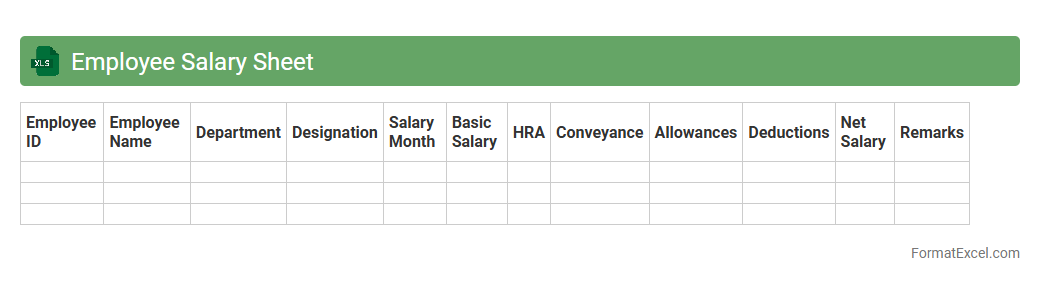

Employee Salary Sheet

An

Employee Salary Sheet Excel document is a detailed record that tracks employee wages, bonuses, deductions, and net pay in a structured format. It helps businesses maintain transparent payroll management, ensuring accurate salary calculations and compliance with tax regulations. This document streamlines financial audits and facilitates efficient salary disbursement processes.

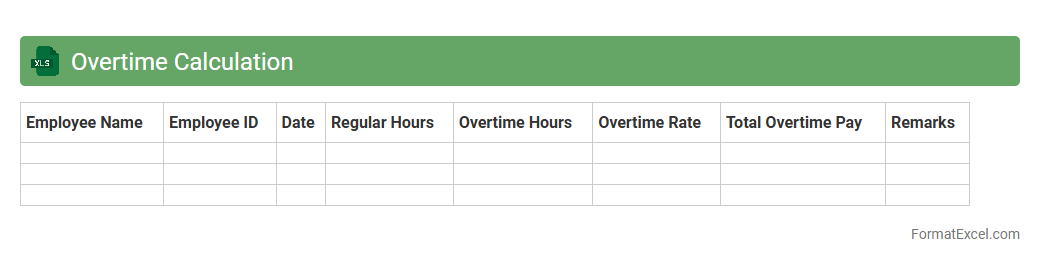

Overtime Calculation

An

Overtime Calculation Excel document automates the tracking and computation of extra hours worked beyond regular schedules, ensuring accurate payroll processing. It simplifies labor cost management by providing clear reports on employee overtime, helping businesses maintain compliance with labor laws and prevent payroll errors. This tool enhances productivity analysis and aids in budget forecasting by offering detailed insights into workforce utilization.

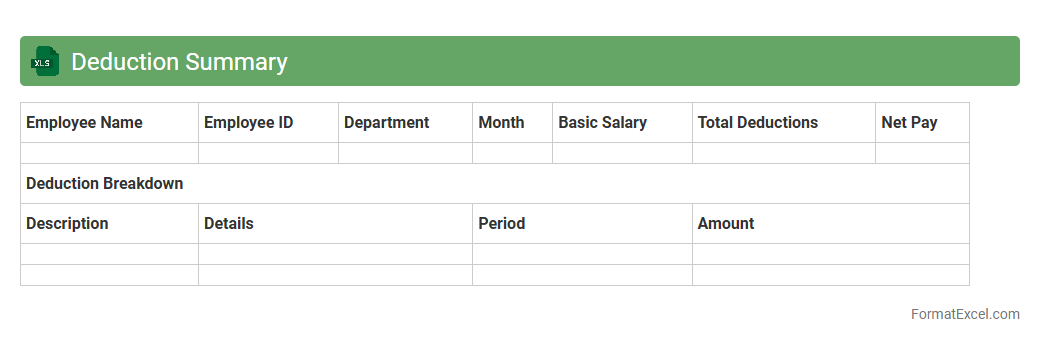

Deduction Summary

A

Deduction Summary Excel document consolidates all payroll deductions such as taxes, insurance, and retirement contributions into a clear and organized format. It enables easy tracking and verification of deduction amounts for accurate financial reporting and compliance with regulatory requirements. This tool streamlines payroll management, reduces errors, and supports efficient auditing processes.

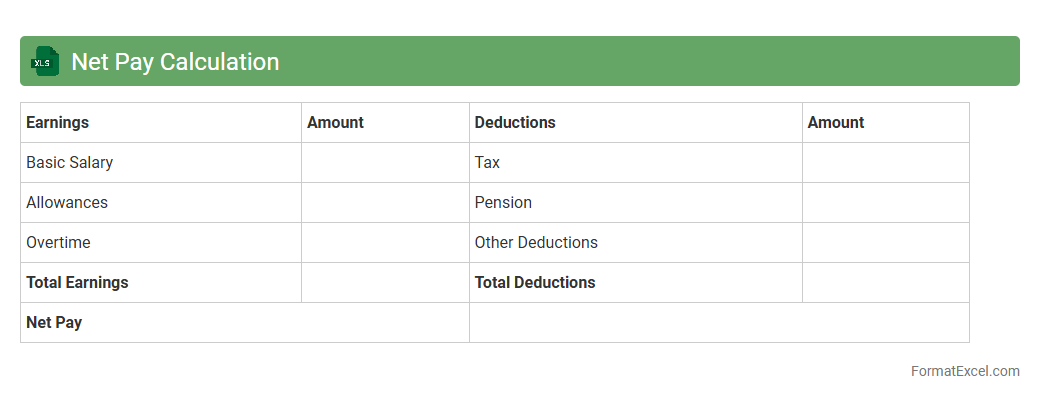

Net Pay Calculation

A

Net Pay Calculation Excel document is a spreadsheet tool designed to accurately compute an employee's take-home salary by deducting taxes, benefits, and other withholdings from gross pay. It simplifies payroll management, ensuring precise and efficient financial record-keeping for both employers and employees. This document is essential for budgeting, compliance with tax regulations, and transparent salary reporting.

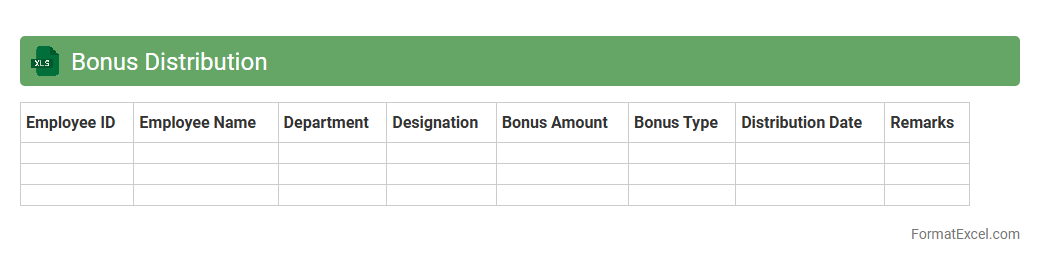

Bonus Distribution

A

Bonus Distribution Excel document is a structured spreadsheet used to calculate and allocate employee bonuses based on predefined criteria such as performance metrics, tenure, or sales targets. This tool enhances accuracy by automating complex calculations, ensuring fair and transparent bonus distribution across teams. Utilizing this document helps organizations streamline payroll processes, maintain records for compliance, and motivate employees by clearly linking rewards to achievements.

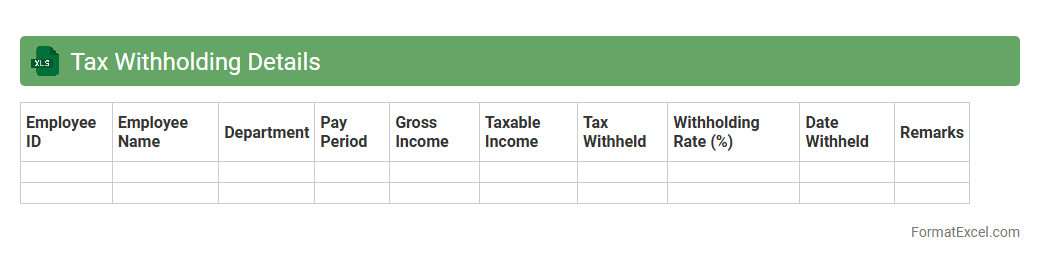

Tax Withholding Details

The

Tax Withholding Details Excel document organizes information on employee tax deductions, including federal, state, and local withholdings, allowing for precise tracking of amounts withheld from wages. This document is essential for payroll accuracy, tax compliance, and streamlining end-of-year reporting processes. Employers and accountants benefit from having clear, accessible records to avoid underpayment penalties and ensure timely tax deposits.

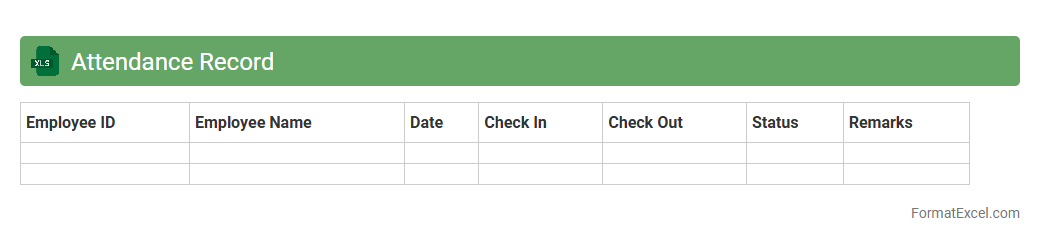

Attendance Record

An

Attendance Record Excel document is a digital spreadsheet used to systematically track employee or student attendance over a specified period. It helps organizations monitor punctuality, calculate absenteeism rates, and ensure compliance with attendance policies, improving overall workforce or classroom management. With customizable columns and formulas, this tool streamlines data entry and generates accurate reports for better decision-making.

Leave Balance Tracker

A

Leave Balance Tracker Excel document is a tool designed to monitor and manage employee leave records, including vacation, sick leave, and other time off. It helps organizations maintain accurate leave balances, ensuring compliance with company policies and labor laws while preventing payroll errors. This tracker enables efficient workforce planning by providing real-time data on available leave, reducing administrative workload and increasing transparency.

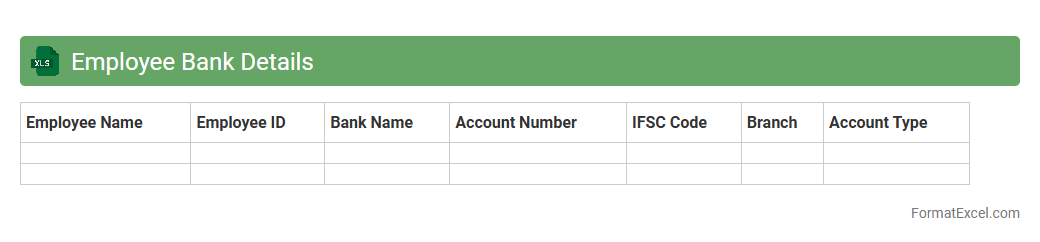

Employee Bank Details

An Employee Bank Details Excel document is a structured spreadsheet containing important financial information such as bank account numbers, bank names, branch codes, and account holder names for each employee. This document is crucial for processing payroll efficiently and ensuring timely salary transfers directly into employees' bank accounts. Maintaining

accurate employee bank details helps reduce payment errors and simplifies financial auditing and record-keeping.

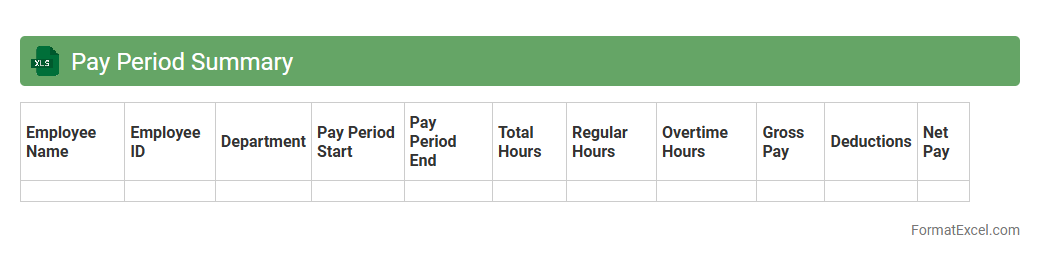

Pay Period Summary

A

Pay Period Summary Excel document aggregates employee work hours, wages, deductions, and net pay for a specific pay cycle, ensuring accurate payroll processing. It streamlines the verification of payment details, helps track labor costs, and supports budgeting efforts within organizations. Employers and payroll specialists rely on this summary to maintain compliance with labor laws and facilitate transparent financial reporting.

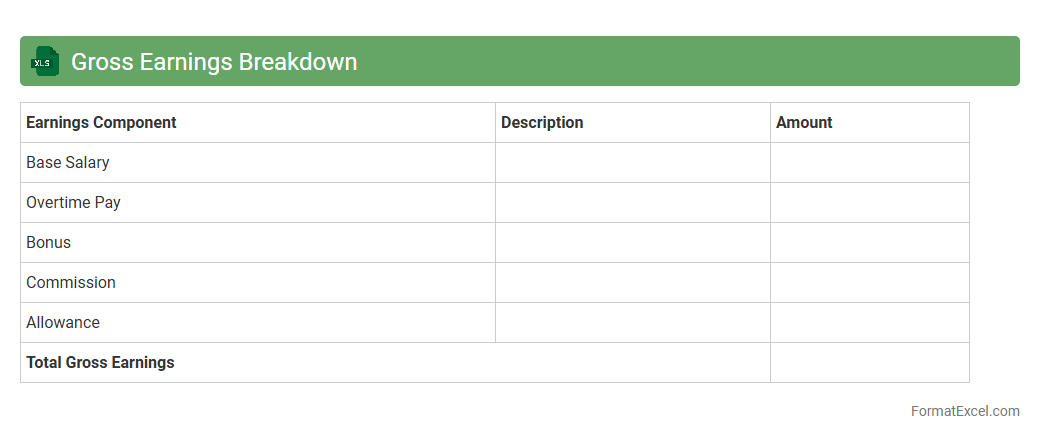

Gross Earnings Breakdown

The

Gross Earnings Breakdown Excel document provides a detailed analysis of total employee earnings before deductions, including wages, bonuses, and overtime pay. It is useful for businesses to monitor payroll expenses accurately, ensuring compliance with financial regulations and assisting in budgeting and financial forecasting. This structured breakdown helps identify trends in compensation, enabling better decision-making for compensation management and resource allocation.

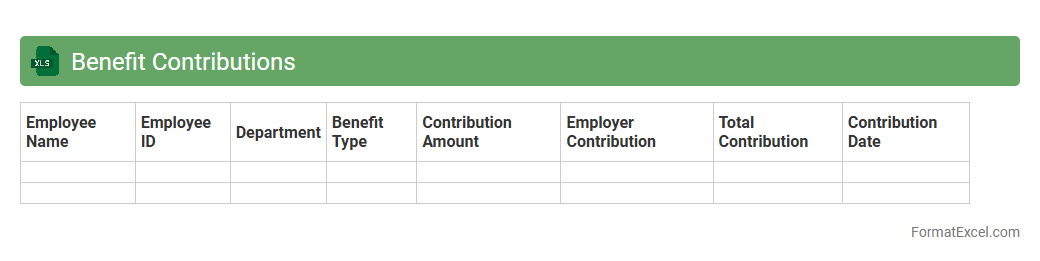

Benefit Contributions

The

Benefit Contributions Excel document serves as a comprehensive tool for tracking employee benefits, including retirement plans, health insurance premiums, and other payroll deductions. It streamlines the management of contribution amounts, payment schedules, and regulatory compliance, ensuring accurate financial records. This document enhances decision-making by providing clear insights into benefit costs and helps maintain transparency between employers and employees.

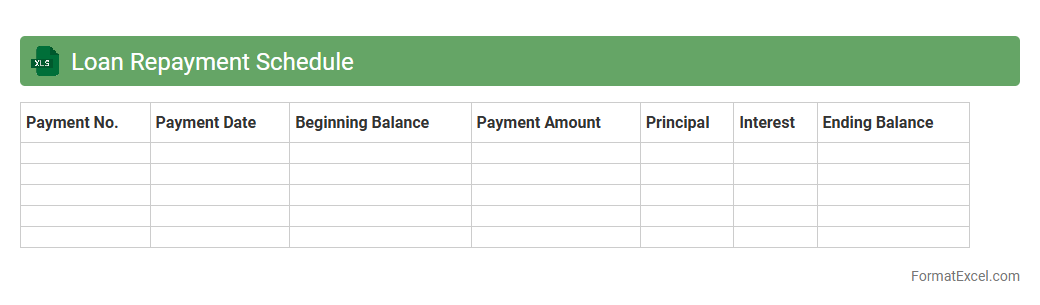

Loan Repayment Schedule

A

Loan Repayment Schedule Excel document organizes and tracks loan payments, including principal, interest, and remaining balance over time. This tool helps borrowers plan their finances by providing clear visibility into payment dates, amounts, and outstanding loan tenure. Using such an Excel sheet enhances financial management and ensures timely repayments, reducing the risk of penalties and improving credit scores.

Pay Slip Generation

A

Pay Slip Generation Excel document is a digital tool designed to automate the calculation and formatting of employee salaries, deductions, and bonuses. It simplifies payroll management by providing accurate, itemized pay slips, reducing manual errors and saving time for HR departments. This document enhances transparency and record-keeping, ensuring employees receive clear and detailed compensation information every pay period.

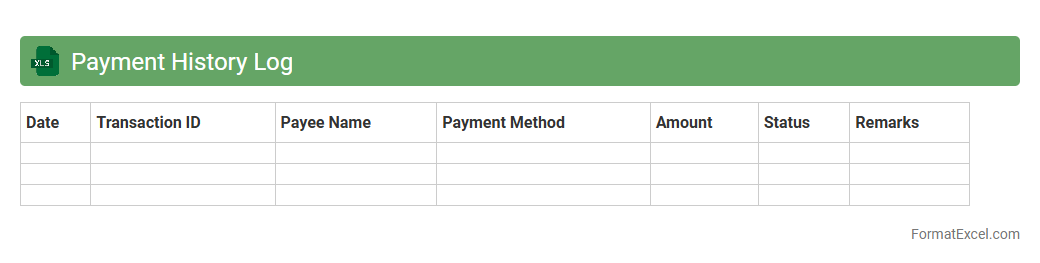

Payment History Log

A

Payment History Log Excel document tracks all financial transactions, including dates, amounts, and payment methods, providing a clear record of payments made and received. This log helps businesses and individuals monitor cash flow, reconcile accounts, and identify any discrepancies quickly. Maintaining an accurate payment history supports efficient financial management and ensures accountability in financial dealings.

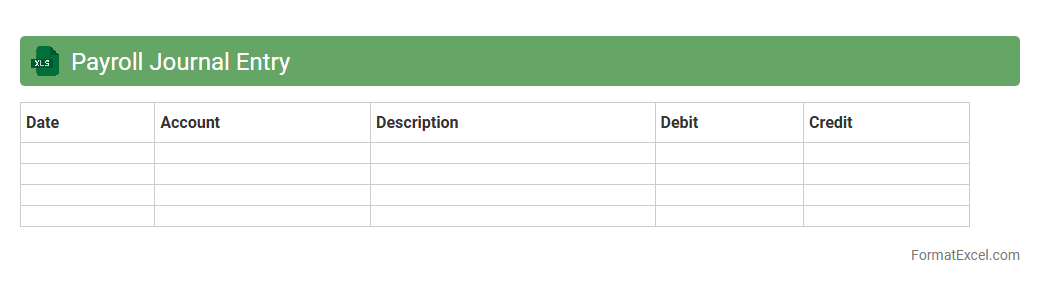

Payroll Journal Entry

A

Payroll Journal Entry Excel document is a structured spreadsheet used to record and organize employee salary payments, deductions, and related financial transactions. It facilitates accurate tracking of payroll expenses and liabilities, ensuring compliance with accounting standards and simplifying audit processes. This tool enhances financial management by providing clear documentation and easy data manipulation for payroll reporting and reconciliation.

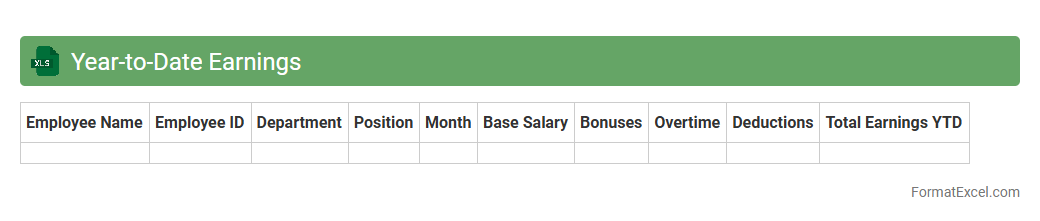

Year-to-Date Earnings

A

Year-to-Date Earnings Excel document tracks cumulative income from the start of the current year to the present date, allowing for clear visualization of financial progress over time. This document is essential for monitoring employee wages, business revenues, or personal income streams, enabling accurate budgeting and financial planning. Its structured format facilitates data analysis, making it easier to identify trends and make informed fiscal decisions.

Salary Increment Tracker

A

Salary Increment Tracker Excel document is a tool designed to systematically record and monitor employee salary increases over time. It helps HR professionals and managers analyze trends, plan budgets, and ensure fair compensation adjustments based on performance or market changes. Using this tracker streamlines salary management, improves transparency, and supports data-driven decisions within an organization.

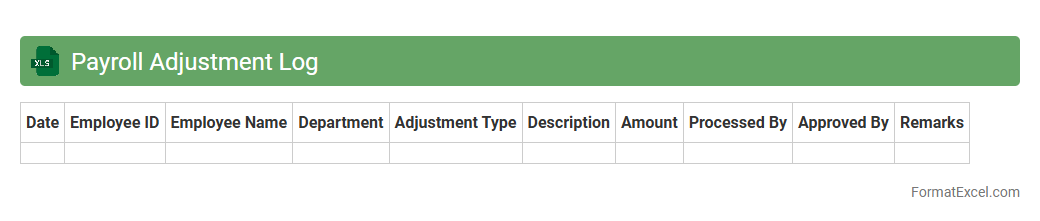

Payroll Adjustment Log

A

Payroll Adjustment Log Excel document is a detailed record that tracks modifications made to employee payroll data, including corrections, bonuses, deductions, and retroactive payments. This log helps maintain accurate payroll processing, ensures compliance with legal and financial standards, and provides an audit trail for resolving discrepancies. Using this tool improves transparency and accountability within payroll management, facilitating efficient payroll reconciliation and reporting.

Approval Status Tracker

An

Approval Status Tracker Excel document is a tool designed to monitor and manage the progress of various approval processes within a project or organization. It consolidates critical information such as request dates, approver names, status updates, and deadlines, enabling efficient oversight and timely follow-ups. This document helps streamline communication, reduce delays, and ensure accountability by providing a clear, organized view of approval workflows.

Employee ID Mapping

An

Employee ID Mapping Excel document serves as a centralized tool to connect employee identification numbers with corresponding personal and job-related information. This mapping facilitates accurate data management, streamlines HR processes like payroll and attendance tracking, and enhances reporting efficiency across departments. By maintaining consistent and organized employee records, businesses reduce errors and improve overall workforce management.

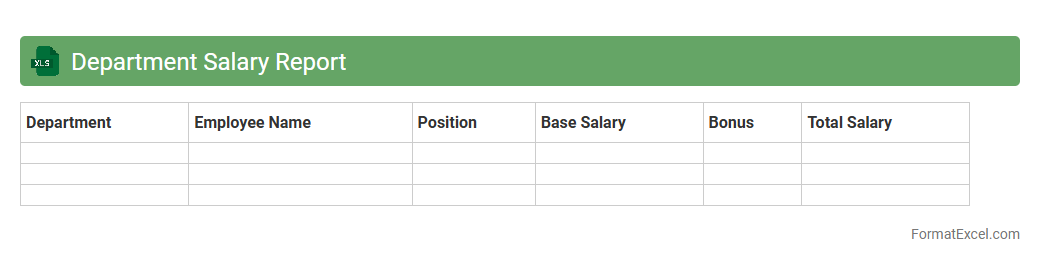

Department Salary Report

The

Department Salary Report Excel document organizes and summarizes employee compensation data by department, enabling efficient payroll management and budget analysis. It provides clear insights into salary distributions, average pay rates, and total departmental payroll expenses, which assist HR and finance teams in making informed staffing and financial decisions. This report streamlines salary tracking, supports compliance with compensation policies, and enhances overall organizational transparency.

Contractual Payment Tracker

A

Contractual Payment Tracker Excel document is a tool designed to monitor and manage payment schedules tied to contractual agreements, ensuring timely payments and reducing financial discrepancies. It helps users organize payment deadlines, track invoice statuses, and maintain accurate financial records for multiple contracts in one centralized location. This enhances cash flow management and facilitates transparent communication between parties involved.

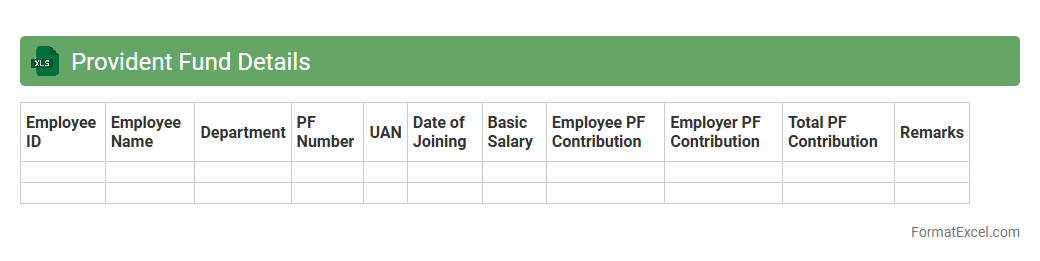

Provident Fund Details

A Provident Fund Details excel document contains comprehensive records of employee contributions, employer contributions, interest accrued, and withdrawal history related to the

Provident Fund. It helps individuals track their retirement savings accurately, plan financial goals, and ensure compliance with statutory regulations. This organized data facilitates easy monitoring, auditing, and reconciliation of Provident Fund accounts for both employees and employers.

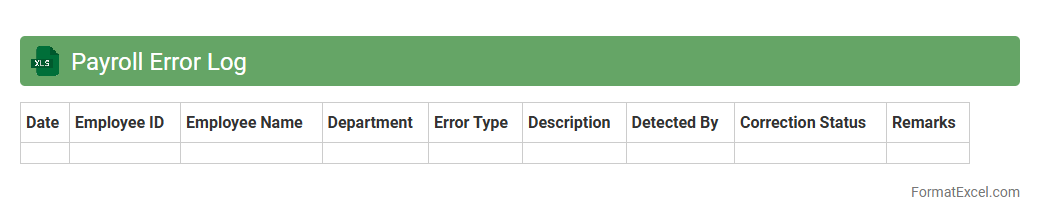

Payroll Error Log

A

Payroll Error Log Excel document systematically records discrepancies and mistakes found in payroll processing, such as incorrect hours, tax miscalculations, or missing employee details. It allows HR and finance teams to quickly identify, track, and resolve errors, ensuring accurate and timely employee payments. This log improves compliance, reduces financial risks, and enhances overall payroll efficiency by providing a clear audit trail and facilitating continuous process improvement.

Introduction to Employee Payroll Formats

An Employee Payroll Format in Excel is a structured template used to calculate and track employee salaries, deductions, and net pay. It simplifies payroll management by organizing data systematically. Using Excel allows for easy customization and automation of payroll processes.

Importance of an Organized Payroll System

An organized payroll system ensures timely and accurate payment, compliance with tax regulations, and proper record-keeping. It reduces errors and enhances employee satisfaction by maintaining transparency. The core benefit lies in streamlining payroll operations efficiently.

Key Elements of an Excel Payroll Format

The key components include employee details, salary breakdowns, attendance records, allowances, deductions, and net pay calculations. Each element is essential for accurate payroll processing. Excel's cell formulas help automate summations and deductions efficiently.

Step-by-Step Guide to Creating a Payroll Template in Excel

Start by setting up columns for employee information and salary components. Then, input formulas for calculating gross pay, deductions, and net salary. Finally, format the sheet for clarity and easy data entry.

Essential Columns in Employee Payroll Sheets

Crucial columns include Employee Name, ID, Basic Salary, Allowances, Deductions, Tax, and Net Pay. These fields capture all necessary payroll details clearly. Accurate column structure is vital for effective payroll processing.

Sample Payroll Format: Downloadable Excel Template

A downloadable Excel payroll template offers a ready-to-use format to simplify your payroll management. It typically includes pre-defined formulas and clear layouts. This template saves time and reduces manual errors.

Managing Deductions and Allowances in Excel

Maintain separate columns for deductions like taxes and loans, and allowances such as bonuses or travel expenses. Excel formulas can automatically subtract or add these values to calculate net salary. This ensures transparency and accuracy in payroll calculations.

Automating Calculations with Excel Formulas

Use functions like SUM, IF, and VLOOKUP to automate payroll calculations in Excel sheets. Automation reduces errors and manual effort, increasing efficiency. It also allows easy updates when payroll components change.

Common Mistakes to Avoid in Payroll Excel Sheets

Avoid data entry errors, missing formulas, and inconsistent formatting to maintain accuracy. Regularly validate calculations and backup payroll data securely. Preventing these common mistakes helps protect payroll integrity.

Best Practices for Secure Payroll Record-Keeping

Secure payroll records by protecting Excel files with passwords and controlling access permissions. Regularly back up payroll data and maintain audit trails. Implementing these practices safeguards sensitive employee information effectively.