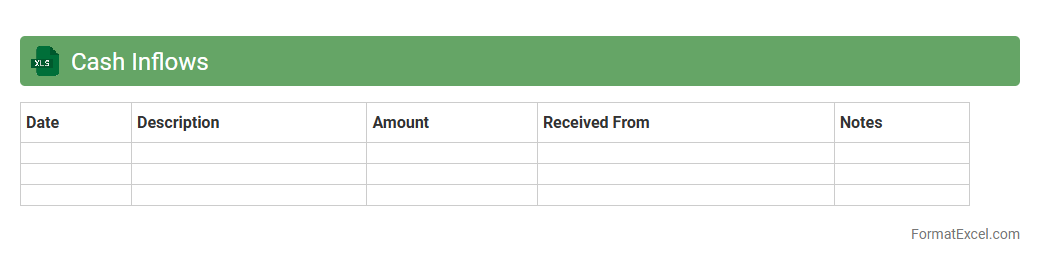

Cash Inflows

A

Cash Inflows Excel document is a financial tool designed to track and record all incoming cash transactions for a business or individual, including sales revenue, loan proceeds, and other income sources. It helps in monitoring liquidity, forecasting future cash availability, and making informed budgeting decisions by providing a clear view of cash movement. Utilizing this document supports effective financial management and improves the accuracy of cash flow analysis.

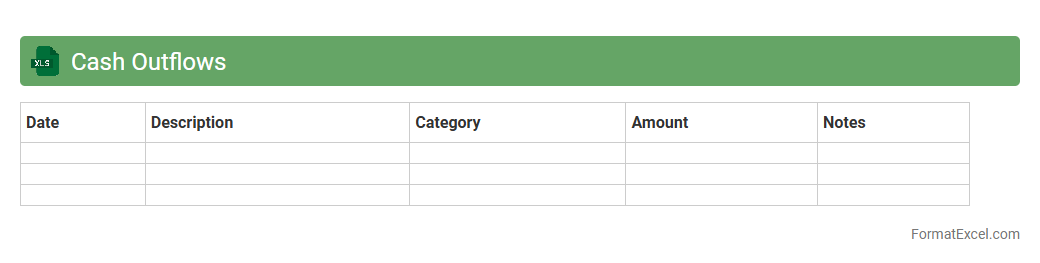

Cash Outflows

A

Cash Outflows Excel document is a financial tool designed to track and manage all expenses and payments over a specific period. It helps businesses and individuals monitor spending patterns, budget effectively, and ensure liquidity by providing clear visibility into outgoing cash flows. Utilizing this document enhances financial planning accuracy and supports strategic decision-making to maintain healthy cash management.

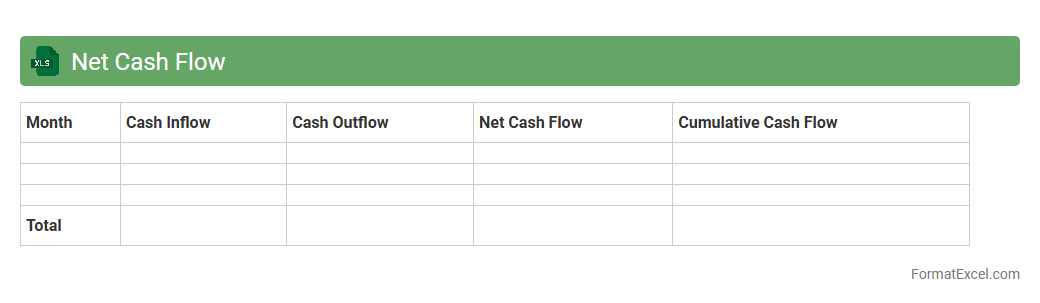

Net Cash Flow

The

Net Cash Flow Excel document tracks the difference between cash inflows and outflows over a specific period, enabling precise financial analysis and planning. It helps businesses and individuals monitor liquidity, forecast future financial positions, and make informed decisions to maintain positive cash flow. This tool is essential for budgeting, managing expenses, and ensuring sustainable financial health.

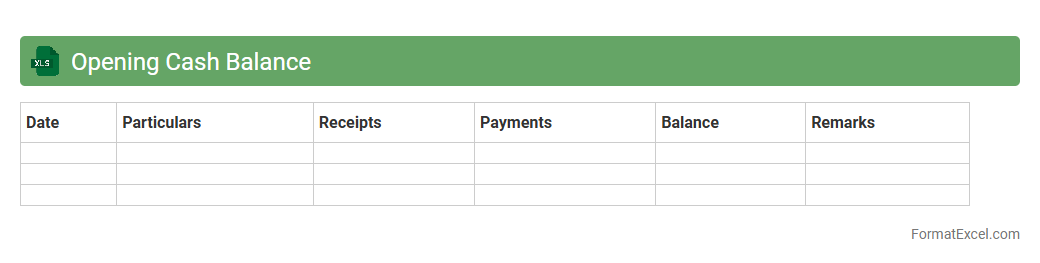

Opening Cash Balance

The

Opening Cash Balance Excel document captures the initial amount of cash available at the start of a financial period, serving as a baseline for cash flow management. It helps track liquidity, enabling businesses to monitor inflows and outflows accurately while ensuring effective budget planning. This document supports financial decision-making by providing a clear snapshot of available funds before any transactions occur.

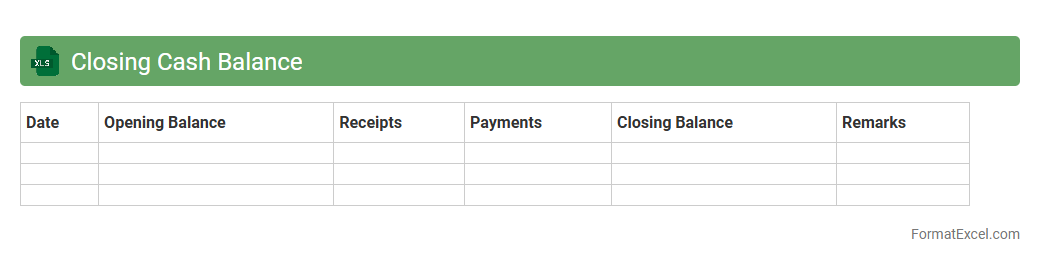

Closing Cash Balance

The

Closing Cash Balance Excel document is a financial tool that tracks the ending cash amount available at the close of a specific period, such as daily, weekly, or monthly. It helps businesses maintain liquidity oversight by comparing opening balances, cash inflows, and outflows to ensure accurate cash management. This document is essential for forecasting cash needs, making informed decisions, and optimizing working capital.

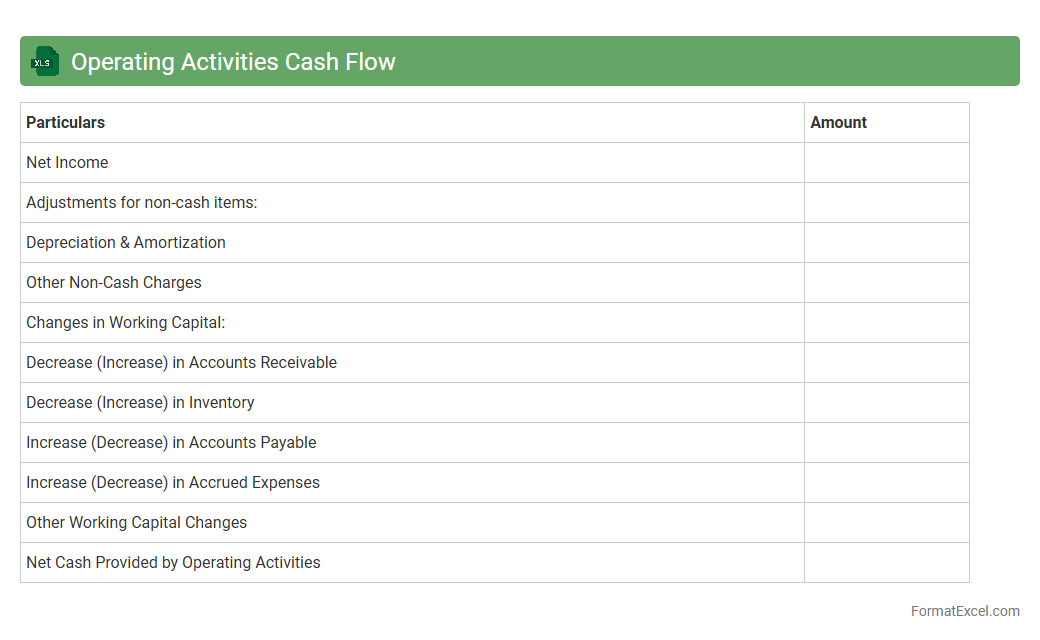

Operating Activities Cash Flow

The

Operating Activities Cash Flow excel document tracks the cash generated or used by a company's core business operations, providing detailed insights into receipts from customers, payments to suppliers, and other operational expenses. It is essential for evaluating a company's liquidity, operational efficiency, and ability to generate sustainable cash flow without relying on external financing. This document aids investors, managers, and analysts in making informed financial decisions and planning for future business activities.

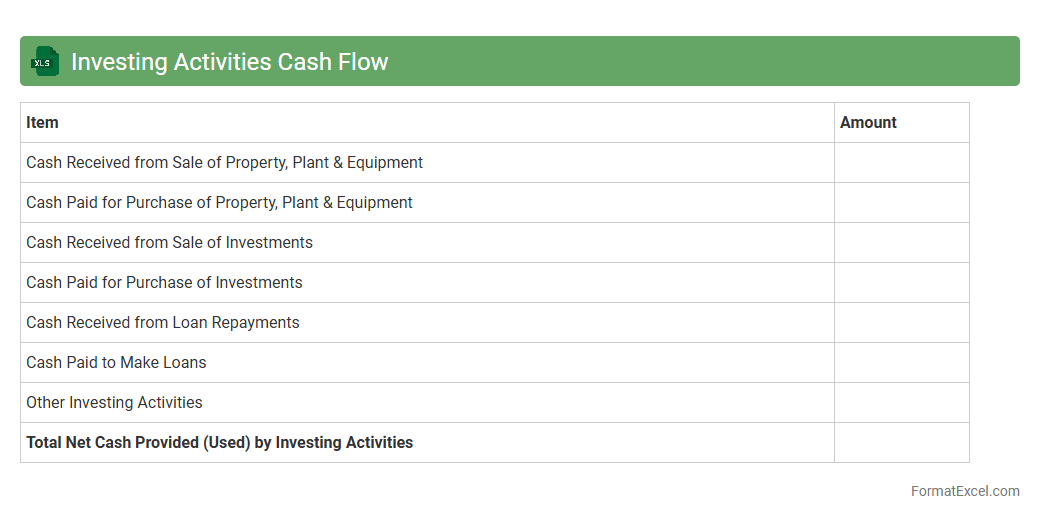

Investing Activities Cash Flow

Investing Activities Cash Flow Excel document tracks cash inflows and outflows related to investments such as purchase or sale of assets, securities, or other long-term investments. It provides crucial insights into how a company allocates resources towards growth and asset management, enabling better financial decision-making. Using this document helps investors and analysts evaluate

investment activities cash flow to assess a company's financial health and future growth potential.

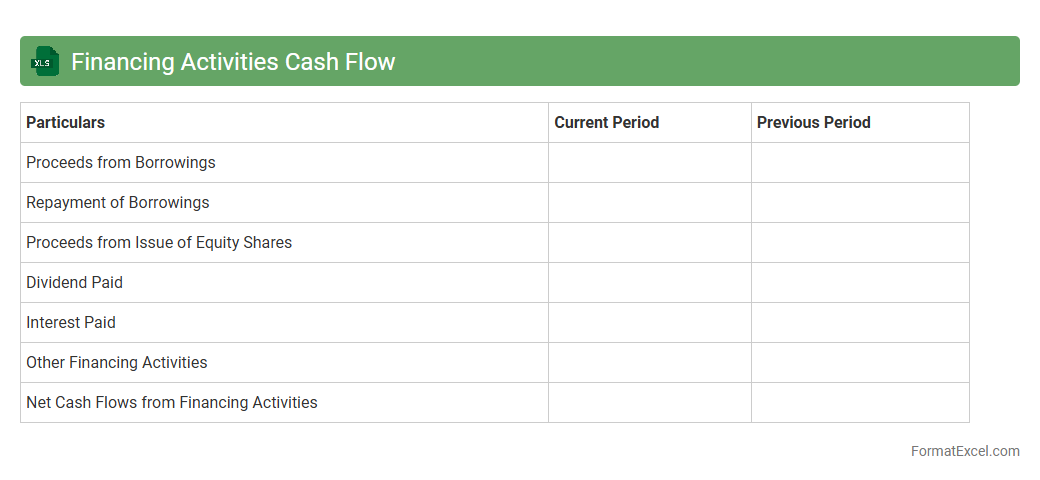

Financing Activities Cash Flow

A

Financing Activities Cash Flow Excel document tracks cash inflows and outflows related to borrowing, repaying debt, issuing stock, and paying dividends, providing a clear view of how a company finances its operations. It helps businesses analyze their capital structure, plan funding strategies, and assess their ability to meet financial obligations. This tool is essential for investors and managers to evaluate financial health and make informed decisions on future investments or financing needs.

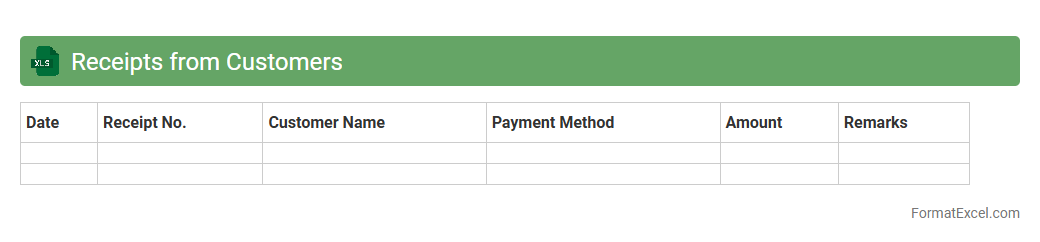

Receipts from Customers

The

Receipts from Customers Excel document is a financial tool designed to track payments received from clients, ensuring accurate record-keeping of incoming cash flows. It helps businesses maintain transparency, monitor outstanding invoices, and reconcile accounts receivable efficiently. By organizing customer receipts, companies can streamline their accounting processes and improve cash management strategies.

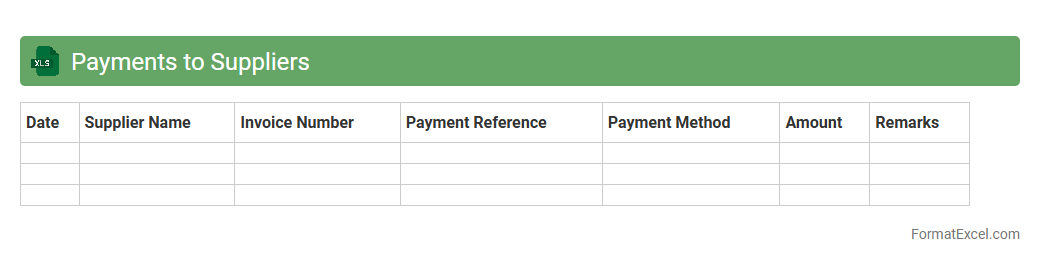

Payments to Suppliers

The

Payments to Suppliers Excel document is a detailed financial record that tracks all transactions made to vendors for goods and services. It helps businesses monitor payment schedules, manage cash flow, and maintain accurate accounts payable data. This document ensures timely payments and supports effective supplier relationship management by providing transparency and organization in financial processes.

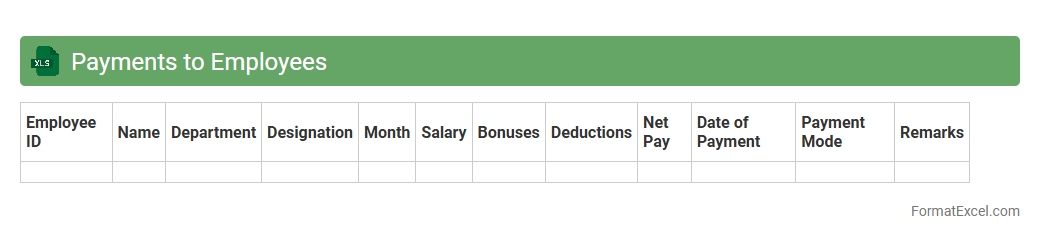

Payments to Employees

The

Payments to Employees Excel document is a structured spreadsheet that tracks salary disbursements, bonuses, and deductions for each employee within an organization. It is useful for maintaining accurate payroll records, ensuring compliance with tax regulations, and simplifying financial audits. This document streamlines payroll management, improves transparency, and helps in budgeting labor costs effectively.

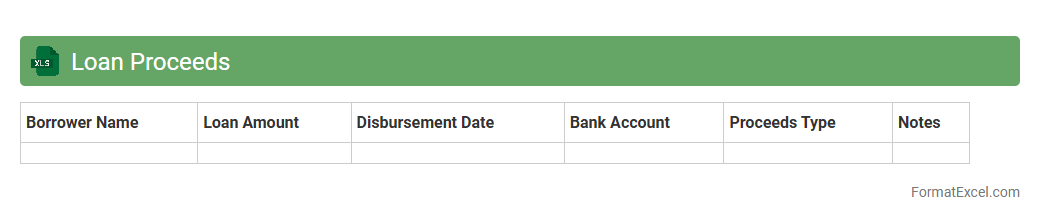

Loan Proceeds

The

Loan Proceeds Excel document is a detailed spreadsheet used to track the disbursement and allocation of loan funds, ensuring accurate financial management throughout the loan lifecycle. It helps users monitor the exact amounts received, payment schedules, and applicable interest or fees, facilitating transparent and efficient loan accounting. This document is essential for maintaining compliance, optimizing cash flow, and making informed financial decisions in lending operations.

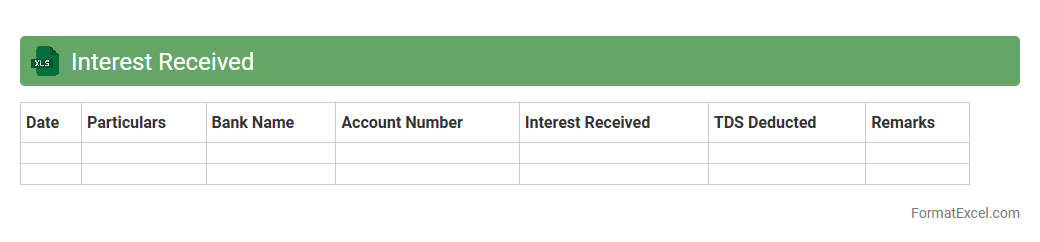

Interest Received

The

Interest Received Excel document tracks all interest payments earned from investments, savings accounts, or loans, providing a clear record of income generated over time. This document is useful for monitoring cash flow, ensuring accurate financial reporting, and simplifying tax preparation by consolidating interest data in one accessible place. It enables efficient analysis of investment performance and supports informed decision-making in personal or business finance management.

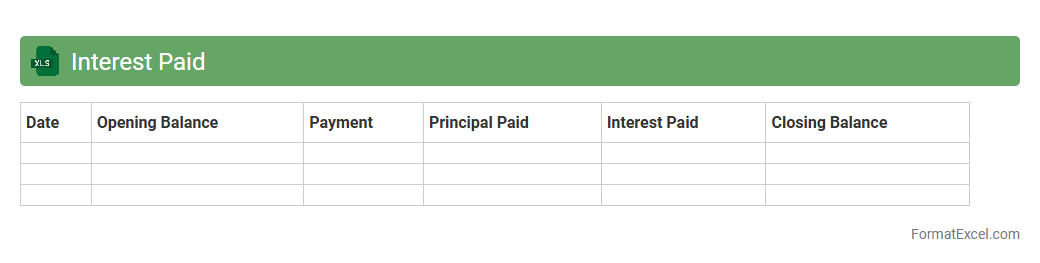

Interest Paid

The

Interest Paid Excel document is a detailed spreadsheet designed to track and calculate the interest paid on loans or mortgages over time. It helps users analyze payment schedules, monitor principal versus interest amounts, and optimize financial planning by providing clear insights into loan costs. This tool is essential for budget management and making informed decisions about refinancing or early loan repayment.

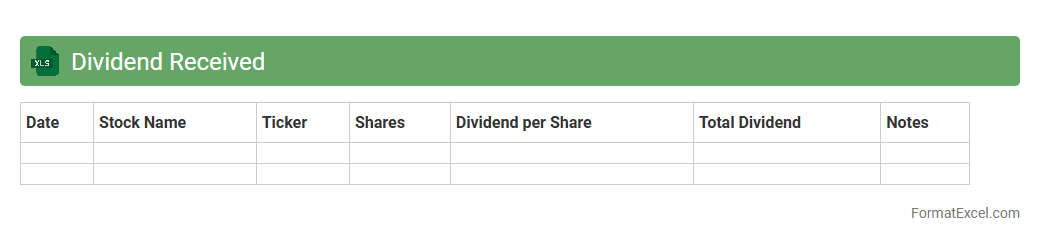

Dividend Received

A

Dividend Received excel document is a specialized spreadsheet designed to track dividends earned from various investments, including stocks and mutual funds, over a specified period. It helps investors systematically record dividend dates, amounts, and sources, enabling accurate income monitoring and tax reporting. By organizing this financial data, users can analyze dividend trends, maximize returns, and make informed investment decisions.

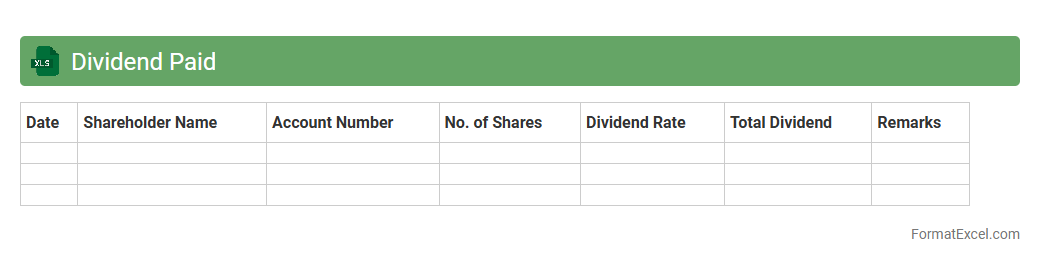

Dividend Paid

A

Dividend Paid Excel document is a spreadsheet used to track and record dividend payments made by a company to its shareholders. It helps investors monitor income streams, calculate total returns, and manage investment portfolios efficiently. By organizing dividend data, users gain insights into payment history, frequencies, and the impact on overall financial planning.

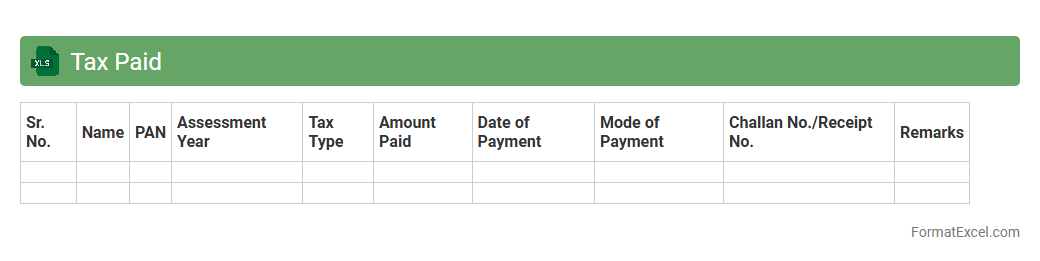

Tax Paid

The

Tax Paid Excel document is a specialized spreadsheet used to record and track tax payments made by individuals or businesses over a fiscal period. It organizes data such as payment dates, amounts, tax types, and receipt numbers, enabling clear financial oversight and accurate tax reporting. This document is essential for ensuring compliance with tax regulations, simplifying audits, and facilitating efficient tax planning.

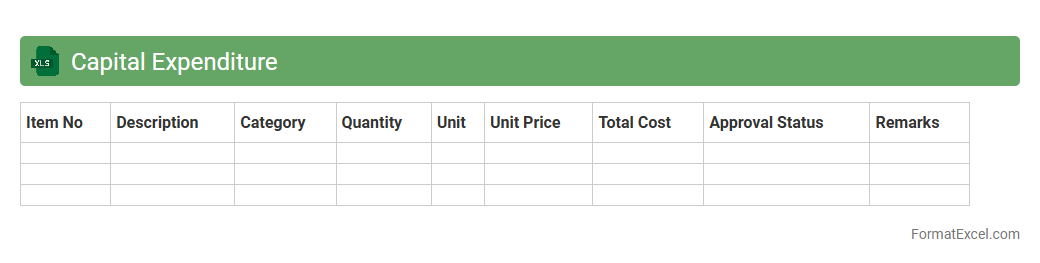

Capital Expenditure

A

Capital Expenditure Excel document is a spreadsheet used to track, plan, and analyze spending on fixed assets such as equipment, buildings, or technology over time. It helps businesses manage budgets, forecast cash flow, and ensure efficient allocation of resources for long-term investments. By organizing expenditure data, it facilitates decision-making and enhances financial control.

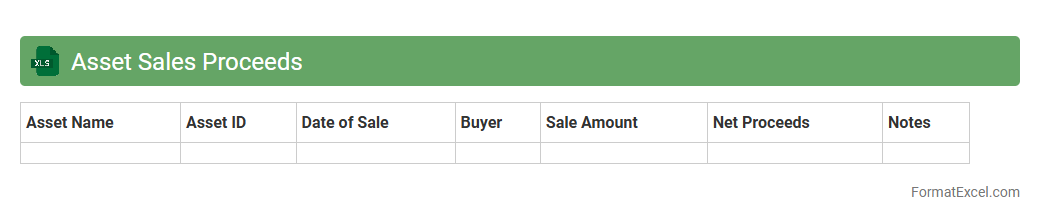

Asset Sales Proceeds

The

Asset Sales Proceeds Excel document is a financial tracking tool designed to record and analyze revenue generated from the sale of company assets. It helps businesses monitor cash inflows, calculate gains or losses on asset disposals, and supports accurate financial reporting and forecasting. Utilizing this document improves decision-making by providing clear insights into the impact of asset sales on overall financial health.

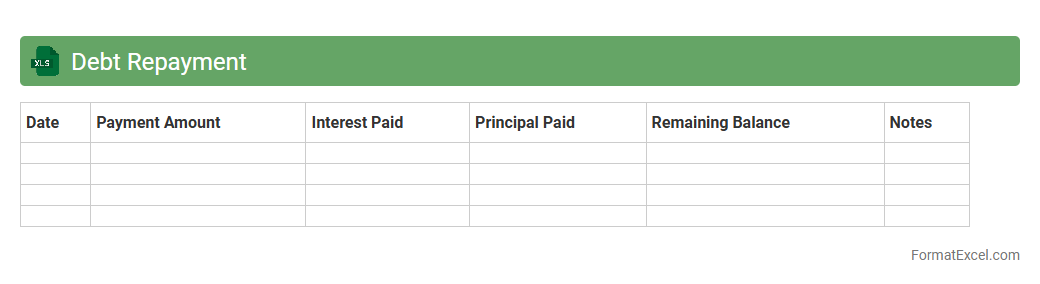

Debt Repayment

A

Debt Repayment Excel document is a spreadsheet tool designed to track and manage loan payments, interest rates, and outstanding balances effectively. It helps users organize their financial obligations, plan repayment schedules, and visualize progress toward becoming debt-free. Utilizing this document enhances financial discipline and supports informed decisions to minimize interest costs and accelerate debt elimination.

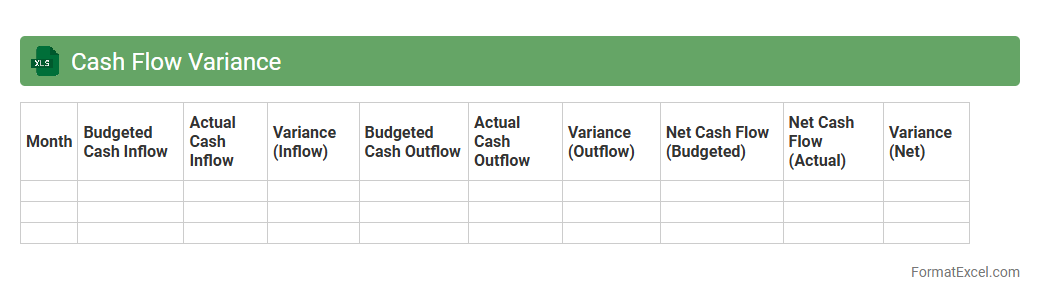

Cash Flow Variance

A

Cash Flow Variance Excel document tracks the differences between projected and actual cash inflows and outflows over a specific period. This tool enables businesses to identify discrepancies, manage liquidity effectively, and make informed financial decisions. By analyzing these variances, companies can adjust budgets, optimize cash management strategies, and ensure financial stability.

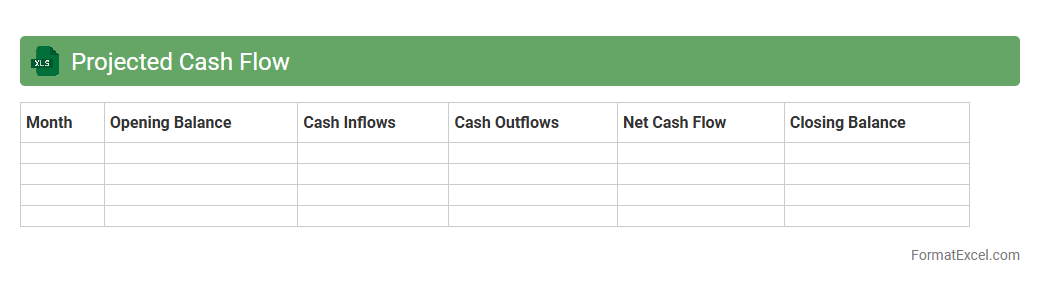

Projected Cash Flow

A

Projected Cash Flow Excel document is a financial tool that estimates future cash inflows and outflows over a specific period. It helps businesses anticipate cash shortages or surpluses, enabling better financial planning and decision-making. Using this document improves budgeting accuracy and supports maintaining adequate liquidity for operational needs.

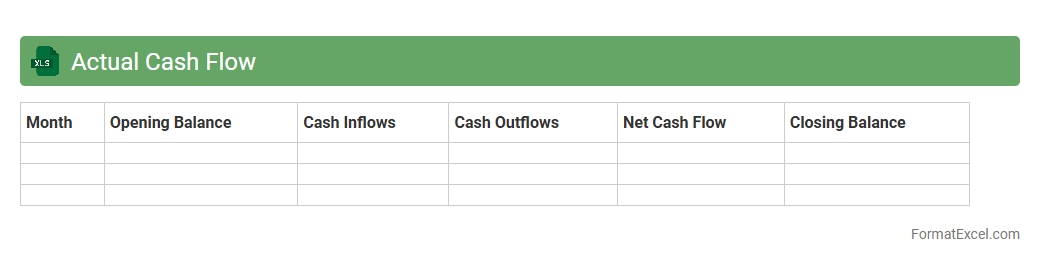

Actual Cash Flow

The

Actual Cash Flow Excel document is a financial tool designed to track and analyze real cash inflows and outflows over a specific period. It helps individuals and businesses monitor liquidity, manage budgets, and make informed decisions based on actual financial performance rather than projections. By comparing actual cash flow with forecasts, users can identify discrepancies and optimize financial planning.

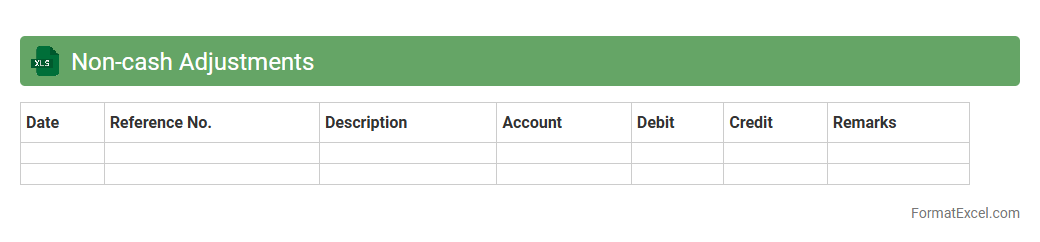

Non-cash Adjustments

A

Non-cash Adjustments Excel document records financial transactions that affect the accounting records without involving actual cash flow, such as depreciation, amortization, and stock-based compensation. This tool is essential for accurately adjusting net income to cash flow from operating activities, aiding in precise financial analysis and reporting. Using this document improves the understanding of a company's true financial health by distinguishing between cash and non-cash activities.

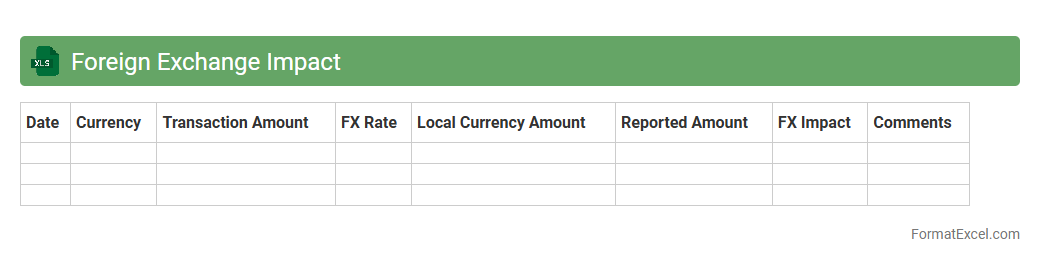

Foreign Exchange Impact

The

Foreign Exchange Impact Excel document analyzes currency fluctuations to quantify their effect on financial statements and business operations. It helps companies assess risks, forecast potential losses or gains from exchange rate movements, and make informed hedging decisions. This tool is essential for multinational businesses to optimize currency management and improve financial planning accuracy.

Introduction to Cash Flow Summary in Excel

A Cash Flow Summary in Excel provides a clear overview of cash inflows and outflows over a specific period. It helps track liquidity and financial health effectively. Excel's flexibility makes it ideal for customizing cash flow reports.

Importance of Cash Flow Management

Effective cash flow management ensures a business can meet its financial obligations on time. It prevents liquidity shortages and supports strategic decision-making. Proper management promotes sustained business growth and stability.

Key Components of a Cash Flow Summary

A comprehensive cash flow summary includes operating, investing, and financing activities. These components reflect the main sources and uses of cash within a business. Accurate categorization enhances financial analysis and planning.

Preparing Your Data for Cash Flow Analysis

Organize all relevant financial transactions by date and category before importing into Excel. Clean and verify data to ensure accuracy in your cash flow analysis. This preparation step is crucial for reliable reporting.

Step-by-Step Guide to Creating a Cash Flow Summary in Excel

Begin by listing cash inflows and outflows in organized rows and columns. Use Excel functions to sum totals and calculate net cash flow. This step-by-step guide helps create an easy-to-understand cash flow summary sheet.

Essential Excel Formulas for Cash Flow Statements

Key formulas such as SUM, IF, and VLOOKUP enhance the accuracy of a cash flow statement. These formulas automate calculations and improve data efficiency. Mastery of these functions is essential for dynamic cash flow analysis.

Sample Cash Flow Summary Format Template

A sample cash flow summary template in Excel typically includes sections for inflows, outflows, and net cash position. Templates save time and provide a structured format for reporting. Customizable templates accommodate various business needs.

Customizing Your Cash Flow Summary for Business Needs

Tailor the cash flow summary to reflect industry-specific cash activities and reporting periods. Incorporate additional data fields relevant to your business needs. Customization ensures the summary aligns with organizational goals.

Best Practices for Cash Flow Reporting in Excel

Maintain consistency in data entry, use clear labels, and update the summary regularly. Visual aids like charts improve the readability of the cash flow report. Regularly reviewing reports supports proactive financial management.

Common Mistakes to Avoid in Cash Flow Summaries

Ignoring data accuracy, missing transaction categories, and irregular updates are common pitfalls in cash flow summaries. Such mistakes can mislead stakeholders and impact decision-making. Avoiding these errors strengthens financial reporting reliability.