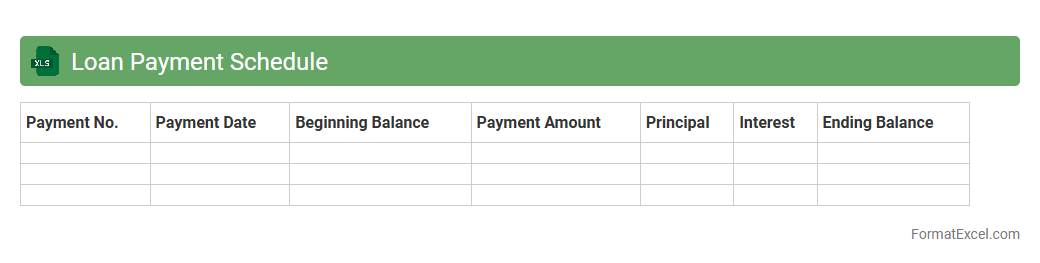

Loan Payment Schedule

A

Loan Payment Schedule Excel document is a structured spreadsheet that outlines the repayment plan for a loan, detailing each payment's principal and interest components over time. It helps borrowers track payment dates, amounts due, and remaining loan balance, ensuring timely payments and better financial planning. Using this tool enhances transparency, prevents missed payments, and provides a clear visual overview of the loan amortization process.

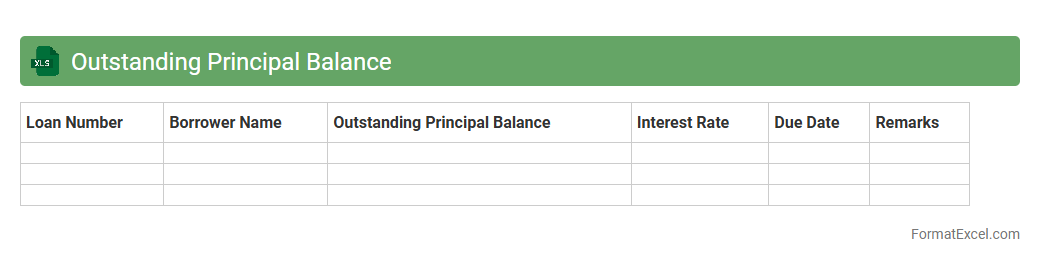

Outstanding Principal Balance

An

Outstanding Principal Balance Excel document tracks the remaining amount owed on loans or mortgages, allowing for precise monitoring of debt reduction over time. This tool helps users analyze payment schedules, forecast financial commitments, and manage loan repayment efficiently. It provides valuable insights for budgeting, financial planning, and ensuring timely loan servicing.

Interest Rate Tracker

An

Interest Rate Tracker Excel document is a tool designed to monitor and record changes in interest rates over time, helping users analyze trends for loans, savings, or investments. By organizing data in a clear, customizable spreadsheet, it allows for quick comparisons and informed financial decisions. This tracker simplifies the management of interest rate fluctuations, ultimately supporting better budgeting and strategic planning.

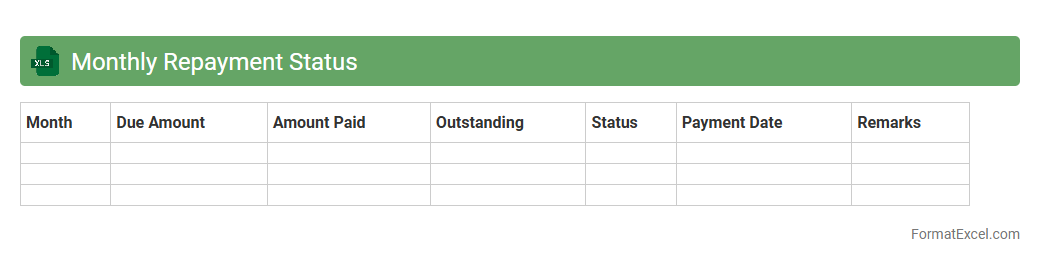

Monthly Repayment Status

The

Monthly Repayment Status Excel document tracks loan or credit repayments by recording payment dates, amounts, and outstanding balances in a structured format. It allows users to monitor timely repayments, identify overdue amounts, and forecast future payment schedules efficiently. Businesses and individuals use this tool to maintain accurate financial records, improve cash flow management, and ensure accountability in debt servicing.

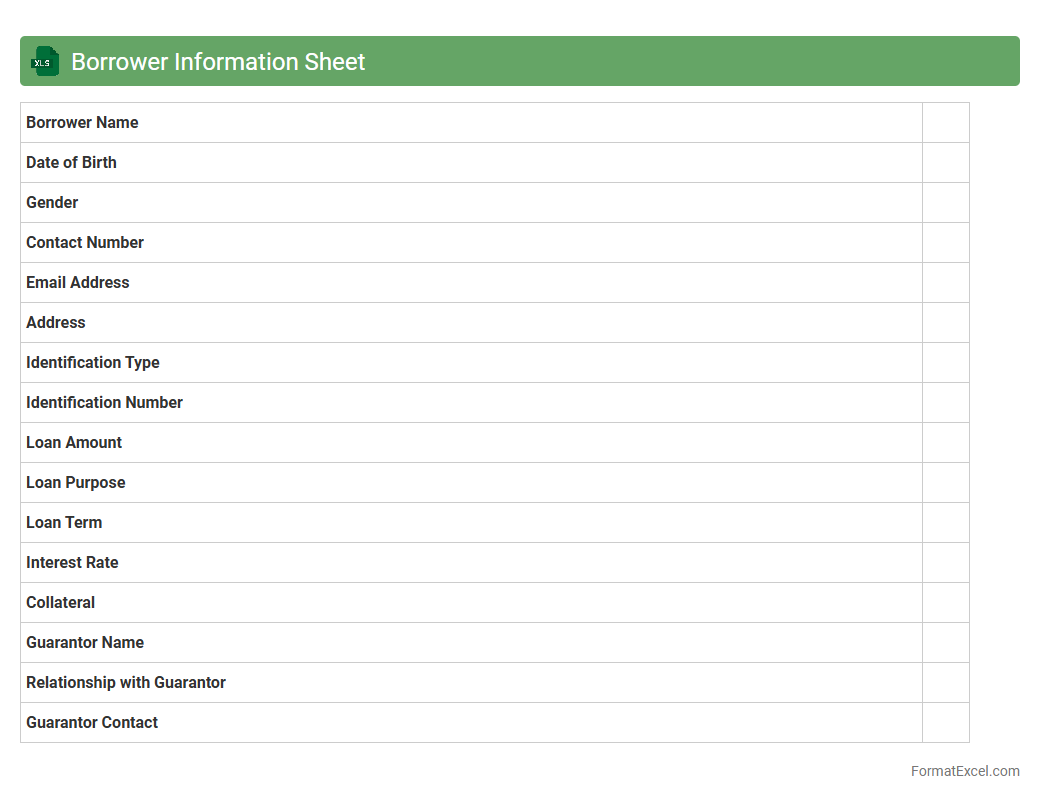

Borrower Information Sheet

The

Borrower Information Sheet Excel document is a comprehensive tool designed to collect and organize essential data about loan applicants, including personal details, financial history, and credit information. It streamlines the evaluation process by providing a clear and structured format for assessing borrower eligibility and risk factors. This document enhances decision-making efficiency and accuracy in lending operations by consolidating all relevant borrower information in one accessible location.

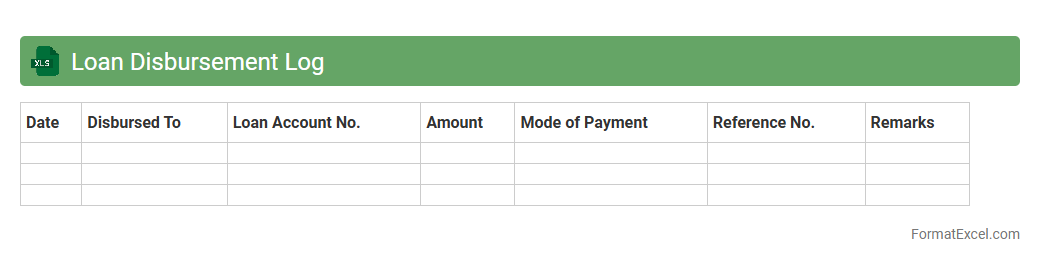

Loan Disbursement Log

A

Loan Disbursement Log Excel document is a structured record that tracks the release of loan funds to borrowers, detailing dates, amounts, and borrower information. It is useful for monitoring loan payment schedules, ensuring timely disbursements, and maintaining accurate financial records for auditing and reporting purposes. This log helps financial institutions and lenders manage cash flow and compliance efficiently.

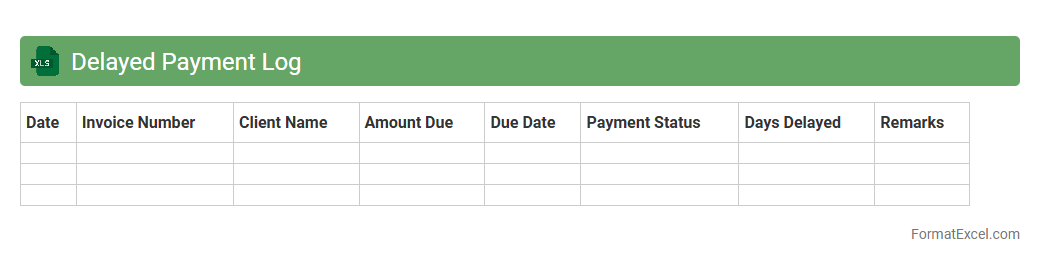

Delayed Payment Log

The

Delayed Payment Log Excel document is a structured spreadsheet designed to track overdue payments systematically, allowing businesses to monitor outstanding invoices and payment dates efficiently. It helps improve cash flow management by identifying late payments, enabling timely follow-ups, and reducing the risk of bad debt. By organizing payment data clearly, it supports informed decision-making and enhances overall financial control.

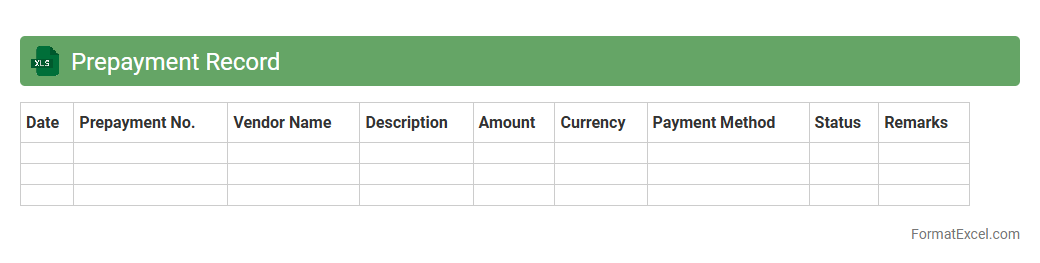

Prepayment Record

A

Prepayment Record Excel document systematically tracks advance payments made before the receipt of goods or services, ensuring accurate financial management. It helps monitor outstanding prepayments, prevents double payments, and provides clear visibility into cash flow and budgeting. This document is essential for businesses aiming to maintain precise accounts and streamline accounting processes.

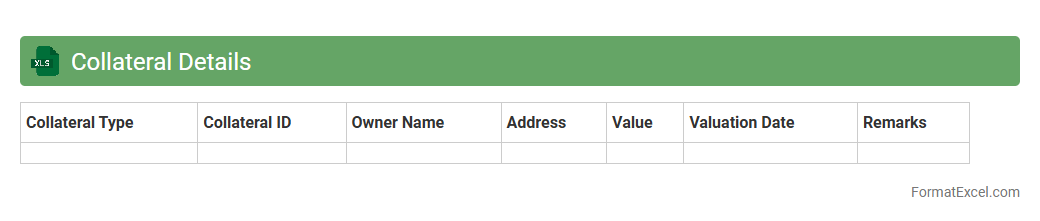

Collateral Details

The

Collateral Details Excel document serves as a comprehensive repository for tracking asset information, loan guarantees, and security interests tied to financial transactions. It enables streamlined management of collateral by organizing vital data such as asset descriptions, values, and legal documentation, ensuring accurate risk assessment and compliance. This document enhances operational efficiency and decision-making in lending or asset management by providing clear visibility into secured assets.

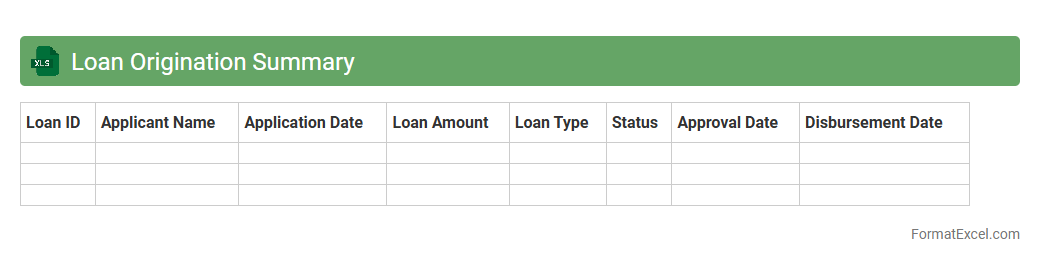

Loan Origination Summary

A

Loan Origination Summary Excel document consolidates key loan application data, including borrower information, loan amounts, interest rates, and approval statuses. It streamlines the loan approval process by providing a clear overview for lenders and underwriters to evaluate multiple applications efficiently. This tool enhances decision-making accuracy and accelerates workflow within financial institutions.

Repayment Mode Tracker

The

Repayment Mode Tracker Excel document is a tool designed to monitor and record various repayment methods such as cash, cheque, online transfer, or auto-debit systematically. It enables users to track repayment schedules, amounts, and modes efficiently, reducing errors and improving financial management accuracy. This document streamlines the reconciliation process by providing clear visibility into payment statuses, helping businesses maintain organized records and timely follow-ups.

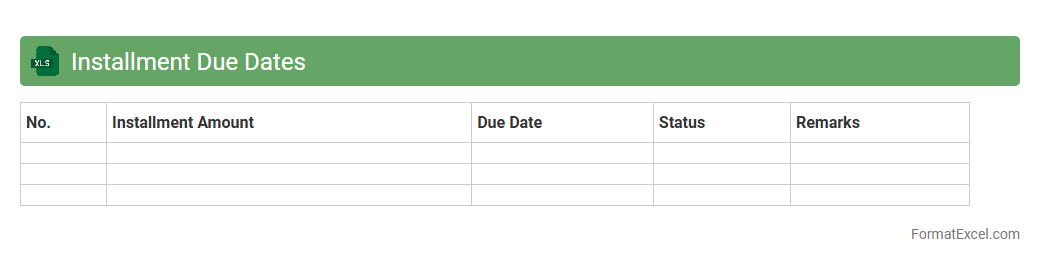

Installment Due Dates

An

Installment Due Dates Excel document is a spreadsheet designed to track scheduled payment deadlines for loans or purchases made in installments. It helps users organize and monitor payment dates, amounts, and outstanding balances, ensuring timely payments and avoiding penalties. This tool enhances financial planning and cash flow management by providing clear visibility of all upcoming installment obligations.

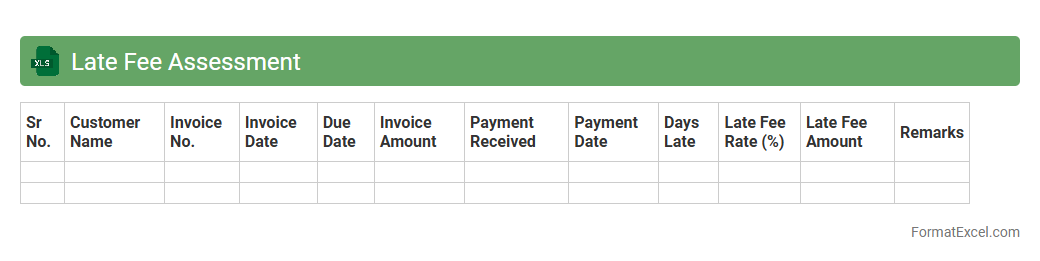

Late Fee Assessment

The

Late Fee Assessment Excel document is a tool designed to calculate and track penalties applied to overdue payments efficiently. It automates the computation of late fees based on predefined rates and payment due dates, reducing manual errors and ensuring timely invoicing. This document helps businesses maintain cash flow discipline and improve financial management by providing clear visibility into outstanding fees and payment statuses.

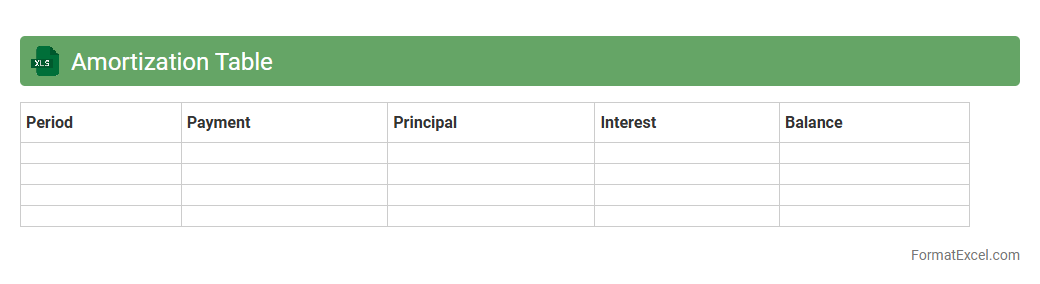

Amortization Table

An

Amortization Table Excel document is a detailed spreadsheet that breaks down loan repayments into principal and interest components over the life of the loan. It helps users visualize payment schedules, total interest paid, and remaining loan balance at each stage, enabling better financial planning and budgeting. This tool is especially useful for managing mortgages, car loans, and other installment-based debts efficiently.

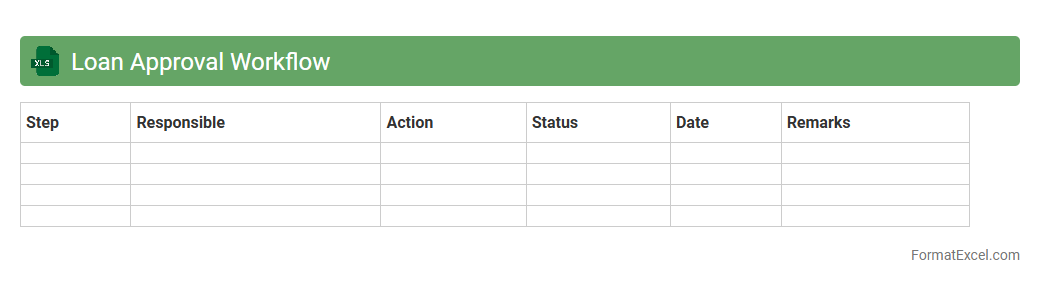

Loan Approval Workflow

A

Loan Approval Workflow Excel document streamlines the loan evaluation process by organizing key steps such as applicant data collection, credit checks, and approval status tracking. This tool enhances efficiency and accuracy by providing a clear, customizable framework for financial institutions or lending officers to monitor each stage of loan processing. It helps reduce errors, accelerates decision-making, and improves compliance with lending policies, ultimately contributing to better risk management and customer satisfaction.

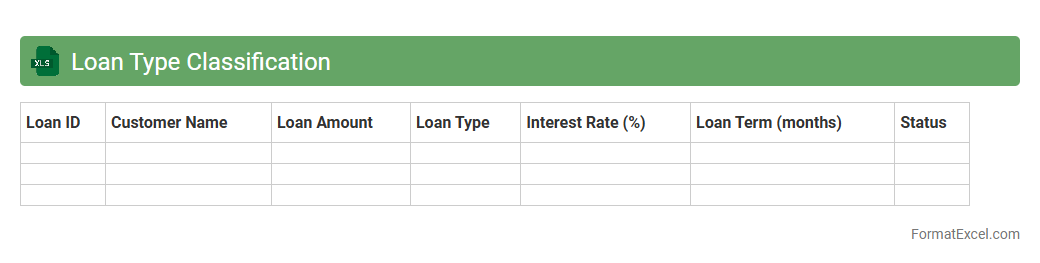

Loan Type Classification

A

Loan Type Classification Excel document categorizes various loan products based on criteria such as purpose, interest rates, tenure, and borrower profile. This tool aids financial institutions and analysts in efficiently organizing and analyzing loan data to make informed decisions, manage risk, and tailor financial solutions. By streamlining loan categorization, it enhances the accuracy of reporting and supports regulatory compliance.

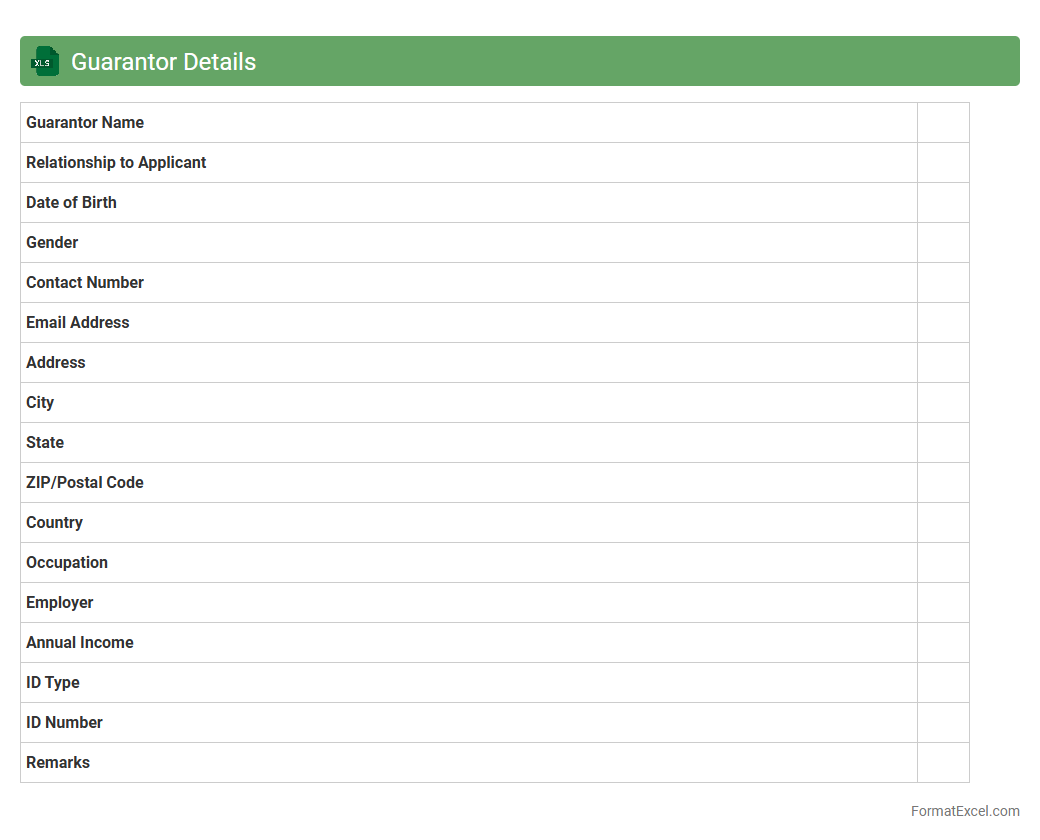

Guarantor Details

The

Guarantor Details Excel document is a comprehensive record that captures vital information about guarantors, including their names, contact details, identification numbers, and financial commitments. It is useful for managing credit risk by providing easy access to guarantor data, enabling quick verification and facilitating better decision-making in loan approvals. This document streamlines the process of tracking guarantor obligations and enhances accountability in financial transactions.

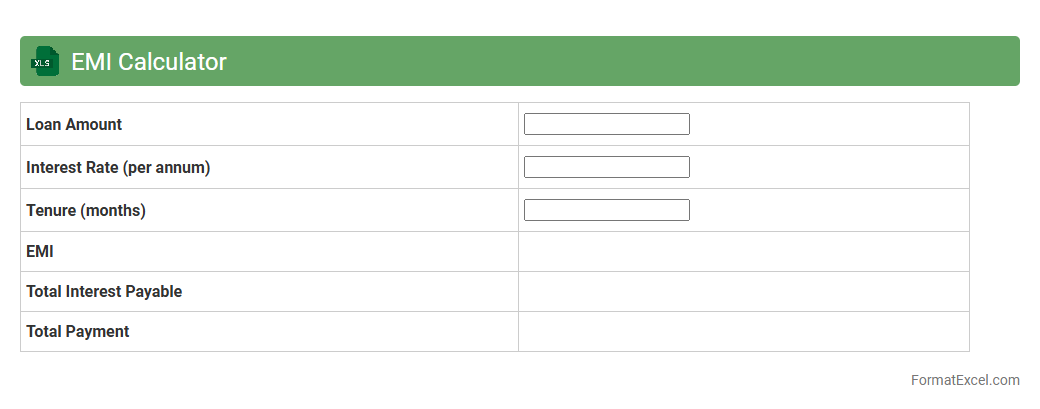

EMI Calculator

An

EMI Calculator Excel document is a spreadsheet tool designed to compute the Equated Monthly Installment for loans by inputting variables like principal amount, interest rate, and loan tenure. It helps users quickly estimate their monthly payment obligations, enabling more informed financial planning and budgeting decisions. This tool also supports scenario analysis by allowing comparisons of different loan terms to choose the most affordable repayment option.

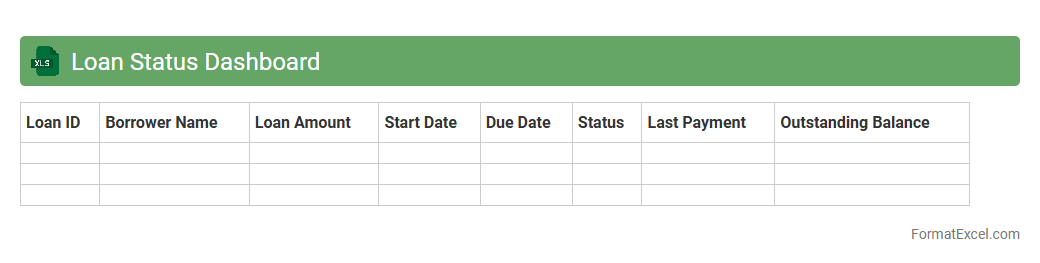

Loan Status Dashboard

The

Loan Status Dashboard Excel document is a comprehensive tool designed to track and visualize the progress and performance of loan applications and repayments. It consolidates crucial data such as loan amounts, approval status, payment schedules, and outstanding balances, enabling efficient monitoring and decision-making. This dashboard enhances financial management by providing real-time insights, reducing errors, and improving communication among stakeholders.

Penalty Charge Tracker

The

Penalty Charge Tracker Excel document is a comprehensive tool designed to record, monitor, and manage penalty charges efficiently. It allows users to track payment deadlines, calculate amounts due, and categorize penalties by type or date, enhancing financial oversight and reducing the risk of missed payments. This organized approach streamlines penalty management, saving time and helping avoid additional fees or legal complications.

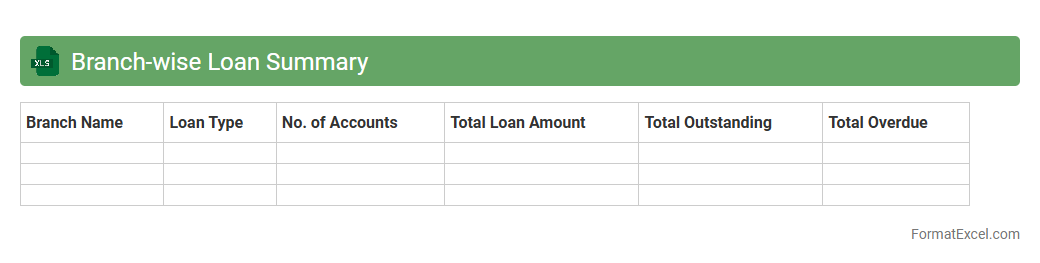

Branch-wise Loan Summary

A

Branch-wise Loan Summary Excel document consolidates loan data across different branches, presenting detailed information such as loan amounts, repayment statuses, and customer demographics. This tool enables financial institutions to efficiently track performance, identify trends, and allocate resources effectively by comparing loan portfolios branch-by-branch. It supports data-driven decision-making, enhancing loan management and risk assessment processes.

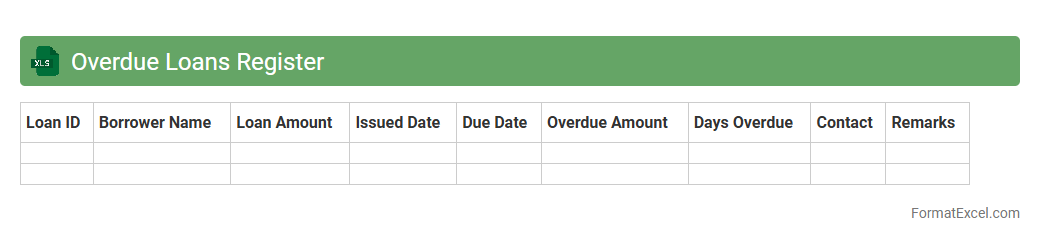

Overdue Loans Register

The

Overdue Loans Register Excel document tracks all loans that have missed their repayment deadlines, providing a clear overview of outstanding debts. It helps businesses and financial institutions monitor overdue payments, manage collections efficiently, and reduce credit risk. By maintaining accurate and up-to-date data, this register supports informed decision-making and improves cash flow management.

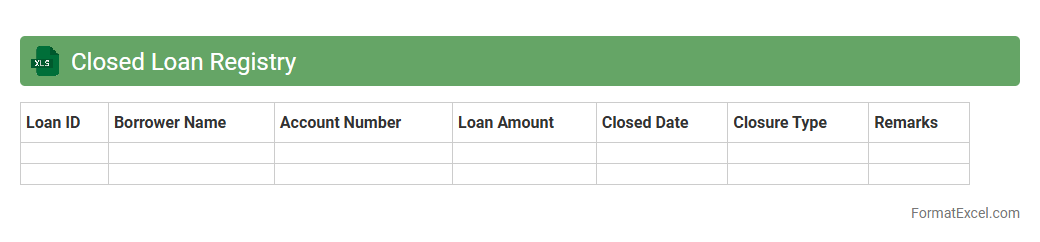

Closed Loan Registry

The

Closed Loan Registry Excel document is a detailed record that tracks finalized loan transactions, including borrower information, loan amounts, interest rates, and closure dates. It is useful for financial institutions and loan officers to maintain an organized history of completed loans for auditing, reporting, and performance analysis. This document enhances transparency and helps streamline loan portfolio management by providing easy access to critical loan closure data.

Loan Renewal Tracker

A

Loan Renewal Tracker Excel document is a tool designed to monitor and manage loan renewal dates, payment schedules, and interest rates effectively. It helps users avoid missed deadlines by providing timely reminders and consolidates crucial loan information in one accessible place. This tracker enhances financial planning by ensuring that borrowers or financial managers stay organized and informed about all active loan renewals.

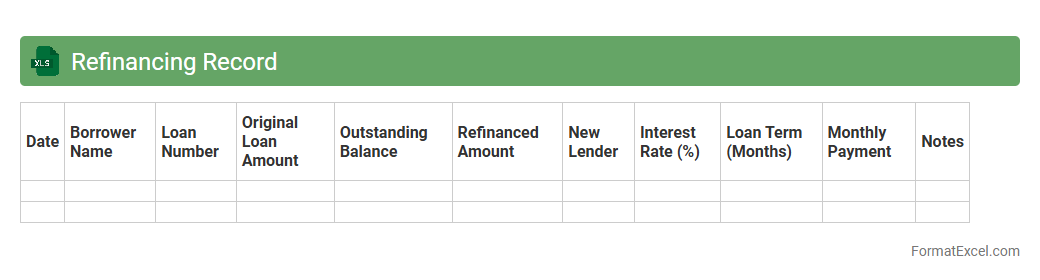

Refinancing Record

A

Refinancing Record Excel document is a detailed spreadsheet that tracks loan refinancing activities, including interest rates, payment schedules, and lender information. It helps users analyze refinancing options, monitor payment progress, and ensure accurate financial planning. This tool is essential for managing debt efficiently and optimizing loan terms to reduce overall borrowing costs.

Introduction to Loan Tracker Format in Excel

A loan tracker in Excel is a structured spreadsheet used to monitor loan details like amounts, payments, and balances efficiently. It helps individuals and businesses stay organized by consolidating all loan information in one place. Utilizing Excel's flexibility, users can tailor the tracker to fit specific loan management needs.

Benefits of Using Excel for Loan Tracking

Excel provides a versatile platform with powerful tools like formulas and charts, making it ideal for tracking loans. It allows for easy updates, customization, and data analysis without needing specialized software. Additionally, Excel can handle multiple loans, helping users monitor various borrowing activities simultaneously.

Key Features of an Effective Loan Tracker

An effective loan tracker features automatic payment calculations, interest tracking, and clear status indicators to keep users informed. Integration of conditional formatting highlights overdue payments or loan milestones. These features enhance accuracy and make loan management straightforward.

Essential Columns for a Loan Tracker Spreadsheet

Important columns include loan amount, interest rate, payment due date, amount paid, outstanding balance, and payment status. These columns provide a comprehensive overview of each loan's health and progress. Proper column setup enhances tracking efficiency and reporting accuracy.

Step-by-Step Guide to Creating a Loan Tracker in Excel

Start by setting up your columns for loan details and payments, followed by entering sample data. Next, apply formulas for interest, payment tracking, and balance updates to automate calculations. Finally, use formatting tools to improve readability and usability of your loan tracker.

Sample Loan Tracker Template Layout

A sample layout typically includes headers such as Loan ID, Borrower Name, Principal, Interest Rate, Start Date, Payment Due, Payment Made, and Remaining Balance. Organized rows capture each loan instance, facilitating easy modifications. This structured template forms the basis for efficient loan monitoring.

Customizing Your Loan Tracker for Different Loan Types

Excel loan trackers can be tailored to handle mortgages, personal loans, or business loans by adjusting columns and formulas accordingly. Customization ensures accurate reflection of different loan types, such as adding amortization schedules for mortgages. This adaptability enhances financial control and reporting.

Incorporating Formulas for Automated Calculations

Formulas like SUM, IF, PMT, and VLOOKUP automate loan payment totals, interest computations, and status updates. These formulas reduce manual errors and save time by dynamically updating data as inputs change. Automation is key for maintaining accurate and reliable loan records.

Tips for Maintaining and Updating Your Loan Tracker

Regular updates and consistent data entry keep your loan tracker accurate and useful. Backing up your Excel file and reviewing formulas periodically protects against data loss and errors. Employing version control or cloud storage improves tracker maintenance and accessibility.

Downloadable Loan Tracker Excel Templates

Many websites offer free and customizable loan tracker templates in Excel designed for various loan scenarios. Users can download these templates to save setup time and ensure incorporation of best tracking practices. Templates provide a reliable starting point for effective loan management.