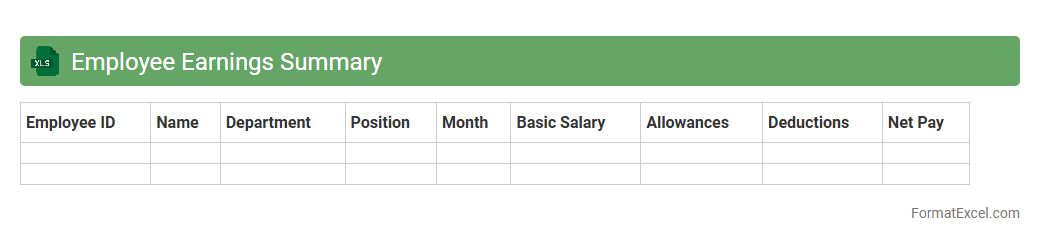

Employee Earnings Summary

Employee Earnings Summary is an

Excel document that consolidates detailed payroll information, including gross wages, deductions, and net pay for each employee within a specific pay period. This summary enables efficient tracking of employee compensation, facilitates accurate financial reporting, and simplifies payroll reconciliation processes. Businesses use this document to ensure compliance with tax regulations and to generate insights for budgeting and workforce management.

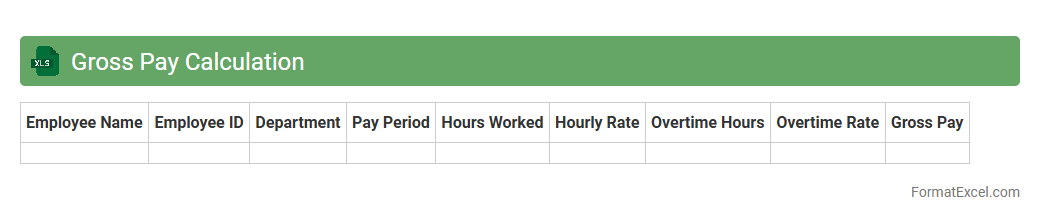

Gross Pay Calculation

A

Gross Pay Calculation Excel document is a spreadsheet designed to compute total employee earnings before deductions by automatically summing wages, overtime, bonuses, and allowances. This tool streamlines payroll processing, ensuring accuracy and saving time while minimizing human error. Businesses use it to maintain consistent payroll records, comply with tax regulations, and generate financial reports efficiently.

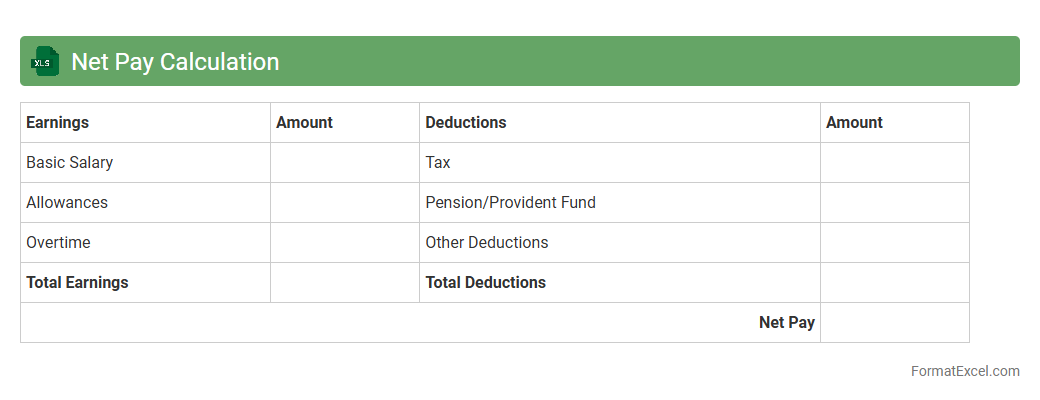

Net Pay Calculation

A

Net Pay Calculation Excel document is a spreadsheet tool designed to compute an employee's take-home salary after deductions like taxes, social security, and benefits. It streamlines payroll processes by automating calculations, reducing errors, and ensuring accurate compensation management. This document is essential for HR and accounting departments to maintain financial transparency and compliance with tax regulations.

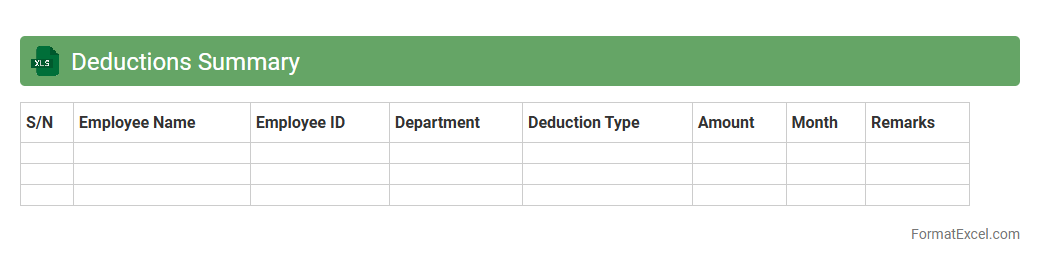

Deductions Summary

The

Deductions Summary Excel document compiles all employee deductions such as taxes, insurance premiums, and retirement contributions into a clear, organized format. This summary enables payroll managers to quickly verify deduction totals, ensuring accurate financial reporting and compliance with legal requirements. It also helps employees understand their paycheck deductions, promoting transparency and trust within the organization.

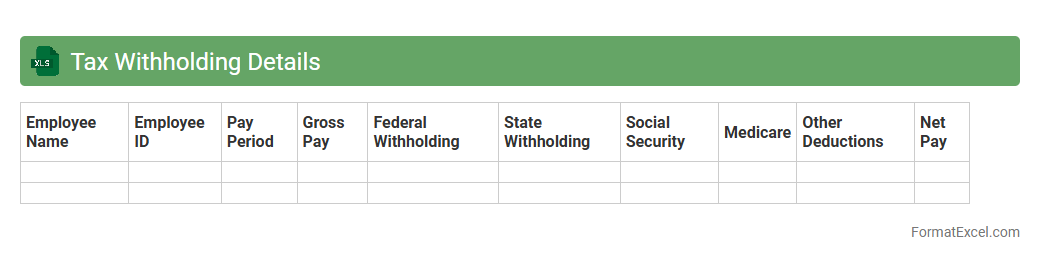

Tax Withholding Details

The

Tax Withholding Details Excel document organizes employee tax deductions, including federal, state, and local withholdings, facilitating accurate tax reporting and compliance. It helps employers track withholding amounts for payroll processing and prepares data for annual tax filings, reducing errors and saving time. This document enhances financial transparency and supports efficient tax management for both employers and employees.

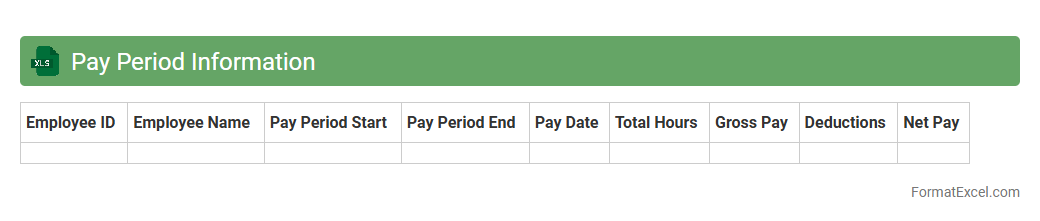

Pay Period Information

The

Pay Period Information Excel document organizes employee payment intervals, including start and end dates, total hours worked, and corresponding wages. This structured data helps businesses accurately calculate payroll, ensuring timely and error-free salary disbursement while maintaining compliance with labor laws. It also facilitates financial analysis and budgeting by providing clear insights into labor costs over specific periods.

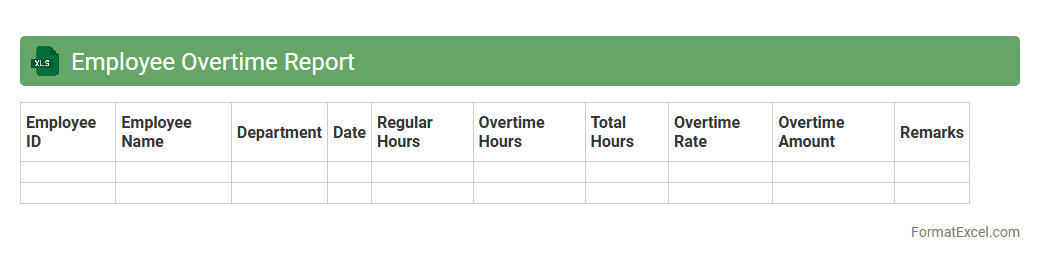

Employee Overtime Report

The

Employee Overtime Report Excel document systematically tracks and analyzes extra working hours logged by employees, providing detailed records of overtime hours, dates, and employee names. This report is essential for ensuring accurate payroll calculations, monitoring labor costs, and maintaining compliance with labor laws. Utilizing this tool helps businesses optimize workforce management and improve operational efficiency by identifying patterns in overtime usage.

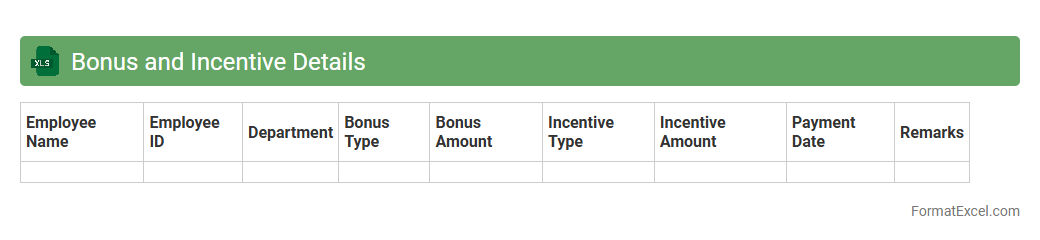

Bonus and Incentive Details

The

Bonus and Incentive Details Excel document serves as a comprehensive record of employee rewards, bonuses, and performance-related incentives. It helps organizations track and manage compensation efficiently, ensuring transparency and accuracy in payroll processing. By using this document, companies can motivate employees through clear performance-linked rewards while maintaining organized financial records for reporting and analysis.

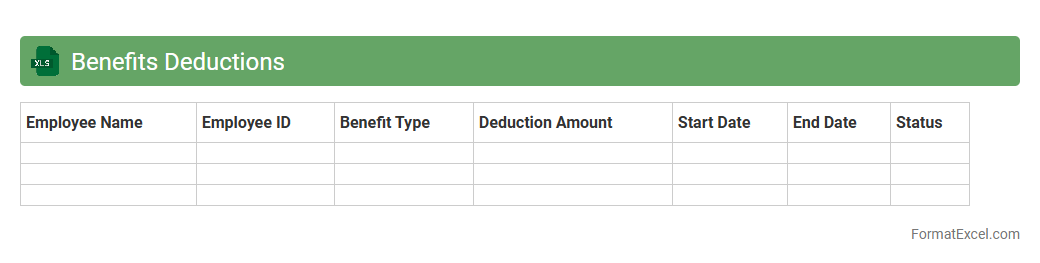

Benefits Deductions

The

Benefits Deductions Excel document is a structured spreadsheet designed to track and manage employee benefit deductions such as health insurance, retirement contributions, and other payroll withholdings. It simplifies the calculation and organization of various deduction types, ensuring accurate payroll processing and compliance with company policies and legal requirements. Using this document enhances financial transparency and helps HR and payroll departments efficiently monitor and update employee benefit deductions.

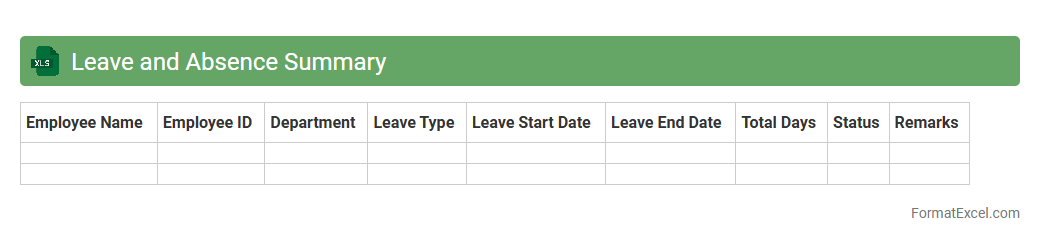

Leave and Absence Summary

A

Leave and Absence Summary Excel document is a structured tool that tracks employee leave types, durations, and patterns over a specific period. It consolidates data such as vacation days, sick leave, and unpaid absences, facilitating efficient monitoring of workforce availability and compliance with company policies. Utilizing this summary helps organizations optimize staffing, manage payroll accurately, and identify trends in employee attendance.

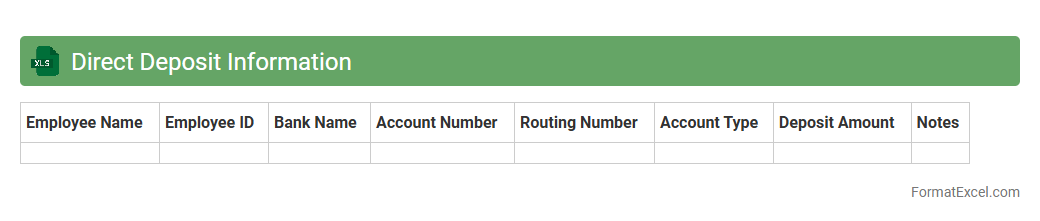

Direct Deposit Information

A

Direct Deposit Information Excel document contains essential details such as bank account numbers, routing numbers, and employee names required for processing electronic payments directly into bank accounts. This document streamlines payroll and vendor payment processes by reducing manual errors and accelerating transaction times. Maintaining accurate direct deposit information ensures timely and secure fund transfers, improving financial efficiency and record-keeping.

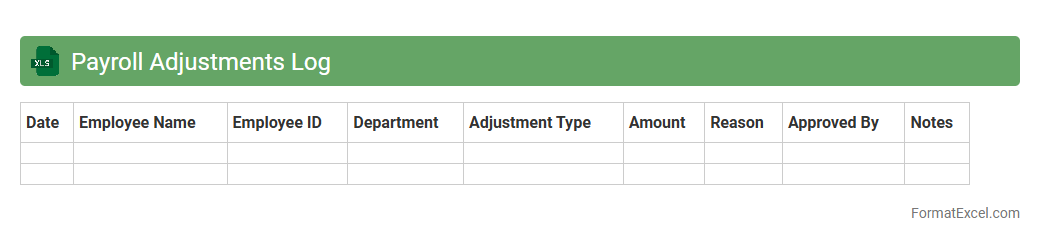

Payroll Adjustments Log

The

Payroll Adjustments Log Excel document serves as a detailed record of changes made to employee payroll, including salary corrections, tax updates, and benefit modifications. It ensures accurate tracking and auditing of all payroll-related adjustments, reducing errors and improving compliance with financial regulations. This log helps payroll managers maintain transparency and streamline the reconciliation process during payroll cycles.

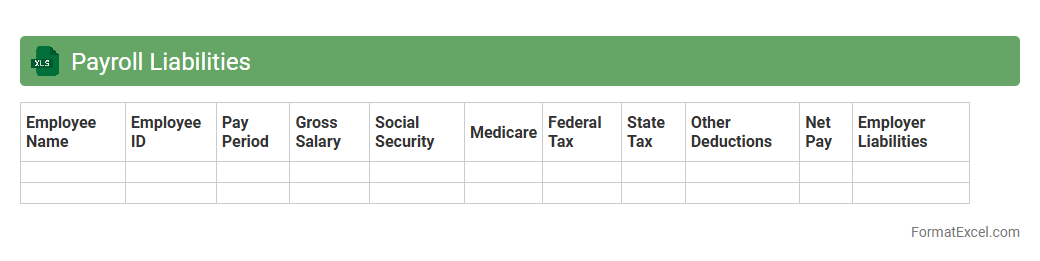

Payroll Liabilities

A

Payroll Liabilities Excel document is a specialized spreadsheet used to track and manage employer obligations related to employee compensation, including taxes, benefits, and deductions. It helps ensure accurate calculation and timely payments of payroll taxes, social security contributions, and other liabilities, reducing the risk of compliance errors. Utilizing this document streamlines payroll accounting, improves financial visibility, and supports efficient record-keeping for audits and reporting.

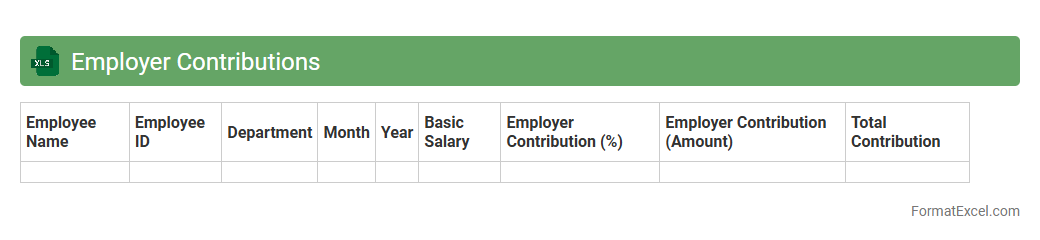

Employer Contributions

The

Employer Contributions Excel document is a detailed spreadsheet designed to track and calculate employer-paid benefits such as social security, retirement funds, and health insurance contributions. It enables HR professionals and payroll teams to maintain accurate financial records, ensuring compliance with labor laws and simplifying audit processes. By organizing contribution data efficiently, the document enhances budgeting accuracy and supports timely reporting to regulatory authorities.

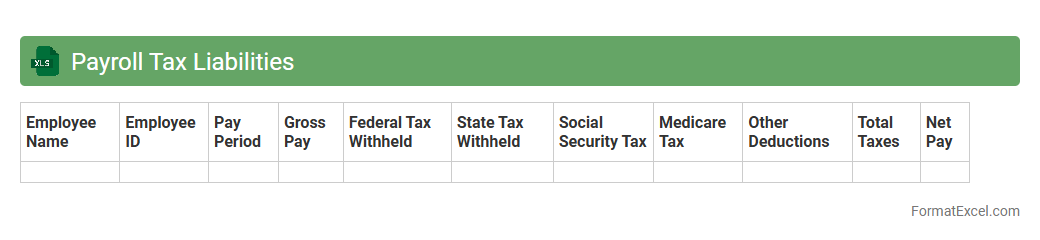

Payroll Tax Liabilities

The

Payroll Tax Liabilities Excel document is a precise financial tool designed to track and calculate employer payroll tax obligations, including Social Security, Medicare, federal and state unemployment taxes. It helps businesses ensure compliance with federal and state regulations by maintaining accurate records of tax withholdings, due dates, and payment amounts. This organized approach reduces the risk of errors, penalties, and missed payments, improving financial management and reporting efficiency.

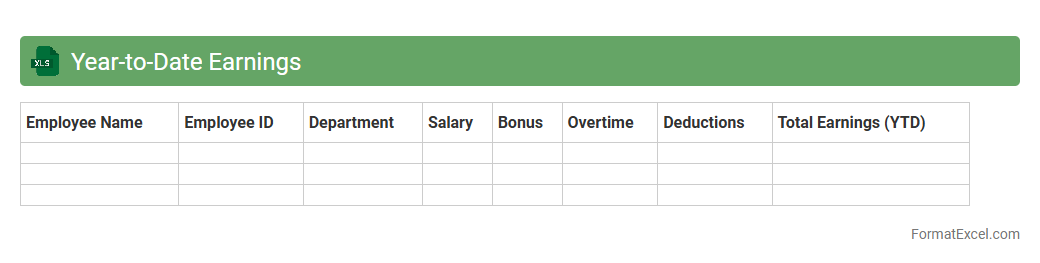

Year-to-Date Earnings

A Year-to-Date Earnings Excel document tracks cumulative income from the start of the fiscal year to the current date, providing a clear overview of financial performance. This tool streamlines payroll management, tax calculations, and budget planning by consolidating salary, bonuses, and deductions in one place. Utilizing a

Year-to-Date Earnings spreadsheet enhances financial accuracy and simplifies reporting for both employees and employers.

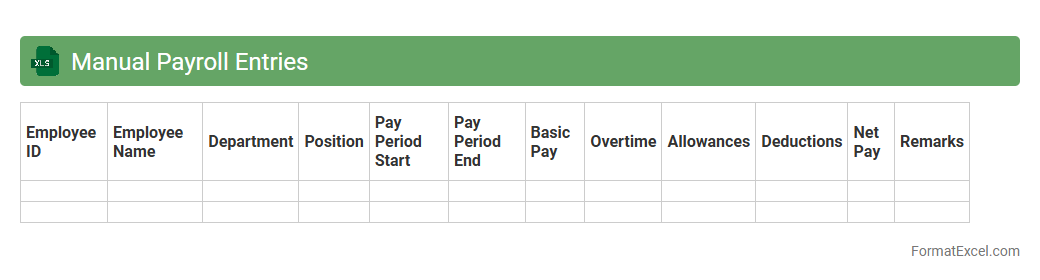

Manual Payroll Entries

A

Manual Payroll Entries Excel document is a spreadsheet designed to record employee payroll data such as hours worked, wages, bonuses, deductions, and taxes manually. It is useful for ensuring accurate payroll processing, enabling easy adjustments, and maintaining a clear audit trail for compliance and financial reporting. This document streamlines payroll management, reduces errors, and supports better decision-making in workforce compensation.

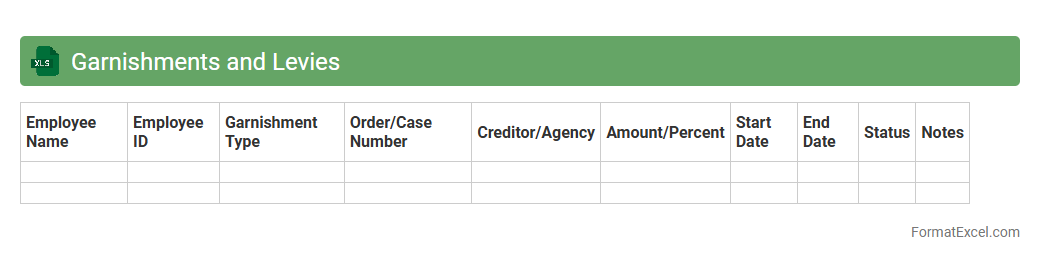

Garnishments and Levies

A

Garnishments and Levies Excel document is a structured spreadsheet used to track, manage, and calculate wage garnishments and bank levies accurately. It helps streamline compliance by organizing debtor information, garnishment amounts, payment schedules, and legal limits, reducing errors and ensuring timely payments. This tool is essential for employers, HR departments, and financial professionals to maintain clear records and avoid costly penalties.

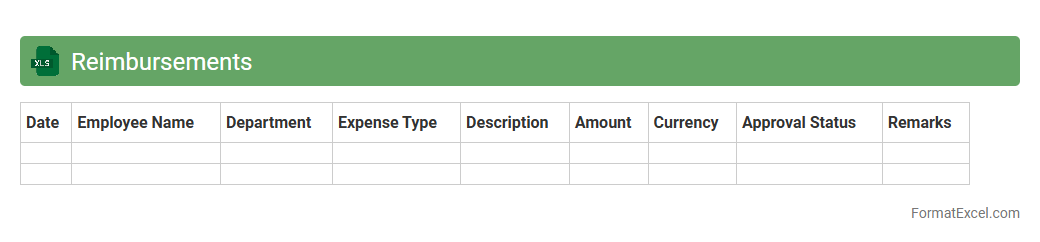

Reimbursements

A

Reimbursements Excel document is a structured spreadsheet used to track and manage expense claims submitted for repayment. It enables efficient organization of financial data, ensuring accuracy in recording dates, amounts, categories, and approval statuses. This tool helps businesses maintain transparent records, streamline reimbursement processes, and simplify auditing tasks.

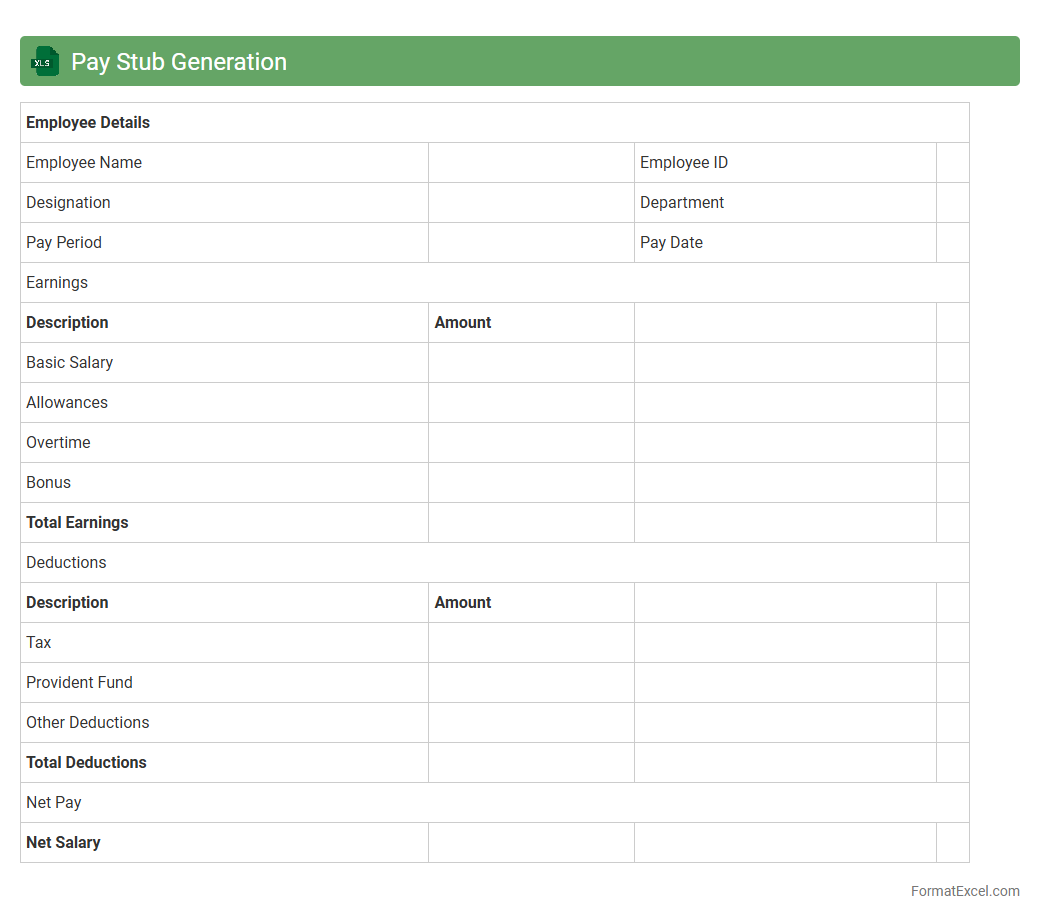

Pay Stub Generation

A

Pay Stub Generation Excel document is a tool designed to automate the creation of employee pay stubs by calculating wages, taxes, deductions, and net pay based on input data. It helps businesses maintain accurate payroll records, ensures compliance with tax regulations, and simplifies the payroll process by reducing manual errors. Using this document enhances efficiency, saves time, and provides clear, detailed payment information for employees.

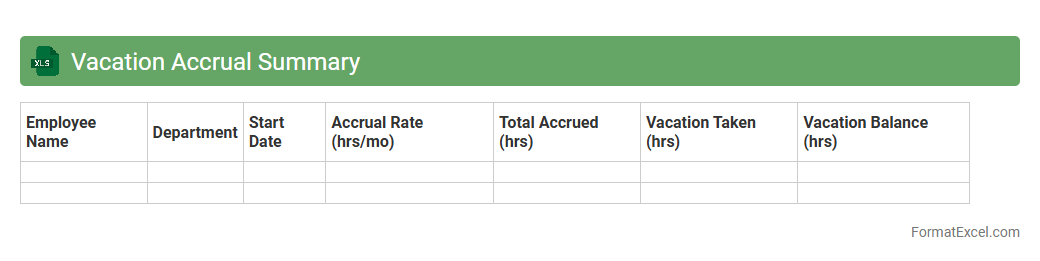

Vacation Accrual Summary

A

Vacation Accrual Summary Excel document tracks and displays the amount of vacation time employees have earned, used, and currently available. It helps organizations manage leave policies efficiently by providing clear visibility into accrual rates and balances for each employee. This tool supports accurate payroll processing and ensures compliance with company vacation regulations.

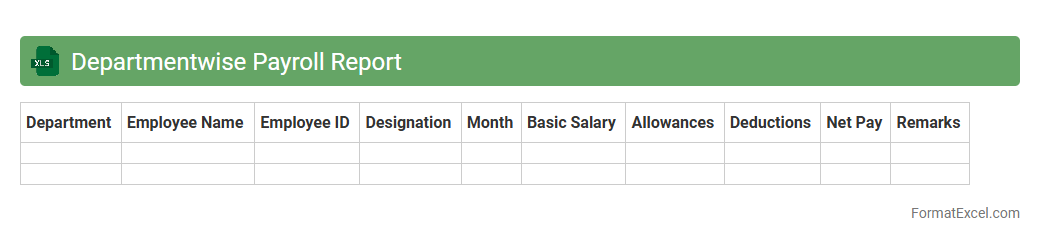

Departmentwise Payroll Report

A

Departmentwise Payroll Report Excel document organizes employee salary data by individual departments, allowing for efficient tracking of payroll expenses and budgeting. It provides detailed insights into each department's wage distribution, overtime payments, tax deductions, and benefits, facilitating accurate financial analysis and departmental cost management. This report streamlines payroll processing, enhances transparency, and supports strategic decision-making to optimize labor costs within the organization.

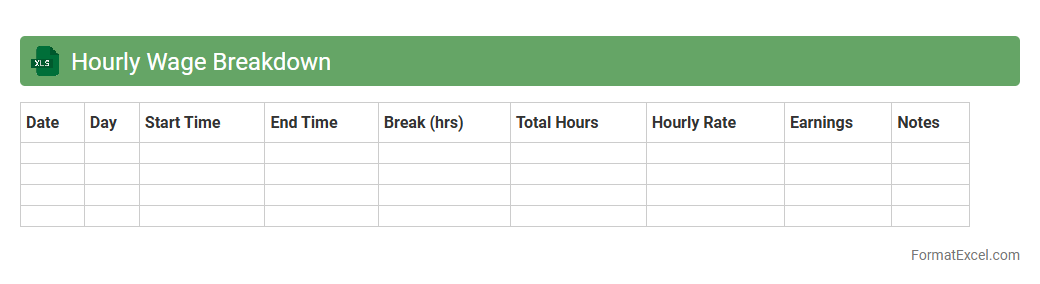

Hourly Wage Breakdown

An

Hourly Wage Breakdown Excel document provides a detailed analysis of hourly earnings by categorizing wages based on hours worked, job roles, or time periods. It helps employers and employees track accurate compensation, identify pay discrepancies, and manage payroll more efficiently. This tool enhances financial planning and ensures compliance with labor regulations by maintaining transparent wage records.

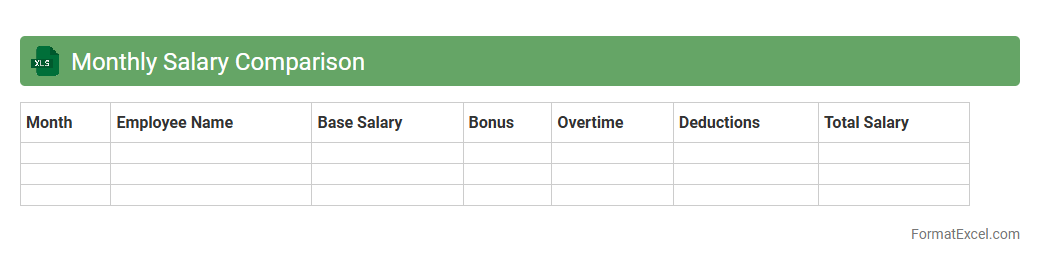

Monthly Salary Comparison

The

Monthly Salary Comparison Excel document is a structured tool designed to track and analyze salary data across different months or employees, enabling clear visibility into income trends and discrepancies. It helps businesses and individuals identify patterns in compensation, assess fairness, and make informed decisions about raises or budget adjustments. By organizing salary information in a comparative format, this document enhances financial planning and supports transparent payroll management.

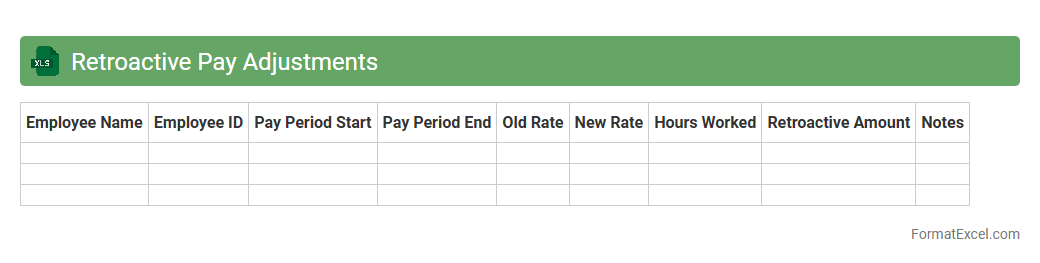

Retroactive Pay Adjustments

A

Retroactive Pay Adjustments Excel document is a structured tool designed to calculate and track salary corrections owed to employees for previous pay periods. It enables precise management of back pay due to errors, missed raises, or negotiated changes, ensuring payroll accuracy and compliance. This document is invaluable for HR and payroll departments, streamlining financial reconciliation and maintaining employee trust by transparently addressing compensation adjustments.

Introduction to Payroll Statement Formats

A payroll statement format is a structured document used to detail employee earnings and deductions. Excel is widely preferred due to its flexibility in organizing payroll data. Understanding the format ensures efficient payroll processing and record keeping.

Importance of Payroll Statements for Businesses

Payroll statements are critical as they provide transparent records of employee compensation and statutory deductions. They support compliance with tax regulations and labor laws. Accurate payroll statements enhance employee trust and financial reporting accuracy.

Key Components of a Payroll Statement

A payroll statement typically includes employee details, gross wages, deductions, taxes, and net pay. Additional elements may cover benefits, bonuses, and leave balances. Highlighting the key components ensures clarity and comprehensive payroll documentation.

Essential Excel Features for Payroll Management

Excel features like formulas, pivot tables, and data validation greatly assist in payroll management. Conditional formatting helps to highlight anomalies or errors in the payroll data. Mastering these Excel features streamlines payroll processing and reduces manual errors.

Step-by-Step Guide to Creating a Payroll Statement in Excel

Begin by setting up columns for employee information, wages, and deductions. Use formulas to calculate taxes and net pay automatically. This step-by-step guide ensures an accurate and professional payroll statement layout in Excel.

Sample Payroll Statement Format in Excel

A sample payroll statement includes headers, employee names, hours worked, pay rates, and total earnings. It should also display deductions such as tax and insurance clearly. Accessing a sample payroll format helps users visualize the final output structure.

Customizing Payroll Templates for Different Industries

Payroll templates must adapt for sectors with unique compensation schemes like commissions or overtime. Custom fields can be added to cover industry-specific deductions or benefits. Tailoring the payroll templates improves their relevance and usability across different industries.

Data Security and Privacy in Payroll Excel Sheets

Protecting payroll data in Excel involves password protection, restricted access, and encryption. Confidential employee information requires stringent data security measures to prevent unauthorized access and data breaches. Maintaining privacy is essential for legal compliance and employee trust.

Tips for Accurate Payroll Calculations in Excel

Use consistent formulas, double-check data entries, and employ Excel's auditing tools for accuracy. Regular reconciliation with financial records minimizes errors in calculations. These tips for accuracy ensure reliable payroll results and fewer discrepancies.

Downloadable Payroll Statement Excel Templates

Many websites offer free and premium downloadable payroll statement templates compatible with Excel. These templates save time and provide a professional starting point for payroll management. Utilizing downloadable payroll templates enhances efficiency for businesses of all sizes.