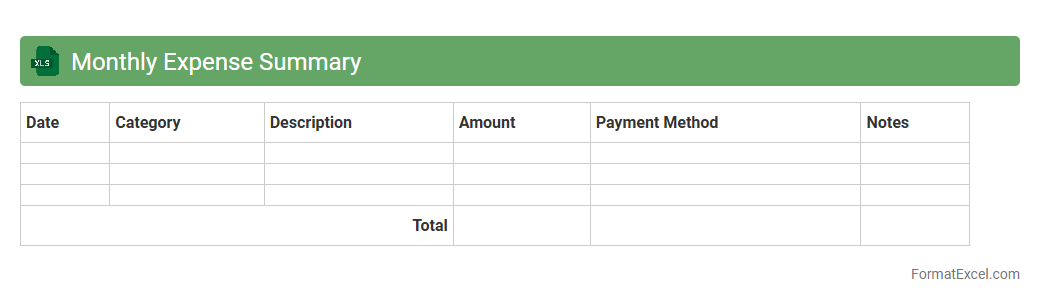

Monthly Expense Summary

The

Monthly Expense Summary Excel document is a tool designed to track and categorize all monthly expenditures, providing a clear overview of spending patterns. It helps users monitor budgets, identify areas for cost-saving, and ensure financial discipline by consolidating income and expenses in one easily accessible format. This summary aids in making informed financial decisions, enhancing personal or business budget management efficiency.

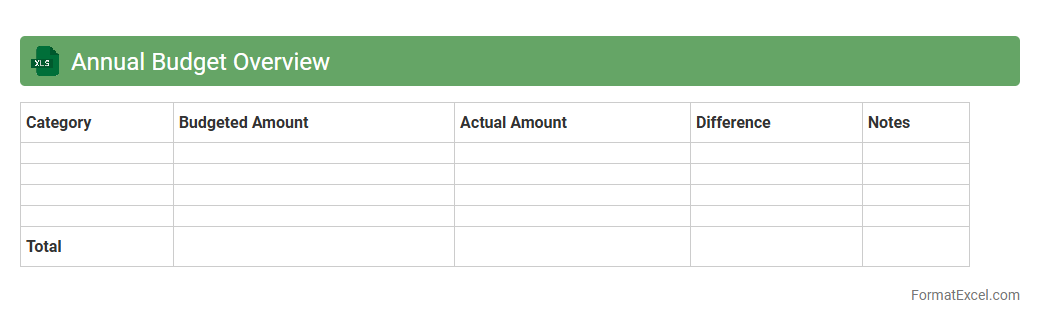

Annual Budget Overview

An

Annual Budget Overview Excel document organizes financial data into categories such as income, expenses, and savings to provide a clear snapshot of an organization's or individual's fiscal health over a year. It helps track spending patterns, forecast future financial needs, and ensures resources are allocated effectively to meet financial goals. This tool supports informed decision-making by offering visual summaries like charts and graphs, enhancing budget management and control.

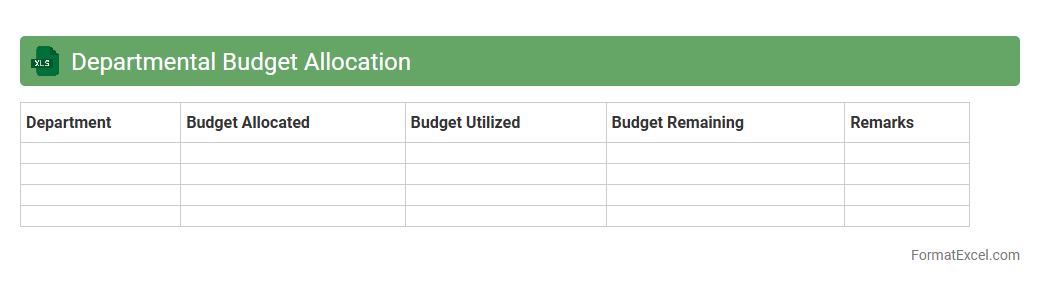

Departmental Budget Allocation

A

Departmental Budget Allocation excel document is a structured spreadsheet designed to organize and distribute financial resources across various departments within an organization. It helps track budgetary limits, expenses, and allocations efficiently, ensuring transparent financial management. Utilizing this document streamlines decision-making and promotes accountability by providing clear insights into departmental spending.

Project Expense Tracker

The

Project Expense Tracker Excel document is a powerful tool designed to monitor and manage all costs associated with a project, ensuring precise budget control and financial transparency. It organizes expenses by categories, dates, and payment methods, enabling users to quickly identify overspending and optimize resource allocation. This document facilitates accurate financial reporting and supports better decision-making throughout the project lifecycle.

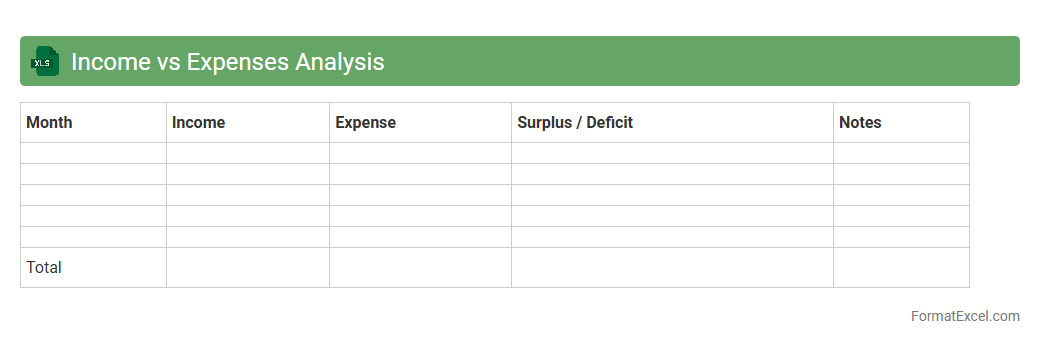

Income vs Expenses Analysis

An

Income vs Expenses Analysis Excel document is a financial tool designed to track and compare revenue against expenditures over a specific period. It helps identify patterns in cash flow, enabling better budgeting and informed decision-making to maintain financial health. By visualizing income and expenses, users can quickly spot areas for cost reduction and optimize savings.

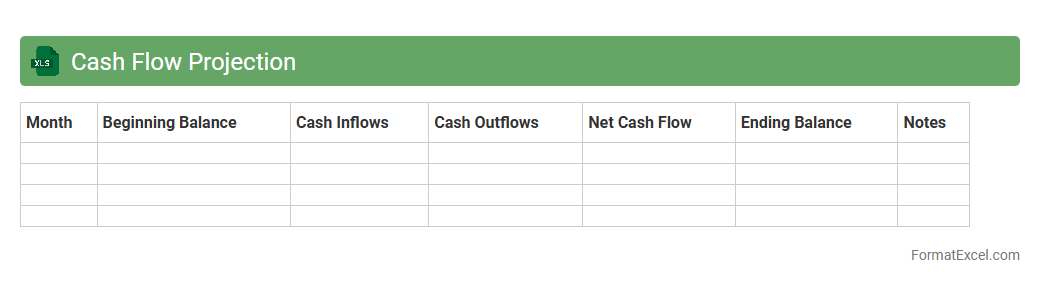

Cash Flow Projection

A

Cash Flow Projection Excel document is a financial tool that forecasts a business's future cash inflows and outflows, helping to predict liquidity over a specific period. It is useful for managing budgeting, planning expenses, and ensuring that the company maintains sufficient cash reserves to meet obligations. By providing a clear overview of expected financial activity, it supports better decision-making and reduces the risk of cash shortages.

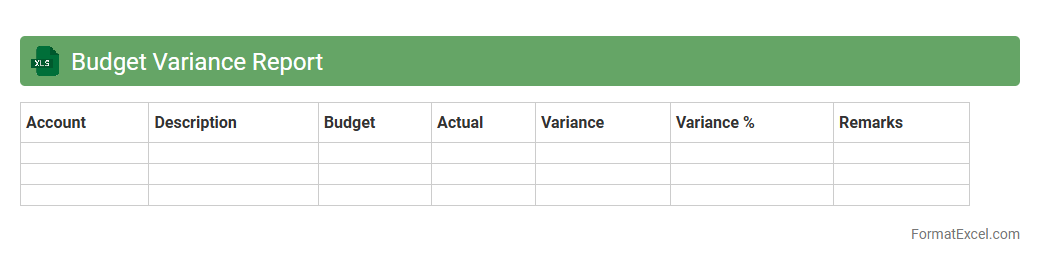

Budget Variance Report

A

Budget Variance Report Excel document tracks the differences between budgeted and actual financial figures, highlighting areas where spending exceeds or falls short of expectations. It enables businesses to monitor financial performance, identify cost overruns or savings, and make informed decisions to improve budgeting accuracy. By providing clear visualizations and detailed comparisons, this report supports effective financial management and resource allocation.

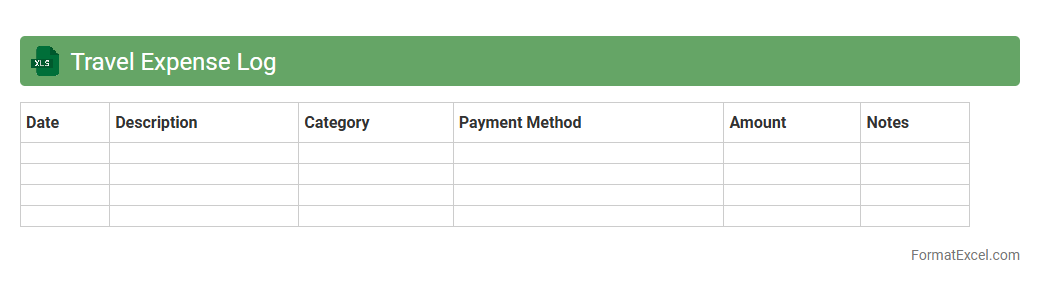

Travel Expense Log

A

Travel Expense Log Excel document systematically records all travel-related expenditures, including transportation, accommodation, meals, and incidentals. It helps individuals and businesses manage budgets, track spending patterns, and streamline reimbursement processes with clear, organized data. This tool enhances financial accountability and ensures accurate reporting for tax deductions or company audits.

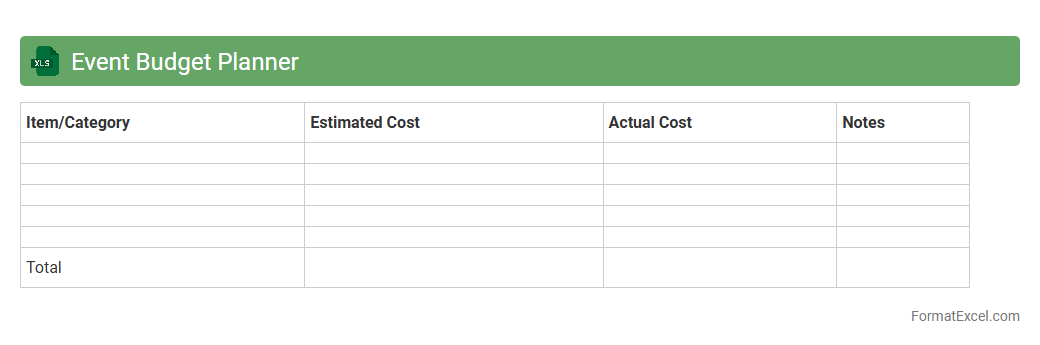

Event Budget Planner

An

Event Budget Planner Excel document is a customizable spreadsheet designed to help organize and track all financial aspects of an event, including expenses, income, and overall budget allocation. It enables precise monitoring of costs, ensuring that spending stays within limits and financial resources are effectively managed. Using this tool enhances financial planning accuracy, reduces the risk of overspending, and supports successful event execution.

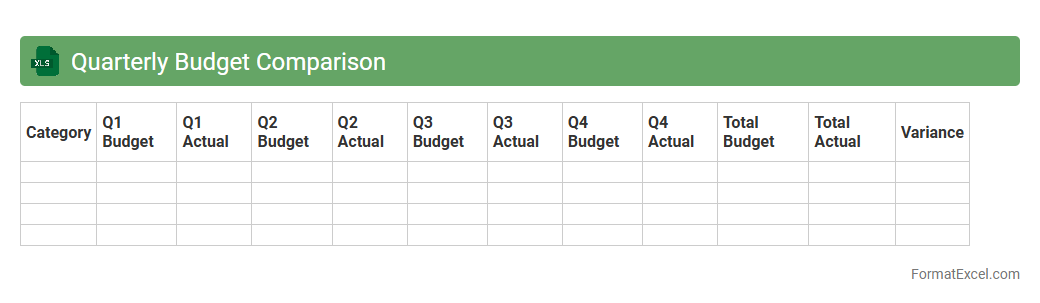

Quarterly Budget Comparison

A

Quarterly Budget Comparison Excel document is a financial tool that tracks and compares budgeted expenses against actual spending over each quarter. It enables businesses to identify variances, measure financial performance, and make informed decisions to improve budget accuracy. This document is essential for monitoring cash flow, controlling costs, and optimizing resource allocation to enhance overall financial management.

Grant Expenditure Tracking

A

Grant Expenditure Tracking Excel document is a specialized financial tool designed to monitor and manage funds allocated from grants. It helps organizations maintain accurate records of spending, ensures compliance with grant conditions, and supports transparent financial reporting. This tool streamlines budget oversight and facilitates timely decision-making for effective grant management.

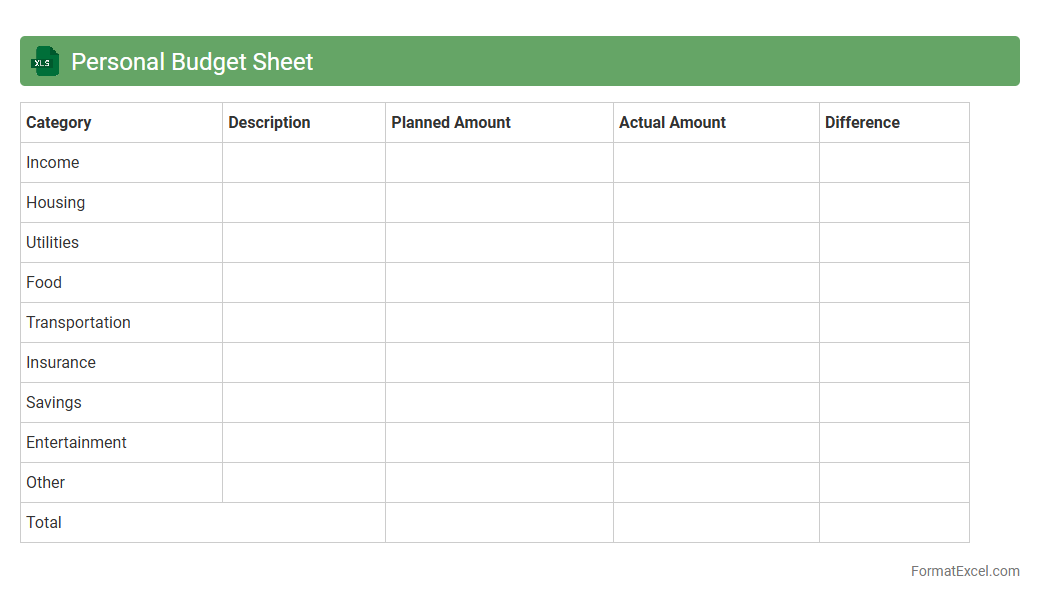

Personal Budget Sheet

A

Personal Budget Sheet Excel document is a structured spreadsheet designed to track income, expenses, and savings over a specified period, helping users manage their finances effectively. It allows for easy categorization of spending, enabling clear visibility of financial habits and identification of areas for cost-cutting or increased savings. By providing a detailed overview of cash flow, this tool supports informed decision-making and helps achieve financial goals with greater discipline and organization.

Capital Expenditure Tracker

A

Capital Expenditure Tracker Excel document is a financial tool designed to monitor and manage the spending on physical assets like equipment, buildings, and technology. It helps businesses maintain accurate records of capital outflows, ensuring better budget control and compliance with accounting standards. This tracker supports decision-making by providing clear visibility into investment patterns and asset lifecycle costs.

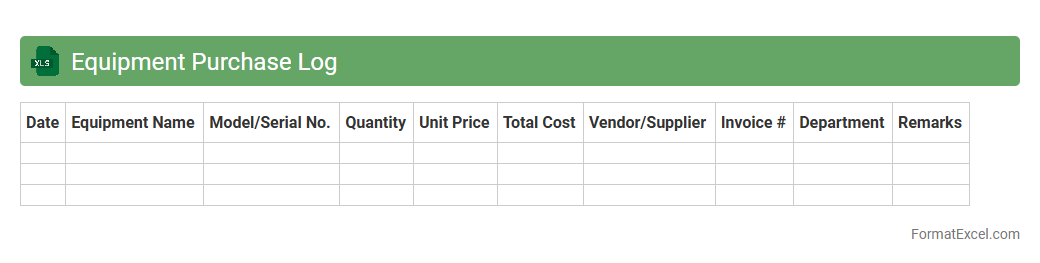

Equipment Purchase Log

An

Equipment Purchase Log Excel document is a structured spreadsheet designed to record and track all equipment acquisitions within an organization. It enables efficient management by documenting purchase dates, vendors, costs, warranty details, and equipment specifications. This log helps maintain accurate financial records, ensures timely maintenance, and supports budgeting and inventory management processes.

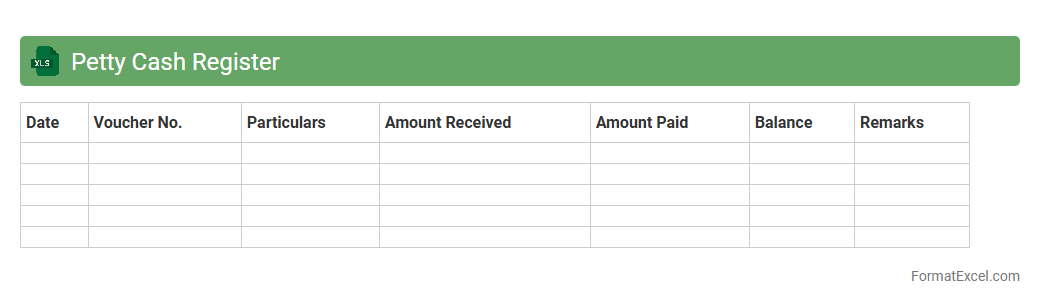

Petty Cash Register

A

Petty Cash Register Excel document is a digital spreadsheet designed to track small daily cash expenditures efficiently. It helps in maintaining accurate records of petty cash inflows and outflows, ensuring transparency and easy reconciliation. This tool is useful for businesses to manage minor expenses without disrupting main accounting processes, facilitating better financial control and audit readiness.

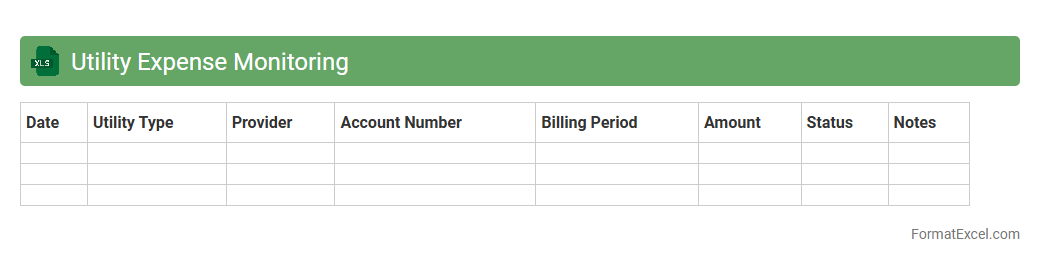

Utility Expense Monitoring

The

Utility Expense Monitoring Excel document is a powerful tool designed to track and analyze utility costs such as electricity, water, and gas over time. It enables users to identify usage patterns, detect anomalies, and forecast future expenses, leading to better budget management and cost reduction strategies. By consolidating all utility bills in one place, it simplifies expense monitoring and supports informed decision-making for both households and businesses.

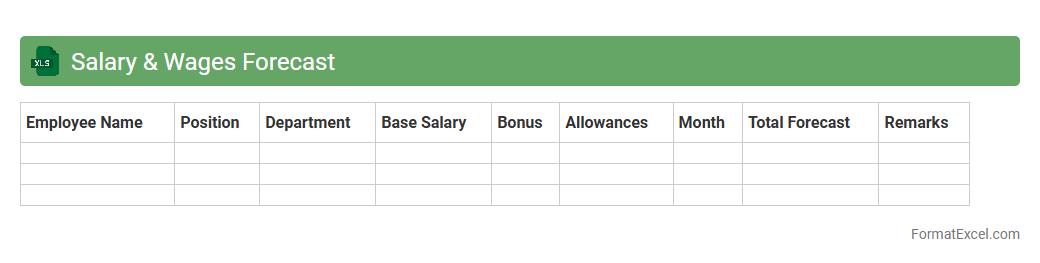

Salary & Wages Forecast

A

Salary & Wages Forecast Excel document is a financial planning tool that estimates future payroll expenses based on current salary data, projected raises, bonuses, and new hires. It helps businesses anticipate labor costs, manage budgets effectively, and make informed decisions regarding staffing and compensation strategies. Utilizing this forecast ensures accurate financial planning and supports strategic workforce management to optimize operational efficiency.

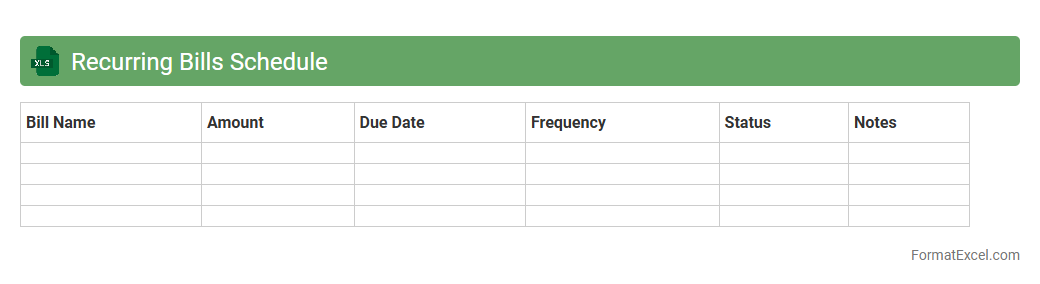

Recurring Bills Schedule

A

Recurring Bills Schedule Excel document is a structured spreadsheet designed to track and manage regular monthly expenses such as utilities, rent, subscriptions, and loan payments. It helps users automate bill monitoring, ensuring timely payments and avoiding late fees by providing clear visibility of due dates and amounts. This tool enhances financial planning by maintaining organized records and enabling budget forecasting for recurring financial obligations.

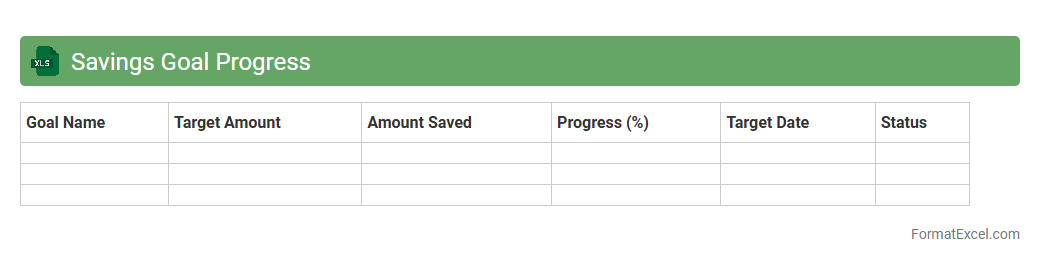

Savings Goal Progress

The

Savings Goal Progress Excel document is a structured tool that tracks and visualizes your savings journey by recording deposits, target amounts, and timelines. It helps users monitor financial milestones, identify saving trends, and make informed adjustments to meet financial objectives efficiently. By providing clear insights into progress, this document promotes disciplined saving habits and enhances overall financial planning.

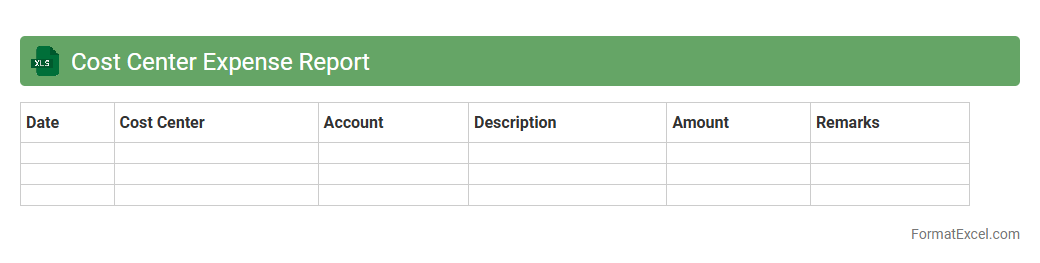

Cost Center Expense Report

A

Cost Center Expense Report Excel document is a financial tool used to track and analyze expenses incurred by different cost centers within an organization. It helps in monitoring budget adherence, identifying cost-saving opportunities, and ensuring accurate allocation of expenses. This report enhances financial transparency and supports strategic decision-making by providing detailed insights into departmental spending patterns.

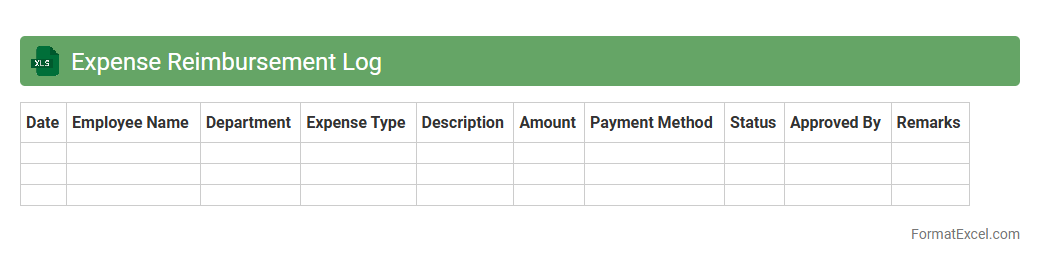

Expense Reimbursement Log

An

Expense Reimbursement Log Excel document is a systematic tool designed to track and record all expense claims made by employees for business-related expenditures. It helps organizations maintain accurate financial records, ensuring timely verification and reimbursement of expenses, which improves budget management and transparency. Utilizing this log reduces errors, streamlines the reimbursement process, and supports compliance with company policies and tax regulations.

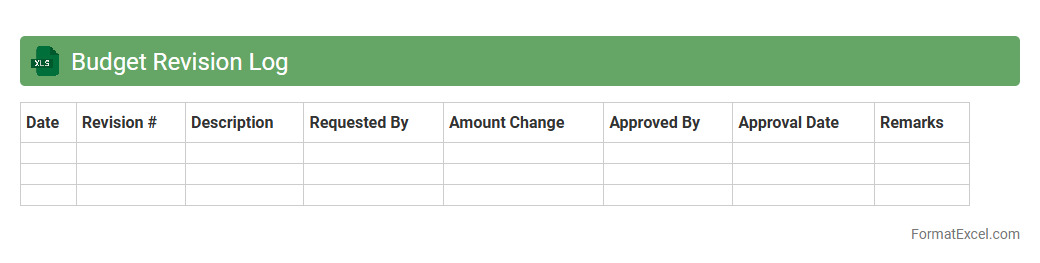

Budget Revision Log

A

Budget Revision Log Excel document is a tool designed to track changes and updates made to an organization's budget over time, capturing details such as revision dates, amounts, reasons, and approvals. This log enhances financial transparency, enabling project managers and accountants to monitor budget adjustments accurately and maintain a clear audit trail. By organizing budget revisions systematically, it aids in effective financial planning, control, and reporting, ensuring alignment with organizational goals and compliance requirements.

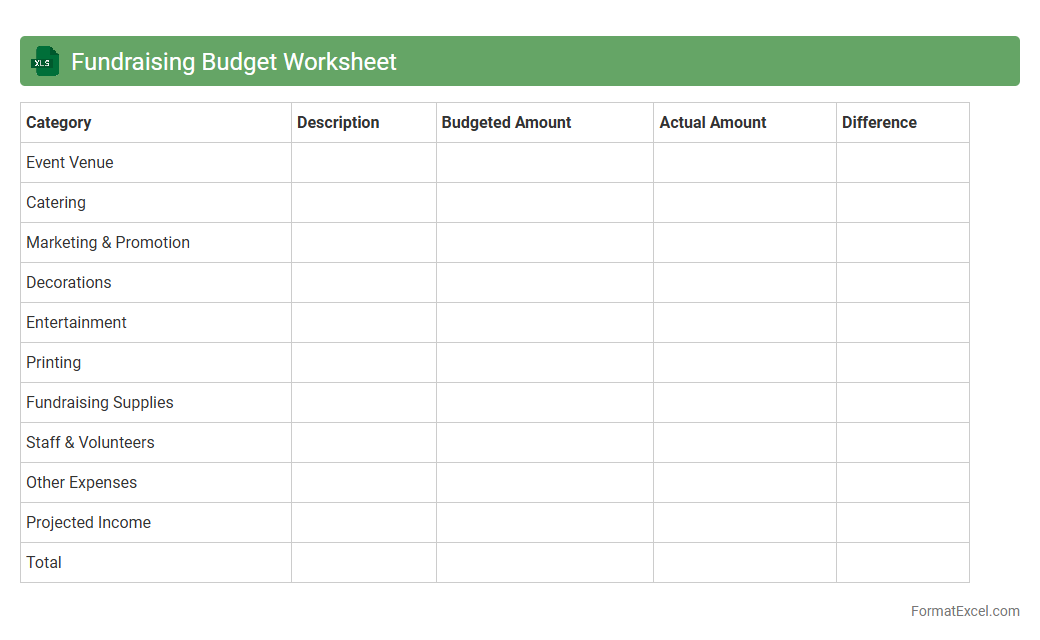

Fundraising Budget Worksheet

A

Fundraising Budget Worksheet Excel document organizes projected income and expenses for fundraising events or campaigns, enabling precise financial planning and tracking. It helps nonprofits and organizations allocate resources efficiently, monitor fundraising goals, and ensure transparency in budget management. Using this tool improves decision-making by providing clear insights into fundraising performance and cost control.

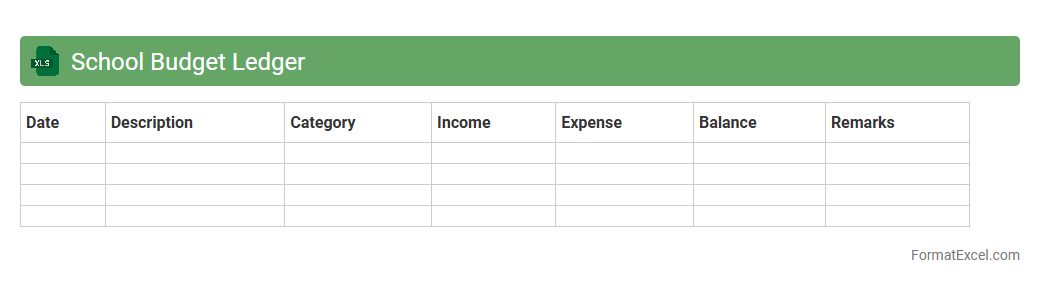

School Budget Ledger

A

School Budget Ledger Excel document is a digital tool designed to systematically track and manage school finances, including income, expenses, and budgets for various departments or projects. It helps administrators maintain transparency, ensure accurate financial planning, and monitor budget adherence effectively. By providing organized financial records, this ledger facilitates informed decision-making and resource allocation within educational institutions.

Office Supplies Expense Tracker

An

Office Supplies Expense Tracker Excel document is a tool designed to monitor and manage the costs associated with purchasing office supplies. It helps businesses maintain organized records of expenses, categorize purchases, and analyze spending patterns to identify cost-saving opportunities. By providing clear visibility into supply expenditures, it supports budget adherence and improves financial decision-making.

Introduction to Budget Tracking in Excel

Budget tracking in Excel allows users to monitor income and expenses efficiently with customizable spreadsheets. Using Excel's versatile grid layout helps organize financial data in real-time for better control. This method simplifies financial planning and expense management.

Benefits of Using Excel for Budget Management

Excel offers flexibility, easy data entry, and powerful calculation features ideal for budget management. Users can leverage formulas and charts to visualize their financial health clearly. The cost-effectiveness of Excel makes it accessible for both personal and business budgeting.

Essential Components of a Budget Tracking Format

A comprehensive budget tracking format includes income, expenses, categories, dates, and balance columns. Clearly defined categories help track spending patterns and identify areas for savings. It should also include totals and variance analysis for accuracy.

Step-by-Step Guide to Creating a Budget Tracker in Excel

Start by listing your expected income and expense categories in columns. Use formulas like SUM and IF to calculate totals and variances. Finally, format the sheet with tables and conditional formatting to enhance readability.

Recommended Excel Functions for Budget Tracking

Functions like SUM, IF, VLOOKUP, and SUMIF are essential for dynamic financial analysis. These functions automate calculations and enable data comparisons across various budgets. Mastering these functions improves tracking accuracy and efficiency.

Sample Budget Tracking Templates in Excel

Excel offers various templates that you can customize for personal or business use. Templates often include pre-built formulas and charts to ease setup. Using a template can save time and ensure structural integrity for your budget sheet.

Tips for Customizing Your Excel Budget Format

Customize your tracker with color coding, dynamic charts, and drop-down menus for easier data entry and visualization. Tailor the budget categories to reflect your unique income and spending habits. Enhancing user experience makes regular tracking more manageable.

Common Mistakes to Avoid in Budget Tracking Spreadsheets

Avoid errors like neglecting to update data regularly or mixing different currencies without conversion. Incorrect formula usage can lead to misleading results, so double-check calculations. Effective data integrity ensures reliable budgeting outcomes.

Automating Budget Analysis with Excel Tools

Use Excel tools such as PivotTables and Macros to automate data summarization and repetitive tasks. Automation accelerates budget reviews and helps identify trends quickly. Incorporating automation saves time and improves consistency.

Best Practices for Maintaining an Accurate Excel Budget

Update your budget tracker consistently and reconcile it with bank statements for accuracy. Backup your files regularly to prevent data loss and review formulas periodically. Commitment to these best practices ensures effective and reliable budget management.