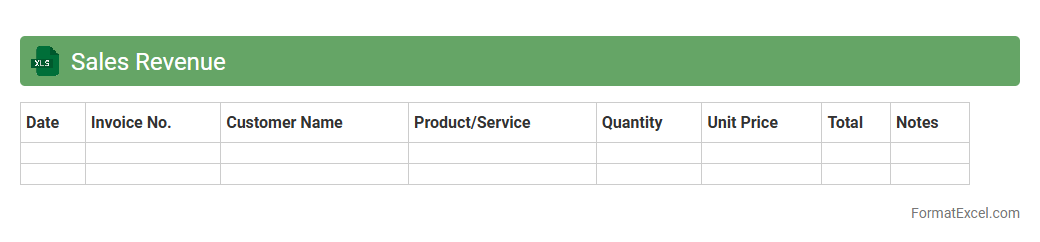

Sales Revenue

A

Sales Revenue Excel document is a spreadsheet designed to track and analyze income generated from sales activities. It allows businesses to organize data by product, date, region, or sales representative, facilitating accurate financial reporting and performance assessment. This tool is essential for monitoring trends, forecasting revenue, and making informed decisions to improve profitability.

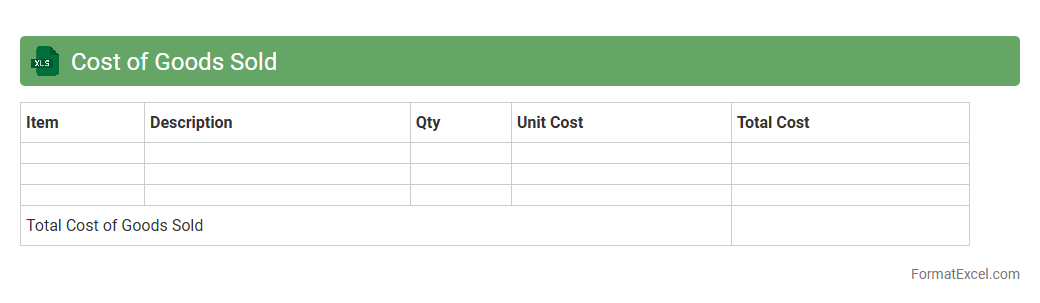

Cost of Goods Sold

A

Cost of Goods Sold (COGS) Excel document is a spreadsheet designed to track and calculate the total expenses directly related to producing goods sold by a business, including raw materials, labor, and manufacturing overhead. This document helps businesses analyze profitability by accurately reflecting the cost associated with inventory sold during a specific period, aiding in financial reporting and decision-making. It streamlines budgeting, forecasting, and pricing strategies by providing clear insights into production costs and inventory management.

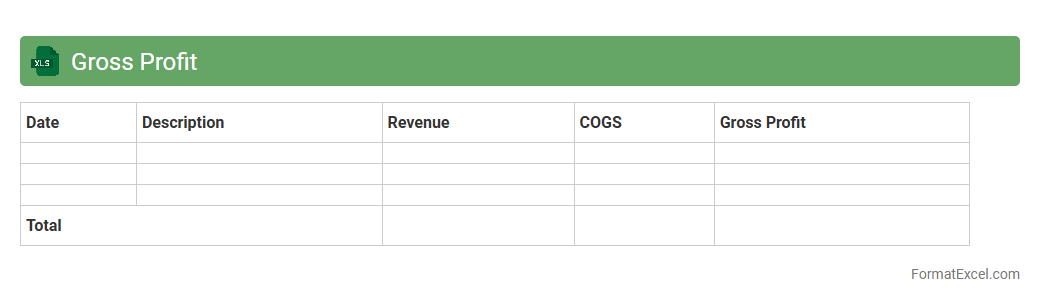

Gross Profit

A

Gross Profit Excel document is a spreadsheet tool designed to calculate and analyze the difference between sales revenue and the cost of goods sold (COGS). It helps businesses track profitability at a fundamental level, enabling better financial decision-making and budgeting. By organizing sales data and expenses efficiently, it supports identifying trends, managing costs, and improving overall financial health.

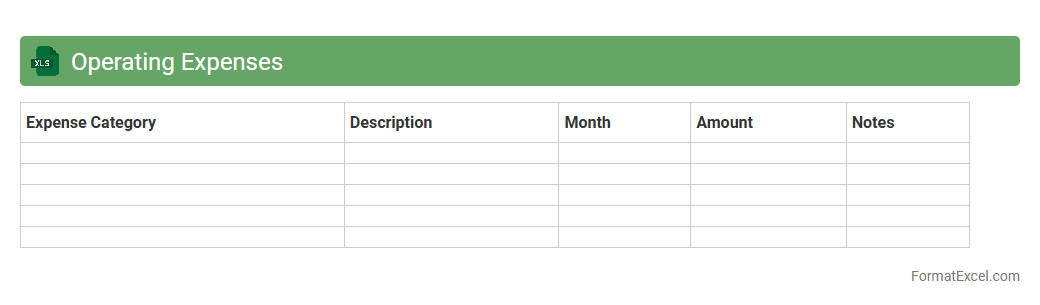

Operating Expenses

An

Operating Expenses Excel document is a financial tool designed to track and categorize day-to-day business costs such as rent, utilities, salaries, and supplies. It helps organizations monitor spending patterns, improve budget management, and make informed decisions to optimize operational efficiency. Using this document enables businesses to identify cost-saving opportunities and maintain accurate financial records for reporting and analysis.

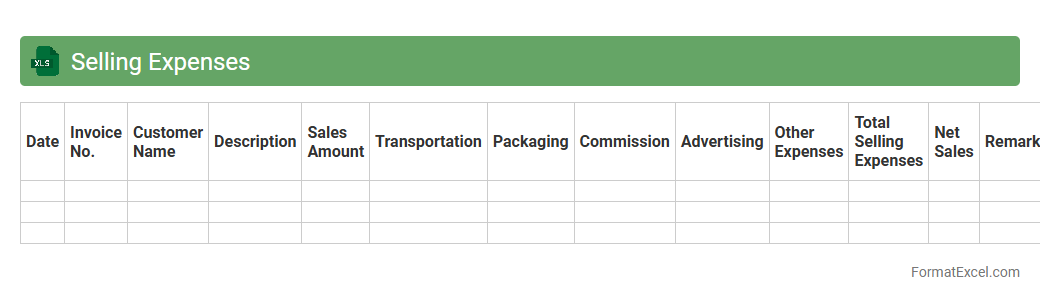

Selling Expenses

A

Selling Expenses Excel document is a spreadsheet designed to track and manage costs related to sales activities, such as advertising, commissions, and shipping expenses. It helps businesses analyze spending patterns, control budget allocation, and improve profitability by identifying areas where expenses can be optimized. Using this tool enhances financial transparency and supports more accurate forecasting and decision-making processes.

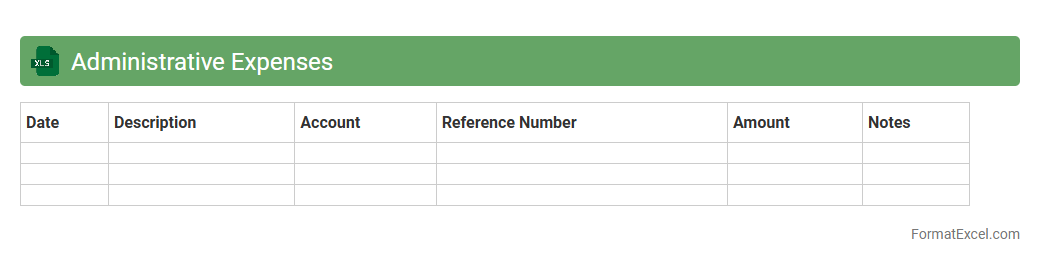

Administrative Expenses

An

Administrative Expenses Excel document is a structured spreadsheet used to record, track, and analyze all costs related to the general administration of a business, such as office supplies, utilities, salaries, and rent. It helps organizations maintain accurate financial records, monitor budget adherence, and identify areas for cost reduction. This tool enhances decision-making by providing clear visibility into operational expenditures and supporting efficient resource allocation.

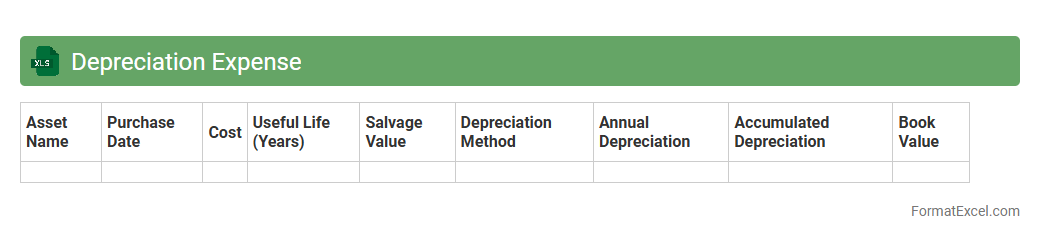

Depreciation Expense

A

Depreciation Expense Excel document is a tool used to systematically calculate and track the reduction in value of assets over time, typically for accounting and tax purposes. It helps businesses allocate the cost of tangible assets across their useful lives, ensuring accurate financial reporting and compliance with accounting standards. Utilizing this document enhances budgeting, asset management, and informed decision-making by providing detailed insights into asset depreciation schedules.

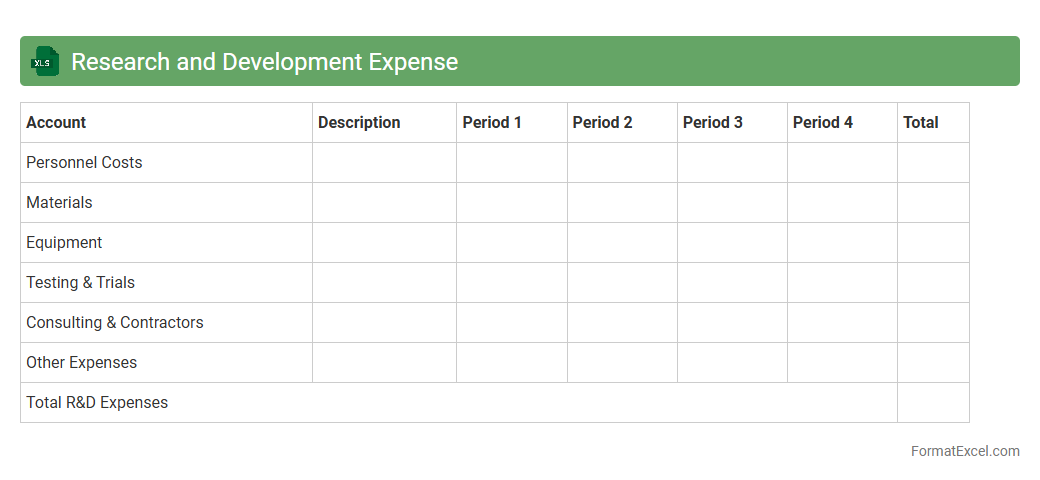

Research and Development Expense

A

Research and Development Expense Excel document is a detailed spreadsheet used to track, analyze, and manage costs associated with research and development activities within a company. This document allows businesses to monitor budget allocations, forecast expenses, and identify cost-saving opportunities, enhancing financial control and strategic planning. It is useful for improving transparency, facilitating decision-making, and ensuring compliance with accounting standards related to R&D expenditures.

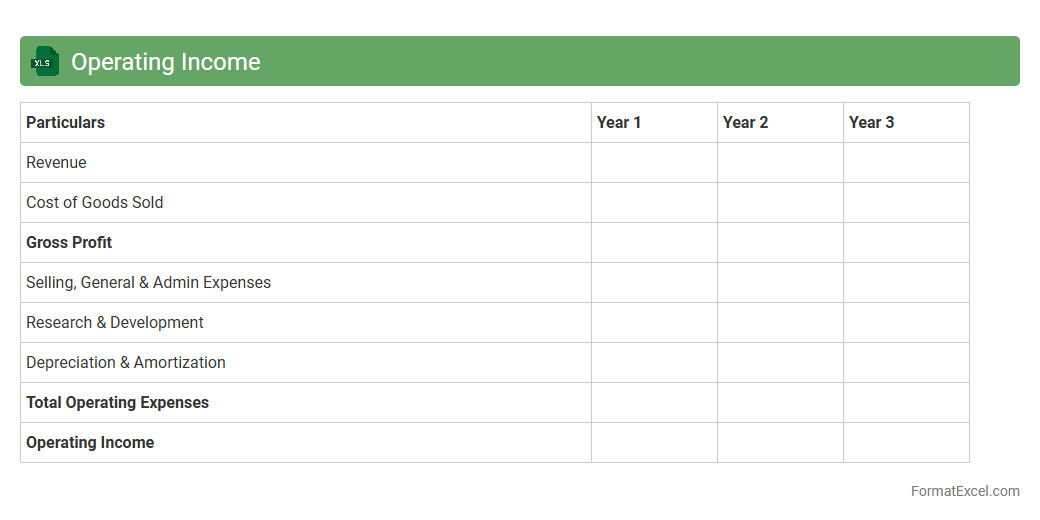

Operating Income

An

Operating Income Excel document is a financial tool that calculates and analyzes a company's operating income, which is the profit generated from core business operations before interest and taxes. This document helps businesses track profitability by organizing revenues, operating expenses, and costs, enabling more accurate financial forecasting and budgeting. It is essential for management to assess operational efficiency and make informed decisions to improve financial performance.

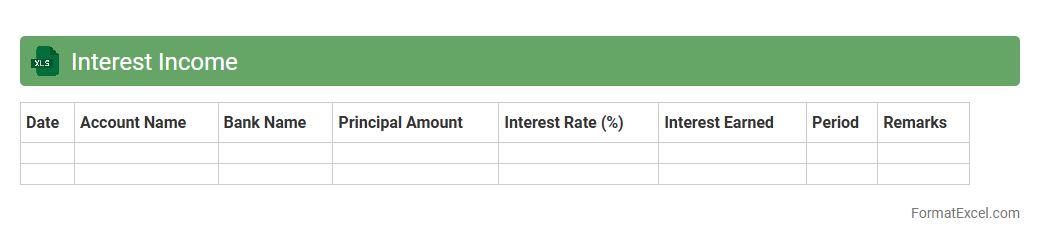

Interest Income

An

Interest Income Excel document is a detailed spreadsheet designed to track and calculate earnings generated from various interest-bearing financial instruments such as savings accounts, bonds, and loans. It helps users efficiently monitor their interest income over time, analyze trends, and ensure accurate financial reporting for tax purposes or investment performance assessment. This tool simplifies complex calculations, reduces errors, and enhances decision-making by providing clear insights into passive income streams.

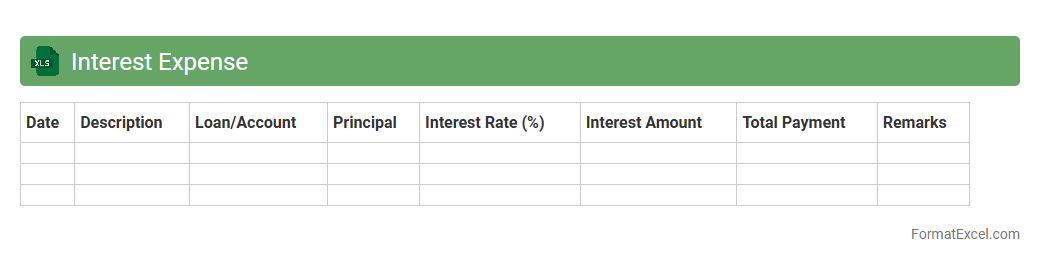

Interest Expense

An

Interest Expense Excel document organizes and calculates the costs associated with borrowed funds over a specific period, helping businesses track loan payments and interest rates effectively. It provides a clear overview of financial obligations, enabling better budgeting and cash flow management. This tool is essential for accurate financial reporting and decision-making, ensuring transparency in debt-related expenses.

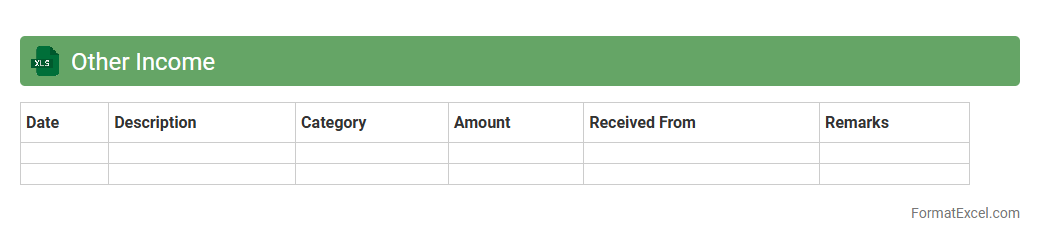

Other Income

The

Other Income Excel document is a financial tool designed to track and manage supplementary revenue streams beyond primary business income. It helps users organize various types of additional income, such as rental income, dividends, or interest, providing a clear overview for accurate budgeting and financial analysis. This document enhances decision-making by offering detailed insights into total earnings and supporting tax reporting and compliance efforts.

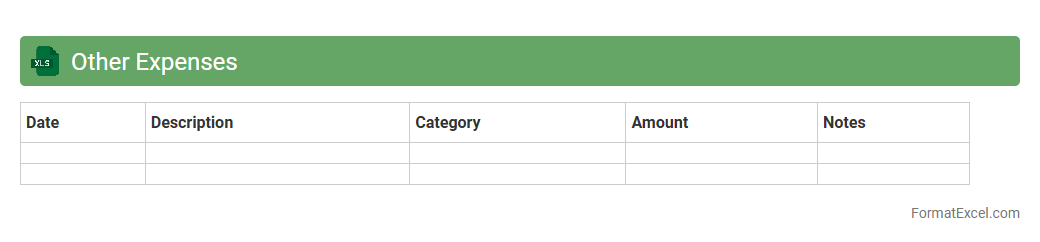

Other Expenses

The

Other Expenses Excel document is a financial tool designed to track and categorize miscellaneous business costs not included in primary expense categories. It helps in maintaining accurate financial records by providing a clear overview of incidental expenditures, aiding in budget management and financial analysis. This document enhances expense monitoring, ensuring better control over company spending and supporting strategic decision-making.

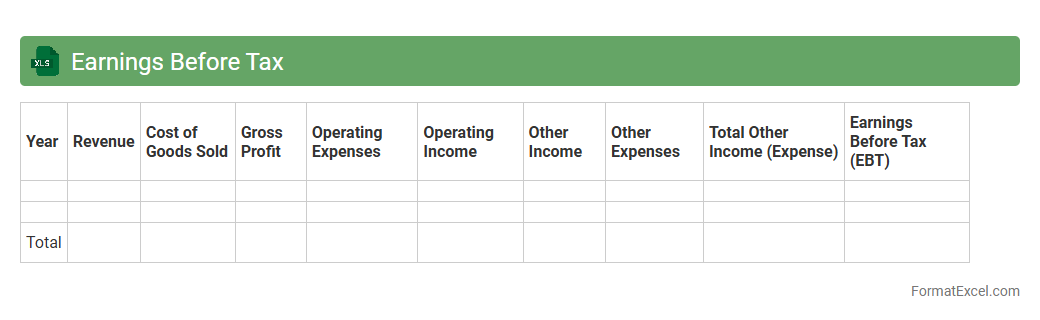

Earnings Before Tax

An

Earnings Before Tax (EBT) Excel document is a financial tool used to calculate a company's profitability before accounting for tax expenses. It organizes revenue, cost, and expense data systematically, enabling precise computation of pre-tax earnings essential for financial analysis and forecasting. This document helps businesses and investors assess operational efficiency and make informed decisions regarding budgeting and tax planning.

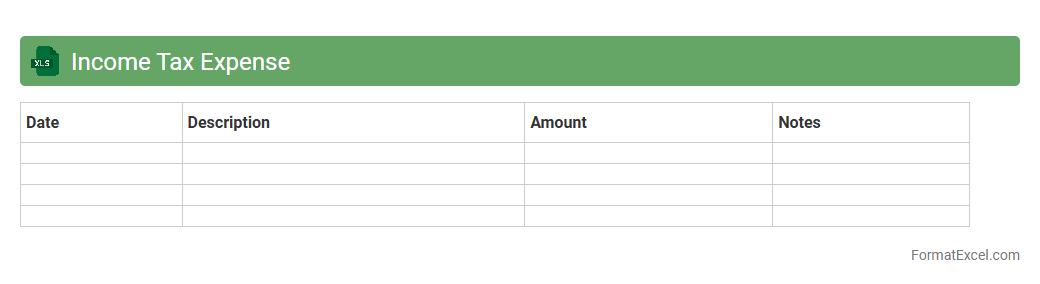

Income Tax Expense

An

Income Tax Expense Excel document is a financial tool that calculates and tracks the tax liabilities of an individual or business based on their taxable income. It automates complex tax computations, enabling accurate estimation of tax expenses for financial reporting and budgeting purposes. This document aids in maintaining compliance with tax regulations while optimizing tax planning and cash flow management.

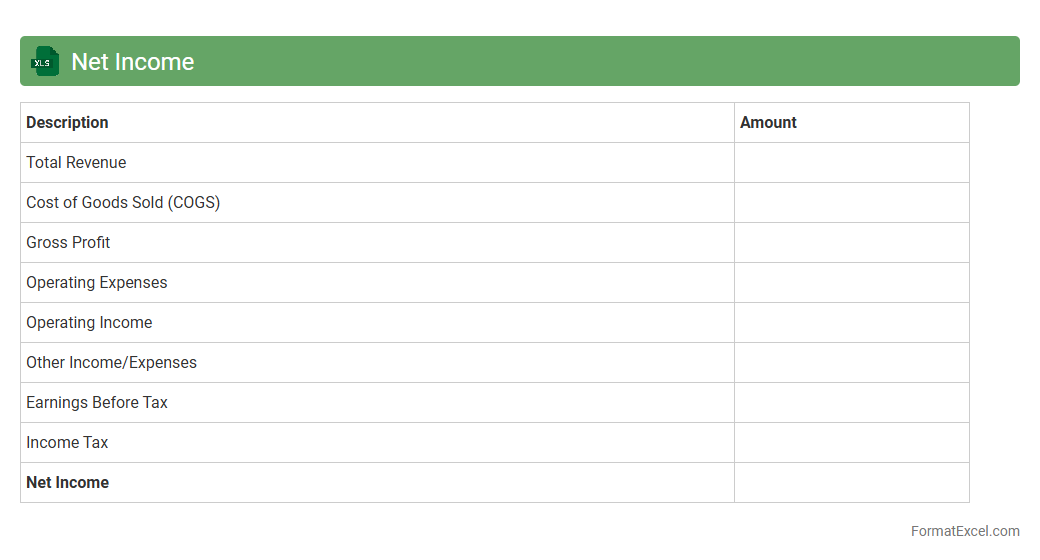

Net Income

A

Net Income Excel document is a spreadsheet used to calculate and analyze a company's net income by organizing revenue, expenses, and taxes in a structured format. It allows users to track profitability over specific periods, identify cost-saving opportunities, and make informed financial decisions. This tool is essential for budgeting, forecasting, and evaluating overall business performance efficiently.

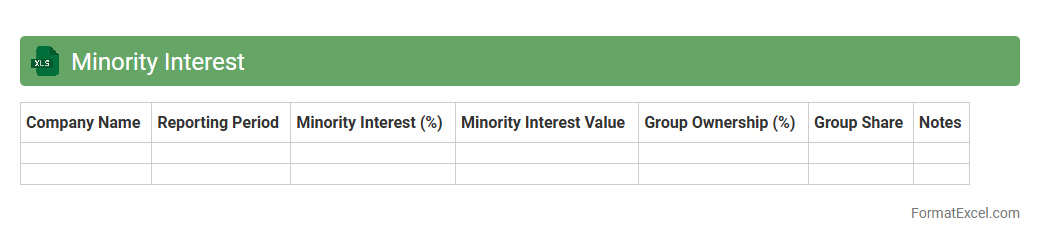

Minority Interest

A

Minority Interest Excel document tracks the portion of subsidiary equity not owned by the parent company, providing clear insights into ownership distribution. It is useful for consolidating financial statements, accurately reflecting the non-controlling shareholders' share in profits and losses. This tool aids in precise financial analysis and reporting, ensuring compliance with accounting standards like IFRS and GAAP.

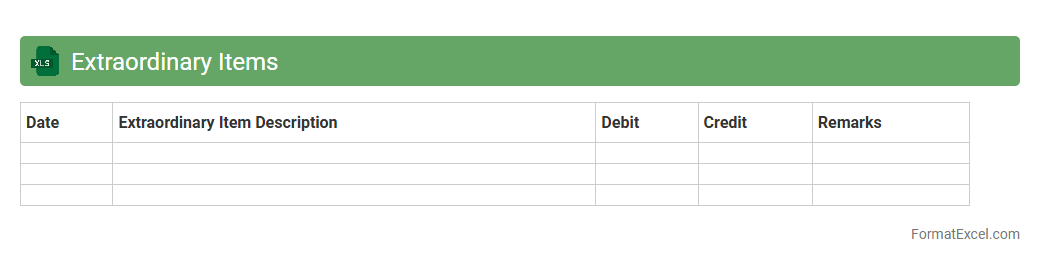

Extraordinary Items

The

Extraordinary Items Excel document is a specialized spreadsheet designed to record and analyze non-recurring financial transactions that fall outside normal business operations. It helps organizations identify and isolate unusual gains or losses, ensuring accurate financial reporting and better decision-making. By providing a clear overview of these items, the document supports improved transparency and compliance with accounting standards.

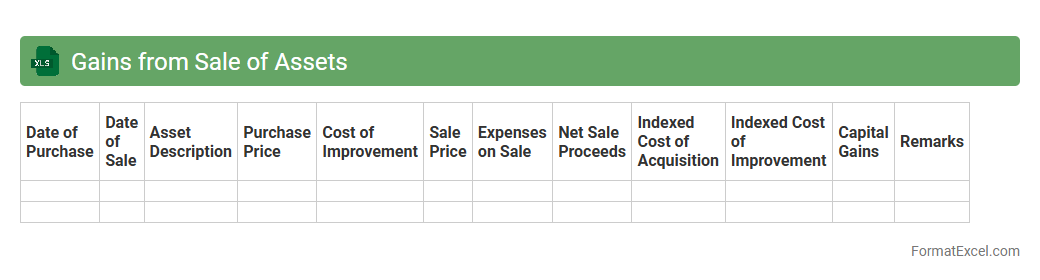

Gains from Sale of Assets

The

Gains from Sale of Assets Excel document is a financial tool designed to accurately calculate and track profits earned from selling company assets. It helps businesses monitor asset disposal by detailing sale proceeds, book values, and resulting gains or losses, ensuring precise financial reporting. This document improves decision-making by providing clear data on asset performance and its impact on overall profitability.

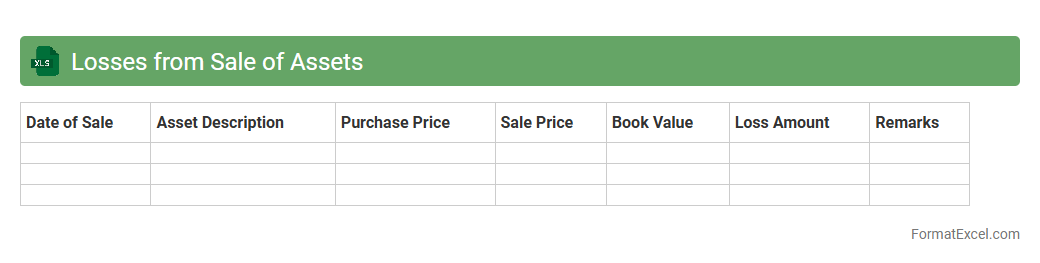

Losses from Sale of Assets

The

Losses from Sale of Assets Excel document is designed to systematically record and calculate the financial impact of disposing fixed or tangible assets at a loss. It helps businesses track asset sales, compare book value against sale price, and accurately determine loss figures for accounting and tax reporting purposes. This tool enhances financial analysis, improves decision-making around asset management, and ensures compliance with accounting standards.

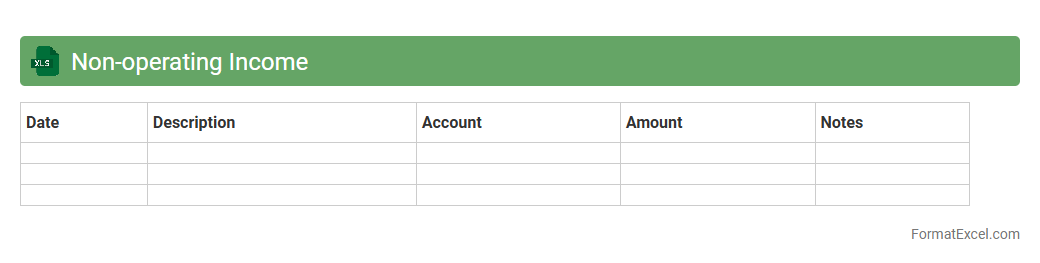

Non-Operating Income

A

Non-Operating Income Excel document is a financial tool that records and analyzes income generated from activities outside a company's core operations, such as interest, dividends, or asset sales. This document helps businesses understand the impact of non-operational revenues on overall profitability and supports more accurate financial forecasting and decision-making. By isolating these income streams, organizations can better assess core business performance and identify opportunities for investment or cost management.

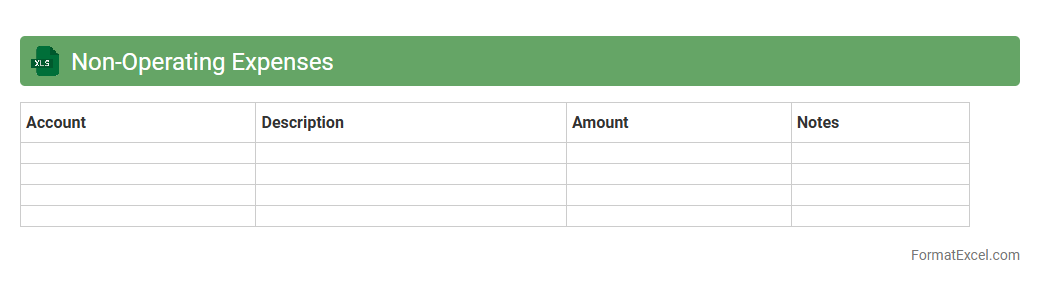

Non-Operating Expenses

A

Non-Operating Expenses Excel document is a spreadsheet designed to track and analyze costs that are not related to a company's core business operations, such as interest expenses, losses on asset sales, or restructuring costs. It helps businesses separate operating from non-operating expenses, providing clearer financial insights for budgeting, forecasting, and decision-making. Using this document improves financial accuracy and supports effective management of overall expenses.

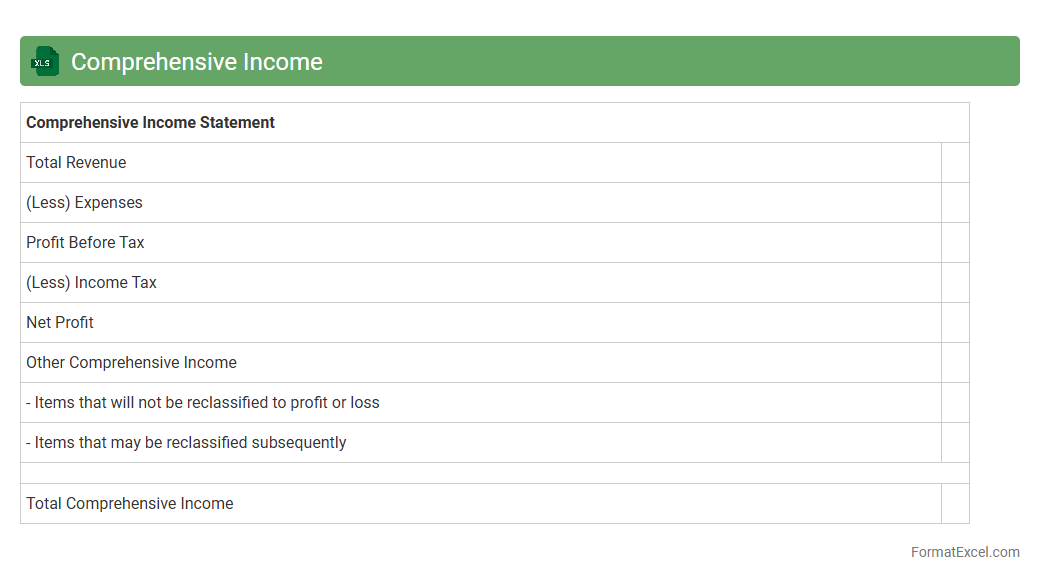

Comprehensive Income

A

Comprehensive Income Excel document is a financial tool designed to track and analyze all components of comprehensive income, including net income, other comprehensive income (OCI), and total comprehensive income over a specified period. It helps businesses and individuals accurately capture unrealized gains and losses from investments, foreign currency translations, and pension adjustments, providing a complete picture of financial performance. Utilizing this document enhances decision-making, ensuring transparency and compliance with accounting standards like IFRS and GAAP.

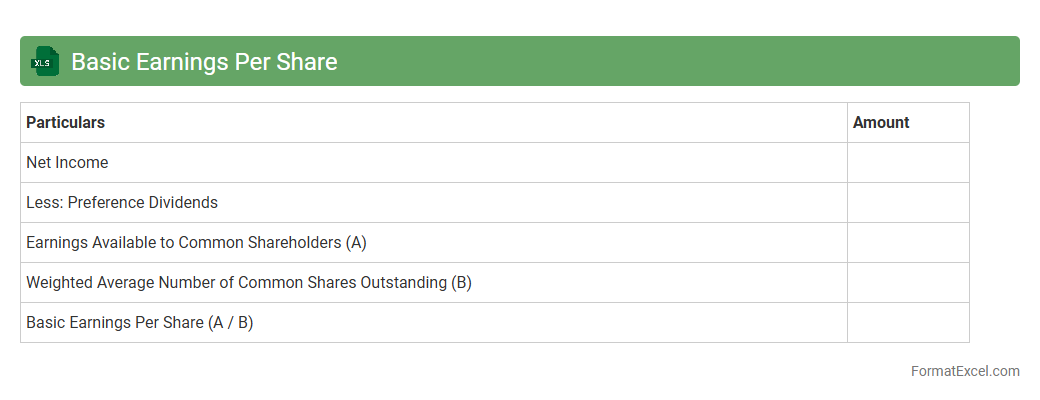

Basic Earnings Per Share

A

Basic Earnings Per Share (EPS) Excel document is a financial tool used to calculate the earnings allocated to each outstanding share of common stock, providing a clear measure of a company's profitability on a per-share basis. It helps investors and analysts assess company performance, make investment decisions, and compare earnings across different firms or periods. By simplifying the computation process, this Excel document enhances accuracy and efficiency in financial analysis and reporting.

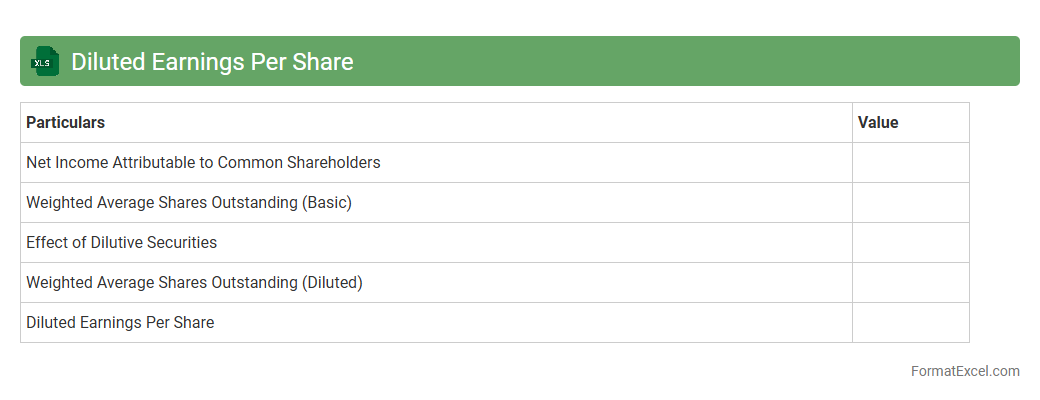

Diluted Earnings Per Share

The

Diluted Earnings Per Share (EPS) Excel document calculates the earnings per share accounting for all convertible securities, options, and warrants that could potentially dilute the share value. This tool provides investors and analysts with a more comprehensive understanding of a company's profitability by reflecting the worst-case scenario for earnings dilution. It is essential for accurate financial analysis, enabling better decision-making regarding investments and corporate performance evaluations.

Introduction to Income Statement Format in Excel

The income statement is a financial document that summarizes a company's revenues and expenses over a specific period. Using Excel to format this statement offers flexibility and ease of calculation. Excel templates help streamline the process of financial reporting.

Key Components of an Income Statement

An income statement consists of revenues, expenses, and net income. Revenues represent total sales, expenses include costs like COGS and operating expenses, and net income reflects profitability. Understanding these components is essential for accurate financial analysis.

Setting Up Your Income Statement Template in Excel

Begin by launching Excel and creating a new worksheet dedicated to the income statement. Define sections clearly and prepare cells for inputting financial data. A well-organized template enhances data readability and accuracy.

Creating Headers and Sections in Excel

Divide your sheet into headers like Revenue, Expenses, and Net Income using bold and merged cells. Use Excel's formatting tools to distinguish each section visually. Clear headers guide users in data entry and review.

Inputting Revenue Data

Enter all revenue sources under the Revenue section, ensuring each category is clearly labeled. Use different rows for product sales, service income, or other income streams. Accurate revenue input is critical for correct profit calculation.

Recording Cost of Goods Sold (COGS)

List all direct costs associated with producing goods or services within the COGS section. This typically includes materials and labor directly linked to production. Properly recording COGS helps determine gross profit accurately.

Detailing Operating Expenses

Operating expenses cover items such as salaries, rent, utilities, and marketing. Create rows for each expense category to maintain detailed records. Thorough documentation of these expenses impacts the net income calculation significantly.

Calculating Net Income Automatically

Use Excel formulas to subtract total expenses from total revenue for an automatic net income calculation. Commonly, the formula '=SUM(revenue_range) - SUM(expenses_range)' streamlines this process. Automated calculations reduce human error and save time.

Formatting Tips for Clarity and Professionalism

Apply consistent fonts, borders, and shading to differentiate sections clearly. Utilize Excel's cell formatting features like currency style for numerical data. A clean and professional format improves report readability and presentation.

Downloadable Income Statement Excel Template

Access a pre-designed Excel income statement template to jumpstart your financial reporting. Many templates are customizable to suit specific business needs and save setup time. Downloading a template ensures accuracy and consistency in your financial documents.