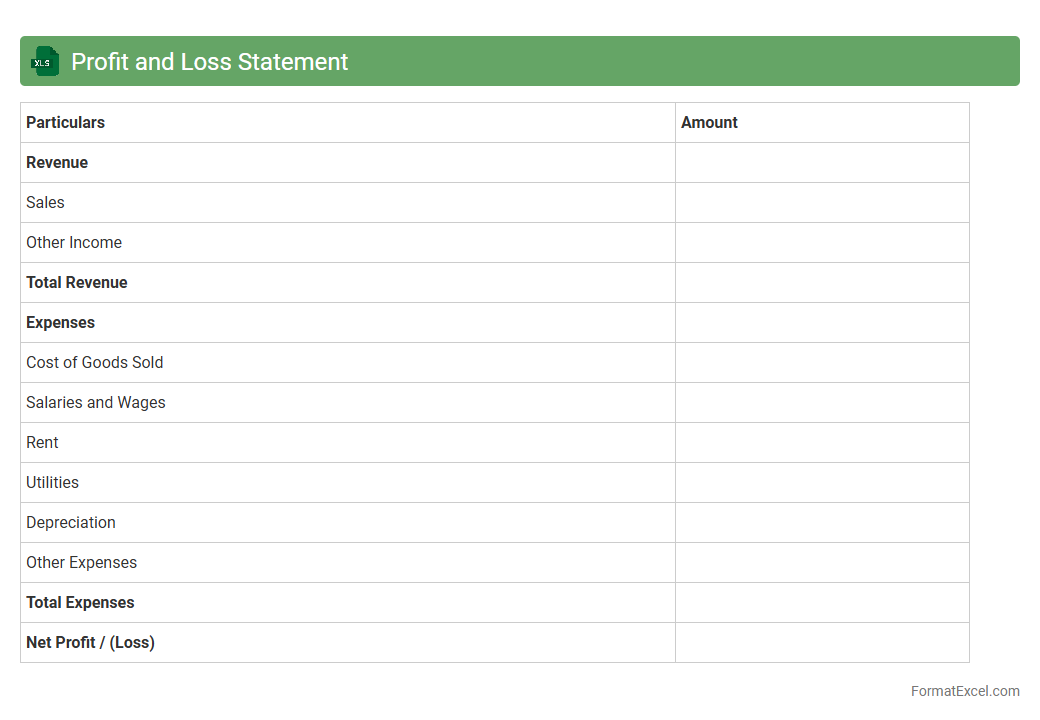

Profit and Loss Statement

A

Profit and Loss Statement Excel document is a financial report template that systematically records revenues, expenses, and net profit over a specific period. It helps businesses track their financial performance, identify areas of cost control, and make informed decisions to enhance profitability. Using this tool increases accuracy in financial analysis and simplifies data visualization through charts and tables.

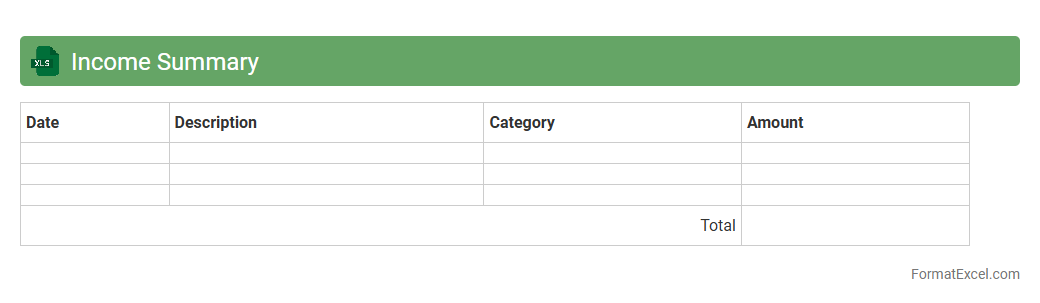

Income Summary

An

Income Summary Excel document is a financial tool designed to consolidate revenues and expenses over a specific period, facilitating accurate calculation of net income or loss. It helps businesses track performance, identify profitability trends, and make informed budgeting decisions. By organizing financial data systematically, it simplifies the closing process and improves overall financial management.

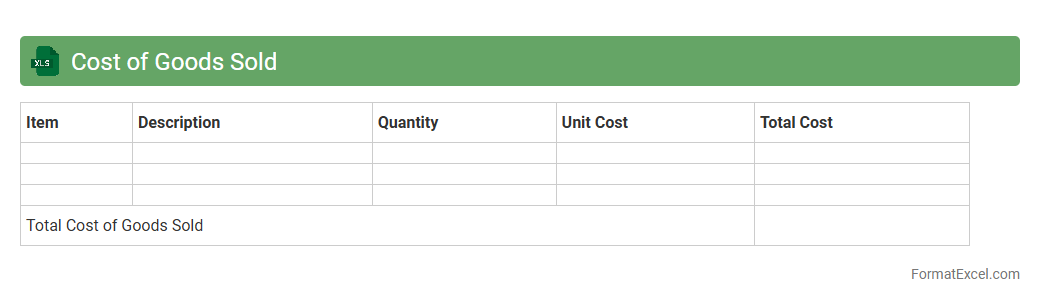

Cost of Goods Sold

A

Cost of Goods Sold (COGS) Excel document is a spreadsheet tool designed to calculate the direct costs attributable to the production of goods sold by a business. It helps track expenses such as raw materials, labor, and manufacturing overhead, providing accurate insights into profit margins and inventory management. Using this document enables businesses to make informed financial decisions, optimize pricing strategies, and improve overall operational efficiency.

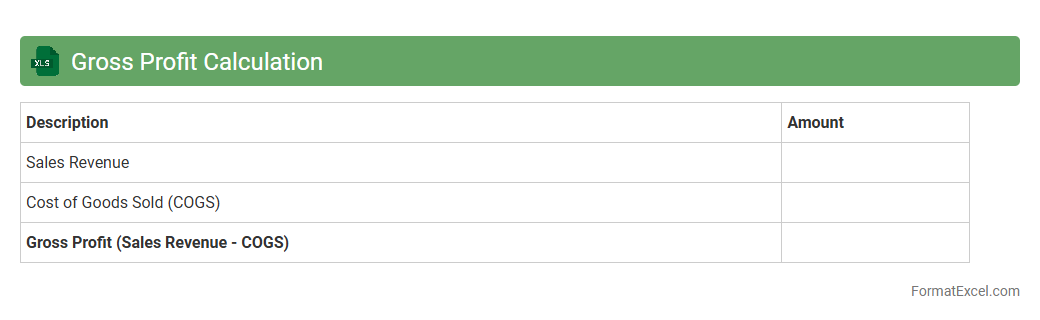

Gross Profit Calculation

A

Gross Profit Calculation Excel document is a financial tool designed to accurately compute gross profit by subtracting the cost of goods sold (COGS) from total revenue. This document enables businesses to analyze profitability on a product or service level, facilitating informed decision-making regarding pricing, cost control, and inventory management. Utilizing this Excel sheet helps streamline financial reporting and supports strategic planning by providing clear insights into the core financial health of a business.

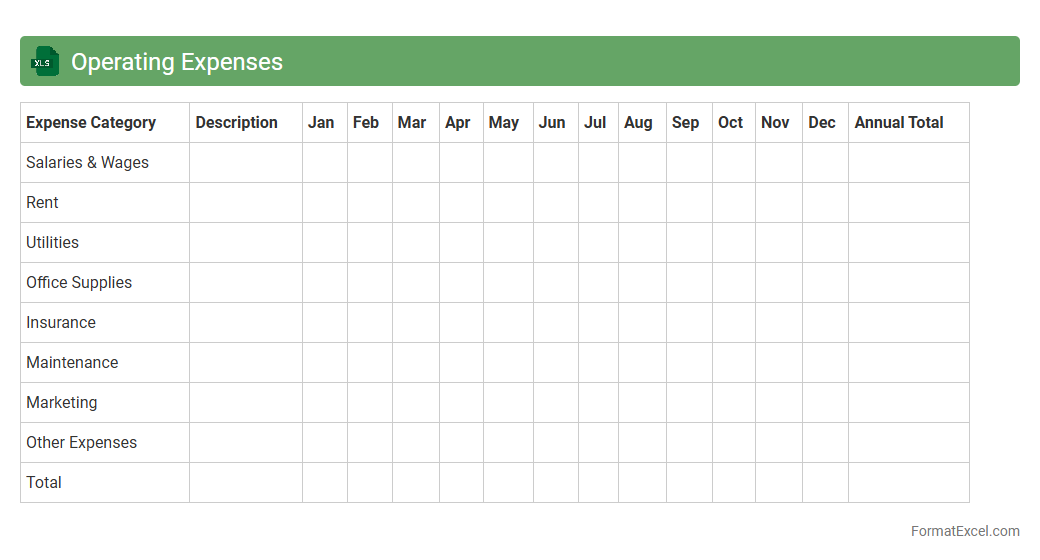

Operating Expenses

An

Operating Expenses Excel document is a financial spreadsheet designed to track, categorize, and analyze day-to-day business costs such as rent, utilities, salaries, and supplies. It helps organizations monitor spending patterns, create budgets, and identify cost-saving opportunities, ensuring effective financial management. By maintaining accurate records in this document, businesses can enhance decision-making, improve cash flow management, and support strategic planning efforts.

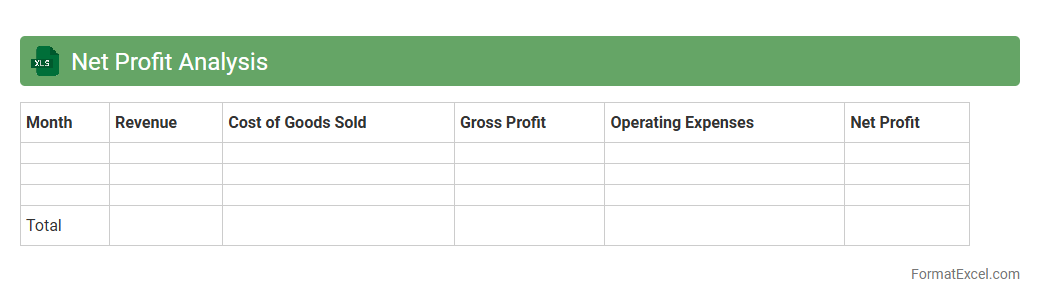

Net Profit Analysis

Net Profit Analysis Excel document is a

financial tool designed to calculate and evaluate the net profit of a business by systematically organizing revenues, costs, and expenses. It helps identify profit margins, track business performance over time, and make informed decisions based on accurate financial data. This document enables efficient budgeting, forecasting, and strategic planning to improve overall profitability.

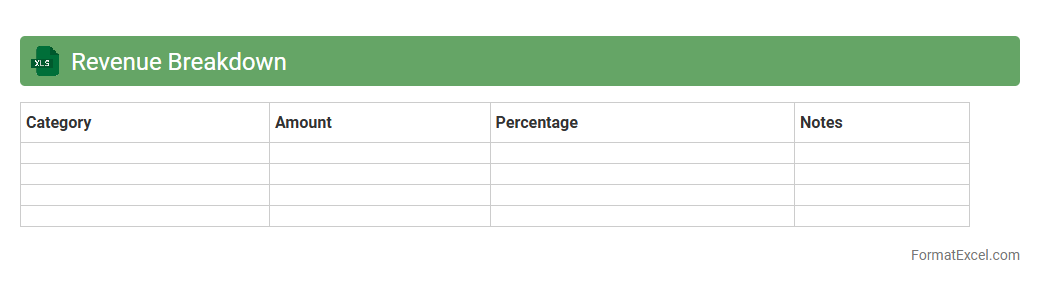

Revenue Breakdown

The

Revenue Breakdown Excel document is a detailed financial tool that categorizes and itemizes income streams by product, service, or region, enabling clear visibility into business performance. It helps identify high-performing segments, track growth trends, and detect potential revenue leakages. Businesses leverage this document to optimize resource allocation, improve forecasting accuracy, and enhance strategic decision-making.

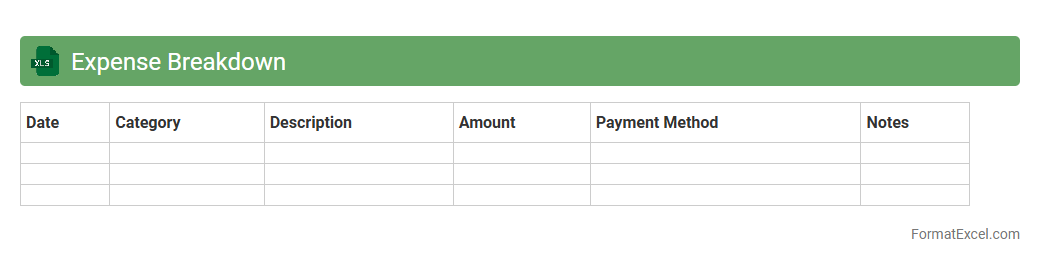

Expense Breakdown

An

Expense Breakdown Excel document systematically categorizes and tracks all expenditures, providing a clear visual representation of spending patterns. It enables effective budgeting, financial analysis, and helps identify areas for cost-saving by breaking down expenses into specific categories. Using this tool enhances financial decision-making and promotes better money management in both personal and business contexts.

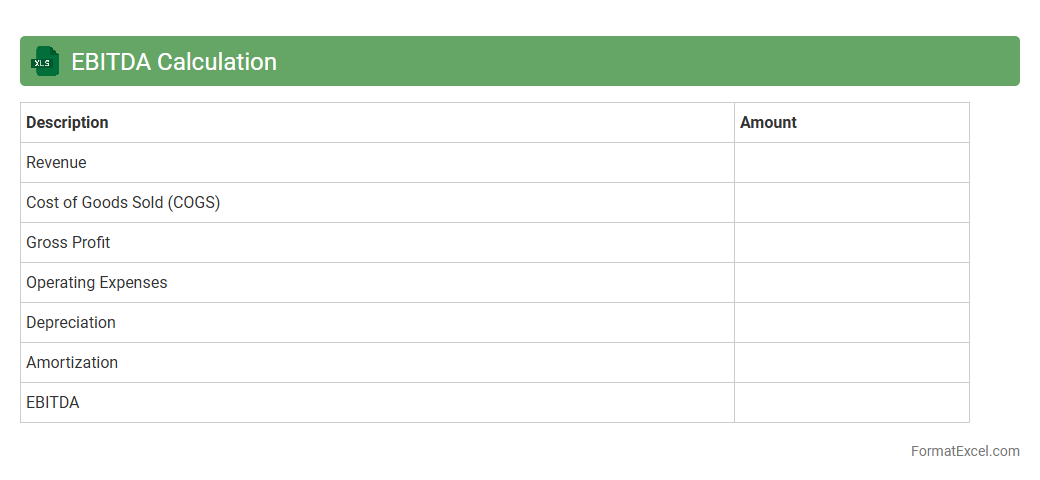

EBITDA Calculation

An

EBITDA Calculation Excel document is a financial tool designed to automate the calculation of Earnings Before Interest, Taxes, Depreciation, and Amortization, providing clear visibility into a company's operating performance. This document includes formulas and templates that help businesses quickly assess profitability by isolating core earnings from non-operating expenses and accounting charges. Using this Excel sheet enhances accurate financial analysis, supports investment decisions, and improves strategic planning by presenting consistent and comparable EBITDA figures.

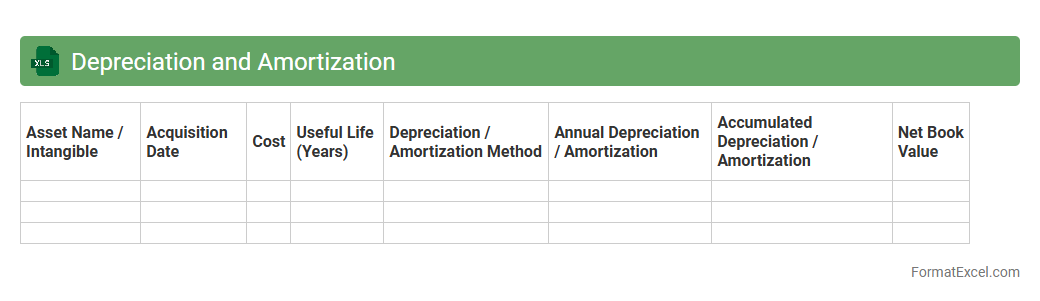

Depreciation and Amortization

A

Depreciation and Amortization Excel document is a financial tool designed to systematically track the allocation of asset costs over their useful life. It helps businesses accurately calculate and record the reduction in value of tangible and intangible assets, ensuring precise financial reporting and tax compliance. Utilizing this document streamlines asset management and supports better budgeting, forecasting, and decision-making processes.

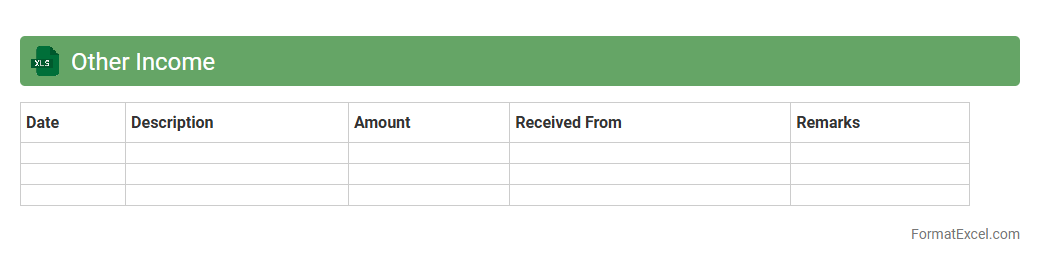

Other Income

The

Other Income Excel document is a structured spreadsheet designed to track and manage miscellaneous revenue streams outside of primary business operations. It helps users organize diverse income sources such as interest, dividends, or rental income, providing accurate financial insights and aiding in comprehensive financial reporting. This tool enhances budgeting, forecasting, and tax compliance by ensuring all additional income is recorded and analyzed effectively.

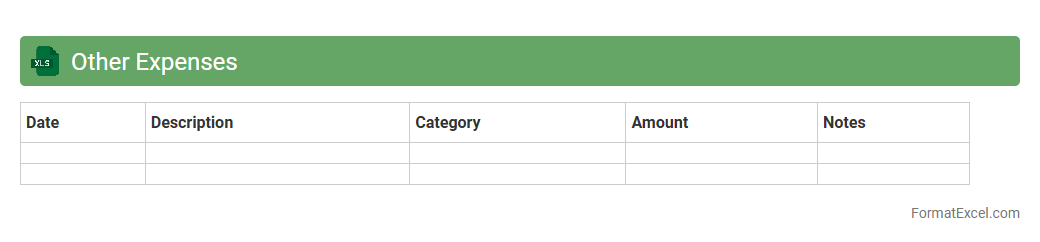

Other Expenses

The

Other Expenses Excel document is a detailed financial record used to track miscellaneous costs that do not fall under standard expense categories, providing clarity and organization for budgeting and accounting. This tool helps businesses and individuals monitor irregular spending, ensuring accurate financial analysis and improved expense management. By categorizing and summarizing diverse expenditures, it enhances transparency and supports better decision-making in financial planning.

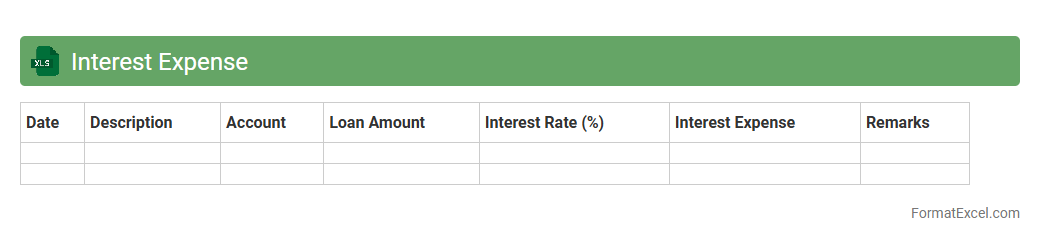

Interest Expense

An

Interest Expense Excel document is a spreadsheet designed to track, calculate, and analyze the cost of borrowing funds over time. It helps users monitor loan interest payments, forecast future expenses, and manage cash flow more effectively. This tool is essential for businesses and individuals seeking to optimize financial planning and maintain accurate records of debt-related costs.

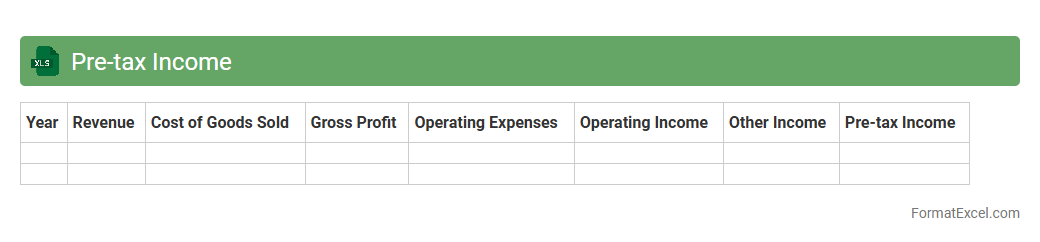

Pre-tax Income

A

Pre-tax Income Excel document is a financial tool that records and calculates a company's earnings before taxes, providing clarity on operational profitability. It enables businesses to analyze income trends, forecast tax liabilities, and make informed financial decisions with precise data management. Using this document enhances budgeting accuracy and supports strategic planning by highlighting pre-tax earnings performance.

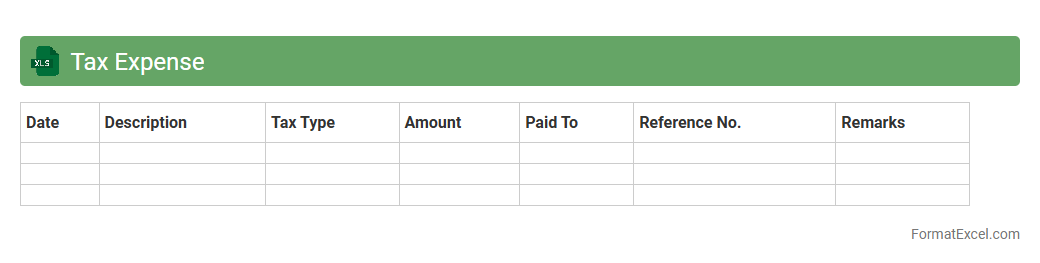

Tax Expense

A

Tax Expense Excel document is a spreadsheet designed to track and calculate a company's tax liabilities based on financial data. It provides detailed insights into tax amounts owed, helps ensure accurate tax reporting, and facilitates compliance with tax regulations. This tool enhances financial planning by allowing users to analyze tax expenses, optimize tax payments, and improve overall budgeting efficiency.

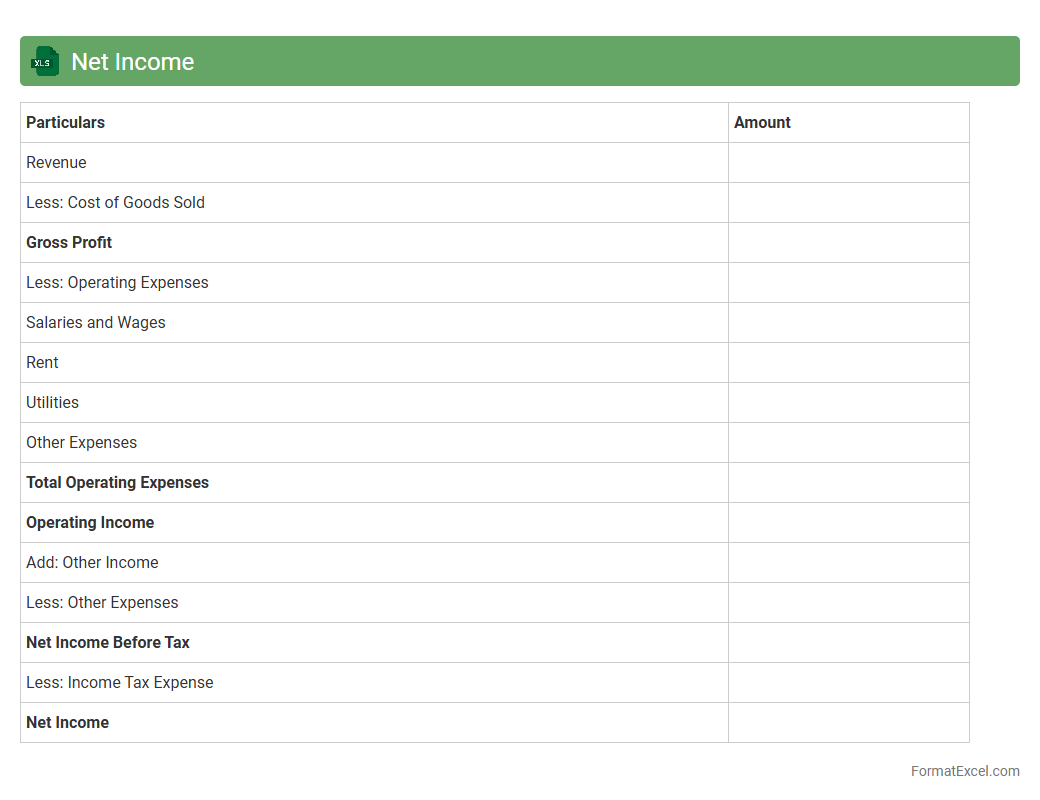

Net Income

A

Net Income Excel document is a financial tool used to calculate and track a company's profitability by summarizing revenues, expenses, and taxes within a specific period. It helps businesses analyze their financial health, make informed budgeting decisions, and prepare accurate financial reports for stakeholders. Utilizing this document enhances financial planning and supports strategic growth initiatives.

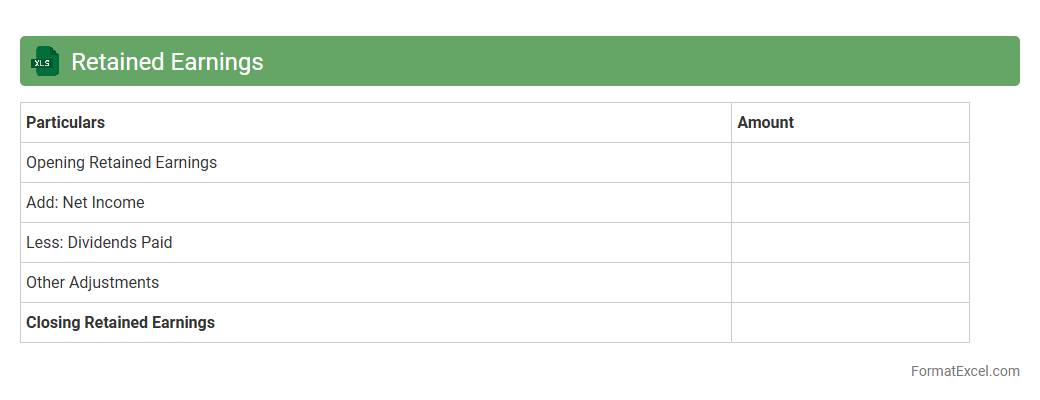

Retained Earnings

The

Retained Earnings Excel document is a financial tool that tracks a company's accumulated profits reinvested in the business rather than distributed as dividends. It helps users analyze profit retention trends, assess financial stability, and make informed decisions about reinvestment or dividend policies. Excel's functionality allows for easy updates, custom calculations, and visualization of retained earnings over multiple periods.

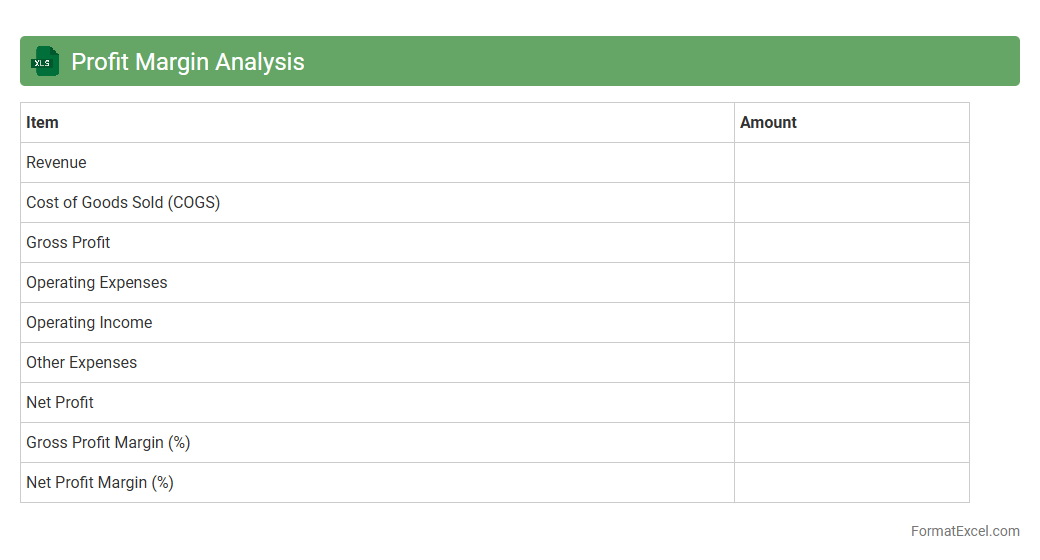

Profit Margin Analysis

A

Profit Margin Analysis Excel document is a financial tool designed to calculate and evaluate the profitability of a business by comparing net income to total revenue. It helps identify trends in profit margins over time, enabling businesses to make informed decisions about pricing, cost control, and operational efficiency. This analysis provides valuable insights that support strategic planning and enhance overall financial performance.

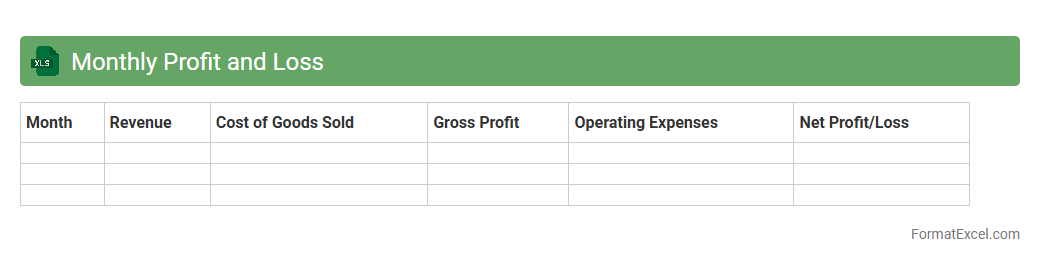

Monthly Profit and Loss

A

Monthly Profit and Loss Excel document is a financial tool that records and summarizes income, expenses, and net profit or loss for each month. It helps businesses and individuals track financial performance, identify trends, and make informed budgeting decisions. By providing clear insights into revenue and costs, this document supports effective financial planning and profitability analysis.

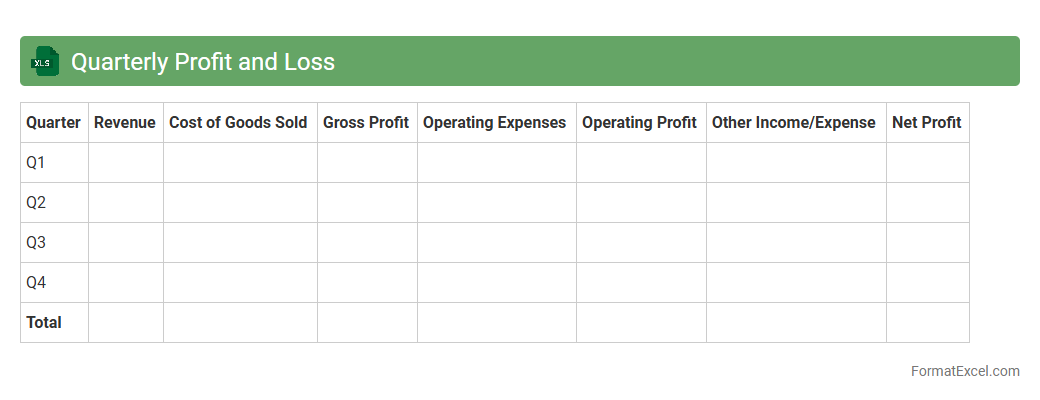

Quarterly Profit and Loss

A

Quarterly Profit and Loss Excel document is a financial tool designed to track and analyze a company's revenues, expenses, and net profit over three-month periods. It helps businesses monitor financial performance, identify trends, and make informed decisions for budgeting and forecasting. This document is essential for maintaining accurate records and enhancing strategic planning throughout the fiscal year.

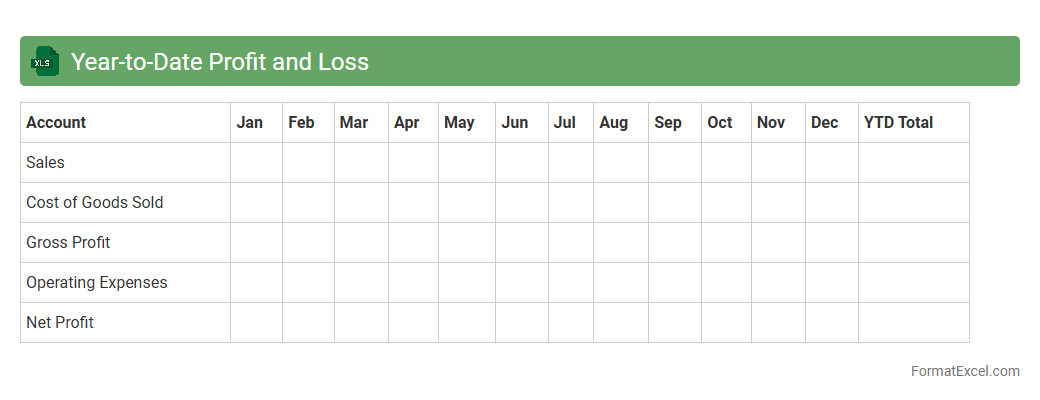

Year-to-Date Profit and Loss

A

Year-to-Date Profit and Loss Excel document tracks a business's revenues, expenses, and net income from the start of the fiscal year to the present date. It enables users to monitor financial performance, identify trends, and make informed budgeting and investment decisions. This tool is essential for maintaining accurate records and ensuring financial accountability throughout the year.

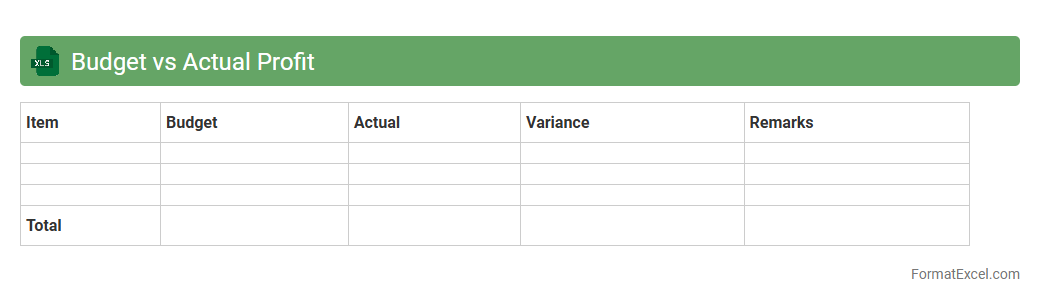

Budget vs Actual Profit

A

Budget vs Actual Profit Excel document is a financial tool that compares projected budget figures with the actual profits earned, allowing businesses to analyze performance accuracy and financial health. It helps identify deviations, control costs, and improve forecasting by providing clear insights into where revenues and expenses differ from expectations. This document supports informed decision-making, enabling companies to adjust strategies and maximize profitability effectively.

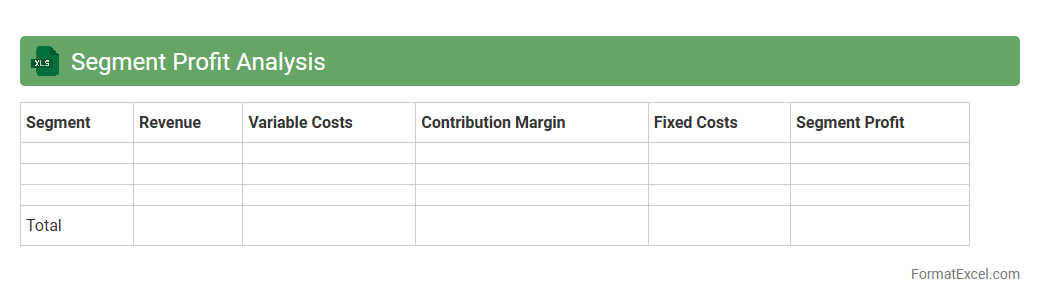

Segment Profit Analysis

A

Segment Profit Analysis Excel document breaks down a company's revenues and expenses by business units, product lines, or geographical areas to identify the profitability of each segment. This tool helps management make informed decisions about resource allocation, cost control, and strategic planning by highlighting high-performing segments and underperforming areas. It also enables detailed financial insights that support budgeting and forecasting processes.

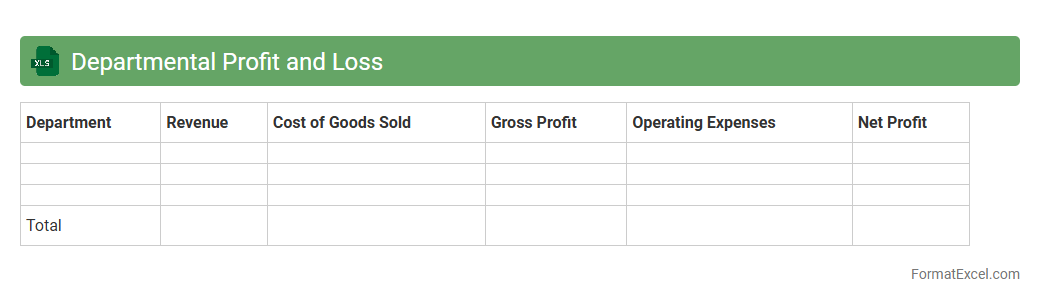

Departmental Profit and Loss

A

Departmental Profit and Loss Excel document is a detailed financial tool that tracks revenues, expenses, and profitability by individual departments within an organization. It enables managers to analyze financial performance, identify cost-saving opportunities, and make informed budgeting decisions for each department. This document enhances financial transparency and supports strategic planning by providing clear insights into how each department contributes to overall profitability.

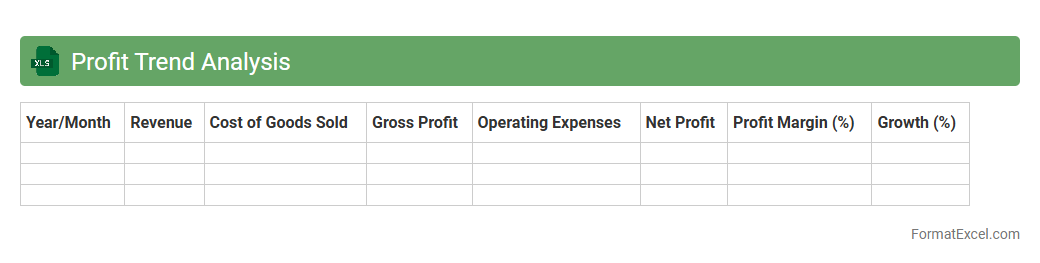

Profit Trend Analysis

Profit Trend Analysis Excel document is a powerful tool designed to track and visualize financial performance over specific periods. It helps businesses identify patterns in revenue and expenses, enabling data-driven decisions to enhance profitability. The

Profit Trend Analysis Excel document provides clear insights into profit fluctuations, making it invaluable for strategic planning and financial forecasting.

Introduction to Profit and Loss Format in Excel

The Profit and Loss statement in Excel is a financial report that summarizes revenues, costs, and expenses during a specific period. It helps businesses assess their profitability efficiently. Using Excel streamlines the organization and calculation of financial data.

Importance of Using Excel for Profit and Loss Statements

Excel offers a flexible and user-friendly platform to track and analyze financial performance. Its powerful formulas and functions allow for accurate profit and loss calculations. Additionally, Excel enhances data management and reporting efficiency for businesses of all sizes.

Key Components of a Profit and Loss Statement

A standard Profit and Loss statement includes revenue, cost of goods sold, gross profit, operating expenses, and net profit. Each component contributes to understanding overall financial health. These elements help identify strengths and areas needing improvement in business operations.

Step-by-Step Guide to Creating Profit and Loss Format in Excel

Begin by listing income sources and expense categories in separate rows or columns. Utilize Excel formulas to automate summing totals and calculating net profit. Carefully format cells to ensure clarity and readability of the financial statement.

Essential Excel Formulas for Profit and Loss Calculation

Basic formulas like SUM, SUBTRACT, and IF statements are crucial for computing totals and conditional results. The formula =SUM(range) quickly adds revenues or expenses, while =(Revenue - Expenses) calculates net profit. Using Excel functions optimizes accuracy and speed in financial calculations.

Customizing the Profit and Loss Template for Your Business

Templates can be tailored by adding specific income streams or expense types relevant to your business. Incorporating customized categories and headings improves the usefulness of your Profit and Loss statement. This personalization aligns the report with unique operational needs.

Common Mistakes to Avoid in Excel Profit and Loss Sheets

Errors like incorrect formulas, inconsistent data entry, and misaligned categories can distort financial analysis. Always double-check calculations and use data validation to reduce mistakes. Maintaining data integrity ensures reliable Profit and Loss reports.

Visualizing Profit and Loss Data with Charts in Excel

Charts like bar graphs and pie charts visually represent income and expenses, making trends easier to identify. Integrating visuals into Excel reports enhances comprehension of financial performance. Effective data visualization aids in better decision-making for businesses.

Downloadable Profit and Loss Excel Templates

Many free and paid templates are available online to help quickly set up Profit and Loss statements in Excel. These templates come pre-formatted with essential formulas and layouts for convenience. Using a downloadable template saves time and ensures accuracy in reporting.

Tips for Efficient Profit and Loss Analysis in Excel

Regularly update your data, use pivot tables for dynamic summaries, and apply conditional formatting to highlight key figures. Efficient analysis depends on maintaining organized and well-structured Excel spreadsheets. These practices improve financial insights and business planning.