Employee Work Hours Tracking

An

Employee Work Hours Tracking Excel document systematically records and monitors the hours each employee works, including start times, end times, breaks, and total hours. This tool is essential for accurate payroll processing, ensuring compliance with labor laws, and identifying productivity patterns. Access to detailed work hour data enables managers to optimize workforce scheduling and improve operational efficiency.

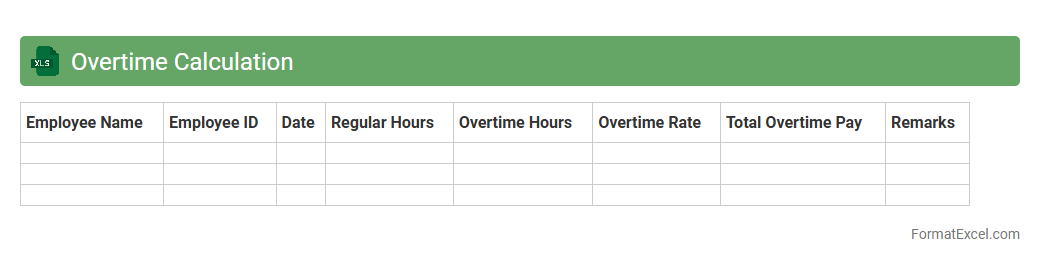

Overtime Calculation

An

Overtime Calculation Excel document is a tool designed to accurately track and compute extra hours worked beyond regular schedules, helping businesses manage employee compensation efficiently. This document uses formulas to automatically calculate overtime pay based on predefined rates, reducing manual errors and saving time in payroll processing. Utilizing such a spreadsheet ensures compliance with labor laws and improves transparency in workforce management.

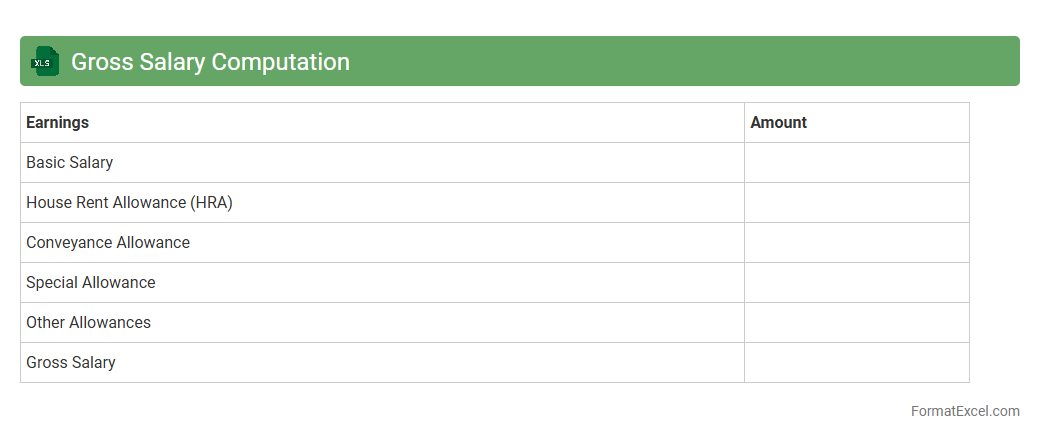

Gross Salary Computation

A

Gross Salary Computation Excel document calculates the total earnings of an employee before deductions such as taxes, insurance, and retirement contributions. It streamlines payroll processing by organizing components like basic salary, allowances, bonuses, and overtime into a clear, automated format. This tool enhances accuracy, saves time for HR departments, and ensures consistent salary management across an organization.

Leave Deduction Tracking

A

Leave Deduction Tracking Excel document is a tool designed to monitor and record employee leave balances and deductions accurately. It helps organizations manage absenteeism by automatically calculating leave taken, remaining balance, and any related salary deductions. This ensures transparency, reduces payroll errors, and streamlines HR processes for effective workforce management.

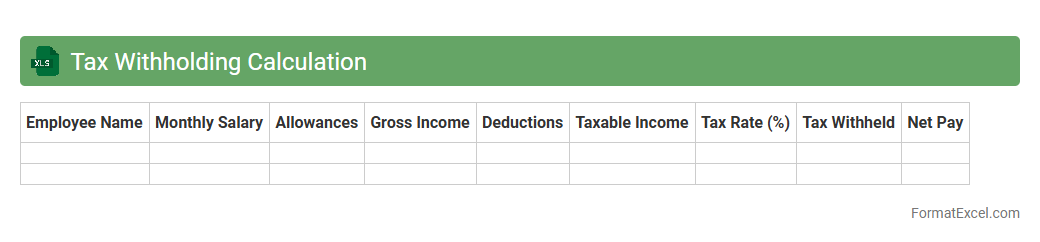

Tax Withholding Calculation

A

Tax Withholding Calculation Excel document is a spreadsheet tool designed to accurately compute the amount of tax an individual or business needs to withhold from income, based on current tax regulations. It is useful for ensuring compliance with tax laws, preventing underpayment or overpayment of taxes, and simplifying payroll or income reporting processes. The document can include formulas for various tax brackets, deductions, and credits, enabling precise and efficient financial planning.

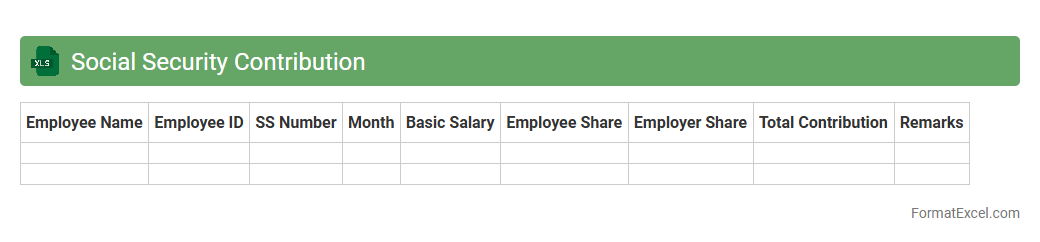

Social Security Contribution

A

Social Security Contribution Excel document is a spreadsheet designed to track and calculate employee and employer contributions to social security programs based on wages and applicable rates. It helps ensure accurate record-keeping for compliance with government regulations and simplifies payroll processes by automating contribution computations. This tool is essential for financial transparency, budgeting, and timely submission of mandatory social security payments.

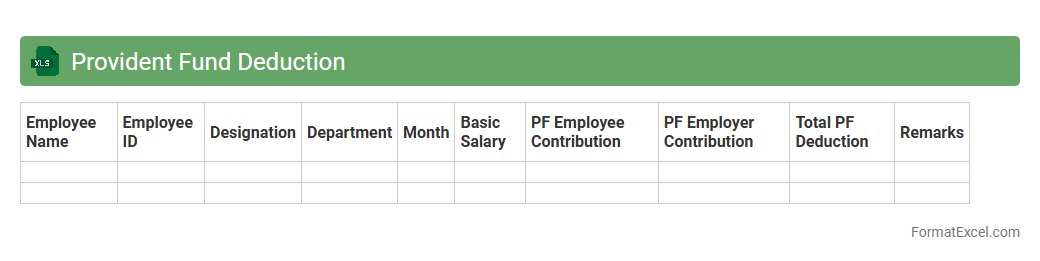

Provident Fund Deduction

The

Provident Fund Deduction Excel document is a structured spreadsheet designed to calculate, track, and manage employee provident fund contributions accurately. It helps employers ensure compliance with statutory deductions and simplifies payroll processing by automating calculations based on salary and contribution rates. This tool provides clear insights into monthly and cumulative deductions, improving financial record-keeping and facilitating efficient fund management.

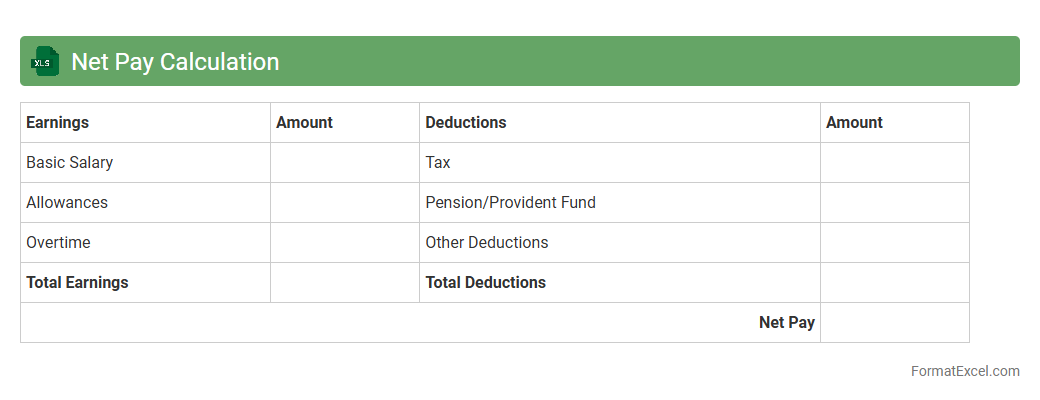

Net Pay Calculation

Net Pay Calculation Excel document is a spreadsheet tool designed to accurately determine an employee's take-home salary after deductions such as taxes, social security, and other withholdings. It streamlines payroll processing by automating calculations, reducing errors, and saving time for HR and finance teams. Using this

Net Pay Calculation Excel enhances financial transparency and helps ensure compliance with labor laws and tax regulations.

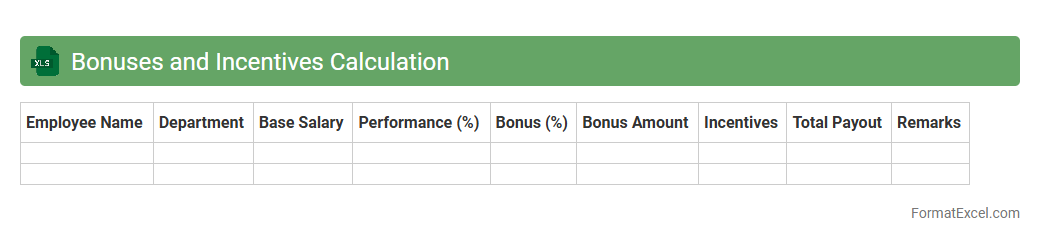

Bonuses and Incentives Calculation

A

Bonuses and Incentives Calculation Excel document is a specialized spreadsheet designed to automate and accurately compute employee bonuses and incentive payouts based on predefined performance metrics and criteria. It streamlines the process of tracking sales targets, performance scores, and commission rates, ensuring transparency and reducing errors in compensation management. Using such a tool enhances payroll efficiency, helps motivate employees by linking rewards to measurable outcomes, and supports data-driven decision-making for HR and finance teams.

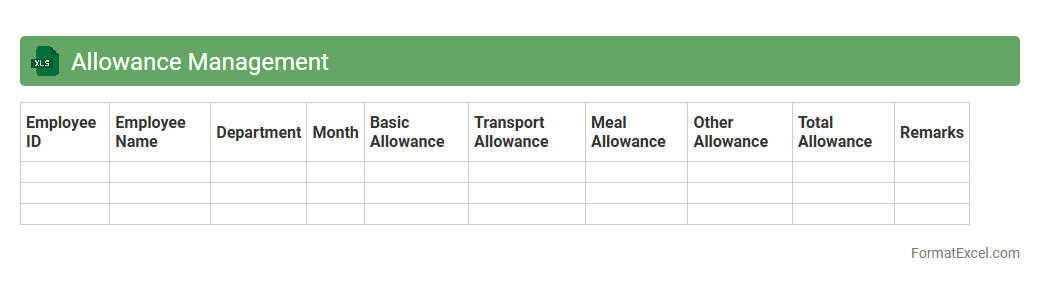

Allowance Management

An

Allowance Management Excel document is a structured spreadsheet designed to track, calculate, and manage various types of allowances such as travel, housing, or meal allowances within an organization or for personal finance. It streamlines the process of monitoring expenses, ensuring accuracy in disbursement and compliance with company policies or budgets. This tool enhances financial control and transparency by providing clear records and summaries, making it easier to analyze spending patterns and prepare reimbursements efficiently.

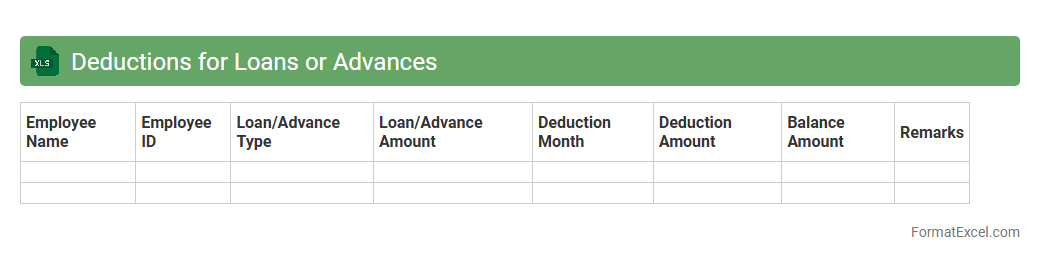

Deductions for Loans or Advances

The

Deductions for Loans or Advances Excel document is a detailed financial tool used to track and calculate loan repayments or advance deductions accurately. It helps in maintaining transparency and ensures precise accounting of amounts deducted from salaries or payments over a specified period. This document is essential for businesses and individuals to monitor outstanding balances and manage financial obligations efficiently.

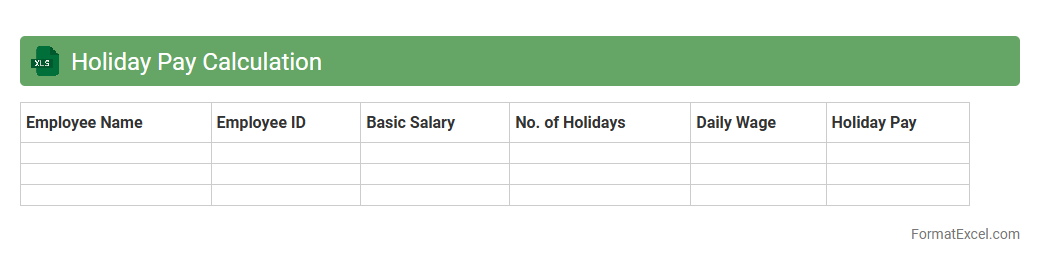

Holiday Pay Calculation

Holiday Pay Calculation Excel document is a specialized spreadsheet designed to accurately compute employee holiday pay based on hours worked, hourly rates, and company-specific leave policies. This tool streamlines payroll processes, reduces errors, and ensures compliance with labor regulations by automatically applying relevant formulas and statutory rules. Using this

Holiday Pay Calculation Excel document enhances financial accuracy and saves valuable time for HR and payroll departments.

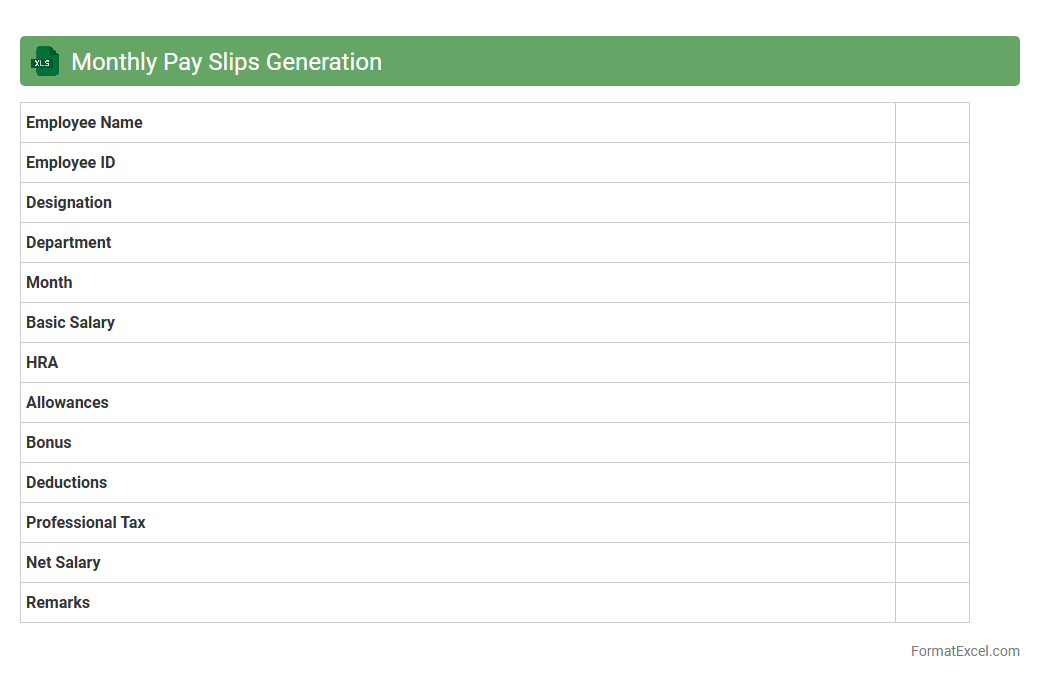

Monthly Pay Slips Generation

The

Monthly Pay Slips Generation Excel document is a digital tool designed to automate the creation of employee pay slips by calculating salaries, deductions, and taxes accurately. It streamlines payroll management, saves time, and reduces errors by consolidating financial data into structured templates. Businesses benefit from this system by ensuring compliance with legal pay regulations and providing employees with clear, professional payment records.

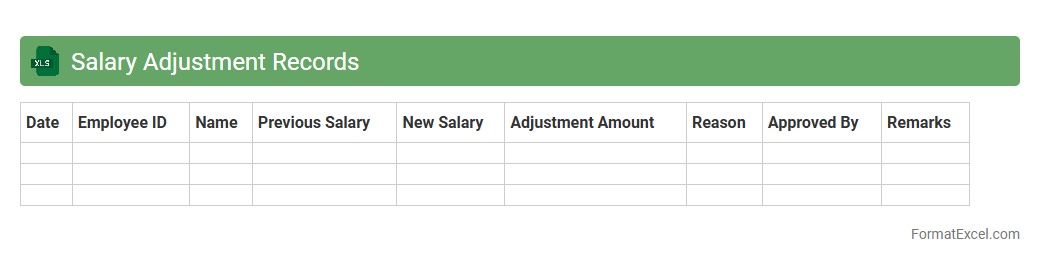

Salary Adjustment Records

Salary Adjustment Records Excel document is a comprehensive spreadsheet that tracks changes in employee compensation over time, including raises, bonuses, and deductions. It provides a clear historical record that helps HR professionals and management monitor salary progression, ensure consistency with company policies, and facilitate accurate payroll processing. Utilizing this document enhances transparency, supports budget planning, and aids in compliance with labor regulations.

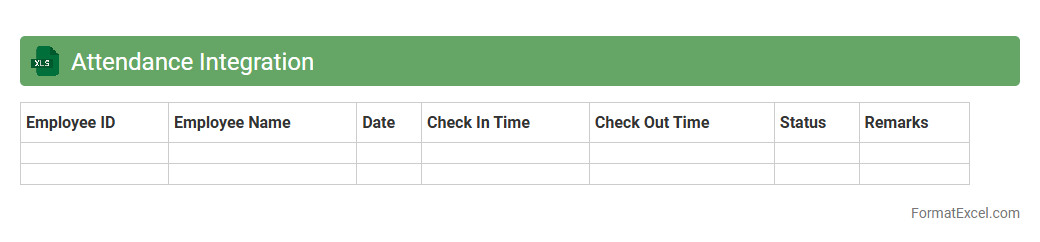

Attendance Integration

The

Attendance Integration Excel document consolidates employee attendance data from multiple sources into a single, organized file for easy tracking and analysis. It streamlines payroll processing, reduces manual errors, and enhances workforce management by providing accurate attendance records. This tool is essential for HR departments and managers seeking efficient monitoring of attendance trends and compliance with company policies.

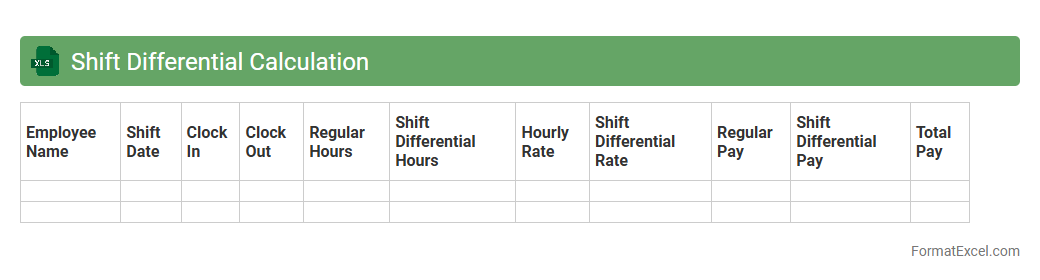

Shift Differential Calculation

A

Shift Differential Calculation Excel document is a spreadsheet tool designed to accurately compute additional pay rates for employees working non-standard hours, such as night or weekend shifts. It streamlines payroll processes by automatically applying differential rates based on predefined time periods, reducing errors and saving time for HR departments. This tool enhances financial transparency and ensures compliance with labor regulations related to shift premiums.

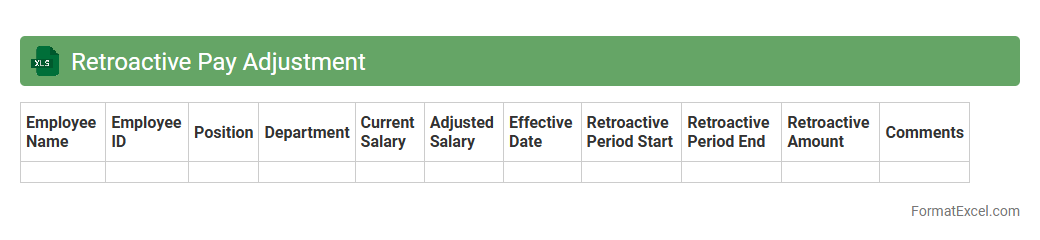

Retroactive Pay Adjustment

A

Retroactive Pay Adjustment Excel document is a structured spreadsheet used to calculate and track backdated salary corrections for employees, ensuring accuracy in payroll management. It automates the process of applying pay scale changes or correcting missed payments over a specific period, reducing manual errors and saving administrative time. This tool is essential for HR departments and payroll managers to maintain compliance with labor laws and provide transparent compensation adjustments.

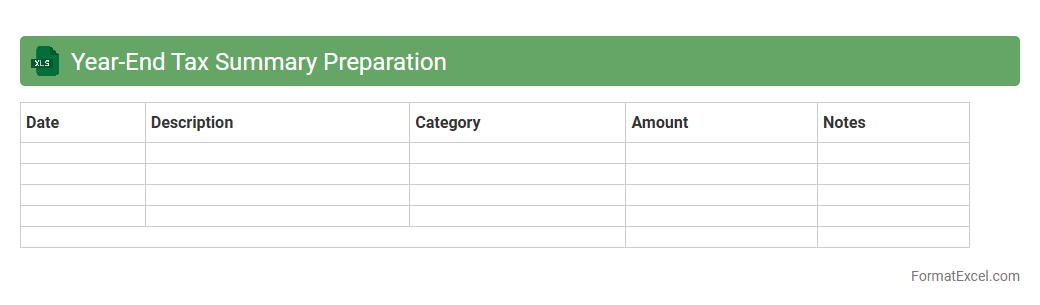

Year-End Tax Summary Preparation

The

Year-End Tax Summary Preparation Excel document consolidates all financial transactions, income, and expenses throughout the year to facilitate accurate tax filing. It helps individuals and businesses systematically organize taxable data, ensuring compliance with tax regulations and minimizing errors. By providing a clear overview of deductions, liabilities, and payments, it streamlines the tax preparation process and supports informed financial decision-making.

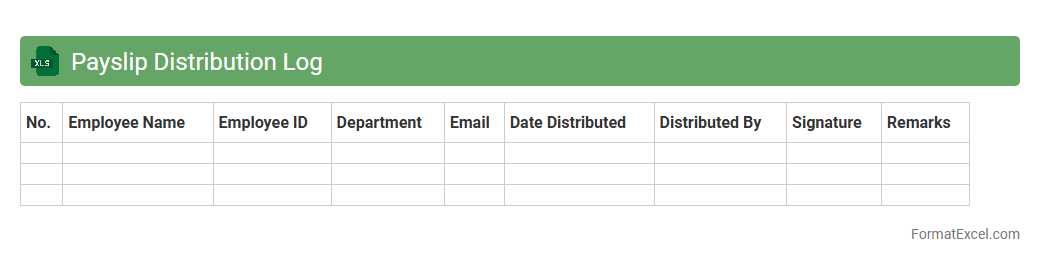

Payslip Distribution Log

The

Payslip Distribution Log Excel document is a detailed record tracking the issuance of employee payslips, including dates, recipient names, and delivery methods. It ensures accurate payroll management by providing a transparent audit trail useful for HR departments and compliance audits. This log helps prevent discrepancies and supports efficient communication of salary details to staff.

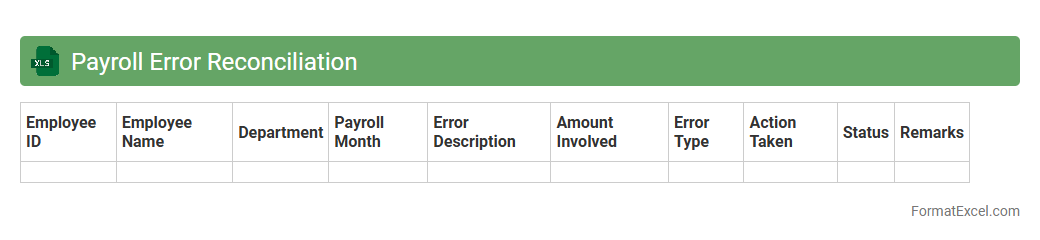

Payroll Error Reconciliation

The

Payroll Error Reconciliation Excel document is a detailed tool designed to identify and correct discrepancies in employee payment records by comparing payroll data against actual working hours and deductions. This document helps organizations maintain accurate financial records, ensures compliance with tax and labor regulations, and prevents payroll fraud or overpayments. Utilizing this reconciliation process improves payroll accuracy, enhances audit readiness, and supports seamless salary disbursements.

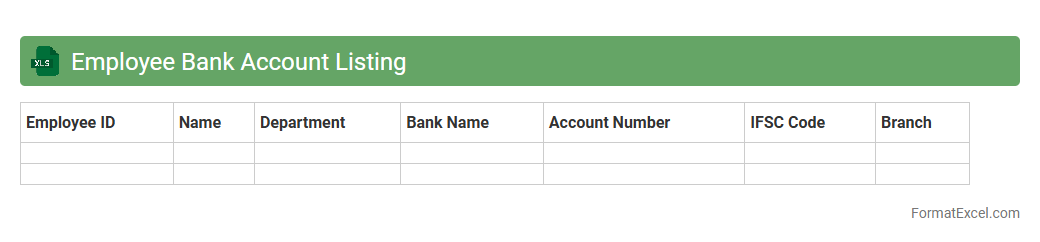

Employee Bank Account Listing

An

Employee Bank Account Listing Excel document is a structured file containing detailed information about employees' bank accounts, including account numbers, bank names, and branch details. This document streamlines payroll processing by providing accurate banking information, reducing errors and ensuring timely salary payments. It also aids in financial auditing and internal record-keeping, enhancing overall organizational efficiency.

Payroll Approval Tracking

The

Payroll Approval Tracking Excel document is a tool designed to monitor and manage the approval status of employee payroll submissions efficiently. It helps organizations ensure accuracy, prevent errors, and maintain compliance by documenting each step of payroll processing, including review dates, approvers' signatures, and payment confirmations. Using this tracker enhances transparency, reduces processing delays, and facilitates audit readiness in payroll management.

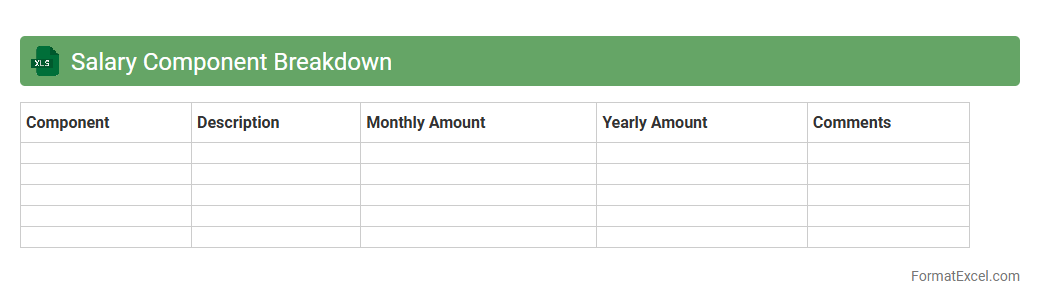

Salary Component Breakdown

A

Salary Component Breakdown Excel document details every element of an employee's compensation, including base salary, allowances, bonuses, and deductions. It simplifies payroll management by providing a clear structure for calculating net salary and ensuring accurate tax and statutory compliance. Businesses use this tool to improve transparency, streamline salary processing, and aid in financial planning and reporting.

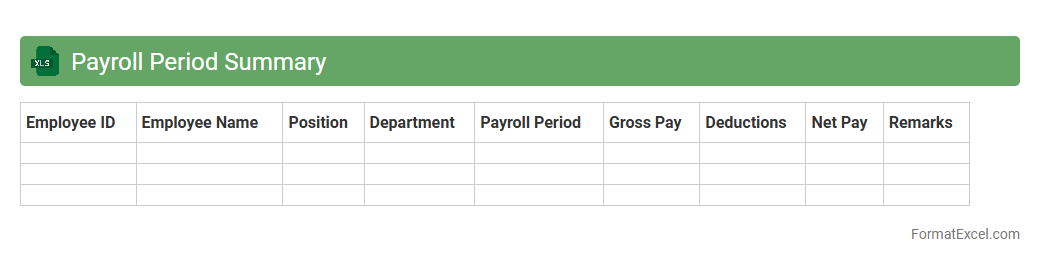

Payroll Period Summary

The

Payroll Period Summary Excel document consolidates employee wage data, hours worked, deductions, and net pay for a specific pay period. It enables efficient tracking and verification of payroll information, ensuring accuracy and compliance with tax regulations. This summary aids HR and finance teams in streamlining payroll processing and generating comprehensive reports for audits and budgeting.

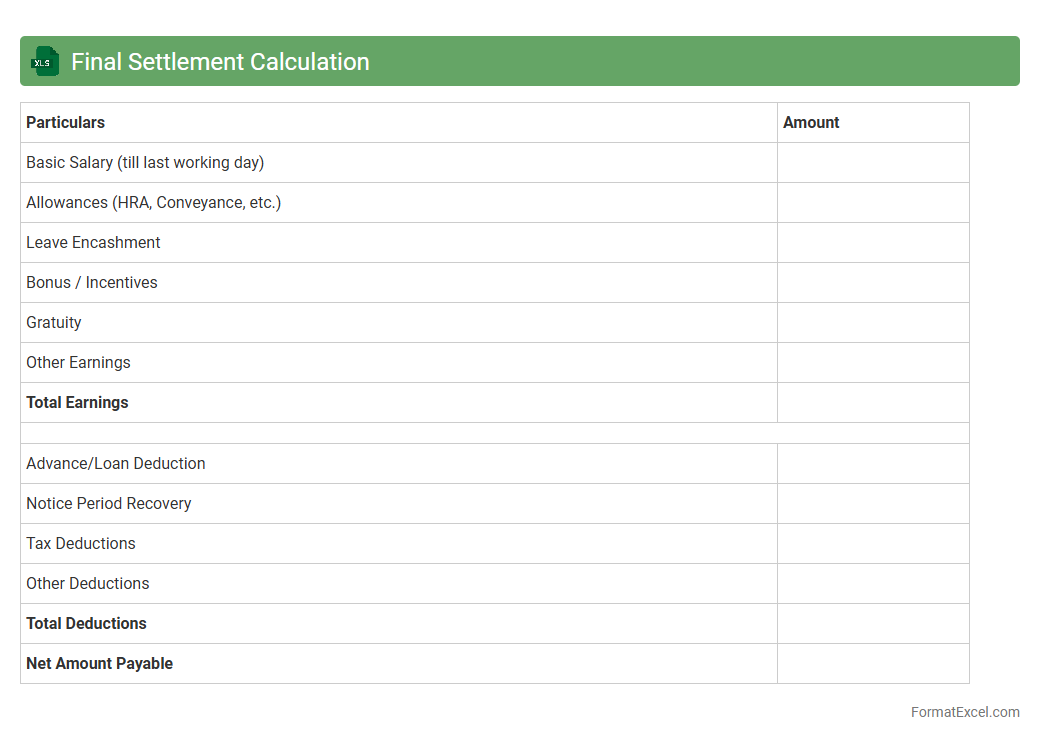

Final Settlement Calculation

The

Final Settlement Calculation Excel document is a detailed tool used to compute the outstanding dues, benefits, and deductions when an employee leaves an organization. It integrates payroll data, leave balances, gratuity, and statutory compliances to ensure accurate financial closure. This document is essential for HR and finance teams to streamline exit formalities, minimize errors, and maintain transparent records for both the employer and employee.

Introduction to Payroll Calculation in Excel

Payroll calculation in Excel involves using spreadsheet tools to compute employee wages efficiently. This method improves accuracy and simplifies payroll management for businesses of all sizes. Excel's flexibility makes it ideal for customizing payroll processes.

Importance of a Structured Payroll Format

A well-organized payroll format ensures consistency and accuracy in salary calculations. It reduces errors, saves time, and helps maintain compliant records. Structured formats facilitate easier audits and reporting.

Key Components of an Excel Payroll Sheet

Essential payroll sheets include employee details, earnings, deductions, and tax calculations. Each component must be clearly defined to reflect accurate pay amounts. Proper segmentation aids in transparency and record keeping.

Setting Up Employee Information Fields

Include fields such as employee ID, name, department, and position to identify each worker clearly. This data is crucial for tracking payroll by employee and department. Accurate employee information forms the foundation of payroll calculations.

Including Earnings and Deductions Columns

Separate columns for basic pay, allowances, bonuses, and deductions ensure clarity. This setup helps calculate gross pay and net pay accurately. Deductions may include taxes, benefits, and other withholdings.

Automating Payroll Calculations with Formulas

Excel formulas automate computations like sum totals, tax withholdings, and net payroll amounts. Using formulas reduces manual errors and speeds up payroll processing. Common Excel functions include SUM, IF, and VLOOKUP.

Incorporating Tax and Compliance Fields

Tax fields should include income tax, social security, and other relevant statutory deductions. Ensuring compliance with local laws avoids penalties. Regularly updating tax rates in the spreadsheet is essential.

Designing a User-Friendly Payroll Template

A clear layout with highlighted input fields and locked formula cells enhances usability and security. Employing color coding helps distinguish data entry areas. A user-friendly template minimizes input errors.

Tips for Accurate Payroll Data Entry

Verify employee data and double-check figures before finalizing payroll. Maintain consistency in formats like dates and currency throughout the sheet. Regular audits help catch discrepancies early.

Sample Excel Payroll Calculation Format

A typical format includes columns for employee info, earnings, deductions, tax calculation, and net pay summary. Incorporating formulas automates totals for each category. This sample serves as a blueprint for creating customized payroll sheets.