managing multiple loans simultaneously.

Free Download: Loan Register Excel Template

Many websites offer free downloadable Excel templates for loan registers, ready for customization. These templates save time and provide a professional structure for tracking loans smoothly. Downloading a template is an ideal way to get started quickly.