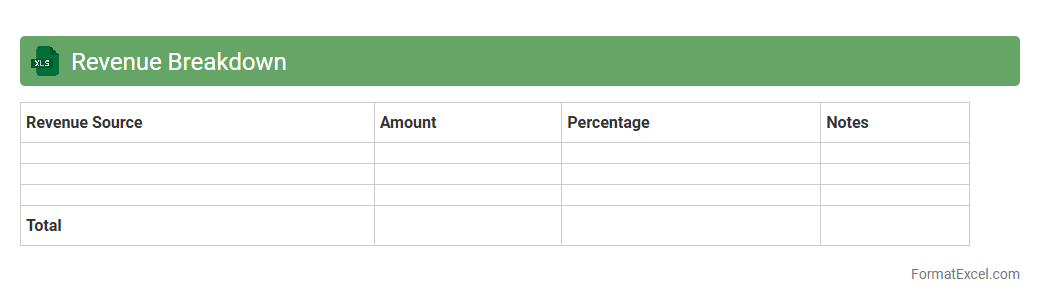

Revenue Breakdown

A

Revenue Breakdown Excel document organizes detailed financial data by categorizing income streams, allowing businesses to analyze sales performance across products, services, or regions efficiently. It provides clarity on which areas generate the most revenue, enabling informed decision-making for budgeting, forecasting, and strategic planning. This tool helps identify growth opportunities and potential risks by visually summarizing complex revenue data into accessible insights.

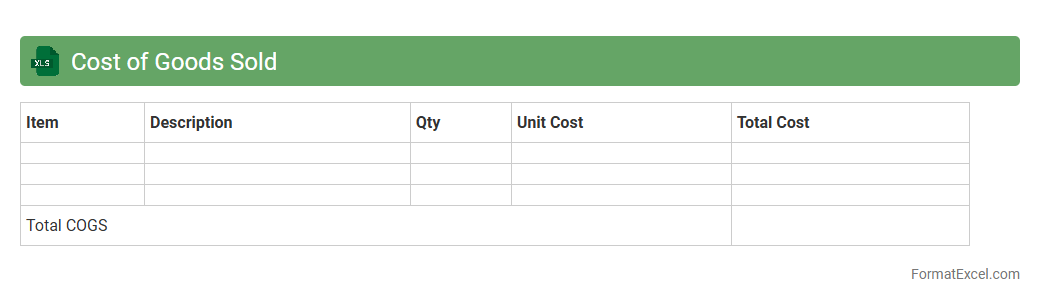

Cost of Goods Sold

A

Cost of Goods Sold (COGS) Excel document is a spreadsheet that tracks the direct costs associated with producing goods sold by a business, including raw materials, labor, and manufacturing overhead. It helps businesses calculate gross profit by subtracting COGS from total sales, enabling precise financial analysis and better inventory management. Utilizing this document improves budgeting accuracy, supports tax preparation, and informs pricing strategies to optimize profitability.

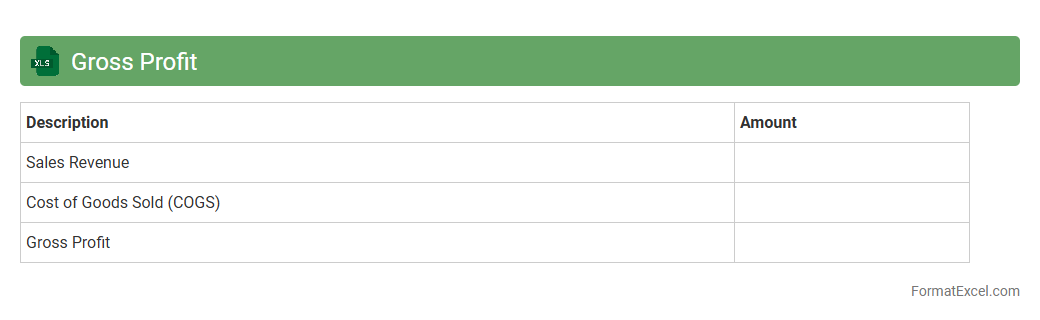

Gross Profit

A

Gross Profit Excel document is a spreadsheet tool designed to calculate and analyze the difference between total revenue and the cost of goods sold (COGS). It helps businesses track profitability by providing clear visibility into sales performance and production costs. Using this document enables informed decision-making for pricing strategies, cost control, and financial forecasting.

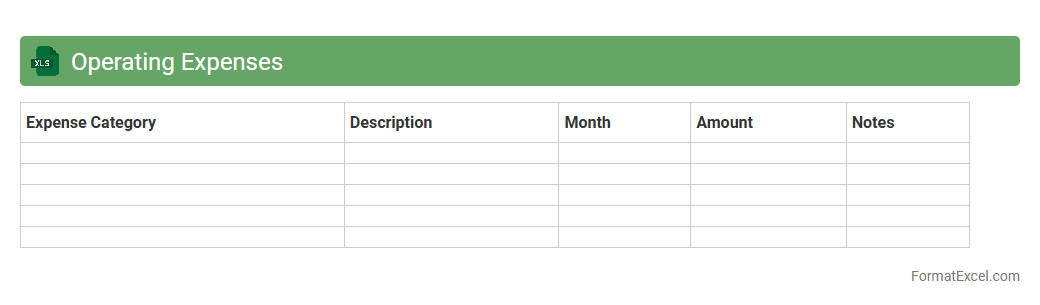

Operating Expenses

An

Operating Expenses Excel document is a spreadsheet designed to track and manage business costs such as rent, utilities, salaries, and maintenance expenses. It allows users to organize financial data systematically, analyze spending trends, and forecast future expenses for better budgeting. This tool enhances decision-making by providing clear insights into operational costs and helping identify areas for cost reduction and efficiency improvement.

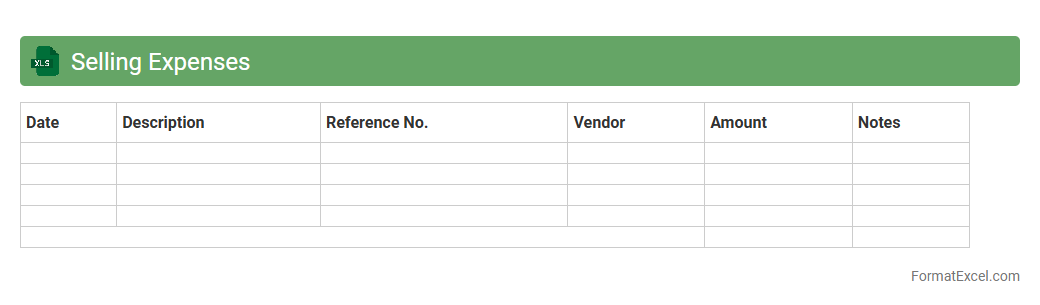

Selling Expenses

The

Selling Expenses Excel document is a detailed spreadsheet designed to track and analyze all costs associated with selling products or services, including advertising, commissions, and distribution expenses. This tool helps businesses monitor expenditure patterns, optimize budget allocation, and improve financial forecasting by providing clear visibility into sales-related costs. Utilizing this document enhances strategic decision-making and supports more accurate profit margin analysis.

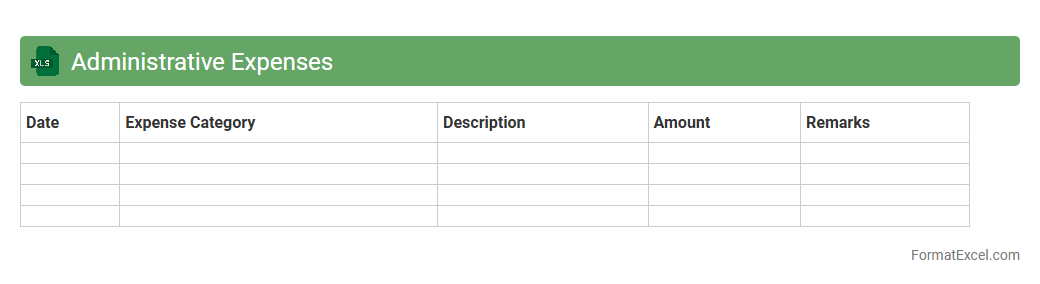

Administrative Expenses

An

Administrative Expenses Excel document is a spreadsheet designed to track, categorize, and analyze the costs associated with the general operation of a business, such as salaries, office supplies, and utilities. This tool allows organizations to monitor and control overhead expenses effectively, helping to identify areas where cost savings can be implemented. By providing a clear overview of administrative spending, it supports budgeting, financial planning, and decision-making processes.

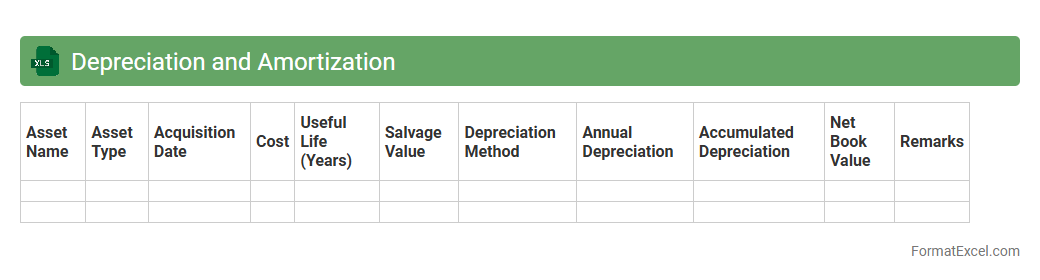

Depreciation and Amortization

A

Depreciation and Amortization Excel document is a financial tool designed to calculate and track the reduction in value of tangible and intangible assets over time. It helps businesses accurately allocate expenses, reflect asset usage, and comply with accounting standards for financial reporting and tax purposes. Using this spreadsheet ensures better budgeting, asset management, and insightful analysis of company profitability.

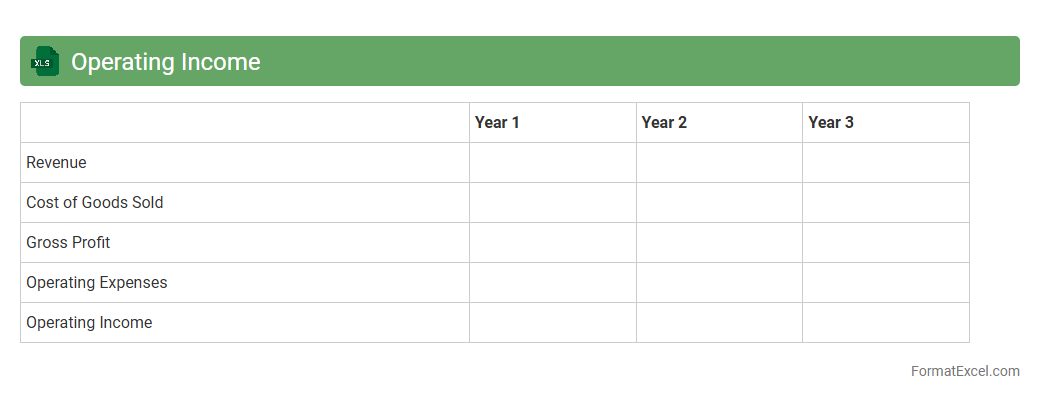

Operating Income

Operating Income Excel document is a financial tool that calculates

operating income by subtracting operating expenses from gross profit, providing a clear view of a company's profitability from core business activities. It helps businesses analyze operational efficiency, manage costs, and make informed strategic decisions by tracking revenue and expense trends over time. Using this document enables accurate financial forecasting and performance evaluation critical for investors and management.

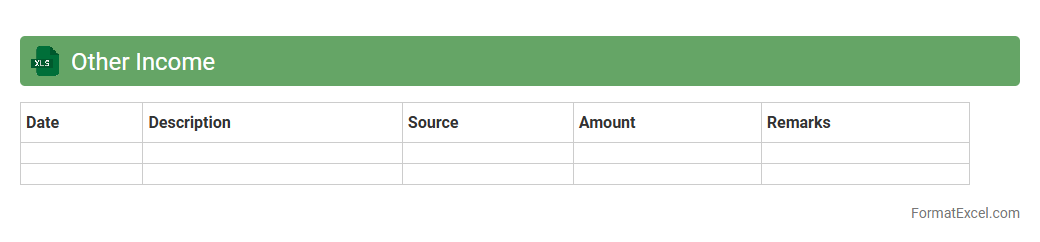

Other Income

The

Other Income Excel document is a financial tool designed to track and categorize various sources of income beyond primary business earnings, such as interest, dividends, and rental income. It provides a clear overview of additional revenue streams, helping businesses or individuals analyze overall profitability and manage cash flow effectively. By organizing other income systematically, users can make informed financial decisions and improve budgeting accuracy.

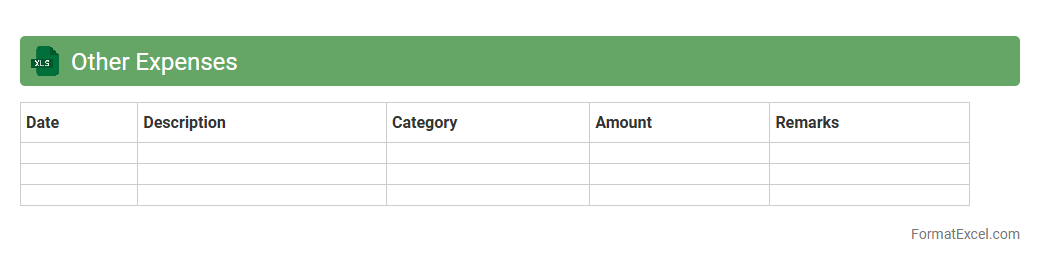

Other Expenses

An

Other Expenses Excel document is a financial tool designed to track and categorize miscellaneous business costs not included in primary expense categories. It helps organizations maintain accurate records, monitor spending patterns, and optimize budget management by providing clear visibility into non-regular expenses. Utilizing this document supports better financial planning and decision-making by ensuring all costs are accounted for systematically.

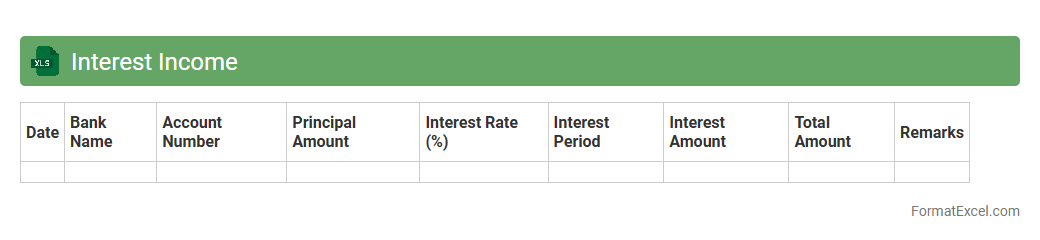

Interest Income

An

Interest Income Excel document is a detailed spreadsheet used to record, track, and analyze interest earned from various financial sources such as savings accounts, bonds, or loans. It helps individuals and businesses monitor their passive income, calculate accrued interest over time, and generate accurate financial reports for tax purposes. Utilizing this tool enhances financial planning by providing clear insights into income streams and supporting informed investment decisions.

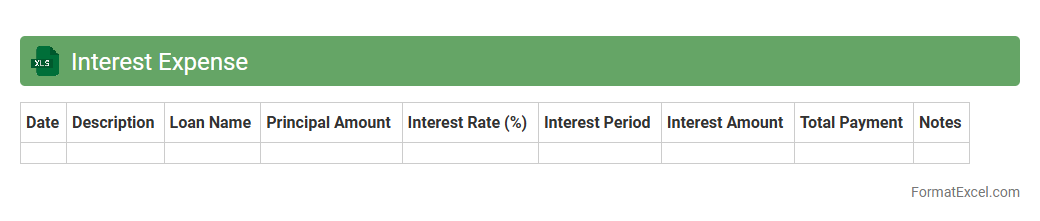

Interest Expense

An

Interest Expense Excel document tracks and calculates the cost of borrowed funds over a specific period, providing clarity on how much a business or individual pays in interest. This tool is useful for accurately managing loan repayments, budgeting for future expenses, and analyzing financial performance related to debt. It helps users optimize their financial planning by offering detailed insights into interest obligations and their impact on overall profitability.

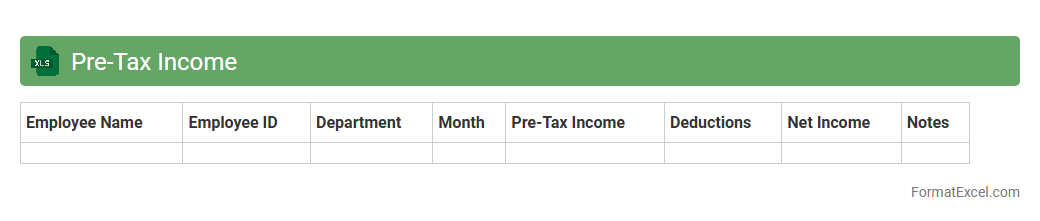

Pre-Tax Income

A

Pre-Tax Income Excel document is a financial spreadsheet designed to calculate and analyze earnings before income tax deductions. It helps businesses and individuals assess profitability and make strategic decisions by providing clear insights into operating performance without the influence of tax expenses. This tool is essential for budgeting, forecasting, and comparing financial results across periods or departments.

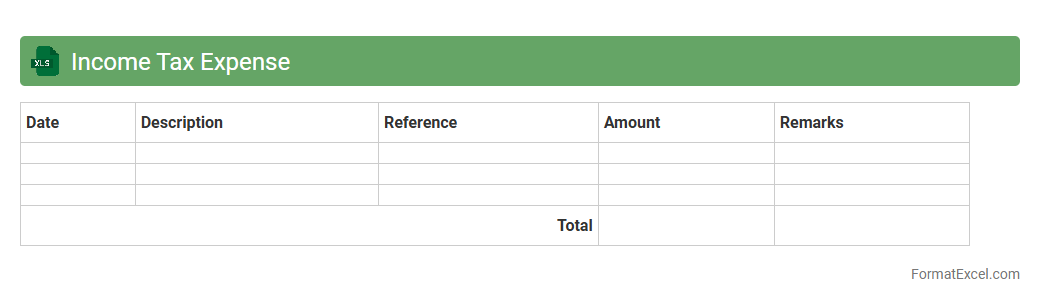

Income Tax Expense

An

Income Tax Expense Excel document is a financial tool that helps businesses and individuals calculate and track their income tax liabilities accurately. It organizes income data, tax rates, deductions, and credits in a structured format, enabling efficient tax planning and compliance. This document is essential for forecasting tax expenses, analyzing tax impacts on financial performance, and simplifying tax return preparation.

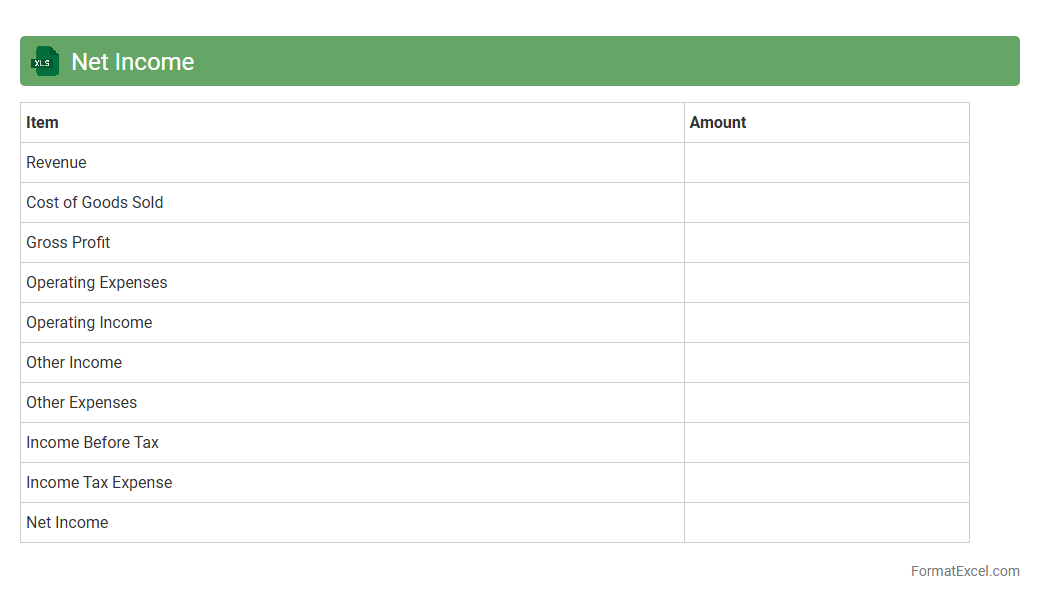

Net Income

A

Net Income Excel document is a financial spreadsheet designed to calculate and track an individual's or company's net income by subtracting total expenses from total revenue. It helps users analyze profitability, manage budgets, and make informed financial decisions by providing clear visibility into earnings over specific periods. This tool improves accuracy and efficiency in financial reporting and planning.

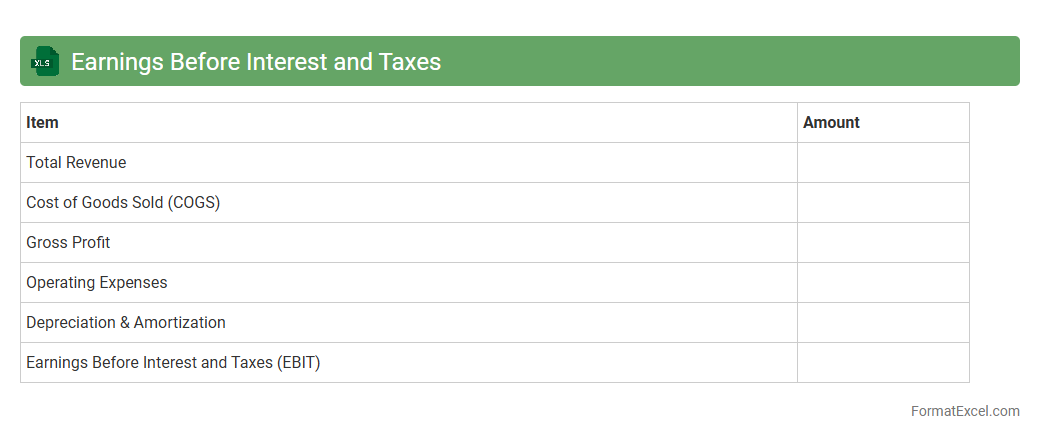

Earnings Before Interest and Taxes

An

Earnings Before Interest and Taxes (EBIT) Excel document is a financial tool used to calculate a company's operating profitability by subtracting operating expenses from total revenue, excluding interest and tax expenses. This spreadsheet helps businesses analyze core operational performance without the impact of financing and tax structures, providing clearer insights into profitability. It is useful for decision-making, budgeting, and comparing operational efficiency across time periods or among competitors.

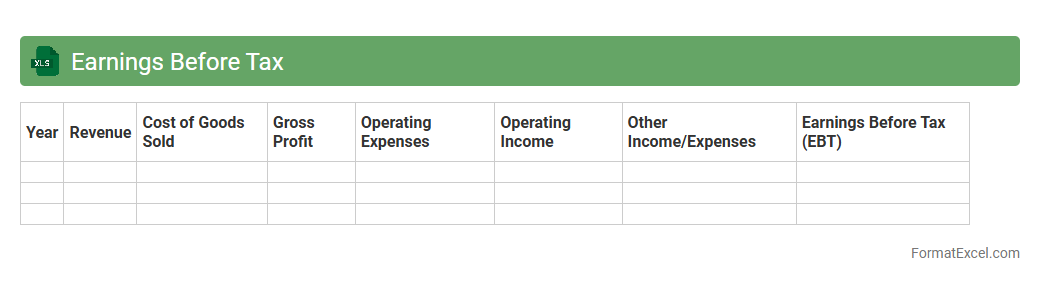

Earnings Before Tax

An

Earnings Before Tax (EBT) Excel document is a financial tool that calculates a company's profit before tax obligations are deducted, providing insights into operational efficiency. It allows businesses to analyze profitability by isolating tax effects, making it easier to compare performance across periods or with competitors. This document streamlines financial planning, budgeting, and decision-making by presenting clear, actionable data on pre-tax earnings.

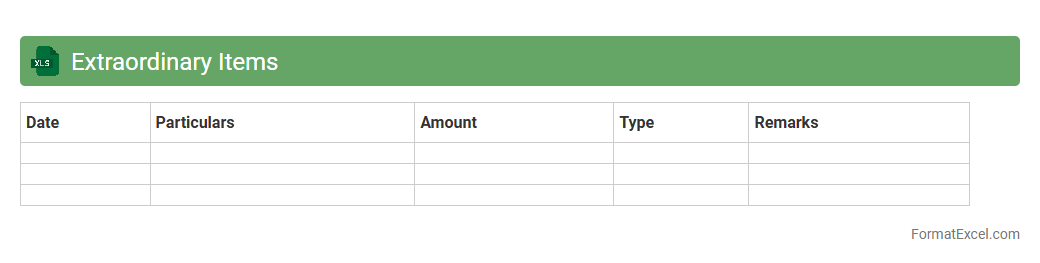

Extraordinary Items

The

Extraordinary Items Excel document is a specialized spreadsheet designed to track and categorize non-recurring financial transactions that significantly impact the profitability of a business. It helps in distinguishing unusual gains or losses from regular operational results, providing clearer insights into a company's true financial performance. This tool is essential for accountants and financial analysts to enhance accuracy in financial reporting and improve decision-making processes.

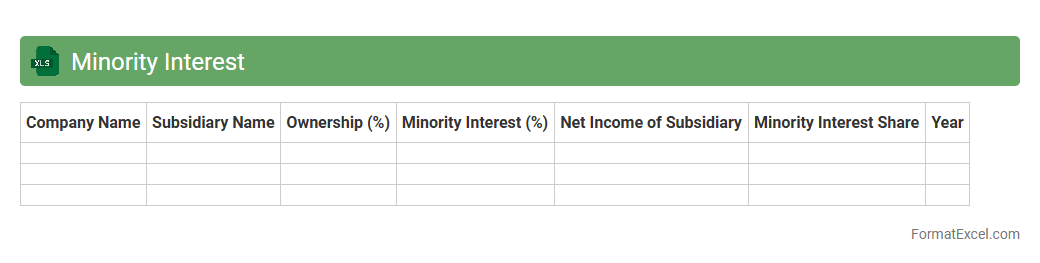

Minority Interest

A

Minority Interest Excel document is a financial tool used to track and analyze the ownership stake held by minority shareholders in subsidiary companies. It helps in accurately consolidating financial statements by clearly separating the portion of equity and net income attributable to non-controlling interests. This document enhances decision-making by providing transparency on minority ownership, aiding in valuation, reporting, and compliance processes.

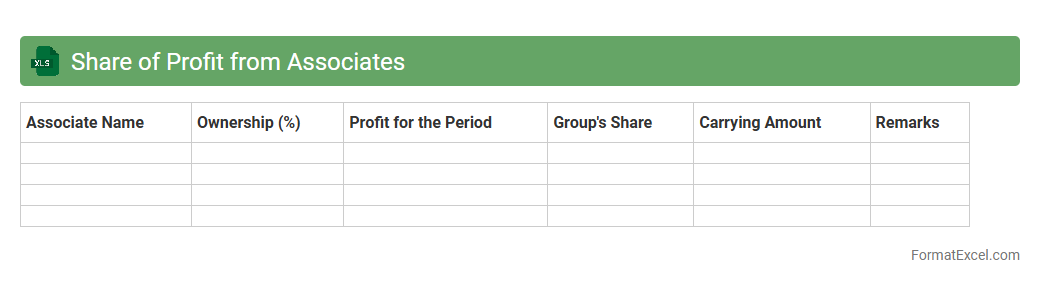

Share of Profit from Associates

The

Share of Profit from Associates Excel document tracks the proportionate profits earned by a company from its investments in associate firms, reflecting the company's financial interest in these entities. This document is crucial for accurately consolidating financial statements, ensuring transparency in reporting earnings from non-controlling stakes. Utilizing it helps stakeholders assess the financial performance and contribution of associate companies to overall profitability and investment strategy.

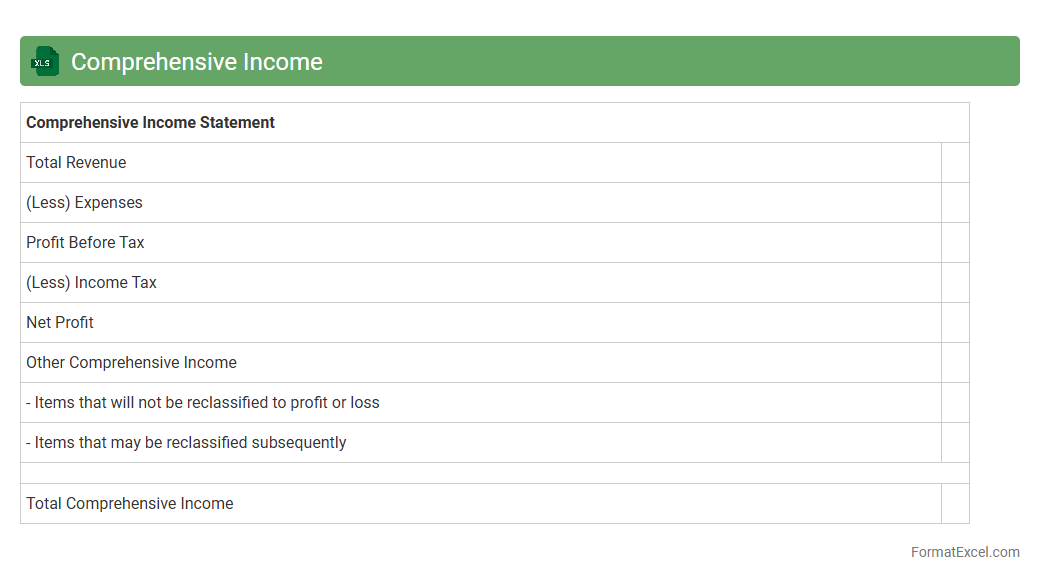

Comprehensive Income

A

Comprehensive Income Excel document consolidates all revenues, expenses, gains, and losses, including those not recorded in net income, providing a complete view of a company's financial performance. It helps businesses track unrealized gains or losses on investments, foreign currency adjustments, and pension liabilities, enhancing financial transparency. This document is essential for analysts and managers to assess true profitability and make informed strategic decisions.

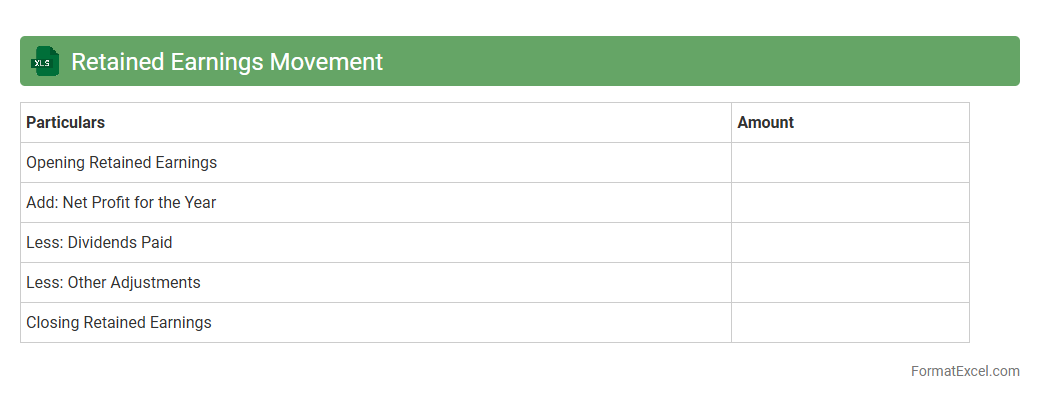

Retained Earnings Movement

The

Retained Earnings Movement Excel document tracks the changes in a company's retained earnings over a specific period, detailing profits reinvested into the business rather than distributed as dividends. It provides valuable insights into the company's financial health, showing how earnings are utilized for growth, debt reduction, or shareholder returns. This tool is essential for investors, accountants, and management to assess profitability trends and make informed financial decisions.

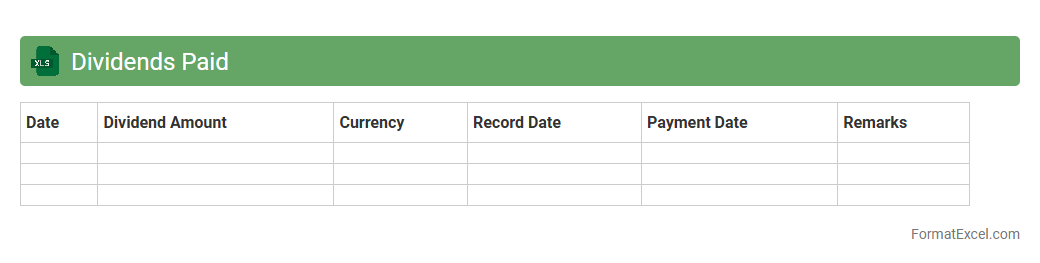

Dividends Paid

The

Dividends Paid Excel document is a financial tool that tracks dividend distributions made by a company to its shareholders over specific periods. It helps investors and analysts monitor dividend payout patterns, calculate dividend yields, and assess the company's profitability and cash flow management. By organizing dividend data systematically, it supports informed decision-making regarding stock investments and portfolio management.

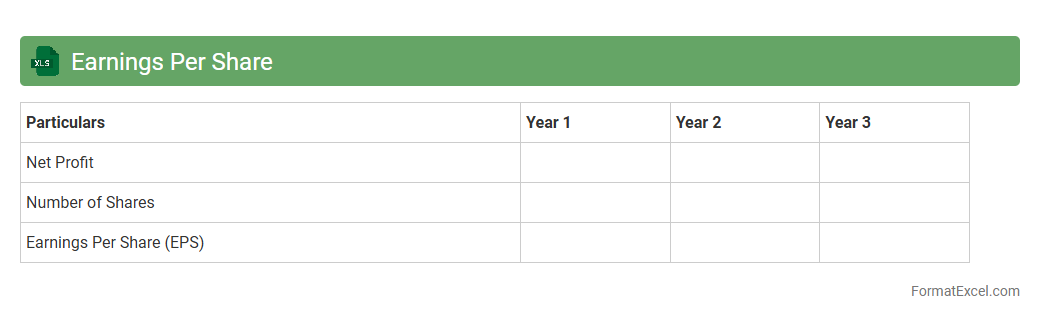

Earnings Per Share

An

Earnings Per Share (EPS) Excel document is a financial tool that calculates a company's profitability on a per-share basis by dividing net income by the number of outstanding shares. It helps investors assess a company's financial health and compare profitability across different firms. Using this document, businesses and analysts can track performance trends and make informed investment decisions efficiently.

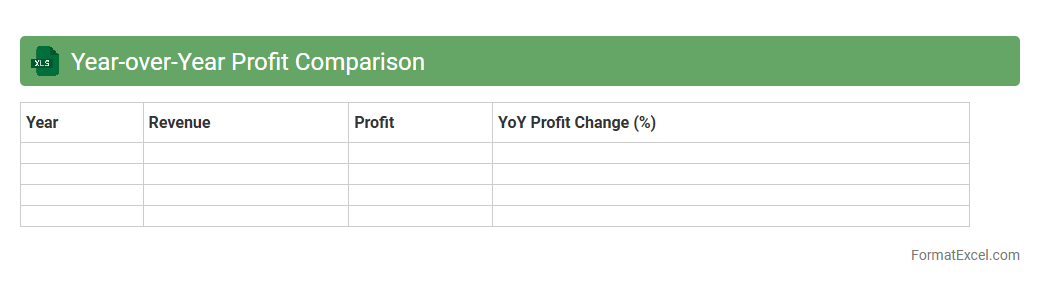

Year-over-Year Profit Comparison

A

Year-over-Year Profit Comparison Excel document is a financial tool that analyzes profit data across multiple years, highlighting trends and growth patterns. It allows businesses to assess performance changes, identify seasonal impacts, and make informed budgeting or investment decisions. By presenting clear, comparative visuals and figures, this document supports strategic planning and improves financial forecasting accuracy.

Introduction to Profit and Loss Summary

A Profit and Loss Summary is a financial statement that outlines revenues, costs, and expenses over a specific period. It helps businesses monitor profitability and operational efficiency. Understanding this summary is essential for informed decision-making and financial planning.

Importance of Profit and Loss Statements

The Profit and Loss Statement provides a clear snapshot of a company's financial health over a given timeframe. It helps stakeholders assess revenue generation, cost management, and net income. This information guides budgeting, investment, and strategic growth.

Key Components of a Profit and Loss Summary

A typical P&L summary includes revenue, cost of goods sold (COGS), gross profit, operating expenses, and net profit. Each component reflects different financial activities and impacts overall performance. Accurate tracking of these elements ensures meaningful insights.

Setting Up an Excel Template

Creating an Excel template for a P&L summary involves structuring rows for revenues and expenses and columns for different time periods. Using Excel's grid system allows easy data entry and organization. Setting consistent formatting enhances readability and analysis.

Step-by-Step Guide to Creating a P&L Summary in Excel

Begin by listing revenue streams and expense categories in Excel. Next, input the corresponding data and use formulas to calculate subtotals like gross profit. Finally, summarize net profit and format the sheet for clarity and presentation.

Essential Formulas for Profit and Loss Calculations

Key Excel formulas include SUM to add revenues and expenses, and subtraction for calculating gross and net profit. The SUMIF function helps segregate data based on specific criteria. These formulas automate calculations, minimizing errors.

Sample Profit and Loss Summary Format in Excel

A sample format includes headings for categories such as income, COGS, and expenses aligned vertically with months or quarters as columns. Totals and subtotals are calculated using formulas for quick insight. Including a percentage change column can highlight trends.

Tips for Customizing Your P&L Summary Template

Customize your P&L by adding relevant expense categories or department-specific revenues. Use conditional formatting to highlight key metrics like negative profits. Incorporating charts can provide visual representation of financial data for better understanding.

Common Mistakes to Avoid in P&L Reporting

Avoid mixing cash flow with revenue, misclassifying expenses, and neglecting periodic updates. Missing data or incorrect formulas can lead to inaccurate financial analysis. Consistent review and validation are critical for reliable reporting.

Finalizing and Analyzing Your Profit and Loss Summary

Once complete, review the P&L summary for discrepancies and ensure formulas are correct. Analyze trends and compare results with budgets or previous periods for actionable insights. Using your finalized summary aids in strategic planning and performance evaluation.