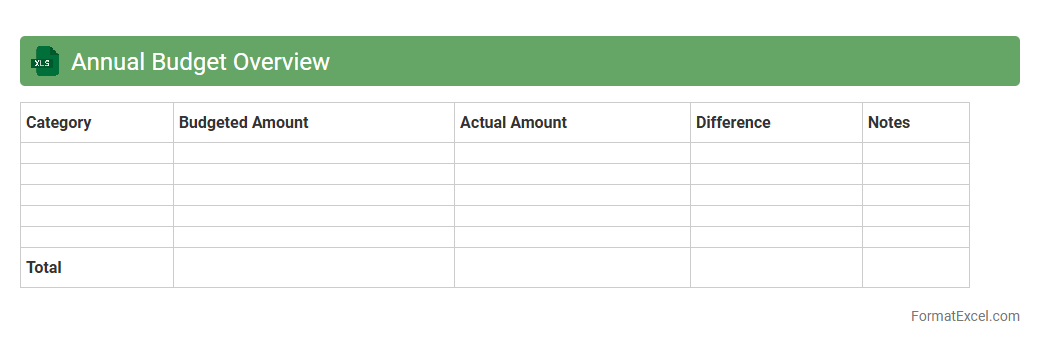

Annual Budget Overview

An

Annual Budget Overview Excel document is a comprehensive tool designed to track income, expenses, and financial goals throughout the year. It allows users to monitor monthly and yearly spending patterns, ensuring better financial planning and resource allocation. By providing clear visual summaries and detailed breakdowns, it enhances decision-making and helps maintain fiscal discipline.

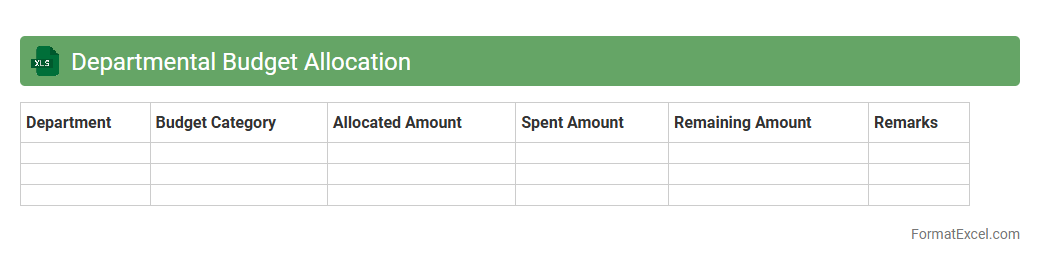

Departmental Budget Allocation

A

Departmental Budget Allocation Excel document is a structured spreadsheet designed to plan, track, and manage the distribution of financial resources across various departments within an organization. It helps in monitoring expenditures against allocated budgets, ensuring efficient use of funds, and identifying areas that require financial adjustments. This tool supports informed decision-making by providing clear visibility into budget performance and facilitating strategic financial planning.

Expense Tracking Sheet

An

Expense Tracking Sheet in Excel is a digital tool designed to record, categorize, and analyze personal or business expenses. It helps users monitor spending patterns, identify cost-saving opportunities, and maintain budget control by providing organized financial data. Using this sheet improves financial decision-making and ensures better management of income versus expenditures.

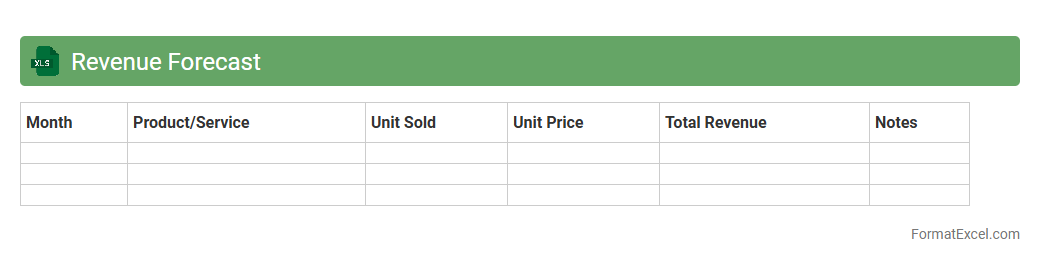

Revenue Forecast

A

Revenue Forecast Excel document is a spreadsheet tool designed to project future income based on historical sales data, market trends, and business assumptions. It helps businesses plan budgets, allocate resources efficiently, and set realistic financial goals by providing clear visibility into expected revenue streams. Using this document enables companies to make informed strategic decisions and assess the impact of different scenarios on their financial health.

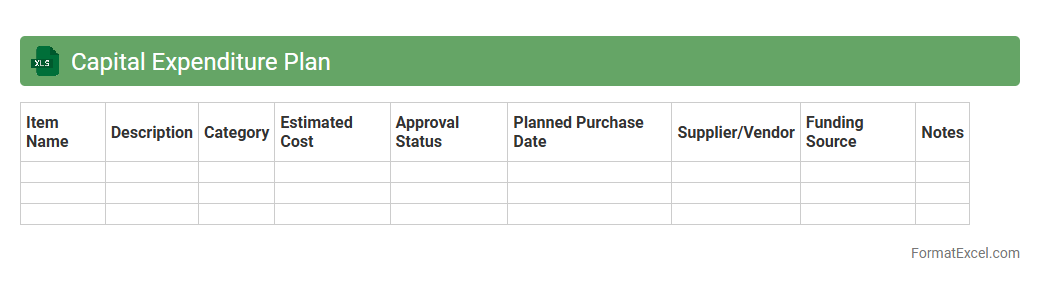

Capital Expenditure Plan

A

Capital Expenditure Plan Excel document is a structured financial tool used to outline and manage an organization's planned investments in long-term assets such as property, equipment, or infrastructure. It helps businesses forecast budget requirements, allocate resources efficiently, and track expenditures against planned capital projects. Utilizing this document enhances financial planning accuracy, supports decision-making, and ensures effective monitoring of large-scale investments.

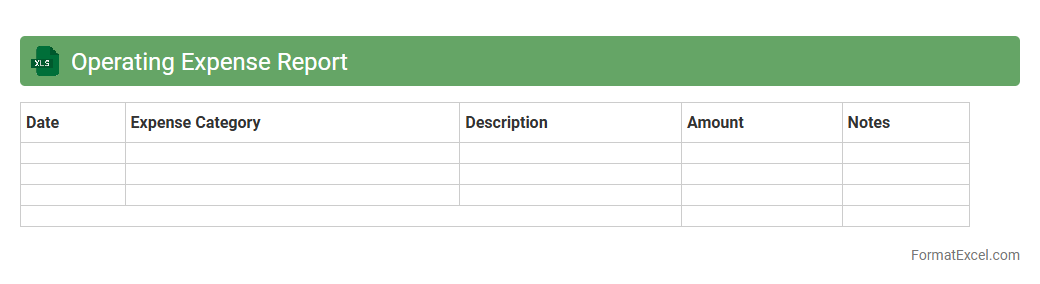

Operating Expense Report

An

Operating Expense Report Excel document is a structured spreadsheet used to track and analyze a company's day-to-day expenses, including rent, utilities, and payroll. It helps businesses monitor cost patterns, manage budgets effectively, and identify areas for potential savings. Regularly updating this report supports informed financial decisions and enhances overall operational efficiency.

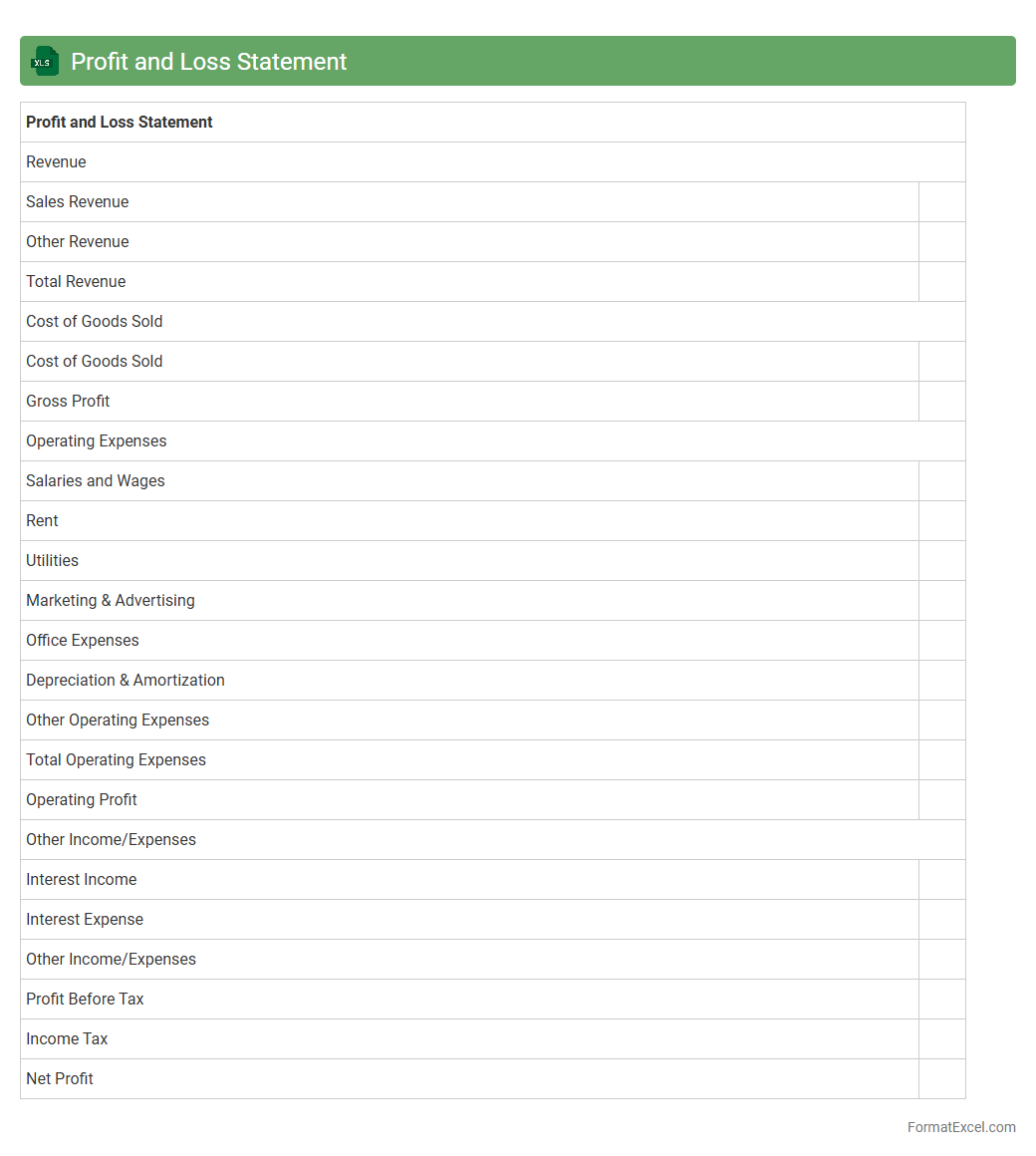

Profit and Loss Statement

A

Profit and Loss Statement Excel document is a financial tool that systematically records revenue, costs, and expenses over a specific period to determine net profit or loss. It is essential for businesses to analyze financial performance, identify trends, and make informed decisions about budgeting and investments. Using this document enhances accuracy, efficiency, and clarity in tracking financial health and driving strategic growth.

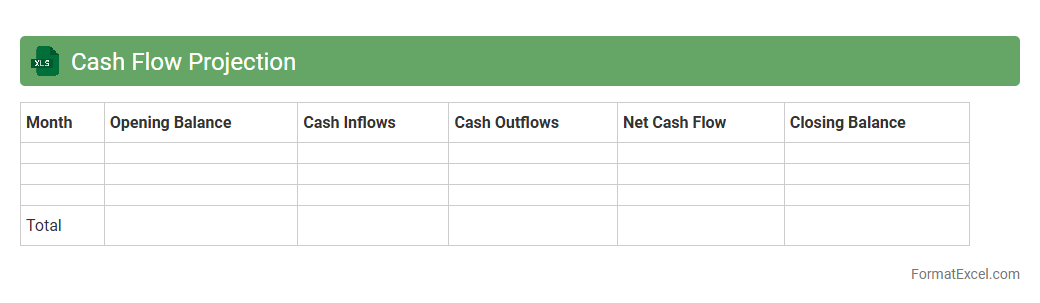

Cash Flow Projection

A

Cash Flow Projection Excel document is a financial tool designed to forecast the inflows and outflows of cash over a specific period, allowing businesses to manage liquidity effectively. It helps identify potential cash shortages, optimize budgeting decisions, and plan for future expenses or investments. Using this projection improves financial stability by providing clear insights into cash availability, enabling timely responses to cash flow challenges.

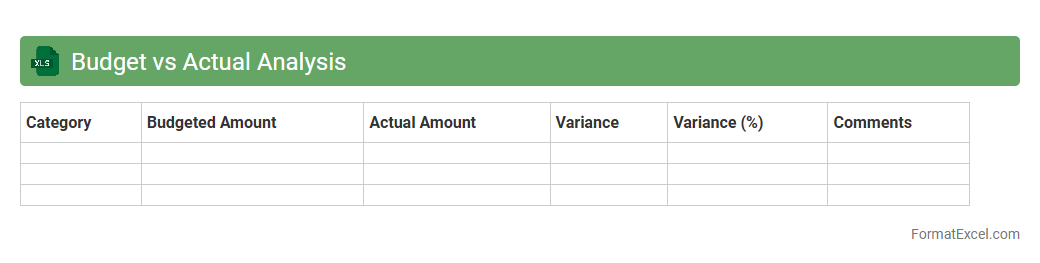

Budget vs Actual Analysis

A

Budget vs Actual Analysis Excel document compares planned financial allocations against actual expenditures to identify discrepancies and improve financial management. It enables businesses to track spending patterns, control costs, and make informed decisions for future budgeting. By highlighting variances, this tool helps optimize resource allocation and enhance overall budgetary accuracy.

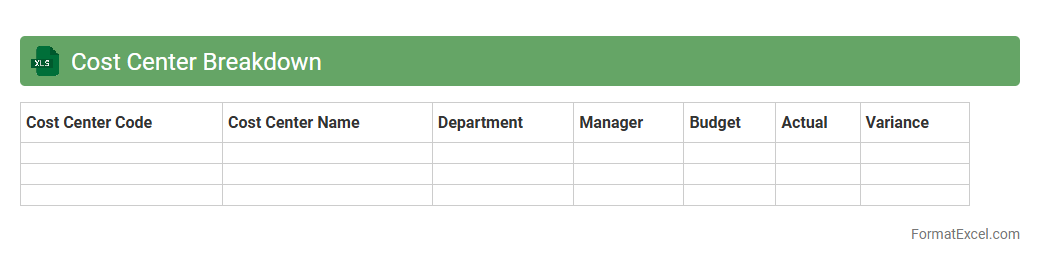

Cost Center Breakdown

A

Cost Center Breakdown Excel document is a detailed financial report that categorizes expenses and revenues by specific departments or cost centers within an organization. It helps track and analyze individual cost drivers, enabling managers to allocate budgets more effectively and identify areas for cost reduction. This tool is essential for improving financial transparency, optimizing resource allocation, and enhancing overall budget control.

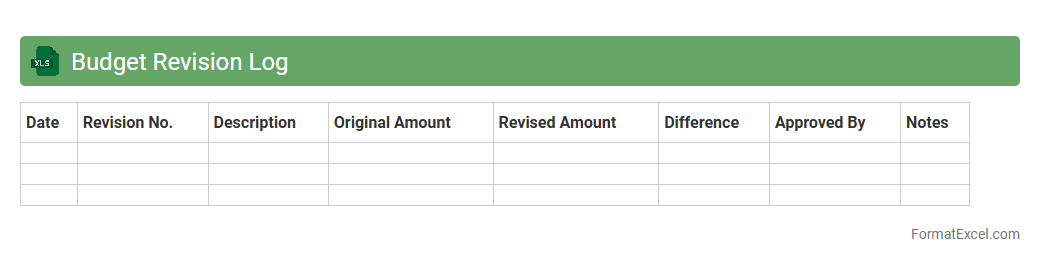

Budget Revision Log

A

Budget Revision Log Excel document is a crucial financial tool that tracks all modifications made to an original budget, allowing clear visibility of changes in allocation, amounts, and timelines. It helps organizations maintain accurate records for auditing purposes, ensures transparency in financial management, and facilitates better decision-making by providing a historical overview of budget adjustments. Using this log improves accountability and aids in forecasting future budget needs based on past revisions.

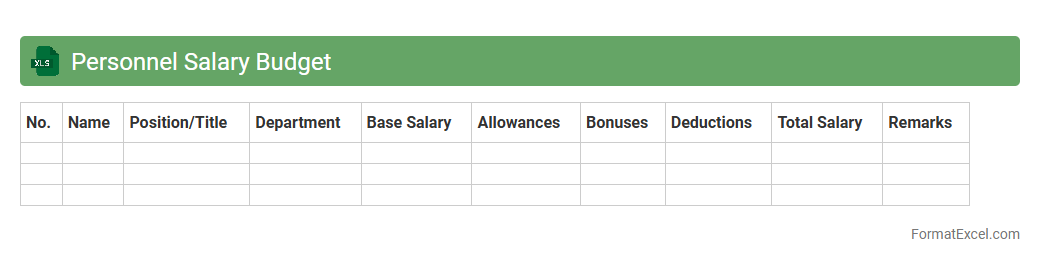

Personnel Salary Budget

A

Personnel Salary Budget Excel document is a structured spreadsheet that helps organizations plan and manage employee compensation efficiently, detailing salaries, bonuses, and benefits. It enables accurate forecasting of payroll expenses, ensuring alignment with financial goals and preventing budget overruns. This document also facilitates scenario analysis, aiding decision-makers in adjusting staffing costs based on changing business needs.

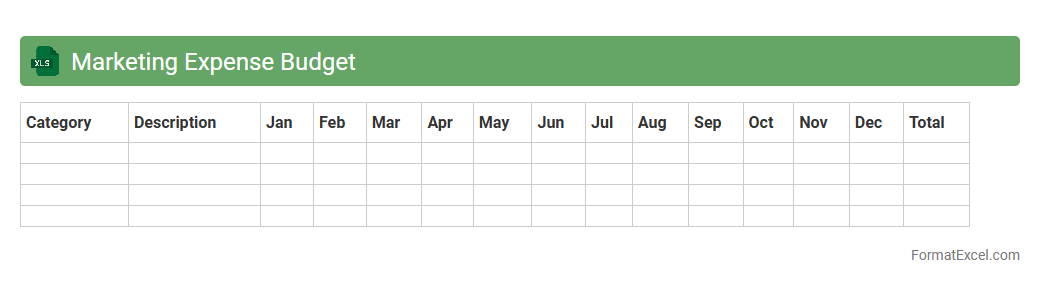

Marketing Expense Budget

A

Marketing Expense Budget Excel document is a structured spreadsheet designed to plan, track, and manage all marketing-related costs efficiently. It allows businesses to allocate funds across various marketing channels, monitor spending against the budget, and analyze cost-effectiveness for campaigns. This tool is essential for optimizing resource allocation, ensuring financial control, and maximizing return on marketing investments.

Project Budget Tracker

A

Project Budget Tracker Excel document is a powerful tool designed to monitor and control project expenses by recording costs, comparing budgeted versus actual spending, and forecasting financial needs. It enhances financial transparency, helps identify potential overspending early, and supports better decision-making by providing a clear overview of the project's financial status. This tracker improves resource allocation efficiency, enabling project managers to keep projects on budget and within financial constraints.

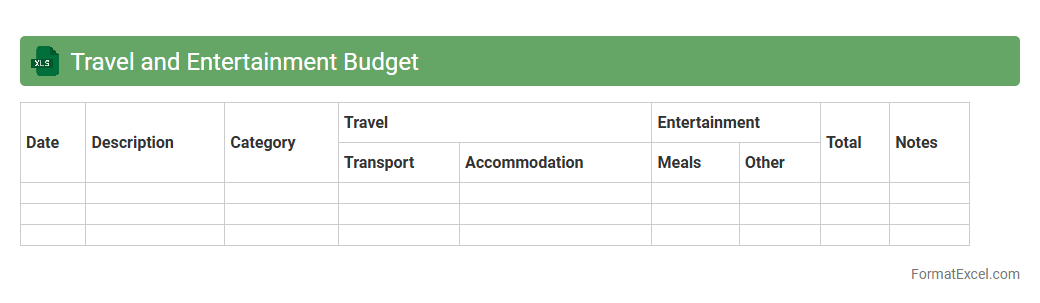

Travel and Entertainment Budget

A

Travel and Entertainment Budget Excel document is a spreadsheet tool designed to track and manage expenses related to business travel and entertainment activities. It helps organizations control costs by categorizing expenses, setting budget limits, and providing clear visibility into spending patterns. Using this document improves financial planning, ensures compliance with company policies, and aids in accurate expense reporting.

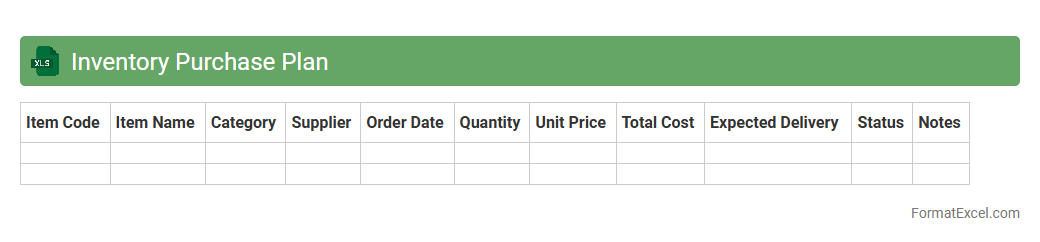

Inventory Purchase Plan

An

Inventory Purchase Plan Excel document is a detailed spreadsheet used to forecast and manage procurement schedules, quantities, and costs for inventory items. It helps businesses maintain optimal stock levels by tracking demand trends, supplier lead times, and budget constraints to prevent overstocking or stockouts. This tool enhances decision-making and operational efficiency by providing clear visibility into purchasing needs and timelines.

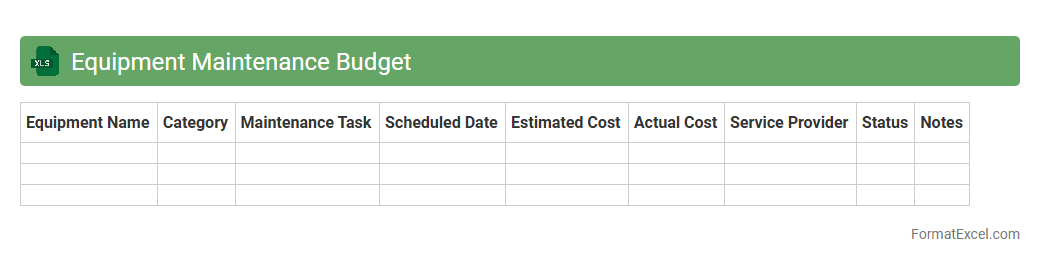

Equipment Maintenance Budget

An

Equipment Maintenance Budget Excel document is a structured spreadsheet designed to track and manage the costs associated with maintaining machinery and equipment. It allows organizations to plan expenses, forecast maintenance needs, and allocate funds efficiently, reducing unexpected downtime and costly repairs. By providing clear visibility into maintenance schedules and expenditures, this tool supports better financial decision-making and operational continuity.

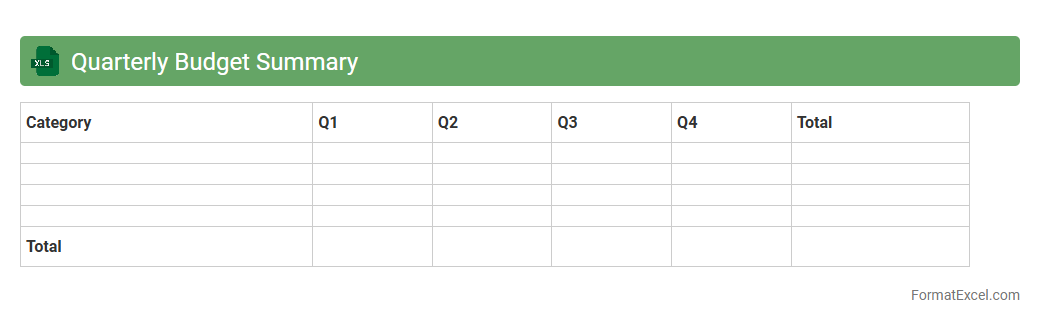

Quarterly Budget Summary

A

Quarterly Budget Summary Excel document consolidates financial data across three months to track income, expenses, and budget variances. It provides clear visibility into spending patterns and resource allocation, enabling more informed forecasting and financial decision-making. This tool is essential for maintaining fiscal discipline and ensuring alignment with organizational financial goals.

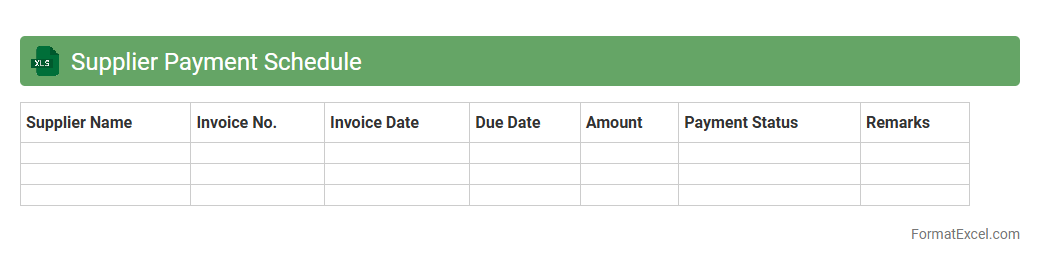

Supplier Payment Schedule

A

Supplier Payment Schedule Excel document is a detailed spreadsheet that organizes and tracks payment dates, amounts, and terms for all supplier invoices. It helps businesses maintain timely payments, avoid late fees, and manage cash flow efficiently by providing a clear overview of upcoming financial obligations. Using this schedule improves financial planning and strengthens supplier relationships through consistent and organized payment processes.

Utility Expense Tracking

A

Utility Expense Tracking Excel document is a tool designed to record and monitor monthly utility costs such as electricity, water, gas, and internet bills. It helps users identify spending patterns, manage budgets effectively, and detect unusual consumption that could indicate leaks or inefficiencies. This organized tracking enhances financial planning and supports cost-saving decisions for households or businesses.

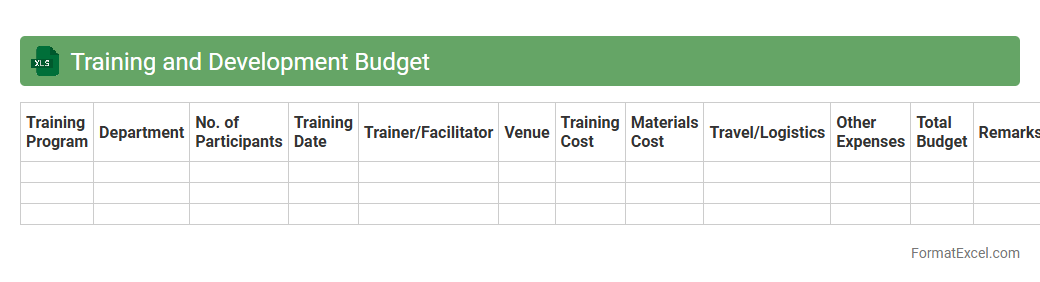

Training and Development Budget

A

Training and Development Budget Excel document is a detailed financial plan that outlines the costs associated with employee training programs, including materials, instructor fees, and facility expenses. It helps organizations allocate resources efficiently, track spending against planned budgets, and measure the return on investment for professional development initiatives. This tool enhances decision-making by providing clear visibility into expenditure patterns and ensuring training activities align with organizational goals.

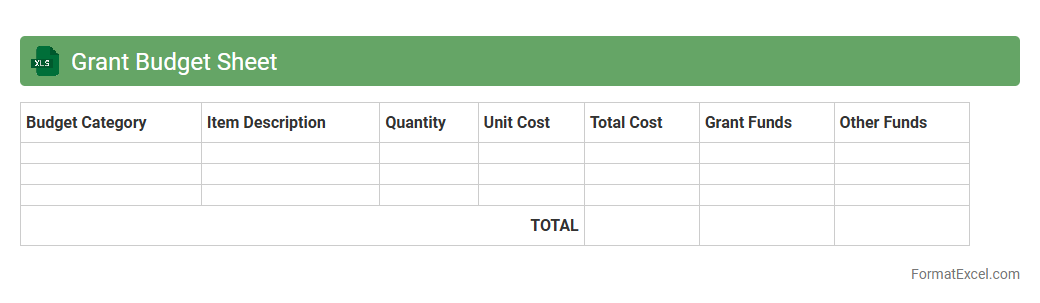

Grant Budget Sheet

A

Grant Budget Sheet Excel document is a structured spreadsheet designed to outline and manage the allocation of funds for grant projects accurately. It allows users to itemize expenses, track budget versus actual spending, and ensure compliance with grant requirements. This tool is essential for maintaining transparent financial records and supporting efficient resource management during the grant lifecycle.

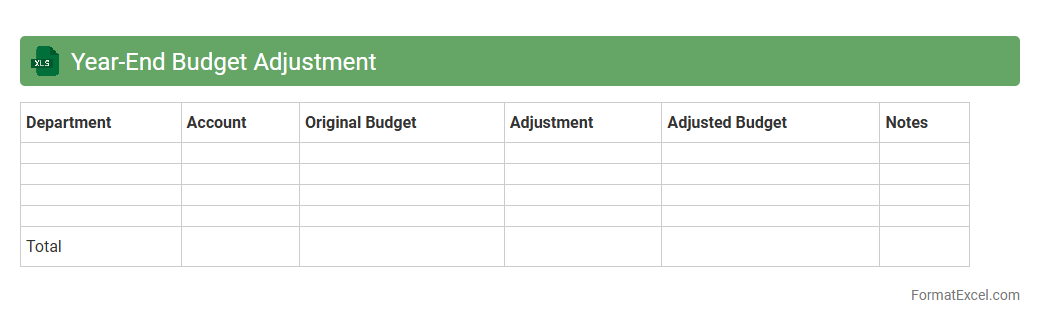

Year-End Budget Adjustment

A

Year-End Budget Adjustment Excel document is a financial tool designed to review, revise, and reconcile budget allocations before the fiscal year closes. It enables accurate tracking of expenses versus forecasted budgets, ensuring departments align expenditures with organizational financial goals. Using this document simplifies decision-making processes for reallocating funds, improving financial accuracy and compliance with accounting standards.

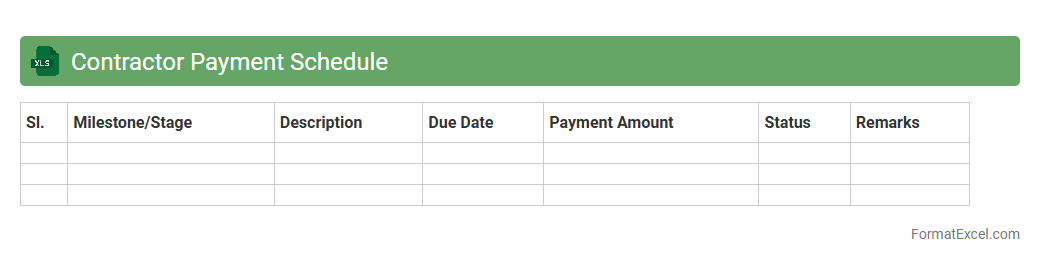

Contractor Payment Schedule

A

Contractor Payment Schedule Excel document is a structured spreadsheet used to organize and track payment milestones for contractors throughout a project. It helps ensure timely payments based on completed work stages, improving cash flow management and contract compliance. By clearly outlining payment timelines, amounts, and conditions, it minimizes disputes and enhances financial transparency between clients and contractors.

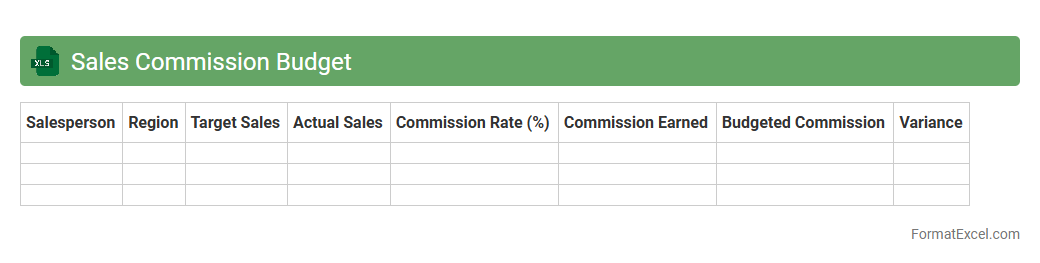

Sales Commission Budget

A

Sales Commission Budget Excel document is a financial tool designed to calculate and track commissions owed to sales representatives based on their performance metrics. It helps organizations manage payroll expenses, forecast commission payouts, and ensure accurate compensation alignment with sales targets. Utilizing this document improves budgeting accuracy, streamlines commission calculations, and supports strategic sales incentive planning.

Introduction to Business Budget Formats

Business budget formats provide a structured plan for managing company finances. A well-defined budget format helps in tracking income and expenses efficiently. Choosing the right format is crucial for financial clarity and control.

Importance of Budgeting in Business

Budgeting is essential for forecasting financial performance and ensuring sustainability. It allows businesses to allocate resources wisely and anticipate future needs. The budgeting process supports strategic decision-making and risk management.

Key Components of a Business Budget

Core elements include revenue projections, fixed and variable expenses, and profit margins. Accurate inclusion of these components ensures a realistic financial overview. The business budget must reflect all anticipated cash flows.

Benefits of Using Excel for Budgeting

Excel offers flexibility and powerful tools for budget creation and analysis. Its customizable features enable tailored budget spreadsheets that suit diverse business needs. Excel also supports real-time data updates and complex calculations.

Step-by-Step Guide to Creating a Budget in Excel

Start by outlining income sources, followed by listing expenses and setting budget goals. Use Excel's formatting and formula tools to organize and calculate totals automatically. Proper structure in the budget template makes tracking easier.

Essential Excel Formulas for Budget Management

Formulas like SUM, IF, and VLOOKUP streamline budgeting tasks by automating calculations. These functions help in summarizing expenses and comparing actual versus projected figures. Mastering these Excel formulas enhances budget accuracy.

Sample Business Budget Template Layout

A typical layout includes sections for income, expenses, and net profit organized by category and timeframe. Clear headings and labels improve readability and usability. A well-designed budget template fosters effective financial monitoring.

Customizing Your Excel Budget Format

Tailor your budget by adding relevant categories and adjusting time periods to match your business cycle. Use conditional formatting to highlight variances or critical items automatically. Customization ensures the budget format aligns with specific operational needs.

Common Mistakes to Avoid in Excel Budgets

Avoid errors such as incorrect formulas, incomplete expense tracking, or neglecting updates. Ensuring data accuracy prevents financial misinterpretations. Overlooking these can compromise the reliability of your Excel budget.

Tips for Maintaining and Updating Your Business Budget in Excel

Regularly review and adjust budgets to reflect changing business conditions and goals. Keep backup copies and document changes to maintain data integrity. Consistent maintenance of the business budget ensures ongoing financial control.